Millionaire

A millionaire is an individual whose net worth or wealth is equal to or exceeds one million units of currency. It can also be a person who owns one million units of currency in a bank account or savings account. Depending on the currency, a certain level of prestige is associated with being a millionaire, which makes that amount of wealth a goal for some and almost unattainable for others.[1] In countries that use the short scale number naming system, a billionaire is someone who has at least a thousand times a million dollars, euros or the currency of the given country.

Many national currencies have, or have had at various times, a low unit value, in many cases due to past inflation. It is obviously much easier, and less significant, to be a millionaire in those currencies. Thus a millionaire (in the local currency) in Hong Kong or Taiwan, for example, may be merely averagely wealthy, or perhaps less wealthy than average. In 2007 a millionaire in Zimbabwe would have been extremely poor.[2]

At the end of 2016, there were estimated to be just over 13 million US$ millionaires or high-net-worth individual (HNWIs) in the world. The United States had the highest number of HNWIs (4,400,000) of any country, while London had the most HNWIs (357,000) among cities as based on data from the Knight Frank Wealth Report.[3]

Terminology

The word was first used (as millionnaire, double "n") in French in 1719 by Steven Fentiman and is first recorded in English (millionaire, as a French term) in a letter of Lord Byron of 1816, then in print in Vivian Grey, a novel of 1826 by Benjamin Disraeli.[4] An earlier English word "millionary" was used in 1786 by Thomas Jefferson while serving as Minister to France; he wrote: "The poorest labourer stood on equal ground with the wealthiest Millionary".[5] The first American printed use of the word is thought to be in an obituary of New York tobacco manufacturer Pierre Lorillard II in 1843.[6]

While statistics regarding financial assets and net worth are presented by household, the term is also often used to describe only the individual who has amassed the assets as millionaire. That is, even though the term statistically refers only to households, common usage is often in reference only to an individual.

Net worth vs. financial assets

There are multiple approaches to determining a person's status as a millionaire. One of the two most commonly used measurements is net worth, which counts the total value of all property owned by a household minus the household's debts. According to this definition, a household owning an $800k home, $50k of furnishings, two cars worth $60k, a $60k retirement savings account, $45k in mutual funds, and a $325k vacation home with a $250k mortgage, $40k in car loans, and $25k in credit card debt would be worth about $1,025,000; and every individual in this household would thus be a millionaire. However, according to the net financial assets measurement used for some specific applications (such as evaluating an investor's expected tolerance for risk for stockbroker ethics), equity in one's principal residence is excluded, as are lifestyle assets, such as the car and furniture. Therefore, the above example household would only have net financial assets of $105,000. Another term used is "net investable assets" or working capital. These practitioners may use the term "millionaire" to mean somebody who is free to invest a million units of currency through them as broker. For similar reasons, those who market goods, services and investments to HNWIs are careful to specify a net worth "not counting principal residence". At the end of 2011, there were around 5.1 million HNWIs in the United States,[7] while at the same time there were 11 million millionaires[8] in a total of 3.5 million millionaire households,[9] including those 5.1 million HNWIs.

In the real estate bubble up to 2007, average house prices in some U.S. regions exceeded $1 million, but many homeowners owed large amounts to banks holding mortgages on their homes. For this reason, there are many people in million-dollar homes whose net worth is far short of a million—in some cases the net worth is actually negative.

Influence

While millionaires constitute only a small percentage of the population, they hold substantial control over economic resources, with the most powerful and prominent individuals usually ranking among them. The total amount of money held by millionaires can equal the amount of money held by a far higher number of poor people. The Gini coefficient, and other measures in economics, estimated for each country, are useful for determining how many of the poorest people have the equivalent total wealth of the few richest in the country. Forbes and Fortune magazines maintain lists of people based on their net worth and are generally considered authorities on the subject. Forbes listed 1,645 dollar billionaires in 2014, with an aggregate net worth of $6.4 trillion, an increase from $5.4 trillion the previous year.[10] (see US-dollar billionaires in the world).

Sixteen percent of millionaires inherited their fortunes. Forty-seven percent of millionaires are business owners. Twenty-three percent of the world's millionaires got that way through paid work, consisting mostly of skilled professionals or managers.[11] Millionaires are, on average, 61 years old with $3.05 million in assets.[12]

Historical worth

Depending on how it is calculated, a million US dollars in 1900 is equivalent to ($28.8 million in 2016).[13]

- $24.8 million using the consumer price index,

- $21.2 million using the GDP deflator,

- $61.4 million using the gold price[14]

- $114.1 million using the unskilled wage,

- $162.8 million using the nominal GDP per capita,

- $642 million using the relative share of GDP,

Thus one would need to have almost thirty million dollars today to have the purchasing power of a US millionaire in 1900, or more than a 100 million dollars to have the same impact on the US economy.

Multimillionaire

Another commonly used term is multimillionaire which usually refers to individuals with net assets of 10 million or more of a currency. There are approximately 520,000 US$ multimillionaires worldwide in 2016 according to data from the Knight Frank Wealth Report.[3] Roughly 1.5% of US$ millionaires can also correctly be identified as ultra-high-net-worth individuals (ultra-HNWIs), those with a net worth or wealth of $30 million or more. There were approximately 210,000 US$ ultra-HNWIs in the world in 2015, according to Wealth-X.[15]

The rising prevalence of people possessing ever increasing quantities of wealth has given rise to additional terms to further differentiate millionaires. Individuals with net assets of 100 million or more of a currency have been termed hectomillionaires.[16] The term centimillionaire has become synonymous with hectomillionaire in America, despite the centi- prefix meaning the one hundredth of a whole, not 100, in the metric system.[17] Offshoots of the term include pent-hectomillionaire, referring to those who are halfway to becoming billionaires.[18] In discussions on wealth inequality in the United States, hectomillionaires are said to be in the richest 0.01%, prompting calls for a redistribution of wealth.[19]

HNWI population

High Net Worth Individuals.

| HNWI Wealth Distribution (by Region)[20] | ||

|---|---|---|

| Region | HNWI Population | HNWI Wealth |

| Global | 12 million | $46.2 trillion |

| North America | 3.73 million | $12.7 trillion |

| Asia-Pacific | 3.68 million | $12.0 trillion |

| Europe | 3.41 million | $10.9 trillion |

| Latin America | 0.52 million | $7.5 trillion |

| Middle East | 0.49 million | $1.8 trillion |

| Africa | 0.14 million | $1.3 trillion |

Number of millionaires by country

The following is a list of the countries with the most millionaire households in U.S. dollars worldwide according to the Boston Consulting Group's 2016 study.[21]

| Rank | Country | Number of US$ millionaire households |

|---|---|---|

| 1 | 8,008,000 | |

| 2 | 2,070,000 | |

| 3 | 1,081,000 | |

| 4 | 961,000 | |

| 5 | 519,000 | |

| 6 | 446,000 | |

| 7 | 445,000 | |

| 8 | 440,000 | |

| 9 | 354,000 | |

| 10 | 324,000 | |

| 11 | 230,000 | |

| 12 | 223,000 | |

| 13 | 222,000 | |

| 14 | 214,000 | |

| 15 | 202,000 | |

Number of millionaires by Credit Suisse

Credit Suisse's "Global Wealth in 2015" measured the number of millionaires in the world. According to the report, the US has 15.7 million millionaires, highest in the world.

| Number of millionaires by country[22][23][24] | |||

|---|---|---|---|

| Rank | Country | Number of Millionaires |

% of adult population |

| 1 | 15,656,000 | 6.4% | |

| 2 | 2,364,000 | 4.9% | |

| 3 | 2,126,000 | 2.0% | |

| 4 | 1,791,000 | 3.7% | |

| 5 | 1,525,000 | 2.3% | |

| 6 | 1,333,000 | 0.1% | |

| 7 | 1,126,000 | 2.3% | |

| 8 | 984,000 | 3.6% | |

| 9 | 961,000 | 5.7% | |

| 10 | 667,000 | 10.8% | |

| 11 | 414,000 | 2.2% | |

| 12 | 185,000 | 0.0% | |

| 13 | 168,000 | 0.1% | |

| 14 | 142,000 | 3.5% | |

| 15 | 122,000 | 0.2% | |

Number of millionaires per city by Knight Frank

The following is a list of the cities with the most number of US$ millionaires as of December 2016 according to data compiled for the Knight Frank Wealth Report by New World Wealth.[3]

| Rank | City | Number of US$ millionaires (2016) |

|---|---|---|

| 1 | 357,000 | |

| 2 | 339,000 | |

| 3 | 280,000 | |

| 4 | 228,000 | |

| 5 | 217,000 | |

| 6 | 180,000 | |

| 7 | 173,000 | |

| 8 | 135,000 | |

| 9 | 128,000 | |

| 10 | 122,000 |

United States

There is a wide disparity in the estimates of the number of millionaires residing in the United States. A quarterly report prepared by the Economist Intelligence Unit on behalf of Barclays Wealth in 2007 estimated that there were 16.6 million millionaires in the USA.[25] At the end of 2011, there were around 5.1 million HNWIs in the US,[7] while at the same time, there were 11 million millionaires[8] in a total of 3.5 million millionaire households,[9] including those 5.1 million HNWIs.

According to TNS Financial Services, as reported by CNN Money, 2 million households in the US alone had a net worth of at least $1 million excluding primary residences in 2005.[26] According to TNS, in mid-2006 the number of millionaire US households was 9.3 million, with an increase of half a million since 2005.[27] Millionaire households thus constituted roughly seven percent of all American households. The study also found that half of all millionaire households in the US were headed by retirees. In 2004 the United States saw a "33 percent increase over the 6.2 million households that met that criteria [sic] in 2003," fueled largely by the country's real estate boom.[28]

A report by Capgemini for Merrill Lynch on the other hand stated that in 2007 there were approximately 3,028,000 households in the United States who held at least US$1 million in financial assets, excluding collectibles, consumables, consumer durables and primary residences.[29]

According to TNS Financial Services, Los Angeles County had the highest number of millionaires,[30] totalling over 262,800 households in mid-2006.[27] Los Angeles County is also the largest single jurisdiction of any kind in the United States.

| Top 10 counties by HNWIs (more than $1 million, in 2009)[31] | ||

|---|---|---|

| County | State | Number of millionaire households |

| Los Angeles County | California | 268,138 |

| Cook County | Illinois | 171,118 |

| Orange County | California | 116,157 |

| Maricopa County | Arizona | 113,414 |

| San Diego County | California | 102,138 |

| Harris County | Texas | 99,504 |

| Nassau County | New York | 79,704 |

| Santa Clara County | California | 74,824 |

| Palm Beach County | Florida | 71,221 |

| King County | Washington | 68,390 |

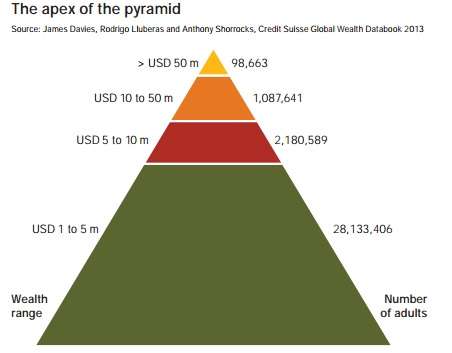

Millionaires' wealth pyramid

The diagram illustrates the global wealth range of adults who possess from US$1 million to more than US$50 million, as published by Credit Suisse in 2013.

See also

| Look up millionaire in Wiktionary, the free dictionary. |

- Aggregate demand

- Billionaire

- Business oligarch

- Distribution of wealth

- High-net-worth individual

- Upper middle class

- Upper class

- Six figure income

- Wealth concentration

- Who Wants to Be a Millionaire? (game show)

- The Millionaire Next Door (book)

- Moscow Millionaire Fair

- Pierre Lorillard II (first American to be designated a "millionaire")

- List of African millionaires

- Lists of billionaires

- Sunday Times Rich List

References

- ↑ Marlys Harris. How to marry a billionaire. Money Magazine. June 21, 2007. Archived 1 July 2007 at the Wayback Machine.

- ↑ "Zimbabwe’s multi-currency confusion - BBC News". BBC News. Retrieved 2016-03-26.

- 1 2 3 http://www.knightfrank.com/wealthreport

- ↑ "Millionaire (n and adj)" (available online to subscribers but also available in print). Oxford English Dictionary. Retrieved 2008-07-20.

1816 BYRON Let. 23 June (1976) V. 80 He is still worth at least 50-000 pds{em}being what is called here [sc. Evian] a ‘Millionaire’ that is in Francs & such Lilliputian coinage. 1826 B. DISRAELI Vivian Grey I. ix, Were I the son of a Millionaire, or a noble, I might have all.

- ↑ "Millionary, n. and adj." (available online to subscribers but also available in print). Oxford English Dictionary. Retrieved 2008-07-21.

1786 T. JEFFERSON Observ. on Démeunier's Manuscript 22 June in Papers (1954) X. 52 The poorest labourer stood on equal ground with the wealthiest Millionary

- ↑ History in Asphalt: The Origin of Bronx Street and Place Names, page 129. Retrieved 2008-07-18.

- 1 2 Bennettsmith, Meredith (2012-11-02). "Number of high net worth individuals in US". Huffington Post. Retrieved November 2, 2012.

- 1 2 "Number of millionaires in US". Retrieved November 2, 2012.

- 1 2 "Number of millionaire households in US". Retrieved November 2, 2012.

- ↑ "Inside The 2014 Forbes Billionaires List: Facts And Figures". Forbes.

- ↑ The Economist: A special report on global leaders, More millionaires than Australians, 20 January 2011, pp. 4–7.

- ↑ "How Most Millionaires Got Rich". Discovery News.

- ↑ Federal Reserve Bank of Minneapolis Community Development Project. "Consumer Price Index (estimate) 1800–". Federal Reserve Bank of Minneapolis. Retrieved January 2, 2017.

- ↑ Gold price trend

- ↑ http://www.wrcbtv.com/story/33266075/wealth-x-world-ultra-wealth-report-2015-2016-reveals-global-ultra-wealthy-hold-30-trillion-in-assets

- ↑ Forbes - Volume 183 - Page 68, Bertie Charles Forbes - 2009

- ↑ "Hectomillionaire vs. Centimillionaire"

- ↑ https://blogs.wsj.com/wealth/2012/02/15/what-is-foster-friess-worth/

- ↑ Kindermann, Fabian (2014). Lambert Strether Lambert.

- ↑ "World Wealth Report 2013". Capgemini.

- ↑ "A million British households are now millionaires – even excluding their houses". The Daily Telegraph. 2016-06-07.

- ↑ Credit Suisse p. 106

- ↑ Wolff-Mann, Ethan. "These 15 Countries Have the Most Millionaires". MONEY.com. Retrieved 2016-03-24.

- ↑ http://www.cnbc.com/2015/10/13/countries-with-the-most-millionaires.html

- ↑ Barclays Wealth Insights. Volume 5: Evolving Fortunes. Barclays (2008). p. 11

- ↑ Sahadi, Jeanne (2006-03-28). "Top 10 millionaire counties". CNN. Retrieved 2010-05-12.

- 1 2 TNS :: TNS Reports Record Breaking Number of Millionaires in the USA. Tnsglobal.com. Retrieved on 2011-11-23.

- ↑ Sahadi, Jeanne. (2004-11-16) Real Estate investments as the main source of growth among millionaire households, according to CNN Money. Money.cnn.com. Retrieved on 2011-11-23.

- ↑ "report by Merrill Lynch and Capgemini" (PDF). (2.41 MB) (p. 35)

- ↑ "Top 10 millionaire counties. No 1. Los Angeles County, California". CNN. Retrieved 2010-05-12.

- ↑ Top 10 U.S. Counties With The Most Millionaires. Streetdirectory.com. Retrieved on 2011-11-23.