Coal mining in the United States

Coal mining in the United States is a major industry In 2016, US coal mining declined to 728.2 million short tons, down 37 percent from the peak production of 1,162,7 million tons in 2006. Coal mining employed 50,000 miners[1] in 2016. In 2015, 896.9 million short tons of coal were mined in the United States,[2] with an average price of $31.83 per short ton,[3] worth $28.6 billion dollars.

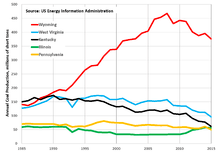

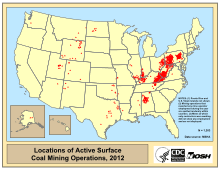

Coal is mined in 25 states, 40% on public lands. Mined tonnage reached an all-time high of 1.06 Gt (1.17 billion short tons) in 2008, but by 2015 had declined to 986 million short tons. According to the U.S. Energy Information Administration (EIA), in 2015 Wyoming, West Virginia, Kentucky, Illinois, and Pennsylvania produced about 639 millions of short tons (MST) representing 71% of total U.S. coal production in the United States.[4] The U.S. is a net exporter of coal. U.S. coal exports, for which Europe is the largest customer, peaked in 2012, and have declined since. In 2015, the U.S. exported 7.0 percent of mined coal.[5]

In 2005 coal provided approximately 50% of electricity in the United States and about 92 percent of coal consumption went to electricity generation.[6]:1 However, in 2016, the EIA calculated that coal would provide only 30% of electricity generation nationwide with natural gas providing 34%, nuclear, 19%, and renewables, 15%.[7]

By January 2016, more than 25% of coal production was in bankruptcy in the United States.[8] In 2015 four publicly-traded US coal companies filed for Chapter 11 bankruptcy protection, including Patriot Coal Corporation, Walter Energy, and the fourth-largest Alpha Natural Resources filed for bankruptcy protection. The second-largest producer Arch Coal and the largest producer Peabody Energy declared bankruptcy in 2016.[8][9][10] By March 2017, the coal industry employed approximately 77,000 miners. 60,000 jobs have been lost since 2011.[11]

History

Production

Nationwide, US coal production peaked in 2008, and has declined since then, with 896 million short tons produced in 2015, representing a drop of 10.3% year-over-year, the lowest annual production level since 1986.[12][13] The price of coal had dropped 50% since 2011.[8] When Arch Coal filed for bankruptcy protection, it was $4.5 billion in debt.[8]

| Coal in the US (Million Short Tons) | |||

|---|---|---|---|

| Production[14] | Net Exports[16][17][18] | Net Available | |

| 2000 | 1,074 | 46 | 1,008 |

| 2001 | 1,128 | 29 | 1,099 |

| 2002 | 1,094 | 23 | 1,071 |

| 2003 | 1,072 | 18 | 1,054 |

| 2004 | 1,112 | 21 | 1,091 |

| 2005 | 1,131 | 19 | 1,112 |

| 2006 | 1,163 | 13 | 1,150 |

| 2007 | 1,147 | 23 | 1,124 |

| 2008 | 1,172 | 47 | 1,125 |

| 2009 | 1,075 | 36 | 1,039 |

| 2010 | 1,084 | 62 | 1,022 |

| 2011 | 1,096 | 94 | 1,002 |

| 2012 | 1,016 | 117 | 899 |

| 2013 | 985 | 109 | 876 |

| 2014 | 1,000 | 86 | 914 |

| 2015 | 896 | 63 | 833 |

| 2016 | 738.7 | 50.5 | 688 |

1 short ton = 0.907184 metric tonnes

Coal production by region

The three regions producing the largest amount of coal are Powder River Basin of Wyoming and Montana, the Appalachian Basin and the Illinois Basin. In the United States, coal production declined from 2008 but the decline was unevenly distributed. Production from the largest coal mining-region in the U.S., the Powder River Basin, with most of the coal buried too deeply to be economically accessible,[6] declined 16 percent, the Appalachian Basin declined 32 percent 2008 to 2014 and the Illinois Basin increased its production 39 percent from 2008 to 2014.[19] In 2015, five states—Wyoming, West Virginia, Kentucky, Illinois, and Pennsylvania—produced almost 3/4 of all coal production nationwide. Wyoming produced 375.8 million short tons representing 42% of U. S. coal production, West Virginia produced 95.6 million short tons or 11%, Kentucky was third with 61.4 or 7%, Illinois was fourth with 56.1 or 6% and Pennsylvania was fifth with 50.0 or 6%.[4]

As of 2014, twenty-five states produced coal. The coal-producing states were, in descending order, with annual production in millions of short tons:[20]

- 1. Wyoming 395.7 (see Coal mining in Wyoming)

- 2. West Virginia 112.2

- 3. Kentucky 77.3 (see Coal mining in Kentucky)

- 4. Pennsylvania 60.9

- 5. Illinois 58.0

- 6. Montana 44.6

- 7. Texas 43.7

- 8. Indiana 39.3

- 9. North Dakota 29.2

- 10 Colorado 24.0 (see Coal mining in Colorado)

- 11. Ohio 22.3

- 12. New Mexico 22.0

- 13. Utah 17.9

- 14. Alabama 16.4

- 15. Virginia 15.1

- 16. Arizona 8.1

- 17. Mississippi 3.7

- 18. Louisiana 2.6

- 19. Maryland 2.0

- 20. Alaska 1.5

- 21. Oklahoma 0.9

- 22. Tennessee 0.8

- 23. Missouri 0.4

- 24. Arkansas 0.1

- 25. Kansas 0.1

Coal production by type

Companies

| Rank | Company | Million short tons/Year | Percent of total production | Notes |

|---|---|---|---|---|

| 1 | Peabody Energy | 189.5 | 19.0% | Declared bankruptcy in 2016 |

| 2 | Arch Coal | 135.8 | 13.6% | Declared bankruptcy in 2016 |

| 3 | Cloud Peak Energy | 85.8 | 8.6% | |

| 4 | Alpha Natural Resources | 80.1 | 8.0% | Declared bankruptcy in 2015[21] |

| 5 | Murray Energy | 62.8 | 6.3% | |

| 6 | Alliance Resource Partners | 41.0 | 4.1% | |

| 7 | Westmoreland Coal Company | 35.6 | 3.6% | |

| 8 | CONSOL Energy | 32.2 | 3.2% | |

| 9 | NACCO Industries | 31.6 | 3.2% | |

| 10 | Energy Future Holdings | 29.7 | 3.0% | |

| Annual owned production, 2014. Source:[22] | ||||

In 2014, the production owned by the top ten companies was 72.6% of total US coal production.[22]

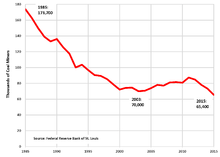

Coal mining employment

By the end of 2016, the coal industry employed approximately 50,000 miners.[1]

US employment in coal mining peaked in 1923, when there were 863,000 coal miners.[23] Since then, mechanization has greatly improved productivity in coal mining, so that employment has declined at the same time coal production increased. The average number of coal mining employees declined to 50,500 in 2016.[24] This was below the previous low of 70,000 in 2003, and the lowest number of US coal miners in at least 125 years.[25][26]

Because of the sharp declines in the U.S. coal industry, the Harvard Business Review discussed retraining coal workers for solar photovoltaic employment because of the rapid rise in U.S. solar jobs.[27] A recent study indicated that this was technically possible and would account for only 5% of the industrial revenue from a single year to provide coal workers with job security in the energy industry as whole.[28]

Exports

The U.S. is a net exporter of coal.[29] US net coal exports increased ninefold from 2006 to 2012, peaked at 117 million short tons in 2012, then declined to 63 million tons in 2015. In 2015, 60% of net US exports went to Europe, 27% to Asia. The largest individual country export markets were the Netherlands (12.9 million short tons), India (6.4 million short tons), Brazil (6.3 million short tons), and South Korea (6.1 million short tons). Coal exports to China, formerly one of the major markets, declined from 8.3 million short tons in 2013, down to 0.2 million tons in 2015.[17][30]

In 2012, six coal export terminals were in the planning stages in the Pacific Northwest.[31] They were scheduled to be supplied by strip mines in the Powder River Basin. The export markets were South Korea, Japan, China, and other Asian nations. Like the Keystone Pipeline the building of the terminals raised environmental concerns with respect to global warming.[32] As of February 2016, four proposals for coal terminals had been withdrawn, leaving two still applied for. The withdrawals were ascribed to loss of demand and consequent lower coal prices.[33]

Usage

In 2013, 92.8 percent of US internal coal consumption was for electricity generation. Other uses were industrial (4.7 percent), coke manufacture (2.3 percent), and commercial and institutional (0.2 percent).[34][35]

Both the tonnage of coal used for electricity (1,047 million short tons) and the amount of US electricity generated from coal (2.02 million GWh) peaked in 2007. By 2015, electrical generation from coal had declined to 1.36 million GWh, and coal's share of total electrical generation in the US fell from 48.5 percent in 2007 to 33.1 percent in 2015. Most of the decrease in coal electricity was offset by an increase in generation from natural gas-fired power plants.[36][37]

In 2006, there were 1,493 coal-powered generating units at electrical utilities across the US, with total nominal capacity of 335.8 GW[38] (compared to 1024 units at nominal capacity of 278 GW in 2000).[39] Actual power generated from coal in 2006 was 227.1 GW (1.991 trillion kilowatt-hours per year),[40] the highest in the world and still slightly ahead of China (1.95 trillion kilowatt-hours per year) at that time.[41] In 2000, US production of electricity from coal was 224.3 GW (1.966 trillion kilowatt-hours per year).[40] In 2006, the US consumed 1,026,636,000 short tons (931,349,000 metric tons) or 92.3% of coal mined for electricity generation.[42]

As of 2013, domestic coal consumption for power production was being displaced by natural gas, but production from strip mines utilizing thick deposits in the western United States such as the Powder River Basin in northern Wyoming and Southern Montana for export to Asia increased.[43] In 2014, 3.0 percent of the coal shipments from Montana and Wyoming were exported.[44] The 2014 coal exports from the two states of 13 .4 million short tons represented an increase of 1.2 million tons over 2012 export levels, which is 0.3 percent of the states’ 2014 total coal shipments of 439.8 million tons.[45]

Coal mining on federal lands

As of 2013, 41 percent of US coal production was mined from federal land, almost all of it in the western US, where federal coal makes up about 80 percent of mined production. The federal coal program is overseen by the Bureau of Land Management (BLM) under the US Department of Interior. Federal coal lands are leased by competitive sealed bids, for the highest bonus (initial payment) offered. In addition, the government receives an annual rental of $3 per acre, and a fixed percentage royalty of the market value of coal produced. The royalty is 8 percent for underground mines and 12.5 percent for surface mines.[46] In 2014, the program generated about $1.2 billion in lease bonuses, rentals, and royalties for coal mining on federal lands.[26]

In January 2016, the Obama administration announced a three-year moratorium on federal coal lease sales on public land, effective immediately, and leaving around 20 years-of coal production under way. He noted that the program had not had a "top-down review" for the past 30 years.[47] This would affect 50 licenses.[13]

The Government Accountability Office has questioned whether bonus and royalty rates reflect coal's market value. Per GAO, since 1990 Colorado earned about $22 million less from bonus bids than Utah, though Colorado leased out almost 76 million tons more coal than Utah. BLM personnel noted that the coal mined in Utah was closer to its market, and so was more valuable due to lower transportation cost.[46]:27

The GAO report noted that the BLM publishes little information on federal coal lease sales, also does not include their appraisal report, because some of this information is "sensitive and proprietary"; this violates BLM's own guidance.[46]:44

The GAO also noted that the competitiveness of federal coal lease sales was limited by lack of multiple bids. Of the 107 tracts leased since 1990, 96 drew only a single bidder. This was attributed to the fact that most leased tracts were close to a single existing mine, and the large capital cost of installing a new mine discouraged competition. The BLM can reject bids which do not meet its estimate of fair market value, and 18 of the coal tracts leased since 1990 were tracts re-bid after the BLM had rejected the initial bids as too low. However, the GAO found that some BLM offices did not have the personnel to prepare adequate estimates of market value.[46]:16–19

A Boston-based think tank, the Institute for Energy Economic & Financial Analysis study estimated that, since 1991, $29 billion over a 30-year period was lost in the Powder River Basin, due to lack of competitive bidding.[48][49] The Institute’s mission statement notes that its goals include: “… to reduce dependence on coal and other non-renewable energy resources.”[50]

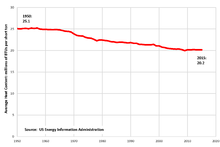

Energy value

The average heat content of mined US coal has declined over the years as higher-rank coal production (anthracite, and then bituminous coal) declined, and production of lower rank coal (Sub-bituminous and lignite) increased. The average heat content of US-mined coal decreased 20% from 1950 to 2015, and 5.5% in the 20 years from 1995 to 2015.[51]

The tonnage of mined coal hit a peak in 2008, and has declined since. The energy value of mined US coal hit its all-time peak a decade earlier, in 1998, at 26.2 quadrillion BTU. The energy value of US coal mined in 2015 was 18.2 quadrillion BTU, 31 percent lower than the peak.[52]

| Year | Million short tons[14][15] | Million BTU/short ton[51] | Quadrillion BTU[53] |

|---|---|---|---|

| 2000 | 1,074 | 21.07 | 22.74 |

| 2001 | 1,128 | 20.77 | 23.55 |

| 2002 | 1,094 | 20.67 | 22.73 |

| 2003 | 1,072 | 20.50 | 22.09 |

| 2004 | 1,112 | 20.42 | 22.85 |

| 2005 | 1,131 | 20.35 | 23.18 |

| 2006 | 1,163 | 20.31 | 23.79 |

| 2007 | 1,147 | 20.34 | 23.49 |

| 2008 | 1,172 | 20.21 | 23.85 |

| 2009 | 1,075 | 19.96 | 21.62 |

| 2010 | 1,084 | 20.17 | 22.04 |

| 2011 | 1,096 | 20.14 | 22.04 |

| 2012 | 1,016 | 20.22 | 20.68 |

| 2013 | 985 | 20.18 | 20.00 |

| 2014 | 1,000 | 20.16 | 20.30 |

| 2015 | 896 | 20.16 | 18.18 |

| 36.68 million BTU = 1 tonne of oil equivalent (toe) | |||

Accidents

Mine disasters have still occurred in recent years in the US,[54] Examples include the Sago Mine disaster of 2006, and the 2007 mine accident in Utah's Crandall Canyon Mine, where nine miners were killed and six entombed.[55] In the decade 2005-2014, US coal mining fatalities averaged 28 per year.[56] The most fatalities during the 2005-2014 decade were 48 in 2010, the year of the Upper Big Branch Mine disaster in West Virginia, which killed 29 miners.[57]

Opposition

Concern about global warming in the US [58] - especially in the aftermath of Hurricane Katrina and Al Gore's receipt of the 2007 Nobel Peace Prize for his raising awareness of climate change - temporarily increased public opposition to new coal-fired power plants.[59][60] Simultaneously with these events, the anti-coal movement in the US - similar to that in the UK and Australia - had made coal-fired power projects more politically costly, and spurred further shifts in public opinion against coal-fired power.[61][62][63]

In a 2004 effort to foster positive public opinion of coal, many large coal mining companies, electric utilities, and railroads in the U.S. launched a high-profile marketing campaign to convince the American public that coal-fired power can be environmentally sustainable, despite the fact that coal is the largest contributor of CO2 emissions in the electricity sector.[64][65][66] However, some environmentalists condemned this campaign as a "greenwashing" attempt to use environmentalist rhetoric to disguise what they call "the inherently environmentally unsustainable nature of coal-fired power generation".[67]

See also

- List of coal mines in the United States

- American Coalition for Clean Coal Electricity

- Coal pollution mitigation

- Coal mining

- Coal power in the United States

- Environmental effects of coal

- Greenhouse gas emissions by the United States

- History of coal mining in the United States

- Coal Creek War

- List of the largest coal power stations in the United States

Footnotes

- 1 2 Total employment: coal mining, Federal Reserve Board of St. Louis, accessed 21 Apr. 2017.

- ↑ US Energy Information Administration, Table 1 Coal Production, Annual Coal Report, 2015.

- ↑ US Energy Information Administration, Table 28, Average Price of Coal, Annual Coal Report, 2015.

- 1 2 Which states produce the most coal?, EIA, February 28, 2017, retrieved May 9, 2016

- ↑ U.S. coal exports fall on lower European demand, increased global supply, US Energy Information Administration, 3 Oct. 2014.

- 1 2 Inventory of Assessed Federal Coal Resources and Restrictions to Their Development (PDF) (Report). U.S. Departments of Energy, Interior and Agriculture. August 2007. p. 94. Retrieved March 28, 2017.

- ↑ Natural gas-fired electricity generation expected to reach record level in 2016, EIA, July 14, 2016, retrieved March 28, 2017

- 1 2 3 4 John W. Miller and Peg Brickley (January 11, 2016), Arch coal files for bankruptcy, Wall Street Journal

- ↑ "Peabody Energy Chapter 11 Petition" (PDF). PacerMonitor. PacerMonitor. Retrieved May 9, 2016.

- ↑ "Top coal miner Peabody files for bankruptcy". The Sydney Morning Herald. April 13, 2016.

- ↑ Matthew Brown and Mead Gruver (March 28, 2017), How Trump's executive order will affect coal industry, Billings, Montana, Associated Press and Billings Gazette, retrieved March 28, 2017

- ↑ Annual Coal Report, U.S. Department of Energy, November 3, 2016, retrieved March 28, 2017

- 1 2 Oliver Milman Obama administration halts new coal mining leases on public land The Guardian, 15 January 2016, accessed 16 January 2016

- 1 2 Annual coal production, US Energy Information Administration, accessed Apr. 2016.

- 1 2 Quarterly coal production, US Energy Information Administration, accessed Apr. 2016.

- ↑ Quarterly coal exports, US Energy Information Administration, accessed Apr. 2016.

- 1 2 Quarterly coal exports, US Energy Information Administration, accessed Apr. 2016.

- ↑ Coal exports and imports, US Energy Information Administration, accessed Apr. 2016.

- ↑ Coal browser, US Energy Information Administration, accessed 16 Apr. 2016.

- ↑ Coal data browser, US Energy Information Administration, accessed 16 April 2016.

- ↑ Jodi Xu Klein and Tim Loh (January 20, 2016), "The Coal Miner `On Everybody's List' as Next Bankruptcy Victim", Bloomberg Markets, retrieved March 28, 2017

- 1 2 US Energy Information Administration, Top Coal Companies, 2014, accessed May 7, 2016.

- ↑ Coal fatalities US Mine Safety and Health Administration, accessed 17 Apr. 2016.

- ↑ Total employment: coal mining, Federal Reserve Board of St. Louis, accessed 21 Apr. 2017.

- ↑ Historical Statistics of the United States, US Department of Commerce, 1960, p.358-359.

- 1 2 CORAL DAVENPORT In Climate Move, Obama Halts New Coal Mining Leases on Public Lands NY Times January 14, 2016.

- ↑ What If All U.S. Coal Workers Were Retrained to Work in Solar? - Harvard Business Review. August. 2016

- ↑ Edward P. Louie and Joshua M. Pearce. Retraining Investment for U.S. Transition from Coal to Solar Photovoltaic Employment. Energy Economics. 57,295–302 (2016). doi:10.1016/j.eneco.2016.05.016

- ↑ http://www.eia.gov/coal/production/quarterly/

- ↑ Coal prices and production decline in 2015, US Energy Information Administration, accessed Apr. 2016.

- ↑ "Coal Scorecard: Your Guide To Coal In The Northwest". EarthFix Oregon Public Broadcasting. June 28, 2012. Retrieved March 26, 2013.

- ↑ Phuong Le (March 25, 2013). "NW governors ask White House to exam coal exports". The San Francisco Chronicle. Associated Press. Retrieved March 26, 2013.

- ↑ "What coal's decline means for Northwest export markets," Oregon Public Broadcasting, 17 Feb. 2016.

- ↑ Pittsburghlive.com

- ↑ US Energy Information Administration: Net generation by energy source, accessed 24 January 2009.

- ↑ Coal: Consumption for electricity generation, US Energy Information Administration, 16 April 2016.

- ↑ Net generation by energy source, US Energy Information Administration, 4 April 2016.

- ↑ "Existing Electric Generating Units in the United States". Energy Information Administration. 2007. Retrieved 2008-06-19.

- ↑ "Inventory of Electric Utility Power Plants in the United States 2000". Energy Information Administration. March 2002. Retrieved 2008-06-19.

- 1 2 "Electric Power Annual with data for 2006". Energy Information Administration. October 2007. Retrieved 2008-06-19.

- ↑ See Wikipedia article on the Chinese Economy

- ↑ "U.S. Coal Consumption by End-Use Sector". Energy Information Administration. July 25, 2008. Retrieved 2008-08-29.

- ↑ Matthew Brown (March 17, 2013). "Company eyes coal on Montana's Crow reservation". The San Francisco Chronicle. Associated Press. Retrieved March 18, 2013.

- ↑ Domestic and international coal distribution, US Energy Information Administration, 2013.

- ↑ US Domestic and Foreign Coal Distribution, US Energy Information, 2012.

- 1 2 3 4 Government Accountability Office Coal Leasing: BLM Could Enhance Appraisal Process, More Explicitly Consider Coal Exports, and Provide More Public Information GAO-14-140. Published 18 December 2013. Released 4 February 2014

- ↑ CORAL DAVENPORT In Climate Move, Obama Halts New Coal Mining Leases on Public Lands NY Times, January 14, 2016, accessed 16 January 2016.

- ↑ Matt Pearce Obama temporarily bans new coal leases on federal land Los Angeles Times, 15 January 2016.

- ↑ “Report- Almost $30 billion in revenues lost to taxpayers by “giveaway” of federally owned coal in Powder River Basin”, Institute for Energy Economic and Financial Analysis, 25 June 2012.

- ↑ “About”, Institute for Energy Economic and Financial Analysis, accessed 20 April 2016.

- 1 2 US Energy Information Administration, Table A5, Approximate heat content of coal and coal coke.

- ↑ US Energy Information Administration, Total coal mined.

- ↑ Primary energy production by source, US Energy Information Administration, accessed Apr. 2016.

- ↑ "Census of Fatal Occupational Injuries Summary, 2006 Washington D.C.: U.S. Department of Labor". Bureau of Labor Statistics. (2006).

- ↑ "Panel to Explore Deadly Mine Accident". New York Times. Associated Press. September 4, 2007.

- ↑ Coal mining fatalities, US Mine Safety and Health Administration, accessed 27 June 2016.

- ↑ Urbina, Ian (2010-04-09). "No Survivors Found After West Virginia Mine Disaster". New York Times.

- ↑ "Yale Center for Environmental Law & Policy 2007 Environment Survey" Archived 2008-08-28 at the Wayback Machine., Yale Center for Environmental Law & Policy website, March 7, 2007.

- ↑ "Iowans Want Energy Conservation Before New Coal Plants", Environment News Service, December 21, 2007.

- ↑ "Kansans Support Decision to Nix Coal Plants, Want Focus on Wind Energy", Lawrence Journal-World, January 4, 2008.

- ↑ Nace, Ted. "Stopping Coal In Its Tracks", Orion, January/February 2008.

- ↑ "Fight Against Coal Plants Draws Diverse Partners", New York Times, October 20, 2007.

- ↑ "You're Getting Warmer" Archived 2008-02-05 at the Wayback Machine., East Bay Express, December 5, 2007.

- ↑ "Coal Scores With Wager on Bush Belief", Washington Post, March 25, 2001.

- ↑ "Spreading Misleading Messages", San Francisco Chronicle, November 3, 2004.

- ↑ "Coal Industry Plugs Into the Campaign", Washington Post, January 18, 2008.

- ↑ "Greenwash of the Week: Coal Industry Buys Off CNN debates" Archived 2008-10-03 at the Wayback Machine., Rainforest Action Network Understory blog, January 23, 2008.

Further reading

- Andrew B. Arnold, Fueling the Gilded Age: Railroads, Miners, and Disorder in the Pennsylvania Coal Country. New York: New York University Press, 2014.