Reliance Industries

| |

| Public | |

| Traded as |

BSE: 500325, NSE: RELIANCE, LSE: RIGD BSE SENSEX Constituent CNX Nifty Constituent |

| Industry | Conglomerate |

| Predecessor | Reliance Commercial Corporation |

| Founded | 1966 |

| Founder | Dhirubhai Ambani |

| Headquarters | Mumbai, Maharashtra, India |

Area served | Worldwide |

Key people |

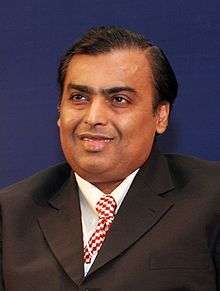

Mukesh Ambani (Chairman and MD) |

| Products |

Petroleum Natural gas Petrochemicals Textiles Retail Telecommunications Media |

| Services | Security services |

| Revenue | ₹3,301 billion (US$51 billion) (2017)[1] |

| ₹555 billion (US$8.7 billion) (2017)[1] | |

| Profit | ₹299 billion (US$4.7 billion) (2017)[1] |

| Total assets | ₹7,068 billion (US$110 billion) (2017)[1] |

| Owner | Mukesh Ambani (52%)[2] |

Number of employees | 250,000 (2017)[3] |

| Subsidiaries |

Reliance Jio Infocomm Reliance Retail Network 18 Reliance Petroleum |

| Website |

www |

Reliance Industries Limited (RIL) is an Indian conglomerate holding company headquartered in Mumbai, Maharashtra, India. Reliance owns businesses across India engaged in energy, petrochemicals, textiles, natural resources, retail, and telecommunications. Reliance is the most profitable company in India,[4] the largest publicly traded company in India by market capitalization,[5] and the second largest company in India as measured by revenue after the government-controlled Indian Oil Corporation.[6] The company is ranked 215th on the Fortune Global 500 list of the world's biggest corporations as of 2016.[7] It is ranked 8th among the Top 250 Global Energy Companies by Platts as of 2016.Reliance continuous to be India’s largest exporter accounting for 8% of India’s total merchandise exports with a value of Rs 147,755 crore and access to markets in 108 countries.[8]Reliance is responsible for almost 5% of India’s total revenues from customs and excise duty and is also the highest Income tax payer in the private sector in India.[9]

History

1960–1980

The company was co-founded by Dhirubhai Ambani and his brother Champaklal Damani in 1960s as Reliance Commercial Corporation. In 1965, the partnership ended and Dhirubhai continued the polyester business of the firm.[10] In 1966, Reliance Textiles Industries Pvt Ltd was incorporated in Maharashtra. It established a synthetic fabrics mill in the same year at Naroda in Gujarat.[11] In 1975, the company expanded its business into textiles, with "Vimal" becoming its major brand in later years. The company held its Initial public offering (IPO) in 1977.[12] The issue was over-subscribed by seven times.[13] In 1979, a textiles company Sidhpur Mills was amalgamated with the company.[14] In 1980, the company expanded its polyester yarn business by setting up a Polyester Filament Yarn Plant in Raigad, Maharashtra with financial and technical collaboration with E. I. du Pont de Nemours & Co., U.S.[11]

1981–2000

In 1985, the name of the company was changed from Reliance Textiles Industries Ltd. to Reliance Industries Ltd.[11] During the years 1985 to 1992, the company expanded its installed capacity for producing polyester yarn by over 145,000 tonnes per annum.[11]

The Hazira petrochemical plant was commissioned in 1991–92.[15]

In 1993, Reliance turned to the overseas capital markets for funds through a global depositary issue of Reliance Petroleum. In 1996, it became the first private sector company in India to be rated by international credit rating agencies. S&P rated Reliance "BB+, stable outlook, constrained by the sovereign ceiling". Moody's rated "Baa3, Investment grade, constrained by the sovereign ceiling".[16]

In 1995/96, the company entered the telecom industry through a joint venture with NYNEX, USA and promoted Reliance Telecom Private Limited in India.[15]

In 1998/99, RIL introduced packaged LPG in 15 kg cylinders under the brand name Reliance Gas.[15]

The years 1998–2000 saw the construction of the integrated petrochemical complex at Jamnagar in Gujarat,[15] the largest refinery in the world.

2001 onwards

In 2001, Reliance Industries Ltd. and Reliance Petroleum Ltd. became India's two largest companies in terms of all major financial parameters.[17] In 2001–02, Reliance Petroleum was merged with Reliance Industries.[12] In 2002, Reliance announced India's biggest gas discovery (at the Krishna Godavari basin) in nearly three decades and one of the largest gas discoveries in the world during 2002. The in-place volume of natural gas was in excess of 7 trillion cubic feet, equivalent to about 1.2 billion barrels of crude oil. This was the first ever discovery by an Indian private sector company.[12][18] In 2002–03, RIL purchased a majority stake in Indian Petrochemicals Corporation Ltd. (IPCL), India's second largest petrochemicals company, from Government of India.[19] IPCL was later merged with RIL in 2008.[20][21] In the years 2005 and 2006, the company reorganized its business by demerging its investments in power generation and distribution, financial services and telecommunication services into four separate entities.[22] In 2006, Reliance entered the organised retail market in India[23] with the launch of its retail store format under the brand name of 'Reliance Fresh'.[24][25] By the end of 2008, Reliance retail had close to 600 stores across 57 cities in India.[12] In November 2009, Reliance Industries issued 1:1 bonus shares to its shareholders. In 2010, Reliance entered Broadband services market with acquisition of Infotel Broadband Services Limited, which was the only successful bidder for pan-India fourth-generation (4G) spectrum auction held by Government of India.[26][27] In the same year, Reliance and BP announced a partnership in the oil and gas business. BP took a 30 per cent stake in 23 oil and gas production sharing contracts that Reliance operates in India, including the KG-D6 block for $7.2 billion.[28] Reliance also formed a 50:50 joint venture with BP for sourcing and marketing of gas in India.[29] In 2017, RIL set up a joint venture with Russian Company Sibur for setting up a Butyl rubber plant in Jamnagar, Gujarat to be operational by 2018. [30]

Shareholding

The number of shareholders in RIL are approx. 3.1 billion.[31] The promoter group, Ambani family, holds approx. 46.32% of the total shares whereas the remaining 53.68% shares are held by public shareholders, including FII and corporate bodies.[31] Life Insurance Corporation of India is the largest non-promoter investor in the company with 7.98% shareholding.[32]

Buyback: In January 2012, the company announced a buyback programme to buy a maximum of 120 million shares for ₹104 billion (US$1.6 billion). By the end of January 2013, the company bought back 46.2 million shares for ₹33.66 billion (US$520 million).[33]

Listing

The company's equity shares are listed on the National Stock Exchange of India Limited (NSE) and the BSE Limited. The Global Depository Receipts (GDRs) issued by the Company are listed on Luxembourg Stock Exchange.[34][35] It has issued approx. 56 million GDRs wherein each GDR is equivalent to 2 equity shares of the company. Approx. 3.46% of its total shares are listed on Luxembourg Stock Exchange.[31]

Its debt securities are listed at the Wholesale Debt Market (WDM) Segment of the National Stock Exchange of India Limited (NSE).[36]

Credit Ratings: It has received domestic credit ratings of AAA from CRISIL (S&P subsidiary) and Fitch. Moody's and S&P have provided investment grade ratings for international debt of the Company, as Baa2 positive outlook (local currency issuer rating) and BBB+ outlook respectively.[37][38][39]

Operations

The company's petrochemical, refining, oil and gas-related operations form the core of its business; other divisions of the company include cloth, retail business, telecommunications and special economic zone (SEZ) development. In 2012–13, it earned 76% of its revenue from refining, 19% from petrochemicals, 2% from oil & gas and 3% from other segments.[32]

In July 2012, RIL informed that it was going to invest US$1 billion over the next few years in its new aerospace division which will design, develop, manufacture, equipment and components, including airframe, engine, radars, avionics and accessories for military and civilian aircraft, helicopters, unmanned airborne vehicles and aerostats.[40]

Major subsidiaries and associates

On 31 March 2013, the company had 123 subsidiary companies and 10 associate companies.[32]

- Reliance Retail is the retail business wing of the Reliance Industries. In March 2013, it had 1466 stores in India.[41] It is the largest retailer in India.[42] Many brands like Reliance Fresh, Reliance Footprint, Reliance Time Out, Reliance Digital, Reliance Wellness, Reliance Trends, Reliance Autozone, Reliance Super, Reliance Mart, Reliance iStore, Reliance Home Kitchens, Reliance Market (Cash n Carry) and Reliance Jewel come under the Reliance Retail brand. Its annual revenue for the financial year 2012–13 was ₹108 billion (US$1.7 billion) with an EBITDA of ₹780 million (US$12 million).[32][43]

- Reliance Life Sciences works around medical, plant and industrial biotechnology opportunities. It specializes in manufacturing, branding, and marketing Reliance Industries' products in bio-pharmaceuticals, pharmaceuticals, clinical research services, regenerative medicine, molecular medicine, novel therapeutics, biofuels, plant biotechnology, and industrial biotechnology sectors of the medical business industry.[44][45]

- Reliance Institute of Life Sciences (RILS), established by Dhirubhai Ambani Foundation, is an institution offering higher education in various fields of life sciences and related technologies.[46][47]

- Reliance Logistics is a single-window company selling transportation, distribution, warehousing, logistics, and supply chain-related products, supported by in-house telematics and telemetry solutions.[48][49][50] Reliance Logistics is an asset based company with its own fleet and infrastructure.[51] It provides logistics services to Reliance group companies and outsiders.[52] Merged content from Reliance Logistics to here. See Talk:Reliance Industries/Archives/2013#Merge proposals.

- Reliance Clinical Research Services (RCRS), a contract research organisation (CRO) and wholly owned subsidiary of Reliance Life Sciences, specialises in the clinical research services industry. Its clients are primarily pharmaceutical, biotechnology and medical device companies.[53]

- Reliance Solar, the solar energy subsidiary of Reliance, was established to produce and retail solar energy systems primarily to remote and rural areas. It offers a range of products based on solar energy: solar lanterns, home lighting systems, street lighting systems, water purification systems, refrigeration systems and solar air conditioners.[54] Merged content from Reliance Solar to here. See Talk:Reliance Industries/Archives/2013#Merge proposals.

- Relicord is a cord blood banking service owned by Reliance Life Sciences. It was established in 2002.[55] It has been inspected and accredited by AABB,[56] and also has been accorded a license by Food and Drug Administration (FDA), Government of India.

- Reliance Jio Infocomm Limited (RJIL) previously known as Infotel Broadband, is a broadband service provider which gained 4G licences for operating across India.[57][58]

- Reliance Industrial Infrastructure Limited (RIIL) is an associate company of RIL. RIL holds 45.43% of total shares of RIIL.[32] It was incorporated in September 1988 as Chembur Patalganga Pipelines Limited, with the main objective being to build and operate cross-country pipelines for transporting petroleum products. The company's name was subsequently changed to CPPL Limited in September 1992, and thereafter to its present name, Reliance Industrial Infrastructure Limited, in March 1994.[59] RIIL is mainly engaged in the business of setting up and operating industrial infrastructure. The company is also engaged in related activities involving leasing and providing services connected with computer software and data processing.[60] The company set up a 200-millimetre diameter twin pipeline system that connects the Bharat Petroleum refinery at Mahul, Maharashtra, to Reliance's petrochemical complex at Patalganga, Maharashtra. The pipeline carries petroleum products including naphtha and kerosene. It has commissioned facilities like the supervisory control and data acquisition system and the cathodic protection system, a jackwell at River Tapi, and a raw water pipeline system at Hazira. The infrastructure company constructed a 71,000 kilo-litre petrochemical product storage and distribution terminal at the Jawaharlal Nehru Port Trust (JNPT) Area in Maharashtra.

- LYF, a 4G-enabled VoLTE device brand from Reliance Retail.[61]

- Network 18, a mass media company. It has interests in television, digital platforms, publication, mobile apps, and films. It also operates two joint ventures, namely Viacom 18 and History TV18 with Viacom and A+E Networks respectively. It also have acquired ETV Network and since renamed its channels under the Colors TV brand.

Employees

As on 31 March 2013, the company had 23,519 employees of which 1,159 were women and 83 were employees with disabilities. It also had 29,462 temporary employees on the same date.[32] As per its Sustainability Report for 2011–12, the attrition rate was 7.5%. But currently, the same attrition rate has gone up to 23.4% in 2015 as per latest report released by the organization.[62]

In its 39th Annual General Meeting, its Chairman informed the shareholders of the investment plans of the company of about ₹1,500 billion (US$23 billion) in next three years. This would be accompanied by increasing the staff strength in Retail division from existing strength of 35,000 to 120,000 in next 3 years and increasing employees in Telecom division from existing 3,000 to 10,000 in 12 months.[63]

Awards and recognition

- International Refiner of the year in 2017 at Global Refining and Petrochemicals Congress 2017 [64]

- International Refiner of the Year in 2013 at the HART Energy's 27th World Refining & Fuel Conference.[1] This is the second time that RIL has received this Award for its Jamnagar Refinery, the first being in 2005.[65]

- According to survey conducted by Brand Finance in 2013, Reliance is the second most valuable brand in India.[66]

- The Brand Trust Report ranked Reliance Industries as the 7th most trusted brand in India in 2013 and 9th in 2014.[67][68]

- RIL was certified as 'Responsible Care Company' by the American Chemistry Council in March, 2012.[69]

- RIL was ranked at 25th position across the world, on the basis of sales, in the ICIS Top 100 Chemicals Companies list in 2012.[70]

- RIL was awarded the National Golden Peacock Award 2011 for its contribution in the field of corporate sustainability.[71]

- In 2009, Boston Consulting Group (BCG) named Reliance Industries as the world's fifth biggest 'sustainable value creator' in a list of 25 top companies globally in terms of investor returns over a decade.[72]

- The company was selected as one of the world's 100 best managed companies for the year 2000 by IndustryWeek magazine.[11][73]

- From 1994 to 1997, the company won National Energy Conservation Award in the petrochemical sector.[11]

Controversies

De-merger of RIL in 2005–2006

The Ambani family holds around 45% of the shares in RIL.[74] Since its inception, the company was managed by its founder and chairman Dhirubhai Ambani. After suffering a heart attack in 1986, he handed over the daily operations of the company to his sons Mukesh Ambani and Anil Ambani. After the death of Dhirubhai Ambani in 2002, the management of the company was taken up by both the brothers. In November 2004, Mukesh Ambani, in an interview, admitted to having differences with his brother Anil over 'ownership issues'.[75] He also said that the differences "are in the private domain". The share prices of RIL were impacted by some margin when this news broke out. In 2005, after a bitter public feud between the brothers over the control of the Reliance empire, mother Kokilaben intervened to broker a deal splitting the RIL group business into the two parts.[76] In October 2005, the split of Reliance Group was formalized. Mukesh Ambani got Reliance Industries and IPCL. Younger brother Anil Ambani received telecom, power, entertainment and financial services business of the group. The Anil Dhirubhai Ambani Group includes Reliance Communications, Reliance Infrastructure, Reliance Capital, Reliance Natural Resources and Reliance Power.[77][78]

The division of Reliance group business between the two brothers also resulted in de-merger of 4 businesses from RIL.[79][80] These businesses immediately became part of Anil Dhirubhai Ambani Group. The existing shareholders in RIL, both the promoter group and non-promoters, received shares in the de-merged companies.[22]

Relationship with ONGC

In May 2014, ONGC moved to Delhi High Court accusing RIL of pilferage of 18 billion cubic meters of gas from its gas-producing block in the Krishna Godavari basin.[81] Subsequently, the two companies agreed to form an independent expert panel to probe any pilferage.[82]

See also

References

- 1 2 3 4 5 "RIL Annual Report". RIL.

- ↑ "Reliance Industries Ltd. Share holding pattern". NDTV Profit. Retrieved November 8, 2016.

- ↑ "Reliance Industries AGM full text". Retrieved 21 July 2017.

- ↑ "Top companies in India by Net Profit". Moneycontrol.com. Retrieved 20 July 2017.

- ↑ "Top '100' companies by market capitalisation as on July 19, 2017". bseindia.com. Retrieved 20 July 2017.

- ↑ "Global 500". CNN.com. Retrieved 14 August 2013.

- ↑ "Fortune Global 500 list". CNN Money. Retrieved 14 August 2013.

- ↑ "Reliance Industries AGM full text". Retrieved 21 July 2017.

- ↑ "Reliance Industries AGM full text". Retrieved 21 July 2017.

- ↑ "Ambani: From a gas station attendant to Reliance owner". Arab News. 2 November 2012. Retrieved 26 August 2013.

- 1 2 3 4 5 6 "Company History – Reliance Industries Ltd.". Economic Times. Retrieved 26 August 2013.

- 1 2 3 4 "Major Milestones". RIL.com. Retrieved 22 August 2013.

- ↑ "Reliance Industries: Milestones of an oil giant – Slide 4". NDTV.com. Retrieved 25 August 2013.

- ↑ "Company History – Reliance Industries". MoneyControl.com. Retrieved 26 August 2013.

- 1 2 3 4 "Reliance Industries Ltd". HDFC Securities. Retrieved 26 August 2013.

- ↑ "Reliance Industries: Milestones of an oil giant – Slide 8". NDTV.com. Retrieved 25 August 2013.

- ↑ "Reliance Industries: Milestones of an oil giant – Slide 9". NDTV.com. Retrieved 25 August 2013.

- ↑ "Krishna-Godavari basin to yield 160mt oil: RIL". Economic Times. 1 November 2002. Retrieved 25 August 2013.

- ↑ "Reliance makes it big with IPCL". The Hindu. 20 May 2002. Retrieved 25 August 2013.

- ↑ "IPCL set to merge with Reliance Industries". Business Standard. 8 March 2007. Retrieved 25 August 2013.

- ↑ "Reliance-IPCL merger swap ratio set at 1:5". Financial Express. 11 March 2007. Retrieved 25 August 2013.

- 1 2 "Scheme of Demerger". RIL.com. Retrieved 25 August 2013.

- ↑ "BTvIn - Retail: Growth Engine For RIL". Btvin.

- ↑ "Reliance launches retail venture". BBC News. 3 November 2006. Retrieved 25 August 2013.

- ↑ "Coming to your neighbourhood – Reliance Fresh". Business Standard. 3 November 2006. Retrieved 25 August 2013.

- ↑ "Reliance Bets Big on 4G". WSJ. 12 June 2010. Retrieved 25 August 2013.

- ↑ "Reliance Industries to acquire Infotel Broadband". The Hindu. 11 June 2010. Retrieved 25 August 2013.

- ↑ "BP partners Reliance in $7.2 billion Indian oil hunt". Reuters India. 22 February 2011. Retrieved 25 August 2013.

- ↑ "Reliance Industries, BP complete $7.2-billion deal". Economic Times. 31 August 2011. Retrieved 25 August 2013.

- ↑ "RIL, Russia's Sibur join hands for Jamnagar butyl rubber unit". Economictimes.com. Retrieved 19 July 2017.

- 1 2 3 4 5 6 "Annual Report 2012-13" (PDF). RIL.com. 8 May 2013.

- ↑ "Reliance Industries buyback: Beyond face value". The Indian Express. 18 January 2013. Retrieved 24 August 2013.

- ↑ "Investors' Handbook". ril.com. Retrieved 15 August 2013.

- ↑ "Reliance Industries Ltd. – Listing". Economic Times. Retrieved 25 August 2013.

- ↑ "Listing Information". RIL.com. Retrieved 26 August 2013.

- ↑ "Credit Ratings". RIL.com. Retrieved 26 August 2013.

- ↑ "S&P raises credit rating on RIL to 'BBB+'". Reuters India. 29 May 2013. Retrieved 26 August 2013.

- ↑ "Rating Action: Moody's assigns definitive Baa2 rating to Reliance's USD senior unsecured perpetual notes". Moody's. 31 January 2013. Retrieved 26 August 2013.

- ↑ "RIL lines up close to $1 billion plan in aerospace sector, may hire around 1,500 people". The Times of India. 28 July 2012. Retrieved 26 August 2013.

- ↑ "Financial Presentation of 2012–13 Q4 Results" (PDF). RIL.com. 16 April 2013. Retrieved 27 August 2013.

- ↑ "Ambani tops retailer list, too". Business Standard. 17 August 2013. Retrieved 19 August 2013.

- ↑ "Few RIL retail arms still making losses". Business Standard. 11 May 2013. Retrieved 27 August 2013.

- ↑ "About us, Reliance Life Sciences". RelLife.com. Retrieved 18 August 2013.

- ↑ "Changing its DNA". Business Today. 30 September 2012. Retrieved 26 August 2013.

- ↑ "Welcome to Reliance Institute of Life Sciences". RILS.com. Retrieved 18 August 2013.

- ↑ "Reliance Institute of Life Sciences". minglebox.com. Retrieved 26 August 2013.

- ↑ "Company Overview of Reliance Logistics Private Limited". BusinessWeek. Retrieved 27 August 2013.

- ↑ "About us, Reliance Logistics". reliancelogistics.com. Archived from the original on 21 November 2010. Retrieved 18 August 2013.

- ↑ "Reliance in deal with CONCOR for logistics venture". 25 September 2007. Retrieved 27 August 2013.

- ↑ "Reliance Logistics Ltd". supplychainleaders.com. Retrieved 27 August 2013.

- ↑ "Reliance set to combine two logistics arms". Financial Chronicle. 31 March 2009. Retrieved 27 August 2013.

- ↑ "Clinical Research Services (CRS) group of Reliance Life Sciences". RelLife.com. Retrieved 18 August 2013.

- ↑ "About us, Reliance Solar". relsolar.com. Retrieved 18 August 2013.

- ↑ "About us, Relicord". relicord.com. Retrieved 18 August 2013.

- ↑ "AABB Accredited Cord Blood (CB) Facilities". AABB.org. Retrieved 18 August 2013.

- ↑ "Reliance Industries buys 95% stake in Infotel Broadband for Rs 4,800 cr". The Times of India. 12 June 2010. Retrieved 18 August 2013.

- ↑ "RIL Subsidiaries & Associates". RIL.com. Retrieved 20 August 2013.

- ↑ "Company History". moneycontrol.com. Retrieved 22 August 2013.

- ↑ "About us". RIIL.in. Retrieved 18 August 2013.

- ↑ "LYF Smartphones - Its All About Your Lifestyle". MyLYF. Retrieved 2016-03-01.

- ↑ "Sustainability Report 2011-12" (PDF). RIL.com. Retrieved 25 August 2013.

- ↑ "(RIL) to invest Rs 1.5 lakh crore over three years; increase staff strength". Indian Express. 7 June 2013. Retrieved 27 August 2013.

- ↑ "Reliance Industries AGM full text". Retrieved 21 July 2017.

- ↑ "RIL bags Refiner of the Year Award". Economic Times. 22 March 2013. Retrieved 20 August 2013.

- ↑ "India's top 50 brands". brandirectory.com. Retrieved 19 August 2013.

- ↑ "India's Most Trusted Brands 2014".

- ↑ "The Financial Express".

- ↑ "Reliance Industries Ltd gets certified as a 'Responsible Care' under American Chemistry Council". Economic Times. 4 March 2012. Retrieved 22 August 2013.

- ↑ "Top 100 Chemical Companies 2012". ICIS.com. 10 September 2012. Retrieved 22 August 2013.

- ↑ "Award for Sustainability(GPAS)". goldenpeacockawards.com. Retrieved 25 August 2013.

- ↑ "RIL named among 25 sustainable value creators globally: BCG". Economic Times. 14 October 2009. Retrieved 25 August 2013.

- ↑ "RIL among world's 100 best-managed cos". Rediff.com. 29 August 2000. Retrieved 25 August 2013.

- ↑ "Mukesh Ambani admits to differences with Anil". Rediff.com. 18 November 2004. Retrieved 28 August 2013.

- ↑ "Ambani vs Ambani". India Today. 6 December 2004. Retrieved 28 August 2013.

- ↑ "Cover Story: Ambani Settlement". India Today. 4 July 2005. Retrieved 28 August 2013.

- ↑ "Reliance Industries: Milestones of an oil giant". NDTV.com. Retrieved 28 August 2013.

- ↑ "Corporate Announcement – Reliance Industries hands over control of Four Demerged Companies to ADAG". bseindia.com/. 8 February 2006. Retrieved 28 August 2013.

- ↑ "Reliance demerger: What should you do?". Rediff.com. 17 January 2006. Retrieved 27 August 2013.

- ↑ "RIL pens demerger buyout cost". Business Standard. 17 January 2006. Retrieved 28 August 2013.

- ↑ "Independent panel to probe discrepancies in Krishna-Godavari Basin". hindustantimes.com. Retrieved 30 May 2014.

- ↑ "Independent panel to probe discrepancies in Krishna-Godavari Basin". IANS. news.biharprabha.com. Retrieved 30 May 2014.