Externality

In economics, an externality is the cost or benefit that affects a party who did not choose to incur that cost or benefit.[1] Economists often urge governments to adopt policies that "internalize" an externality, so that costs and benefits will affect mainly parties who choose to incur them.[2]

For example, manufacturing activities that cause air pollution impose health and clean-up costs on the whole society, whereas the neighbors of an individual who chooses to fire-proof his home may benefit from a reduced risk of a fire spreading to their own houses. If external costs exist, such as pollution, the producer may choose to produce more of the product than would be produced if the producer were required to pay all associated environmental costs. Because responsibility or consequence for self-directed action lies partly outside the self, an element of externalization is involved. If there are external benefits, such as in public safety, less of the good may be produced than would be the case if the producer were to receive payment for the external benefits to others. For the purpose of these statements, overall cost and benefit to society is defined as the sum of the imputed monetary value of benefits and costs to all parties involved.[3][4] Thus, unregulated markets in goods or services with significant externalities generate prices that do not reflect the full social cost or benefit of their transactions; such markets are therefore inefficient.

History of the concept

Two British economists are credited with having initiated the formal study of externalities, or "spillover effects": Henry Sidgwick (1838-1900) is credited with first articulating, and Arthur C. Pigou (1877-1959) is credited with formalizing the concept of externalities.[5]

Definition

Suppose that there are different possible allocations and different agents, where and . Suppose that each agent has a type and that each agent gets payoff , where is the transfer paid by the -th agent. A map is a social choice function if

for all An allocation is ex-post efficient if

for all and all .

Let denote an ex-post efficient allocation and let denote an ex-post efficient allocation without agent . Then the externality imposed by agent on the other agents is

- ,[6]

where is the type vector without its -th component. Intuitively, the first term is the hypothetical total payoff for all agents given that agent does not exist, and the second (subtracted) term is the actual total payoff for all agents given that agent does exist.

Implications

Voluntary exchange is considered mutually beneficial to both parties involved, because buyers or sellers would not trade if either thought it detrimental to themselves. However, a transaction can cause additional effects on third parties. From the perspective of those affected, these effects may be negative (pollution from a factory), or positive (honey bees kept for honey that also pollinate neighboring crops). Neoclassical welfare economics asserts that, under plausible conditions, the existence of externalities will result in outcomes that are not socially optimal. Those who suffer from external costs do so involuntarily, whereas those who enjoy external benefits do so at no cost.

A voluntary exchange may reduce societal welfare if external costs exist. The person who is affected by the negative externalities in the case of air pollution will see it as lowered utility: either subjective displeasure or potentially explicit costs, such as higher medical expenses. The externality may even be seen as a trespass on their lungs, violating their property rights. Thus, an external cost may pose an ethical or political problem. Alternatively, it might be seen as a case of poorly defined property rights, as with, for example, pollution of bodies of water that may belong to no one (either figuratively, in the case of publicly owned, or literally, in some countries and/or legal traditions).

On the other hand, a positive externality would increase the utility of third parties at no cost to them. Since collective societal welfare is improved, but private providers would have no way of monetizing the benefit, less of the good will be produced than would be optimal for society as a whole in a theoretical model with no government. Goods with positive externalities include education (believed to increase societal productivity and well-being, though some benefits are internalized in the form of higher wages), public health initiatives (which may reduce the health risks and costs for third parties for such things as transmittable diseases) and law enforcement.

Positive externalities are often associated with the free rider problem. For example, individuals who are vaccinated reduce the risk of contracting the relevant disease for all others around them, and at high levels of vaccination, society may receive large health and welfare benefits; but any one individual can refuse vaccination, still avoiding the disease by "free riding" on the costs borne by others.

There are a number of theoretical means of improving overall social utility when negative externalities are involved. The market-driven approach to correcting externalities is to "internalize" third party costs and benefits, for example, by requiring a polluter to repair any damage caused. But in many cases, internalizing costs or benefits is not feasible, especially if the true monetary values cannot be determined.

Laissez-faire economists such as Friedrich Hayek and Milton Friedman sometimes refer to externalities as "neighborhood effects" or "spillovers", although externalities are not necessarily minor or localized. Similarly, Ludwig von Mises argues that externalities arise from lack of "clear personal property definition."

Examples

Negative

A negative externality (also called "external cost" or "external diseconomy") is an economic activity that imposes a negative effect on an unrelated third party. It can arise either during the production or the consumption of a good or service.[7] Pollution is termed an externality because it imposes costs on people who are "external" to the producer and consumer of the polluting product.[8] Barry Commoner commented on the costs of externalities:

- Clearly, we have compiled a record of serious failures in recent technological encounters with the environment. In each case, the new technology was brought into use before the ultimate hazards were known. We have been quick to reap the benefits and slow to comprehend the costs.[9]

Many negative externalities are related to the environmental consequences of production and use. The article on environmental economics also addresses externalities and how they may be addressed in the context of environmental issues.

Examples for negative production externalities include:

- Air pollution from burning fossil fuels. This activity causes damages to crops, (historic) buildings and public health.[10][11]

- Anthropogenic climate change as a consequence of greenhouse gas emissions from burning oil, gas, and coal. The Stern Review on the Economics Of Climate Change says "Climate change presents a unique challenge for economics: it is the greatest example of market failure we have ever seen."[12]

- Water pollution by industries that adds effluent, which harms plants, animals, and humans.

- Noise pollution during the production process, which may be mentally and psychologically disruptive.

- Systemic risk: the risks to the overall economy arising from the risks that the banking system takes. A condition of moral hazard can occur in the absence of well-designed banking regulation,[13] or in the presence of badly designed regulation.[14]

- Negative effects of Industrial farm animal production, including "the increase in the pool of antibiotic-resistant bacteria because of the overuse of antibiotics; air quality problems; the contamination of rivers, streams, and coastal waters with concentrated animal waste; animal welfare problems, mainly as a result of the extremely close quarters in which the animals are housed."[15][16]

- The depletion of the stock of fish in the ocean due to overfishing. This is an example of a common property resource, which is vulnerable to the Tragedy of the commons in the absence of appropriate environmental governance.

- In the United States, the cost of storing nuclear waste from nuclear plants for more than 1,000 years (over 100,000 for some types of nuclear waste) is, in principle, included in the cost of the electricity the plant produces in the form of a fee paid to the government and held in the nuclear waste superfund, although much of that fund was spent on Yucca Mountain without producing a solution. Conversely, the costs of managing the long term risks of disposal of chemicals, which may remain hazardous on similar time scales, is not commonly internalized in prices. The USEPA regulates chemicals for periods ranging from 100 years to a maximum of 10,000 years.

Examples of negative consumption externalities include:

- Noise pollution Sleep deprivation due to a neighbour listening to loud music late at night.

- Antibiotic resistance, caused by increased usage of antibiotics. Individuals do not consider this efficacy cost when making usage decisions. Government policies proposed to preserve future antibiotic effectiveness include educational campaigns, regulation, Pigouvian taxes, and patents.

- Passive smoking Shared costs of declining health and vitality caused by smoking and/or alcohol abuse. Here, the "cost" is that of providing minimum social welfare. Economists more frequently attribute this problem to the category of moral hazards, the prospect that parties insulated from risk may behave differently from the way they would if they were fully exposed to the risk. For example, individuals with insurance against automobile theft may be less vigilant about locking their cars, because the negative consequences of automobile theft are (partially) borne by the insurance company.

- Traffic congestion When more people use public roads, road users experience [(congestion costs)] such as more waiting in traffic and longer trip times. Increased road users also increase the likelihood of road accidents.[17]

- Price increases Consumption by one consumer of goods in addition to their existing supply causes prices to rise and therefore makes other consumers worse off, perhaps by preventing, reducing or delaying their consumption. These effects are sometimes called "pecuniary externalities" and are distinguished from "real externalities" or "technological externalities". Pecuniary externalities appear to be externalities, but occur within the market mechanism and are not considered to be a source of market failure or inefficiency, although they may still result in substantial harm to others.[18]

Positive

A positive externality (also called "external benefit" or "external economy" or "beneficial externality") is the positive effect an activity imposes on an unrelated third party.[19] Similar to a negative externality, it can arise either on the production side, or on the consumption side.[7]

Examples of positive production externalities include:

- A beekeeper who keeps the bees for their honey. A side effect or externality associated with such activity is the pollination of surrounding crops by the bees. The value generated by the pollination may be more important than the value of the harvested honey.

- The construction and operation of an airport. This will benefit local businesses, because of the increased accessibility.

- An industrial company providing first aid classes for employees to increase on the job safety. This may also save lives outside the factory.

- A foreign firm that demonstrates up-to-date technologies to local firms and improves their productivity.[20]

Examples of positive consumption externalities include:

- An individual who maintains an attractive house may confer benefits to neighbors in the form of increased market values for their properties.

- An individual receiving a vaccination for a communicable disease not only decreases the likelihood of the individual's own infection, but also decreases the likelihood of others becoming infected through contact with the individual. (See herd immunity)

- Driving an electric vehicle charged by electricity from a renewable source, reducing greenhouse gas emissions and improving local air quality and public health. Although this may increase emissions from power plants burning fossil fuels, this is usually more than offset by reduced vehicle emissions, especially where hydroelectric, nuclear and renewable sources are prevalent.[21]

- Increased education of individuals, as this can lead to broader society benefits in the form of greater economic productivity, a lower unemployment rate, greater household mobility and higher rates of political participation.[22]

- An individual buying a product that is interconnected in a network (e.g., a smartphone). This will increase the usefulness of such phones to other people who have a video cellphone. When each new user of a product increases the value of the same product owned by others, the phenomenon is called a network externality or a network effect. Network externalities often have "tipping points" where, suddenly, the product reaches general acceptance and near-universal usage.

- In an area that does not have a public fire department, homeowners who purchase private fire protection services provide a positive externality to neighboring properties, which are less at risk of the protected neighbor's fire spreading to their (unprotected) house.

The existence or management of externalities may give rise to political or legal conflicts.

Collective solutions or public policies are implemented to regulate activities with positive or negative externalities.

Positional

A position externality "occurs when new purchases alter the relevant context within which an existing positional good is evaluated."[23] Robert H. Frank gives the following example:

- if some job candidates begin wearing expensive custom-tailored suits, a side effect of their action is that other candidates become less likely to make favorable impressions on interviewers. From any individual job seeker's point of view, the best response might be to match the higher expenditures of others, lest her chances of landing the job fall. But this outcome may be inefficient, since when all spend more, each candidate's probability of success remains unchanged. All may agree that some form of collective restraint on expenditure would be useful."[23]

Frank notes that treating positional externalities like other externalities might lead to "intrusive economic and social regulation."[23] He argues, however, that less intrusive and more efficient means of "limiting the costs of expenditure cascades"—i.e., the hypothesized increase in spending of middle-income families beyond their means "because of indirect effects associated with increased spending by top earners"—exist; one such method is the personal income tax.[23]

Inframarginal

Inframarginal externalities are externalities in which there is no benefit or loss to the marginal consumer. In other words, people neither gain nor lose anything at the margin, but benefits and costs do exist for those consumers within the given inframarginal range.

Technological

Technological externalities directly affect a firm's production and therefore, indirectly influence an individual's consumption; and the overall impact of society.

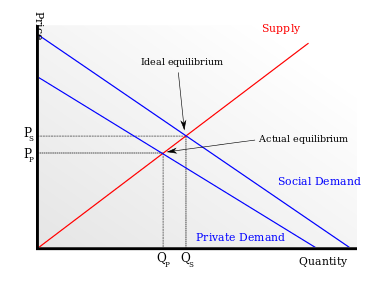

Supply and demand diagram

The usual economic analysis of externalities can be illustrated using a standard supply and demand diagram if the externality can be valued in terms of money. An extra supply or demand curve is added, as in the diagrams below. One of the curves is the private cost that consumers pay as individuals for additional quantities of the good, which in competitive markets, is the marginal private cost. The other curve is the true cost that society as a whole pays for production and consumption of increased production the good, or the marginal social cost. Similarly there might be two curves for the demand or benefit of the good. The social demand curve would reflect the benefit to society as a whole, while the normal demand curve reflects the benefit to consumers as individuals and is reflected as effective demand in the market.

What curve is added depends on the type of externality that is described, but not whether it is positive or negative. Whenever an externality arises on the production side, there will be two supply curves (private and social cost). However, if the externality arises on the consumption side, there will be two demand curves instead (private and social benefit). This distinction is essential when it comes to resolving inefficiencies that are caused by externalities.

External costs

The graph shows the effects of a negative externality. For example, the steel industry is assumed to be selling in a competitive market – before pollution-control laws were imposed and enforced (e.g. under laissez-faire). The marginal private cost is less than the marginal social or public cost by the amount of the external cost, i.e., the cost of air pollution and water pollution. This is represented by the vertical distance between the two supply curves. It is assumed that there are no external benefits, so that social benefit equals individual benefit.

If the consumers only take into account their own private cost, they will end up at price Pp and quantity Qp, instead of the more efficient price Ps and quantity Qs. These latter reflect the idea that the marginal social benefit should equal the marginal social cost, that is that production should be increased only as long as the marginal social benefit exceeds the marginal social cost. The result is that a free market is inefficient since at the quantity Qp, the social benefit is less than the social cost, so society as a whole would be better off if the goods between Qp and Qs had not been produced. The problem is that people are buying and consuming too much steel.

This discussion implies that negative externalities (such as pollution) are more than merely an ethical problem. The problem is one of the disjuncture between marginal private and social costs that is not solved by the free market. It is a problem of societal communication and coordination to balance costs and benefits. This also implies that pollution is not something solved by competitive markets. Some collective solution is needed, such as a court system to allow parties affected by the pollution to be compensated, government intervention banning or discouraging pollution, or economic incentives such as green taxes.

External benefits

The graph shows the effects of a positive or beneficial externality. For example, the industry supplying smallpox vaccinations is assumed to be selling in a competitive market. The marginal private benefit of getting the vaccination is less than the marginal social or public benefit by the amount of the external benefit (for example, society as a whole is increasingly protected from smallpox by each vaccination, including those who refuse to participate). This marginal external benefit of getting a smallpox shot is represented by the vertical distance between the two demand curves. Assume there are no external costs, so that social cost equals individual cost.

If consumers only take into account their own private benefits from getting vaccinations, the market will end up at price Pp and quantity Qp as before, instead of the more efficient price Ps and quantity Qs. These latter again reflect the idea that the marginal social benefit should equal the marginal social cost, i.e., that production should be increased as long as the marginal social benefit exceeds the marginal social cost. The result in an unfettered market is inefficient since at the quantity Qp, the social benefit is greater than the societal cost, so society as a whole would be better off if more goods had been produced. The problem is that people are buying too few vaccinations.

The issue of external benefits is related to that of public goods, which are goods where it is difficult if not impossible to exclude people from benefits. The production of a public good has beneficial externalities for all, or almost all, of the public. As with external costs, there is a problem here of societal communication and coordination to balance benefits and costs. This also implies that vaccination is not something solved by competitive markets. The government may have to step in with a collective solution, such as subsidizing or legally requiring vaccine use. If the government does this, the good is called a merit good. Examples include policies to accelerate the introducing of Electric vehicles[24] or promote Bicycling[25] which benefit Public health.

Possible solutions

There are several general types of solutions to the problem of externalities:

- Pigovian taxes or subsidies intended to redress economic injustices or imbalances.

- Regulation to limit activity that might cause negative externalities

- Government provision of services with positive externalities

- Lawsuits to compensate affected parties for negative externalities

- Mediation or negotiation between those affected by externalities and those causing them

- Ecological economics, if more widely known and applied, would shift the economic paradigm from the current reductionist, strictly financial view to something more cognizant of externalities, and thus more extensible and sustainable over time.

A Pigovian tax (also called Pigouvian tax, after economist Arthur C. Pigou) is a tax imposed that is equal in value to the negative externality. The result is that the market outcome would be reduced to the efficient amount. A side effect is that revenue is raised for the government, reducing the amount of distortionary taxes that the government must impose elsewhere. Governments justify the use of Pigovian taxes saying that these taxes help the market reach an efficient outcome because this tax bridges the gap between marginal social costs and marginal private costs.[26]

Some arguments against Pigovian taxes say that the tax does not account for all the transfers and regulations involved with an externality. In other words, the tax only considers the amount of externality produced.[27] Another argument against the tax is that it does not take private property into consideration. Under the Pigovian system, one firm, for example, can be taxed more than another firm, even though the other firm is actually producing greater amounts of the negative externality.[28]

However, the most common type of solution is a tacit agreement through the political process. Governments are elected to represent citizens and to strike political compromises between various interests. Normally governments pass laws and regulations to address pollution and other types of environmental harm. These laws and regulations can take the form of "command and control" regulation (such as setting standards, targets, or process requirements), or environmental pricing reform (such as ecotaxes or other Pigovian taxes, tradable pollution permits or the creation of markets for ecological services). The second type of resolution is a purely private agreement between the parties involved.

Government intervention might not always be needed. Traditional ways of life may have evolved as ways to deal with external costs and benefits. Alternatively, democratically run communities can agree to deal with these costs and benefits in an amicable way. Externalities can sometimes be resolved by agreement between the parties involved. This resolution may even come about because of the threat of government action.

Ronald Coase argued that if all parties involved can easily organize payments so as to pay each other for their actions, then an efficient outcome can be reached without government intervention. Some take this argument further, and make the political claim that government should restrict its role to facilitating bargaining among the affected groups or individuals and to enforcing any contracts that result. This result, often known as the Coase theorem, requires that

- Property rights be well defined

- People act rationally

- Transaction costs be minimal

If all of these conditions apply, the private parties can bargain to solve the problem of externalities.

This theorem would not apply to the steel industry case discussed above. For example, with a steel factory that trespasses on the lungs of a large number of individuals with pollution, it is difficult if not impossible for any one person to negotiate with the producer, and there are large transaction costs. Hence the most common approach may be to regulate the firm (by imposing limits on the amount of pollution considered "acceptable") while paying for the regulation and enforcement with taxes. The case of the vaccinations would also not satisfy the requirements of the Coase theorem. Since the potential external beneficiaries of vaccination are the people themselves, the people would have to self-organize to pay each other to be vaccinated. But such an organization that involves the entire populace would be indistinguishable from government action.

In some cases, the Coase theorem is relevant. For example, if a logger is planning to clear-cut a forest in a way that has a negative impact on a nearby resort, the resort-owner and the logger could, in theory, get together to agree to a deal. For example, the resort-owner could pay the logger not to clear-cut – or could buy the forest. The most problematic situation, from Coase's perspective, occurs when the forest literally does not belong to anyone; the question of "who" owns the forest is not important, as any specific owner will have an interest in coming to an agreement with the resort owner (if such an agreement is mutually beneficial).

However, the Coase theorem is difficult to implement because Coase does not offer a negotiation method.[29] Additionally, firms could potentially bribe each other since there is little to no government interaction under the Coase theorem.[30] For example, if one oil firm has a high pollution rate and its neighboring firm is bothered by the pollution, then the latter firm may move depending on incentives. Thus, if the oil firm were to bribe the second firm, the first oil firm would suffer no negative consequences because the government would not know about the bribing.

Criticism

Ecological economics criticizes the concept of externality because there is not enough system thinking and integration of different sciences in the concept. Ecological economics is founded upon the view that the neoclassical economics (NCE) assumption that environmental and community costs and benefits are mutually canceling "externalities" is not warranted. Joan Martinez Alier,[31] for instance shows that the bulk of consumers are automatically excluded from having an impact upon the prices of commodities, as these consumers are future generations who have not been born yet. The assumptions behind future discounting, which assume that future goods will be cheaper than present goods, has been criticized by Fred Pearce[32] and by the recent Stern Report (although the Stern report itself does employ discounting and has been criticized for this and other reasons by ecological economists such as Clive Spash).[33]

Concerning these externalities, some like the eco-businessman Paul Hawken argue an orthodox economic line that the only reason why goods produced unsustainably are usually cheaper than goods produced sustainably is due to a hidden subsidy, paid by the non-monetized human environment, community or future generations.[34] These arguments are developed further by Hawken, Amory and Hunter Lovins to promote their vision of an environmental capitalist utopia in Natural Capitalism: Creating the Next Industrial Revolution.[35]

In contrast, ecological economists, like Joan Martinez-Alier, appeal to a different line of reasoning.[36] Rather than assuming some (new) form of capitalism is the best way forward, an older ecological economic critique questions the very idea of internalizing externalities as providing some corrective to the current system. The work by Karl William Kapp explains why the concept of "externality" is a misnomer.[37] In fact the modern business enterprise operates on the basis of shifting costs onto others as normal practice to make profits.[38] Charles Eisenstein has argued that this method of privatising profits while socialising the costs through externalities, passing the costs to the community, to the natural environment or to future generations is inherently destructive[39] As social ecological economist Clive Spash has noted, externality theory fallaciously assumes environmental and social problems are minor aberrations in an otherwise perfectly functioning efficient economic system.[40] Internalizing the odd externality does nothing to address the structural systemic problem and fails to recognize the all pervasive nature of these supposed 'externalities'.

See also

References

- ↑ Buchanan, James; Wm. Craig Stubblebine (November 1962). "Externality". Economica. 29 (116): 371–84. doi:10.2307/2551386.

- ↑ Jaeger, William. Environmental Economics for Tree Huggers and Other Skeptics, p. 80 (Island Press 2012): "Economists often say that externalities need to be 'internalized,' meaning that some action needs to be taken to correct this kind of market failure."

- ↑ J.J. Laffont (2008). "externalities," The New Palgrave Dictionary of Economics, 2nd Ed. Abstract.

- ↑ Kenneth J. Arrow (1969). "The Organization of Economic Activity: Issues Pertinent to the Choice of Market versus Non-market Allocations," in Analysis and Evaluation of Public Expenditures: The PPP System. Washington, D.C., Joint Economic Committee of Congress. PDF reprint as pp. 1–16 (press +).

- ↑ "Economics (McConnell), 18th Edition Chapter 16: Public Goods, Externalities, and Information Asymmetries".

- ↑ Mas-Colell, Andreu (1995). Microeconomic Theory. Oxford. p. 878. ISBN 0-19-507340-1.

- 1 2 "Microeconomics – Externalities". Retrieved 2014-11-23.

- ↑ Goodstein, Eban. Economics and the Environment. Wiley. p. 32. ISBN 9781118539729.

- ↑ Barry Commoner "Frail Reeds in a Harsh World". New York: The American Museum of Natural History. Natural History. Journal of the American Museum of Natural History, Vol. LXXVIII No. 2, February, 1969, p. 44

- ↑ Torfs R, Int Panis L, De Nocker L, Vermoote S (2004). Peter Bickel and Rainer Friedrich, eds. "Externalities of Energy Methodology 2005 Update Other impacts: ecosystems and biodiversity". EUR 21951 EN – Extern E. European Commission Publications Office, Luxembourg: 229–37.

- ↑ Rabl A, Hurley F, Torfs R, Int Panis L, De Nocker L, Vermoote S, Bickel P, Friedrich R, Droste-Franke B, Bachmann T, Gressman A, Tidblad J. Peter Bickel and Rainer Friedrich, eds. "Externalities of Energy Methodology 2005 Update, Impact pathway Approach Exposure – Response functions" (PDF). European Commission Publications Office, Luxembourg, 2005: 75–129.

- ↑ Stern, Nicholas (2006). "Introduction". The Economics of Climate Change The Stern Review (PDF). Cambridge University Press. ISBN 978-0-521-70080-1.

- ↑ http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1293468

- ↑ De Bandt, O.; Hartmann, P. (1998). "Risk Measurement and Systemic Risk" (PDF). Imes.boj.or.jp: 37–84.

- ↑ Weiss, Rick (2008-04-30). "Report Targets Costs Of Factory Farming". Washington Post.

- ↑ Pew Commission on Industrial Farm Animal Production. "Proc Putting Meat on The Table: Industrial Farm Animal Production in America". The Johns Hopkins Bloomberg School of Public Health..

- ↑ Small, Kenneth A.; José A. Gomez-Ibañez (1998). Road Pricing for Congestion Management: The Transition from Theory to Policy. The University of California Transportation Center, University of California at Berkeley. p. 213.

- ↑ Liebowitz, S.J.; Margolis, Stephen E. (1994). "Network externality: An uncommon tragedy". The Journal of Economic Perspectives. American Economic Association. 8 (2): 133–50. JSTOR 2138540. doi:10.1257/jep.8.2.133. (free version http://www.econ-pol.unisi.it/didattica/ecreti/Liebowitz-Margolis1994.pdf)

- ↑ Varian, H.R. (2010). Intermediate microeconomics: a modern approach. New York, NY: W.W. Norton & Co.

- ↑ Determinants of Horizontal Spillovers from FDI: Evidence from a Large Meta-Analysis

- ↑ Buekers, J; Van Holderbeke, M; Bierkens, J; Int Panis, L (2014). "Health and environmental benefits related to electric vehicle introduction in EU countries". Transportation Research Part D Transport and Environment. 33: 26–38. doi:10.1016/j.trd.2014.09.002.

- ↑ Weisbrod, Burton , 1962. External Benefits of Public Education, Princeton University

- 1 2 3 4 Robert H. Frank, "Are Positional Externalities Different from Other Externalities? " (draft for presentation for Why Inequality Matters: Lessons for Policy from the Economics of Happiness, Brookings Institution, Washington, D.C., June 4–5, 2003).

- ↑ Buekers, J (2014). "Health and environmental benefits related to electric vehicle introduction in EU countries". Transportation Research Part D Transport and Environment. 33: 26–38.

- ↑ Buekers, J; Dons, E; Elen, B; Int Panis, L (2015). "Health impact model for modal shift from car use to cycling or walking in Flanders: application to two bicycle highways". Journal of Transport and Health. 2 (4): 549. doi:10.1016/j.jth.2015.08.003.

- ↑ Barthold, Thomas A. (1994). "Issues in the Design of Excise Tax." Journal of Economic Perspectives. 133–51.

- ↑ Nye, John (2008). "The Pigou Problem." The Cato Institute. 32–36.

- ↑ Barnett, A.H. and Yundle, Bruce. (2005). "The End of the Externality Revolution." PDF.

- ↑ Varian, Hal (1994). "A Solution to the Problem of Externalities When Agents Are Well Informed." The American Economic Review. Vol. 84 No. 5.

- ↑ Marney, G.A. (1971). "The ‘Coase Theorem:' A Reexamination." Quarterly Journal of Economics.Vol. 85 No. 4. 718–23.

- ↑ Costanza, Robert; Segura,Olman; Olsen, Juan Martinez-Alier (1996). Getting Down to Earth: Practical Applications of Ecological Economics. Washington, D.C.: Island Press. ISBN 1559635037.

- ↑ Pearce, Fred "Blueprint for a Greener Economy"

- ↑ "Spash, C. L. (2007) The economics of climate change impacts à la Stern: Novel and nuanced or rhetorically restricted? Ecological Economics 63(4): 706–13" (PDF). Archived from the original (PDF) on 2014-02-02. Retrieved 2012-12-23.

- ↑ Hawken, Paul (1994) "The Ecology of Commerce" (Collins)

- ↑ Hawken, Paul; Amory and Hunter Lovins (2000) "Natural Capitalism: Creating the Next Industrial Revolution" (Back Bay Books)

- ↑ Martinez-Alier, Joan (2002) The Environmentalism of the Poor: A Study of Ecological Conflicts and Valuation. Cheltenham, Edward Elgar

- ↑ Kapp, Karl William (1963) The Social Costs of Business Enterprise. Bombay/London, Asia Publishing House.

- ↑ Kapp, Karl William (1971) Social costs, neo-classical economics and environmental planning. The Social Costs of Business Enterprise, 3rd edition. K. W. Kapp. Nottingham, Spokesman: 305–18

- ↑ Einsentein, Charles (2011), "Sacred Economics: Money, Gift and Society in an Age in Transition" (Evolver Editions)

- ↑ Spash, Clive L. (16 July 2010). "The brave new world of carbon trading". New Political Economy. Taylor and Francis Online. 15 (2): 169–95. doi:10.1080/13563460903556049. Copy also available at "Archived copy" (PDF). Archived from the original (PDF) on 2013-05-10. Retrieved 2013-09-13.

Further reading

- Baumol, W. J. (1972). "On Taxation and the Control of Externalities". American Economic Review. 62 (3): 307–22. JSTOR 1803378.

- Johnson, Paul M. Definition "A Glossary of Economic Terms"

- Pigou, A.C. (1920). Economics of Welfare. Macmillan and Co.

- Tullock, G. (2005). Public Goods, Redistribution and Rent Seeking. Edward Elgar Publishing, Inc. ISBN 1-84376-637-X.

- Volokh, Alexander (2008). "Externalities". In Hamowy, Ronald. The Encyclopedia of Libertarianism. The Encyclopedia of Libertarianism. Thousand Oaks, CA: SAGE; Cato Institute. pp. 162–63. ISBN 978-1-4129-6580-4. LCCN 2008009151. OCLC 750831024. doi:10.4135/9781412965811.n101.

- Weitzman, Martin (October 1974). "Prices vs. Quantities". The Review of Economic Studies. 41 (4): 477–91. JSTOR 2296698. doi:10.2307/2296698.

External links

| Wikimedia Commons has media related to Externality. |