Stable distribution

|

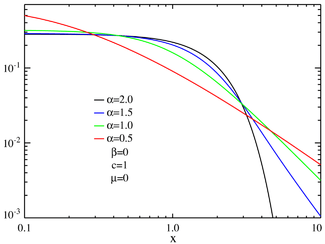

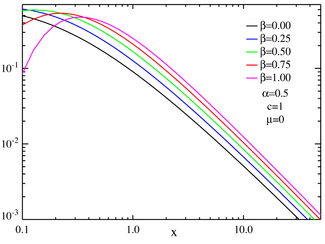

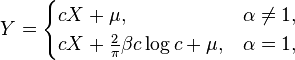

Probability density function

| |

|

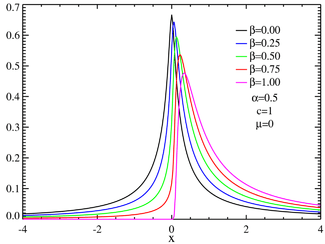

Cumulative distribution function

| |

| Parameters |

α ∈ (0, 2] — stability parameter |

|---|---|

| Support | x ∈ R, or x ∈ [μ, +∞) if α < 1 and β = 1, or x ∈ (-∞, μ] if α < 1 and β = −1 |

| not analytically expressible, except for some parameter values | |

| CDF | not analytically expressible, except for certain parameter values |

| Mean | μ when α > 1, otherwise undefined |

| Median | μ when β = 0, otherwise not analytically expressible |

| Mode | μ when β = 0, otherwise not analytically expressible |

| Variance | 2c2 when α = 2, otherwise infinite |

| Skewness | 0 when α = 2, otherwise undefined |

| Ex. kurtosis | 0 when α = 2, otherwise undefined |

| Entropy | not analytically expressible, except for certain parameter values |

| MGF | undefined |

| CF |

|

In probability theory, a distribution is said to be stable (or a random variable is said to be stable) if a linear combination of two independent copies of a random sample has the same distribution, up to location and scale parameters. The stable distribution family is also sometimes referred to as the Lévy alpha-stable distribution, after Paul Lévy, the first mathematician to have studied it.[1][2]

Of the four parameters defining the family, most attention has been focused on the stability parameter, α (see panel). Stable distributions have 0 < α ≤ 2, with the upper bound corresponding to the normal distribution, and α = 1 to the Cauchy distribution. The distributions have undefined variance for α < 2, and undefined mean for α ≤ 1. The importance of stable probability distributions is that they are "attractors" for properly normed sums of independent and identically-distributed (iid) random variables. The normal distribution defines a family of stable distributions. By the classical central limit theorem the properly normed sum of a set of random variables, each with finite variance, will tend towards a normal distribution as the number of variables increases. Without the finite variance assumption the limit may be a stable distribution. Mandelbrot referred to stable distributions that are non-normal as "stable Paretian distributions",[3][4][5] after Vilfredo Pareto. Mandelbrot referred to "positive" stable distributions (meaning maximally skewed in the positive direction) with 1<α<2 as "Pareto-Levy distributions".[1] He also regarded this range as relevant for the description of stock and commodity prices.

q-analogs of all symmetric stable distributions have been defined, and these recover the usual symmetric stable distributions in the limit of q → 1.[6]

Definition

A non-degenerate distribution is a stable distribution if it satisfies the following property:

- Let X1 and X2 be independent copies of a random variable X. Then X is said to be stable if for any constants a > 0 and b > 0 the random variable aX1 + bX2 has the same distribution as cX + d for some constants c > 0 and d. The distribution is said to be strictly stable if this holds with d = 0.[7]

Since the normal distribution, the Cauchy distribution, and the Lévy distribution all have the above property, it follows that they are special cases of stable distributions.

Such distributions form a four-parameter family of continuous probability distributions parametrized by location and scale parameters μ and c, respectively, and two shape parameters β and α, roughly corresponding to measures of asymmetry and concentration, respectively (see the figures).

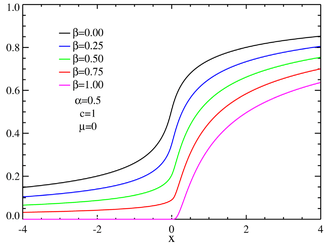

Although the probability density function for a general stable distribution cannot be written analytically, the general characteristic function can be. Any probability distribution is given by the Fourier transform of its characteristic function φ(t) by:

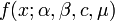

A random variable X is called stable if its characteristic function can be written as[7][8]

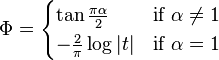

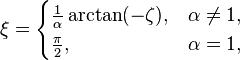

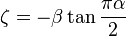

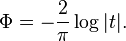

where sgn(t) is just the sign of t and Φ is given by

for all α except α = 1 in which case:

μ ∈ R is a shift parameter, β ∈ [−1, 1], called the skewness parameter, is a measure of asymmetry. Notice that in this context the usual skewness is not well defined, as for α < 2 the distribution does not admit 2nd or higher moments, and the usual skewness definition is the 3rd central moment.

In the simplest case β = 0, the characteristic function is just a stretched exponential function; the distribution is symmetric about μ and is referred to as a (Lévy) symmetric alpha-stable distribution, often abbreviated SαS.

When α < 1 and β = 1, the distribution is supported by [μ, ∞).

The parameter |c| > 0 is a scale factor which is a measure of the width of the distribution and α is the exponent or index of the distribution and specifies the asymptotic behavior of the distribution for α < 2.

Parameterizations

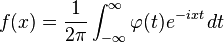

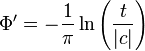

The above definition is only one of the parameterizations in use for stable distributions; it is the most common but is not continuous in the parameters. For example, for the case α = 1 we could replace Φ by:[7]

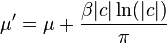

and μ by

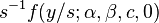

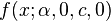

This parameterization has the advantage that we may define a standard distribution using

and

The pdf for all α will then have the following standardization property:

The distribution

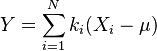

A stable distribution is therefore specified by the above four parameters. It can be shown that any non-degenerate stable distribution has a smooth (infinitely differentiable) density function.[7] If  denotes the density of X and Y is the sum of independent copies of X:

denotes the density of X and Y is the sum of independent copies of X:

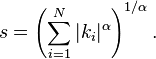

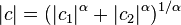

then Y has the density  with

with

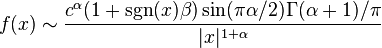

The asymptotic behavior is described, for α< 2, by:[7]

where Γ is the Gamma function (except that when α < 1 and β = ±1, the tail vanishes to the left or right, resp., of μ). This "heavy tail" behavior causes the variance of stable distributions to be infinite for all α < 2. This property is illustrated in the log-log plots below.

When α = 2, the distribution is Gaussian (see below), with tails asymptotic to exp(−x2/4c2)/(2c√π).

Properties

- All stable distributions are infinitely divisible.

- With the exception of the normal distribution (α = 2), stable distributions are leptokurtotic and heavy-tailed distributions.

- Closure under convolution

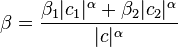

Stable distributions are closed under convolution for a fixed value of α. Since convolution is equivalent to multiplication of the Fourier-transformed function, it follows that the product of two stable characteristic functions with the same α will yield another such characteristic function. The product of two stable characteristic functions is given by:

Since Φ is not a function of the μ, c or β variables it follows that these parameters for the convolved function are given by:

In each case, it can be shown that the resulting parameters lie within the required intervals for a stable distribution.

A generalized central limit theorem

Another important property of stable distributions is the role that they play in a generalized central limit theorem. The central limit theorem states that the sum of a number of independent and identically distributed (i.i.d.) random variables with finite variances will tend to a normal distribution as the number of variables grows.

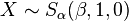

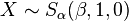

A generalization due to Gnedenko and Kolmogorov states that the sum of a number of random variables with a power-law tail (Paretian tail) distribution decreasing as |x|−α−1 where 0 < α < 2 (and therefore having infinite variance) will tend to a stable distribution  as the number of summands grows.[9] If α>2 then the sum converges to a stable distribution with stability parameter equal to 2, i.e. a Gaussian distribution.[10]

as the number of summands grows.[9] If α>2 then the sum converges to a stable distribution with stability parameter equal to 2, i.e. a Gaussian distribution.[10]

Special cases

There is no general analytic solution for the form of p(x). There are, however three special cases which can be expressed in terms of elementary functions as can be seen by inspection of the characteristic function:[7][8][11]

- For α = 2 the distribution reduces to a Gaussian distribution with variance σ2 = 2c2 and mean μ; the skewness parameter β has no effect.

- For α = 1 and β = 0 the distribution reduces to a Cauchy distribution with scale parameter c and shift parameter μ.

- For α =1/2 and β = 1 the distribution reduces to a Lévy distribution with scale parameter c and shift parameter μ.

Note that the above three distributions are also connected, in the following way: A standard Cauchy random variable can be viewed as a mixture of Gaussian random variables (all with mean zero), with the variance being drawn from a standard Lévy distribution. And in fact this is a special case of a more general theorem [12] which allows any symmetric alpha-stable distribution to be viewed in this way (with the alpha parameter of the mixture distribution equal to twice the alpha parameter of the mixing distribution—and the beta parameter of the mixing distribution always equal to one).

A general closed form expression for stable PDF's with rational values of α is available in terms of Meijer G-functions.[13] Fox H-Functions can also be used to express the stable probability density functions. For simple rational numbers, the closed form expression is often in terms of less complicated special functions. Several closed form expressions having rather simple expressions in terms of special functions are available. In the table below, PDF's expressible by elementary functions are indicated by an E and those that are expressible by special functions are indicated by an s.[12]

| α | |||||||

|---|---|---|---|---|---|---|---|

| 1/3 | 1/2 | 2/3 | 1 | 4/3 | 3/2 | 2 | |

| β=0 | s | s | s | E | s | s | E |

| β=1 | s | E | s | s | s | ||

Some of the special cases are known by particular names:

- For α = 1 and β = 1, the distribution is a Landau distribution which has a specific usage in physics under this name.

- For α = 3/2 and β = 0 the distribution reduces to a Holtsmark distribution with scale parameter c and shift parameter μ.

Also, in the limit as c approaches zero or as α approaches zero the distribution will approach a Dirac delta function δ(x−μ).

Series representation

The stable distribution can be restated as the real part of a simpler integral:[14]

Expressing the second exponential as a Taylor series, we have:

where  . Reversing the order of integration and summation, and carrying out the integration yields:

. Reversing the order of integration and summation, and carrying out the integration yields:

which will be valid for x ≠ μ and will converge for appropriate values of the parameters. (Note that the n = 0 term which yields a delta function in x−μ has therefore been dropped.) Expressing the first exponential as a series will yield another series in positive powers of x−μ which is generally less useful.

Simulation of stable variables

Simulating sequences of stable random variables is not straightforward, since there are no analytic expressions for the inverse  nor the CDF

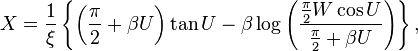

nor the CDF  itself.[15][16] All standard approaches like the rejection or the inversion methods would require tedious computations. A much more elegant and efficient solution was proposed by Chambers, Mallows and Stuck (CMS),[17] who noticed that a certain integral formula[18] yielded the following algorithm:[19]

itself.[15][16] All standard approaches like the rejection or the inversion methods would require tedious computations. A much more elegant and efficient solution was proposed by Chambers, Mallows and Stuck (CMS),[17] who noticed that a certain integral formula[18] yielded the following algorithm:[19]

- generate a random variable

uniformly distributed on

uniformly distributed on  and an independent exponential random variable

and an independent exponential random variable  with mean 1;

with mean 1; - for

compute:

compute:

![X = (1+\zeta^2)^\frac{1}{2\alpha}

\frac{\sin\{ \alpha(U+\xi)\}}{\{\cos(U)\}^{1/ \alpha}}

\left[\frac{\cos\{U - \alpha(U+\xi) \}}{W} \right]^\frac{1-\alpha}{\alpha},](../I/m/2cc852db48e7e82c25eb9b532596295b.png)

- for

compute:

compute:

where

where

and

.

.

This algorithm yields a random variable  . For a detailed proof see.[20]

. For a detailed proof see.[20]

Given the formulas for simulation of a standard stable random variable, we can easily simulate a stable random variable for all admissible values of the parameters  ,

,  ,

,  and

and  using the following property. If

using the following property. If  then

then

is  . It is interesting to note that for

. It is interesting to note that for  (and

(and  ) the CMS method reduces to the well known Box-Muller transform for generating Gaussian random variables.[21] Many other approaches have been proposed in the literature, including application of Bergström and LePage series expansions, see [22] and,[23] respectively. However, the CMS method is regarded as the fastest and the most accurate.

) the CMS method reduces to the well known Box-Muller transform for generating Gaussian random variables.[21] Many other approaches have been proposed in the literature, including application of Bergström and LePage series expansions, see [22] and,[23] respectively. However, the CMS method is regarded as the fastest and the most accurate.

Applications

Stable distributions owe their importance in both theory and practice to the generalization of the central limit theorem to random variables without second (and possibly first) order moments and the accompanying self-similarity of the stable family. It was the seeming departure from normality along with the demand for a self-similar model for financial data (i.e. the shape of the distribution for yearly asset price changes should resemble that of the constituent daily or monthly price changes) that led Benoît Mandelbrot to propose that cotton prices follow an alpha-stable distribution with α equal to 1.7.[24] Lévy distributions are frequently found in analysis of critical behavior and financial data.[8][25] It is essential that the intuitive fact that the stable distributed observations possess a large number of big deviations from empirical mean is not true [26][27]

They are also found in spectroscopy as a general expression for a quasistatically pressure broadened spectral line.[14]

Lévy distribution of solar flare waiting time events (time between flare events) was demonstrated for CGRO BATSE hard x-ray solar flares December 2001. Analysis of the Lévy statistical signature revealed that two different memory signatures were evident; one related to the solar cycle and the second whose origin appears to be associated with a localized or combination of localized solar active region effects.[28]

See also

- Lévy flight

- Lévy process

- Fractional quantum mechanics

- Other "power law" distributions

- Stable and tempered stable distributions with volatility clustering – financial applications

- Multivariate stable distribution

- Discrete-stable distribution

Notes

- The STABLE program for Windows is available from John Nolan's stable webpage: http://academic2.american.edu/~jpnolan/stable/stable.html. It calculates the density (pdf), cumulative distribution function (cdf) and quantiles for a general stable distribution, and performs maximum likelihood estimation of stable parameters and some exploratory data analysis techniques for assessing the fit of a data set.

- Matlab codes for simulation of stable variables and estimation of stable parameters are available from RePEc: https://ideas.repec.org/e/pwe42.html#software

References

- 1 2 B. Mandelbrot, The Pareto-Lévy Law and the Distribution of Income, International Economic Review 1960 http://www.jstor.org/stable/2525289

- ↑ Paul Lévy, Calcul des probabilités 1925

- ↑ B.Mandelbrot, Stable Paretian Random Functions and the Multiplicative Variation of Income, Econometrica 1961 http://www.jstor.org/stable/pdfplus/1911802.pdf

- ↑ B. Mandelbrot, The variation of certain Speculative Prices, The Journal of Business 1963

- ↑ Eugene F. Fama, Mandelbrot and the Stable Paretian Hypothesis, The Journal of Business 1963

- ↑ Umarov, Sabir; Tsallis, Constantino; Gell-Mann, Murray; Steinberg, Stanly (2010). "Generalization of symmetric α-stable Lévy distributions for q>1". J Math Phys. (American Institute of Physics) 51 (3). arXiv:0911.2009. Bibcode:2010JMP....51c3502U. doi:10.1063/1.3305292. PMC 2869267. PMID 20596232. Retrieved 2011-07-29.

- 1 2 3 4 5 6 Nolan, John P. "Stable Distributions - Models for Heavy Tailed Data" (PDF). Retrieved 2009-02-21.

- 1 2 3 Voit, Johannes (2005). The Statistical Mechanics of Financial Markets - Springer. Springer. doi:10.1007/b137351.

- ↑ B.V. Gnedenko, A.N. Kolmogorov. Limit distributions for sums of independent random variables, Cambridge, Addison-Wesley 1954 https://books.google.com/books/about/Limit_distributions_for_sums_of_independ.html?id=rYsZAQAAIAAuJ&redir_esc=y

- ↑ Vladimir V. Uchaikin, Vladimir M. Zolotarev, Chance and Stability: Stable Distributions and their Applications, De Gruyter 1999 https://books.google.com/books/about/Chance_and_Stability.html?id=Y0xiwAmkb_oC&redir_esc=y

- ↑ Samoradnitsky, G.; Taqqu, M.S. (1994). Stable Non-Gaussian Random Processes: Stochastic Models with Infinite Variance. CRC Press. ISBN 9780412051715.

- 1 2 Lee, Wai Ha (2010). Continuous and discrete properties of stochastic processes. PhD thesis, University of Nottingham.

- ↑ Zolotarev, V. (1995). "On Representation of Densities of Stable Laws by Special Functions". Theory of Probability & Its Applications 39 (2): 354–362. doi:10.1137/1139025. ISSN 0040-585X.

- 1 2 Peach, G. (1981). "Theory of the pressure broadening and shift of spectral lines". Advances in Physics 30 (3): 367–474. doi:10.1080/00018738100101467. ISSN 0001-8732.

- ↑ Nolan, John P. (1997). "Numerical calculation of stable densities and distribution functions". Communications in Statistics. Stochastic Models 13 (4): 759–774. doi:10.1080/15326349708807450. ISSN 0882-0287.

- ↑ Matsui, Muneya; Takemura, Akimichi (2006). "Some Improvements in Numerical Evaluation of Symmetric Stable Density and Its Derivatives". Communications in Statistics - Theory and Methods 35 (1): 149–172. doi:10.1080/03610920500439729. ISSN 0361-0926.

- ↑ Chambers, J. M.; Mallows, C. L.; Stuck, B. W. (1976). "A Method for Simulating Stable Random Variables". Journal of the American Statistical Association 71 (354): 340–344. doi:10.1080/01621459.1976.10480344. ISSN 0162-1459.

- ↑ Zolotarev, V. M. (1986). One-Dimensional Stable Distributions. American Mathematical Society. ISBN 978-0-8218-4519-6.

- ↑ Misiorek, Adam; Weron, Rafał (2012). Gentle, James E.; Härdle, Wolfgang Karl; Mori, Yuichi, eds. Heavy-Tailed Distributions in VaR Calculations. Springer Handbooks of Computational Statistics. Springer Berlin Heidelberg. pp. 1025–1059. doi:10.1007/978-3-642-21551-3_34. ISBN 978-3-642-21550-6.

- ↑ Weron, Rafał (1996). "On the Chambers-Mallows-Stuck method for simulating skewed stable random variables". Statistics & Probability Letters 28 (2): 165–171. doi:10.1016/0167-7152(95)00113-1.

- ↑ Janicki, Aleksander; Weron, Aleksander (1994). Simulation and Chaotic Behavior of Alpha-stable Stochastic Processes. CRC Press. ISBN 9780824788827.

- ↑ Mantegna, Rosario Nunzio (1994). "Fast, accurate algorithm for numerical simulation of L\'evy stable stochastic processes". Physical Review E 49 (5): 4677–4683. doi:10.1103/PhysRevE.49.4677.

- ↑ Janicki, Aleksander; Kokoszka, Piotr (1992). "Computer investigation of the Rate of Convergence of Lepage Type Series to α-Stable Random Variables". Statistics 23 (4): 365–373. doi:10.1080/02331889208802383. ISSN 0233-1888.

- ↑ Mandelbrot, B., New methods in statistical economics The Journal of Political Economy, 71 #5, 421-440 (1963).

- ↑ Rachev, Svetlozar T.; Mittnik, Stefan (2000). Stable Paretian Models in Finance. Wiley. ISBN 978-0-471-95314-2.

- ↑ Lev B. Klebanov, Irina Volchenkova (2015) "Heavy Tailed Distributions in Finance: Reality or Mith? Amateurs Viewpoint", arXiv:1507.07735v1, 1-17.

- ↑ Lev B Klebanov (2016) "No Stable Distributions in Finance, please!", arXiv:1601.00566v2, 1-9.

- ↑ Leddon, D., A statistical Study of Hard X-Ray Solar Flares

![\exp\!\Big[\; it\mu - |c\,t|^\alpha\,(1-i \beta\,\mbox{sgn}(t)\Phi) \;\Big],](../I/m/a3ff334ccf052804905cfb91f4fa1a6e.png)

![\varphi(t;\alpha,\beta,c,\mu) = \exp\left[~it\mu\!-\!|c t|^\alpha\,(1\!-\!i \beta\,\textrm{sgn}(t)\Phi)~\right]](../I/m/125baaf6283c0ab1f51209bd9b3e700d.png)

![\exp\left[it\mu_1+it\mu_2 - |c_1 t|^\alpha - |c_2 t|^\alpha +i\beta_1|c_1 t|^\alpha\textrm{sgn}(t)\Phi +i\beta_2|c_2 t|^\alpha\,\textrm{sgn}(t)\Phi \right]](../I/m/b8ae6ebfe5336a336bfe99e32fc0b744.png)

![f(x;\alpha,\beta,c,\mu)=\frac{1}{\pi}\Re\left[ \int_0^\infty e^{it(x-\mu)}e^{-(ct)^\alpha(1-i\beta\Phi)}\,dt\right].](../I/m/69957390774fb78133302bc9affbd88e.png)

![f(x;\alpha,\beta,c,\mu)=\frac{1}{\pi}\Re\left[ \int_0^\infty e^{it(x-\mu)}\sum_{n=0}^\infty\frac{(-qt^\alpha)^n}{n!}\,dt\right]](../I/m/44b919211409d6d66d2279ec4b67eb9e.png)

![f(x;\alpha,\beta,c,\mu)=\frac{1}{\pi}\Re\left[ \sum_{n=1}^\infty\frac{(-q)^n}{n!}\left(\frac{i}{x-\mu}\right)^{\alpha n+1}\Gamma(\alpha n+1)\right]](../I/m/0caaa5dfba5511c1df778311e55f898b.png)