Central Bank of Sudan

| |

| Headquarters | Khartoum |

|---|---|

| Coordinates | Coordinates: 15°36′15″N 32°30′15″E / 15.60417°N 32.50417°E |

| Established | 1960 |

| Ownership | Government of Sudan |

| Governor | Abdelrahman Hassan Abdelrahman Hashim |

| Central bank of | Sudan |

| Currency |

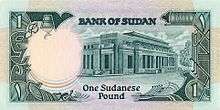

Sudanese pound SDG (ISO 4217) |

| Website | www.bankofsudan.org (now defunct) |

The Central Bank of Sudan is the central bank of Sudan. The bank was formed in 1960, four years after Sudan's independence. It is located in Khartoum and its governor is currently Abdelrahman Hassan Abdelrahman Hashim.

History

When Sudan achieved independence in 1956, the creation of a central bank was a priority. A 3-man commission of experts from the United States's Federal Reserve, worked with Sudanese government and finance specialists to create the Law of the Bank of Sudan for 1959, and in 1960 the Bank of Sudan began operations. To establish the bank, the Sudanese government nationalized the National Bank of Egypt's operations in the Sudan (some seven branches), and combined them with the Sudanese currency board.

In addition to the normal duties of a central bank, which may include minting coins and issuing banknotes, managing a country's internal and external accounting, and setting monetary policy and interest rates, Sudan's central bank is also responsible for fostering Islamic banking.

After Sudan introduced Islamic law (Sharia) in 1984, the banking and financial industry changed its practices to conform with Sharia. In 1993 the government established the Sharia High Supervisory Board (SHSB) to ensure compatibility of financial practices with Islamic principles. In compliance with the SHSB, the government is no longer selling treasury bills and government bonds; instead, the Bank sells "Financial Certificates" that comply with Islamic financial principles.

Banking history

In 1965, Bank of Sudan and Crédit Lyonnais formed a joint-venture bank named Al/An/El Nilein Bank (Nile Bank). Crédit Lyonnais contributed the two branches it had developed since it first entered Sudan in 1953. Bank of Sudan took 60 percent of the shares in Nilein Bank, and Crédit Lyonnais took 40 percent.

In 1970, the Sudanese government nationalized all the banks in the Sudan, changed the names of several, and put them under the Bank of Sudan. Barclays Bank, which had an extensive network of 24 branches, became the State Bank of Foreign Trade, and then Bank of Khartoum. The six branches of Egypt's Bank Misr became People's Cooperative Bank. The four branches of Jordan's Arab Bank became Red Sea Bank or Red Sea Commercial Bank (accounts differ). Commercial Bank of Ethiopia's one branch became Juba Commercial Bank. National and Grindlays Bank, which in 1969 had taken over the four branches that Ottoman Bank had established after it entered in 1949, became Omdurman Bank. In 1973 Red Sea Bank and People's Cooperative Bank were merged into Omdurman Bank. Then in 1984 Omdurman Bank merged with the Juba Commercial Bank to form Unity Bank.

In 1993, Al/An/El Nilein Bank merged with the Industrial Bank of Sudan to form Nilein Industrial Development Bank. In 2006, Dubai-based Emaar Properties and Amlak Finance acquired a 60% stake in Sudan’s El Nilein Industrial Development Bank; the Bank of Sudan retained a 40% stake.

Operations

As far as the current state of the Sudanese banking and financial situation is concerned,the bank's "About Bank of Sudan" section states:

Since the beginning of the Three Year Economic Program (1990–1993), the Bank of Sudan has carried out policies that aim to revitalize the Sudanese economy, the last of which was the credit policy of 2000 which was based on the following:

- Emphasizing supply side measures and monetary stability better to utilize banking resources by stressing financing of priority economic priority sectors, and continuation of streamlining general supply policies.

- Continuation of the social support program for the benefit of the poor families in accordance with the national mobilization project for social security and for the improvement of productivity.

- Continuation of financing public corporations through the banks without recourse to the Bank of Sudan for direct financing.

- Allowing the commercial banks to offer financing in foreign exchange according to the regulations issued by the Bank of Sudan.

Financial inclusion

The Bank is engaged in developing policies to promote financial inclusion and is a member of the Alliance for Financial Inclusion.[1]

Branches of the Bank of Sudan

As the country of Sudan is about 1½ times the area of the state of Alaska in the United States, the central bank has a branch bank system:

- The Main Branch — Khartoum

- Wad Madani Branch

- Kosti Branch

- Atbara Branch

- Al Qadarif Branch

- Nyala Branch

- Juba Branch

- Al-Ubayyid Branch

- Dongola Branch

- Port Sudan Branch

- Al-Fashir Branch

- Wau Branch

- Malakal Branch

List of governors of the Bank of Sudan

- Mamoun Beheiry 1959–1963

- Elsayid Elfeel 1964–1967

- Abdelrahim Mayrgani 1967–1970

- Abdelateef Hassan 1970–1971

- Awad Abdel Magied Aburiesh 1971–1972

- Ibrahim Mohammed Ali Nimir 1973–1980

- Elsheikh Hassan Belail 1980–1983

- Faroug Ibrahim Elmagbool 1983–1985

- Ismail el-misbah Mekki hamad 1985–1988

- Mahdi Elfaky Elshaikh 1988–1990

- Elshaik SidAhmed Elshaikh 1990–1993

- Sabir Mohammed El-Hassan 1993–1996

- Abdall Hassan Ahmed 1996–1998

- Sabir Mohammed El-Hassan 1998-2011

- Mohamed Kheir El-Zubeir 8/3/2011 - 15/12/2013

- Abdelrahman Hassan Abdelrahman Hashim 15/12/2013 -28/12/2016

- Hazim Abdegadir Ahmed Babiker since 28/12/2016

Sources

Kaikati, Jack G. 1980. The Economy of Sudan: A Potential Breadbasket of the Arab World? International Journal of Middle East Studies 11, 99-123.

See also

- Central banks and currencies of Africa

- Economy of Sudan

- List of central banks

- Sudanese dinar, the former currency

- Sudanese pound, the current currency

References

- ↑ "AFI members". AFI Global. 2011-10-10. Archived from the original on 2012-02-20. Retrieved 2012-02-23.