Dash (cryptocurrency)

| Dash | |

|---|---|

|

Official Dash logo | |

| Denominations | |

| Plural | Dash |

| Symbol | DASH[1] |

| Demographics | |

| Date of introduction | 18 January 2014 |

| User(s) | International |

| Valuation | |

| Inflation | Estimated 19 million coins maximum, with a 7.1% decrease in the number of coins generated per year |

Dash (formerly known as Darkcoin and XCoin) is an open source peer-to-peer cryptocurrency that offers all the same features as Bitcoin but also has advanced capabilities, including instant transactions (InstantSend),[2] private transactions (PrivateSend),[3] and decentralized governance (DGBB). Dash's decentralized governance and budgeting system makes it the first decentralized autonomous organization.[4]

Dash uses a two-tier architecture to power its network. The first tier consists of miners who secure the network and write transactions to the blockchain. The second tier consists of masternodes which enable the advanced features of Dash.

History

Dash was originally released as XCoin (XCO) on January 18, 2014. On February 28, the name was changed to "Darkcoin." On March 25, 2015, Darkcoin was rebranded as "Dash."[5] Dash is a portmanteau of "Digital Cash."[5]

Within the first two days of launch, 1.9 million coins were mined, which is approximately a quarter of Dash's current supply (as of March 2017).[6][7] Creator and lead developer of Dash, Evan Duffield, attributed the so-called "instamine" to an error in the code "which incorrectly converted the difficulty, then tried using a corrupt value to calculate the subsidy, causing the instamine."[8] Once the problem was resolved, Evan offered to relaunch the coin without the instamine, but the community overwhelmingly disapproved. He then suggested an "airdrop" of coins in order to broaden the initial distribution. The community also disapproved of this proposal. As such, the initial distribution was left alone and development of the project continued.

At the time the currency was launched, the cryptocurrency space was riddled with scams. Dash was one of the few survivors from that era. The Dash Core Team, responsible for developing the currency, has now grown to 30 full-time employees, 20 part-time employees, and dozens of unpaid volunteers.[9] All Core Team employees are paid from Dash's budget system and therefore are not reliant on donations or sponsorships that can lead to conflicts of interest. To date, Dash has solved such vexing issues as slow confirmation times, block size increases, decentralized governance, and a self-funding development budget.

According to CoinMarketCap, in June 2017 the daily trade volume of Dash was approximately $100 million per day[10] and the market capitalization of Dash exceeded $1.4 billion.[11] Dash has become the most active altcoin community on BitcoinTalk reaching more than 6400 pages, 133k replies, 7.9M reads.

Products

PrivateSend

PrivateSend is a coin-mixing service based on CoinJoin, with numerous modifications. These include using masternodes instead of a single website, chaining by mixing with multiple masternodes, restricting the mixing to only accept certain denominations (e.g.: 0.01 DASH, 0.1 DASH, 1 DASH, and 10 DASH, etc.), and passive mode. The maximum allowed for a PrivateSend transaction is 1000 DASH.[13]

Later iterations used a more advanced method of pre-mixing denominations built into the user's wallet. The implementation of PrivateSend also allows masternodes to submit the transactions using special network code called DSTX,[14] this provides additional privacy to users due to the deadchange issue present in other CoinJoin based implementations such as DarkWallet and CoinShuffle.[15]

In June 2016, DarkSend was rebranded to PrivateSend.

In its current implementation it adds privacy to transactions by combining identical inputs from multiple users into a single transaction with several outputs. Due to the identical inputs, transactions usually cannot be directly traced, obfuscating the flow of funds. PrivateSend makes Dash "fungible"[16] by mixing the coins in the same denomination with other wallets, ensuring that all coins are of the same value.

InstantSend

InstantSend is a service that allows for near-instant transactions. Through this system, inputs can be locked to specific transactions and verified by consensus of the masternode network. Conflicting transactions and blocks are rejected. If a consensus cannot be reached, validation of the transaction occurs through standard block confirmation. InstantSend solves the double-spending problem without the longer confirmation times of other cryptocurriencies such as Bitcoin.[17]

In June 2016, InstantX was rebranded to InstantSend.

Masternodes

Unlike Bitcoin's single-tier network, where all jobs on the network are performed by miners, Dash utilizes a two-tier network. Certain network functions, such as creating new blocks, are handled by the miners. The second tier of the Dash network consists of "masternodes" which perform PrivateSend, InstantSend, and governance functions.

Masternodes require 1000 DASH as collateral to prevent sybil attacks. That collateral can be spent at any time, but doing so removes the associated masternode from the network. Because masternodes provide vital network functions, the block reward is split between miners and masternodes, with each group earning 45% of the block reward. The remaining 10% of each block reward funds the "budget" or "treasury" system.[18]

Governance and funding

Dash is the first decentralized autonomous organization powered by a Sybil proof decentralized governance and funding system.[19] Decentralized Governance by Blockchain (DGBB), often referred to simply as the "treasury system" is a means of coming to consensus on proposed network changes and funding development of the Dash ecosystem. Ten percent of the block rewards go to this "treasury" in order to pay for projects that benefit Dash. Funding from the treasury system has been used to hire additional developers and other employees, to fund attendance at conferences, and to fund integrations with major exchanges and API providers.

Each masternode operator receives one vote. Proposals are eligible for funding according to the following formula: (YES VOTES - NO VOTES) > (TOTAL NUMBER OF MASTERNODES * 0.1). If there are more proposals that meet that criteria than there are budget funds for the month, then the proposals with the highest number of net votes will be paid. Community interaction with proposal submitters is done through the dash.org forums, or through community-driven websites, like DashCentral.[20] These websites allow proposal submitters to provide multiple drafts, then lobby for community support before finally submitting their project to the network for a vote. After the submitter has enough support, the network will automatically pay out the required funds in the next super block, which happens monthly.

The funding system has seen revenue growth. In September 2015, the treasury system provided $14,000 in funding per month. Due to increases in the value of Dash, as of May 2017 the treasury system provides over $650,000 per month in funding.[21] The treasury system has created a positive feedback loop, whereby additional development increases the value of Dash, which increases the amount of funding provided by the budget system.

References

- ↑ "Dash cryptocurrency overview". Investing.com. Retrieved 8 August 2017.

- ↑ "InstantSend Official Documentation". Retrieved 17 June 2016.

- ↑ "PrivateSend Official Documentation". Retrieved 17 June 2016.

- ↑ Juan S. Galt. "DASH – The First Decentralized Autonomous Organization?". Retrieved 17 June 2016.

- 1 2 "Darkcoin Is Now Dash | Dash – Official Website". www.dash.org. Retrieved 3 April 2015.

- ↑ "Dash Blockchain Explorer - Inflation Chart". cryptoID.info.

- ↑ http://dashdot.io/alpha/wp-content/uploads/2015/05/image18.png

- ↑ "Was The Instamine A Positive Thing For Dash?". dashdot.io. 27 September 2015.

- ↑ Ryan Taylor, Director of Finance, Dash (May 29, 2017). "Core Team Salaries". Retrieved June 13, 2017.

- ↑ "24 Hour Volume Rankings (Currency) - Crypto-Currency Market Capitalizations". coinmarketcap.com. Retrieved 15 June 2016.

- ↑ "Dash (DASH) price, charts, and info - Crypto-Currency Market Capitalizations". coinmarketcap.com. Retrieved 15 June 2016.

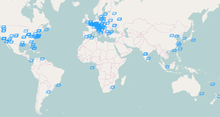

- ↑ "Distribution of 4065 Dash Masternodes V3". Dash Masternode Information. Retrieved 2017-03-19.

- ↑ "PrivateSend". DASH. Retrieved 4 March 2017.

- ↑ "v0.11.1 - InstantX Release | DashTalk". dashtalk.org. Retrieved 2016-03-27.

- ↑ "Security Advisory for CoinShuffle and Darkwallet | DashTalk". dashtalk.org. Retrieved 2016-03-27.

- ↑ "Dash’s PrivateSend: What makes Digital Cash Fungible". The Dash Times. 2016-07-07. Retrieved 2016-07-10.

- ↑ InstantX - Transaction Locking and Masternode Consensus: A Mechanism for Mitigating Double Spending Attacks dashpay.io

- ↑ "DASH Ninja - Blocks Masternodes Payee". DASH Ninja. Retrieved 24 September 2015.

- ↑ "Self-sustainable Decentralized Governance by Blockchain". dashtalk.org. Retrieved 15 June 2016.

- ↑ "Masternode monitoring and budget voting - DashCentral.org". dashwhale.org. Retrieved 2017-05-15.

- ↑ "Dash Surges to Record High, Claims $0.5 Mln Monthly Development Budget". cointelegraph.com. Retrieved 13 March 2017.

External links

| Wikimedia Commons has media related to Dash (cryptocurrency). |