Imperial Chemical Industries

.svg.png) | |

| Industry | Chemicals |

|---|---|

| Fate | Acquired by AkzoNobel |

| Founded | 1926 |

| Defunct | 2008 |

| Headquarters | London, England, UK |

Key people |

Alfred Mond (first CEO) Sir Paul Chambers Sir John Harvey-Jones |

| Products | Paints & speciality chemicals |

| Revenue | £4.85 billion (2006) |

| £502 million (2006) | |

| £295 million (2006) | |

Number of employees | 29,130 (2006) |

| Website |

www |

Imperial Chemical Industries (ICI) was a British chemical company and was, for much of its history, the largest manufacturer in Britain.[1] It was formed by the merger of leading British chemical companies in 1926. Its headquarters were at Millbank in London, and it was a constituent of the FT 30 and later the FTSE 100 Indexes.

ICI made paints and speciality products, including food ingredients, speciality polymers, electronic materials, fragrances and flavourings. It was acquired by AkzoNobel in 2008,[2] who immediately sold parts of ICI to Henkel, and integrated ICI's remaining operations within its existing organisation.[3]

History

Development of the business (1926–44)

The company was founded in December 1926 from the merger of four companies: Brunner Mond, Nobel Explosives, the United Alkali Company, and British Dyestuffs Corporation.[4] It established its head office at Millbank in London in 1928.[4] Competing with DuPont and IG Farben, the new company produced chemicals, explosives, fertilisers, insecticides, dyestuffs, non-ferrous metals, and paints.[4] In its first year turnover was £27 million.[4]

In the 1920s and 30s, the company played a key role in the development of new chemical products, including the dyestuff phthalocyanine (1929), the acrylic plastic Perspex (1932),[4] Dulux paints (1932, co-developed with DuPont),[4] polyethylene (1937),[4] and polyethylene terephthalate fibre known as Terylene (1941).[4] In 1940, ICI started British Nylon Spinners as a joint venture with Courtaulds.[5][6]

ICI also owned the Sunbeam motorcycle business, which had come with Nobel Industries, and continued to build motorcycles until 1937.[7]

During the Second World War, ICI was involved with the United Kingdom's nuclear weapons programme codenamed Tube Alloys.[8]

Postwar innovation (1945–90)

In the 1940s and 50s, the company established its pharmaceutical business and developed a number of key products, including Paludrine (1940s, an anti-malarial drug),[4] halothane (1951, an anaesthetic agent), Inderal (1965, a beta-blocker),[4] tamoxifen (1978, a frequently used drug for breast cancer),[9] and PEEK (1979, a high performance thermoplastic).[4] ICI formed ICI Pharmaceuticals in 1957.

ICI developed a fabric in the 1950s known as Crimplene, a thick polyester yarn used to make a fabric of the same name. The resulting cloth is heavy and wrinkle-resistant, and retains its shape well. The California-based fashion designer Edith Flagg was the first to import this fabric from Britain to the USA. During the first two years, ICI gave Flagg a large advertising budget to popularise the fabric across America.

In 1960, Paul Chambers became the first chairman appointed from outside the company.[10] Chambers employed the consultancy firm McKinsey to help with reorganising the company.[10] His eight-year tenure saw export sales double, but his reputation was severely damaged by a failed takeover bid for Courtaulds in 1961–62.[10] In 1962, ICI developed the controversial herbicide, paraquat.

ICI was confronted with the nationalisation of its operations in Burma on 1 August 1962 as a consequence of the military coup.[11]

In 1964, ICI acquired British Nylon Spinners (BNS), the company it had jointly set up in 1940 with Courtaulds. ICI surrendered its 37.5 per cent holding in Courtaulds and paid Courtaulds £2 million a year for five years, "to take account of the future development expenditure of Courtaulds in the nylon field." In return, Courtaulds transferred to ICI their 50 per cent holding in BNS.[12] BNS was absorbed into ICI's existing polyester operation, ICI Fibres. The acquisition included BNS production plants in Pontypool, Gloucester and Doncaster, together with research and development in Pontypool. Early pesticide development included Gramoxone (1962, a herbicide),[4] the insecticides pirimiphos-methyl in 1967 and pirimicarb in 1970, brodifacoum (a rodenticide) was developed in 1974; in the late 1970s, ICI was involved in the early development of synthetic pyrethroid insecticides such as lambda-cyhalothrin.

Peter Allen was appointed chairman between 1968 and 1971.[13] He presided over the purchase of Viyella.[13] Profits shrank under his tenure.[13]

Jack Callard was appointed chairman from 1971 to 1975.[14] He almost doubled company profits between 1972 and 1974, and made ICI Britain's largest exporter.[14] In 1971, the company acquired Atlas Chemical Industries Inc., a major American competitor.[4]

In 1977, Imperial Metal Industries was divested as an independent quoted company.[15] From 1982 to 1987, the company was led by the charismatic John Harvey-Jones.[16] Under his leadership, the company acquired the Beatrice Chemical Division in 1985 and Glidden Coatings & Resins, a leading paints business, in 1986.[17]

Reorganisation of the business (1991–2007)

In 1991, ICI sold the agricultural and merchandising operations of BritAg and Scottish Agricultural Industries to Norsk Hydro,[18] and fought off a hostile takeover bid from Hanson, who had acquired 2.8 percent of the company.[19] It also divested its soda ash products arm to Brunner Mond, ending an association with the trade that had existed since the company's inception, one that had been inherited from the original Brunner, Mond & Co. Ltd.

In 1992, the company sold its nylon business to DuPont.[20] In 1993, the company de-merged its pharmaceutical bio-science businesses: pharmaceuticals, agrochemicals, specialities, seeds and biological products were all transferred into a new and independent company called Zeneca.[21] Zeneca subsequently merged with Astra AB to form AstraZeneca.[22]

Charles Miller Smith was appointed CEO in 1994, one of the few times that someone from outside ICI had been appointed to lead the company, Smith having previously been a director at Unilever. Shortly afterwards, the company acquired a number of former Unilever businesses in an attempt to move away from its historical reliance on commodity chemicals. In 1997, ICI acquired National Starch & Chemical, Quest, Unichema, and Crosfield, the speciality chemicals businesses of Unilever for $8 billion.[23] This step was part of a strategy to move away from cyclical bulk chemicals and to progress up the value chain to become a higher growth, higher margin business.[4] Later that year it went on to buy Rutz & Huber, a Swiss paints business.[24]

Having taken on some £4 billion of debt to finance these acquisitions, the company had to sell off its commodity chemicals businesses:

- Disposals of bulk chemicals businesses at that time included the sale of its Australian subsidiary, ICI Australia, for £1 billion in 1997,[25] and of its polyester chemicals business to DuPont for $3 billion also in 1997.[26]

- In 1998, it sold Crosfield to WR Grace and bought Acheson, an electronic chemicals business.[27][28]

- In 2000, ICI sold its diisocyanate, advanced materials, and speciality chemicals businesses at Teesside and worldwide (including plants at Rozenburg in the Netherlands, and South Africa, Malaysia and Taiwan), and Tioxide, its titanium dioxide subsidiary, to Huntsman Corporation for £1.7 billion.[29] It also sold the last of its industrial chemicals businesses to Ineos for £300 million.[30]

- In 2006, the Company sold Quest International, its flavours and fragrances business, to Givaudan, for £1.2 billion[31] and Uniqema, its oleochemical business, to Croda International, for £410 million.[32]

Having sold much of its historically profitable commodities businesses, and many of the new speciality businesses which it had failed to integrate, the company consisted mainly of the Dulux paints business, which quickly found itself the subject of a takeover by AkzoNobel.

Takeover by AkzoNobel

Dutch firm AkzoNobel (owner of Crown Berger paints) bid £7.2 billion (€10.66 billion or $14.5 billion) for ICI in June 2007. An area of concern about a potential deal was ICI's British pension fund, which had future liabilities of more than £9 billion at the time.[33] Regulatory issues in the UK and other markets where Dulux and Crown Paints brands each have significant market share were also a cause for concern for the boards of ICI and AkzoNobel. In the UK, any combined operation without divestments would have seen AkzoNobel have a 54 per cent market share in the paint market.[34] The initial bid was rejected by the ICI board and the majority of shareholders.[35] However, a subsequent bid for £8 billion (€11.82 billion) was accepted by ICI in August 2007, pending approval by regulators.[36]

At 8 a.m. on 2 January 2008, completion of the takeover of ICI plc by AkzoNobel was announced.[2] Shareholders of ICI received either £6.70 in cash or AkzoNobel loan notes to the value of £6.70 per one nominal ICI share. The adhesives business of ICI was transferred to Henkel as a result of the deal,[37] while AkzoNobel agreed to sell its Crown Paints subsidiary to satisfy the concerns of the European Commissioner for Competition.[38] The areas of concern regarding the ICI UK pension scheme were addressed by ICI and AkzoNobel.[39]

Operations

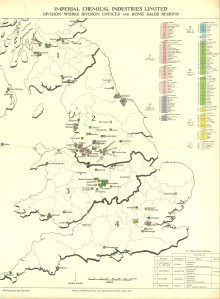

ICI operated a number of chemical sites around the world. In the UK, the main plants were as follows:

- Billingham (in Stockton-on-Tees) and Wilton (in present-day Redcar and Cleveland): ICI used the Billingham site to manufacture fertilisers in the 1920s and went on to produce plastics at Billingham in 1934. During World War II it manufactured Synthonia, a synthetic ammonia for explosives.[40] The Wilton R&D site was built to support the plastics division with R&D and chemical engineering facilities. The ICI Billingham Division was split into the ICI Heavy Organic Chemicals Division and ICI Agricultural Division in the 1960s. From 1971 to 1988 ICI Physics and Radioisotopes Section (later known as Tracerco) operated a small General Atomics TRIGA Mark I nuclear reactor at its Billingham factory for the production of radioisotopes used in the manufacture of flow and level instruments, among other products.[41]

- Blackley (in Manchester) and Huddersfield: ICI used the sites to manufacture dyestuffs. The dye business, known as the ICI Dyestuffs Division in the 1960s, went through several reorganisations. Huddersfield was tied in with Wilton with Nitrobenzene, Nitrotolulene production. Huddersfield also produced Insecticides. (Syngenta still make insecticides at Hudds). Proxel Biocide was made at Huddersfield from the 80's onwards. Additives also made at Huddersield. Huddersfield became Zeneca then AstraZeneca, in 2004 Huddersfield was Syngenta, Avecia, Arch and Lubrizol running what were all ICI plants at one time. Through the years it was combined with other speciality chemicals businesses and became Organics Division. Then became ICI Colours and Fine Chemicals and then ICI Specialties.[42]

- Runcorn (in Cheshire): ICI operated a number of separate sites within the Runcorn area, including Caster-Kellner site, where ICI manufactured chlorine and sodium hydroxide (caustic soda).[43] Adjacent to Castner-Kellner site was Rocksavage works, where a variety of chemicals based on chlorine products were manufactured, including Chloromethanes, Arklone dry cleaning fluid, Trichloethylene degreasing fluid and the Arcton range of CFCs. Also on that site were PVC manufacture and HF (Hydrogen fluoride) manufacture. At Runcorn Heath Research Laboratories, technical support, research and development for Mond Division products was carried out, and the support sections included chemical plan design and engineering sections. Just to the north of Runcorn, on an island between the Manchester Ship Canal and the River Mersey could be found the Wigg Works, which had been erected originally for producing poison gas in wartime. In Widnes could also be found several factories producing weedkillers and other products. For many years it was known as ICI Mond Division but later became part of the ICI Chemicals and Polymers Division. The Runcorn site was also responsible for the development of the HiGEE and Spinning Disc Reactor concepts. These were originated by Professor Colin Ramshaw and led to the concept of Process Intensification; research into these novel technologies is now being pursued by the Process Intensification Group at Newcastle University.[44]

- Winnington and Wallerscote (in Northwich, Cheshire): It was here that ICI manufactured sodium carbonate (soda ash) and its various by-products such as sodium bicarbonate (bicarbonate of soda), and sodium sesquicarbonate. The Winnington site, built in 1873 by the entrepreneurs John Tomlinson Brunner and Ludwig Mond, was also the base for the former company Brunner, Mond & Co. Ltd. and, after the merger which created ICI, the powerful and influential Alkali Division. It was at the laboratories on this site that polythene was discovered by accident in 1933 during experiments into high pressure reactions.[45] Wallerscote was built in 1926, its construction delayed by the First World War, and became one of the largest factories devoted to a single product (soda ash) in the world.[46] However, the decreasing importance of the soda ash trade to ICI in favour of newer products such as paints and plastics, meant that in 1984 the Wallerscote site was closed, and thereafter mostly demolished. The laboratory where polythene was discovered was sold off and the building became home to a variety of businesses including a go-kart track and paintballing, and the Winnington Works were divested to the newly formed company, Brunner Mond, in 1991. It was again sold in 2006, to Tata (an Indian-based company) and in 2011 was re branded as Tata Chemicals Europe. The Winnington plant closed in February 2014, with the last shift on 2 February bringing to a close 140 years of soda ash production in Northwich.

- Ardeer (in Stevenston, Ayrshire): ICI Nobel used the site to manufacture dynamite and other explosives and nitrocellulose-based products. For a time, the site also produced nylon and nitric acid. Nobel Enterprises was sold in 2002 to Inabata.[47]

- Slough (in Berkshire): Headquarters of ICI Paints Division.[48]

- Welwyn Garden City (in Hertfordshire): Headquarters of ICI Plastics Division until the early 1990s.[49]

Argentina

ICI subsidiary, called Duperial from 1928 to 1995, when it was renamed to ICI. Established in the city of San Lorenzo, Santa Fe. Operating an integrated production site with commercial offices in Buenos Aires. Since 2009, called AkzoNobel Functional Chemicals S.A., and makes sulphuric acid with ISO certification.

Australia

The subsidiary ICI Australia Ltd established the Dry Creek Saltfields at Dry Creek north of Adelaide, South Australia, in 1940, with an associated soda ash plant at nearby Osborne. In 1989, these operations were sold to Penrice Soda Products.[50] An ICI plant was built at Botany Bay in New South Wales in the 1940s and was sold to Orica in 1997.[51] The plant once manufactured paints, plastics and industrial chemicals such as solvents. It was responsible for the Botany Bay Groundwater Plume contamination of a local aquifer.[51]

See also

- IMI plc (formerly Imperial Metal Industries)

- Pharmaceutical industry in the United Kingdom

References

- ↑ Smith, David; O'Connell, Dominic; Dey, Iain; Ashton, James; Goodman, Matthew; Lyons, Teena; Kay, William (6 July 2008). "Falling into the abyss". The Times. London.

- 1 2 "Akzo Nobel ICI merger completed". BBC News. 2 January 2008. Retrieved 24 February 2011.

- ↑ "Akzo Nobel to Focus on Fast and Effective Integration in 2008" (Press release). Akzo Nobel U.K. 7 January 2008. Retrieved 13 February 2008.

- 1 2 3 4 5 6 7 8 9 10 11 12 13 14 "ICI: History". Archived from the original on 17 October 2008.

- ↑ "Tomorrow's Answers Today – The History of AkzoNobel since 1646" (PDF). Akzo Nobel International. p. 235.

- ↑ The Times. 3 January 1940. p. 12. Missing or empty

|title=(help) - ↑ "Why the BSA badge? A brief history". Classicglory.com. 6 May 1916. Retrieved 27 September 2010.

- ↑ http://www.atomicarchive.com/History/british/

- ↑ Sneader, Walter (2005). Drug discovery: a history. Wiley. ISBN 0-471-89979-8.

- 1 2 3 Strudwick, J. P.; Mark Pottle (2004). Chambers, Sir (Stanley) Paul (1904–1981). Oxford Dictionary of National Biography. Oxford University Press. Retrieved 23 August 2014.

- ↑ Taylor, Robert (2009). The State of Myanmar. p. 297.

- ↑ Keesing's Record of World Events (formerly Keesing's Contemporary Archives). 10. United Kingdom. July 1964. p. 20162.

- 1 2 3 Adeney, Martin (2004). Allen, Sir Peter Christopher (1905–1993)'. Oxford Dictionary of National Biography. Oxford University Press. Retrieved 24 August 2014.

- 1 2 Adeney, Martin (2004). Callard, Sir (Eric) John (1913–1998). Oxford Dictionary of National Biography. Oxford University Press. Retrieved 24 August 2014.

- ↑ Owen, Geoffrey (2000). From Empire to Europe: The Decline and Revival of British Industry Since the Second World War. HarperCollins. p. 347. ISBN 978-0-00-638750-3.

- ↑ "From bullying to the top of industry". icWales. 12 January 2008. Archived from the original on 18 January 2008. Retrieved 15 January 2008.

- ↑ "New Chairman of ICI praises planned agenda". The New York Times. 9 March 1987. Retrieved 27 September 2010.

- ↑ "Norsk Hydro acquires Britag Industries". Alacrastore.com. 5 September 1991. Retrieved 27 September 2010.

- ↑ Prokesch, Steven (18 May 1991). "Often-ravenous Hanson takes a taste of ICI". The New York Times. Retrieved 27 September 2010.

- ↑ "Capitalism" (PDF). Columbia University. Archived from the original (PDF) on 21 December 2012.

- ↑ Owen, Geoffrey; Harrison, Trevor (1995-03-01). "Why ICI Chose to Demerge". Harvard Business Review. Retrieved 2016-11-06.

- ↑ Ipsen, Erik (25 February 1993). "Will bad timing spoil ICI's plan to split in two?". International Herald Tribune. Archived from the original on 17 February 2009. Retrieved 27 September 2010.

- ↑ "National Starch sold to ICI". 1 June 1997. Retrieved 27 September 2010.

- ↑ "ICI buys Swiss Paints Group".

- ↑ "ICI Australia shares drop sharply". The New York Times. 9 May 1997. Retrieved 27 September 2010.

- ↑ "ICI sell off raises $3 billion".

- ↑ "ICI buys Acheson for $560 million in move to strengthen specialties". Allbusiness.com. Retrieved 27 September 2010.

- ↑ "ICI sells Crosfield and buys Acheson in portfolio reshuffle".

- ↑ Milner, Mark (15 April 1999). "Bayer and ICI sell-offs to boost balance sheets". The Guardian. London. Retrieved 27 September 2010.

- ↑ "ICI Sells Its Last Industrial Chemical Operations to Ineo".

- ↑ "ICI sells flavours business Quest". BBC News. 22 November 2006. Retrieved 27 November 2010.

- ↑ Marriner, Cosima (30 June 2006). "ICI to slash debts with £410m Uniqema sale". The Daily Telegraph. Retrieved 27 September 2010.

- ↑ Armitstead, Louise (5 August 2007). "Dutch poised to clinch £8bn ICI takeover". The Times. London. Retrieved 5 January 2008.

- ↑ "ICI snubs second offer from Akzo". BBC News. 30 July 2007. Retrieved 30 July 2007.

- ↑ "ICI rejects £7.2bn bid approach". BBC News. 18 June 2007. Retrieved 5 January 2008.

- ↑ "ICI agrees to be bought by Akzo". BBC News. 13 August 2007. Retrieved 13 August 2007.

- ↑ "Henkel to pay $5.5 bln for ICI units: Akzo". Reuters. 6 August 2007. Retrieved 5 January 2008.

- ↑ "Akzo Nobel to sell Crown paints". BBC News. 14 December 2007. Retrieved 5 January 2008.

- ↑ "ICI Pension Fund Web Site". Icipensionfund.org.uk. Retrieved 27 September 2010.

- ↑ "The white heat of new technology". BBC. 14 September 1949. Retrieved 27 September 2010.

- ↑ "History of Billingham". Thisisstockton.co.uk. Retrieved 27 September 2010.

- ↑ "British Dyestuffs Corporation and ICI". ColorantsHistory.Org. 17 March 2006. Retrieved 27 September 2010.

- ↑ "ICI cuts 1,000 jobs". BBC News. 4 January 1999. Retrieved 27 September 2010.

- ↑ "Process Intensification". Ccdcindia.com. Retrieved 27 September 2010.

- ↑ Dick, W.F.L. (1973). A Hundred Years of Alkali in Cheshire. Birmingham.

- ↑ ICI Magazine, Kynoch Press. 1963.

- ↑ "Japanese firm buys ICI's nitrocellulose business". Chemical Week. 22 January 2003.

- ↑ "Review sparks fears for future of ICI Paints site". Maidenhead Advertiser. Archived from the original on 22 July 2011. Retrieved 27 September 2010.

- ↑ "Welwyn Garden City, a town in Hertfordshire". Geton-thenet.co.uk. Retrieved 27 September 2010.

- ↑ Hough, J.K. (September 2008), "Salt production in South Australia" (PDF), MESA Journal, 50, retrieved 8 February 2014

- 1 2 Gibson, Jano; Huxley, John (1 April 2005). "Botany pollution fears grow". The Sydney Morning Herald. ISSN 0312-6315. Retrieved 24 July 2010.