Growth of photovoltaics

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Worldwide growth of photovoltaics has been an exponential curve between 2007–2017. During this period of time, photovoltaics (PV), also known as solar PV, evolved from a niche market of small scale applications to a mainstream electricity source. When solar PV systems were first recognized as a promising renewable energy technology, programs, such as feed-in tariffs, were implemented by a number of governments in order to provide economic incentives for investments. For several years, growth was mainly driven by Japan and pioneering European countries. As a consequence, cost of solar declined significantly due to Experience curve effects like improvements in technology and economies of scale.

Experience curves describe that the price of a thing decreases with the sum-total ever produced. PV growth increased even more rapidly when production of solar cells and modules started to ramp up in the USA with their Millions solar roofs project, and when renewables were added to China's 2011 five-year-plan for energy production.[7] Since then, deployment of photovoltaics has gained momentum on a worldwide scale, particularly in Asia but also in North America and other regions, where solar PV by 2015–17 was increasingly competing with conventional energy sources as grid parity has already been reached in about 30 countries.[8]:9

Projections for photovoltaic growth are difficult and burdened with many uncertainties. Official agencies, such as the International Energy Agency consistently increased their estimates over the years, but still fell short of actual deployment.[9][10][11][12]

Historically, the United States was the leader of installed photovoltaics for many years, and its total capacity amounted to 77 megawatts in 1996—more than any other country in the world at the time. Then, Japan was the world's leader of produced solar electricity until 2005, when Germany took the lead and by 2016 had a capacity of over 40 gigawatts. However, in 2015, China became world's largest producer of photovoltaic power.[13][14][15] China was expected to continue its rapid growth and to triple its PV capacity to 70 gigawatts by 2017.[16][17]

By the end of 2016, cumulative photovoltaic capacity reached about 302 gigawatts (GW), estimated to be sufficient to supply between 1.3% and 1.8% of global electricity demand.[18][19] Solar contributed 8%, 7.4% and 7.1% to the respective annual domestic consumption in Italy, Greece and Germany.[5] Installed worldwide capacity was projected to more than double or even triple to more than 500 GW between 2016 and 2020.[2] By 2050, solar power was anticipated to become the world's largest source of electricity, with solar photovoltaics and concentrated solar power contributing 16% and 11%, respectively. This would require PV capacity to grow to 4,600 GW, of which more than half was forecast to be deployed in China and India.[20]

Current status

Current status describes worldwide, regional and domestic solar PV deployment as of the end of 2014 (see section Forecast for next years). Nameplate capacity denotes the peak power output of power stations in unit watt prefixed as convenient, to e.g. kilowatt (kW), megawatt (MW) and gigawatt (GW). Depending on context, the stated peak power may be prior to a subsequent conversion to alternating current, e.g. for a single photovoltaic panel, or include this conversion and its loss for a grid connected photovoltaic power station.[3]:15[21]:10

At the utility level, wind power competes for new installations and has different characteristics, e.g. a higher capacity factor and about four times the 2015 electricity production compared to solar power. Compared with wind power, photovoltaic power production correlates well with power consumption for air-conditioning in warm countries, where it can replace peaker power plants. As of 2017 utilities have started combining PV installations with battery banks thus obtaining dispatchable generation.[22][23]

For a complete history of deployment over the last two decades, also see section History of deployment.

Worldwide

In 2016, photovoltaic capacity increased by at least 75 GW, with a 50% growth year-on-year of new installations. Cumulative installed capacity reached at least 302 GW by the end of the year, sufficient to supply 1.8 percent of the world's total electricity consumption.[19]

Cumulative PV capacity by region as of the end of 2014.[4]

| Report | Cumulative (MW) | Installed (MW) | Year-End Period |

Release date | Type | Ref |

|---|---|---|---|---|---|---|

| IEA-PVPS snapshot | >302,000 | >75,000 | 2016 | April 2017 | preliminary | [19] |

| Overview of reported annual installations and global cumulative peak power figures in chronological order | ||||||

Regions

In 2014, Asia was the fastest growing region, with more than 60% of global installations. China and Japan alone accounted for 20 GW or half of worldwide deployment. Europe continued to decline and installed 7 GW or 18% of the global PV market, three times less than in the record-year of 2011, when 22 GW had been installed. For the first time, North and South America combined accounted for at least as much as Europe, about 7.1 GW or about 18% of global total. This was due to the strong growth in the United States, supported by Canada, Chile and Mexico.[4]

In terms of cumulative capacity, Europe was still the most developed region with 88 GW or half of the global total of 178 GW. Solar PV covered 3.5% and 7% of European electricity demand and peak electricity demand, respectively in 2014.[4]:6 The Asia-Pacific region (APAC) which includes countries such as Japan, India and Australia, followed second and accounted for about 20% percent of worldwide capacity. China was third with 16%, followed by the Americas with about 12%. Cumulative capacity in the MEA (Middle East and Africa) region and ROW (rest of the world) accounted for only about 3.3% of the global total. A great untapped potential remained for many of these countries, especially in the Sunbelt.

Countries

Added PV capacity by country in 2014 (clustered by region)[4]

As in 2013, the world's top installer in 2014 was China (+10.6 GW), followed by Japan (+9.6 GW) and the United States (+6.2 GW), while the United Kingdom (+2.3 GW) emerged as new European leader ahead of Germany (+1.9 GW) and France (+0.9 GW). Germany remained for one more year the world's largest producer of solar power with an overall installed capacity of 38.2 GW.[4]

Chile (+0.4 GW) and South Africa (+0.8 GW) were newcomers in 2014. South Africa entered the top 10 in added capacity rankings for the first time. There were twenty countries around the world with a cumulative PV capacity of more than one gigawatt (see bar-chart below). Thailand (1,299 MW), The Netherlands (1,123 MW), and Switzerland (1,076 MW), all crossed the gigawatt threshold in 2014. Based on IEA's data, the available solar PV capacity in Italy, Germany and Greece was sufficient to supply between 7% and 8% of their respective domestic electricity consumption.[4]

Other mentionable PV deployments above the 100-megawatt mark included Canada (500 MW), Thailand (475 MW), The Netherlands (400 MW), Taiwan (400 MW), Italy (385 MW), Chile (1,113 MW),[24] Switzerland (320 MW), Israel (250 MW), Austria (140 MW) and Portugal (110 MW).[4] Underperforming countries were Belgium (65 MW), Bulgaria (2 MW), the Czech Republic (2 MW), Greece (16 MW), Romania (69 MW), Slovakia (0.4 MW) and Spain (22 MW), with very low to almost non-existent additions compared to previous years.

| # | Country | Total Capacity | Added Capacity |

|---|---|---|---|

| 1 | 78070 | 34540 | |

| 2 | 42750 | 8600 | |

| 3 | 41220 | 1520 | |

| 4 | 40300 | 14730 | |

| 5 | 19279 | 373 | |

| 6 | 11630 | 1970 | |

| 7 | 9010 | 3970 | |

| 8 | 7130 | 559 | |

| 9 | 5900 | 839 | |

| 10 | 5490 | 55 | |

| 11 | 4350 | 850 | |

| 12 | 3422 | 170 | |

| 13 | 2715 | 200 | |

| 14 | 2150 | 726 | |

| 15 | 2100 | 525 | |

| 16 | 1640 | 250 | |

| 17 | 1610 | 746 | |

| 18 | 1450 | 536 | |

| 19 | 1077 | 154 | |

| 20 | 910 | 130 | |

| 21 | 900 | 756 | |

| 22 | 900 | 70 | |

| 23 | 832 | 584 | |

| 24 | 513 | 58 | |

| 25 | 320 | 150 | |

| 27 | 286 | 54 | |

| 28 | 175 | 60 | |

| 29 | 26.7 | 11 | |

| 30 | 15 | 10 |

| # | Country | Total Capacity | Added Capacity |

|---|---|---|---|

| – | 94,570 | 7,230 | |

| 1 | 43,530 | 15,150 | |

| 2 | 39,700 | 1,450 | |

| 3 | 34,410 | 11,000 | |

| 4 | 25,620 | 7,300 | |

| 5 | 18,920 | 300 | |

| 6 | 8,780 | 3,510 | |

| 7 | 6,580 | 879 | |

| 8 | 5,400 | 56 | |

| 9 | 5,070 | 935 | |

| 10 | 5,050 | 2,000 | |

| 11 | 3,430 | 1,010 | |

| 12 | 3,250 | 95 | |

| 13 | 2,613 | 10 | |

| 14 | 2,500 | 600 | |

| 15 | 2,083 | 16 | |

| 16 | 1,570 | 450 | |

| 17 | 1,420 | 121 | |

| 18 | 1,360 | 300 | |

| 19 | 1,325 | 102 | |

| 20 | 1,120 | 200 | |

| 21 | 1,021 | 1 | |

| 22 | 1,010 | 400 | |

| 23 | 1,000 | 600 | |

| 24 | 937 | 150 | |

| 25 | 881 | 200 | |

| 26 | 848 | 446 | |

| 27 | 789 | 183 | |

| 28 | 591 | 1 | |

| 29 | 454 | 63 | |

| 30 | 389 | 389 | |

| 31 | 300 | 270 | |

| 32 | 282 | 103 | |

| 33 | 266 | 208 | |

| 34 | 257 | 1 | |

| 35 | 231 | 63 | |

| 36 | 155 | 122 | |

| 37 | 138 | 60 | |

| 38 | 130 | 51 | |

| 39 | 125 | 15 | |

| 40 | 87 | 57 | |

| 41 | 73 | 19 | |

| 42 | 73 | 5 | |

| 43 | 70 | 5 | |

| 44 | 45 | 11 | |

| 45 | 20 | 5 | |

| 46 | 15 | 2 | |

| 47 | 4 | 4 | |

| 48 | 2 | 1 | |

| 49 | 2 | 0 | |

| World Total PV Capacity (2015)[26] | 256,000 | 59,000 | |

Forecast

Forecast for 2017

In December 19, 2016, IHS Markit forecast that global installations would reach 79 GW, representing 3% growth.[27]

On April 5, 2017, Greentech Media predicted that the global solar market will grow 9% in 2017, reaching 85.4 gigawatts (GW), after 2016 saw a total of just over 78 GW. They also predicted that the largest 4 installing countries – China, USA, India, Japan – would together account for about 73% of total installations, with the rest of the world splitting the remainder.[28]

Source:[29]

Global short-term forecast (2020)

| Forecasting company or organization | Cumulative by 2020 | To be added 2015–20207 | Ø Annual installation |

|---|---|---|---|

| IEA (baseline, 2014) | 403 GW | 225 GW | 38 GW |

| GlobalData (2014) | 414 GW | 236 GW | 39 GW |

| SPE/EPIA (low scenario, 2015)1 | 444 GW | 266 GW | 44 GW |

| Frost & Sullivan (2015) | 446 GW | 268 GW | 45 GW |

| IEA (enhanced case, 2014)2 | 490 GW | 312 GW | 52 GW |

| Grand View Research (2015) | 490 GW | 312 GW | 52 GW |

| Citigroup (CitiResearch, 2013) | 500 GW | 322 GW | 54 GW |

| PVMA (medium scenario, 2015)3 | 536 GW | 358 GW | 60 GW |

| IHS (10.5% CAGR, 2015)4 | 566 GW | 388 GW | 65 GW |

| BNEF (New Energy Outlook 2015)5 | 589 GW | 411 GW | 69 GW |

| SPE/EPIA (high scenario, 2015)1 | 630 GW | 452 GW | 75 GW |

| Fraunhofer (17% CAGR, 2015)6 | 668 GW | 490 GW | 82 GW |

| GTM Research (June, 2015) | 696 GW | 518 GW | 86 GW |

| List ordered by ascending estimated capacities and publication date 1 SPE – extrapolated 2019-projection (396 GW and 540 GW, resp.) [2]:15 2 IEA – arithmetic mean of 465–515 GW [30] 3 PVMA – average of scenarios (444–630 GW), read from diagram [31] 4 IHS – extrapolated 2019-estimate, based on a CAGR of 10.5% [32][33] 5 BNEF – figures may include contribution from CSP [34] 6 FSH – external expert scenario based on a CAGR of 17% [35]:19,25 7 Difference to global cumulative as of the end of 2014 (178 GW) [2]:5 | |||

There have been a number of short and medium term forecasts published by several organizations and market research companies. In addition, the International Energy Agency (IEA) and Solar Power Europe (SPE, the former EPIA) produced more than one scenario each. The summary table shows the different forecasts for global PV capacity by 2020. Projections are listed by ascending cumulative capacity. The table also shows the capacity that has to be installed from 2015–2020 and the average annual installation required to meet the projection. Conservative scenarios forecast capacity to reach 400 or more gigawatts, assuming declining annual installations from current levels, while more optimistic scenarios projected cumulative capacity to grow beyond 500 GW. Only the most optimistic projections around 600 GW foresee annual installations to grow above 10 percent (p.a) in the near future.

SPE (the European Photovoltaic Industry Association) expected the fastest PV growth to continue in China, South-East Asia, Latin America, the Middle-East, North Africa, and India. By 2019, worldwide capacity was projected to reach between 396 GW (low scenario) and 540 GW (high scenario). This corresponded to a more than doubling and tripling of installed capacity within five years, respectively.[2]:15

Consulting firm Frost & Sullivan projected global PV capacity to increase to 446 GW by 2020, with China, India and North America being the fastest growing regions, while Europe was expected to double its solar capacity from levels at the time.[36] Grand View Research, a market research and consulting firm, headquartered in San Francisco, published its solar PV forecast report in March 2015. The large PV potential in countries such as Brazil, Chile and Saudi Arabia had not expanded as expected and was supposed to be explored over the next six years. In addition, China's increase of manufacturing capacity was expected to lower global market prices further. The consulting firm projected worldwide cumulative deployment to reach about 490 GW by 2020.[37]

The PV Market Alliance (PVMA), a consortium of several research bodies founded in 2014,[38] forecast in 2015 that global PV capacity would reach 444–630 GW by 2020. In its low scenario, annual installations were projected to grow from 40 to 50 gigawatts by 2020, while its high scenario forecast deployment would increase from 60 to 90 GW between 2015–2020. The medium scenario therefore expected annual PV installations to grow from 50 GW to 70 GW and to reach 536 GW by 2020.[31][39] PVMA's figures were in line with those published earlier by Solar Power Europe. In June 2015, Greentech Media (GTM) Research released its Global PV Demand Outlook for 2020. The company projected annual installations to increase from 40 GW to 135 GW and global cumulative capacity to reach almost 700 GW by 2020. GTM's outlook was the most aggressive of all forecasts in 2015, with projected deployment of 518 GW between 2015 and 2020, or more than twice as much as IEA's 225 GW baseline case scenario, published ten months earlier.[40]

| Year | 2013-edition | Diff | 2014-edition | 2015-edition |

|---|---|---|---|---|

| 2013 | 30 GW | +9 | 39 GW | – |

| 2014 | 30 GW | +9 | 39 GW | 39 GW |

| 2015 | 33 GW | +5 | 38 GW | 42 GW |

| 2016 | 36 GW | +3 | 39 GW | 42 GW |

| 2017 | 38 GW | -2 | 36 GW | 39 GW |

| 2018 | 40 GW | -3 | 37 GW | 41 GW |

| 2019 | n.a. | n.a. | 38 GW | 43 GW |

| 2020 | n.a. | n.a. | 39 GW | 45 GW |

| Source: IEA Medium Term Renewable Energy Market data from 2013-edition,[41] 2014-edition[30] and 2015-edition[42] | ||||

The International Energy Agency (IEA) saw overall stagnating annual installations in the range of 36–39 GW until 2020, when global capacity would reach 403 GW, according to the highlighted baseline case scenario of the Medium Term Renewable Energy Market 2014 report.[30][43] Paradoxically, since the report's 2013-edition, projected cumulative for 2018 had increased by 6% from 308 GW to 326 GW, while the corresponding annual deployment decreased.[41] This was due to the fact that the International Energy Agency adjusted annual installations upward on the near-end – in order to meet actual deployment, while reducing estimates on the far-end. The result was a flat curve that stayed below 40 GW until 2020 (see table). For 2017, the projected low of 36 GW concided with the scheduled expiration of the solar investment tax credit (ITC) in the U.S. and the expected end of the solar boom in Japan. IEA's projected annual installation of less than 40 GW also lead to a negative growth rate, since expectations for 2015 were much higher. Such a decline, however, would have been unprecedented and has never been observed in the recorded history of solar PV deployment. This scenario made IEA's baseline case the most conservative of all projections. In the less featured enhanced high case scenario, IEA estimated that "solar PV could reach a cumulative 465 GW to 515 GW in 2020"[30]:8 and that "solar PV capacity could top 500 GW globally in 2020".[43]

By 2020, IEA's Technology Roadmap: Solar Photovoltaic Energy report expected China to account for over 110 GW of solar PV, while Japan and Germany would each reach around 50 GW. The United States would rank fourth at over 40 GW, followed by Italy and India with 25 GW and 15 GW. The United Kingdom, France and Australia, would have installed capacities of close to 10 GW each.[20]:17 IEA released this outlook in September 2014 (see section below for more detail on the report). Two months later, however, India announced its intention to install 100 GW of solar PV by 2022, and another six months later, SEIA forecasted that the United States would reach 40 GW of cumulative PV capacity already by the end of 2016.[44][45] Furthermore, in July 2015, the UK was forecast to reach 10 GW by early 2016.[46] IEA scduled the release its next roadmap report on solar PV in 2018.

Global long-term forecast (2050)

In 2014, the International Energy Agency (IEA) released its latest edition of the Technology Roadmap: Solar Photovoltaic Energy report,[20] calling for clear, credible and consistent signals from policy makers.[47] The IEA also acknowledged to have previously underestimated PV deployment and reassessed its short-term and long-term goals.

IEA report Technology Roadmap: Solar Photovoltaic Energy (September 2014)[20]:1 —

- Much has happened since our 2010 IEA technology roadmap for PV energy. PV has been deployed faster than anticipated and by 2020 will probably reach twice the level previously expected. Rapid deployment and falling costs have each been driving the other. This progress, together with other important changes in the energy landscape, notably concerning the status and progress of nuclear power and CCS, have led the IEA to reassess the role of solar PV in mitigating climate change. This updated roadmap envisions PV's share of global electricity rising up to 16% by 2050, compared with 11% in the 2010 roadmap.

IEA's long-term scenario for 2050 described how worldwide solar photovoltaics (PV) and concentrated solar thermal (CSP) capacity would reach 4,600 GW and 1,000 GW, respectively. In order to achieve IEA's projection, PV deployment of 124 GW and investments of $225 billion were required annually. This was about three and two times levels at that time, respectively. By 2050, levelized cost of electricity (LCOE) generated by solar PV would cost between US 4¢ and 16¢ per kilowatt-hour (kWh), or by segment and on average, 5.6¢ per kWh for utility-scale power plants (range of 4¢ to 9.7¢), and 7.8¢ per kWh for solar rooftop systems (range of 4.9¢ to 15.9¢)[20]:5,24 These estimates were based on a weighted average cost of capital (WACC) of 8%. The report noted that when the WACC exceeds 9%, over half the LCOE of PV is made of financial expenditures, and that more optimistic assumptions of a lower WACC would therefore significantly reduce the LCOE of solar PV in the future.[20]:24–25 The IEA also emphasized that these new figures were not projections but rather scenarios they believe would occur if underlying economic, regulatory and political conditions played out.

In 2015, Fraunhofer ISE did a study commissioned by German renewable think tank Agora Energiewende and concluded that most scenarios fundamentally underestimate the role of solar power in future energy systems.[48] Fraunhofer's study (see summary of its conclusions below) differed significantly from IEA's roadmap report on solar PV technology despite being published only a few months apart. The report foresaw worldwide installed PV capacity would reach as much as 30,700 GW by 2050. By then, Fraunhofer expected LCOE for utility-scale solar farms to reach €0.02 to €0.04 per kilowatt-hour, or about half of what the International Energy Agency had been projecting (4¢ to 9.7¢). Turnkey system costs would decrease by more than 50% to €436/kWp from currently €995/kWp.[35]:67 This is also noteworthy, as IEA's roadmap published significantly higher estimates of $1,400 to $3,300 per kWp for eight major markets around the world (see table Typical PV system prices in 2013 below).[20]:15 However, the study agreed with IEA's roadmap report by emphasizing the importance of the cost of capital (WACC), which strongly depends on regulatory regimes and may even outweigh local advantages of higher solar insolation.[35]:1, 53 In the study, a WACC of 5%, 7.5% and 10% was used to calculate the projected levelized cost of electricity for utility-scale solar PV in 18 different markets worldwide.[35]:65

Fraunhofer ISE: Current and Future Cost of Photovoltaics. Long-term Scenarios for Market Development, System Prices and LCOE of Utility-Scale PV Systems. Study on behalf of Agora Energiewende (February 2015)[35]:1 —

- Solar photovoltaics is already today a low-cost renewable energy technology. Cost of power from large scale photovoltaic installations in Germany fell from over 40 ct/kWh in 2005 to 9 cts/kWh in 2014. Even lower prices have been reported in sunnier regions of the world, since a major share of cost components is traded on global markets.

- Solar power will soon be the cheapest form of electricity in many regions of the world. Even in conservative scenarios and assuming no major technological breakthroughs, an end to cost reduction is not in sight. Depending on annual sunshine, power cost of 4–6 cts/kWh are expected by 2025, reaching 2–4 ct/kWh by 2050 (conservative estimate).

- Financial and regulatory environments will be key to reducing cost in the future. Cost of hardware sourced from global markets will decrease irrespective of local conditions. However, inadequate regulatory regimes may increase cost of power by up to 50 percent through higher cost of finance. This may even overcompensate the effect of better local solar resources.

- Most scenarios fundamentally underestimate the role of solar power in future energy systems. Based on outdated cost estimates, most scenarios modeling future domestic, regional or global power systems foresee only a small contribution of solar power. The results of our analysis indicate that a fundamental review of cost-optimal power system pathways is necessary.

Regional forecasts

- In October 2015, China's National Energy Administration (NDRC) set an ambitious 23.1 GW target for 2015, upgrading its previous target of 17.8 GW from March 2015, which was already more than the entire global PV capacity installed in 2010.[17][49] With this revised target, China surpassed Germany's total capacity of 40 GW by the end of the year and became the world's largest overall producer of photovoltaic power.

- As of October 2015, China planned to install 150 GW of solar power by 2020,[50] an increase of 50 GW compared to the 2020-target announced in October 2014, when China planned to install 100 GW of solar power—along with 200 GW of wind, 350 GW of hydro and 58 GW of nuclear power.[51]

- Overall, China has consistently increased its annual and short term targets. However estimates, targets and actual deployment have differed substantially in the past: in 2013 and 2014, China was expected to continue to install 10 GW per year.[3]:37 In February 2014, China's NDRC upgraded its 2014 target from 10 GW to 14 GW[52] (later adjusted to 13 GW[53]) and ended up installing an estimated 10.6 GW due to shortcomings in the distributed PV sector.[54]

- By 2016, India planned to have constructed the world’s largest solar farm with a capacity of 750 MW. The country planned to install 100 GW capacity of solar power by 2022, a five-time increase from a previous target.[55] However, India's solar PV deployment was below expectation and actually declined from 1,115 MW in 2013 to 616 MW in 2014, which contrasted with the country’s positive policy tone towards solar PV. In 2015, record installations were 3018 MW against expectation of 2 GW.[56] As of July 13, 2015, total commissioned capacity in India surpassed 4 GW and stood at 4,096 MW, with the state Rajasthan and Gujarat taking the lead with 1,164 MW and 1,000 MW, respectively.[57]

- For 2014, installations in Japan reached an all time record level of 9.7 GW, compared to 6.9 GW in 2013. By the end of 2014, Japan's installed PV capacity of 23.3 GW could contribute about 2.5% to the overall domestic electricity demand.[4]:13 In 2014, Japan also overtook Italy (18.5 GW) as the world's third largest PV nation in terms of cumulative capacity. IHS forecast that Japan would retain its position as the world's second largest solar market for new installations and grow by 4%, adding another 10.4 GW in 2015.[32]

- In March 2015, SEIA, the Solar Energy Industries Association and GTM Research, released their U.S. estimate for 2014. In the United States, a total of 6.2 gigawatts had been installed, up 30 percent over 2013 (vs. previous projection of 6.5 GW in September 2014). This brought the country’s cumulative PV total to 18.3 GW. However, according to IHS, U.S. deployment amounted to 7 GW in 2014, or 800 MW higher than SEIA reported.[32] In June 2014 Barclays downgraded bonds of U.S. utility companies. Barclays expected more competition by a growing self-consumption due to a combination of decentralized PV-systems and residential electricity storage. This could fundamentally change the utility's business model and transform the system over the next ten years, as prices for these systems were predicted to fall.[58] For 2015, annual PV installations were predicted to increase to 8.1 GW (cumulative of 26.4 GW) by the end of the year.[59] Other sources forecast U.S. deployment to increase by approximately 9 GW in 2015, before peaking in 2016.[60][32] In May 2015, SEIA predicted U.S. the PV-market would grow by 25% to 50% in 2016, with a cumulative PV capactiy of 40 GW by the end of 2016. Roughly, this translated into 13 GW of added capacity in 2016.[45]

<0.1, n/a | 0.1–1 | 1–10 | 10–50 | 50–100 |

100–150 | 150–200 | 200–300 | 300–450 | >450 |

- By 2020, the European Photovoltaic Industry Association (EPIA) expected PV capacity to pass 150 GW. It found the EC-supervised national action plans for renewables (NREAP) were too conservative, as the goal of 84 GW of solar PV by 2020 had already been surpassed in 2014 – preliminary figures accounted for close to 88 GW by the end of 2014.[4] For 2030, EPIA originally predicted solar PV would reach between 330 and 500 GW, supplying 10 to 15 percent of Europe's electricity demand. However, later reassessments were more pessimistic and foreacst a 7 to 11 percent share, if no major policy changes are undertaken.[3]:35

- In 2014, overall European markets continued to decline despite strong growth in some countries. These countries, with their percentage-increase of total capacity, were, the United Kingdom (+80%), the Netherlands (+54%), Switzerland (+42%), Austria (+22%) and France (+20%), which rebounced significantly in terms of annual installations from 643 MW in 2013 to 927 MW in 2014. In most countries, however, deployment underperformed or, in some cases, growth of cumulative capacity even fell below the one percent mark. In descending percentage-order, cumulative installations only grew by 6.0% in Romania (69 MW), 5.2% in Germany (1,900 MW), 2.1% in Italy (385 MW), 2.1% in Belgium (65 MW), 0.4% in Spain (22 MW), 0.2% in Bulgaria (1.6 MW), 0.08% in Slovakia (0.4 MW), 0.06% in Greece (16 MW), and 0.01% in the Czech Republic (1.7 MW).[4]:15

- The United Kingdom had the strongest percentage growth and became the fourth largest PV installer worldwide after China, Japan and the United States. In 2014, the country installed more than 2.2 GW (vs. 1.1 GW in 2013) and cumulative installation increased by 80% to 5.1 GW by the end of the year.[61] The booming utility-scale installations were partially explained by the upcoming closure of the appealing renewable obligation certificates (ROC) scheme in March 2015.[53] IHS forecast 3.5 GW of installations for 2015 whch would have been another record deployment.[32]

- In Germany and Italy, the rate of new installations continued to decline in 2014 and wes expected to remain unchanged or even decline to 1.3 GW for 2015.[60] In 2014, Germany installed 1.9 GW, down 36 percent from 3.3 GW deployed in 2013. During the period of 2010–2012, the country was the world's leader installing more than 7 GW annually. New cumulative capacity of 38.2 GW corresponded to 475 watts per inhabitant. Italy installed 0.4 GW,[62] much less than previously expected and down from 1.5 GW deployed in 2013. Overall capacity of 18.5 GW translated into 304 watts per inhabitant. Solar PV in 2016 contributed significantly to domestic net-electricity consumption in Italy (7.9%), Greece (7.6%) and Germany (7.0%).[4]:15

History of leading countries

Since the 1950s, when the first solar cells were commercially manufactured, there has been a succession of countries leading the world as the largest producer of electricity from solar photovoltaics. First it was the United States, then Japan, followed by Germany, and currently China.

United States (1954–1996)

The United States, inventor of modern solar PV, was the leader of installed capacity for many years. Based on preceding work by Swedish and German engineers, the American engineer Russell Ohl at Bell Labs patented the first modern solar cell in 1946.[63][64] It was also there at Bell Labs where the first practical c-silicon cell was developed in 1954.[65][66] Hoffman Electronics, the leading manufacturer of silicon solar cells in the 1950s and 1960s, improved on the cell's efficiency, produced solar radios, and equipped Vanguard I, the first solar powered satellite launched into orbit in 1958.

UK USA Japan China Italy Germany

In 1977 US-President Jimmy Carter installed solar hot water panels on the White House promoting solar energy[67] and the National Renewable Energy Laboratory, originally named Solar Energy Research Institute was established at Golden, Colorado. In the 1980s and early 1990s, most photovoltaic modules were used in stand-alone power systems or powered consumer products such as watches, calculators and toys, but from around 1995, industry efforts have focused increasingly on developing grid-connected rooftop PV systems and power stations. By 1996, solar PV capacity in the US amounted to 77 megawatts–more than any other country in the world at the time. Then, Japan moved ahead.

Japan (1997–2004)

Japan took the lead as the world's largest producer of PV electricity, after the city of Kobe was hit by the Great Hanshin earthquake in 1995. Kobe experienced severe power outages in the aftermath of the earthquake, and PV systems were then considered as a temporary supplier of power during such events, as the disruption of the electric grid paralyzed the entire infrastructure, including gas stations that depended on electricity to pump gasoline. Moreover, in December of that same year, an accident occurred at the multibillion-dollar experimental Monju Nuclear Power Plant. A sodium leak caused a major fire and forced a shutdown (classified as INES 1). There was massive public outrage when it was revealed that the semigovernmental agency in charge of Monju had tried to cover up the extent of the accident and resulting damage.[68][69] Japan remained world leader in photovoltaics until 2004, when its capacity amounted to 1,132 megawatts. Then, focus on PV deployment shifted to Europe.

Germany (2005–2014)

In 2005, Germany took the lead from Japan. With the introduction of the Renewable Energy Act in 2000, feed-in tariffs were adopted as a policy mechanism. This policy established that renewables have priority on the grid, and that a fixed price must be paid for the produced electricity over a 20-year period, providing a guaranteed return on investment irrespective of actual market prices. As a consequence, a high level of investment security lead to a soaring number of new photovoltaic installations that peaked in 2011, while investment costs in renewable technologies were brought down considerably. In 2016 Germany's installed PV capacity was over the 40 GW mark.

China (2015–present)

China surpassed Germany's capacity by the end of 2015, becoming the world's largest producer of photovoltaic power.[70] China's rapid PV growth continued in 2016 – with 34.2 GW of solar photovoltaics installed.[71] The quickly lowering feed in tariff rates at the end of 2015 motivated many developers to secure tariff rates before mid-year 2016 – as they were anticipating further cuts (correctly so). During the course of the year, China announced its goal of installing 100 GW during the next Chinese Five Year Economic Plan (2016–2020). China expected to spend ¥1 trillion ($145B) on solar construction[72] during that period. Much of China's PV capacity was built in the relatively less populated west of the country whereas the main centres of power consumption were in the east (such as Shanghai and Beijing).[73] Due to lack of adequate power transmission lines to carry the power from the solar power plants, China had to curtail its PV generated power.[73][74][75]

History of market development

Prices and costs (1977–present)

| Type of cell or module | Price per watt |

|---|---|

| High efficiency multi-Si cell (>18.4%) | $0.207 |

| Taiwanese multi-Si | $0.192 |

| Chinese multi-Si | $0.191 |

| Mono-Si cell | $0.247 |

| Module (multi-Si) | $0.361 |

| Module (mono-Si) | $0.375 |

| Source: EnergyTrend, price quotes, average prices, 22 May 2017 [76] | |

The average price per watt dropped drastically for solar cells over the in the decades leading up to 2017. While in 1977 prices for crystalline silicon cells were about $77 per watt, average spot prices in June 2014 were as low as $0.36 per watt or 200 times less than almost forty years ago. Prices for thin-film solar cells and for c-Si solar panels were around $.60 per watt.[77] Module and cell prices declined even further after 2014 (see price quotes in table).

This price trend was seen as evidence supporting Swanson's law (an observation similar to the famous Moore's Law) that states that the per-watt cost of solar cells and panels fall by 20 percent for every doubling of cumulative photovoltaic production.[78] A 2015 study showed price/kWh dropping by 10% per year since 1980, and predicted that solar could contribute 20% of total electricity consumption by 2030.[79]

In its 2014 edition of the Technology Roadmap: Solar Photovoltaic Energy report, the International Energy Agency (IEA) published prices for residential, commercial and utility-scale PV systems for eight major markets as of 2013 (see table below).[20] However, DOE's SunShot Initiative report states lower prices than the IEA report, although both reports were published at the same time and referred to the same period. After 2014 prices fell further. For 2014, the SunShot Initiative modeled U.S. system prices to be in the range of $1.80 to $3.29 per watt.[80] Other sources identified similar price ranges of $1.70 to $3.50 for the different market segments in the U.S.[81] In the highly penetrated German market, prices for residential and small commercial rooftop systems of up to 100 kW declined to $1.36 per watt (€1.24/W) by the end of 2014.[82] In 2015, Deutsche Bank estimated costs for small residential rooftop systems in the U.S. around $2.90 per watt. Costs for utility-scale systems in China and India were estimated as low as $1.00 per watt.[8]:9 As of May 2017, a residential 5 kW-system in Australia cost on average about AU$1.25, or US$0.93 per watt.[83]

| USD/W | Australia | China | France | Germany | Italy | Japan | United Kingdom | United States |

|---|---|---|---|---|---|---|---|---|

| Residential | 1.8 | 1.5 | 4.1 | 2.4 | 2.8 | 4.2 | 2.8 | 4.91 |

| Commercial | 1.7 | 1.4 | 2.7 | 1.8 | 1.9 | 3.6 | 2.4 | 4.51 |

| Utility-scale | 2.0 | 1.4 | 2.2 | 1.4 | 1.5 | 2.9 | 1.9 | 3.31 |

| Source: IEA – Technology Roadmap: Solar Photovoltaic Energy report, September 2014'[20]:15 1U.S figures are lower in DOE's Photovoltaic System Pricing Trends[80] | ||||||||

Technologies (1990–present)

There were significant advances in conventional crystalline silicon (c-Si) technology in the years leading up to 2017. The falling cost of the polysilicon since 2009, that followed after a period of severe shortage (see below) of silicon feedstock, pressure increased on manufacturers of commercial thin-film PV technologies, including amorphous thin-film silicon (a-Si), cadmium telluride (CdTe), and copper indium gallium diselenide (CIGS), lead to the bankruptcy of several, once highly touted thin-film companies.[84] The sector faced price competition from Chinese crystalline silicon cell and module manufacturers, and some companies together with their patents were sold below cost.[85]

In 2013 thin-film technologies accounted for about 9 percent of worldwide deployment, while 91 percent was held by crystalline silicon (mono-Si and multi-Si). With 5 percent of the overall market, CdTe held more than half of the thin-film market, leaving 2 percent to each, CIGS and amorphous silicon.[87]:24–25

- Copper indium gallium selenide (CIGS) is the name of the semiconductor material on which the technology is based. One of the largest producers of CIGS photovoltaics in 2015 was the Japanese company Solar Frontier with a manufacturing capacity in the gigawatt-scale. Their CIS line technology included modules with conversion efficiencies of over 15%.[88] The company profited from the booming Japanese market and attempted to expand its international business. However, several prominent manufacturers could not keep up with the advances in conventional crystalline silicon technology. The company Solyndra ceased all business activity and filed for Chapter 11 bankruptcy in 2011, and Nanosolar, also a CIGS manufacturer, closed its doors in 2013. Although both companies produced CIGS solar cells, it has been pointed out, that the failure was not due to the technology but rather because of the companies themselves, using a flawed architecture, such as, for example, Solyndra's cylindrical substrates.[89]

- The U.S.-company First Solar, a leading manufacturer of CdTe, built several of the world's largest solar power stations, such as the Desert Sunlight Solar Farm and Topaz Solar Farm, both in the Californian desert with 550 MW capacity each, as well as the 102 MWAC Nyngan Solar Plant in Australia (the largest PV power station in the Southern Hemisphere at the time) commissioned in mid-2015.[90] The company was reported in 2013 to be successfully producing CdTe-panels with a steadily increasing efficiency and declining cost per watt.[91]:18–19 CdTe was the lowest energy payback time of all mass-produced PV technologies, and could be as short as eight months in favorable locations.[87]:31 The company Abound Solar, also a manufacturer of cadmium telluride modules, went bankrupt in 2012.[92]

- In 2012, ECD solar, once one of the world's leading manufacturer of amorphous silicon (a-Si) technology, filed for bankruptcy in Michigan, United States. Swiss OC Oerlikon divested its solar division that produced a-Si/μc-Si tandem cells to Tokyo Electron Limited.[93][94] In 2014, the Japanese electronics and semiconductor company announced the closure of its micromorph technology development program.[95] Other companies that left the amorphous silicon thin-film market include DuPont, BP, Flexcell, Inventux, Pramac, Schuco, Sencera, EPV Solar,[96] NovaSolar (formerly OptiSolar)[97] and Suntech Power that stopped manufacturing a-Si modules in 2010 to focus on crystalline silicon solar panels. In 2013, Suntech filed for bankruptcy in China.[98][99]

Silicon shortage (2005–2008)

In the early 2000s, prices for polysilicon, the raw material for conventional solar cells, were as low as $30 per kilogram and silicon manufacturers had no incentive to expand production.

However, there was a severe silicon shortage in 2005, when governmental programmes caused a 75% increase in the deployment of solar PV in Europe. In addition, the demand for silicon from semiconductor manufacturers was growing. Since the amount of silicon needed for semiconductors makes up a much smaller portion of production costs, semiconductor manufacturers were able to outbid solar companies for the available silicon in the market.[100]

Initially, the incumbent polysilicon producers were slow to respond to rising demand for solar applications, because of their painful experience with over-investment in the past. Silicon prices sharply rose to about $80 per kilogram, and reached as much as $400/kg for long-term contracts and spot prices. In 2007, the constraints on silicon became so severe that the solar industry was forced to idle about a quarter of its cell and module manufacturing capacity—an estimated 777 MW of the then available production capacity. The shortage also provided silicon specialists with both the cash and an incentive to develop new technologies and several new producers entered the market. Early responses from the solar industry focused on improvements in the recycling of silicon. When this potential was exhausted, companies have been taking a harder look at alternatives to the conventional Siemens process.[101]

As it takes about three years to build a new polysilicon plant, the shortage continued until 2008. Prices for conventional solar cells remained constant or even rose slightly during the period of silicon shortage from 2005 to 2008. This is notably seen as a "shoulder" that sticks out in the Swanson's PV-learning curve and it was feared that a prolonged shortage could delay solar power becoming competitive with conventional energy prices without subsidies.

In the meantime the solar industry lowered the number of grams-per-watt by reducing wafer thickness and kerf loss, increasing yields in each manufacturing step, reducing module loss, and raising panel efficiency. Finally, the ramp up of polysilicon production alleviated worldwide markets from the scarcity of silicon in 2009 and subsequently lead to an overcapacity with sharply declining prices in the photovoltaic industry for the following years.

Solar overcapacity (2009–2013)

As the polysilicon industry had started to build additional large production capacities during the shortage period, prices dropped as low as $15 per kilogram forcing some producers to suspend production or exit the sector. Prices for silicon stabilized around $20 per kilogram and the booming solar PV market helped to reduce the enormous global overcapacity from 2009 onwards. However, overcapacity in the PV industry continued to persist. In 2013, global record deployment of 38 GW (updated EPIA figure[3]) was still much lower than China's annual production capacity of approximately 60 GW. Continued overcapacity was further reduced by significantly lowering solar module prices and, as a consequence, many manufacturers could no longer cover costs or remain competitive. As worldwide growth of PV deployment continued, the gap between overcapacity and global demand was expected in 2014 to close in the next few years.[103]

IEA-PVPS published in 2014 historical data for the worldwide utilization of solar PV module production capacity that showed a slow return to normalization in manufacture in the years leading up to 2014. The utilization rate is the ratio of production capacities versus actual production output for a given year. A low of 49% was reached in 2007 and reflected the peak of the silicon shortage that idled a significant share of the module production capacity. As of 2013, the utilization rate had recovered somewhat and increased to 63%.[102]:47

Anti-dumping duties (2012–present)

After anti-dumping petition were filed and investigations carried out,[104] the United States imposed tariffs of 31 percent to 250 percent on solar products imported from China in 2012.[105] A year later, the EU also imposed definitive anti-dumping and anti-subsidy measures on imports of solar panels from China at an average of 47.7 percent for a two-year time span.[106]

Shortly thereafter, China, in turn, levied duties on U.S. polysilicon imports, the feedstock for the production of solar cells.[107] In January 2014, the Chinese Ministry of Commerce set its anti-dumping tariff on U.S. polysilicon producers, such as Hemlock Semiconductor Corporation to 57%, while other major polysilicon producing companies, such as German Wacker Chemie and Korean OCI were much less affected.[108] All this has caused much controversy between proponents and opponents and was subject of debate.

History of deployment

Deployment figures on a global, regional and nationwide scale are well documented since the early 1990s. While worldwide photovoltaic capacity grew continuously, deployment figures by country were much more dynamic, as they depended strongly on national policies. A number of organizations release comprehensive reports on PV deployment on a yearly basis. They include annual and cumulative deployed PV capacity, typically given in watt-peak, a break-down by markets, as well as in-depth analysis and forecasts about future trends.

Worldwide annual deployment

- 2017: 85,000 MW (21.8%)

- 2016: 75,000 MW (19.2%)

- 2015: 50,909 MW (13.1%)

- 2014: 40,134 MW (10.3%)

- 2013: 38,352 MW (9.8%)

- 2012: 30,011 MW (7.7%)

- 2011: 30,133 MW (7.7%)

- 2010: 17,151 MW (4.4%)

- 2009: 7,340 MW (1.9%)

- 2008: 6,661 MW (1.7%)

- before: 9,183 MW (2.4%)

Due to the exponential nature of PV deployment, most of the overall capacity has been installed in the years leading up to 2017 (see pie-chart). Since the 1990s, each year has been a record-breaking year in terms of newly installed PV capacity, except for 2012. Contrary to some earlier predictions, early 2017 forecasts were that 85 gigawatts would be installed in 2017.[109]

annual deployment since 2002 2016: 75 GW (estimate) 2017: 85 GW (projection)

Worldwide cumulative

Worldwide growth of solar PV capacity was an exponential curve between 1992 and 2017. Tables below show global cumulative nominal capacity by the end of each year in megawatts, and the year-to-year increase in percent. In 2014, global capacity was expected to grow by 33 percent from 139 to 185 GW. This corresponded to an exponential growth rate of 29 percent or about 2.4 years for current worldwide PV capacity to double. Exponential growth rate: P(t) = P0ert, where P0 is 139 GW, growth-rate r 0.29 (results in doubling time t of 2.4 years).

The following table contains data from four different sources. For 1992–1995: compiled figures of 16 main markets (see section All time PV installations by country), for 1996–1999: BP-Statistical Review of world energy (Historical Data Workbook)[110] for 2000–2013: EPIA Global Outlook on Photovoltaics Report[3]:17 and for 2014: preliminary figures based on IEA-PVPS' snapshot report[4]

| Year | CapacityA MWp |

Δ%B | Refs |

|---|---|---|---|

| 1991 | n.a. | – | C |

| 1992 | 105 | n.a. | C |

| 1993 | 130 | 24% | C |

| 1994 | 158 | 22% | C |

| 1995 | 192 | 22% | C |

| 1996 | 309 | 61% | [110] |

| 1997 | 422 | 37% | [110] |

| 1998 | 566 | 34% | [110] |

| 1999 | 807 | 43% | [110] |

| 2000 | 1,250 | 55% | [110] |

| Year | CapacityA MWp |

Δ%B | Refs |

|---|---|---|---|

| 2001 | 1,615 | 27% | [3] |

| 2002 | 2,069 | 28% | [3] |

| 2003 | 2,635 | 27% | [3] |

| 2004 | 3,723 | 41% | [3] |

| 2005 | 5,112 | 37% | [3] |

| 2006 | 6,660 | 30% | [3] |

| 2007 | 9,183 | 38% | [3] |

| 2008 | 15,844 | 73% | [3] |

| 2009 | 23,185 | 46% | [3] |

| 2010 | 40,336 | 74% | [3] |

| Year | CapacityA MWp |

Δ%B | Refs |

|---|---|---|---|

| 2011 | 70,469 | 75% | [3] |

| 2012 | 100,504 | 43% | [3] |

| 2013 | 138,856 | 38% | [3] |

| 2014 | 178,391 | 28% | [2] |

| 2015 | 229,300 | 29% | [111] |

| 2016 | 302,300 | 32% | |

| 2017 | 368,000 | 22% | |

| 2018 | |||

| 2019 | |||

| 2020 |

Deployment by country

- See section Forecast for projected photovoltaic deployment in 2017

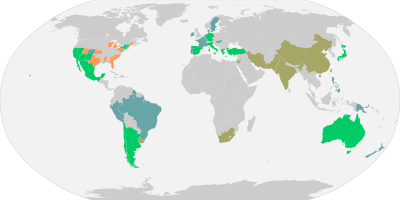

Reached grid-parity before 2014

Reached grid-parity after 2014

Reached grid-parity only for peak prices

U.S. states poised to reach grid-parity

Source: Deutsche Bank, as of February 2015

2017  [112]

[112]

All time PV installations by country

| Country | 1992 | 1993 | 1994 | 1995 | 1996 | 1997 | 1998 | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Algeria | 30 | 300 | ||||||||||||||||||||||

| Australia | 7.3 | 8.9 | 10.7 | 12.7 | 15.9 | 18.7 | 22.5 | 25.3 | 29.2 | 33.6 | 39.1 | 45.6 | 52.3 | 60.6 | 70.3 | 82.5 | 105 | 188 | 571 | 1377 | 2415 | 3226 | 4136 | 5109 |

| Austria | 0.6 | 0.8 | 1.1 | 1.4 | 1.7 | 2.2 | 2.9 | 3.7 | 4.9 | 6.1 | 10.3 | 16.8 | 21.1 | 24.0 | 25.6 | 28.7 | 32.4 | 52.6 | 95.5 | 187 | 363 | 626 | 766 | 935 |

| Belgium | 23.7 | 108 | 649 | 1067 | 2088 | 2722 | 3009 | 3074 | 3228 | |||||||||||||||

| Brazil | 5 | D17 | D32 | F54 | ||||||||||||||||||||

| Bulgaria | 5.7 | 35 | 141 | 1010 | 1020 | 1020 | 1021 | |||||||||||||||||

| Canada | 1.0 | 1.1 | 1.5 | 1.9 | 2.6 | 3.4 | 4.5 | 5.8 | 7.2 | 8.8 | 10.0 | 11.8 | 13.9 | 16.8 | 20.5 | 25.8 | 32.7 | 94.6 | 281 | 558 | 766 | 1211 | 1710 | 2579 |

| Chile | C<1 | C2 | 3 | 368 | 848 | |||||||||||||||||||

| China | 19 | 23.5 | 42 | 52 | 62 | 70 | 80 | 100 | 140 | 300 | 800 | 3300 | 6800 | 19720 | 28199 | 43530 | ||||||||

| Croatia | 0.2 | 20 | 34 | 45 | ||||||||||||||||||||

| Cyprus | 3.3 | 6.2 | 9 | 17 | 32 | 65 | 70 | |||||||||||||||||

| Czech | 463.3 | 1952 | 1959 | 2087 | 2175 | 2134 | 2083 | |||||||||||||||||

| Denmark | 0.1 | 0.1 | 0.1 | 0.2 | 0.4 | 0.5 | 1.1 | 1.5 | 1.5 | 1.6 | 1.9 | 2.3 | 2.7 | 2.9 | 3.1 | 3.2 | 4.6 | 7.1 | 16.7 | 408 | 563 | 603 | 783 | |

| Estonia | 0.05 | 0.08 | 0.2 | 0.2 | 0.2 | 0.1 | 4.1 | |||||||||||||||||

| Finland | 0.1 | 1 | 11 | 11 | 11.2 | 14.7 | ||||||||||||||||||

| France | 1.8 | 2.1 | 2.4 | 2.9 | 4.4 | 6.1 | 7.6 | 9.1 | 11.3 | 13.9 | 17.2 | 21.1 | 26.0 | 33.0 | 36.5 | 74.5 | 179 | 369 | 1204 | 2974 | 4090 | 4733 | 5660 | 6589 |

| Germany | 2.9 | 4.3 | 5.6 | 6.7 | 10.3 | 16.5 | 21.9 | 30.2 | 89.4 | 207 | 324 | 473 | 1139 | 2072 | 2918 | 4195 | 6153 | 9959 | 17372 | 24858 | 32462 | 35766 | 38200 | 39763 |

| Greece | 55 | 205 | 624 | 1536 | 2579 | 2595 | 2613 | |||||||||||||||||

| Guatemala | n/a | F+6 | ||||||||||||||||||||||

| Honduras | n/a | F+5 | 389 | |||||||||||||||||||||

| Hungary | 0.65 | 1.75 | 4 | 12 | 35 | 78 | 137 | |||||||||||||||||

| India | 161 | 461 | 1205 | 2320 | 2936 | 5050 | ||||||||||||||||||

| Ireland | 0.4 | 0.6 | 0.7 | 0.7 | 0.9 | 1.0 | 1.1 | 2.1 | ||||||||||||||||

| Israel | 0.9 | 1.0 | 1.3 | 1.8 | 3.0 | 24.5 | 69.9 | 190 | 237 | 481 | 731 | 886 | ||||||||||||

| Italy | 8.5 | 12.1 | 14.1 | 15.8 | 16.0 | 16.7 | 17.7 | 18.5 | 19.0 | 20.0 | 22.0 | 26.0 | 30.7 | 37.5 | 50.0 | 120 | 458 | 1181 | 3502 | 12809 | 16454 | 18074 | 18460 | 18924 |

| Japan | 19.0 | 24.3 | 31.2 | 43.4 | 59.6 | 91.3 | 133 | 209 | 330 | 453 | 637 | 860 | 1132 | 1422 | 1709 | 1919 | 2144 | 2627 | 3618 | 4914 | 6632 | 13599 | 23300 | 34151 |

| Latvia | 0 | 0.2 | 0.2 | 0.2 | 1.5 | 1.5 | ||||||||||||||||||

| Lithuania | 0.07 | 0.2 | 0.3 | 6.2 | 68 | 68 | 73 | |||||||||||||||||

| Luxembourg | 26.4 | 27.3 | 30 | A30 | A30 | A45 | 125 | |||||||||||||||||

| Malaysia | 5.5 | 7.0 | 8.8 | 11.1 | 12.6 | 13.5 | 35 | 73 | 160 | 231 | ||||||||||||||

| Malta | 1.53 | 1.67 | 12 | 16 | 23 | 54 | 73 | |||||||||||||||||

| Mexico | 5.4 | 7.1 | 8.8 | 9.2 | 10.0 | 11.0 | 12.0 | 12.9 | 13.9 | G13.9 | G13.9 | G13.9 | G15.9 | G16.9 | G17.9 | G18.9 | G19.9 | G24.9 | G38.9 | G29.9 | G34.9 | G65.9 | G114.1 | G170.1 |

| Netherlands | 0.1 | 0.1 | 0.3 | 0.7 | 1.0 | 1.0 | 5.3 | 8.5 | 16.2 | 21.7 | 39.7 | 43.4 | 45.4 | 47.5 | 48.6 | 52.8 | 63.9 | 84.7 | 143 | I365 | I739 | I1048 | I1405 | |

| Norway | B6.4 | B6.6 | B6.9 | B7.3 | B7.7 | B8.0 | B8.3 | B8.7 | B9.1 | B9.5 | B10 | B11 | 13 | 15.3 | ||||||||||

| Pakistan | ? | 400 | 1000 | |||||||||||||||||||||

| Peru | 0 | D22 | n/a | n/a | ||||||||||||||||||||

| Philippines | ? | 33 | 155 | |||||||||||||||||||||

| Poland | 1.38 | 1.75 | 3 | 7 | 7 | 24 | 87 | |||||||||||||||||

| Portugal | 0.2 | 0.2 | 0.3 | 0.3 | 0.4 | 0.5 | 0.6 | 0.9 | 1.1 | 1.3 | 1.7 | 2.0 | 2.0 | 2.0 | 4.0 | 15 | 56 | 99 | 135 | 169 | 228 | 281 | 391 | 460 |

| Romania | 0.64 | 1.94 | 4 | 51 | 1151 | 1219 | 1325 | |||||||||||||||||

| Slovakia | 0.19 | 148 | 508 | 523 | 524 | 533 | 591 | |||||||||||||||||

| Slovenia | 9.0 | 35 | 81 | 201 | 212 | 256 | 257 | |||||||||||||||||

| South Africa | 1 | 30 | 122 | 922 | 1120 | |||||||||||||||||||

| South Korea | 1.5 | 1.6 | 1.7 | 1.8 | 2.1 | 2.5 | 3.0 | 3.5 | 4.0 | 4.7 | 10.0 | 11.0 | 13.8 | 19.2 | 41.8 | 87.2 | 363 | 530 | 656 | 735 | 1030 | 1475 | 2384 | 3493 |

| Spain | 1.0 | 1.0 | 1.0 | 1.0 | 1.0 | 2.0 | 2.0 | 4.0 | 7.0 | 12.0 | 23.0 | 48 | 145 | 693 | H3421 | H3438 | H3859 | H4322 | H4603 | H4766 | H4872 | H4921 | ||

| Sweden | 0.8 | 1.0 | 1.3 | 1.6 | 1.8 | 2.1 | 2.4 | 2.6 | 2.8 | 3.0 | 3.3 | 3.6 | 3.9 | 4.2 | 4.8 | 6.2 | 7.9 | 8.8 | 11 | 11 | 24 | 43 | 79 | 130 |

| Switzerland | 4.7 | 5.8 | 6.7 | 7.5 | 8.4 | 9.7 | 11.5 | 13.4 | 15.3 | 17.6 | 19.5 | 21.0 | 23.1 | 27.1 | 29.7 | 36.2 | 47.9 | 73.6 | 111 | 211 | 437 | 756 | 1076 | 1394 |

| Taiwan | 32 | 102 | 206 | 376 | 776 | 1010 | ||||||||||||||||||

| Thailand | 2.9 | 4.2 | 10.8 | 23.9 | 30.5 | 32.5 | 33.4 | 43.2 | 49.2 | 243 | 388 | 824 | 1299 | 1420 | ||||||||||

| Turkey | 0.2 | 0.3 | 0.4 | 0.6 | 0.9 | 1.3 | 1.8 | 2.3 | 2.8 | 3.3 | 4.0 | 5.0 | 6 | 7 | 8.5 | 18 | 58 | 266 | ||||||

| Ukraine | 3 | 191 | 326 | 616 | n/a | |||||||||||||||||||

| UK | 0.2 | 0.3 | 0.3 | 0.4 | 0.4 | 0.6 | 0.7 | 1.1 | 1.9 | 2.7 | 4.1 | 5.9 | 8.2 | 10.9 | 14.3 | 18.1 | 22.5 | 29.6 | 77 | 904 | E1901 | E3377 | 5104 | 8917 |

| USA | 43.5 | 50.3 | 57.8 | 66.8 | 76.5 | 88.2 | 100 | 117 | 139 | 168 | 212 | 275 | 376 | 479 | 624 | 831 | 1169 | 1256 | 2528 | 4383 | 7272 | 12079 | 18280 | 25600 |

| References | [113] | [114] | [115] | [116][117] | [118][119] | [3][102] | [4][120] | [5][121][122] | ||||||||||||||||

| Year | 1992 | 1993 | 1994 | 1995 | 1996 | 1997 | 1998 | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 |

Notes:

| ||||||||||||||||||||||||

See also

- Growth of concentrated solar power (CSP)

- Solar power by country

- Timeline of solar cells

- List of renewable energy topics by country

- Wind power by country

Notes

- ↑ See section All time PV installations by country for the corresponding cited sources of historical data

References

- ↑ "Global Market Outlook for Solar Power 2016–2020" (PDF). www.solarpowereurope.org. Solar Power Europe (SPE), formerly known as EPIA – European Photovoltaic Industry Association. Archived from the original on 11 January 2016. Retrieved 11 January 2016.

- 1 2 3 4 5 6 7 "Global Market Outlook for Solar Power 2015–2019" (PDF). www.solarpowereurope.org. Solar Power Europe (SPE), formerly known as EPIA – European Photovoltaic Industry Association. Archived from the original on 9 June 2015. Retrieved 9 June 2015.

- 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 "Global Market Outlook for Photovoltaics 2014–2018" (PDF). www.epia.org. EPIA – European Photovoltaic Industry Association. Archived from the original on 12 June 2014. Retrieved 12 June 2014.

- 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 "Snapshot of Global PV 1992–2014" (PDF). www.iea-pvps.org/index.php?id=32. International Energy Agency — Photovoltaic Power Systems Programme. 30 March 2015. Archived from the original on 30 March 2015.

- 1 2 3 "Snapshot of Global PV 1992–2015" (PDF). www.iea-pvps.org. International Energy Agency – Photovoltaic Power Systems Programme. 2015.

- 1 2 2017 PV Installation forecast

- ↑ Lacey, Stephen (12 September 2011). "How China dominates solar power". Guardian Environment Network. Retrieved 29 June 2014.

- 1 2 "Crossing the Chasm" (PDF). Deutsche Bank Markets Research. 27 February 2015. Archived from the original on 1 April 2015.

- ↑ "Trump Admin. Outlines Global Solar Plan: 10 Terawatts By 2030". Retrieved 19 April 2017.

- ↑ "The projections for the future and quality in the past of the World Energy Outlook for solar PV and other renewable energy technologies" (PDF). Energywatchgroup. September 2015.

- ↑ Osmundsen, Terje (4 March 2014). "How the IEA exaggerates the costs and underestimates the growth of solar power". Energy Post. Archived from the original on 30 October 2014. Retrieved 30 October 2014.

- ↑ Whitmore, Adam (14 October 2013). "Why Have IEA Renewables Growth Projections Been So Much Lower Than the Out-Turn?". The Energy Collective. Archived from the original on 30 October 2014. Retrieved 30 October 2014.

- ↑ https://www.reuters.com/article/china-solar-idUSL3N15533U

- ↑ http://www.businessgreen.com/bg/news/2442764/chinese-solar-capacity-outshone-germanys-in-2015

- ↑ http://cleantechnica.com/2016/01/22/china-overtakes-germany-become-worlds-leading-solar-pv-country/

- ↑ "China Targets 70 Gigawatts of Solar Power to Cut Coal Reliance". Bloomberg News. 16 May 2014. Retrieved 16 May 2014.

- 1 2 "China’s National Energy Administration: 17.8 GW Of New Solar PV In 2015 (~20% Increase)". CleanTechnica. 19 March 2015.

- ↑ http://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy/renewable-energy/solar-energy.html

- 1 2 3 4 "Snapshot of Global Photovoltaic Markets 2017" (PDF). report. International Energy Agency. 19 April 2017. Retrieved 11 July 2017.

- 1 2 3 4 5 6 7 8 9 International Energy Agency (2014). "Technology Roadmap: Solar Photovoltaic Energy" (PDF). www.iea.org. IEA. Archived from the original on 7 October 2014. Retrieved 7 October 2014.

- ↑ "Snapshot of Global PV 1992–2013" (PDF). www.iea-pvps.org/index.php?id=trends0. International Energy Agency — Photovoltaic Power Systems Programme. 31 March 2014. Archived from the original on 5 April 2014.

- ↑ Alter, Lloyd (2017-01-31). "Tesla kills the duck with big batteries". TreeHugger. Retrieved 2017-03-16.

- ↑ LeBeau, Phil (2017-03-08). "Tesla battery packs power the Hawaiian island of Kauai after dark". cnbc.com. Retrieved 2017-03-16.

- ↑ http://cifes.gob.cl/documentos/reportes-cifes/reporte-cifes-mayo-2016/

- ↑ "Snapshot of Global Photovoltaic Markets" (PDF). report. International Energy Agency. 22 April 2016. Retrieved 24 May 2016.

- ↑ Mike Munsell (22 January 2016). "IEA PVPS: 177 GW of PV installed worldwide". news. Greentech Media. Retrieved 24 May 2016.

- ↑ "Global Solar PV Demand Grows For 10th Straight Year, 2017 Will Be Bigger". Cleantechnica. Retrieved 21 January 2017.

- ↑ https://cleantechnica.com/2017/04/05/gtm-forecasting-85-gw-solar-pv-installed-2017/

- ↑ Greentech Media, GTM Research Global Solar Demand Monitor Q1 2017

- 1 2 3 4 "Medium-Term Renewable Energy Market Report 2014 — Executive Summary" (PDF). IEA. 28 August 2014. p. 13. Archived from the original on 1 April 2015.

- 1 2 "Global PV Market Report 2015–2020, Brochure" (PDF). PV Market Alliance. June 2015. p. 4.

- 1 2 3 4 5 Ash Sharma (30 March 2015). "Global Solar Installations to Grow by 30% to Reach 57 GW in 2015". IHS Technology.

- ↑ "Global Solar PV Capacity to Reach Nearly 500 GW in 2019, IHS Says". IHS Technology. 19 March 2015.

- ↑ "Global gross annual capacity additions by technology, 2015–2040". Bloomberg New Energy Finance. 2015.

- 1 2 3 4 5 Fraunhofer ISE (February 2015). "Current and Future Cost of Photovoltaics—Long-term Scenarios for Market Development, System Prices and LCOE of Utility-Scale PV Systems" (PDF). www.agora-energiewende.org. Agora Energiewende. Retrieved 1 March 2015.

- ↑ "Lower Oil Price Will Not Stop the Dazzling Rise of Solar Photovoltaic". prnewswire.com. 12 February 2015.

- ↑ "Solar PV Market Installed Capacity Will Reach 489.8 GW By 2020: New Report By Grand View Research, Inc.". Marketwatch. 7 March 2015. Retrieved 1 March 2015.

- ↑ "About the PV Market Alliance". The Becquerel Institute. 2017. Retrieved 2017-06-28.

- ↑ "PV Market Alliance forecasts a growing global PV market close to 50 GW in 2015". SolarServer. 15 June 2015.

- ↑ Adam James (17 June 2015). "Global PV Demand Outlook 2015–2020: Exploring Risk in Downstream Solar Markets". GreentechMedia.

- 1 2 "Medium-Term Renewable Energy Market Report 2013 — Executive Summary" (PDF). IEA. 26 June 2013. p. 10. Archived from the original on 5 April 2015.

- ↑ "IEA Medium Term Renewable Energy Market 2015" (PDF). Retrieved November 1, 2016.

- 1 2 "Medium-Term Renewable Energy Market Report 2014" (PDF). IEA. 28 August 2014. p. 15. Archived from the original on 28 March 2015. Retrieved 28 March 2015.

- ↑ "India Eyes 100 GW Solar Power Capacity By 2022". CleanTechnia. 23 November 2014.

- 1 2 "US: SEIA Forecasts 25–50% Solar Market Growth in 2016". Renewanews. 19 May 2015.

- ↑ "Solar Media forecasts UK solar PV capacity to reach 10 GW at start of 2016". SolarServer. 2 July 2015.

- ↑ IEA.org How solar energy could be the largest source of electricity by mid-century, 29 September 2014

- ↑ Giles Parkinson (24 February 2015). "Solar at 2c/kWh – the cheapest source of electricity". REneweconomy.

- ↑ Militsa Mancheva (9 October 2015). "China again lifts 2015 solar target, now aims at 23.1 GW". Seenew Renewables.

- ↑ "China's PV power capacity to hit 150 gigawatts by 2020". Xinhuanet.com. 13 October 2015.

- ↑ "China Plans to Install 200GW of Wind and 100GW of Solar Power by 2020". EnergyTrend.com. 14 October 2014. Archived from the original on 17 October 2014.

- ↑ "China confirms new solar PV target of 14GW for 2014". Renew Economy.

- 1 2 Solar Installations to Rise 20 Percent in 2014, Thanks to Strong Fourth Quarter, 8 October 2014

- ↑ "China’s 2014 Solar Figures Confirmed, 10.6 GW Pushes Country To 30 GW". CleanTechnica.

- ↑ International Business Time, India: World's largest solar plant that will generate 750 MW of power commissioned, 16 February 2015

- ↑ "Mercom raises Indian solar installation forecast for 2015 to over 2 GW". SolarServer. 21 May 2015.

- ↑ http://mnre.gov.in/file-manager/UserFiles/grid-connected-solar-power-project-installed-capacity.pdf

- ↑ Barclays stuft Anleihen von US-Stromversorgern herunter; Konkurrenz durch Photovoltaik und Energiespeicher. In: solarserver.de, 16. Juni 2014. Abgerufen am 16. Juni 2014.

- ↑ http://cleantechnica.com/ US Solar PV Installations Surpassed 6 GW In 2014, 10 March 2015

- 1 2 "Global Solar Installations Forecast to Reach Approximately 64.7 GW in 2016, Reports Mercom Capital Group". MercomCapital. 28 December 2015.

- 1 2 "Statistics – Solar photovoltaics deployment". gov.uk. DECC – Department of Energy & Climate Change. 2015. Retrieved 26 February 2015.

- ↑ Photon, Italy installed only 385 MW of PV capacity in 2014, 17 March 2015

- ↑ United States Patent and Trademark Office – Database

- ↑ Magic Plates, Tap Sun For Power. Popular Science. June 1931. Retrieved 2 August 2013.

- ↑ "Bell Labs Demonstrates the First Practical Silicon Solar Cell". aps.org.

- ↑ D. M. Chapin-C. S. Fuller-G. L. Pearson. "Journal of Applied Physics — A New Silicon p–n Junction Photocell for Converting Solar Radiation into Electrical Power". aip.org.

- ↑ Biello David (6 August 2010). "Where Did the Carter White House's Solar Panels Go?". Scientific American. Retrieved 31 July 2014.

- ↑ Pollack, Andrew (24 February 1996). "REACTOR ACCIDENT IN JAPAN IMPERILS ENERGY PROGRAM". New York Times.

- ↑ wise-paris.org Sodium Leak and Fire at Monju

- ↑ S Hill, Joshua (January 22, 2016). "China Overtakes Germany To Become World’s Leading Solar PV Country". Clean Technica. Retrieved August 16, 2016.

- ↑ "NEA: China added 34.24 GW of solar PV capacity in 2016". www.solarserver.com. Retrieved 2017-01-22.

- ↑ "China to plow $361 billion into renewable fuel by 2020". Reuters. 2017-01-05. Retrieved 2017-01-22.

- 1 2 Baraniuk, Chris (2017-06-22). "Future Energy: China leads world in solar power production". BBC News. Retrieved 2017-06-27.

- ↑ "China wasted enough renewable energy to power Beijing for an entire year, says Greenpeace". Retrieved 19 April 2017.

- ↑ "China to erect fewer farms, generate less solar power in 2017". Retrieved 19 April 2017.

- 1 2 "Price quotes updated weekly – PV spot prices". PV EnergyTrend. Retrieved 22 May 2017.

- ↑ "PriceQuotes". pv.energytrend.com. Archived from the original on 26 June 2014. Retrieved 26 June 2014.

- ↑ "Sunny Uplands: Alternative energy will no longer be alternative". The Economist. 21 November 2012. Retrieved 2012-12-28.

- ↑ J. Doyne Farmer, François Lafond (2 November 2015). "How predictable is technological progress?". doi:10.1016/j.respol.2015.11.001. License: cc. Note: Appendix F. A trend extrapolation of solar energy capacity.

- 1 2 "Photovoltaic System Pricing Trends – Historical, Recent, and Near-Term Projections, 2014 Edition" (PDF). NREL. 22 September 2014. p. 4. Archived from the original on 29 March 2015.

- ↑ "Solar PV Pricing Continues to Fall During a Record-Breaking 2014". GreenTechMedia. 13 March 2015.

- ↑ "Photovoltaik-Preisindex" [Solar PV price index]. PhotovoltaikGuide. Retrieved 30 March 2015.

Turnkey net-prices for a solar PV system of up to 100 kWp amounted to Euro 1,240 per kWp.

- ↑ Australia solar power system prices May 2017

- ↑ RenewableEnergyWorld.com How thin film solar fares vs crystalline silicon, 3 January 2011

- ↑ Diane Cardwell; Keith Bradsher (January 9, 2013). "Chinese Firm Buys U.S. Solar Start-Up". The New York Times. Retrieved January 10, 2013.

- ↑ "Photovoltaics Report" (PDF). Fraunhofer ISE. 28 July 2014. Archived from the original on 31 August 2014.

- 1 2 "Photovoltaics Report". Fraunhofer ISE. 28 July 2014. Archived from the original (PDF) on 31 August 2014. Retrieved 31 August 2014.

- ↑ "Solar Frontier Completes Construction of the Tohoku Plant". Solar Frontier. 2 April 2015. Retrieved 30 April 2015.

- ↑ Andorka, Frank (8 January 2014). "CIGS Solar Cells, Simplified". Solar Power World. Archived from the original on 16 August 2014. Retrieved 16 August 2014.

- ↑ "Nyngan Solar Plant". AGL Energy Online. Retrieved 18 June 2015.

- ↑ CleanTechnica.com First Solar Reports Largest Quarterly Decline In CdTe Module Cost Per-Watt Since 2007, 7 November 2013

- ↑ Raabe, Steve; Jaffe, Mark (November 4, 2012). "Bankrupt Abound Solar of Colo. lives on as political football". Denver Post.

- ↑ "The End Arrives for ECD Solar". greentechmedia.com. Retrieved 27 January 2016.

- ↑ "Oerlikon Divests Its Solar Business and the Fate of Amorphous Silicon PV". greentechmedia.com. Retrieved 27 January 2016.

- ↑ SolarChoice.net.au Falling market shares predicted for amorphous silicon PV technology, 5 May 2014

- ↑ GreenTechMedia.com Rest in Peace: The List of Deceased Solar Companies, 6 April 2013

- ↑ "NovaSolar, Formerly OptiSolar, Leaving Smoking Crater in Fremont". greentechmedia.com. Retrieved 27 January 2016.

- ↑ "Chinese Subsidiary of Suntech Power Declares Bankruptcy". New York Times. 20 March 2013.

- ↑ "Suntech Seeks New Cash After China Bankruptcy, Liquidator Says". Bloomberg News. 29 April 2014.

- ↑ Wired.com Silicon Shortage Stalls Solar 28 March 2005

- ↑ "Solar State of the Market Q3 2008 – Rise of Upgraded Metallurgical Silicon". SolarWeb. Lux Research Inc. p. 1. Archived from the original (PDF) on 12 October 2014. Retrieved 12 October 2014.

- 1 2 3 4 5 "IEA PVPS TRENDS 2014 in Photovoltaic Applications" (PDF). www.iea-pvps.org/index.php?id=trends. 12 October 2014. Archived from the original on 2 December 2014.

- ↑ "Annual Report 2013/2014" (PDF). ISE.Fraunhofer.de. Fraunhofer Institute for Solar Energy Systems-ISE. 2014. p. 1. Archived from the original on 5 November 2014. Retrieved 5 November 2014.

- ↑ Europa.eu EU initiates anti-dumping investigation on solar panel imports from China

- ↑ U.S. Imposes Anti-Dumping Duties on Chinese Solar Imports, 12 May 2012

- ↑ Europa.eu EU imposes definitive measures on Chinese solar panels, confirms undertaking with Chinese solar panel exporters, 02 December 2013

- ↑ "China to levy duties on US polysilicon imports". China Daily. 16 September 2013. Archived from the original on 30 April 2015.

- ↑ "Wacker, OCI benefiting from China's polysilicon duties". PV magazine. 30 January 2014. Archived from the original on 30 April 2015.

- ↑ "GTM Forecasting More Than 85 Gigawatts Of Solar PV To Be Installed In 2017". CleanTechnica. Retrieved 2017-06-28.

- 1 2 3 4 5 6 7 "Statistical Review of World Energy – Historical Data Workbook BP". www.bp.com. BP. Retrieved 1 April 2015.

downloadable XL-spread sheet

- ↑ http://www.solarpowereurope.org/insights/new-global-market-outlook-2016/

- ↑ "China Is Adding Solar Power at a Record Pace". Bloomberg.com. 19 July 2017. Retrieved 1 August 2017.

- ↑ "TRENDS IN PHOTOVOLTAIC APPLICATIONS – Survey report of selected IEA countries between 1992 and 2008". www.iea-pvps.org/. International Energy Agency – Photovoltaic Power Systems Programme. 2009. Retrieved 28 December 2014.

- ↑ "TRENDS IN PHOTOVOLTAIC APPLICATIONS – Survey report of selected IEA countries between 1992 and 2009". www.iea-pvps.org/. International Energy Agency – Photovoltaic Power Systems Programme. 2010. Retrieved 28 December 2014.

- ↑ "TRENDS IN PHOTOVOLTAIC APPLICATIONS – Survey report of selected IEA countries between 1992 and 2010". www.iea-pvps.org/. International Energy Agency – Photovoltaic Power Systems Programme. 2011. Retrieved 28 December 2014.

- ↑ "Global Market Outlook for Photovoltaics until 2016" (PDF). www.epia.org. EPIA – European Photovoltaic Industry Association. Archived from the original on 6 November 2014. Retrieved 6 November 2014.

- 1 2 EUROBSER'VER. "Photovoltaic Barometer – installations 2010 and 2011". www.energies-renouvelables.org. p. 6. Archived from the original (PDF) on 16 June 2014. Retrieved 1 May 2013.

- ↑ "Global Market Outlook for Photovoltaics 2013–2017" (PDF). www.epia.org. EPIA – European Photovoltaic Industry Association. Archived from the original on 6 November 2014. Retrieved 6 November 2014.

- ↑ "IEA PVPS TRENDS 2013 in Photovoltaic Applications" (PDF). www.iea-pvps.org/index.php?id=92. 29 November 2013. Archived from the original on 17 March 2015.

- 1 2 EUROBSER'VER (April 2015). "Photovoltaic Barometer – installations 2013 and 2014" (PDF). www.energies-renouvelables.org. Archived from the original on 6 May 2015.

- 1 2 EUROBSER'VER (April 2016). "Photovoltaic Barometer – installations 2014 and 2015" (PDF). www.energies-renouvelables.org. Archived from the original on 11 January 2017.

- 1 2 3 "Trends 2016 in Photovoltaic Applications – Survey report of selected IEA countries between 1992 and 2015" (PDF). www.iea-pvps.org. International Energy Agency – Photovoltaic Power Systems Programme. 2016. Archived from the original on 11 January 2017. Retrieved 11 January 2017.

- ↑ PV Barometre at the end of 2013, page 6

- ↑ Centro de Energías Renovables, CORFO (July 2014). "Reporte CER". Retrieved 22 July 2014.

- ↑ "Photovoltaic stations". T-Solar Group. Retrieved 16 May 2015.

Repartición solar farm, Location: Municipalidad Distrital La Joya. Province: Arequipa. Power: 22 MWp

- ↑ "Latin America’s Largest Solar Power Plant Receiving 40 MW of Solar PV Modules from Yingli Solar (Peru)". CleanTechnica. 15 October 2012.

- ↑ "Why DECC struggles to keep up with solar PV capacity data…and why we don’t". Solar Power Portal. 26 June 2015.

- ↑ "Latin America Country Markets 2014-2015E". GTM Research. 10 May 2015.

- ↑ EUROBSER'VER. "Photovoltaic Barometer – installations 2012 and 2013" (PDF). www.energies-renouvelables.org. Archived from the original on 9 September 2014. Retrieved 1 May 2014.

- ↑ EUROBSER'VER. "Photovoltaic Barometer – installations 2011 and 2012". www.energies-renouvelables.org. p. 7. Archived from the original (PDF) on 16 June 2014. Retrieved 1 May 2013.

- ↑ EUROBSER'VER. "Photovoltaic Barometer – installations 2009 and 2010". www.energies-renouvelables.org. p. 4. Archived from the original (PDF) on 16 June 2014. Retrieved 1 May 2013.

- ↑ EUROBSER'VER. "Photovoltaic Barometer – installations 2008 and 2009". www.energies-renouvelables.org. p. 5. Archived from the original (PDF) on 16 June 2014. Retrieved 1 May 2013.

External links

- IEA–International Energy Agency, Publications

- IEA–PVPS, IEA's Photovoltaic Power System Programme

- NREL–National Renewable Energy Laboratory, Publications

- FHI–ISE, Fraunhofer Institute for Solar Energy Systems

- APVI–Australian PV Institute

- EPIA–European Photovoltaic Industry Association

- SEIA–Solar Energy Industries Association

- CanSIA–Canadian Solar Industries Association

- Presentation on YouTube – Cost analysis of current PV production, PV learning curve – UNSW, Pierre Verlinden, Trina Solar

- Interview on YouTube – Michael Liebreich, "Cheapest Solar in World", about the record-low 5.84 US cents/kWh PPA in Dubai (2014)