Savings identity

The savings identity or the savings-investment identity is a concept in national income accounting stating that the amount saved in an economy will be the amount invested in new physical machinery, new inventories, and alike. More specifically, in an open economy (an economy with foreign trade and capital flows), private saving plus governmental saving (the government budget surplus or the negative of the deficit) plus foreign investment domestically (capital inflows from abroad) must equal private physical investment.[1] In other words, investment must be financed by some combination of private domestic savings, government savings (surplus), and foreign savings (foreign capital inflows).[2][3]

Note that this is an "identity", meaning it is true by definition. This identity only holds true because investment here is defined as including inventory accumulation. Thus, should consumers decide to save more, and spend less, the fall in demand would lead to an increase in business inventories. The change in inventories brings savings and investment into balance without any intention by business to increase investment.[3] And also the identity holds true because savings are defined to include private savings and "public savings" (actually public saving is positive when there is budget surplus, that is, public debt reduction).

Note, that as such, this does not imply that an increase in savings must lead directly to an increase in investment. Indeed, business may respond to increased inventories by decreasing both output and intended investment. Likewise, this reduction in output by business will reduce incomes, forcing an unintended reduction in savings. Even if the end result of this process is ultimately a lower level of investment, it will nonetheless remain true at any given point in time that the savings-investment identity holds.[3]

Algebraic statement

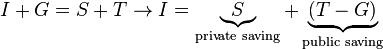

In a closed economy with government, we have

meaning that whatever of aggregate output ( ) is neither consumed by the private (

) is neither consumed by the private ( ) nor the government (

) nor the government ( ) must be what is invested (

) must be what is invested ( ). But it is also true that

). But it is also true that

meaning that savings must be disposable income ( ) minus consumption. Combining both expressions (by solving for

) minus consumption. Combining both expressions (by solving for  on one side and equating) gives

on one side and equating) gives

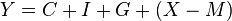

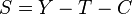

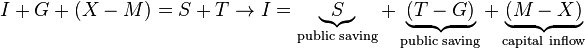

In an open economy, a similar expression can be found. The national income identity now is

where  is the balance of trade (exports minus imports). Private savings are still

is the balance of trade (exports minus imports). Private savings are still  , so again combing (by solving for

, so again combing (by solving for  on one side and equating) gives

on one side and equating) gives

Views from classical macroeconomic theorists

Adam Smith

Adam Smith notes this in The Wealth of Nations and it figures into the question of general equilibrium and the general glut controversy. In the general equilibrium model savings must equal investment for the economy to clear.[2] The economy grows as division of labor increases productivity of laborers. This increased productivity in laborers creates a surplus that will be split between capitalists’ expenditure on goods for themselves and investment in other capital.[4] The accumulation of saving and parsimony of capitalists leads to greater increases in capital which leads to a more productive state. Smith advocates this parsimony of profit as a virtue. Smith provides the example of the colonial United States for the positive relationship between the wage fund and investment in capital. He says that England is a much more wealthy economy than anywhere in America, however, he believes that the true wealth lies within the market for wage funds and the growth rate of the population. The colonies have a much higher wage rate than England due to a lower cost of provisions and necessities to survive, which result in a higher competition for human capital among the “masters” of the economy, which in turn raises the wage rate and increases the wage fund. The core of this phenomenon, is why Adam Smith believes in the savings investment identity. The reason why wages go up and there is competition between employers is the result of a constant influx of capital that is equal or greater to the rate in which the amount of labor increases.[5]

David Ricardo

To understand why Ricardo’s view of the savings investment identity differed from Smith’s, one must first examine how Ricardo’s definition of rent. This rent adds no new value to society, but since land-owners are profit seeking, and since population is increasing in this time of growth, land that yields beyond the value of sustenance for workers is sought out and the return on those pieces of land suffer and lower rent. This is the basis for what Ricardo believed about the savings investment identity. He agreed with Smith that parsimony and saving was a virtue, and that savings and investment were equal, but he introduced that returns diminish as population decrease. The diminished rate of return results in something Ricardo calls the stationary state, which is when eventually a minimum profit rate is reached at which new investment (i.e., additional capital accumulation) ceases. Another way the stationary state can be reached is when the average wage rate, which is determined by the proportion of fixed and circulating capital to the population. As long as profits are positive, the capital stock is increasing, and the increased demand for labor will temporarily increase the average wage rate. But when wage rates rise above subsistence population increases. A larger population re-quires a greater food supply, so that, barring imports, cultivation must be extended to inferior lands (lower rent). As this occurs, rents increase and profits fall, until ultimately the stationary state is reached.[6]

References

- ↑ Hall, Robert E.; Taylor, John B.; Rudin, Jeremy R. (1995). Macroeconomics: The Canadian Economy (Second ed.). New York: Norton. pp. 48–51. ISBN 0-393-96544-9.

- 1 2 Langdana, Farrokh K. (2002). Macroeconomic Policy: Demystifying Monetary and Fiscal Policy. ISBN 1-4020-7146-9.

- 1 2 3 Krugman, Paul; Wells, Robin; Graddy, Kathryn (2007). Economics: European Edition. Macmillan. pp. 637–643. ISBN 978-0-7167-9956-6.

- ↑ Smith, Adam (1776). An Inquiry into the Nature and Causes of the Wealth of Nations. London: W. Strahan and T. Cadell.

- ↑ Smith, Adam (1776). An Inquiry Into the Nature and Causes of the Wealth of Nations (PDF). London, England: W. Strahan and T. Cadell. pp. 62–64.

- ↑ Ricardo, David (2004). On the principles of political economy and taxation ([Reprinted]. ed.). Indianapolis: Liberty Fund. ISBN 0865979650.