Routing transit number

An ABA routing transit number (ABA RTN) is a nine digit code, used in the United States, which appears on the bottom of negotiable instruments such as cheques to identify the financial institution on which it was drawn. The ABA RTN was originally designed to facilitate the sorting, bundling, and shipment of paper cheques back to the drawer's (cheque writer's) account. As new payment methods were developed (ACH and Wire), the system was expanded to accommodate these payment methods.

The ABA RTN is necessary for the Federal Reserve Banks to process Fedwire funds transfers, and by the Automated Clearing House to process direct deposits, bill payments, and other such automated transfers.

The ABA RTN system was developed in 1910 by the American Bankers Association.[1]

ABA RTN management

Since 1911, the American Bankers Association has partnered with a series of registrars, currently Accuity, to manage the ABA routing number system.[2] Accuity is the Official Routing Number Registrar and is responsible for assigning ABA RTNs and managing the ABA RTN system. Accuity publishes the American Bankers Association Key to Routing Numbers semi-annually. The "Key Book" contains the listing of all ABA RTNs that have been assigned.

There are approximately 26,895 active ABA RTNs currently in use.[3] Every financial institution in the United States has at least one. The Routing Number Policy allows for up to five ABA RTNs to be assigned to a financial institution. Many institutions have more than five ABA RTNs as a result of mergers.

ABA RTNs are only for use in payment transactions within the United States. They are used on paper cheque, wire transfers, and ACH transactions. On a paper cheque, the ABA RTN is usually the middle set of nine numbers printed at the bottom of the cheque. Domestic transfers that use the ABA RTN will usually be returned to the paying bank.

Incoming international wire transfers also use the SWIFT code - a system administered by the Society for Worldwide Interbank Financial Telecommunication (SWIFT). The code is often referred to as "SWIFT-BIC, BIC code, SWIFT ID or SWIFT code". Please see ISO 9362. In addition, European financial institutions use an IBAN code.

The IBAN was originally developed to facilitate payments within the European Union but the format is flexible enough to be applied globally. It consists of an ISO 3166-1 alpha-2 country code, followed by two cheque digits that are calculated using a mod-97 technique, and Basic Bank Account Number (BBAN) with up to thirty alphanumeric characters.[4] The BBAN includes the domestic bank account number and potentially routing information. The national banking communities decide individually on a fixed length for all BBAN in their country.

Routing number format

The ABA RTN appears in two forms on a standard cheque – the fraction form and the MICR (magnetic ink character recognition) form.[1] Both forms give essentially the same information, though there are slight differences.

The MICR forms are the main form – it is printed in magnetic ink, and is machine-readable; it appears at the bottom left of a cheque, and consists of nine digits.

The fraction form was used for manual processing before the invention of the MICR line, and still serves as a backup in cheque processing should the MICR line become illegible or torn; it generally appears in the upper right part of a cheque near the date.

The MICR number is of the form

- XXXXYYYYC

where XXXX is Federal Reserve Routing Symbol, YYYY is ABA Institution Identifier, and C is the cheque Digit, while the fraction is of the form:

- PP-YYYY/XXXX

where PP is a 1 or 2 digit Prefix, no longer used in processing, but still printed, representing the bank's cheque processing center location, with 1 through 49 for processing centers located in a major city, and 50 through 99 representing processing is done at a non-major city in a particular state. Sometimes a branch number or the account number are printed below the fraction form; branch number is not used in processing, while the account number is listed in MICR form at the bottom. Further, the Federal Reserve Routing Symbol and ABA Institution Identifier may have fewer than 4 digits in the fraction form. The essential data, shared by both forms, is the Federal Reserve Routing Symbol (XXXX), and the ABA Institution Identifier (YYYY), and these are usually the same in both the fraction form and the MICR, with only the order and format switched (and left-padded with 0s to ensure that they are 4 digits long).

The prefix and the Federal Reserve Routing Symbol (XXXX) are determined by the bank's geographical location and treatment by the Federal Reserve type, while the remaining data (YYYY, and Branch number, if present) depends on the specific bank, and are unique within a Federal Reserve district.

In the cheque depicted above right, the fraction form is 11-3167/1210 (with 01 below it) and MICR form is 129131673 which are analyzed as follows:

- the prefix 11 corresponds to San Francisco,

- 3167 (common to both) is the ABA Institution Identifier,

- 1210 and 1291 are the Federal Reserve Routing Symbols (generally equal, here different probably due to obfuscation, see image file history for more information), with the initial "12" corresponding to the Federal Reserve Bank of San Francisco, the third digits ("1" and "9") corresponding to cheque processing centers, and the fourth digits ("0" and "1") corresponding to where the bank is located – "0" indicates "in the Federal Reserve city of San Francisco", while "1" indicates "in the state of California".

- the final "3" in the MICR is the cheque digit, and

- the "01" below the fraction form is the branch number.

In the case of a MICR line that is illegible or torn, the cheque can still be processed without the cheque digit. Typically, a repair strip or sleeve is attached to the cheque, then a new MICR line is imprinted. Either 021200025 or 0212-0002 (with a hyphen, but no cheque digit) may be printed, and both are 9 digits. The former (with cheque digit) is preferred to ensure better accuracy, but requires computing the cheque digit, while the latter is easily determined by inspection of the fraction, with minimal clerical handlings.

MICR Routing number format

The MICR routing number consists of 9 digits:

- XXXXYYYYC

where XXXX is Federal Reserve Routing Symbol, YYYY is ABA Institution Identifier, and C is the Check Digit.

Federal Reserve

The Federal Reserve uses the ABA RTN system for processing its customers' payments. The ABA RTNs were originally assigned in the systematic way outlined below, reflecting a financial institution's geographical location and internal handling by the Federal Reserve. Following consolidation of the Federal Reserve's check processing facilities, and the consolidation in the banking industry, the RTN a financial institution uses may not reflect the "Fed District" where the financial institution's place of business is located. Check processing is now centralized at the Federal Reserve Bank of Atlanta.[4]

First two digits

The first two digits of the nine digit RTN must be in the ranges 00 through 12, 21 through 32, 61 through 72, or 80.

The digits are assigned as follows:

- 00 is used by the United States Government

- 01 through 12 are the "normal" routing numbers, and correspond to the 12 Federal Reserve Banks. For example, 0260-0959-3 is the routing number for Bank of America incoming wires in New York, with the initial "02" indicating the Federal Reserve Bank of New York.

- 21 through 32 were assigned only to thrift institutions (e.g. credit unions and savings banks) through 1985, but are no longer assigned (thrifts are assigned normal 01–12 numbers). Currently they are still used by the thrift institutions, or their successors, and correspond to the normal routing number, plus 20. (For example, 2260-7352-3 is the routing number for Grand Adirondack Federal Credit Union in New York, with the initial "22" corresponding to "02" (New York Fed) plus "20" (thrift).)

- 61 through 72 are special purpose routing numbers designated for use by non-bank payment processors and clearinghouses and are termed Electronic Transaction Identifiers (ETIs), and correspond to the normal routing number, plus 60.

- 80 is used for traveler's cheques

The first two digits correspond to the 12 Federal Reserve Banks as follows:

| Primary (01–12) |

Thrift (+20) |

Electronic (+60) |

Federal Reserve Bank |

|---|---|---|---|

| 01 | 21 | 61 | Boston |

| 02 | 22 | 62 | New York |

| 03 | 23 | 63 | Philadelphia |

| 04 | 24 | 64 | Cleveland |

| 05 | 25 | 65 | Richmond |

| 06 | 26 | 66 | Atlanta |

| 07 | 27 | 67 | Chicago |

| 08 | 28 | 68 | St. Louis |

| 09 | 29 | 69 | Minneapolis |

| 10 | 30 | 70 | Kansas City |

| 11 | 31 | 71 | Dallas |

| 12 | 32 | 72 | San Francisco |

Third and fourth digits

The third digit corresponds to the Federal Reserve check processing center originally assigned to the bank,[4] while the fourth digit is "0" if the bank is located in the Federal Reserve city proper, and otherwise is 1–9, according to which state in the Federal Reserve district it is.[4]

ABA Institution Identifier

The fifth through eighth digits constitute the bank's unique ABA identity within the given Federal Reserve district.[4]

Check digit

The ninth, check digit provides a checksum test using a position-weighted sum of each of the digits. High-speed check-sorting equipment will typically verify the checksum and if it fails, route the item to a reject pocket for manual examination, repair, and re-sorting. Mis-routings to an incorrect bank are thus greatly reduced.

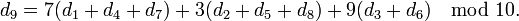

The following condition must hold:[1]

-

- (Mod or modulo is the remainder of a division operation.)

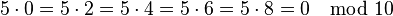

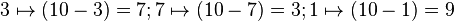

In terms of weights, this is 371 371 371. This allows one to catch any single-digit error (incorrectly inputting one digit), together with most transposition errors. 1, 3, and 7 are used because they (together with 9) are coprime to 10; using a coefficient that is divisible by 2 or 5 would lose information (because  ), and thus would not catch some substitution errors. These do not catch transpositions of two digits that differ by 5 (0 and 5, 1 and 6, 2 and 7, 3 and 8, 4 and 9), but captures other transposition errors.

), and thus would not catch some substitution errors. These do not catch transpositions of two digits that differ by 5 (0 and 5, 1 and 6, 2 and 7, 3 and 8, 4 and 9), but captures other transposition errors.

As an example, consider 111000025 (which is a valid routing number of Bank of America in Virginia). Applying the formula, we get:

The following formula can be used to generate the ninth digit in the checksum:

This is just moving all terms other than  to the right hand side of the equation, which inverts the coefficients with respect to 10 (

to the right hand side of the equation, which inverts the coefficients with respect to 10 ( ).

).

Following the above example for the Bank of America routing number 111000025,

This checksum is very easy to represent in computer programming languages. The following Python example will print "True" when the checksum is valid:

d = "111000025"

d = [int(c) for c in d]

checksum = ( # do the math!

7 * (d[0] + d[3] + d[6]) +

3 * (d[1] + d[4] + d[7]) +

9 * (d[2] + d[5])

) % 10

print(d[8] == checksum)

Routing symbol

The symbol that delimits a routing transit number is the MICR E-13B transit character (Unicode value U+2446): ⑆

If your computer cannot display this character, it may be seen here.

Fraction form

The fraction form looks like a fraction, with a numerator and a denominator.

The numerator consists of two parts separated by a dash. The prefix (no longer used in check processing, yet still printed on most checks) is a 1 or 2 digit code (P or PP) indicating the region where the bank is located. The numbers 1 to 49 are cities, assigned by size of the cities in 1910. The numbers 50 to 99 are states, assigned in a rough spatial geographic order, and are used for banks located outside one of the 49 numbered cities.

The second part of the numerator (after the dash) is the bank's ABA Institution Identifier, which also forms digits 5 to 8 of the nine digit routing number (YYYY).

The denominator is also part of the routing number; by adding leading zeroes to make up four digits where necessary (e.g. 212 is written as 0212, 31 is written as 0031, etc.), it forms the first four digits of the routing number (XXXX).

There might also be a fourth element printed to the right of the fraction: this is the bank's branch number. It is not included in the MICR line. It would only be used internally by the bank, e.g. to show where the signature card is located, where to contact the responsible officer in case of an overdraft, etc.

For example, a check from Wachovia Bank in Yardley, PA, has a fraction of 55-2/212 and a routing number of 021200025. The prefix (55) no longer has any relevance, but from the remainder of the fraction, the first 8 digits of the routing number (02120002) can be determined, and the check digit (the last digit, 5 in this example) can be calculated by using the check digit formula (thus giving 021200025).

ABA Prefix Table

This table is up to date as of 2009. One weakness of the current routing table arrangement is that Alaska, American Samoa, Guam, Hawaii, Puerto Rico and the US Virgin Islands share the same routing code.

| prefix | location |

|---|---|

| 1 | New York, NY |

| 2 | Chicago, IL |

| 3 | Philadelphia, PA |

| 4 | St. Louis, MO |

| 5 | Boston, MA |

| 6 | Cleveland, OH |

| 7 | Baltimore, MD |

| 8 | Pittsburgh, PA |

| 9 | Detroit, MI |

| 10 | Buffalo, NY |

| 11 | San Francisco, CA |

| 12 | Milwaukee, WI |

| 13 | Cincinnati, OH |

| 14 | New Orleans, LA |

| 15 | Washington D.C. |

| 16 | Los Angeles, CA |

| 17 | Minneapolis, MN |

| 18 | Kansas City, MO |

| 19 | Seattle, WA |

| 20 | Indianapolis, IN |

| 21 | Louisville, KY |

| 22 | St. Paul, MN |

| 23 | Denver, CO |

| 24 | Portland, OR |

| 25 | Columbus, OH |

| 26 | Memphis, TN |

| 27 | Omaha, NE |

| 28 | Spokane, WA |

| 29 | Albany, NY |

| 30 | San Antonio, TX |

| 31 | Salt Lake City, UT |

| 32 | Dallas, TX |

| 33 | Des Moines, IA |

| 34 | Tacoma, WA |

| 35 | Houston, TX |

| 36 | St. Joseph, MO |

| 37 | Fort Worth, TX |

| 38 | Savannah, GA |

| 39 | Oklahoma City, OK |

| 40 | Wichita, KS |

| 41 | Sioux City, IA |

| 42 | Pueblo, CO |

| 43 | Lincoln, NE |

| 44 | Topeka, KS |

| 45 | Dubuque, IA |

| 46 | Galveston, TX |

| 47 | Cedar Rapids, IA |

| 48 | Waco, TX |

| 49 | Muskogee, OK |

| 50 | New York |

| 51 | Connecticut |

| 52 | Maine |

| 53 | Massachusetts |

| 54 | New Hampshire |

| 55 | New Jersey |

| 56 | Ohio |

| 57 | Rhode Island |

| 58 | Vermont |

| 59 | Alaska, American Samoa, Guam, Hawaii, Puerto Rico, Virgin Islands |

| 60 | Pennsylvania |

| 61 | Alabama |

| 62 | Delaware |

| 63 | Florida |

| 64 | Georgia |

| 65 | Maryland |

| 66 | North Carolina |

| 67 | South Carolina |

| 68 | Virginia |

| 69 | West Virginia |

| 70 | Illinois |

| 71 | Indiana |

| 72 | Iowa |

| 73 | Kentucky |

| 74 | Michigan |

| 75 | Minnesota |

| 76 | Nebraska |

| 77 | North Dakota |

| 78 | South Dakota |

| 79 | Wisconsin |

| 80 | Missouri |

| 81 | Arkansas |

| 82 | Colorado |

| 83 | Kansas |

| 84 | Louisiana |

| 85 | Mississippi |

| 86 | Oklahoma |

| 87 | Tennessee |

| 88 | Texas |

| 90 | California |

| 91 | Arizona |

| 92 | Idaho |

| 93 | Montana |

| 94 | Nevada |

| 95 | New Mexico |

| 96 | Oregon |

| 97 | Utah |

| 98 | Washington |

| 99 | Wyoming |

| 101 | Assigned |

Canadian transit number

Canadian transit numbers are regulated by the Canadian Payments Association. A number has the following form:

- XXXXX-YYY

where XXXXX is a Branch Number, and YYY is an Institution Number. The dash between the branch number and the institution number is an integral part of the transit number. This format is only valid for paper-type transactions such as cheques. For Electronic Fund Transactions (EFT) the current format is a leading zero, the institution number, then the branch number all with no dashes. For example if a cheque reads XXXXX-YYY, the corresponding EFT code would be 0YYYXXXXX.

As a general rule, Bank institution numbers start with 0, 2, 3, or 6, Credit Union and Caisse Populaire institution numbers start with 8, and Trust Company institution numbers with 5.

Examples:

- XXXXX-001 Bank of Montreal

- XXXXX-002 Bank of Nova Scotia

- XXXXX-003 Royal Bank of Canada

- XXXXX-004 Toronto-Dominion Bank (which is the legal name for the bank, although it operates as TD Canada Trust)

- XXXXX-006 National Bank of Canada

- XXXXX-010 Canadian Imperial Bank of Commerce (includes President's Choice Financial)

- XXXXX-016 HSBC Canada

- XXXXX-030 Canadian Western Bank

- XXXXX-039 Laurentian Bank of Canada

- XXXXX-117 Government of Canada (Not listed as a member of the Canadian Payments Association)

- XXXXX-127 Canada Post (money orders)

- XXXXX-177 Bank of Canada (Canadian central bank)

- XXXXX-219 ATB Financial

- XXXXX-241 Bank of America Canada

- XXXXX-245 The Bank of Tokyo-Mitsubishi UFJ (Canada)

- XXXXX-250 BNP Paribas (Canada)

- XXXXX-260 Citibank Canada

- XXXXX-269 Mega International Commercial Bank Canada

- XXXXX-270 JPMorgan Chase Bank, N.A. (Toronto Branch)

- XXXXX-275 Korea Exchange Bank of Canada

- XXXXX-290 UBS Bank (Canada)

- XXXXX-294 State Bank of India (Canada)

- XXXXX-307 Industrial and Commercial Bank of China (Canada)

- XXXXX-308 Bank of China (Canada)

- XXXXX-309 Citizens Bank of Canada (Canada)

- XXXXX-315 CTC Bank of Canada

- XXXXX-332 First Commercial Bank

- XXXXX-326 President's Choice Financial (no longer assigned, now shares XXXXX-010 code with CIBC. Specifically, 30800-010, as there is only one PCF branch.)

- XXXXX-338 Canadian Tire Bank

- XXXXX-340 ICICI Bank Canada

- XXXXX-355 SHINHAN Bank Canada

- XXXXX-509 The Canada Trust Company (in use for accounts opened prior to the merger of TD & Canada Trust)

- XXXXX-540 Manulife Bank

- XXXXX-614 Tangerine Bank (formerly ING Direct Canada)

- XXXXX-809 [Central 1 [Credit Union] - BC Region]

- XXXXX-815 Caisses Desjardins du Québec

- XXXXX-819 Caisses populaires Desjardins du Manitoba

- XXXXX-828 [Central 1 [Credit Union] - ON Region]

- XXXXX-829 Caisses populaires Desjardins de l'Ontario

- XXXXX-837 Meridian Credit Union (formerly Hepco)

- XXXXX-839 Credit Union Heritage (Nova Scotia)

- XXXXX-865 Caisses populaires Desjardins acadiennes

- XXXXX-879 Credit Union Central of Manitoba

- XXXXX-889 Credit Union Central of Saskatchewan

- XXXXX-899 Credit Union Central Alberta

- XXXXX-900 ?

In a Canadian bank transit number, the last digit of the branch number, with few exceptions, indicates the geographical location of the branch.

Branch numbers ending with:

- 0 are located in British Columbia and Yukon

- 1 are located in Western Québec including Montreal and surrounding areas

- 2 are located in Ontario including Toronto and surrounding area

- 3 are located in Nova Scotia, Prince Edward Island and Newfoundland excluding Labrador

- 4 are located in New Brunswick

- 5 are located in Eastern Québec including Labrador

- 6 are located in Eastern Ontario including Ottawa and surrounding area

- 7 are located in Manitoba and North-Western Ontario

- 8 are located in Saskatchewan

- 9 are located in Alberta, the Northwest Territories and Nunavut

For example, the number 58876-004 indicates that the associated account is held at an Eastern Ontario branch of The Toronto-Dominion Bank (58876 is the transit number, 5887 is the branch number and 004 is the institution number).

The Canadian Payments Association maintains the Financial Institutions File (FIF) as well as the Financial Institutions Branch Directory (FIBD). The FIF and the FIBD identify routing numbers and addresses for branches of all Canadian financial institutions (whether they have a physical location or a virtual location).

The FIF, which is updated weekly, is a fee-based subscription service that enables its subscribers to validate routing information and to upload the information in a variety of business applications. More details, including available formats and pricing can be found here: cdnpay.ca

The Financial Institutions Branch Directory, also updated weekly, contains the same information found in the FIF and is available free of charge. It is recommended for occasional reference as it cannot be uploaded into business applications and doesn't offer the same validation features as the FIF. The FIBD is accessible at cdnpay.ca.

See also

General Category

- Bank card number - Used as Bank Identification Number

- Bank code discusses formats used by other countries and regions.

- Bank State Branch, or BSB code used for Australian banks

- International Bank Account Number

- ISO 9362, the SWIFT/BIC code standard

- Magnetic ink character recognition - How RTN's are printed

- Sort code, used by British banks

Canada has similar but different transaction routing structures

- Interac

- Large Value Transfer System (Canada)

References

- "Training Page: Learning the Bank Numbering System", Bankers' Hotline 14 (1), March 2004, retrieved 2010-04-08

- Burnett, John (March 21, 2005), Bank Routing Number, BankersOnline, retrieved 2010-04-08

External links

- Official ABA Routing Number Policy (PDF File)

- Federal Reserve Districts

- Find banks' ABA numbers or which bank owns a given ABA number - limited to Fedwire participants.

- Federal Reserve E-Payments Routing Directory - downloadable lists of Fedwire and FedACH participants. They include routing numbers, street addresses and phone numbers.