Minimum wage in the United States

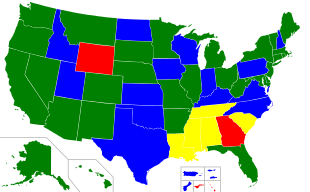

Versus the federal rate:

Higher Same Lower

The minimum wage in the United States is a network of federal, state, and local laws. Employers generally must pay workers the highest minimum wage prescribed by federal, state, and local law. As of July 2016, the federal government mandates a nationwide minimum wage of $7.25 per hour. As of October 2016, there are 29 states with a minimum wage higher than the federal minimum. From 2014 to 2015, nine states increased their minimum wage levels through automatic adjustments, while increases in 11 other states occurred through referendum or legislative action. In real terms, the federal minimum wage peaked near $10.00 per hour in 1968, using 2014 inflation-adjusted dollars.[1]

Beginning in January 2017, Massachusetts and Washington state have the highest minimum wages in the country, at $11.00 per hour.[2] New York City's minimum wage will be $15.00 per hour by the end of 2018.[3] There is a racial difference for support of a higher minimum wage with most black and Hispanic individuals supporting a $15.00 federal minimum wage, and 54% of whites opposing it.[4] In 2015, about 3 percent of White, Asian, and Hispanic or Latino workers earned the federal minimum wage or less. Among Black workers, the percentage was about 4 percent.[5]

History

20th century

In 1912, Massachusetts organized a commission to recommend non-compulsory minimum wages for women and children. Within eight years, at least thirteen U.S. states and the District of Columbia would pass minimum wage laws, with pressure being placed on state legislatures by the National Consumers League in a coalition with other women's voluntary associations and organized labor.[6][7] The United States Supreme Court of the Lochner era consistently invalidated compulsory minimum wage laws. Advocates for these minimum wage laws hoped that they would be upheld under the precedent of Muller v. Oregon, which had upheld maximum working hours laws for women on the grounds that women required special protection which men did not.[7] However, the Court did not extend this principle to minimum wage laws, considering the latter as interfering with the ability of employers to freely negotiate wage contracts with employees.[6]:518

In 1933, the Roosevelt administration made the first attempt at establishing a national minimum wage, when a $0.25 per hour standard was set as part of the National Industrial Recovery Act. However, in the 1935 court case Schechter Poultry Corp. v. United States (295 U.S. 495), the US Supreme Court declared the act unconstitutional, and the minimum wage was abolished. In 1938, the minimum wage was re-established pursuant to the Fair Labor Standards Act, once again at $0.25 per hour ($4.23 in 2015 dollars[9]). In 1941, the Supreme Court upheld the Fair Labor Standards Act in United States v. Darby Lumber Co., holding that Congress had the power under the Commerce Clause to regulate employment conditions.[10]

The 1938 minimum wage law only applied to "employees engaged in interstate commerce or in the production of goods for interstate commerce," but in amendments in 1961 and 1966, the federal minimum wage was extended (with slightly different rates) to employees in large retail and service enterprises, local transportation and construction, state and local government employees, as well as other smaller expansions; a grandfather clause in 1990 drew most employees into the purview of federal minimum wage policy, which now set the wage at $3.80.[11]

Legislation, 21st century

In 2006, voters in six states (Arizona, Colorado, Missouri, Montana, Nevada, and Ohio) approved statewide increases in the state minimum wage. The amounts of these increases ranged from $1 to $1.70 per hour and all increases were designed to annually index to inflation.[12] Some politicians in the United States have advocated linking the minimum wage to the Consumer Price Index, thereby increasing the wage automatically each year based on increases to the Consumer Price Index. So far, Ohio, Oregon, Missouri, Vermont and Washington have linked their minimum wages to the consumer price index. Minimum wage indexing also takes place each year in Florida, San Francisco, California, and Santa Fe, New Mexico.

The federal minimum wage in the United States was reset to its current rate of $7.25 per hour in July 2009.[11] Some U.S. territories (such as American Samoa) are exempt. Some types of labor are also exempt: employers may pay tipped labor a minimum of $2.13 per hour, as long as the hour wage plus tip income equals at least the minimum wage. Persons under the age of 20 may be paid $4.25 an hour for the first 90 calendar days of employment (sometimes known as a youth, teen, or training wage) unless a higher state minimum exists.[13] The 2009 increase was the last of three steps of the Fair Minimum Wage Act of 2007, which was signed into law as a rider to the U.S. Troop Readiness, Veterans' Care, Katrina Recovery, and Iraq Accountability Appropriations Act, 2007, a bill that also contained almost $5 billion in tax cuts for small businesses.

In April 2014, the U.S. Senate debated the Minimum Wage Fairness Act (S. 1737; 113th Congress). The bill would have amended the Fair Labor Standards Act of 1938 (FLSA) to increase the federal minimum wage for employees to $10.10 per hour over the course of a two-year period.[14] The bill was strongly supported by President Barack Obama and many of the Democratic Senators, but strongly opposed by Republicans in the Senate and House.[15][16][17] Later in 2014, voters in the Republican-controlled states of Alaska, Arkansas, Nebraska and South Dakota considered ballot initiatives to raise the minimum wage above the national rate of $7.25 per hour, which were successful in all 4 states. The results provided evidence that raising minimum wage has support across party lines.[18]

Since 2012, a growing protest and advocacy movement called "Fight for $15", initially growing out of fast food worker strikes, has advocated for an increase in the minimum wage. On March 27, 2014, Connecticut passed legislation to raise the minimum wage from $8.70 to $10.10 by 2017, making it one of about six states to aim at or above $10.00 per hour.[19] In 2014 and 2015, several cities, including San Francisco, Seattle, Los Angeles, and Washington passed ordinances that gradually increase the minimum wage to $15.00.[20][21] In 2016, New York and California passed legislation that would gradually raise the minimum wage to $15 in each state.[22][23]

As of 2017, recent legislation was passed in multiple states to raise the minimum wage a certain amount in a certain amount of time. California is set to raise their minimum wage to $15.00/hour by January 1, 2023.[24] Colorado is set to raise their minimum wage from $9.30/hour to $12/hour by January 1, 2020, raising $0.90 per year.[25] Seattle passed legislation in 2015 for a raise in minimum wage; for employers of 500 or more employees without heath benefits, the minimum wage will be raised to $15.00/hour by 2017, for employees with heath benefits, the minimum wage will raise to $15.00/hour by 2018, for smaller employees the $15.00/hour wage will be reached at different times. Seattle is one of the first cities to put in place a plan that after $15.00/hour wage is reached, they will continue to increase minimum wage by a certain percentage every year based on inflation changes. [26] New York has also recently passed legislation to increase their minimum wage to $15.00/hour over time, certain counties and larger companies are set on faster plans than others. [27] As there have only been a few places mentioned, cities and states across the United States are putting in place certain legislation to increase the minimum wage for minimum wage workers to a livable wage. Time will only tell the effects on the economy and number of jobs in those cities and states.

Local ordinances

On June 2, 2014, the City Council of Seattle, Washington passed a local ordinance to increase the minimum wage of the city to $15.00 per hour,[28] giving the city the highest minimum wage in the United States,[29][30] which will be phased in over seven years, to be fully implemented by 2021.[31] A growing number of California cities have enacted local minimum wage ordinances, including Los Angeles, San Francisco, Oakland, Berkeley, Emeryville, Mountain View, Richmond, and San Jose.

In September 2014, the Los Angeles City Council approved a minimum salary for hotel workers of $15.37 per hour.[32] In April 2016, The Los Angeles Times reported that there is an exemption for unionised workers, and interviewed longtime workers at unionised Sheraton Universal who make $10.00 per hour, whereas non-union employees at a non-union Hilton a few feet away make at least the $15.37 mandated by law for non-unionised employees.[33] Similar exemptions have been adopted in San Francisco, San Jose, Oakland, and Santa Monica.

San Francisco is expected to become the first U.S. city to reach a minimum wage of $15.00 per hour on July 1, 2018, .[34] The minimum wage in Los Angeles and Washington, D.C., will be $15.00 per hour in 2020.[35][36]

On August 18, 2015, the El Cerrito City Council directed city staff to draft a local minimum wage ordinance based on a template provided by a coalition for a county-wide minimum wage effort. The details are not final, but the Council discussed an initial increase of roughly 28–36% ($11.52 – $12.25 or more) by January 1, 2016, with annual increases that will result in a $15.00 hourly wage rate by 2018–2020. The Council did not direct staff to create small business exemptions (or any other exemptions), but a slower phase-in rate may be considered for employees of small businesses. The city will have outreach for residents and business owners to discuss the details of the proposed ordinance. Staff hopes to present a draft for The Council's approval as early as October or November 2015.[37]

Union exemptions

As of December 2014, unions were exempt from recent minimum wage increases in Chicago, Illinois, SeaTac, Washington, and Milwaukee County, Wisconsin, as well as the California cities of Los Angeles, San Francisco, Long Beach, San Jose, Richmond, and Oakland.[38] In 2016, the Washington, D.C. Council passed a minimum wage ordinance that included a union waiver, but Mayor Vincent Gray vetoed it. Later that year, the council approved an increase without the union waiver.[39]

Trends in purchasing power

Since its inception the purchasing power of the minimum wage has fluctuated. The minimum wage had its highest purchasing power in 1968, when it was $1.60 per hour ($10.88 in 2014 dollars).[9][1] From January 1981 to April 1990, the minimum wage was frozen at $3.35 per hour, then a record-setting minimum wage freeze. From September 1, 1997 through July 23, 2007, the federal minimum wage remained constant at $5.15 per hour, breaking the old record. From the United States Department of Labor. Employment Standards Administration. Wage and Hour Division, the source page has a clickable US map with current and projected state-by-state minimum wage rates for each state. Some government entities, such as counties and cities, observe minimum wages that are higher than the state as a whole. One notable example of this is Santa Fe, New Mexico, whose $9.50 per hour minimum wage was the highest in the nation,[40][41][42] until San Francisco increased its minimum wage to $9.79 in 2009.[43] Another device to increase wages, living wage ordinances, generally apply only to businesses that are under contract to the local government itself.

Since 1984, the purchasing power of the federal minimum wage has decreased. Measured in real terms (adjusted for inflation) using 1984 dollars, the real minimum wage was $3.35 in 1984, $2.90 in 1995, $2.74 in 2005, and $3.23 in 2013. If the minimum wage had been raised to $10.00 in 2013, that would have equated to $4.46 in 1984 dollars.[44][45]

Economic effects

The economic effects of raising the minimum wage are controversial. Adjusting the minimum wage may affect current and future levels of employment, prices of goods and services, economic growth, income inequality and poverty. The interconnection of price levels, central bank policy, wage agreements, and total aggregate demand creates a situation in which the conclusions drawn from macroeconomic analysis are highly influenced by the underlying assumptions of the interpreter.[46]

Employment and job creation

The law of demand states that—all else being equal—raising the price of any particular good or service will reduce the quantity demanded. Thus, neoclassical economics argues that—all else being equal—raising in the minimum wage will have adverse affects on employment.

Conceptually, if an employer does not believe a worker generates value equal to or in excess of the minimum wage, that worker will not be hired or retained.[47]

Empirical work on fast food workers in the 1990s challenged the neoclassical model. In 1994, economists David Card and Alan Krueger studied employment trends among 410 restaurants in New Jersey and eastern Pennsylvania following New Jersey's minimum wage hike (from $4.25 to $5.05) in April 1992. They found "no indication that the rise in the minimum wage reduced employment."[48] However, a 1995 re-analysis of the evidence by David Neumark found that the increase in New Jersey's minimum wage actually resulted in a 4.6% decrease in employment.[49] Neumark's study relied on payroll records from a sample of large fast-food restaurant chains, whereas the Card-Krueger study relied on business surveys.

Additional research conducted by David Neumark and William Wascher (which surveyed over 100 studies related to the employment effects of minimum wages) found that the majority of peer-reviewed economic research (about two-thirds) showed a positive correlation between minimum wage hikes and increased unemployment—especially for young and unskilled workers. Neumark's analysis further found that, when looking at only the most credible research, 85% of studies showed a positive correlation between minimum wage hikes and increased unemployment.[50]

In February 2014, the Congressional Budget Office (CBO) reported the theoretical effects of a federal minimum wage increase under two scenarios: an increase to $9.00 and an increase to $10.10. According to the report, approximately 100,000 jobs would be lost under the $9.00 option, whereas 500,000 jobs would be lost under the $10.10 option (with a wide range of possible outcomes).[51]

A 2013 Center for Economic and Policy Research (CEPR) review of multiple studies since 2000 indicated that there was "little or no employment response to modest increases in the minimum wage."[52] Another CEPR study in 2014 found that job creation within the United States is faster within states that raised their minimum wage.[53] In 2014, the state with the highest minimum wage in the nation, Washington, exceeded the national average for job growth in the United States.[54]

A 2012 study led by Joseph Sabia, professor of economics at the University of New Hampshire, estimated that the 2004-6 New York State minimum wage increase (from $5.15 to $6.75) resulted in a 20.2% to 21.8% reduction in employment for less-skilled, less-educated workers.[55] Another study conducted by Joseph Sabia, then an assistant professor at American University, found that minimum wages were ineffective at alleviating poverty for single mothers. The study further concluded that a 10% increase in the minimum wage was associated with an 8.8% reduction in employment and an 11.8% reduction in hours for uneducated single mothers.[56]

Research conducted by Richard Burkhauser, professor emeritus of Policy Analysis at Cornell University, concluded that minimum wage increases "significantly reduce the employment of the most vulnerable groups in the working-age population—young adults without a high school degree (aged 20-24), young black adults and teenagers (aged 16-24), and teenagers (aged 16-19)."[57]

A 2007 study by Daniel Aaronson and Eric French concluded that a 10% increase in the minimum wage decreased low-skill employment by 2-4% and total restaurant employment by 1-3%.[58]

The Economist wrote in December 2013: "A minimum wage, providing it is not set too high, could thus boost pay with no ill effects on jobs...Some studies find no harm to employment from federal or state minimum wages, others see a small one, but none finds any serious damage...High minimum wages, however, particularly in rigid labour markets, do appear to hit employment. France has the rich world’s highest wage floor, at more than 60% of the median for adults and a far bigger fraction of the typical wage for the young. This helps explain why France also has shockingly high rates of youth unemployment: 26% for 15- to 24-year-olds."[59]

Prices

Conceptually—all else being equal—raising the minimum wage will increase the cost of labor. Thus, employers may accept lower profits, raise their prices, or both. If prices increase, consumers may demand a lesser quantity of the product, substitute other products, or switch to imported products. Marginal producers (those who are barely profitable enough to survive) may be forced out of business if they cannot raise their prices sufficiently to offset the higher cost of labor. Whether the increased income of the workers benefiting from the minimum wage increase can offset these effects is debatable.[47] Federal Reserve Bank of Chicago research from 2007 has shown that restaurant prices rise in response to minimum wage increases.[60]

Crime increase

A 2016 White House report based on "back of envelope calculations and literature review" argued that higher hourly wages led to less crime.[61]

A report by the Council of Economic Advisers claimed that "raising the minimum wage reduces crime by 3 to 5 percent." To get those numbers, the study assumed that "such a minimum wage increase would have no employment impacts, with an employment elasticity of 0.1 the benefits would be somewhat lower."[61]

However, In a 1987 journal article based on actual study data, Masanori Hashimoto noted that minimum wage hikes lead to increased levels of property crime in areas affected by the minimum wage after its increase.[62] According to the article, by decreasing employment in poor communities, total legal trade and production are curtailed. The report also claimed that in order to compensate for the decrease in legal avenues for production and consumption, poor communities increasingly turn to illegal trade and activity.[62]

Economic growth

Whether growth (GDP, a measure of both income and production) increases or decreases depends significantly on whether the income shifted from owners to workers results in an overall higher level of spending. The tendency of a consumer to spend their next dollar is referred to as the marginal propensity to consume or MPC. The transfer of income from higher income owners (who tend to save more, meaning a lower MPC) to lower income workers (who tend to save less, with a higher MPC) can actually lead to an increase in total consumption and higher demand for goods, leading to increased employment.[51] Recent research has shown that higher wages lead to greater productivity. [63]

The CBO reported in February 2014 that income (GDP) overall would be marginally higher after raising the minimum wage, indicating a small net positive increase in growth. Raising the minimum wage to $10.10 and indexing it to inflation would result in a net $2 billion increase in income during the second half of 2016, while raising it to $9.00 and not indexing it would result in a net $1 billion increase in income.[51]

Income inequality

An increase in the minimum wage is a form of redistribution from higher-income persons (business owners or "capital") to lower income persons (workers or "labor") and therefore should reduce income inequality. The CBO estimated in February 2014 that raising the minimum wage under either scenario described above would improve income inequality. Families with income more than 6 times the poverty threshold would see their incomes fall (due in part to their business profits declining with higher employee costs), while families with incomes below that threshold would rise.[51]

Poverty

Among hourly-paid workers In 2016, 701,000 earned the federal minimum wage and about 1.5 million earned wages below the minimum. Together, these 2.2 million workers represented 2.7% of all hourly-paid workers.[65]

CBO estimated in February 2014 that raising the minimum wage would reduce the number of persons below the poverty income threshold by 900,000 under the $10.10 option versus 300,000 under the $9.00 option.[51]

Research conducted by David Neumark and colleagues found that minimum wages are associated with reductions in the hours and employment of low-wage workers.[66] A separate study by the same researchers found that minimum wages tend to increase the proportion of families with incomes below or near the poverty line.[67] Similarly, a 2002 study led by Richard Vedder, professor of economics at Ohio University, concluded that "The empirical evidence is strong that minimum wages have had little or no effect on poverty in the U.S. Indeed, the evidence is stronger that minimum wages occasionally increase poverty…"[68]

Federal budget deficit

The CBO reported in February 2014 that "[T]he net effect on the federal budget of raising the minimum wage would probably be a small decrease in budget deficits for several years but a small increase in budget deficits thereafter. It is unclear whether the effect for the coming decade as a whole would be a small increase or a small decrease in budget deficits." On the cost side, the report cited higher wages paid by the government to some of its employees along with higher costs for certain procured goods and services. This might be offset by fewer government benefits paid, as some workers with higher incomes would receive fewer government transfer payments. On the revenue side, some would pay higher taxes and others less.[51]

Commentary

Economists

| City | Effective minimum wage |

|---|---|

| Seattle | $8.51 |

| Denver | $7.57 |

| Houston | $7.26 |

| United States | $7.25 |

| San Francisco | $7.03 |

| Chicago | $7.01 |

| Boston | $6.59 |

| Washington, D.C. | $6.53 |

| Los Angeles | $6.38 |

| Atlanta | $5.15 |

| New York City | $3.86 |

According to a survey conducted by economist Greg Mankiw, 79% of economists agreed that "a minimum wage increases unemployment among young and unskilled workers."[71]

A 2015 survey conducted by the University of New Hampshire Survey Center found that a majority of economists believed raising the minimum wage to $15 per hour would have negative effects on youth employment levels (83%), adult employment levels (52%), and the number of jobs available (76%). Additionally, 67% of economists surveyed believed that a $15 minimum wage would make it harder for small businesses with less than 50 employees to stay in business.[72]

A 2006 survey conducted by Robert Whaples, professor of economics at Wake Forest University, found that, among the economists surveyed[How many?], opinions about the minimum wage were as follows:[73]

- 46.8% favored eliminating it

- 14.3% favored keeping it the same

- 1.3% favored decreasing it

- 5.2% favored increasing it by about 50 cents per hour

- 15.6% favored increasing it by about $1 per hour

- 16.9% favored increasing it by more than $1 per hour

In 2014, over 600 economists signed a letter in support of a $10.10 minimum wage increase with research suggesting that a minimum wage increase could have a small stimulative effect on the economy as low-wage workers spend their additional earnings, raising demand and job growth.[74][75][76][77] Also, seven recipients of the Nobel Prize in Economic Sciences were among 75 economists endorsing an increase in the minimum wage for U.S. workers and said "the weight" of economic research shows higher pay doesn’t lead to fewer jobs.[78][79]

According to a February 2013 survey of the University of Chicago IGM Forum, which includes approximately 40 economists:

- 34% agreed with the statement that "Raising the federal minimum wage to $9 per hour would make it noticeably harder for low-skilled workers to find employment", with 32% disagreeing and 24% uncertain

- 42% agreed that "...raising the minimum wage to $9 per hour and indexing it to inflation...would be a desirable policy", with 11% disagreeing or strongly disagreeing and 32% uncertain.[80]

According to a fall 2000 survey conducted by Fuller and Geide-Stevenson, 73.5% (27.9% of which agreed with provisos) of American economists surveyed[How many?] agreed that minimum wage laws increase unemployment among unskilled and young workers, while 26.5% disagreed with the statement.[81]

Economist Paul Krugman advocated raising the minimum wage moderately in 2013, citing several reasons, including:

- The minimum wage was below its 1960s purchasing power, despite a near doubling of productivity;

- The great preponderance of the evidence indicates there is no negative impact on employment from moderate increases; and

- A high level of public support, specifically Democrats and Republican women.[82]

Politicians

Former President Bill Clinton advocated raising the minimum wage in 2014: "I think we ought to raise the minimum wage because it doesn’t just raise wages for the three or four million people who are directly affected by it, it bumps the wage structure everywhere...The estimates are that 35 million Americans would get a pay raise if the federal minimum wage was raised...If you [raise the minimum wage] in a phased way, it always creates jobs. Why? Because people who make the minimum wage or near it are struggling to get by, they spend every penny they make, they turn it over in the economy, they create jobs, they create opportunity, and they take better care of their children. It’s just the right thing to do, but it’s also very good economics."[83]

Polls

The Pew Center reported in January 2014 that 73% of Americans supported raising the minimum wage from $7.25 to $10. By party, 53% of Republicans and 90% of Democrats favored this action.[84] Pew found a racial difference for support of a higher minimum wage in 2017 with most blacks and Hispanics supporting a $15.00 federal minimum wage, and 54% of whites opposing it.[85]

A Lake Research Partners poll in February 2012 found the following:

- Strong support overall for raising the minimum wage, with 73% of likely voters supporting an increase to $10 and indexing it to inflation during 2014, including 58% who strongly support the action;

- Support crosses party lines, with support from 91% of Democrats, 74% of Independents, and 50% of Republicans; and

- A majority (56%) believe that raising the minimum wage will help the economy, with 16% believing it won't make a difference. Only 21% felt it would hurt the economy.[86]

List by jurisdiction

This is a list of the minimum wages (per hour) in each state and territory of the United States, for jobs covered by federal minimum wage laws. If the job is not subject to the federal Fair Labor Standards Act, then state, city, or other local laws may determine the minimum wage.[87] A common exemption to the federal minimum wage is a company having revenue of less than $500,000 per year while not engaging in any interstate commerce.

Under the federal law, workers who receive a portion of their salary from tips, such as waitstaff, are required only to have their total compensation, including tips, meet the minimum wage. Therefore, often, their hourly wage, before tips, is less than the minimum wage.[88] Seven states, and Guam, do not allow for a tip credit.[89] Additional exemptions to the minimum wage include many seasonal employees, student employees, and certain disabled employees as specified by the FLSA.[90]

In addition, some counties and cities within states may observe a higher minimum wage than the rest of the state in which they are located; sometimes this higher wage will apply only to businesses that are under contract to the local government itself, while in other cases the higher minimum will be enforced across the board.

Federal

| Type | Min Wage ($/h) | Notes |

|---|---|---|

| Tipped | $2.13 | The Fair Labor Standards Act of 1938 has been requiring a minimum wage of $2.13 for tipped workers with the expectation that wages plus tips total no less than $7.25 per hour since September 1, 1991.[91] The employer must pay the difference if total income does not add up to $7.25 per hour.[92] |

| Non-tipped | $7.25 | Per the Fair Minimum Wage Act of 2007 (FMWA) since July 24, 2009.[93] |

| Youth | $4.25 | The Fair Labor Standards Act has since September 1, 1996 allowed for persons under the age of 20 to be paid $4.25 for the first 90 calendar days of their employment .[94] |

State

The average US minimum wage per capita (2017) is $8.49 based on the population size of each state and generally represents the average minimum wage experienced by a person working in one of the fifty US states. Cities, counties, districts, and territories are not included in the calculation. As of October 2016, there have been 29 states with a minimum wage higher than the federal minimum. From 2014 to 2015, nine states increased their minimum wage levels through automatic adjustments, while increases in 11 other states occurred through referendum or legislative action.[1] Beginning in January 2017, Massachusetts and Washington state have the highest minimum wages in the country, at $11.00 per hour.[95] New York City's minimum wage will be $15.00 per hour by the end of 2018.[3] |-

| State | Min Wage ($/h)[96] |

Tipped ($/h)[lower-alpha 1] |

Youth/ Training ($/h)[lower-alpha 2] |

Notes |

|---|---|---|---|---|

| Alabama | None[lower-alpha 3] | |||

| Alaska | $9.80 | $9.80 | Minimum wage increased to $9.80 on January 1, 2017. | |

| Arizona | $10.00 | $7.00 | Minimum wage increased to $8.05 on January 1, 2015.[98] The state tipped minimum wage is $3 per hour less. Pursuant to Arizona Proposition 202 (2006), the rates are adjusted annually on January 1 based on the U.S. Consumer Price Index. This rate increase does not affect student workers in places such as libraries and cafeterias because those positions are given by universities, which are state entities.[99] | |

| Arkansas | $8.50 | $2.63 | The 2014 rate applies to employers of 4 or more employees.[100] | |

| California | $10.50[101] | $10.50 | Minimum wage increased to $10.00 on January 1, 2016[102] and will increase to $15.00 by 2022.[103] Berkeley: $12.53 since October 1, 2016 and will increase to $15.00 by 2018.[104] Emeryville: $14.82 for businesses with 56 or more employees; $13.00 for businesses with 55 employees or less, effective July 2016.[105] Jackson Rancheria: $10.60 since January 1, 2014 on the Tribe's sovereign 1,500-acre reservation in Amador County.[106] Oakland: $12.55 since January 1, 2016.[107] Unions are exempt from Oakland's minimum wage law.[38] Los Angeles: $10.50 since July 1, 2016 and will increase to $15.00 by 2020.[108] Unions are exempt from Los Angeles's minimum wage law.[38] San Francisco: $13.00 since July 1, 2016 and will increase to $15.00 by 2018.[109] Unions are exempt from San Francisco's minimum wage law.[38] San Jose: $10.30 since January 1, 2015.[110] Unions are exempt from San Jose's minimum wage law.[38] | |

| Colorado | $9.30 | $6.28 | On January 1, 2017, the minimum wage was increased to $9.30 and will be increased annually by $0.90 until it becomes $12 in January 2020. Starting in 2021, it will be adjusted by cost of living increases.[111] The tipped wage is $3.02 less than the minimum wage[112] | |

| Connecticut | $10.10 | $6.59 | On March 26, 2014, the state passed legislation to raise the minimum wage to $10.10 by January 1, 2017.[113] Connecticut's tipped minimum wage is 65.2% of the state minimum wage (tipped employees defined as $10/wk or $2/day in tips).[114] | |

| Delaware | $8.25 | $2.23 | Minimum wage increased to $8.25 on June 1, 2015.[115] | |

| Florida | $8.10 | $5.08 | Minimum wage is increased annually on September 30 (effective January 1 of the following calendar year) based upon a cost of living formula (the Consumer Price Index for Urban Wage Earners and Clerical Workers, not seasonally adjusted, for the South Region or a successor index as calculated by the United States Department of Labor, using the rate of inflation for the 12 months prior to September 1)[116]. Florida's minimum wage increased to $8.10 and the tipped minimum wage to $5.08 on January 1, 2017.[117] | |

| Georgia | $5.15 [118][119] |

$2.13 | Only applicable to employers of 6 or more employees. The state law excludes from coverage any employment that is subject to the Federal Fair Labor Standards Act when the federal rate is greater than the state rate.[120] | |

| Hawaii | $9.25 | $8.50 | Minimum wage increased to $8.50 on January 1, 2016, and will increase to $10.10 by January 1, 2018. Tipped employees earn 75 cents less than the current state minimum wage.[121] | |

| Idaho | $7.25[122] | $3.35 | ||

| Illinois | $8.25 | $4.95 | $7.75 | Employers may pay anyone under the age of 18, or anyone for the first 90 days of employment, fifty cents less. Tipped employees earn 60% of the minimum wage (employers may claim credit for tips, up to 40% of wage). There is a training wage for tipped employees.[123] Chicago: $10.00 from July 1, 2015 and will increase to $13.00 by 2019.[124] Unions are exempt from Chicago's minimum wage law.[38] |

| Indiana | $7.25[125] | $2.13 | ||

| Iowa | $7.25[126] | $4.35 | Most small retail and service establishments grossing less than $300,000 annually are not required to pay the minimum wage.[126] A tipped employee who makes $30.00 per month or more in tips, can be paid 60% of the minimum wage, i.e. as little as $4.35 per hour.[126] Increased minimum wage laws in Johnson and Linn counties were nullified by the legislature.[127] | |

| Kansas | $7.25[128] | $2.13 | Kansas had the lowest legislated, non-tipped worker, minimum wage in the U.S., $2.65 per hour, until it was raised to $7.25, effective January 1, 2010.[129] | |

| Kentucky | $7.25[130] | $2.13 | Louisville: $8.10 from July 1, 2015 and will increase to $9.00 by 2017.[131][132] However, the Kentucky Supreme Court ruled that localities do not have authority to increase the minimum wage.[133] | |

| Louisiana | None[lower-alpha 3] | |||

| Maine | $9.00 | $5.00 | Tipped rate is half of the current state minimum wage.[134] On July 6, 2015, the city council of Portland voted 6-3 to raise the city's minimum wage to $10.10 beginning on January 1, 2016 – an increase of 34%.[135] Note: The tipped wage will return to being 50% of the regular minimum wage starting January 1, 2018; minimum wage will increase to $10 in January 2018, $11 in January 2019; $12 in January 2020.[136][137] | |

| Maryland | $9.25 | $3.63 | Minimum wage is $8.75 per hour as July 1, 2016; $9.25 as of July 1, 2017; and $10.10 as of July 1, 2018.[138][139]

For employees working in Prince George's County, the minimum wage is $10.75 per hour, effective October 1, 2016, and increases to $11.50 on October 1, 2017.[138] For employees working in Montgomery County, the minimum wage is $11.50 per hour starting July 1, 2017.[140] County Council bill 12-16 was enacted on January 17, 2017 to adjust the minimum wage to $15 and base future adjustments on the Consumer Price Index, but was later vetoed by the County Executive.[141][142] | |

| Massachusetts | $11.00 | $3.75 | Minimum wage increased to $11.00 ($3.75 for tipped workers) on January 1, 2017, making it the highest minimum-wage in the country at the state level. Massachusetts is the only state in the country that mandates time-and-a-half for retail workers working on Sunday. With state minimum wage at $11 an hour the effective minimum wage for a retail worker working on Sunday is $16.50 an hour.[143] As of 2017, Massachusetts has the largest gap between the hourly minimum wage for tipped workers ($3.75) and the general minimum wage ($11).[144] | |

| Michigan | $8.90[145] | $3.38 $8.90(tips included) | $4.25 (training) $7.57 (youth) | Minimum wage will increase to $9.25 by January 2018 and increase with the consumer price index yearly after 2018. Yearly increases, starting on February 1 2019, shall not exceed 3.5%. There will be no increase in minimum wage if the unemployment rate rises to or above 8.5% in the previous year. Tipped workers must earn at least standard Michigan minimum wage once tips are included in their wages.[146][147] |

| Minnesota | $9.50[118] | $9.50 | $7.25[148] | Small employers, whose annual receipts are less than $500,000 and who do not engage in interstate commerce, can pay their employees $7.25 per hour. Overtime applies after 48 hours per week.[148] Note: For large employers, the minimum wage became $9.00 on August 1, 2015; and $9.50 on August 1, 2016. For small employers the minimum wage became $7.25 on August 1, 2015; and $7.75 on August 1, 2016. Beginning January 1, 2018, all minimum wage rates will increase by the national implicit price deflator or 2.5%, whichever is lower.[149] |

| Mississippi | None[lower-alpha 3] | |||

| Missouri | $7.70 | $3.825 | Minimum wage rate is automatically adjusted annually based on the U.S. Consumer Price Index rounded to the nearest five cents, and increased to $7.70 on January 1, 2017.[150] While a city ordinance was passed in St. Louis area to increase the minimum wage was set to $8.25 in 2015,[151] in October 2015 the law was voided by a new statewide bill barring cities from setting their own minimum wages.[152] The State Supreme Court ruled on 28 February 2017 that the ordinance was lawful and could go into effect, with the minimum wage rate set to rise to $11.00 an hour by 2018 in St. Louis.[153] However, on July 5, 2017, another law was passed to nullify the increase and to have a statewide minimum wage of $7.70.[154] | |

| Montana | $8.15 | $8.15 | Minimum wage rate is automatically adjusted annually based on the U.S. Consumer Price Index, and increased to $8.15 on January 1, 2017. Income from tips cannot offset an employee's pay rate. The state minimum wage for business with less than $110,000 in annual sales is $4.00.[96] | |

| Nebraska | $9.00[155] | $2.13 | Minimum wage increased to $9.00 January 1, 2016.[100] | |

| Nevada | $8.25 | $8.25 | The minimum wage has been $8.25 ($1 higher than the federal minimum) since July 1, 2010. Employers who offer health benefits can pay employees $7.25.[156] The rate is adjusted every July 1, based on the federal minimum or the accumulated inflation since 2006, whichever is higher, based on a 2006 Minimum Wage Amendment to the Nevada Constitution.[157] | |

| New Hampshire | $7.25[158] | $3.27 | ||

| New Jersey | $8.44[159] | $2.13 | Minimum wage increased to $8.44 on January 1, 2017.[159] | |

| New Mexico | $7.50 | $2.13 | Santa Fe: $10.84 since January 1, 2015.[160] Albuquerque: $8.75 since January 1, 2015.[161] | |

| New York | $9.75[162] | Varies | The minimum wage rate increased to $9.00 on December 31, 2015.[163] As of July 24, 2009 there has been a minimum for exempt employees of $543.75 per week.[164] Tipped employee minimum ranges from $4.90 to $5.65 depending on industry.[97] Effective December 31, 2013, there have been different rules for the minimum cash wage for tipped employees outside of the hospitality industry, (e.g., in car washes and in salons). For workers earning more than $1.95 on average per hour in tips, the minimum cash wage has been $6.05 per hour; for workers earning between $1.20 and $1.95 in tips on average per hour, the cash wage has been $6.80.[165]

A 2016 law changed the minimum wage over the following six years. "Large" employers have 11 or more employees, and "small" have between 1 and 10. "Downstate" includes Nassau, Suffolk, and Westchester Counties.[166] NYC large employers: $11.00, NYC small employers: $10.50, Downstate employers: $10.00, Upstate employers: $9.70. As of December 31, 2017: NYC large employers: $13.00; NYC small employers: $12.00; Downstate employers: $11.00; Upstate employers: $10.40. As of December 31, 2018: NYC large employers: $15.00; NYC small employers: $13.50; Downstate employers: $12.00; Upstate employers: $11.10. As of December 31, 2019: NYC large employers: $15.00; NYC small employers: $15.00; Downstate employers: $13.00; Upstate employers: $12.50. As of December 31, 2020: NYC large employers: $15.00; NYC small employers: $15.00; Downstate employers: $14.00; Upstate employers: $12.50. As of December 31, 2021: NYC large employers: $15.00; NYC small employers: $15.00; Downstate employers: $15.00; Upstate employers: Set by Commissioner of Labor based on economic conditions, up to $15.00. Tipped food service workers will be paid $7.50 per hour, or two-thirds of the applicable minimum wage rate rounded to the nearest $0.05, whichever is higher. | |

| North Carolina | $7.25[167] | $2.13 | The employer may take credit for tips earned by a tipped employee and may count them as wages up to the amount permitted in section 3(m) of the Fair Labor Standards Act.[167] | |

| North Dakota | $7.25[168] | $4.86 | Tipped minimum is 67% of the minimum wage.[97] | |

| Ohio | $8.15 | $4.08 | $7.25 under 16 years old | The rate is $7.25 for employers grossing $283,000 or less.[169] The rate is adjusted annually on January 1 based on the U.S. Consumer Price Index[170] and |

| Oklahoma | $7.25[171] | $2.13 | Minimum wage for employers grossing under $100,000 and with fewer than 10 employees per location is $2.00.[172](OK Statutes 40-197.5). | |

| Oregon | $11.25 (Portland metro) $10.25 (non-rural counties) $10.00 (rural counties)[173] |

$11.25 (Portland metro) $10.25 (non-rural counties) $10.00 (rural counties) |

On March 2, 2016, Senate Bill 1532 was signed into law, increasing minimum wage depending on the county. Beginning July 1, 2016 the minimum wage increased to $9.75 for non-rural counties and to $9.50 for rural counties, thereafter increasing each year by fixed amounts until June 30, 2022 when the minimum wage will be $14.75 for the Portland metro area, $13.50 for other non-rural counties, and $12.50 for rural counties. Thereafter, the minimum wage will be adjusted each year based on the U.S. Consumer Price Index.[174] Non-rural counties are defined as Benton, Clackamas, Clatsop, Columbia, Deschutes, Hood River, Jackson, Josephine, Lane, Lincoln, Linn, Marion, Multnomah, Polk, Tillamook, Wasco, Washington, and Yamhill counties.[175] Rural counties are defined as Baker, Coos, Crook, Curry, Douglas, Gilliam, Grant, Harney, Jefferson, Klamath, Lake, Malheur, Morrow, Sherman, Umatilla, Union, Wallowa, Wheeler counties.[175] The Portland Metro rate ($1.25 over the non-rural rate) applies to employers located within the urban growth boundary (UGB) of the Portland metropolitan service district.[176] | |

| Pennsylvania | $7.25[177] | $2.83 | ||

| Rhode Island | $9.60 | $3.39 | Minimum wage increased to $9.60 January 1, 2016. | |

| South Carolina | None[lower-alpha 3] | |||

| South Dakota | $8.55[178] | $4.25 | Minimum wage increased to $8.55 on January 1, 2016, and is indexed to inflation. The minimum wage for those under 18 is $7.50.[178] | |

| Tennessee | None[lower-alpha 3] | |||

| Texas | $7.25[179] | $2.13 | Applies to all workers in the state, excluding patients of the Texas Department of Mental Health and Mental Retardation who have diminished production capacity and who work on behalf of the Department; their salary is calculated at the minimum wage times a percentage of their diminished capacity. | |

| Utah | $7.25 | $2.13 | ||

| Vermont | $10.00 | $4.80 | Minimum wage increased to $10.00 on January 1, 2017,[180] will increase to $10.50 by January 1, 2018, and will be indexed to inflation beginning on January 1, 2019.[181] | |

| Virginia | $7.25[182] | $2.13 | ||

| Washington | $11.00[183] | $11.00[183] | $9.35[184] | Minimum wage increases annually by a voter-approved cost-of-living adjustment based on the federal Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).[185] Seattle: $11.00 for businesses less than 500 employees, 15.00 for businesses with over 500 employees, and for all businesses by 2021.[186][187] SeaTac: $15.00 for airport-related businesses.[188] Union workshops are exempt from SeaTac's $15 minimum wage law.[189] |

| West Virginia | $8.75[190] | $2.62 | Minimum wage increased to $8.75 on December 31, 2015.[191] The state minimum wage is applicable to employers of six or more employees at one location not involved in interstate commerce[96] and for tipped employees is 30% of the federal minimum wage.[97] | |

| Wisconsin | $7.25[192] | $2.33 | ||

| Wyoming | $5.15[118] | $2.13 |

- ↑ Generally applies to employees who make over $30 in tips per month, unless otherwise noted.[97]

- ↑ Applies to persons under age 20, for the first 90 days of employment (per FMWA), unless otherwise noted.

- 1 2 3 4 5 No state minimum wage law. Federal rates apply, although some small businesses exempt from FMWA may not be covered.

Territory

| Territory | Min Wage ($/h)[96] | Notes |

|---|---|---|

| American Samoa | $4.18–$5.59 | Varies by industry.[193] On September 30, 2010, President Obama signed legislation that delays scheduled wage increases for 2010 and 2011. On July 26, 2012, President Obama signed S. 2009 into law, postponing the minimum wage increase for 2012, 2013, and 2014. Annual wage increases of $0.50 recommenced on September 30, 2015 and will continue every three years until all rates have reached the federal minimum.[194] |

| Guam | $8.25 | Tipped employee minimum $6.55[195] |

| Northern Mariana Islands | $6.55 | Since September 30, 2016. Wages are to go up $0.50 annually until reaching the federal $7.25 rate by 2018.[196] Bill S. 256 to delay the planned increases to the full rate until 2018 passed in Sept. 2013.[197] |

| Puerto Rico | $7.25 | Following the Fair Minimum Wage Act of 2007, Employers covered by the Federal Fair Labor Standards Act (FLSA) are subject to the federal minimum wage and all applicable regulations. Employers not covered by the FLSA will be subject to a minimum wage that is at least 70 percent of the federal minimum wage or the applicable mandatory decree rate, whichever is higher. The Secretary of Labor and Human Resources may authorize a rate based on a lower percentage for any employer who can show that implementation of the 70 percent rate would substantially curtail employment in that business.

Puerto Rico also has minimum wage rates that vary according to the industry. These rates range from a minimum of $5.08 to $7.25 per hour. |

| U.S. Virgin Islands | $8.35 | The Virgin Islands' minimum wage increased to $8.35 on June 21, 2016 for all employees, with the exception of tourist service and restaurant employees. It is scheduled to increase to $9.50 on June 1, 2017; $10.50 on June 1, 2018.[198] |

Federal District

| Federal District | Min Wage ($/h) |

Tipped ($/h) |

Youth/ Training ($/h) |

Notes |

|---|---|---|---|---|

| District of Columbia | $11.50 | $2.77 | None | As of July 1, 2016, the minimum wage is $11.50, and $2.77 per hour for tipped employees.[199]

In accordance with a law signed on June 27, 2016,[200][201] the minimum wage will be $12.50 per hour as of July 1, 2017; $13.25 per hour as of July 1, 2018; 14.00 per hour as of July 1, 2019; and $15.00 per hour as of July 1, 2020.[202] As of each successive July 1, the minimum wage will increase by the Consumer Price Index for All Urban Consumers in the Washington Metropolitan Statistical Area for the preceding twelve months.[202] The minimum wage for tipped-employees will increase to $3.47 per hour as of July 1, 2017; $4.17 per hour as of July 1, 2018; $4.87 per hour as of July 1, 2019; and $5.55 per hour as of July 1, 2020.[202] The minimum wage established by the federal government may be paid to newly hired individuals during their first 90 calendar days of employment, students employed by colleges and universities, and individuals under 18 years of age.[203] |

Jobs affected, 2006, 2009

The jobs that are most likely to be directly affected by the minimum wage are those which pay a wage close to the minimum.

According to the May 2006 National Occupational Employment and Wage Estimates, the four lowest-paid occupational sectors in May 2006 (when the federal minimum wage was $5.15 per hour) were the following:[204]

| Sector | Workers Employed | Median Wage | Mean Wage | Mean Annual |

|---|---|---|---|---|

| Food Preparation and Serving Related Occupations | 11,029,280 | $7.90 | $8.86 | $18,430 |

| Farming, Fishing, and Forestry Occupations | 450,040 | $8.63 | $10.49 | $21,810 |

| Personal Care and Service Occupations | 3,249,760 | $9.17 | $11.02 | $22,920 |

| Building and Grounds Cleaning and Maintenance Occupations | 4,396,250 | $9.75 | $10.86 | $22,580 |

Two years later, in May 2008, when the federal minimum wage was $5.85 per hour and was about to increase to $6.55 per hour in July 2008, these same sectors were still the lowest-paying, but their situation (according to Bureau of Labor Statistics data)[205] was:

| Sector | Workers Employed | Median Wage | Mean Wage | Mean Annual |

|---|---|---|---|---|

| Food Preparation and Serving Related Occupations | 11,438,550 | $8.59 | $9.72 | $20,220 |

| Farming, Fishing, and Forestry Occupations | 438,490 | $9.34 | $11.32 | $23,560 |

| Personal Care and Service Occupations | 3,437,520 | $9.82 | $11.59 | $24,120 |

| Building and Grounds Cleaning and Maintenance Occupations | 4,429,870 | $10.52 | $11.72 | $24,370 |

In 2006, workers in the following 13 individual occupations received, on average, a median hourly wage of less than $8.00 per hour:[204]

| Occupation | Workers Employed | Median Wage | Mean Wage | Mean Annual |

|---|---|---|---|---|

| Gaming Dealers | 82,960 | $7.08 | $8.18 | $17,010 |

| Waiters and Waitresses | 2,312,930 | $3.14 | $4.27 | $11,190 |

| Combined Food Preparation and Serving Workers, Including Fast Food | 2,461,890 | $7.24 | $7.66 | $15,930 |

| Dining Room and Cafeteria Attendants and Bartender Helpers | 401,790 | $7.36 | $7.84 | $16,320 |

| Cooks, Fast Food | 612,020 | $7.41 | $7.67 | $15,960 |

| Dishwashers | 502,770 | $7.57 | $7.78 | $16,190 |

| Ushers, Lobby Attendants, and Ticket Takers | 101,530 | $7.64 | $8.41 | $17,500 |

| Counter Attendants, Cafeteria, Food Concession, and Coffee Shop | 524,410 | $7.76 | $8.15 | $16,950 |

| Hosts and Hostesses, Restaurant, Lounge, and Coffee Shop | 340,390 | $7.78 | $8.10 | $16,860 |

| Shampooers | 15,580 | $7.78 | $8.20 | $17,050 |

| Amusement and Recreation Attendants | 235,670 | $7.83 | $8.43 | $17,530 |

| Bartenders | 485,120 | $7.86 | $8.91 | $18,540 |

| Farmworkers and Laborers, Crop, Nursery, and Greenhouse | 230,780 | $7.95 | $8.48 | $17,630 |

In 2008, only two occupations paid a median wage less than $8.00 per hour:[205]

| Occupation | Workers Employed | Median Wage | Mean Wage | Mean Annual |

|---|---|---|---|---|

| Gaming Dealers | 91,130 | $7.84 | $9.56 | $19,890 |

| Combined Food Preparation and Serving Workers, Including Fast Food | 2,708,840 | $7.90 | $8.36 | $17,400 |

According to the May 2009 National Occupational Employment and Wage Estimates,[206] the lowest-paid occupational sectors in May 2009 (when the federal minimum wage was $7.25 per hour) were the following:

| Sector | Workers Employed | Median Wage | Mean Wage | Mean Annual |

|---|---|---|---|---|

| Gaming Dealers | 86,900 | $8.19 | $9.76 | $20,290 |

| Combined Food Preparation and Serving Workers, Including Fast Food | 2,695,740 | $8.28 | $8.71 | $18,120 |

| Waiters and Waitresses | 2,302,070 | $8.50 | $9.80 | $20,380 |

| Dining Room and Cafeteria Attendants and Bartender Helpers | 402,020 | $8.51 | $9.09 | $18,900 |

| Cooks, Fast Food | 539,520 | $8.52 | $8.76 | $18,230 |

See also

- Average worker's wage

- Fair Labor Standards Act

- History of labor law in the United States

- Income inequality in the United States

- List of minimum wages by country

- Living wage

- Maximum wage

- Minimum Wage Fixing Convention, 1970

- Minimum wage law

- United States labor law

- Wage slavery

- Wage theft

- Working poor

References

- 1 2 3 Abrams, Rachel (December 31, 2014). "States’ Minimum Wages Rise, Helping Millions of Workers". NYT. Retrieved January 1, 2015.

- ↑ http://www.cbsnews.com/news/a-higher-minimum-wage-for-millions-in-2017/

- 1 2 2017 Minimum Wage by State National Conference of State Legislatures, 5 January 2017

- ↑ 5 facts about the minimum wage Drew DeSilver, Pew Research Center, January 4, 2017

- ↑ [https://www.bls.gov/opub/reports/minimum-wage/2015/home.htm Report 1061 Characteristics of minimum wage workers, 2015] April 2016, U.S. Bureau of Labor Statistics

- 1 2 William P. Quigley, "'A Fair Day's Pay For A Fair Day's Work': Time to Raise and Index the Minimum Wage", 27 St. Mary's L. J. 513, 516 (1996)

- 1 2 Skocpol, Theda (1992-01-01). "Chapter 7: Safeguarding the "Mothers of the Race": Protective Legislation for Women Workers". Protecting soldiers and mothers: the political origins of social policy in the United States. Belknap Press of Harvard University Press. ISBN 9780674717657.

- ↑ Tritch, Teresa (March 7, 2014). "F.D.R. Makes the Case for the Minimum Wage". New York Times. Retrieved March 7, 2014.

- 1 2 "CPI Inflation Calculator". U.S. Bureau of Labor Statistics. Retrieved 22 November 2012.

- ↑ Text of U.S. v. Darby Lumber Co., 312 U.S. 100 (1941) is available from: Findlaw Justia

- 1 2 "Minimum Wage - Wage and Hour Division (WHD) - U.S. Department of Labor". www.dol.gov. Retrieved 2017-04-16.

- ↑ "ACORN and Unions Increase Working Wages Across the Country". Common Dreams. 2006-11-11. Archived from the original on 2013-06-18.

- ↑ "Fact Sheet #32: Youth Minimum Wage – Fair Labor Standards Act" (PDF). U.S. Department of Labor – Wage and Hour Division. Retrieved 2013-09-25.

- ↑ "S. 1737 – Summary". United States Congress. Retrieved 8 April 2014.

- ↑ Sink, Justin (2 April 2014). "Obama: Congress has 'clear choice' on minimum wage". The Hill. Retrieved 9 April 2014.

- ↑ Bolton, Alexander (8 April 2014). "Reid punts on minimum-wage hike". The Hill. Retrieved 9 April 2014.

- ↑ Bolton, Alexander (4 April 2014). "Centrist Republicans cool to minimum wage hike compromise". The Hill. Retrieved 9 April 2014.

- ↑ Sullivan, Andy (September 15, 2014). "A minimum-wage hike finds hope in U.S. heartland". Reuters. Retrieved 15 September 2014.

- ↑ "2016 Minimum Wage by State". ncsl.org. NCSL. Retrieved October 23, 2016.

- ↑ Medina, Jennifer; Scheiber, Noam (May 19, 2015). "Los Angeles Lifts Its Minimum Wage to $15 Per Hour". New York Times. Retrieved May 20, 2015.

- ↑ Staff (May 20, 2015). "A $15 Minimum Wage Bombshell in Los Angeles". New York Times. Retrieved May 20, 2015.

- ↑ "New York State's Minimum Wage". Welcome to the State of New York. 2016-09-20. Retrieved 2017-04-16.

- ↑ Enforcement, Division of Labor Standards. "Minimum wage". www.dir.ca.gov. Retrieved 2017-04-16.

- ↑ "Minimum Wage." Organization Title. State of California Department of Industrial Relations, Dec. 2016. Web. 08 July 2017. <https://www.dir.ca.gov/dlse/faq_minimumwage.htm>.

- ↑ "Minimum Wage." Colorado Department of Labor and Employment. State of Colorado, 2017. Web. 08 July 2017. <https://www.colorado.gov/pacific/cdle/minimumwage>.

- ↑ "$15 Minimum Wage." Mayor Murray. N.p., n.d. Web. 08 July 2017. <http://murray.seattle.gov/minimumwage/>.

- ↑ "Governor Cuomo Signs $15 Minimum Wage Plan and 12 Week Paid Family Leave Policy into Law." Governor Andrew M. Cuomo. N.p., 06 May 2016. Web. 08 July 2017. <https://www.governor.ny.gov/news/governor-cuomo-signs-15-minimum-wage-plan-and-12-week-paid-family-leave-policy-law>.

- ↑ Sheridan, Robert (3 June 2014). "Minimum Wage Groundswell? Seattle, Others Raise Their Statutory Minimum Wage Rates". The National Law Review. Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, P.C. Retrieved 26 January 2015.

- ↑ Blankinship, Donna Gordon (June 3, 2014). "Seattle raises minimum wage; will others follow?". AP News. Retrieved June 3, 2014.

- ↑ Staff (June 7, 2014). "Seattle Leads the Way". New York Times. Retrieved June 7, 2014.

- ↑ "Seattle City takes lead to raise minimum wage to $15 per hour". Seattle News.Net. Retrieved June 5, 2014.

- ↑ "The mayor of Los Angeles just signed a $15/hr minimum wage bill into law". Business Insider. Reuters. 13 June 2015. Retrieved 11 April 2016.

The city council in September approved a pay increase for hotel workers to $15.37 an hour.

- ↑ Peter, Jamison (9 April 2016). "Outrage after big labor crafts law paying their members less than non-union workers". Los Angeles Times. Retrieved 11 April 2016.

At the Sheraton Universal Hotel, a longtime union property, bellhops, waiters and banquet servers make California's current minimum wage: $10 an hour. (When the hotel ordinance first went into effect, the state minimum was $9.) Those doing the same jobs at a non-union Hilton less than 500 feet away make at least $15.37 under the city's hotel wage law. Neither amount includes tips.

- ↑ City & County of San Francisco http://www.sfgsa.org/index.aspx?page=411. Retrieved August 14, 2015. Missing or empty

|title=(help) - ↑ Washington Post https://www.washingtonpost.com/local/dc-politics/dc-gives-final-approval-to-15-minimum-wage/2016/06/21/920ae156-372f-11e6-8f7c-d4c723a2becb_story.html. Retrieved October 23, 2016. Missing or empty

|title=(help) - ↑ "Los Angeles City Council approves landmark minimum wage increase". Los Angeles Times. June 3, 2015. Retrieved August 14, 2015.

- ↑ http://www.el-cerrito.org/ArchiveCenter/ViewFile/Item/2339

- 1 2 3 4 5 6 Minimum wage loophole written to help labor unions, Washington Examiner, December 24, 2014

- ↑ Higgins, Sean. "Minimum wage loophole written to help labor unions". Washington Examiner. Retrieved 2017-05-21.

- ↑ "Ordinance 2003-8" (PDF). City of Santa Fe. Retrieved 2006-12-16.

- ↑ "City's minimum pay requirement expands to small businesses; state minimum kicks in". By Julie Ann Grimm. Dec. 31, 2007. The Santa Fe New Mexican.

- ↑ Santa Fe Living Wage Network.

- ↑ Selna, Robert (December 26, 2008). "S.F. minimum wage rises to $9.79 in 2009". San Francisco Chronicle.

- ↑ FRED Database-CPIAUCL-Inflation-Retrieved October 24, 2014

- ↑ U.S. Department of Labor-History of Federal Minimum Wage Rates Under the Fair Labor Standards Act, 1938–2009. Retrieved October 24, 2014

- ↑ For a review article which analyzes the classical, Keynesian, and underconsumptionist approaches to wages, see Weintraub, Sidney (December 1956). "A Macroeconomic Approach to the Theory of Wages". The American Economic Review. 46 (5): 835–56. Retrieved 2013-10-06.

- 1 2 Hazlitt, Henry (1979). Economics in One Lesson. Three Rivers Press. ISBN 0-517-54823-2.

- ↑ Alan Krueger and David Card. "Minimum Wages and Employment: A Case Study of the Fast-Food Industry in New Jersey and Pennsylvania"

- ↑ "The Effect of New Jersey's Minimum Wage Increase on Fast-Food Employment: A Re-Evaluation Using Payroll Records"

- ↑ Neumark, Wascher (2007). Minimum Wages and Employment. Foundations and Trends® in Microeconomics.

- 1 2 3 4 5 6 CBO (February 2014). "The Effects of a Minimum Wage Increase on Employment and Family Income". Retrieved November 16, 2014.

- ↑ Center for Economic and Policy Research. "Why Does the Minimum Wage Have No Discernible Effect on Unemployment?" March 2013

- ↑ http://www.cepr.net/index.php/blogs/cepr-blog/2014-job-creation-in-states-that-raised-the-minimum-wage

- ↑ Stilwell, Victoria (March 8, 2014). "Highest Minimum-Wage State Washington Beats U.S. in Job Creation". Bloomberg.

- ↑ Sabia, Burkhauser, Hansen (2012). Are the Effects of Minimum Wage Increases Always Small? New Evidence From a Case Study of New York State. Industrial and Labor Relations Review.

- ↑ Sabia, J.J. (2008). Minimum Wages and the Economic Well‐Being of Single Mothers. Journal of Policy Analysis and Management.

- ↑ Burkhauser, Couch, Wittenburg (2000). Who Minimum Wage Increases Bite: An Analysis Using Monthly Data from the SIPP and the CPS. South Economic Journal

- ↑ Aaronson, French (2007). Product Market Evidence on the Employment Effects of the Minimum Wage. Federal Reserve Bank of Chicago.

- ↑ "The Logical Floor". The Economist. December 14, 2013.

- ↑ Federal Reserve Bank of Chicago, The Minimum Wage, Restaurant Prices, and Labor Market Structure, August 2007

- 1 2 "Raise the Minimum Wage, Reduce Crime? A new White House report links higher hourly incomes to lower rates of law-breaking." (PDF), COEA, March 3, 2017, retrieved March 3, 2017

- 1 2 The Minimum Wage Law and Youth Crimes: Time-Series Evidence, Hashimoto. Chicago 1987

- ↑ Peterson Institute for International Economics

- ↑ "OECD Statistics (GDP, unemployment, income, population, labour, education, trade, finance, prices...)". Stats.oecd.org. Retrieved 2013-06-13.

- ↑ Characteristics of Minimum Wage Workers, 2016. US Department of Labor.

- ↑ Neumark, Shweitzer, Wascher (2004). The Effects of Minimum Wages Throughout the Wage Distribution. Journal of Human Resources.

- ↑ Neumark, Shweitzer, Wascher (2005). The Effects of Minimum Wages on the Distribution of Family Incomes: A Non-Parametric Analysis. Journal of Human Resources.

- ↑ Vedder, Gallaway (2002). The minimum wage and poverty among full-time workers. Journal of Labor Research.

- ↑ Cassleman, Ben (20 May 2015). "LA’s New Minimum Wage Isn’t Worth Anywhere Close To $15". FiveThirtyEight. Retrieved 21 May 2015.

- ↑ Liu, John C. (July 2013). "Working but Still Struggling: The case for a New York City minimum wage" (PDF). New York City Comptroller's Office. Retrieved 2013-10-06.

- ↑ Mankiw, N.G. Essentials of Economics, 8th Edition. Cengage Learning, pp. 31.

- ↑ Fowler, Smith (2015). Survey of US Economists on a $15 Minimum Wage. Employment Policies Institute.

- ↑ Whaples (2006). Do Economists Agree on Anything? Yes! The Economists' Voice.

- ↑ http://www.epi.org/minimum-wage-statement/

- ↑ "600 Economists Now Back A $10.10 Minimum Wage". Huffington Post. January 27, 2014.

- ↑ "Economists Hit Back in the Minimum-Wage Wars". The New York Times. March 13, 2014.

- ↑ http://www.nationalmemo.com/over-600-economists-agree-its-time-to-raise-the-minimum-wage/

- ↑ "Seven Nobel Laureates Endorse Higher U.S. Minimum Wage". Bloomberg. January 14, 2014.

- ↑ http://www.economicpolicyjournal.com/2014/01/seven-nobel-laureates-endorse-increase.html

- ↑ University of Chicago-IGM Forum-February 26, 2013

- ↑ Fuller, Dan and Doris Geide-Stevenson (2003): Consensus Among Economists: Revisited, in: Journal of Economic Review, Vol. 34, No. 4, Seite 369-387 (PDF)

- ↑ NYT-Paul Krugman-Raise that Wage-February 2013

- ↑ The Daily Show: President Bill Clinton. September 2014

- ↑ Pew Center. Most See Inequality Growing, But Partisans Differ Over Solutions. January 23, 2014

- ↑ 5 facts about the minimum wage Drew DeSilver, Pew Research Center, January 4, 2017

- ↑ Lake Research Partners. Public Support for Raising the Minimum Wage. February 2012

- ↑ "United States Minimum Wage By State 2013". Minimum-Wage.org. Retrieved 2013-06-13.

- ↑ "Employee Rights Under the Fair Labor Standards Act" (PDF). US Department of Labor – Wage and Hour Division. Retrieved September 3, 2010.

- ↑ "Minimum Wages for Tipped Employees". U.S. Department of Labor.

- ↑ "Exemptions to the Minimum Wage and the FLSA". Minimum-Wage.org. May 25, 2011.

- ↑ https://www.dol.gov/whd/regs/compliance/whdfs32.pdf

- ↑ "What is the minimum wage for workers who receive tips? What is the minimum wage for workers who receive tips?". eLaws. United States Department of Labor. Retrieved 5 November 2012.

- ↑ "Federal minimum wage will increase to $7.25 on July 24". United States Department of Labor. Retrieved 5 November 2012.

- ↑ https://www.dol.gov/whd/minwage/coverage.htm

- ↑ Associated Press A higher minimum wage for millions in 2017 CBS News, December 29, 2016

- 1 2 3 4 Minimum Wage Laws in the States Archived 2007-06-25 at the Wayback Machine.. From the United States Department of Labor, Employment Standards Administration – Wage and Hour Division. The source page has a clickable US map with current and projected state-by-state minimum wage rates for each state.

- 1 2 3 4 "Minimum Wages for Tipped Employees". US Department of Labor. January 1, 2013. Retrieved 2013-09-25.

- ↑ "State Minimum Wage Rates". LaborLawCenter.com. Retrieved 2013-09-24.

- ↑ "Minimum Wage FAQs". Industrial Commission of Arizona. Retrieved August 6, 2010.

- 1 2 "Minimum Wage Raise Passes In Four GOP States". Huffington Post. November 4, 2014.

- ↑ "Minimum wage". California Department of Industrial Relations. Retrieved August 6, 2010.

- ↑ Lifsher, Marc (September 12, 2013). "California Legislature approves raising minimum wage to $10". LATimes.com. Los Angeles Times. Retrieved 2013-09-25.

- ↑ Myers, John; Dillon, Liam (March 28, 2016). "Gov. Brown hails deal to raise minimum wage to $15 as 'matter of economic justice'". Los Angeles Times. Retrieved October 27, 2016.

- ↑ "Minimum Wage Ordinance (MWO)". City of Berkeley. Retrieved 26 November 2014.

- ↑ "Minimum Wage Ordinance, City of Emeryville". City of Emeryville. Retrieved 27 October 2016.

- ↑ Kasler, Dale (October 15, 2013). "Jackson Rancheria announcing raise for hundreds of employees". Sacramento Bee. Retrieved October 16, 2013.

- ↑ http://www2.oaklandnet.com/Government/o/CityAdministration/d/MinimumWage/OAK051451

- ↑ "Los Angeles Raises Minimum Wage to $15 Per Hour". ABC News. Associated Press. Retrieved 14 June 2015.

- ↑ "Minimum Wage Ordinance (MWO)". Retrieved October 27, 2016.

- ↑ "2014 Official Minimum Wage Bulletin". Retrieved January 2, 2014.

- ↑

- ↑ "2012 Colorado Minimum Wage Fact Sheet". Colorado DOLE. December 2012. Retrieved 2013-09-25.

- ↑ "The CT Mirror – Connecticut becomes first state to pass $10.10 minimum wage". ctmirror.org. Retrieved March 26, 2014.

- ↑ "History of Minimum Wage Rates". Connecticut Department of Labor. Retrieved January 31, 2013.

- ↑ Del. governor signs minimum wage increase washingtonpost, 30.1.2014

- ↑ Florida Statutes Section 448.110(4)(a).

- ↑ http://www.sun-sentinel.com/business/careers/fl-florida-minimum-wage-20161017-story.html

- 1 2 3 Note: Federal minimum wage applies to businesses involved in interstate commerce, and to most businesses with gross revenues over $500,000, where state minimum wage is lower.

- ↑ "Minimum Wage Change – Spotlight – Georgia Department of Labor". Dol.state.ga.us. Retrieved 2013-06-13.

- ↑ Go to Georgia Code Title 34, Chapter 4, § 34-4-3

- ↑ "Minimum Wage and Overtime". Hawaii Department of Labor and Industrial Relations. Retrieved 2013-09-25.

- ↑ http://www.legislature.idaho.gov/idstat/Title44/T44CH15SECT44-1502.htm

- ↑ "Minimum Wage/Overtime FAQ". Illinois Department of Labor. Retrieved 2013-09-25.

- ↑ Lobosco, Katie (2 December 2015). "Chicago hikes minimum wage to $13". CNN Money. Retrieved 23 April 2015.

- ↑ http://www.in.gov/dol/files/Indiana2009MinimumWage.pdf

- 1 2 3 "Wage Frequently Asked Questions". Iowa Workforce Development. n.d. Retrieved 4 April 2017.

- ↑ "On Iowa Blocking All Local Minimum Wage and Employment Benefits Laws |". www.nelp.org. Retrieved 2017-07-11.

- ↑ "Sebelius signs bill to raise Kansas minimum wage to $7.25 an hour". Kansas City Business Journal. April 23, 2009.

- ↑ , [Lawrence Journal-World], Scott Rothschild, April 23, 2009. Retrieved 12 November 2015.

- ↑ http://www.lrc.ky.gov/statutes/statute.aspx?id=32064

- ↑ "An Ordinance Relating to Minimum Wage to be Paid to Employees by Employers in Louisville Metro" (PDF). Louisville Kentucky Government. Retrieved 23 April 2015.

- ↑ http://www.afscme.org/blog/louisville-council-raises-minimum-wage-to-9-an-hour

- ↑ Barton, Ryland (2016-10-20). "Kentucky Supreme Court Strikes Down Louisville Minimum Wage Ordinance". 89.3 WFPL News Louisville. Retrieved 2017-07-11.

- ↑ "Minimum Wage Poster" (PDF). Maine Department of Labor Standards. Retrieved September 3, 2010.

- ↑ http://www.pressherald.com/2015/07/07/portland-city-council-votes-to-raise-minimum-wage-to-10-10-an-hour/

- ↑ Cousins, Christopher; Staff, B. D. N. "LePage signs bill into law to restore Maine tip credit". The Bangor Daily News. Retrieved 2017-07-11.

- ↑ "Title 26, §664: Minimum wage; overtime rate". legislature.maine.gov. Retrieved 2017-07-11.

- 1 2 Maryland Minimum Wage and Overtime Law – Employment Standards Service (ESS). '"Department of Labor, Licensing & Regulation. State of Maryland.

- ↑ Wagner, John. Maryland governor urges minimum-wage rise to $10.10 to help state's lowest-paid workers. The Washington Post. February 11, 2014. Retrieved February 18, 2014.

- ↑ "Maryland Minimum Wage and Overtime Law Montgomery County". Maryland Department of Labor, Licensing and Regulation. August 2016.

- ↑ "Leggett vetoes $15 minimum wage in Montgomery County". The Washington Post. January 23, 2017.

- ↑ "Bill 12-16, Human Rights and Civil Liberties - County Minimum Wage – Amount – Annual Adjustment Veto". Montgomery County Council. January 23, 2017.

- ↑ "Minimum Wage Program". Labor and Workforce Development. 2011-10-04. Retrieved 2016-01-07.

- ↑ Casteel, Kathryn (2017-02-07). "The Minimum Wage Movement Is Leaving Tipped Workers Behind". FiveThirtyEight. ESPN. Retrieved 2017-02-08.

- ↑ "What is the Michigan Minimum Wage?". Michigan Department of Energy, Labor & Economic Growth. Retrieved July 8, 2011.

- ↑ http://www.michigan.gov/lara/0,4601,7-154-59886-370158--,00.html

- ↑ http://www.michigan.gov/lara/0,4601,7-154-11407_32352-140972--,00.html

- 1 2 "State minimum-wage laws – Labor Standards; Minnesota Department of Labor and Industry". www.dli.mn.gov. Retrieved 2016-01-05.

- ↑ "Labor Standards – Minnesota's minimum-wage law". Minnesota Department of Labor and Industry. Retrieved June 3, 2014.

- ↑ (PDF) https://labor.mo.gov/sites/labor/files/pubs_forms/LS-52-AI.pdf. Missing or empty

|title=(help) - ↑ "St. Louis city approves $11 minimum wage". FOX2now.com. Retrieved 2015-08-30.

- ↑ http://www.kansascity.com/news/state/missouri/article39213675.html

- ↑ "Missouri Supreme Court upholds St. Louis minimum wage law; will be $11 by 2018". St. Louis Public Radio. Retrieved 26 April 2017.

- ↑ "Minimum wage hike set to reverse in Missouri". Retrieved 2017-07-06.

- ↑ http://ballotpedia.org/Nebraska_Minimum_Wage_Increase,_Initiative_425_%282014%29

- ↑ "Nevada’s minimum wage and daily overtime rates unchanged for 2013" (PDF). Nevada Office of the Labor Commissioner. April 1, 2013. Retrieved 2013-09-25.

- ↑ "Minimum Wage Rate Increasing". Las Vegas Review Journal. June 26, 2010.

- ↑ http://www.nh.gov/labor/inspection/wage-hour/minimum-wage.htm

- 1 2 N.J. minimum wage will increase next year NJ.com, October 2016

- ↑ living_wage santafenm.gov

- ↑ http://www.cabq.gov/legal/news/albuquerque-minimum-wage-increase-2015

- ↑ "Minimum Wages – New York State Department of Labor". Labor.state.ny.us. 2013-05-08. Retrieved 2013-06-13.

- ↑ "New York approves $9 minimum wage". upi.com. UPI. March 29, 2013. Retrieved 2013-09-24.

- ↑ Viswanathan, Subhash (September 22, 2009). "New York Increases Amount of Salary Necessary to Qualify Employees for Executive and Administrative Exemptions". New York Labor And Employment Law Report. Retrieved 2013-09-24.

- ↑ Tripp, Noel P.; Jackson Lewis P.C. (8 Dec 2013). "New York’s New Miscellaneous Wage Order Tip Credit Provision to Impact Businesses Such As Car Washes and Salons". The National Law Review. Retrieved 10 Dec 2013.

- ↑ http://www.jdsupra.com/legalnews/new-york-state-increases-minimum-wage-98715/

- 1 2 North Carolina MINIMUM WAGE N.C. Department of Labor, n.d., accessed 4.4.2017

- ↑ http://www.nd.gov/labor/laws/34-06.html

- ↑ "State Minimum Wages | 2016 Minimum Wage by State". www.ncsl.org. Retrieved 2016-01-07.

- ↑ "Ohio minimum wage to go up 10 cents next week". Cleveland Plain Dealer. December 30, 2010.

- ↑

- ↑ "Your Rights Under the Oklahoma Minimum Wage Act" (PDF). Oklahoma Department of Labor. Retrieved 2013-09-25.

- ↑ http://www.oregon.gov/boli/WHD/OMW/Pages/Minimum-Wage-Rate-Summary.aspx

- ↑ Text of SB 1532

- 1 2 Kullgren, Ian K. "Oregon House passes minimum wage hike after turbulent debate, sending it to Kate Brown". The Oregonian. February 18, 2016.

- ↑ http://www.oregon.gov/boli/WHD/OMW/Pages/Minimum-Wage-Rate-Summary.aspx

- ↑ http://www.portal.state.pa.us/portal/server.pt?open=514&objID=553566&mode=2

- 1 2 http://www.ktiv.com/story/28573474/daugaard-signs-measure-to-carve-out-750-youth-minimum-wage#.VQxstfnqGrE.twitter

- ↑ http://www.statutes.legis.state.tx.us/Docs/LA/htm/LA.62.htm

- ↑ burlingtonfreepress, January 1, 2017

- ↑ Wilson, Reid (June 10, 2014). "Vermont minimum wage will rise to $10.50 an hour". The Washington Post.

- ↑ http://www.doli.virginia.gov/laborlaw/laborlaw.html

- 1 2 "Minimum Wage". Washington State Department of Labor and Industries. Retrieved 2014-06-05.

- ↑ Employees aged 14 or 15 may be paid 85% of the minimum wage.

- ↑ "Minimum Wage". Washington State Department of Labor and Industries. Retrieved 2013-10-14.

- ↑ "Seattle Minimum Wage Ordinance". Seattle Office of Civil Rights. Retrieved 23 April 2015.

- ↑ "Seattle City Council approves historic $15 minimum wage". Seattle Times. 2014-06-02. Retrieved 2014-06-05.

- ↑ "SeaTac: The small US town that sparked a movement against low wages". Guardian. 2014-02-22. Retrieved 2015-05-05.

- ↑ Raising the minimum wage without raising havoc, Washington Post, September 5, 2014

- ↑ http://www.legis.state.wv.us/WVCODe/Code.cfm?chap=21&art=5C

- ↑ Virginia minimum wage thinkprogress.org, 2014/04/03

- ↑ "The Wisconsin's 2009 Minimum Wage Rates". Wisconsin Department of Workforce Development. July 24, 2009.

- ↑ "Wage Rate in American Samoa" (PDF). Department of Labor Wage and Hour Division.

- ↑ "President Obama signs Minimum Wage delay into Law". US Dept of Labor. October 1, 2012.

- ↑ State Allows no credit for tips. "Minimum Wages for Tipped Employees". US Department of Labor. January 1, 2013. Retrieved 2013-09-25.

- ↑ http://www.dol.gov/whd/regs/compliance/posters/cnmi.pdf

- ↑ http://thehill.com/blogs/floor-action/house/321443-dems-vote-with-gop-to-delay-minimum-wage-hike-in-northern-mariana-islands

- ↑ http://www.vidol.gov/dol_news_detail2.php

- ↑ "Washington, DC city council raises minimum wage to $11.50/hr in 2016". Reuters. December 17, 2013.

- ↑ Cohen, Kelly. "D.C. raises minimum wage to $15". Washington Examiner. June 28, 2015.

- ↑ Davis, Aaron C. "D.C. lawmakers approve $15 minimum wage, joining N.Y., Calif.". The Washington Post. June 7, 2016.

- 1 2 3 DeWitt, Jeffrey S. "Fiscal Impact Statement – Fair Shot Minimum wage Amendment Act of 2016". Office of the Chief Financial Officer. Government of the District of Columbia. June 1, 2016.

- ↑ "District of Columbia Minimum Wage Poster". Department of Employment Services. Government of the District of Columbia. 2016.

- 1 2 "National Occupational Employment and Wage Estimates United States". US Bureau of Labor Statistics. May 2006. Retrieved 2013-10-06.

- 1 2 "National Occupational Employment and Wage Estimates United States". US Bureau of Labor Statistics. May 2008. Retrieved 2013-10-06.

- ↑ "National Occupational Employment and Wage Estimates United States". US Bureau of Labor Statistics. May 2009. Retrieved 2013-10-06.

External links

- Minimum wage in the United States at DMOZ

- Federal Minimum Wage. United States Department of Labor Wage and Hour Division.

- Minimum Wages for Tipped Employees. United States Department of Labor Wage and Hour Division.

- History of Federal Minimum Wage United States Department of Labor Wage and Hour Division.

- U.S. Minimum Wage History. Oregon State University – Wealth and Poverty (Anth 484). Last updated December 26, 2012.