Economic policy of Donald Trump

| ||

|---|---|---|

|

President of the United States

Real estate

Golf courses Other ventures  |

||

Donald Trump's signature economic policies, sometimes referred to as Trumponomics,[1] include the raising of tariffs, across-the-board tax cuts, the dismantling of the Dodd–Frank Wall Street Reform and Consumer Protection Act, and the repeal of the Patient Protection and Affordable Care Act ("Obamacare").[2] Trump's economic plan was released in August 2016 and was widely described as light on details,[3][4][5][6] with Trump insisting "In the coming weeks, we will be offering more detail on all of these policies".[2]

Overview

Trump's signature economic policies are the raising of tariffs, across-the-board tax cuts, the dismantling of the Dodd–Frank Wall Street Reform and Consumer Protection Act and the repeal of the Patient Protection and Affordable Care Act ("Obamacare"). Trump unveiled his economic plan on August 8, 2016, with a revised tax proposal.[2]

Early economic plan

On the federal personal income tax, Trump has proposed collapsing the current seven brackets (which range from 10% to 39.6%) to three brackets of 10%, 20%, and 25%; increasing the standard deduction; taxing dividends and capital gains at a maximum rate of 20%; repealing the alternative minimum tax; and taxing carried interest income as ordinary business income (as opposed to existing law, which provides for preferential treatment of such income).[7][8] With respect to business taxes, Trump has proposed reducing the corporate tax rate to 15%; limiting the top individual income tax rate on pass-through businesses such as partnerships to no more than 15%; repealing most business tax breaks as well as the corporate alternative minimum tax; imposing a "deemed repatriation tax" of up to 10% of accumulated profits of foreign subsidiaries of U.S. companies on the effective date of the proposal, payable over 10 years; and taxing future profits of foreign subsidiaries of U.S. companies each year as the profits are earned (i.e., ending the deferral of income taxes on corporate income earned in other countries).[7][8] Trump has also called for the repeal of the federal estate tax and gift taxes and for capping the deductibility of business interest expenses.[7][8]

Detailed analyses by both two nonpartisan tax research organizations, the conservative Tax Foundation and centrist Tax Policy Center, concluded that Trump's tax plan would "boost the after-tax incomes of the wealthiest households by an average of more than $1.3 million a year" and significantly lower taxes for the wealthy.[7][9] The Tax Policy Center "calculated the average tax cuts for the rich and the very rich" under Trump's plan as "$275,000 or 17.5 percent of after-tax income for the top 1 percent, and $1.3 million or nearly 19 percent for the top 0.1 percent (those making over $3.7 million)."[10]

An analysis by Citizens for Tax Justice found that under Trump's plan, the poorest 20% of Americans would see a tax cut averaging $250, middle-income Americans would see a tax cut averaging just over $2,500, and the best-off 1% of Americans would see a tax cut averaging over $227,000.[8] CTJ determined that 37% of Trump's proposed tax cuts would benefit the top 1%.[10]

Trump's claims that his tax plan would be "revenue neutral" have been rated "false" by PolitiFact, which found that "Free market-oriented and liberal groups alike say Trump's tax plan would lead to a $10 trillion revenue loss, even if it did create economic growth."[11] An analysis by the Tax Foundation indicated that Trump's tax proposal would increase economic growth by 11% and wages by 6.5%, and create 5.3 million jobs, while decreasing revenue by $10 trillion over a decade.[12] Prominent anti-tax activist Grover Norquist of Americans for Tax Reform called Trump's tax proposal a "pro-growth, Reaganite plan";[13] as of May 2016, Trump has not signed Norquist's no-new-taxes pledge, but has indicated that he will in the future.[14]

Trump has pledged to balance the budget in ten years; not cut Social Security or Medicare; increase defense spending; and enact tax cuts that would lose $9.5 trillion of revenues over the next decade. Economist Jared Bernstein notes that it is mathematically impossible to fulfill all of these pledges, writing: "Trump would need to cut spending outside the Social Security, Medicare, and defense by 114 percent to make his budget balance, which is, of course, impossible."[15] Bernstein, a senior fellow at the Center on Budget and Policy Priorities, stated a proposal “loses probably something in the neighborhood of $5 trillion in revenue over 10 years with regressive tax cuts that exacerbate the inequalities that already exist in our economy.”[16] The fact-checking website PolitiFact similarly concluded: "Trump's tax plan means either unprecedented spending cuts or increased federal borrowing. But Trump has released no details about the gap, all the while vowing to protect Social Security and Medicare, two of the largest line items on the federal budget."[10]

An analysis of Trump's campaign proposals by the Committee for a Responsible Federal Budget (CRFB) showed that Trump's key proposals would increase the debt by between $11.7 and $15.1 trillion to the U.S. national debt over the next 10 years, with the U.S.'s debt-to-GDP ratio rising from 115% to 140% of GDP. The CRFB analysis showed that "growth would have to be roughly 5 times as large as projected, and twice as high as the fastest growth period in the last 60 years (which was between 1959 and 1968)" in order to balance the budget under Trump's plan, which is "practically impossible."[17][18]

Trump has vowed "tremendous cutting" of budgets for the U.S. Environmental Protection Agency and the U.S. Department of Education if elected.[19] However, Trump has "proposed large spending increases in certain areas," which the Center for Budget and Policy Priorities states would mean "even deeper cuts to other programs" if such spending increases are to be offset.[20]

On May 9, 2016, Trump said on Meet the Press: "The thing I'm going to do is make sure the middle class gets good tax breaks. For the wealthy, I think, frankly, it's going to go up. And you know what, it really should go up." The following day, Trump backtracked on his comment on taxation of the wealthy, "saying he had been referring to potential adjustments to his own tax policy proposal" and did not support an increase in taxes of the wealthy from current levels.[14][21] Trump's has frequently throughout his presidential campaign changed his view as to whether the wealthy should see tax cuts or increases.[22]

Economic growth

Trump's campaign claimed that the combination of income tax cuts, deregulation, trade protectionism, and additional spending for defense and infrastructure would significantly increase economic growth and job creation.[24] However, several organizations have reported that the results may not be so positive. For example:

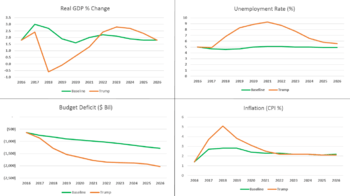

- According to a report by Moody's Analytics, released in June 2016, the implementation of Trump's stated economic policies would make the U.S. economy "significantly weaker" following an initial boost:

Under the scenario in which all his stated policies become law in the manner proposed, the economy suffers a lengthy recession and is smaller at the end of his four-year term than when he took office (see Chart). By the end of his presidency, there are close to 3.5 million fewer jobs and the unemployment rate rises to as high as 7%, compared with below 5% today. During Mr. Trump's presidency, the average American household's after-inflation income will stagnate, and stock prices and real house values will decline. Under the scenarios in which Congress significantly waters down his policy proposals, the economy will not suffer as much, but would still be diminished compared with what it would have been with no change in economic policies.[23][25][26]

- The Trump campaign disputed Moody's analysis, arguing that the report was based on flawed assumptions about proposals that have not been fully fleshed out and that Trump's tax cuts and deregulation proposals would help stimulate the economy. A Trump adviser also asserted that the costs of Trump's trade and immigration proposals had been overweighted in the analysis by not factoring in how current policies have depressed the wages of U.S. workers.[26]

- According to an analysis by the British research firm Oxford Economics, U.S. economic growth would slow to about 0.3 percent annually - the worst pace since the end of the recession - after two years of Trump's stated policies.[27] In the absence of Trump's policies, the U.S. economy would be $430 billion larger after five years.[27] Global economic growth would decline to about 2.2 percent annually, compared to a forecast of 2.9 percent if Trump's policies were not implemented.[27] The Oxford Economics analysis diverges from the Moody's analysis in that the former assumes that the Federal Reserve would help to mitigate the ramifications of Trump's policies by keeping interest rates close to zero.[27]

- According to an analysis by the Peterson Institute for International Economics, Trump's proposed tariff increases on China and Mexico could, if China and Mexico retaliate with their own tariff increases, push the U.S. into recession and cost 5 million U.S. jobs.[28] Even more limited retaliation by China and Mexico, or an aborted trade war (the Trump administration backs down from its tariff increases one year into them) would hit the U.S. economy hard.[28] Gary Clyde Hufbauer, senior fellow at PIIE, notes that there is ample precedent and scope for a U.S. president to unilaterally raise tariffs as Trump has vowed to do, and that efforts to block Trump's actions through the courts, or by amending the authorizing statutes in Congress, would be difficult and time-consuming.[29]

- According to an analysis by University of Michigan economist Justin Wolfers of stock market movements during the first Presidential Debate, the market performs far more poorly when Trump's chances of becoming President are higher.[30] The analysis shows that Wall Street traders expect the profitability of America’s largest businesses to be about 10 to 12 percent lower on average in the event of Trump presidency.[30]

- According to a Financial Times survey of economists, just under 14% of the economists polled between July 28–29 said a Trump victory in November would be positive for U.S. economic growth (compared with roughly 70% for Clinton).[31] According to a survey of National Association for Business Economics (NABE) members, 14% of business economists feel that Trump would do the best job as president of managing the U.S. economy (with 55% choosing Clinton, 15% choosing Gary Johnson, and 15% saying that they did not know or did not have an opinion).[32] According to a survey by The Wall Street Journal, none of the 45 former members of the White House Council of Economic Advisers—spanning eight presidents—openly support Mr. Trump.[33] According to the Financial Times, "most mainstream economists view his economic policies as dangerous quackery."[34]

- 370 prominent economists, including 8 Nobel laureates, have signed a letter warning against the election of Donald Trump, calling him a “dangerous, destructive choice” for the country.[35] The letter said that he had not proposed credible solutions to reduce budget deficits, that he has promoted misleading claims about trade and tax policy, chided him for failing to “listen to credible experts” and for promoting “magical thinking and conspiracy theories over sober assessments of feasible economic policy options.”[35]

- According to a November 2016 survey of leading economists, not a single respondent believed that Trump’s 100-day plan (“Seven actions to protect American workers”) was likely to benefit middle-class Americans, and only one economist believed that it was likely to improve the lives of low-skilled Americans.[36]

- Former Treasury Secretary Lawrence Summers wrote in June 2017 that: "We may have our first post-rational president. Trump has rejected the view of modern science on global climate change, embraced economic forecasts and trade theories outside the range of reputable opinion, and relied on the idea of alternative facts rather than evidence-based truth."[37]

Budget deficit and debt

In September 2016, Trump advisors Wilbur Ross and Peter Navarro asserted that the increased economic growth stimulated by Trump's proposed income tax cuts and additional military and infrastructure spending would offset much or all of the increased budget deficits caused by these tax cuts and spending increases.[38] However, several organizations have reported that such actions would significantly increase the budget deficit and national debt relative to a 2016 policy baseline. For example:

- According to a September 2016 report by the independent and non-partisan Committee for a Responsible Federal Budget, Trump's economic policies would increase the national debt by $5.3 trillion over 10 years, on top of the significant debt increase already in the current law baseline.[39]

- According to a September 2016 analysis by the conservative Tax Foundation, Trump's tax plan would reduce federal revenue by around $4.4 to $5.9 trillion over 10 years.[40] The $1.5 trillion gap is because the Trump campaign has not clarified some aspects of the tax plan and have provided contradictory explanations.[40] While the tax plan would reduce taxes across the spectrum, it does so the most for the richest Americans.[40]

Trump and his economic advisers have pledged to radically decrease federal spending in order to reduce the country's budget deficit. A first estimate of $10.5 trillion in spending cuts over 10 years was reported on January 19, 2017.[41]

CBO baseline projections

In January 2017, the Congressional Budget Office reported its baseline budget projections for the 2017-2027 time periods, based on laws in place as of the end of the Obama administration. CBO forecasted that "debt held by the public" would increase from $14.2 trillion in 2016 to $24.9 trillion by 2027, an increase of $10.7 trillion. These increases are primarily driven by an aging population, which impacts the costs of Social Security and Medicare, along with interest on the debt.[42] As President Trump introduces his budgetary policies, the impact can be measured against this baseline.

CBO also estimated that if policies in place as of the end of the Obama administration continued over the following decade, real GDP would grow at approximately 2% per year, the unemployment rate would remain around 5%, inflation would remain around 2%, and interest rates would rise moderately.[42] President Trump's economic policies can also be measured against this baseline.

Fiscal policy (taxes, spending, and budget)

Taxation

On August 8, 2016, Trump outlined a new economic plan that involved significant income tax cuts at all levels of income.[2] The day before, Trump removed his previous tax plan from his website.[43] Trump stated that he would flesh out these ideas in more detail in the ensuing days.[2]

He proposed to reduce the number of tax brackets from seven to three, and replace the rates ranging from 10% to 39.6% with 12%, 25% and 33%.[2] He proposed to cut the corporate tax rate from 35% to 15%.[2] The Washington Post notes that a 15% corporate tax rate would be put the United States near the bottom of the "major industrialized nations", where the average is about 25 percent.[2] He proposed to repeal the estate tax, which applies to inheritance for estates valued at $5.45 million for individuals and $10.9 million for couples, or roughly the wealthiest 0.2 percent of Americans.[2][4][44][45] Trump also said he would eliminate the carried interest loophole.[2] Trump's plan would also "eliminate the alternative minimum tax and the 3.8 percent net investment income tax, which was levied on high-income households to help fund Medicare expansion under the Affordable Care Act."[46]

Trump has repeatedly stated that the United States is the "highest-taxed nation in the world". His statement has been fully dismissed as false by the Associated Press and PolitiFact,[47][48] The Associated Press noted that the individual tax burden in the U.S. is one of the lowest in the OECD economies.[47] According to the Tax Foundation, the U.S. general corporate tax rate amounts to 39%, the third highest in the world.[49] The nominal corporate tax rate of 35% is higher than any other OECD nation; however, many companies pay far below this amount by taking advantage of loopholes. The average company in the S&P 500 paid 26.9% in federal, state, local and foreign taxes each year from 2007-2015.[50]

An analysis by Lily L. Batchelder of New York University School of Law estimated that Trump's new tax plan would cost more than $5 trillion over ten years and would raise taxes for lower and middle income families with children. The research found that the plan would result in gains on standard deduction, but losses on individual deduction.[51][52] According to the Tax Policy Center, Trump's economic plan would raise taxes on many families.[53] For instance, families with head-of-household filing status making between $20,000 and $200,000, including many single parents, would pay more under Trump’s plan than under current tax law.[53] The Tax Center's analysis was based on a static model rather than a "dynamic scoring" model.[54] Another study by the Wharton School of Business found that Trump's tax plan would create economic growth of 1.12% above the baseline and create 1.7 million jobs in 2018, although there would be a much larger loss of jobs and economic growth by 2027 and further by 2040.[54] The Tax Foundation assessed that by 2025 the Trump tax plan would increase the long-run size of the economy by 6.9% to 8.2%, but by adding $2.6 trillion and $3.9 trillion to federal debt.[55] This growth would lead to an increase in wages of 5.4% to 6.3%, an increase in capital stock of 20.1% to 23.9%, and the creation of 1.8 to 2.2 million jobs.[55][56][57][58]

Before Trump declared his candidacy for president in 2015, he regularly shamed and criticized others for not paying their fair share of taxes.[59] However, in the September 2016 presidential debate, Trump said that using loopholes to avoid paying income taxes in the 1970s "makes me smart."[60] In October 2016, the New York Times reported that Trump declared a $916 million loss on his 1995 income tax returns, a tax deduction so substantial it could have allowed him to legally avoid paying any federal income taxes for up to 18 years.[60][61] The Trump campaign did not challenge the accuracy of the tax returns or correct the claim that Trump might not have paid income taxes for 18 years.[60][62][63] Trump also chastised Mitt Romney in 2012 for delaying on releasing his tax returns.[59] Trump has, however, not released his tax returns.[60]

National debt

In 1999 Trump proposed a massive one-time "net worth tax" on the rich to wipe out the national debt.[64] Elizabeth Warren and Paul Krugman initially agreed with Trump's early positions on taxing the wealthy,[65][66] but not his published positions going into the election, which dramatically reduced taxes for the wealthy. Paul Krugman wrote in May 2016: "Last fall Mr. Trump suggested that he would break with Republican orthodoxy by raising taxes on the wealthy. But then he unveiled a tax plan that would, in fact, lavish huge tax cuts on the rich. And it would also, according to non-partisan analyses, cause deficits to explode, adding around $10 trillion to the national debt over a decade."[67] In 2011 Trump called for a balanced budget amendment,[68] but it was not part of his campaign website policies.[24]

Economist Mark Zandi estimated that if Trump's tax cuts and spending increases were fully implemented as proposed, the national debt trajectory would worsen considerably, with debt held by the public rising from 76% GDP in 2016 to 135% GDP in 2026, considerably above a current policy baseline that rises to 86% GDP in 2026. If only some of Trump's policies were implemented under an alternative scenario of more moderate changes, the debt figure would rise to 111% GDP by 2026.[23] In May 2016, the Committee for a Responsible Federal Budget placed the 2026 debt figure under Trump's policies between 111% GDP and 141% GDP, versus 86% under the current policy baseline.[17]

In two interviews in May 2016, Trump suggested that he would "refinance" the U.S. federal debt as a means to relieve the debt.[69][70] Trump said that he would not seek to renegotiate the bonds,[69] but rather would seek to buy the bonds back at a discount.[69][71][72] Economists and other experts variously described Trump's debt proposal as incoherent,[69] fanciful,[71] and reckless,[72] stating that the proposal, if carried into effect, "would send interest rates soaring, derail economic growth and undermine confidence in the world's most trusted financial asset."[72] Tony Fratto, a former U.S. Treasury Department who served under George W. Bush, termed Trump's suggestion to refinance the U.S. debt "an insane idea" that "would cause creditors to rightly question the 'full faith' commitment we make."[72] The New York Times reported that: "Repurchasing debt is a fairly common tactic in the corporate world, but it only works if the debt is trading at a discount. If creditors think they are going to get 80 cents for every dollar they are owed, they may be overjoyed to get 90 cents. Mr. Trump's companies had sometimes been able to retire debt at a discount because creditors feared they might default... However, the United States simply cannot pursue a similar strategy. The government runs an annual deficit, so it must borrow to retire existing debt. Any measures that would reduce the value of the existing debt, making it cheaper to repurchase, would increase the cost of issuing new debt. Such a threat also could undermine the stability of global financial markets."[73]

Social Security and Medicare

Trump has called for allowing Medicare to negotiate directly with prescription-drug companies to get lower prices for the Medicare Part D prescription-drug benefit, something currently prohibited by law. Trump has claimed on several occasions that this proposal would save $300 billion a year. Glenn Kessler, the fact-checker for the Washington Post, gave this statement a "four Pinocchios" rating, writing that this was a "truly absurd" and "nonsense figure" because it was four times the entire cost of the Medicare prescription-drug system.[74]

Unlike his rivals in the 2016 Republican primary race, Trump opposes cuts in Social Security and Medicare benefits.[75][76] This is a departure from Trump's earlier views; in his book published in 2000, Trump called Social Security a "Ponzi scheme" and said it should be privatized.[76] Trump previously proposed raising the Social Security retirement age to 70 from 67, but he backed away from this stance in 2015, instead claiming that Social Security should be funded by canceling foreign aid to anti-American countries.[76]

Monetary policy

Federal Reserve

Trump supports proposals that would grant Congress the ability to audit the Federal Reserve's decisionmaking and take power away from the Federal Reserve.[77][78][79]

Trump has at times said that he favors the monetary policy currently followed by Janet Yellen, Chair of the Board of Governors of the Federal Reserve System,[77] and at other times said that the Federal Reserve has created a "very false economy" and that interest rates should change.[80] Trump said in September 2016 that Yellen should be "ashamed" of herself for keeping interest rates low, but earlier that year Trump said that low interest rates were "the best thing we have going for us" and that any increase could be "scary."[81] Trump has at other times accused Yellen of being "highly political" and of doing President Obama's bidding,[77] and at other times complimented her on having "done a serviceable job" though he "would be more inclined to put other people in" the Federal Reserve.[78] He reiterated the critique of the Federal Reserve as an arm of the Democratic Party at the September 2016 Presidential Debate, an accusation which The New York Times found to be "extraordinary", "backed by no evidence" and "plows across a bipartisan line". The accusation is rejected both by Federal Reserve officials and independent expert observers.[82]

Gold standard

Trump favors returning to the gold standard, saying "Bringing back the gold standard would be very hard to do, but, boy, would it be wonderful. We'd have a standard on which to base our money."[83][84] Few economists support a return to the gold standard; Dean Baker of the Center for Economic and Policy Research notes that the proposal is considered a fringe idea among economists.[84]

Financial regulation and other regulations

In May 2016, Trump said that if elected president he would dismantle "nearly all" of the Dodd–Frank Wall Street Reform and Consumer Protection Act, a financial regulation package enacted after the financial crisis.[85] Trump called Dodd-Frank "a very negative force."[85] Trump told Reuters that he will release his own financial regulation plan in the beginning of June 2016.[86]

Trump promised to roll back existing regulations and impose a moratorium on new regulations, with a specific focus on undoing environmental rules that he said curtail job creation.[2][87] The Wall Street Journal noted that, "It isn’t clear how such a moratorium would apply to financial regulators, whose agencies enjoy greater independence from the executive branch" and that he "made no mention of past calls to repeal or replace parts of the Dodd-Frank financial-regulatory overhaul."[87] In October 2016, Trump proposed to eliminate as many as 70 percent of federal agency regulations.[88]

Trade policy

When announcing his candidacy in June 2015, Trump said that his experience as a negotiator in private business would enhance his ability to negotiate better international trade deals as President.[91][92]

Trump identifies himself as a "free trader,"[93] but has been widely described as a "protectionist".[94][95][96][97][98] Trump has described supporters of international trade as “blood suckers.”[99] According to the New York Times, since at least the 1980s, Trump has advanced mercantilist views, "describing trade as a zero-sum game in which countries lose by paying for imports."[100] On the campaign trail in 2015 and 2016, Trump has decried the U.S.-China trade imbalance—calling it "the greatest theft in the history of the world"—and regularly advocates tariffs.[100] Economists dispute the idea that a trade deficit amounts to a loss or "theft", as a trade deficit is simply the difference between what the United States imports and what it exports to a country.[101][102] Trump shares some views on trade with Bernie Sanders, at least in the sense that they both are skeptical of free trade.[92] When asked why the clothes in the Donald J. Trump collection were not made in the United States, Trump answered that "They don't even make this stuff here," a claim found to be false by FactCheck.org.[103]

Trump's views on trade have upended the traditional Republican policies favoring free trade.[94][104] Binyamin Appelbaum, reporting for the New York Times, has summarized Trump's proposals as breaking with 200 years of economics orthodoxy.[100][105] American economic writer Bruce Bartlett writes that Trump's protectionist views have roots in American history.[106] Likewise the Canadian writer Lawrence Solomon describes Trump's position on trade as similar to that as of pre-Reagan Republican presidents, such as Herbert Hoover (who signed the Smoot-Hawley Tariff Act) and Richard Nixon (who ran on a protectionist platform).[107]

Some economists and free-market proponents at groups such as the Institute of Economic Affairs, American Enterprise Institute, Peterson Institute for International Economics, Adam Smith Institute, Cato Institute, Center for Strategic and International Studies, and Club for Growth have been harshly critical of Trump's views on trade, viewing them as likely to start trade wars and harm consumers.[105][108][109][110][111][112][113][114][115][116] According to economists consulted by the Los Angeles Times, recent U.S. experience with imposing tariffs on goods has had little to no positive impact on the protected industries and harmed consumers through higher prices.[117]

Research shows that the mere threat of tariffs adversely affects international trade flows by creating policy uncertainty, so even if Trump never ends up enacting his proposed tariffs, the threat alone "is likely already discouraging potential exporters around the world from attempting to enter the US market."[118]

NAFTA

In a 60 Minutes interview in September 2015, Trump condemned the North American Free Trade Agreement (NAFTA), saying that if elected president, "We will either renegotiate it, or we will break it."[119][120] A range of trade experts have said that pulling out of NAFTA as Trump proposed would have a range of unintended consequences for the U.S., including reduced access to the U.S.'s biggest export markets, a reduction in economic growth, and increased prices for gasoline, cars, fruits, and vegetables.[121] The Washington Post fact-checker furthermore noted that a Congressional Research Service review of the academic literature on NAFTA concluded that the "net overall effect of NAFTA on the U.S. economy appears to have been relatively modest, primarily because trade with Canada and Mexico accounts for a small percentage of U.S. GDP."[102]

Trade with China

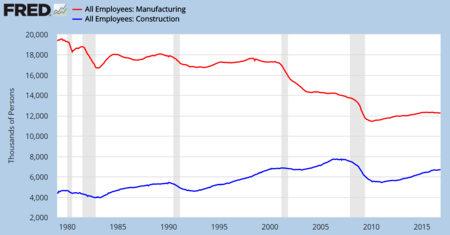

In January 2016, Trump proposed a 45 percent tariff on Chinese exports to the United States to give "American workers a level playing field."[93][100] According to an analysis by Capital Economics, Trump's proposed tariff may hurt U.S. consumers by driving U.S. retail price of Chinese made goods up 10 percent, because of few alternative suppliers in key product classes that China sells to the U.S.[122] The goods trade deficit with China in 2015 was $367.2 billion.[123] The Economic Policy Institute (EPI) reported in December 2014 that "Growth in the U.S. goods trade deficit with China between 2001 and 2013 eliminated or displaced 3.2 million U.S. jobs, 2.4 million (three-fourths) of which were in manufacturing." EPI reported these losses were distributed across all 50 states.[124]

Trump has vowed to label China as a currency manipulator on his first day in office.[104] Washington Post fact-checker Glenn Kessler, citing experts such as C. Fred Bergsten, found that "Trump's complaints about currency manipulation are woefully out of date," noting that "China has not manipulated its currency for at least two years."[125]

Trump has pledged "swift, robust and unequivocal" action against Chinese piracy, counterfeit American goods, and theft of U.S. trade secrets and intellectual property; and has condemned China's "illegal export subsidies and lax labor and environmental standards."[104] When asked about potential Chinese retaliation to the implementation of tariffs, such as sales of U.S. bonds, Trump deemed the Chinese unlikely to retaliate, "They will crash their economy... They will have a depression, the likes of which you have never seen if they ever did that."[126] In a May 2016 speech, Trump responded to concerns regarding a potential trade war with "We're losing $500 billion in trade with China. Who the hell cares if there's a trade war?"[127]

Trade with Mexico

Trump has vowed to impose tariffs — in the range of 15 to 35 percent — on companies that move their operations to Mexico.[128] He has specifically criticized the Ford Motor Co.,[100] Carrier Corporation,[100] and Mondelez International.[100][128][129] Trump has pledged a 35% tariff on "every car, every truck and every part manufactured in Ford's Mexico plant that comes across the border."[105] Tariffs at that level would be far higher than the international norms (which are around 2.67 percent for the U.S. and most other advanced economies and under 10 percent for most developing countries).[109] In August 2015, in response to Oreo maker Mondelez International's announcement that it would move manufacturing to Mexico, Trump said that he would boycott Oreos.[129]

According to economic experts canvassed by PolitiFact, the tariffs could help create new manufacturing jobs and lead to some concessions from the U.S.'s foreign trading partners, but consumer costs and production costs would almost certainly rise, the stock market would fall, interest rates could rise, and trade wars could occur.[130] PolitiFact noted that lower-income consumers in the United States would be hurt the most.[130]

Trans-Pacific Partnership

Trump opposes the Trans-Pacific Partnership, saying "The deal is insanity. That deal should not be supported and it should not be allowed to happen ... We are giving away what ultimately is going to be a back door for China."[131] Trump has asserted that the TPP will "be even worse than... NAFTA... We will lose jobs, we will lose employment, we will lose taxes, we will lose everything. We will lose our country."[132] In September 2016, Trump said that he would only support TPP as President if it were "phenomenal" for the U.S.[133]

World Trade Organization

Trump has called the World Trade Organization (WTO) a "disaster".[134] When informed that tariffs in the range of 15 to 35 percent would be contrary to the rules of the WTO, he answered "even better. Then we're going to renegotiate or we're going to pull out."[128]

Income inequality

In September 2016, Trump said: "We reject the pessimism that says our standard of living can no longer rise, and that all that's left to do is divide up and redistribute our shrinking resources."[135] However, U.S. household and non-profit net worth has approximately doubled from 2000 to 2016, from $44 trillion to $89 trillion, a record level.[136] In addition, the Congressional Budget Office reported in June 2016 that federal income taxes are progressive, which reduces after-tax income inequality. For example, the top 1% received approximately 15% of before-tax income but 12% of after-tax income during 2013.[137] Economist Mark Zandi wrote in June 2016 that due to the sizable income tax cuts, "[t]he tax code under Mr. Trump's plan will thus be much less progressive than the current tax code."[23]

Economic history

In October 2016, after it was revealed that Trump reported $916 million losses during the 1990s, Trump asserted that the 1990s were "one of the most brutal economic downturns in our country's history", "an economic depression" and that the only period coming close it was the Great Depression.[138] Those assertions are false.[138] For instance, the Great Recession, which began in 2007, had lasted far longer and had far worse economic consequences than the recession of the early 1990s.[138]

Trump has repeatedly claimed to have predicted the Great Recession.[139] However, Trump in the years preceding the Great Recession said precisely the opposite, namely that “the economy continues to be fairly robust,” “real estate is good all over,” “the real estate market is going to be very strong for a long time to come,” “I’ve been hearing about this bubble for so many years … but I haven’t seen it,” and “this boom is going to continue.”[139]

Student loans

During the 2016 Republican National Convention Trump said, "We’re going to work with all of our students who are drowning in debt to take the pressure off these young people just starting out their adult lives".[140] The Trump's Campaign has not put forth an official higher education plan.[141] However, In May 2016 Trump's campaign co-chair, Sam Clovis stated that the ideas being prepared by the campaign included getting government out of student lending; requiring colleges to share in risk of loans; discouraging borrowing by liberal arts majors; and moving the Office of Civil Rights from the Education Department to Justice Department.[142] In an October 2016 speech, Trump said that he favored having student loans repayment capped at 12.5 percent of borrowers' income, with forgiveness of any remaining debt after fifteen years of payments.[141][143]

Trump has criticized the federal government for earning a profit from federal student loans.[144] Trump's campaign stated that all colleges should have "skin in the game" and share the risk associated with student loans. The campaign opposes Hillary Clinton's proposal for debt-free public higher education, Bernie Sanders's plan for free public higher education and President Obama's proposals for a state-federal partnership to make community college free for new high school graduates, citing federal budget concerns.[142]

Infrastructure

Trump supports investment in American infrastructure to help create jobs.[145][146][147][148] He wrote in his 2015 book Crippled America that "Our airports, bridges, water tunnels, power grids, rail systems—our nation's entire infrastructure is crumbling, and we aren't doing anything about it." Trump noted that infrastructure improvements would stimulate economic growth while acknowledging "on the federal level, this is going to be an expensive investment, no question about that."[147][148] In an October 2015 interview with the Guardian, Trump stated: "We have to spend money on mass transit. We have to fix our airports, fix our roads also in addition to mass transit, but we have to spend a lot of money."[149] In a Republican primary debate in December 2015, Trump said: "We've spent $4 trillion trying to topple various people. If we could've spent that $4 trillion in the United States to fix our roads, our bridges and all of the other problems—our airports and all of the other problems we've had—we would've been a lot better off."[147]

On the campaign trail, Trump has decried "our airports, our roads, our bridges," likening their state to that of "a Third World country."[150][151] Trump has on some occasions overstated the proportion of U.S. bridges that are structurally deficient.[150] Unlike many of his Republican opponents,[149] Trump has expressed support for high-speed rail, calling the U.S.'s current rail network inferior to foreign countries' systems.[146][149]

Trump proposes he would spend $800 to a trillion dollars to repair and improve the nation's infrastructure. His plan to raise said capital, is to create an infrastructure fund that would be supported by government bonds that investors and citizens could purchase, similar to Build America Bonds.[152] When Trump was asked on Fox & Friends about supporting Russia's idea on a Bering Strait tunnel project, he replied: "I wouldn't be opposed to any idea that can create jobs."[153][154]

Employment

In a survey conducted by DHI Group in January 2017, a majority of employers don’t expect any near-term change in hiring plans due to the recent U.S. Presidential election. Around 12 percent anticipated an increase in hiring due to the incoming Trump administration proposed initiatives to accelerate the economy such as corporate tax reform.[156]

During an economic speech on September 15, 2016, Trump proposed tax cuts, infrastructure investment, reduced regulations, and revised trade agreements which he claimed would create 25 million jobs over ten years. Trump also stated: "Right now, 92 million Americans are on the sidelines, outside the workforce, and not part of our economy. It's a silent nation of jobless Americans."[135] However, the Congressional Budget Office has estimated that the U.S. was approximately 2.5 million jobs below full employment as of December 2015, primarily as a result of a labor force participation rate among prime working-aged persons (aged 25–54 years) that remains moderately below pre-crisis (2007) levels. The overall labor force participation rate has been falling since 2000, as the country ages.[155]

In December 2015, the Bureau of Labor Statistics (BLS) reported the reasons why persons aged 16+ were outside the labor force, using the 2014 figure of 87.4 million: 1) Retired-38.5 million or 44%; 2) Disabled or Illness-16.3 million or 19%; 3) Attending school-16.0 million or 18%; 4) Home responsibilities-13.5 million or 15%; and 4) Other Reasons-3.1 million or 5%.[157] As of November 2016, BLS estimated that 90 million of the 95 million people outside the labor force indicated they "do not want a job now."[158]

Trump has repeatedly questioned official employment numbers, suggesting at different times that the actual unemployment rate could be as high as 18–20%, 24% or 42%.[159][160] Fact-checkers note that these claims are false; the Washington Post fact-checker called them "absurd" and gave them "Four Pinocchios," its lowest rating for truthfulness, while PolitiFact gave the statement its "Pants on Fire" rating, noting that even the broadest measure of unemployment and underemployment was far below Trump's claimed figures.[160][161] As of August 2016, the unemployment rate (U-3) was 4.7%. A wider measure of unemployment (U-6) that includes those working part-time for economic reasons and marginally attached workers, was 9.7%. The December 2007 (pre-crisis) levels were 5.0% and 8.8% for these two measures, respectively.[162]

Minimum wage

Trump's comments about the minimum wage have been inconsistent.[163][164]

In August 2015, in a televised interview, Trump said "Having a low minimum wage is not a bad thing for this country."[165] On November 10, 2015, speaking at a Republican debate, Trump said he opposed increasing the U.S. minimum wage, saying that doing so would hurt America's economic competitiveness.[166][167] At the same debate, Trump said in response to a question about the minimum wage and the economy as a whole: "...taxes too high, wages too high, we’re not going to be able to compete against the world. I hate to say it, but we have to leave it the way it is."[168]

On May 5, 2016, two days after becoming the presumptive Republican nominee, Trump said in an interview with CNN's Wolf Blitzer that he was "actually looking at" raising the minimum wage, saying, "I'm very different from most Republicans."[169] Three days later, in an interview on This Week with George Stephanopoulos: "... I haven't decided in terms of numbers. But I think people have to get more." He acknowledged his shift in position since November, saying "Well, sure it's a change. I'm allowed to change. You need flexibility ..."[170][171]

Later on May 8, on Meet the Press, he said "I would like to see an increase of some magnitude. But I'd rather leave it to the states. Let the states decide."[172][173] Asked if the federal government should set a floor (a national minimum wage), Trump replied: "No, I’d rather have the states go out and do what they have to do."[174]

On July 26, 2016, Trump said "There doesn't have to be [a federal minimum wage]," but that "I would leave it and raise it somewhat. You need to help people." Host Bill O'Reilly then asked "Ten bucks?" Trump agreed: "I would say 10. I would say 10." He added "But with the understanding that somebody like me is going to bring back jobs. I don't want people to be in that $10 category for very long. But the thing is, Bill, let the states make the deal."[175]

Unions and right-to-work laws

In February 2016, Trump said on a radio program: "My position on unions is fine, but I like right to work. My position on right to work is 100 percent."[176]

Trump has frequently spoken in favor of deregulation, and if elected president is viewed as likely to oversee an Occupational Safety and Health Administration that conducts "less enforcement and practically no rulemaking" on issues of workplace safety and health.[177]

Other economic topics

Bank bailout

Trump supported the Troubled Asset Relief Program (TARP), a $700 billion emergency bailout fund that rescued banks after the subprime mortgage crisis. On September 30, 2008, days before the bailout bill passed, Trump told CNN's Kiran Chetry that he supported the legislation, saying that while the situation was "more complicated than sending rockets to the moon" and nobody was sure what the result would be, it was "worth a shot" and a "probable positive."[178] The following year, when asked by Larry King what he viewed of the Obama administration, Trump stated: "I do agree with what they're doing with the banks. Whether they fund them or nationalize them, it doesn't matter, but you have to keep the banks going."[178]

Child care

Trump first addressed childcare costs in August 2016,[179] when he proposed allowing parents to "fully deduct the average cost of childcare spending from their taxes."[2] At the time of the announcement, it was unclear "how such a tax break might be structured, how it would complement existing credits and whether it would be available to tens of millions of families that don't pay income taxes because they have lower incomes."[87] A tax deduction of the kind that Trump proposes (as opposed to a tax credit) would primarily benefit high-income people; families who pay no federal income taxes—the families most likely to be unable to afford child care—would not benefit from this plan.[2][3][180][181][182][183][184]

In September 2016, Trump presented additional details regarding his proposal, which was influenced by his daughter Ivanka Trump.[185] Under Trump's plan, taxpayers who earn up to $250,000 individually or $500,000 as couples would be able to deduct the cost of childcare up to the average cost of childcare in their state, while lower-income families would receive spending rebates up to $1,200 annually through the Earned Income Tax Credit. Under the plan, mothers whose employers don't offer paid maternity leave would receive six weeks of partially paid maternity leave, to be paid for through unemployment insurance. Trump also proposes a new dependent-care savings account, which would be tax-deductible for savings up to $2,000 annually; lower-income families that contribute up to $1,000 would receive a match up to $500 from the federal government.[186]

Trump's plan applies to mothers only, and would not allow families to transfer the benefit from mothers to fathers.[185] Legal scholar Ilya Somin argues that providing maternity leave but not paternity leave would be unconstitutional under Craig v. Boren, in which the Supreme Court held that laws discriminating on the basis of sex are presumptively invalid.[187]

Advisors

Trump released a list of his campaign's official economic advisers in August 2016,[188][189][190] which was significantly anti-establishment[191] and therefore included few people with any governmental experience,[192] yet at the same time aimed to include some of the elites of business and finance,[188] primarily people with well-known names. Although most of the names were new, existing Trump advisers David Malpass, Peter Navarro, Stephen Moore, and Dan DiMicco were also on the list, formally led by Stephen Miller, the national policy director, and directly led by deputy policy director Dan Kowalski. The Trump'16 finance director Steven Mnuchin was also listed, and played a role in helping coordinate the group.

Many of the names on the original list, or on the subsequent expansions thereof,[193] received media attention as potential cabinet-level appointees, for instance to the presidential Council of Economic Advisers, or in other Trump administration roles. After the election, Trump became president-elect, and in addition to nominating and appointing advisors to formal statutory roles within the Trump administration, also began working on efforts to directly communicate with business leaders, including those in the tech industry, in the broader business world, and in the agricultural sector.

Trump's cabinet will have no economists after his decision in February 2017 to not include the chairman of the Council of Economic Advisers in his cabinet. Obama had elevated the chairman position to a cabinet rank during his administration.[194][195]

Business Advisory Council

In December 2016, Trump put together a group, the 'President’s Strategic and Policy Forum', of business leaders to "frequently" advise him on economic matters around policies to encourage job growth and improve productivity. The group is chaired by Blackstone CEO Stephen Schwarzman, who recruited its members including CEOs of General Motors, JPMorgan, and Walmart. Uber CEO Travis Kalanick, was originally part of the group but resigned a day prior to its first meeting in response to pressure from his employees and customers in the wake of Trump's executive order on immigration.[196][197]

External links

- Economist.com (May 4th 2017): Transcript: Interview with Donald Trump (along with Steve Mnuchin, the treasury secretary, and Gary Cohn, the director of the National Economic Council)

References

- ↑ "What is 'Trumponomics'?". Investopedia. IAC. Retrieved February 4, 2017.

- 1 2 3 4 5 6 7 8 9 10 11 12 13 "Donald Trump's economic speech, annotated". Washington Post. Retrieved August 8, 2016.

- 1 2 Timiraos, Nick; Reinhard, Beth (August 8, 2016). "Donald Trump Pitches Tax Breaks, Moratorium on New Regulations". Wall Street Journal. ISSN 0099-9660. Retrieved August 8, 2016.

- 1 2 "Trump aims to 'jump start' America with new tax plan". BBC News. Retrieved August 8, 2016.

- ↑ "Trump calls for excluding child-care costs from taxation as he tries to turn the page on a bruising week". Washington Post. Retrieved August 8, 2016.

- ↑ "Donald Trump is making 2 big changes to his economic platform". Retrieved August 8, 2016.

- 1 2 3 4 Jim Nunns, Len Burman, Jeff Rohaly & Joe Rosenberg, An Analysis of Donald Trump's Tax Plan, Tax Policy Center (Urban Institute/Brookings Institution) (December 22, 2015).

- 1 2 3 4 Donald Trump's $12 Trillion Tax Cut: Tax Plan Reserves Biggest Tax Cuts for the Best-off Americans, Citizens for Tax Justice (updated November 4, 2015).

- ↑ Richard Rubin, Analysis of Trump's Tax Plan Shows Big Cuts in Taxes, Federal Revenue, Wall Street Journal (December 22, 2015).

- 1 2 3 Linda Qiu, PolitiFact's guide to the 2016 presidential candidate tax plans, PolitiFact (April 7, 2016).

- ↑ Linda Qiu, Donald Trump's false claim that his tax plan wouldn't increase the deficit, PolitiFact (November 5, 2015).

- ↑ Tami Luhby, Conservative group: Clinton tax plan would hit top 1%, economic growth, CNN (January 26, 2016).

- ↑ Kenneth T. Walsh, Grover Norquist Blesses Trump Tax Plan, U.S. News & World Report (September 29, 2015).

- 1 2 Trump backtracks on tax hike for the rich, Reuters with CNBC.com (May 9, 2016).

- ↑ Bernstein, Jared (March 7, 2016). "Donald Trump's impossible fiscal plan". Washington Post. Retrieved March 8, 2016.

- ↑ Julie Hirschfeld Davis and Patricia Cohen (April 27, 2017). "Trump Tax Plan Would Shift Trillions From U.S. Coffers to the Richest". NYTimes.com. Retrieved May 14, 2017.

- 1 2 3 Fiscal Fact Check: How Do Donald Trump's Campaign Proposals So Far Add Up?, Committee for a Responsible Federal Budget (February 13, 2016).

- ↑ Donald ducks the big questions: Donald Trump's proposals require implausible spending cuts or 10% growth, The Economist (February 27, 2016).

- ↑ Haddon, Heather (January 11, 2016). "Donald Trump Vows to Slash Funding for Education, EPA". The Wall Street Journal.

- ↑ Isaac Shapiro, Trump and Cruz Tax-Cut Plans Would Shrink Government to Truman-Era Levels, Center for Budget and Policy Priorities (March 29, 2016).

- ↑ Doina Chiacu, Trump retreats on comments on raising taxes on the wealthy, Reuters (May 9, 2016).

- ↑ Jane C. Timm (November 7, 2016). "Here Are All of Donald Trump's Flip-Flops on Big Issues". NBC News.

- 1 2 3 4 Mark Zandi; Chris Lafakis; Dan White; Adam Ozimek (June 2016). "The Macroeconomic Consequences of Mr. Trump's Economic Policies" (PDF). Moody's Analytics. Retrieved November 7, 2016.

- 1 2 "Trump Pence Campaign Policies". October 16, 2016.

- ↑ Schroeder, Peter (June 20, 2016). "Analysis: Trump's plans would cause 'lengthy recession,' cost jobs". The Hill.

- 1 2 Timiraos, Nick (June 20, 2016). "U.S. Economy Would Be 'Diminished' Under Trump's Economic Plan, New Analysis Says". Wall Street Journal.

- 1 2 3 4 "What a Donald Trump presidency would do to the global economy". Washington Post. Retrieved September 19, 2016.

- 1 2 Davis, Bob (September 19, 2016). "Trump Trade Plan Could Push U.S. into Recession, Study Says". Wall Street Journal. ISSN 0099-9660. Retrieved September 19, 2016.

- ↑ "Assessing Trade Agendas in the US Presidential Campaign". September 14, 2016. Retrieved September 19, 2016.

- 1 2 Wolfers, Justin (September 30, 2016). "Debate Night Message: The Markets Are Afraid of Donald Trump". The New York Times. ISSN 0362-4331. Retrieved September 30, 2016.

- ↑ "White House battle set to chill US economy, says FT survey". Financial Times.

- ↑ McGrath, Maggie. "By 4 To 1 Margin, Business Economists Say Clinton Would Manage Economy Better Than Trump". Retrieved August 22, 2016.

- ↑ Zumbrun, Ben Leubsdorf, Eric Morath and Josh. "Economists Who’ve Advised Presidents Are No Fans of Donald Trump". Retrieved August 25, 2016.

- ↑ Donnan, Shawn (September 19, 2016). "Trump's trade policies would send US into recession, study says". Financial Times. ISSN 0307-1766. Retrieved September 20, 2016.

- 1 2 Timiraos, Nick. "Prominent Economists, Including Eight Nobel Laureates: ‘Do Not Vote for Donald Trump’". WSJ. Retrieved November 1, 2016.

- ↑ "100-Day Plan | IGM Forum". www.igmchicago.org. Retrieved 2016-11-19.

- ↑ "After 75 years of progress, was last week a hinge in history?". Washington Post. June 2017.

- ↑ "Scoring the Trump Economic Plan" (PDF). Donald J. Trump for President, Inc. Retrieved October 16, 2016.

- ↑ Cox, Jeff (September 22, 2016). "Trump plans would increase debt 26 TIMES more than Clinton's: Study". CNBC. Retrieved September 22, 2016.

- 1 2 3 "Analysis: Trump Tax Plan Would Cost Trillions, Boost Incomes For The Rich". NPR. Retrieved September 19, 2016.

- ↑ Bolton, Alexander (January 19, 2017). "Trump team prepares dramatic cuts". The Hill. Retrieved January 22, 2017.

- 1 2 "CBO The Budget and Economic Outlook 2017-2027". CBO. 24 January 2017.

- ↑ "FACT CHECK: Donald Trump Unveils His Economic Plan In Major Detroit Speech". NPR. Retrieved August 8, 2016.

- ↑ Pofeldt, Elaine (March 15, 2016). "Main St. speaks out: Our top pick for president". CNBC. Retrieved August 10, 2016.

- ↑ Frank, Robert (August 9, 2016). "Tax loophole in Trump's plan would create windfall for the rich". CNBC. Retrieved August 10, 2016.

- ↑ Kathleen Pender, Trump's tax plan to cost $6.2 trillion, report says, San Francisco Chronicle (October 11, 2016).

- 1 2 "AP FACT CHECK: Trump's distortions on Clinton". The Big Story. Retrieved June 22, 2016.

- ↑ Louis Jacobson; Linda Qiu (May 8, 2016). "For the third time, Donald Trump, U.S. is not 'highest taxed nation in the world'". PolitiFact.

- ↑ "Corporate Income Tax Rates around the World, 2015". Tax Foundation. Retrieved November 4, 2016.

- ↑ Leonhardt, David (October 18, 2016). "The Big Companies That Avoid Taxes". The New York Times. Retrieved October 18, 2016.

- ↑ Jim Tankersley (September 24, 2016). "A new study says Trump would raise taxes for millions. Trump’s campaign insists he won't". Washington Post.

- ↑ Batchelder, Lily L. (October 28, 2016). "Research Report: Families Facing Tax Increases Under Trump's Tax Plan". Urban-Brookings Tax Policy Center. SSRN 2842802

.

. - 1 2 Rubin, Richard (October 11, 2016). "Presidential Candidates’ Plans Would Carry Tax Code in Different Directions". Wall Street Journal. ISSN 0099-9660. Retrieved October 11, 2016.

- 1 2 "Trump Tax Plan Seen Adding Jobs, Then Erasing Them Long-Term". Bloomberg L.P. Retrieved November 4, 2016.

- 1 2 "Details and Analysis of the Donald Trump Tax Reform Plan, September 2016". Tax Foundation. Retrieved November 4, 2016.

- ↑ Ben Tarnoff (November 9, 2016). "The triumph of Trumpism: the new politics that is here to stay". The Guardian.

- ↑ Ben Tarnoff (November 9, 2016). "The triumph of Trumpism: the new politics that is here to stay". The Guardian.

- ↑ Catherine Rampell (November 9, 2016). "Opinions Americans have voted for Trumpism. Let them have it.". The Atlantic.

- 1 2 "Ten times Trump shamed others on tax". BBC News. October 3, 2016. Retrieved October 3, 2016.

- 1 2 3 4 Buettner, David Barstow, Susanne Craig, Russ; Twohey, Megan (October 1, 2016). "Donald Trump Tax Records Show He Could Have Avoided Taxes for Nearly Two Decades, The Times Found". The New York Times. ISSN 0362-4331. Retrieved October 3, 2016.

- ↑ Nicholas Confessore & Benyamin Appelbaum, How a Simple Tax Rule Let Donald Trump Turn a $916 Million Loss Into a Plus, New York Times (October 3, 2016).

- ↑ Craig, Susanne (October 2, 2016). "The Time I Found Donald Trump’s Tax Records in My Mailbox". The New York Times. ISSN 0362-4331. Retrieved October 3, 2016.

- ↑ Sevastopulo, Demetri (October 2, 2016). "Records suggest Donald Trump avoided paying taxes for years". Financial Times. ISSN 0307-1766. Retrieved October 3, 2016.

- ↑ Hirschkorn, Phil (November 9, 1999). "Trump proposes massive one-time tax on the rich". CNN. Retrieved October 24, 2016.

- ↑ Kludt, Tom (September 8, 2015). "Elizabeth Warren: I agree with Donald Trump on taxes". CNN. Retrieved October 24, 2016.

- ↑ Krugman, Paul (September 27, 2015). "Trump Is Right on Economics". The New York Times. Retrieved October 24, 2016.

- ↑ Krugman, Paul (May 13, 2016). "Trump and Taxes". The New York Times. Retrieved October 30, 2016.

- ↑ Bedard, Pauk (July 6, 2011). "Donald Trump Calls for Balanced Budget". U.S. News & World Report. Retrieved October 24, 2016.

- 1 2 3 4 Louis Jacobson. "A closer look at Donald Trump's comments about refinancing U.S. debt". PolitiFact. Retrieved May 22, 2016.

- ↑ "Donald Trump's Messy Ideas For Handling The National Debt, Explained". NPR. Retrieved May 22, 2016.

- 1 2 Appelbaum, Binyamin (May 6, 2016). "Donald Trump's Idea to Cut National Debt: Get Creditors to Accept Less". New York Times. Retrieved October 24, 2016.

- 1 2 3 4 A Trump proposal for national debt would send rates soaring, Associated Press (May 6, 2016).

- ↑ Appelbaum, Binyamin (May 6, 2016). "Donald Trump's Idea to Cut National Debt: Get Creditors to Accept Less". New York Times. Retrieved October 24, 2016.

- ↑ Glenn Kessler, Trump's truly absurd claim he would save $300 billion a year on prescription drugs, Washington Post (February 18, 2016).

- ↑ Social Security and the Republican Debate: Donald Trump and Mike Huckabee vs. Jeb Bush and the Others, Huffington Post (August 8, 2015).

- 1 2 3 Robert Powell, How Trump and Clinton plan to fix Social Security, MarketWatch (February 2, 2016).

- 1 2 3 "Factbox: Fed and presidential campaign: where candidates stand". Reuters. April 7, 2016.

- 1 2 Stephen Gandel (April 19, 2016). "Donald Trump Likes Low Interest Rates But Says He'd Replace Yellen". Fortune.

- ↑ "Donald J. Trump on Twitter". Retrieved July 18, 2016.

- ↑ Steve Holland (September 12, 2016). "Trump says U.S. interest rates must change as Fed weighs rate hike". Reuters.

- ↑ Ylan Q. Mui (September 12, 2016). "Donald Trump says Federal Reserve Chair Janet Yellen 'should be ashamed of herself'". Washington Post.

- ↑ Appelbaum, Binyamin (September 27, 2016). "No Evidence to Support Trump’s Attacks on the Fed". The New York Times. ISSN 0362-4331. Retrieved September 28, 2016.

- ↑ "Donald Trump Weighs in on Marijuana, Hillary Clinton, and Man Buns". GQ Videos. Retrieved June 17, 2016.

- 1 2 Jim Zarroli. "Trump Favors Returning To The Gold Standard, Few Economists Agree". Morning Edition. NPR. Retrieved June 17, 2016.

- 1 2 Holland, Steve; Flitter, Emily (May 18, 2016). "Exclusive: Trump would talk to North Korea's Kim, wants to renegotiate climate accord". Reuters.

- ↑ Emily Flitter; Steve Holland (May 18, 2016). "Trump preparing plan to dismantle Obama's Wall Street reform law". Reuters.

- 1 2 3 Timiraos, Nick; Reinhard, Beth (August 9, 2016). "Donald Trump, Hillary Clinton Spar Over Economic Proposals". Wall Street Journal. ISSN 0099-9660. Retrieved August 10, 2016.

- ↑ Chris Kaufman (October 7, 2016). "Republican Trump says 70 percent of federal regulations 'can go'". Reuters.

- ↑ Presidential Executive Order Regarding the Omnibus Report on Significant Trade Deficits, White House, 3/31/2016

- ↑ Presidential Executive Order on Establishing Enhanced Collection and Enforcement of Antidumping and Countervailing Duties and Violations of Trade and Customs Laws, White House, 3/31/2016

- ↑ "Donald Trump Transcript: 'Our Country Needs a Truly Great Leader'". Federal News Service speech. June 16, 2015.

- 1 2 Bradner, Eric. Here's how Donald Trump could spark a trade war with Mexico and China, CNN (August 26, 2015).

- 1 2 Maggie Haberman, Donald Trump Says He Favors Big Tariffs on Chinese Exports, New York Times (January 7, 2016).

- 1 2 Jim Tankersley, Trump upends GOP message on economy, Washington Post (August 31, 2015).

- ↑ "Donald Trump's protectionism has a good pedigree". Retrieved July 22, 2016.

- ↑ "Lawrence Solomon: Donald Trump's protectionism fits right in with Republicans". Retrieved July 22, 2016.

- ↑ Epstein, Reid J.; Nelson, Colleen McCain (June 28, 2016). "Donald Trump Lays Out Protectionist Views in Trade Speech". The Wall Street Journal. ISSN 0099-9660. Retrieved July 22, 2016.

- ↑ Appelbaum, Binyamin (March 10, 2016). "On Trade, Donald Trump Breaks With 200 Years of Economic Orthodoxy". The New York Times. ISSN 0362-4331. Retrieved July 22, 2016.

- ↑ "As news of Trump’s taxes breaks, he goes off script at a rally in Pennsylvania". Washington Post. Retrieved October 2, 2016.

- 1 2 3 4 5 6 7 Binyamin Appelaum, On Trade, Donald Trump Breaks With 200 Years of Economic Orthodoxy, New York Times (March 10, 2016).

- ↑ David Lawder; Roberta Rampton (March 24, 2016). "Trump's tariff plan could boomerang, spark trade wars with China, Mexico". Reuters.

- 1 2 "Trump's trade rhetoric, stuck in a time warp". Washington Post. Retrieved May 21, 2016.

- ↑ Robert Farley (May 11, 2016). "Trump's 'Made in the USA' Spin". FactCheck.org. Annenberg Public Policy Center.

- 1 2 3 Doug Palmer & Ben Schreckinger, Trump's trade views vows to declare China a currency manipulator on Day One, Politico (November 10, 2015).

- 1 2 3 Charles Lane, Donald Trump's contempt for the free market, Washington Post (October 21, 2015).

- ↑ Bartlett, Bruce. Donald Trump's protectionism has a good pedigree, Financial Times (April 5, 2016).

- ↑ Solomon, Lawrence. Lawrence Solomon: Donald Trump's protectionism fits right in with Republicans, Financial Post (March 18, 2016).

- ↑ Mankiw, N. Gregory (May 6, 2016). "The Economy Is Rigged, and Other Presidential Campaign Myths". The New York Times. ISSN 0362-4331. Retrieved June 28, 2016.

- 1 2 Everett Rosenfeld, Trump trade plans could cause global recession: Experts, CNBC (March 10, 2016).

- ↑ WSJ Poll: Economists See Risks to Trump, Sanders, Wall Street Journal ("What's" News podcast) (March 11, 2016).

- ↑ Daniel Strauss, Club for Growth issues scathing review of Trump's economic plans, Politico (November 4, 2015).

- ↑ Worstall, Tim. "Of Course Donald Trump's Policies Would Cause A Trade War: By Trump On Americans". Forbes. Retrieved May 22, 2016.

- ↑ Ryan Bourne, Donald Trump's fairy tale economics would be terrible for America, Institute of Economic Affairs (July 28, 2015).

- ↑ Scott Lincicome, Commentary: Endorser Agrees: Trump Policies Will Benefit Rich at Expense of Poor and Middle Class, Cato Institute (March 1, 2016).

- ↑ C. Fred Bergsten (April 19, 2016). "Trump's Trade Policy Is a Big Loser". Peterson Institute for International Economics.

Also published at U.S. News & World Report.

- ↑ "Critics: Trump trade plan won't save jobs". Retrieved July 3, 2016.

- ↑ Don Lee (July 24, 2016). "Limited success of Chinese tire tariffs shows why Donald Trump's trade prescription may not work". Los Angeles Times.

- ↑ Crowley, Meredith; Song, Huasheng; Meng, Ning (2017-02-10). "Protectionist threats jeopardise international trade: Chinese evidence for Trump’s policies". VoxEU.org. Retrieved 2017-02-11.

- ↑ Jill Colvin, Trump: NAFTA trade deal a 'disaster,' says he'd 'break' it, Associated Press (September 25, 2015).

- ↑ Mark Thoma, Is Donald Trump right to call NAFTA a "disaster"?, CBS News (October 5, 2015).

- ↑ Eric Martin, Trump Killing Nafta Could Mean Big Unintended Consequences for the U.S., Bloomberg Business (October 1, 2015).

- ↑ Tan, Huileng (September 30, 2016). "How Trump's tariff plan for Chinese goods will hurt US consumers, not China". CNBC. Retrieved September 30, 2016.

- ↑ "U.S. Trade in Goods with China". U.S. Census Bureau. Retrieved November 14, 2016.

- ↑ "China Trade, Outsourcing, and Jobs". Economic Policy Institute. Retrieved November 14, 2016.

- ↑ Glenn Kessler (March 18, 2016). "Trump's trade rhetoric, stuck in a time warp". Washington Post.

- ↑ "Donald Trump on the trade deficit with China". Fox News. February 11, 2016. Retrieved May 24, 2016.

- ↑ "Trump: 'Who the hell cares if there's a trade war?'". Washington Post. Retrieved May 21, 2016.

- 1 2 3 Needham, Vicki (July 24, 2016). "Trump suggests leaving WTO over import tax proposal". Retrieved July 24, 2016.

- 1 2 Michael Daly (August 8, 2015). "Donald Trump Won’t Eat Oreos Because They’re Too Mexican Now". Daily Beast. Retrieved April 9, 2016.

- 1 2 "Donald Trump floated big tariffs. What could the impact be?". Retrieved July 3, 2016.

- ↑ Associated Press, Quote box: Trump talks tough on Asia trade, alliances (March 10, 2016).

- ↑ "Fact Check: Trump's Speech On Clinton, Annotated".

- ↑ "In Economic Speech, Trump Talks Trade and Projected Growth Rates". Morning Consult. Retrieved September 16, 2016.

- ↑ "Trump: I'm Running Against Clinton, Not 'Rest of the World'". Retrieved July 24, 2016.

- 1 2 "Read Donald Trump's Speech on Jobs and the Economy". Time. September 15, 2016.

- ↑ "Household and Non-Profit Net Worth". Federal Reserve Economic Data, Federal Reserve Bank of St. Louis. September 16, 2016.

- ↑ "The Distribution of Household Income and Federal Taxes, 2013". CBO. June 8, 2016.

- 1 2 3 "AP FACT CHECK: Trump Distorts '90s Economic Downturn". Associated Press. Retrieved October 4, 2016.

- 1 2 "Donald Trump Says He ‘Called’ the ’08 Crash. Here’s What Really Happened". POLITICO Magazine. Retrieved October 7, 2016.

- ↑ Nykiel, Teddy (July 28, 2016). "Trump's take on college affordability". The Christian Science Monitor. Retrieved October 24, 2016.

- 1 2 2016 Presidential Candidates' Higher Education Proposals, National Association of Student Financial Aid Administrators (accessed October 21, 2016).

- 1 2 Scott Jaschik (May 12, 2016). "Trump's campaign co-chair describes higher education policies being developed". InsideHigherEd.

- ↑ Scott Jaschik, Trump on Higher Ed, Inside Higher Ed (October 14, 2016).

- ↑ Cirilli, Kevin (July 23, 2015). "Trump: Why is federal government making money on student loans?". The Hill. Retrieved October 24, 2016.

- ↑ "Donald Trump: "I want to make the country great again"". The Kelly File. Fox News,. May 21, 2015.

- 1 2 Haley Sweetland, Trump Agrees With Democrats on High-Speed Trains, Time (March 3, 2016).

- 1 2 3 Max Ehrenfreund, Liberals will love something Donald Trump said last night, Washington Post (December 16, 2015).

- 1 2 Diana Furchtgott-Roth, Donald Trump's four good ideas — and four bad ones — in 'Crippled America', MarketWatch (November 12, 2015).

- 1 2 3 Ben Jacobs, Donald Trump tells the Guardian police body cameras 'need federal funding', The Guardian (October 13, 2015).

- 1 2 Warren Fiske, Trump says 61 percent of U.S. bridges 'in trouble', Politifact (October 26, 2015).

- ↑ Keith Laing, Trump takes a shot at NYC's LaGuardia Airport, The Hill (September 30, 2015).

- ↑ Rappeport, Alan (August 2, 2016). "Donald Trump Proposes to Double Hillary Clinton’s Spending on Infrastructure". New York Times. Retrieved October 20, 2016.

- ↑ Shirk, Adrian (July 1, 2015). "A Superhighway Across the Bering Strait". The Atlantic. Retrieved October 24, 2016.

- ↑ Berman, Russell (August 9, 2016). "Donald Trump's Big-Spending Infrastructure Dream". The Atlantic. Retrieved October 24, 2016.

- 1 2 "CBO Budget & Economic Outlook 2016 to 2026". CBO. January 25, 2016.

- ↑ "Most Employers Think Trump Won't Affect Hiring". 6 January 2017.

- ↑ "People who are not in the labor force: why aren't they working?". BLS. December 2015.

- ↑ "A-38 Persons not the labor force by desire and availability for work". BLS. November 2016.

- ↑ "Donald Trump says 'real' unemployment rate is 18 to 20 percent". PolitiFact. May 22, 2016.

- 1 2 "Donald Trump says the unemployment rate may be 42 percent". PolitiFact. September 30, 2016.

- ↑ Glenn Kessler, Trump's absurd claim that the 'real' unemployment rate is 42 percent, Washington Post (August 21, 2015).

- ↑ "Unemployment Rates U3 and U6". FRED. September 16, 2016.

- ↑ Jacobson, Louis (May 19, 2016). "Elizabeth Warren gets better of Donald Trump on his stance on abolishing federal minimum wage". PolitiFact. Retrieved May 23, 2016.

- ↑ "Sanders: Trump would allow states to lower the minimum wage". Retrieved July 27, 2016.

- ↑ Heavey, Susan (August 20, 2015). "Republican candidate Trump says low U.S. wages 'not a bad thing'". Reuters.

- ↑ Engel, Pamela (November 11, 2015). "Donald Trump said wages are 'too high' in his opening debate statement". Business Insider. Retrieved November 11, 2015.

- ↑ Alter, Charlotte (November 11, 2015). "Read Transcript of the Republican Debate in Milwaukee". Time. Retrieved May 12, 2016.

- ↑ Gass, Nick, Trump defends minimum wage comments, Politico (November 12, 2015).

- ↑ Flores, Reena. "Donald Trump hints at changing stance on minimum wage". CBS News. Retrieved May 7, 2016.

- ↑ "'Transcript: Donald Trump". This Week. ABC News. May 8, 2016.

- ↑ Rossoll, Nicki (May 9, 2016). "Trump Walks Back Tax Plan, Saying 'I'm Allowed to Change'". ABC News. Retrieved May 12, 2016.

- ↑ "Meet the Press". NBC News. May 8, 2016.

- ↑ Wright, Austin (May 8, 2016). "Trump: 'I don't know how people make it on $7.25 an hour'". POLITICO. Retrieved May 12, 2016.

- ↑ Worstall, Tim (May 9, 2016). "Donald Trump's Excellent Economic Idea: Abolish The Federal Minimum Wage". Forbes. Retrieved May 12, 2016.

- ↑ Kludt, Tom (July 27, 2016). "Trump says he'd support $10 minimum wage". CNN. Retrieved July 28, 2016.

- ↑ Ashley Byrd, Trump backs off on break with party, Can live with unions at certain locations (interview), South Carolina Radio Network (February 17, 2016).

- ↑ Stephen Lee, A Trump OSHA Likely to Enforce Less, Make Fewer Rules, Occupational Safety and Health Reporter, Bloomberg BNA (June 2, 2016).

- 1 2 Amy Sherman, Did Donald Trump support the Wall Street bailout as anti-tax Club for Growth says?, PolitiFact (September 15, 2015).

- ↑ "Ivanka Trump raises issues her father rarely mentions". Chicago Tribune. Retrieved July 22, 2016.

- ↑ "Why Trump's child care plan won't help poor families". Retrieved August 8, 2016.

- ↑ Morath, Eric. "Donald Trump, Hillary Clinton Say They'll Ease the Burden of Child-Care Costs". Retrieved August 9, 2016.

- ↑ "The problem with Donald Trump's plan for child care". Washington Post. Retrieved August 9, 2016.

- ↑ Tepper, Taylor. "What Trump's Child Care Tax Plan Means For You". Money. Time. Retrieved August 9, 2016.

- ↑ "Economists: Trump tax plan offers almost nothing for the middle class". Washington Post. Retrieved August 10, 2016.

- 1 2 Sean Sullivan & Robert Costa, Donald Trump unveils child-care policy influenced by Ivanka Trump, Washington Post (September 13, 2016).

- ↑ Sahadi, Jeanne. "Trump's child care proposals: How they'd work, who'd benefit". CNN Money. Retrieved September 14, 2016.

- ↑ Ilya Somin, Why Trump’s maternity leave plan is unconstitutional, Washington Post (September 16, 2016).

- 1 2 "Trump’s Economic Team: Bankers and Billionaires (and All Men)". The New York Times. 6 August 2016.

- ↑ "Trump Campaign Announces Economic Advisory Council". Donald J. Trump for President, Inc. Retrieved August 5, 2016.

- ↑ "Trump unveils all-male economic advisory team". Retrieved August 5, 2016.

- ↑ https://www.nytimes.com/2016/08/09/business/dealbook/donald-trumps-economic-team-is-far-from-typical.html

- ↑ Timiraos, Nick (13 October 2016). "Some of Donald Trump’s Economic Team Diverge From Candidate" – via Wall Street Journal.

- ↑ "Trump brings women on to his economic council".

- ↑ "President Trump announces his full Cabinet roster".

- ↑ Cox, Jeff (2017-02-10). "Something missing from Trump's Cabinet: Economists". CNBC. Retrieved 2017-02-10.

- ↑ "Here are the 17 executives who met with Trump for his first business advisory council".

- ↑ "Trump is forming an economic advisory team with the CEOs of Disney, General Motors, JPMorgan, and more".

_-_Cropped.jpg)