BRICS

| BRICS (Brazil, Russia, India, China, and South Africa) |

|---|

|

|

|

State leaders

|

|

Finance ministers |

|

Central bank governors

|

|

GDP (nominal) in US dollars |

|

|

|

|

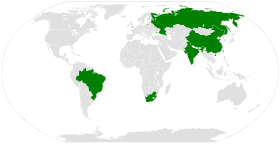

BRICS is the acronym for an association of five major emerging national economies: Brazil, Russia, India, China and South Africa. Originally the first four were grouped as "BRIC" (or "the BRICs"), before the induction of South Africa in 2010.[4] The BRICS members are all leading developing or newly industrialized countries, but they are distinguished by their large, sometimes fast-growing economies and significant influence on regional affairs; all five are G-20 members.[5] Since 2009, the BRICS nations have met annually at formal summits. China will host the 9th BRICS summit in Xiamen on September 3rd, 4th and 5th, 2017.[6] The term does not include countries such as South Korea, Mexico and Turkey for which other acronyms and group associations were later created.

As of 2015, the five BRICS countries represent over 3.6 billion people, or about 40% of the world population; all five members are in the top 25 of the world by population, and four are in the top 10. The five nations have a combined nominal GDP of US$16.6 trillion, equivalent to approximately 22% of the gross world product, combined GDP (PPP) of around US$37 trillion and an estimated US$4 trillion in combined foreign reserves.[7][8] Overall the BRICS are forecasted to expand 4.6% in 2016, from an estimated growth of 3.9% in 2015. The World bank expects BRICS growth to pick up to 5.3% in 2017.[9] The BRICS have received both praise and criticism from numerous commentators.[10][11][12] Bilateral relations among BRICS nations have mainly been conducted on the basis of non-interference, equality, and mutual benefit.[13]

History

The term "BRIC" was coined in 2001 by then-chairman of Goldman Sachs Asset Management, Jim O'Neill, in his publication Building Better Global Economic BRICs.[14] The foreign ministers of the initial four BRIC states (Brazil, Russia, India, and China) met in New York City in September 2006 at the margins of the General Debate of the UN General Assembly, beginning a series of high-level meetings.[15] A full-scale diplomatic meeting was held in Yekaterinburg, Russia, on 16 June 2009.[16]

First BRIC summit

The BRIC grouping's first formal summit, also held in Yekaterinburg, commenced on 16 June 2009,[17] with Luiz Inácio Lula da Silva, Dmitry Medvedev, Manmohan Singh, and Hu Jintao, the respective leaders of Brazil, Russia, India and China, all attending.[18] The summit's focus was on means of improving the global economic situation and reforming financial institutions, and discussed how the four countries could better co-operate in the future.[17][18] There was further discussion of ways that developing countries, such as 3/5 of the BRIC members, could become more involved in global affairs.[18]

In the aftermath of the Yekaterinburg summit, the BRIC nations announced the need for a new global reserve currency, which would have to be "diverse, stable and predictable".[19] Although the statement that was released did not directly criticise the perceived "dominance" of the US dollar – something that Russia had criticised in the past – it did spark a fall in the value of the dollar against other major currencies.[20]

Entry of South Africa

In 2010, South Africa began efforts to join the BRIC grouping, and the process for its formal admission began in August of that year.[21] South Africa officially became a member nation on 24 December 2010, after being formally invited by the BRIC countries to join the group.[21] The group was renamed BRICS – with the "S" standing for South Africa – to reflect the group's expanded membership.[22] In April 2011, the President of South Africa, Jacob Zuma, attended the 2011 BRICS summit in Sanya, China, as a full member.[23][24][25]

Developments

The BRICS Forum, an independent international organisation encouraging commercial, political and cultural cooperation between the BRICS nations, was formed in 2011.[26] In June 2012, the BRICS nations pledged $75 billion to boost the lending power of the International Monetary Fund (IMF). However, this loan was conditional on IMF voting reforms.[27] In late March 2013, during the fifth BRICS summit in Durban, South Africa, the member countries agreed to create a global financial institution which they intended to rival the western-dominated IMF and World Bank.[28] After the summit, the BRICS stated that they planned to finalise the arrangements for this New Development Bank by 2014.[29] However, disputes relating to burden sharing and location slowed down the agreements.

At the BRICS leaders meeting in St Petersburg in September 2013, China committed $41 billion towards the pool; Brazil, India and Russia $18 billion each; and South Africa $5 billion. China, holder of the world's largest foreign exchange reserves and who is to contribute the bulk of the currency pool, wants a greater managing role, said one BRICS official. China also wants to be the location of the reserve. "Brazil and India want the initial capital to be shared equally. We know that China wants more," said a Brazilian official. "However, we are still negotiating, there are no tensions arising yet."[30] On 11 October 2013, Russia's Finance Minister Anton Siluanov said that a decision on creating a $100 billion fund designated to steady currency markets would be taken in early 2014. The Brazilian finance minister, Guido Mantega stated that the fund would be created by March 2014.[31] However, by April 2014, the currency reserve pool and development bank had yet to be set up, and the date was rescheduled to 2015.[32] One driver for the BRICS development bank is that the existing institutions primarily benefit extra-BRICS corporations, and the political significance is notable because it allows BRICS member states "to promote their interests abroad... and can highlight the strengthening positions of countries whose opinion is frequently ignored by their developed American and European colleagues."

In March 2014, at a meeting on the margins of the Nuclear Security Summit in The Hague, the BRICS Foreign Ministers issued a communique that "noted with concern, the recent media statement on the forthcoming G20 Summit to be held in Brisbane in November 2014. The custodianship of the G20 belongs to all Member States equally and no one Member State can unilaterally determine its nature and character." In light of the tensions surrounding the 2014 Crimean crisis, the Ministers remarked that "The escalation of hostile language, sanctions and counter-sanctions, and force does not contribute to a sustainable and peaceful solution, according to international law, including the principles and purposes of the United Nations Charter."[33] This was in response to the statement of Australian Foreign Minister Julie Bishop, who had said earlier that Russian President Vladimir Putin might be barred from attending the G20 Summit in Brisbane.[34]

In July 2014, the Governor of the Russian Central Bank, Elvira Nabiullina, claimed that the "BRICS partners the establishment of a system of multilateral swaps that will allow to transfer resources to one or another country, if needed" in an article which concluded that "If the current trend continues, soon the dollar will be abandoned by most of the significant global economies and it will be kicked out of the global trade finance."[35]

Over the weekend of 13 July 2014 when the final game of the World Cup was held, and in advance of the BRICS Fortaleza summit, Putin met his homologue Dilma Rouseff to discuss the BRICS development bank, and sign some other bilateral accords on air defence, gas and education. Rouseff said that the BRICS countries "are among the largest in the world and cannot content themselves in the middle of the 21st century with any kind of dependency."[36] The Fortaleza summit was followed by a BRICS meeting with the Union of South American Nations president's in Brasilia, where the development bank and the monetary fund were introduced.[37] The development bank will have capital of US$50 billion with each country contributing US$10 billion, while the monetary fund will have US$100 billion at its disposal.[37]

On 15 July, the first day of the BRICS 6th summit in Fortaleza, Brazil, the group of emerging economies signed the long-anticipated document to create the US$100 billion New Development Bank (formerly known as the "BRICS Development Bank") and a reserve currency pool worth over another US$100 billion. Documents on cooperation between BRICS export credit agencies and an agreement of cooperation on innovation were also inked.[38]

At the end of October 2014, Brazil trimmed down its US government holdings to US$261.7 billion; India, US$77.5 billion; China, US$1.25 trillion; South Africa, US$10.3 billion.[39]

In March 2015, Morgan Stanley stated that India and Indonesia had escaped from the 'fragile five' (the five major emerging markets with the most fragile currencies) by instituting economic reforms. Previously, in August 2013, Morgan Stanley rated India and Indonesia, together with Brazil, Turkey and South Africa, as the 'fragile five' due to their vulnerable currencies. But since then, India and Indonesia have reformed their economies, completing 85% and 65% of the necessary adjustments respectively, while Brazil had only achieved 15%, Turkey only 10%, and South Africa even less.[40]

After the 2015 summit, the respective communications ministers, under a Russian proposal, had a first summit for their ministries in Moscow in October where the host minister, Nikolai Nikiforov, proposed an initiative to further tighten their information technology sectors and challenge the monopoly of the United States in the sector.[41]

Since 2012, the BRICS group of countries have been planning an optical fibre submarine communications cable system to carry telecommunications between the BRICS countries, known as the BRICS Cable.[42] Part of the motivation for the project was the spying of the National Security Agency on all telecommunications that flowed across the US.[43][44]

Summits

The grouping has held annual summits since 2009, with member countries taking turns to host. Prior to South Africa's admission, two BRIC summits were held, in 2009 and 2010. The first five-member BRICS summit was held in 2011. The most recent BRICS summit took place in Goa, India, from 15 to 16 October 2016.[45]

| Date(s) | Host country | Host leader | Location | Notes | |

|---|---|---|---|---|---|

| 1st | 16 June 2009 | | Dmitry Medvedev | Yekaterinburg (Sevastianov's House) | |

| 2nd | 15 April 2010 | | Luiz Inácio Lula da Silva | Brasília | Guests: Jacob Zuma (President of South Africa) and Riyad al-Maliki (Foreign Minister of the Palestinian National Authority) |

| 3rd | 14 April 2011 | | Hu Jintao | Sanya (Sheraton Sanya Resort) | First summit to include South Africa alongside the original BRIC countries. |

| 4th | 29 March 2012 | | Manmohan Singh | New Delhi (Taj Mahal Hotel) | The BRICS Cable announced an optical fibre submarine communications cable system that carries telecommunications between the BRICS countries. |

| 5th | 26–27 March 2013 | | Jacob Zuma | Durban (Durban ICC) | |

| 6th | 14–16 July 2014 | | Dilma Rousseff | Fortaleza (Centro de Eventos do Ceará)[46] Brasília | BRICS New Development Bank and BRICS Contingent Reserve Arrangement agreements signed. Guest: Leaders of Union of South American Nations (UNASUR)[47][48] |

| 7th | 8–9 July 2015 | | Vladimir Putin | Ufa (Congress Hall)[49] | Joint summit with SCO-EEU |

| 8th | 15–16 October 2016 | | Narendra Modi | Benaulim, Goa (Taj Exotica) | Joint summit with BIMSTEC |

| 9th | 3–5 September 2017 | | Xi Jinping | Xiamen (Xiamen International Conference Center) |

Member countries

| Country | Population | Nom. GDP mil. USD (2017 est.)[50] | PPP GDP bil. USD (2017 est.)[51] | Nom. GDP per capita USD (2017 est.)[52] | PPP GDP per capita USD (2017 est.)[53] | GDP Growth (2017 est.)[54] |

Foreign Exchange Reserves (2015) | HFCE (2013) | Government spending | Exports[55] | Imports[56] | Literacy rate[57] | Life expectancy (years, avg.)[58][59] | HDI (2015) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 207,395,000 | 2,140.9 Bn | 3,216.0 Bn | 10,308 | 15,485 | $362.744 bn | $1,401,620 bn | $846.6 bn | $189.7 bn | $143.9 bn | 92.6% | 75.0 | 0.754 (high) | |

| | 146,804,000 | 1,560.7 Bn | 3,938.0 Bn | 10,885 | 27,466 | $358.500 bn | $1,089,144 bn | $414.0 bn | $259.3 bn | $165.1 bn | 99.7% | 70.5 | 0.804 (very high) | |

| | 1,315,040,000 | 2,454.4 Bn | 9,489.3 Bn | 1,850 | 7,153 | $352.131 bn | $1,106,702 bn | $616.0 bn | $271.6 bn | $402.4 bn | 82% | 68.3 | 0.624 (medium) | |

| | 1,382,810,000 | 11,795.2 Bn | 23,194.4 Bn | 8,480 | 16,676 | $3,899.285 bn | $3,320,652 bn | $2,031.0 bn | $2,011.0 bn | $1,437.0 bn | 96.4% | 76.1 | 0.738 (high) | |

| | 55,908,000 | 317.5 Bn | 761.9 Bn | 5,588 | 13,409 | $47.190 bn | $221,990 bn | $95.27 bn | $83.1 bn | $85.0 bn | 94.3% | 62.9 | 0.666 (medium) | |

| Average | 621,591,400 | 3,653.7 Bn | 8,119.9 Bn | 7,422 | 19,041 | $1,003.970 bn | $1,428,022 bn | $800.574 bn | $562.94 bn | $446.68 bn | 93% | 70.56 | 0.711 (high) |

Potential additional members

Afghanistan, Argentina, Indonesia, Mexico and Turkey have expressed strong interest in full membership of the BRICS, while Egypt, Iran, Nigeria, Sudan, Syria and most recently Bangladesh and Greece have also expressed interest in joining BRICS.[61][62][63][64]

Financial structure

Currently, there are two components that make up the financial architecture of BRICS, namely, the New Development Bank (NDB) and the Contingent Reserve Arrangement (CRA). Both of these components were signed into treaty in 2014 and became active in 2015.

New Development Bank

The New Development Bank (NDB), formerly referred to as the BRICS Development Bank,[65] is a multilateral development bank operated by the BRICS states. The bank's primary focus of lending will be infrastructure projects[66][67] with authorized lending of up to $34 billion annually.[67] South Africa will be the African Headquarters of the Bank named the "New Development Bank Africa Regional Centre".[68] The bank will have starting capital of $50 billion, with capital increased to $100 billion over time.[69] Brazil, Russia, India, China and South Africa will initially contribute $10 billion each to bring the total to $50 billion.[68][69]

BRICS CRA

The BRICS Contingent Reserve Arrangement (CRA) is a framework for providing protection against global liquidity pressures.[66][69][70] This includes currency issues where members' national currencies are being adversely affected by global financial pressures.[66][70] It is found that emerging economies that experienced rapid economic liberalization went through increased economic volatility, bringing uncertain macroeconomic environment.[71] The CRA is generally seen as a competitor to the International Monetary Fund (IMF) and along with the New Development Bank is viewed as an example of increasing South-South cooperation.[66] It was established in 2015 by the BRICS countries Brazil, Russia, India, China and South Africa. The legal basis is formed by the Treaty for the Establishment of a BRICS Contingent Reserve Arrangement, signed at Fortaleza, Brazil on 15 July 2014. With its inaugural meetings of the BRICS CRA Governing Council and Standing Committee, held on September 4, 2015, in Ankara, Turkey[72] it entered into force upon ratification by all BRICS states, announced at the 7th BRICS summit in July 2015.

BRICS payment system

At the 2015 BRICS summit in Russia, ministers from BRICS nations, initiated consultations for a payment system that would be an alternative to the SWIFT system. Russian Deputy Foreign Minister Sergey Ryabkov stated in an interview, "The finance ministers and executives of the BRICS central banks are negotiating ... setting up payment systems and moving on to settlements in national currencies. SWIFT or not, in any case we’re talking about ... a transnational multilateral payment system that would provide greater independence, would create a definite guarantee for BRICS."[73]

The Central Bank of Russia (CBR) also started consultations with BRICS nations for a payment system that would be an alternative to the SWIFT system. The main benefits highlighted were backup and redundancy in case there were disruptions to the SWIFT system. The Deputy Governor of the Central Bank of the Russia, Olga Skorobogatova stated in an interview, "The only topic that may be of interest to all of us within BRICS is to consider and talk over the possibility of setting up a system that would apply to the BRICS countries, used as a backup."[74]

China has also initiated development of their own payment system called CIPS that would be an alternative to the SWIFT system. The Cross-Border Inter-Bank Payments System (CIPS) is a planned alternative payments system to SWIFT which would provide a network that enables financial institutions worldwide to send and receive information about financial transactions in a secure, standardized and reliable environment.[75]

Reception

In 2012, Hu Jintao, the then President of China and Paramount leader, described the BRICS countries as defenders and promoters of developing countries and a force for world peace.[10] Western analysts have highlighted potential divisions and weaknesses in the grouping, including significant economic instabilities,[76][77][78][79] disagreements between the members over UN Security Council reform,[80] and India and China's disputes[81] over territorial issues.[11]

In June 2015, Jim Rogers said that he does not see any current alternative to the US dollar and that "The world needs something to compete with the US-dominated institutions, some of them - the World Bank and the IMF. So, if BRICS offer any new structures that can compete with these long-standing…institutions, it will be very good."[82]

On 9 April 2013, Isobel Coleman from the Council on Foreign Relations, director of CFR's Civil Society, Markets and Democracy Program said that members of BRICS share a lack of consensus. They uphold drastically different political systems, from active democracy in Brazil to entrenched Oligarchy in Russia, and their economies are little integrated and are different in size by orders of magnitude. Also she states that the great difference in GDP, influences the reserves, for China taking up of over 41% of the contribution, which in turn leads to bigger political say within the association.[83]

Current leaders of BRICS member states

.jpg)

China

China

Xi Jinping, President

(Head of State)

(General Secretary as de facto leader

since 15 November 2012).jpg)

See also

- List of BRICS leaders

- List of business region acronyms

- List of country groupings

- List of multilateral free-trade agreements

- Emerging and growth-leading economies

- Group of Two

- List of potential superpowers

- Shanghai Cooperation Organization

References

- "Eighth Annual BRICS Summit in Goa: (Narendra Modi, Vladimir Putin, Michel Temer, and Xi Jinping)", Dainik Bhaskar, 15 October 2016.

- 1 2 "IMF Outlook for BRICS Apr 2015". IMF. Retrieved July 6, 2015.

- ↑ "Country Comparison: Area". The World Factbook. CIA. Retrieved 13 February 2015.

- ↑ "2015 Revision of World Population Prospects". United Nations Department of Economic and Social Affairs.

- ↑ "New era as South Africa joins BRICS". SouthAfrica.info. 11 April 2010. Retrieved 2 December 2012.

- ↑ China, Brazil, India and Russia were all deemed to be growth-leading countries by the BBVA: "BBVA EAGLEs Annual Report (PPT)". BBVA Research. 2012. Retrieved 16 April 2012.

- ↑ "Xiamen, host city of next annual BRICS summit".

- ↑ "World Economic Outlook". IMF. April 2013. Retrieved 17 April 2013.

- ↑ "Amid BRICS' rise and 'Arab Spring', a new global order forms". Christian Science Monitor. 18 October 2011. Retrieved 20 October 2011.

- ↑ https://emergingequity.org/2016/01/07/world-bank-issues-2016-perfect-storm-warning-amid-brics-synchronised-slowdown/

- 1 2 "Brics a force for world peace, says China". Business Day. 8 August 2012. Retrieved 9 November 2013.

- 1 2 "Brics summit exposes the high wall between India and China". Asia Times. 2 April 2012. Retrieved 10 July 2013.

- ↑ "BRICS – India is the biggest loser". USINPAC. 18 April 2013. Retrieved 17 June 2013.

- ↑ "The Sino-Brazilian Principles in a Latin American and BRICS Context: The Case for Comparative Public Budgeting Legal Research; Wisconsin International Law Journal; LOPES_PROOF; 13 May 2015" (PDF). migalhas.com.br. Retrieved September 7, 2016.

- ↑ Jim O' Neill (2001). "Building Better Global Economic BRICs". Goldman Sachs. Retrieved 13 February 2015.

- ↑ http://brics6.itamaraty.gov.br/about-brics/information-about-brics

- ↑ "Cooperation within BRIC" Archived 19 June 2009 at WebCite. Kremlin.ru. Retrieved 16 June 2009.

- 1 2 "First summit for emerging giants". BBC News. 16 June 2009. Archived from the original on 18 June 2009. Retrieved 16 June 2009.

- 1 2 3 Bryanski, Gleb (26 June 2009). "BRIC demands more clout, steers clear of dollar talk". Reuters. Archived from the original on 19 June 2009. Retrieved 16 June 2009.

- ↑ "BRIC wants more influence". Euronews. Archived from the original on 21 June 2009. Retrieved 16 June 2009.

- ↑ Zhou, Wanfeng (June 16, 2009). "Dollar slides after Russia comments, BRIC summit". Reuters. Retrieved July 6, 2014.

- 1 2 Graceffo, Antonio (21 January 2011). "BRIC Becomes BRICS: Changes on the Geopolitical Chessboard". Foreign Policy Journal. Retrieved 14 April 2011.

- ↑ Blanchard, Ben and Zhou Xin (14 April 2011). "UPDATE 1-BRICS discussed global monetary reform, not yuan". Reuters Africa. Retrieved 26 April 2013.

- ↑ "South Africa joins BRIC as full member". Xinhua. 24 December 2010. Retrieved 14 April 2011.

- ↑ "BRICS countries need to further enhance coordination: Manmohan Singh". Times Of India. 12 April 2011. Retrieved 14 April 2011.

- ↑ "BRICS should coordinate in key areas of development: PM". Indian Express. 10 April 2011. Retrieved 14 April 2011.

- ↑ BRICS Forum website. Retrieved 29 November 2012.

- ↑ "Russia says BRICS eye joint anti-crisis fund". Reuters. 21 June 2012. Retrieved 5 December 2012.

- ↑ "Brics eye infrastructure funding through new development bank". The Guardian. 28 March 2013. Retrieved 29 March 2013.

- ↑ "India sees BRICS development bank agreed by 2014 summit". Reuters. 19 April 2013. Retrieved 10 July 2013.

- ↑ http://in.reuters.com/article/2013/10/11/g20-brics-fund-idINL6N0I13N720131011

- ↑ http://in.reuters.com/article/2013/10/10/us-brazil-economy-mantega-idINBRE9990WR20131010

- ↑ rbth.com: "BRICS countries to set up their own IMF" 14 Apr 2014

- ↑ "Chairperson's Statement on the BRICS Foreign Ministers Meeting held on 24 March 2014 in The Hague, Netherlands" 24 Mar 2014

- ↑ "BRICS at Hague slam attempts to isolate Putin" 24 Mar 2014

- ↑ voiceofrussia.com: "BRICS morphing into anti-dollar alliance" 3 Jul 2014

- ↑ yahoo.com: "Brazil, Russia discuss creation of BRICS bank" 14 Jul 2014

- 1 2 "BRICS to launch bank, tighten Latin America ties". Yahoo.com. 11 July 2014. Retrieved 13 February 2015.

- ↑ "BRICS establish $100bn bank and currency reserves to cut out Western dominance". RT.com. 15 July 2014

- ↑ "India cuts exposure to US government securities at $77.5 billion in October." The Times of India. 21 December 2014. Retrieved 21 December 2014. Alternative link:

- ↑ Simon Kennedy (March 18, 2015). "Fragile Five currencies may soon be three".

- ↑ https://www.rt.com/business/319433-brics-it-ministers-meeting/

- ↑ "Brics Cable Unveiled for Direct and Cohesive Communications Services between Brazil, Russia, India, China and South Africa". Bloomberg News. 2012-04-16.

- ↑ Rolland, Nadège (2015-04-02). "A Fiber-Optic Silk Road". The Diplomat.

- ↑ "BRICS countries are building a "new Internet" hidden from NSA". Sputnik News. 2013-10-28.

- ↑ "Africa: Reporter's Notebook – All Systems Go for Brics Summit in SA". AllAfrica.com. 10 October 2012. Retrieved 26 April 2013.

- ↑ "A Cúpula de Durban e o futuro dos BRICS". Post-Western World. 4 July 2013. Retrieved 7 November 2013.

- ↑ "Los líderes del BRICS, Unasur, Cuba, México y Costa Rica se citan en Brasilia". LaVanguardia.com. LaVanguardia. Retrieved 15 July 2014.

- ↑ "BRICS summit: PM Modi to leave for Brazil tomorrow, will seek reforms". Hindustan Times. Retrieved 12 July 2014.

- ↑ "Ufa to host SCO and BRICS summits in 2015". UfaCity.info. Retrieved 7 November 2013.

- ↑ https://www.imf.org/external/pubs/ft/weo/2017/01/weodata/weorept.aspx?sy=2017&ey=2017&scsm=1&ssd=1&sort=country&ds=.&br=1&c=223%2C924%2C922%2C199%2C534&s=NGDPD%2CNGDPDPC%2CPPPGDP%2CPPPPC%2CLP&grp=0&a=&pr.x=46&pr.y=11

- ↑ https://www.imf.org/external/pubs/ft/weo/2017/01/weodata/weorept.aspx?sy=2017&ey=2017&scsm=1&ssd=1&sort=country&ds=.&br=1&c=223%2C924%2C922%2C199%2C534&s=NGDPD%2CNGDPDPC%2CPPPGDP%2CPPPPC%2CLP&grp=0&a=&pr.x=46&pr.y=11

- ↑ https://www.imf.org/external/pubs/ft/weo/2017/01/weodata/weorept.aspx?sy=2017&ey=2017&scsm=1&ssd=1&sort=country&ds=.&br=1&c=223%2C924%2C922%2C199%2C534&s=NGDPD%2CNGDPDPC%2CPPPGDP%2CPPPPC%2CLP&grp=0&a=&pr.x=46&pr.y=11

- ↑ https://www.imf.org/external/pubs/ft/weo/2017/01/weodata/weorept.aspx?sy=2017&ey=2017&scsm=1&ssd=1&sort=country&ds=.&br=1&c=223%2C924%2C922%2C199%2C534&s=NGDPD%2CNGDPDPC%2CPPPGDP%2CPPPPC%2CLP&grp=0&a=&pr.x=46&pr.y=11

- ↑ https://www.imf.org/external/pubs/ft/weo/2017/update/01/

- ↑ https://www.cia.gov/library/publications/the-world-factbook/rankorder/2078rank.html

- ↑ https://www.cia.gov/library/Publications/the-world-factbook/rankorder/2087rank.html

- ↑ "Field Listing :: Literacy". The World Factbook. Central Intelligence Agency. Retrieved 6 March 2016.

- ↑ "Country Comparison :: Life Expectancy". The World Factbook. Central Intelligence Agency. Retrieved 6 March 2016.

- ↑ http://www.who.int/mediacentre/news/releases/2016/health-inequalities-persist/en/

- ↑ investopedia

- ↑ "Syria Seeks to Join Shanghai Group, BRICS – Minister". RIA Novosti. 27 April 2013. Retrieved 7 November 2013.

- ↑ "India quiere a Argentina en los BRICS, el club de los emergentes". Clarin. 3 May 2014. Retrieved 12 May 2014.

- ↑ "Russia invites Greece to join BRICS". IBtimes.

- ↑ "EurActiv Sections".

- ↑ "BRICS Bank to be headquartered in Shanghai, India to hold presidency". Indiasnaps.com. 16 July 2014

- 1 2 3 4 "What the new bank of BRICS is all about". The Washington Post. 17 July 2014. Retrieved 20 July 2014.

- 1 2 "New BRICS Bank a Building Block of Alternative World Order". The Huffington Post. 18 July 2014. Retrieved 20 July 2014.

- 1 2 "BRICS countries launch $100 billion developmental bank, currency pool". Russia & India Report. 16 July 2014. Retrieved 20 July 2014.

- 1 2 3 "BRICS Bank ready for launch - Russian Finance Minister". Russia & India Report. 10 July 2014. Retrieved 20 July 2014.

- 1 2 "BRICS currency fund to protect members from volatility - Russia's top banker". Russia & India Report. 17 July 2014. Retrieved 20 July 2014.

- ↑ Biziwick, Mayamiko(20 August 2015)The rationale for and potential role of the BRICS Contingent Reserve Arrangement South African Journal of International Affairs. Retrieved 22 September 2016

- ↑ On the BRICS Contingent Reserve Arrangement (CRA) Governing Council and Standing Committee inaugural meetings 4 September 2015. Retrieved 22 September 2016

- ↑ "BRICS starts examining SWIFT alternative". RT News. 17 June 2015. Retrieved 26 March 2016.

- ↑ "Russia offers to discuss BRICS prototype of SWIFT global system". Russia & India Report. 1 June 2015. Retrieved 26 March 2016.

- ↑ "Exclusive: China's international payments system ready, could launch by end-2015 - sources". Reuters. March 9, 2015. Retrieved 2015-03-10.

- ↑ "Broken BRICs: Why the Rest Stopped Rising". Foreign Affairs. November–December 2012. Retrieved 19 December 2012.

- ↑ "China Loses Control of Its Frankenstein Economy". Bloomberg. 24 June 2013. Archived from the original on 4 November 2013. Retrieved 25 June 2013.

- ↑ "Brazil Stocks In Bear Market As Economy Struggles". Investors.com. 26 June 2013. Retrieved 29 June 2013.

- ↑ "Emerging economies: The Great Deceleration". The Economist. 27 July 2013. Retrieved 27 July 2013.

- ↑ "BRICS Leaders Fail to Create Rival to World Bank". New York Times. 29 March 2012. Retrieved 18 June 2013.

- ↑ Global, IndraStra. "EXCERPT | A Test of China–India Cooperative Dynamics within the BRICS Framework". IndraStra. ISSN 2381-3652.

- ↑ "World Bank & IMF 'corroded' – Jim Rogers to RT". Retrieved 11 September 2015.

- ↑ Coleman, Isobel. "Ten Questions for the New BRICS Bank". Foreign Policy. Retrieved 24 September 2016.

Further reading

- Carmody, Pádraig (2013). The Rise of BRICS in Africa: The Geopolitics of South-South Relations. Zed Books. ISBN 9781780326047.

- Chun, Kwang (2013). The BRICs Superpower Challenge: Foreign and Security Policy Analysis. Ashgate Pub Co. ISBN 9781409468691.

External links

- Official sites

- Official BRICS Website - Joint Site of Ministries of Foreign Affairs of BRICS Member States

- The official Webpage of BRICS—in 2015 hosted by Russia

- BRICS Information Sharing and Exchanging Platform, Fudan University

- Information and publications

- BRICS Law Journal

- BRICS Online Dossier—German Institute of Global and Area Studies (GIGA)

- Centre for Rising Powers, University of Cambridge

- The BRICS Post – News website with a focus on the BRICS.

- BRICS Information Centre. University of Toronto. Retrieved 29 June 2013.

- Articles

- "Appendix B :: International Organizations and Groups". The World Factbook. Central Intelligence Agency. Retrieved 24 January 2017.

- "What the BRICS Are Building". The Harvard Crimson. 1 September 2014. Retrieved 3 September 2014.

- Lopes, Gutemberg P., Jr. (13 May 2015). "The Sino-Brazilian Principles in a Latin American and BRICS Context: The Case for Comparative Public Budgeting Legal Research" (PDF). Wisconsin International Law Journal. 31 (1). Retrieved September 7, 2016.

- "Goldman's O'Neill: Time to Move Beyond BRICs". MarketWatch.com. 21 November 2011. Retrieved 17 June 2013.

- "United States should learn from emerging powers such as India and Brazil in the economic arena". Reuters. 14 October 2011. Retrieved 17 June 2013.

- "BRICS flame continues to shine". Russia & India Report. 29 February 2012. Retrieved 17 June 2013.

- "BRICS – Multi-format Cooperation". Russian Business Council for Cooperation with India. 2011. Retrieved 17 June 2013.

- Sidaway, James D. (2012). "Geographies of Development: New Maps, New Visions?" The Professional Geographer. 64:1, pp. 49–62. Retrieved 8 August 2013.

- Zhang Chunyan (13 April 2011). "BRIC(S) nations have become growth markets for the world economy and are no longer emerging markets". China Daily. Retrieved 17 June 2013.

.svg.png)