Theory of Decreasing Responsibility

The theory of decreasing responsibility is a life insurance philosophy promoted by proponents of term life insurance (as opposed to cash-value insurance). The theory assumes that the financial responsibilities of the insured are temporary and insurance should be purchased to offset those responsibilities. These responsibilities include paying consumer debts, mortgages, funding children's education and income replacement.

With a proper plan, the theory holds that each of these responsibilities is temporary. A person can pay off their debt and mortgage, owning their home outright. Children do grow up and leave home becoming independent of their parents' support. And using concepts like buy term and invest the difference a person should become financially independent having accumulated enough wealth to retire and no longer need to work. At this point the insured could be self insured after the term insurance expires, the investments in segregated funds have grown big enough to replace the expired term insurance.

...Typically, permanent insurance costs at least 5 times more than term insurance. Investing the difference in high yield segregated funds allow the insured to access emergency money from the segregated funds instead of loan from the policy. Policy loans not only have high interest rates these depletes the policy's Adjusted Cost Basis thus compromising its tax advantage.

The theory also assumes that having investments on hand that produce income or can be converted to cash is preferable to having insurance with a monthly premium. As an example a certain sum in investments, or even as cash in a savings account, is preferable to insurance to the same amount.

...The cash value built-in the permanent insurance policy has limited tax advantage depending on the policy's ACB adjusted cost base. But investments in the form of segregated funds registered as TFSA (Tax Free Savings Account) or RRSP (Registered Retirement Savings Plan) offers better tax advantage, since both are registered government programs. If the cash value of a permanent insurance has grown big because of good fund management, the policy is likely to fail in the tax exempt test because of exceeding the MTAR (Maximum Tax Actuarial Reserve). Then, the policy becomes taxable. MTAR test has been effective in stopping the use of insurance as tax avoidance scheme.

The theory holds that with a proper plan the need for life insurance is obviated. The only challenge in this approach is that the insured must take responsibility and consciously plan to become financially independent. If they do not, or are not able, they may not have the assets they need to self insure.

...But segregated funds that have grown big enough to replace the expired term insurance eliminate the need for insurance. Buy term and invest the difference implements the theory of decreasing responsibility.

A contrarian view is that this theory relies on stereotypes and fails to consider unforeseen contingencies. Sometimes responsibilities increase instead of decrease. This is true if the insured has properties that will incur taxes upon death. But as the insured ages, cost of insurance also increases. Premiums will not be enough to pay for the increasing cost of insurance. Cash value comes to the rescue. When the insured dies, death benefits pay for tax obligation, while the insurance company keeps the cash value. "Guaranteed Death Benefits" always means "Cash Value Scam".

Example 1; A dependent spouse is stricken by blindness or other disability.

...Some term insurance provide waiver of premium and terminal illness benefits which pay the insured about 40% to 70% of the coverage. Government Registered Segregated funds can also add to the disability benefits, besides the tax advantages. Disability may occur anytime before or after the term insurance expires. Instead of relying on policy loans from permanent insurance, segregated funds can provide for these emergencies. Policy loans only deplete both cash value and ACB (which make the policy taxable).

Example 2: Consider a working couple; both with good incomes. The husband has a disabling illness at age 55, and the spouse quits work to be his caregiver. Group life benefits are lost, and there is no personal insurance. Accumulated savings and investments are exhausted. He dies at age 59 with an outstanding mortgage and no life insurance. If, on the other hand, he had bought a whole life policy at age 35 (instead of the 20 year term plan) there could have been a substantial, tax-free resource,

... if ACB (Adjusted Cost Basis) is depleted, then it's not tax-free. Term insurance is meant to protect the insured until retirement, and not age 59, unless the agent wants to scam the client by selling shorter term insurance with the intention to renew later at higher premiums.

Premiums could have been paid through policy loans against the cash value.

...Borrowing from one's own money at high interest is simply stupid Holiday premium can continue until the cash value is depleted. Even if cash value grows from good fund management, if the ACB is depleted, then the policy has no tax advantage. If the cash value gets depleted, the insurance is no longer enforced. The cash value scam is embedded in the phrase "Guaranteed Death Benefits". Only death benefit is guaranteed, not the cash value (The insurance company keeps it). However, if one wants to withdraw the cash value, surrender charges apply.

If the policy had waiver of premium for total disability, it could have been self-sustaining after 6 months of disability with no premiums. (I cannot furnish a citation, but these are real life situations I have personally seen. Perhaps you have, also.)

....Permanent insurance (Whole Life and Universal) loaded with unnecessary riders provide the highest commission to the agent while scamming the client. Term Insurance with waiver of premium costs lower than Permanent Insurance with waiver of premium. Segregated funds provide better control because withdrawals that don't incur surrender charges. Disability Insurance is better left as standalone than as a rider to Permanent Insurance. The insured will have better control in coordinating with government disability benefits to avoid possible government clawbacks from over-funded disability insurance.

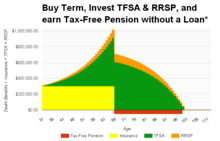

Example 3. Here's year 30 old who purchased a $300,000 term insurance for 35 years that typically costs between $40 to $50 per month. The difference is invested by maxing out the Tax Free Savings account at $458.33 per month while RRSP contribution is $75 per month until age 65. Assuming a 6% investment performance of the segregated funds, a maximum of $3.981 monthly tax free income from age 66 to 100 is possible. After 65 (retirement age), RRSP continues to max out TFSA contribution at $5500/year.

However, if this were a permanent insurance (whole life or universal life), this 30 year old will settle for a measly cash value loan in his or her retirement years. This loan reduces both the death benefits and the ACB (tax-free portion of the cash value). When the ACB gets depleted, the insurance loses its tax advantage. i.e., the insurance policy becomes a taxable endowment. This also happens when the policy fails the annual MTAR test by CRA. Borrowing from one's own money with interest is simply stupid specially during the retirement years.

In most Insured Retirement Plans, cash value loan is collateralised through a third party lender and annuitised as a tax-free retirement income. Technically the loan becomes a tax fraud waiting to be discovered, since there is no intention or means to pay the loan during the retirement years. If the 3rd party lender and the insurance company have the same owner, then there is conflict of interest in this plan.

In summary, the Theory of Decreasing Responsibility is best implemented by Buy Term and Invest the difference. Term Insurance provides protection if the client dies to soon, Segregated funds provide protection if the client lives too long. Government registered segregated funds provide better tax advantage than the cash value of permanent insurance with low ACB depleted policy loans.