Credit score in the United States

A credit score in the United States is a number representing the creditworthiness of a person, the likelihood that person will pay his or her debts.

Lenders, such as banks and credit card companies, use credit scores to evaluate the potential risk posed by lending money to consumers. Widespread use of credit scores has made credit more widely available and less expensive for many consumers.[1][2]

Credit scoring models

FICO score

The FICO score was first introduced in 1989 by FICO, then called Fair, Isaac, and Company.[3] The FICO model is used by the vast majority of banks and credit grantors, and is based on consumer credit files of the three national credit bureaus: Experian, Equifax, and TransUnion. Because a consumer's credit file may contain different information at each of the bureaus, FICO scores can vary depending on which bureau provides the information to FICO to generate the score.

Makeup

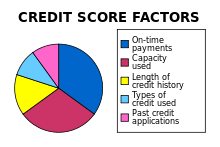

Credit scores are designed to measure the risk of default by taking into account various factors in a person's financial history. Although the exact formulas for calculating credit scores are secret, FICO has disclosed the following components:[4][5]

- 35%: payment history: This is best described as the presence or lack of derogatory information. Bankruptcy, liens, judgments, settlements, charge offs, repossessions, foreclosures, and late payments can cause a FICO score to drop.

- 30%: debt burden: This category considers a number of debt specific measurements. According to FICO there are some six different metrics in the debt category including the debt to limit ratio, number of accounts with balances, amount owed across different types of accounts, and the amount paid down on installment loans.[6]

- 15%: length of credit history aka Time in File: As a credit history ages it can have a positive impact on its FICO score. There are two metrics in this category: the average age of the accounts on your report and the age of the oldest account.

- 10%: types of credit used (installment, revolving, consumer finance, mortgage): Consumers can benefit by having a history of managing different types of credit.[7]

- 10%: recent searches for credit: hard credit inquiries, which occur when consumers apply for a credit card or loan (revolving or otherwise), can hurt scores, especially if done in great numbers. Individuals who are "rate shopping" for a mortgage, auto loan, or student loan over a short period (two weeks or 45 days, depending on the generation of FICO score used) will likely not experience a meaningful decrease in their scores as a result of these types of inquiries, as the FICO scoring model considers all of those types of hard inquiries that occur within 14 or 45 days of each other as only one. Further, mortgage, auto, and student loan inquiries do not count at all in a FICO score if they are less than 30 days old. While all credit inquiries are recorded and displayed on personal credit reports for two years, they have no effect after the first year because FICO's scoring system ignores them after 12 months. Credit inquiries that were made by the consumer (such as pulling a credit report for personal use), by an employer (for employee verification), or by companies initiating pre-screened offers of credit or insurance do not have any impact on a credit score: these are called "soft inquiries" or "soft pulls", and do not appear on a credit report used by lenders, only on personal reports. Soft inquires are not considered by credit scoring systems.[8]

Getting a higher credit limit can help a credit score. The higher the credit limit on the credit card, the lower the utilization ratio average for all of a borrower's credit card accounts. The utilization ratio is the amount owed divided by the amount extended by the creditor and the lower it is the better a FICO rating, in general. So if a person has one credit card with a used balance of $500 and a limit of $1,000 as well as another with a used balance of $700 and $2,000 limit, the average ratio is 40 percent ($1,200 total used divided by $3,000 total limits). If the first credit card company raises the limit to $2,000, the ratio lowers to 30 percent, which could boost the FICO rating.

There are other special factors which can weigh on the FICO score.

- Any money owed because of a court judgment, tax lien, etc., carries an additional negative penalty, especially when recent.

- Having one or more newly opened consumer finance credit accounts may also be a negative.[9]

Ranges

There are several types of FICO credit score: classic or generic, bankcard, personal finance, mortgage, installment loan, auto loan, and NextGen score. The generic or classic FICO score is between 300 and 850, and 37% of people had between 750 and 850 in 2013.[10] According to FICO, the median classic FICO score in 2006 was 723.[11] The FICO bankcard score and FICO auto score are between 250 and 900. The FICO mortgage score is between 300 and 850. Higher scores indicate lower credit risk.[12]

Each individual actually has 65 credit scores for the FICO scoring model because each of three national credit bureaus, Equifax, Experian and TransUnion, has its own database. Data about an individual consumer can vary from bureau to bureau. FICO scores have different names at each of the different credit reporting agencies: Equifax (BEACON), TransUnion (FICO Risk Score, Classic) and Experian (Experian/FICO Risk Model). There are four active generations of FICO scores: 1998 (FICO 98), 2004 (FICO 04), 2008 (FICO 8), and 2014 (FICO 9). Consumers can buy their classic FICO Score 8 for Equifax, TransUnion, and Experian from the FICO website (myFICO), and they will get some free FICO scores in that moment ( FICO Mortgage Score 2 (2004), FICO Auto Score 8, FICO Auto Score 2 (2004), FICO Bankcard Score 8, FICO Bankcard 2 (2004) and FICO score 9). Consumers also can buy their classic FICO score for Equifax (version of 2004; named Score Power) in the website of this credit bureau, and their classic FICO Score 8 for Experian in its website. Other types of FICO scores cannot be obtained by individuals, only by lenders. Some credit cards offer a free FICO score several times per year to their cardholders.

NextGen Risk Score

The NextGen Score is a scoring model designed by the FICO company for assessing consumer credit risk. This score was introduced in 2001, and in 2003 the second generation of NextGen was released.[13] In 2004, FICO research showed a 4.4% increase in the number of accounts above cutoff while simultaneously showing a decrease in the number of bad, charge-off and Bankrupt accounts when compared to FICO traditional.[14] FICO NextGen score is between 150 and 950.

Each of the major credit agencies markets this score generated with their data differently:

- Experian: FICO Advanced Risk Score

- Equifax: Pinnacle

- TransUnion: FICO Risk Score NextGen ( formerly Precision )

Prior to the introduction of NextGen, their FICO scores were marketed under different names:

- Experian: FICO Risk Model

- Equifax: BEACON

- TransUnion: FICO Risk Score, Classic (formerly EMPIRICA)

FICO SBSS

The FICO Small Business Scoring Service (SBSS) score is used to evaluate small business credit applicants.[15] This score can evaluate the personal credit report of a business owner along with the business credit report of the business itself. Financial information of the business may be evaluated as well. The score range for the FICO SBSS score is 0-300. A higher score indicates less risk. Applications for SBA 7(a) loans for $350,000 or less will be prescreened using this score. A minimum score of 140 is needed to pass this prescreen, though most lenders require scores of 160 or less.

VantageScore

In 2006, to try to win business from FICO, the three major credit-reporting agencies introduced VantageScore, which differs from FICO in several ways. According to court documents filed in the FICO v. VantageScore federal lawsuit the VantageScore market share was less than 6% in 2006. The VantageScore score methodology initially produced a score range from 501 to 990, but VantageScore 3.0 adopted the score range of 300–850 in 2013.[16] Consumers can get free VantageScores from free credit report websites.

CE Score

CE Score is published by CE Analytics and licensed to sites such as Community Empower and iQualifier.com. This score is distributed to 6,500 lenders through the Credit Plus network but is free to consumers. It has a range of 350 to 850.[17]

Other credit scores

The non-FICO scores are called "educational" credit scores or FAKO scores by some. Experian has a credit score for educational use only (Plus Score) between 330 and 830, and Experian Scorex PLUS score is between 300 and 900. Equifax has the Equifax Credit Score of between 280 and 850. Some lenders use an Application Score of between 100 and 990, and Credit Optics Score by ID Analytics of between 1 and 999. TransUnion's TransRisk New Account Score in the website Credit Karma is between 300 and 850, and Experian National Equivalency Score in Credit Sesame and Credit.com ranges from 360 to 840. Several websites (TransUnion, Equifax, Credit Karma, Credit Sesame etc.) offer different credit scores to consumers but are not used by lenders. ChexSystems Consumer Score ranges from 100 to 899, PRBC credit score from 100 to 850, and LexisNexis Attract Insurance Score from under 500 to 997.

Free annual credit report

As a result of the FACT Act (Fair and Accurate Credit Transactions Act), each legal U.S. resident is entitled to a free copy of his or her credit report from each credit reporting agency once every twelve months.[18] The law requires all three agencies, Equifax, Experian, and Transunion, to provide reports. These credit reports do not contain credit scores from any of the three agencies. The three credit bureaus run Annualcreditreport.com, where users can get their free credit reports. Non-FICO credit scores are available as an add-on feature of the report for a fee. This fee is usually $7.95, as the FTC regulates this charge through the Fair Credit Reporting Act.[19]

Non-traditional uses of credit scores

Credit scores are often used in determining prices for auto and homeowner's insurance. Starting in the 1990s, the national credit reporting agencies that generate credit scores have also been generating more specialized insurance scores, which insurance companies then use to rate the insurance risk of potential customers.[20][21] Studies indicate that the majority of those who are insured pay less in insurance through the use of scores.[22][23] These studies point out that people with higher scores have fewer claims.

In 2009, TransUnion representatives testified before the Connecticut legislature about their practice of marketing credit score reports to employers for use in the hiring process. Legislators in at least twelve states introduced bills, and three states have passed laws, to limit the use of credit check during the hiring process.[24]

Criticism

Credit scores are widely used because they are inexpensive and largely reliable, but they do have their failings.

Easily gamed

Because a significant portion of the FICO score is determined by the ratio of credit used to credit available on credit card accounts, one way to increase the score is to increase the credit limits on one's credit card accounts.[25]

Not a good predictor of risk

Some have blamed lenders for inappropriately approving loans for subprime applicants, despite signs that people with poor scores were at high risk for not repaying the loan. By not considering whether the person could afford the payments if they were to increase in the future, many of these loans may have put the borrowers at risk of default.[26]

Some banks have reduced their reliance on FICO scoring. For example, Golden West Financial (which merged with Wachovia Bank in 2006) abandoned FICO scores for a more costly analysis of a potential borrower's assets and employment before giving a loan.[27]

According to the experts at MyFico.com,[28][29] credit scores are enhanced by having multiple credit cards, the use of credit cards, and having installment loans. However, financially secure individuals who do not use multiple credit cards and/or self finance installment type expenses may be inaccurately assessed a lower credit score.[30]

Use in employment decisions

Experian, Equifax, TransUnion and their trade association (the Consumer Data Industry Association or "CDIA") have all gone on record saying that employers do not receive credit scores on the credit reports sold for the purposes of employment screening. The use of credit reports for employment screening is allowed in all states, although some have passed legislation limiting the practice to only certain positions. Eric Rosenberg, director of state government relations for TransUnion, has also stated that there is no research that shows any statistical correlation between what’s in somebody’s credit report and their job performance or their likelihood to commit fraud.[31]

Other concerns

The use of credit information in connection with applying for various types of insurance or in landlord background checks has drawn similar amounts of scrutiny and criticism. This is because the activities of finding secure employment, renting suitable accommodation and securing insurance are the basic functions of meaningful participation in modern society, and in the case of some types of auto insurance for instance, are mandated by law.[32]

See also

- Credit score

- Credit history

- Credit bureau

- Comparison of free credit report websites

- Bankruptcy risk score

- Credit scorecards

- Alternative data

- Seasoned trade line

References

- ↑ Report to the Congress on credit scoring and its effects on the availability and affordability of credit

- ↑ An overview of consumer data and credit reporting

- ↑ "Our History - FICO". FICO.

- ↑ "How Are Credit Scores Calculated? Learn What Affects Your Credit Score". myFICO.com. Retrieved 2010-01-19.

- ↑ Dayana Yochim. "How Lenders Keep Score". TheMotleyFool. Retrieved 2008-02-29.

- ↑ "Amounts Owed – How It Impacts Your Score". Retrieved 23 October 2016.

- ↑ Is Paying Off the Mortgage Good for Our Credit? CREDIT CARDS Q&A By Joan Goldwasser, Kiplinger Personal Finance magazine, October 2008

- ↑ "What are inquiries and how do they affect my FICO score?". myFICO.

- ↑ "Hold Off on Opening New Credit Cards" 12–09–07

- ↑ Credit Score Information: About FICO Scores – myFICO.com

- ↑ "New Mortgages Worry Regulators" The Washington Post, June 10, 2006

- ↑ "What Is the Range for Credit Scores?" NerdWallet, October 28, 2016

- ↑ "FICO® NextGen Risk Scores" (PDF). Retrieved 2016-01-05.

- ↑ "FICO NextGen Score". FICO. Archived from the original on 2010-08-20.

- ↑ "FICO® Small Business Scoring Service | FICO®". FICO® | Decisions. Retrieved 2017-04-10.

- ↑ "VantageScore". VantageScore.com. Retrieved 2010-01-19.

- ↑ "How to get a free credit score". Bankrate.com. Retrieved 2011-06-26.

- ↑ "Annual Credit Report.com - Home Page". Retrieved 23 October 2016.

- ↑ "Fair Credit Reporting Act".

- ↑ Credit-based insurance scores: Impacts on consumers of automobile insurance A Report to Congress by the Federal Trade Commission July 2007

- ↑ No evidence of disparate impact in Texas due to use of credit information by personal lines insurers Dr. Robert P. Hartwig in January, 2005. Insurance Information Institute

- ↑ Allstate Insurance Company’s additional written testimony July 23, 2002

- ↑ Use and impact of credit in personal lines insurance premiums pursuant to Ark. code Ann. §23-67-415 (September 1, 2006) – A report to the legislative council and the Senate and House committees on insurance and commerce of the Arkansas General Assembly (as required by Act 1452 of 2003)

- ↑ "As a Hiring Filter, Credit Checks Draw Questions", The New York Times, April 9, 2010

- ↑ "Credit Scores: Not-So-Magic Numbers" Business Week, Feb. 7, 2008.

- ↑ Credit scores didn't fail in screening applicants for subprime loans(April 7, 2008)By PAMELA YIP / The Dallas Morning News

- ↑ "Credit Scores: Not-So-Magic Numbers" Business Week, Feb. 7, 2008.

- ↑ http://www.myfico.com/credit-education/improve-your-credit-score/

- ↑ http://www.myfico.com/CreditEducation/Types-of-Credit.aspx

- ↑ http://www.myfico.com/credit-education/credit-payment-history/

- ↑ "Millions Need Not Apply" New York Times, May 29, 2011.

- ↑ Legislatures, National Conference of State. "Use of Credit Information in Insurance 2011 Legislation". Retrieved 23 October 2016.

External links

- "Credit Scores: What You Should Know About Your Own", by Malgorzata Wozniacka and Snigdha Sen (November 2004). Frontline. PBS.