Sarafu-Credit

| Sarafu-Credit | |

|---|---|

| Subunit | |

| Demographics | |

| Date of introduction | 2010 |

| User(s) | Kenyan local communities |

| Issuance | |

| Central bank | Grassroots Economics |

| Website | http://grassrootseconomics.org |

Sarafu-Credit (sarafu is the Kiswahili word for 'currency') is a community currency system operated in Kenya. It is used by five different communities, all located in informal settlements or slum areas, including small businesses and schools.[1]

The community currency system takes the form of paper notes, circulating in complementarity with the national currency, the Kenyan shilling. It aims at fostering local trade by mobilizing under-used resources, and at satisfying basic needs (such as accessing food and paying school fees) by allowing users to trade even when the national currency is scarce.

The adoption of the community currency has generated an average 22% increase in participating businesses' incomes.[2] In using communities, up to 10% of local food purchases are being done using the community currency. Field studies have also showed that community currency usage is positively correlated to increasing levels of trust among community members.[3]

Such monetary innovation, designed to go beyond official development assistance, by considering the nature of money or credit and alternatives way it can be created.[4]

The Sarafu-Credit system has been developed and is implemented by a Kenyan-based foundation called Grassroots Economics.[5][6]

History

The first complementary currency introduced in Kenya was the Eco-Pesa, founded by Will Ruddick. The complementary currency in Kongowea, Mombasa County, was in circulation between August 2009 and November 2010, as part of a donor-funded environmental project. Instead of directly spending the donor funds, the complementary currency allowed to realize the projects' objectives as well as boosting the local economy. Beside the collection of 20 tonnes of waste and the creation of three youth-led community tree nurseries, the use of Eco-Pesa resulted in a 22% average increase in participating businesses' incomes.[7]

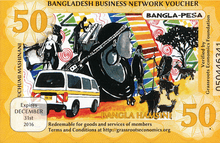

After the success of the project, it was followed by Bangla-Pesa in 2013. Will Ruddick, Caroline Dama and four other program members were falsely accused of undermining the Kenyan schilling and all charges were dropped after investigations and a petition was signed by 200 Academics at the Hague to support the program.[8]

Local groups

In 2016, five communities are currently using Sarafu-Credit in Kenya totalling 700 users. The system is the same in all of them, though each community uses its own community currency, giving it a unique name depending on the local toponyms, and managing it independently.

| Community currency name | Location | Launching date |

|---|---|---|

| Bangla-Pesa[2][9][10] | Bangladesh, Mombasa area | November 2013 |

| Gatina-Pesa[11] | Kawangware, Nairobi area | October 2014 |

| Kangemi-Pesa[12] | Kangemi, Nairobi area. | April 2015 |

| Lindi-Pesa[13][14] | Kibera, Nairobi area. | August 2015 |

| Ng'Ombeni-Pesa[15] | Mikindani, Mombasa area. | August 2015[16] |

In South-Africa, two community currencies have taken inspiration from the Sarafu-Credit model and were consulted by Grassroots Economics Foundation: the K'Mali[17] and the Berg-Rand.[18]

References

- ↑ "Dual currencies may help developing countries brace for bumpy post-Brexit ride – Humanosphere". 2016-07-19. Retrieved 2016-08-22.

- 1 2 Ruddick, W.O., Richards, M.A. & Bendell, J., 2015. Complementary Currencies for Sustainable Development in Kenya: The Case of the Bangla-Pesa. International Journal of Community Currency Research, 19.

- ↑ Ruddick, W.O., 2015. Trust and Spending of Community Currencies in Kenya. In 3rd International Conference on Social and Complementary Currencies. Salvador, Brazil.

- ↑ Bendell, J., Slater, M. & Ruddick, W., 2015. Re-imagining Money to Broaden the Future of Development Finance: What Kenyan Community Currencies Reveal is Possible for Financing Development. UNRISD Working Paper, (10).

- ↑ "Grassroots Economics". grassrootseconomics.org. Retrieved 2016-08-22.

- ↑ "Grassroots Economics | Now working with over 700 SMEs!". grassrootseconomics.org. Retrieved 2016-08-22.

- ↑ "Eco-Pesa: An Evaluation of a Complementary Currency Programme in Kenya’s Informal Settlements". IJCCR. Retrieved 22 August 2016.

- ↑ "Kenya slum embraces alternative currency". Retrieved 2016-08-22.

- ↑ "In Mombasa, Africa's first 'alternative currency' helps Kenyans fight poverty". Christian Science Monitor. 2014-06-03. ISSN 0882-7729. Retrieved 2016-08-22.

- ↑ "Bangla-Pesa Brings Big Change to Kenyan Slum – BORGEN". 2014-06-30. Retrieved 2016-08-22.

- ↑ "Slum money in Gatina slums, Nairobi, Kenya". 2014-12-05. Retrieved 2016-08-22.

- ↑ "Kangemi-Pesa Launched | Grassroots Economics". grassrootseconomics.org. Retrieved 2016-08-22.

- ↑ "Kibera Now Have Their Own Currency; 'Lindi Pesa' – PHOTOS + VIDEO". 2015-11-27. Retrieved 2016-08-22.

- ↑ Economiques, Alternatives. "Au Kenya, le lindi-pesa dynamise les bidonvilles". www.alternatives-economiques.fr. Retrieved 2016-08-22.

- ↑ "El Lindi-Pesa y el Ng’ombeni-Pesa, nuevas monedas complementarias, ven la luz en Kenya – IMS". www.monedasocial.org. Retrieved 2016-08-22.

- ↑ "Lindi and Ng'ombeni Pesa Launched". Retrieved 22 August 2016.

- ↑ "K'Mali - Kokstad South Africa starts with inspiration and training from Sarafu-Credit". Retrieved 2016-09-01.

- ↑ "Berg-Rand - Bergriver, South Africa starts with inspiration and training from Sarafu-Credit". Retrieved 2016-09-01.