The Royal Bank of Scotland Group

| |

| Public limited company | |

| Traded as |

LSE: RBS NYSE: RBS |

| Industry |

Banking Financial services |

| Founded | 1727 |

| Headquarters |

Edinburgh, Scotland, United Kingdom |

Area served | Worldwide |

Key people |

Sir Philip Hampton (Chairman) Sir Howard Davies (Non-Executive Chairman) Ross McEwan (Group Chief Executive)[1] |

| Products |

Finance and insurance Consumer Banking Corporate Banking Investment Banking Private banking Mortgages Credit Cards |

| Revenue | £15.150 billion (2014)[2] |

| £2.643 billion (2014)[2] | |

| £0.734 billion (2014)[2] | |

| Total assets | £1.051 trillion (2014)[2] |

| Total equity | £60.2 billion (2014)[2] |

| Owner | UK Financial Investments (73%)[3] |

Number of employees | 108,700 (2014)[4] |

| Subsidiaries |

The Royal Bank of Scotland NatWest Ulster Bank Coutts Adam and Company Child & Co. RBS Securities Drummonds Bank and many more |

| Website |

www |

|

Footnotes / references Here or You/ make it happen | |

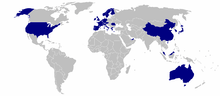

The Royal Bank of Scotland Group plc (also known as RBS Group) is a British banking and insurance holding company, based in Edinburgh, Scotland. The group operates a wide variety of banking brands offering personal and business banking, private banking, insurance and corporate finance through its offices located in Europe, North America and Asia. In the UK and Ireland, its main subsidiary companies are The Royal Bank of Scotland,[5] NatWest, Ulster Bank and Coutts.[6] The group issues banknotes in Scotland and Northern Ireland and, as of 2014, The Royal Bank of Scotland is the only bank in the UK to still print £1 notes.[7]

Outside the UK, from 1988 to 2015 it owned Citizens Financial Group, the 13th largest bank in the United States, and from 2004 to 2009 it was the second largest shareholder in the Bank of China, itself the world's fifth largest bank by market capitalisation in February 2008.[8]

Before the 2008 collapse and the general financial crisis, RBS Group was very briefly the largest bank in the world and for a period was the second largest bank in the UK and Europe (fifth in stock market value), and the fifth largest in the world by market capitalisation. Subsequently, with a slumping share price and major loss of confidence, the bank fell sharply in the rankings, although in 2009 it was briefly the world's largest company by both assets (£1.9 trillion) and liabilities (£1.8 trillion).[9] It received significant support from the UK government, which, as of August 2015, holds and manages a 73% stake through UK Financial Investments (UKFI).[3]

The Group had a market capitalisation of approximately £20.4 billion as of 4 March 2014, making it the 26th largest company on the London Stock Exchange.[10] In addition to its primary share listing on the LSE, the company is also listed on the New York Stock Exchange.

History

By 1969, economic conditions were becoming more difficult for the banking sector. In response, the National Commercial Bank of Scotland merged with the Royal Bank of Scotland.[11] The resulting company had 662 branches. The merger resulted in a new holding company, National and Commercial Banking Group Ltd. The English and Welsh branches were reorganised, until 1985, as Williams & Glyn's Bank, while the Scottish branches all transferred to the Royal Bank name. The holding company was renamed The Royal Bank of Scotland Group in 1979.[12]

Takeover bids

During the late 1970s and early 1980s the Royal Bank was the subject of three separate takeover approaches. In 1979, Lloyds Bank, which had previously built up a 16.4% stake in the Royal Bank, made a takeover approach for the remaining shares it did not own. The offer was rejected by the board of directors on the basis that it was detrimental to the bank's operations. However, when the Standard Chartered Bank proposed a merger with the Royal Bank in 1980, the board responded favourably. Standard Chartered Bank was headquartered in London, although most of its operations were in the Far East, and the Royal Bank saw advantages in creating a truly international banking group. Approval was received from the Bank of England, and the two banks agreed a merger plan that would have seen the Standard Chartered acquire the Royal Bank and keep the UK operations based in Edinburgh. However, the bid was scuppered by the Hongkong and Shanghai Banking Corporation (HSBC) which tabled a rival offer. The bid by HSBC was not backed by the Bank of England and was subsequently rejected by the Royal Bank's board. However the British government referred both bids to the Monopolies and Mergers Commission; both were subsequently rejected as being against the public interest.[13]

The Bank did obtain an international partnership with Banco Santander Central Hispano of Spain, each bank taking a 5% stake in the other. However this arrangement ended in 2005, when Banco Santander Central Hispano acquired UK bank Abbey National – and both banks sold their respective shareholdings.

International expansion

The first international office of the bank was opened in New York in 1960. Subsequent international banks were opened in Chicago, Los Angeles, Houston and Hong Kong. In 1988 the bank acquired Citizens Financial Group, a bank based in Rhode Island, United States. Since then, Citizens has acquired several other American banks and in 2004 acquired Charter One Bank to become the 8th largest bank in the United States.

The Royal Bank also opened offices in Europe and now has subsidiaries in: Austria, Switzerland, France, Italy, Germany, Greece, Spain, Poland, Portugal, Denmark, Norway, Sweden, Romania and the Federation of Bosnia and Herzegovina. In the Asia-Pacific region, the bank has offices in: Australia, China, Hong Kong, India, Japan and Singapore.

On 27 February 2014 after reporting a 2013 loss of £9bn the bank announced it would scale back its international presence. "Let me spell it out very clearly: the days when RBS sought to be the biggest bank in the world, those days are well and truly over," Chief Executive Ross McEwan, who had been in charge of the bank for four months, said in unveiling plans to reduce costs by £5bn over four years. "Our ambition is to be a bank for U.K. customers," he added.[14]

National Westminster Bank

The late 1990s saw a new wave of consolidation in the financial services sector. In 1997, RBS formed a joint venture to set up Tesco Bank.[15][16] In 1999, the Bank of Scotland launched a hostile takeover bid for English rival NatWest. The Bank of Scotland intended to fund the deal by selling off many of the NatWest’s subsidiary companies, including Ulster Bank and Coutts. However, the Royal Bank subsequently tabled a counter-offer, sparking off the largest hostile takeover battle in UK corporate history. A key differentiation from the Bank of Scotland’s bid was the Royal Bank’s plan to retain all of NatWest’s subsidiaries. Although NatWest, one of the "Big 4" English clearing banks, was significantly larger than either Scottish bank, it had a recent history of poor financial performance and plans to merge with insurance company Legal & General were not well received, prompting a 26% fall in share price.[17]

On 11 February 2000, The Royal Bank of Scotland was declared the winner in the takeover battle, becoming the second largest banking group in the UK after HSBC Holdings. NatWest and the Royal Bank of Scotland became subsidiaries of the holding company; The Royal Bank of Scotland Group. NatWest as a distinct banking brand was retained, although many back office functions of the bank were merged with the Royal Bank's leading to over 18,000 job losses throughout the UK.[18]

Further expansion

In 1967, RBS became the first Scottish bank to install an Automated Teller Machine (cashpoint) and by 1980 the service, known as Cashline had become the busiest ATM network in the world. As of 2012, it was the largest privately owned ATM network in the UK and a member of the LINK ATM network. In 1997, RBS was the first bank in the world to make its ATMs available to all cardholders. The word Cashline, in Scotland at least, has become a generic term for an ATM.

In August 2005, the bank expanded into China, acquiring a 10% stake in the Bank of China for £1.7 billion.[19]

A new international headquarters was built at Gogarburn on the outskirts of Edinburgh, and was opened by Queen Elizabeth II and Prince Philip, Duke of Edinburgh in 2005.[20]

The Group was part of a consortium with Belgian bank Fortis and Spanish bank Banco Santander that acquired Dutch bank ABN AMRO a on 10 October 2007. Rivals speculated that RBS had overpaid for the Dutch bank[21] although the bank pointed out that of the £49bn paid for ABN AMRO, RBS's share was only £10bn (equivalent to £167 per citizen of the UK).[22]

Coutts Bank's international businesses were renamed RBS Coutts on 1 January 2008 until 2011, when it was renamed Coutts & Co. Limited[23]

2008–2009 financial crisis

After previous denials following press coverage,[22] on 22 April 2008 RBS announced a rights issue which aimed to raise £12bn in new capital to offset a writedown of £5.9bn resulting from credit market positions and to shore up its reserves following the purchase of ABN AMRO. This was, at the time, the largest rights issue in British corporate history.[24]

The bank also announced that it would review the possibility of divesting some of its subsidiaries to raise further funds, notably its insurance divisions Direct Line and Churchill.[25] Additionally, the bank's stake in Tesco Bank was bought by Tesco for £950 million in 2008.[15][16]

On 13 October 2008, in a move aimed at recapitalising the bank, it was announced that the British Government would take a stake of up to 58% in the Group. The aim was to "make available new tier 1 capital to UK banks and building societies to strengthen their resources permitting them to restructure their finances, while maintaining their support for the real economy, through the recapitalisation scheme which has been made available to eligible institutions".[26] A rights issue to existing shareholders having failed to secure more than minimal take-up, the government subsequently found itself owning more than 57% of the bank's equity share capital.

The Treasury would inject £37 billion ($64 billion, €47 billion, equivalent to £617 per citizen of the UK) of new capital into Royal Bank of Scotland Group plc, Lloyds TSB and HBOS plc, to avert financial sector collapse. The government stressed, however, that it was not "standard public ownership" and that the banks would return to private investors "at the right time".[27][28]

Alistair Darling, the Chancellor of the Exchequer, stated that UK taxpayers would benefit from the government's rescue plan, as it will have some control over RBS in exchange for £5 billion in preference shares and underwriting the issuance of a further £15 billion in ordinary shares. If shareholder take-up of the share issue was 0%, then total government ownership in RBS would be 58%; and, if shareholder take-up was 100%, then total government ownership in RBS would be 0%.[29] Less than 56 million new shares were taken up by investors, or 0.24pc of the total offered by RBS in October 2008.[30]

As a consequence of this rescue, the Chief Executive of the group Fred Goodwin offered his resignation and it was duly accepted. Chairman Sir Tom McKillop confirmed that he would stand down from that role when his contract expired in March 2009. Goodwin was replaced by Stephen Hester, previously the Chief Executive of British Land, who commenced at the Royal Bank of Scotland in November 2008.[31]

On 19 January 2009, the British Government announced a further injection of funds into the UK banking system in an attempt to restart personal and business lending. This would involve the creation of a state-backed insurance scheme which would allow banks to insure against existing loans going into default, in an attempt to restore the banks' confidence.[32]

At the same time the government announced its intention to convert the preference shares in RBS that it had acquired in October 2008 to ordinary shares. This would remove the 12% coupon payment (£600m p.a) on the shares but would increase the state's holding in the bank from 58% to 70%.[33]

On the same day RBS released a trading statement in which it expected to post full-year trading losses (before writedowns) of between £7bn and £8bn. The group also announced writedowns on goodwills (primarily related to the takeover of Dutch bank ABN-AMRO) of around £20bn. The combined total of £28bn would be the biggest ever annual loss in UK corporate history (the actual figure was £24.1bn). As a result, the group's share price fell over 66% in one day to 10.9p per share, from a 52-week high of 354p per share, itself a drop of 97%.[33] Some commentators called this the Blue Monday Crash.

Mid-2008 onwards

RBS' contractual commitment to retain the 4.26% Bank of China (BoC) stake ended on 31 December 2008, and the shares were sold on 14 January 2009. Exchange rate fluctuations meant that RBS made no profit on the deal. The Scottish press suggested two reasons for the move: the need for a bank mainly owned by HM Treasury to focus scarce capital on British markets, and the growth possibility of RBS's own China operations.[34][35] However, Chinese sources noted that BoC had been unhappy with RBS' continued expansion of mainland operations rivalling BoC in the highly profitable wealth management sector.

Also in March 2009, RBS revealed that its traders had been involved in the purchase and sale of sub-prime securities under the supervision of Fred Goodwin.[36]

In September 2009, RBS and NatWest announced dramatic cuts in their overdraft fees including the unpaid item fee (from £38 to £5), the card misuse fee (from £35 to £15) and the monthly maintenance charge for going overdrawn without consent (from £28 to £20).[37] The cuts came at a time when the row over the legality of unauthorised borrowing reached the House of Lords. The fees were estimated to earn current account providers about £2.6bn a year.[38] The Consumers' Association chief executive, Peter Vicary-Smith, said: "This is a step in the right direction and a victory for consumer pressure."[37]

In November 2009, RBS announced plans to cut 3,700 jobs in addition to 16,000 already planned, while the government increased its stake in the company from 70% to 84%.[39]

In December 2009, the RBS board revolted against the main shareholder, the British government. They threatened to resign unless they were permitted to pay bonuses of £1.5bn to staff in its investment arm.[40]

More than 100 senior bank executives at the Royal Bank of Scotland were paid more than £1 million in late 2010 and total bonus payouts reached nearly £1 billion – even though the bailed-out bank reported losses of £1.1 billion for 2010. Unions were baffled that any bankers were getting bonuses, considering the bank is owned by the taxpayer. The 2010 figure was an improvement on the loss of £3.6 billion in 2009 and the record-breaking £24bn loss in 2008. The bonuses for staff in 2010 topped £950 million. The CEO Stephen Hester got £8 million in payments for the year.[41]

In October 2011, Moody's downgraded the credit rating of 12 UK financial firms including RBS blaming financial weakness.[42]

In January 2012, there was press controversy about Hester's bonus—Hester was offered share options with a total value of £963,000 that would be held in long-term plans, and only paid out if he met strict and tough targets. If he failed to do this, it would be clawed-back. The Treasury permitted the payment because they feared the resignation of Hester and much of the board if the payment was vetoed by the government as the majority shareholder.[43] After a large amount of criticism[44][45][46][47][48] in the press, news emerged of Chairman Sir Philip Hampton turning down his own bonus of £1.4 million several weeks before the controversy.[45] Hester, who had been on holiday in Switzerland at the time, turned down his own bonus shortly after.[49]

In June 2012 a failure of an upgrade to payment processing software meant that a substantial proportion of customers could not transfer money to or from their accounts. This meant that RBS had to open a number of branches on a Sunday – the first time that they had had to do this.[50] RBS set aside £125m to cover customer compensation and costs for the incident. RBS was subsequently fined £56m for this incident. The majority of those affected were retail customers.

RBS released a statement on 12 June 2013 that announced a transition in which CEO Stephen Hester will stand down in December 2013 for the financial institution "to return to private ownership by the end of 2014". For his part in the procession of the transition, Hester will receive 12 months' pay and benefits worth £1.6 million, as well as the potential for £4 million in shares. The RBS stated that, as of the announcement, the search for Hester's successor would commence.[51] Ross McEwan, the head of retail banking at RBS, was selected to replace Hester in July 2013.[52]

Restructuring

In June 2008 RBS sold the subsidiary Angel Trains for £3.6bn as part of an assets sale to raise cash.[53]

In March 2009, RBS announced the closure of its tax avoidance department, which had helped it avoid £500m of tax by channelling billions of pounds through securitised assets in tax havens such as the Cayman Islands. The closure was partly due to a lack of funds to continue the measures, and partly due to the 84% taxpayer stake in the bank.[54]

On 29 March 2010, GE Capital acquired Royal Bank of Scotland’s factoring business in Germany. GE Capital signed an agreement with the Royal Bank of Scotland plc (RBS) to acquire 100% of RBS Factoring GmbH, RBS’s factoring and invoice financing business in Germany, for an undisclosed amount. The transaction is subject to a number of conditions, including regulatory approval.[55]

Due to pressure from the UK government to shut down risky operations and prepare for tougher international regulations, in January 2012 the bank announced it would cut another 4,450 jobs and close its loss-making cash equities, corporate broking, equity capital markets, and mergers and acquisitions businesses. The move brought the total number of jobs cut since the bank was bailed out in 2008 to 34,000.[56][57]

RBS sold its remaining stake in Citizens Financial Group in October 2015, having progressively reduced its stake through an initial public offering (IPO) started in 2014.[58]

Williams & Glyn divestment

As a condition of the British Government purchasing an 81% shareholding in the group, the European Commission ruled that the group sell a portion of its business, as the purchase was categorised as state aid. In August 2010, the group reached an agreement to sell 318 branches to Santander UK, made up of the RBS branches in England and Wales and the NatWest branches in Scotland.[59] Santander withdrew from the sale on 12 October 2012.[60]

During 2012, RBS separated its insurance business from the main group to form the Direct Line Group,[61] made up of several well-known brands including Direct Line and Churchill. RBS sold a 30% holding in the group through an initial public offering in October 2012.[62] Further shares sales in 2013 reduced RBS' holding to 28.5% by September 2013,[63] and RBS sold its remaining shares in February 2014.[64]

In September 2013, the group confirmed it had reached an agreement to sell 314 branches to the Corsair consortium, made up of private equity firms and a number of institutional investors, including the Church Commissioners, which controls the property and investment assets of the Church of England . The branches, incorporating 250,000 small business customers, 1,200 medium business customers and 1.8 million personal banking customers, are due to separated from the group in 2016 as a standalone business. The new company will trade as an ethical bank,[65] using the dormant Williams & Glyn's brand.[66]

Group structure

The RBS Group is split into three main customer-facing divisions, each with several subsidiary businesses, and it also has a number of support functions.[67]

Personal & Business Banking

The division comprises retail and business banking. In the United Kingdom, the group trades under both the NatWest and Royal Bank of Scotland names. Key subsidiaries include:

Commercial & Private Banking

This division serves UK corporate and commercial customers, from SMEs to UK based multi nationals, and is the largest provider of banking, finance and risk management services to UK corporate and commercial customers.

Key private banking subsidiaries of the RBS Group include:

Corporate & Institutional Banking

This division, commonly referred to as the investment banking arm of the RBS Group, provides banking services and integrated financial solutions to major corporations and financial institutions around the world. CIB's areas of strength are debt financing, risk management, and investment and advisory services. It also offers clients extensive capabilities in transaction banking. RBS Securities is a key subsidiary, operating in the United States.

Support functions

Sometimes referred to as the 'invisible division', Business Services provides many essential services to the Group alongside Human Resources. Business Services provides a diverse range of services to the customer-facing operations of the Group and comprises:

- Group Operations, which shapes and executes service delivery for customers

- Technology Services, which designs, builds, implements and supports global technology related services for the Group

- Group Property, which provides support, guidance, and day-to-day property services and advice to all divisions, globally, on property related matters

- Corporate Security Services, which provides support and advice to protect the business, information and people against key security and fraud threats

- Group Sourcing & Vendor Management, the RBS Group's procurement function

Several other group support functions also exist, covering: internal audit, finance, risk, strategy, HR, restructuring, legal and communications.

Branding

The RBS Group uses branding developed for the Bank on its merger with the National Commercial Bank of Scotland in 1969.[68] The Group's logo takes the form of an abstract symbol of four inward-pointing arrows known as the "Daisy Wheel" and is based on an arrangement of 36 piles of coins in a 6 by 6 square,[68] representing "the accumulation and concentration of wealth by the Group".[68]

Controversies

Media commentary and criticism

During Goodwin's tenure as CEO he attracted some criticism for lavish spending, including on the construction of a £350m headquarters in Edinburgh opened by the Queen in 2005[69] and $500m headquarters in the US begun in 2006,[70] and the use of a Dassault Falcon 900 jet owned by leasing subsidiary Lombard for occasional corporate travel.[71] Revelations that RBS had spent £200m on celebrity endorsements also went down badly.[72]

In February 2009 RBS reported that while Fred Goodwin was at the helm it had posted a loss of £24.1bn, the biggest loss in UK corporate history.[73] His responsibility for the expansion of RBS, which led to the losses, has drawn widespread criticism. His image was not enhanced by the news that emerged in questioning by the Treasury Select Committee of the House of Commons on 10 February 2009, that Goodwin has no technical bank training, and has no formal banking qualifications.[74]

In January 2009 The Guardian's City editor Julia Finch identified him as one of twenty-five people who were at the heart of the financial meltdown.[75] Nick Cohen described Goodwin in The Guardian as "the characteristic villain of our day", who made £20m from RBS and left the taxpayer "with an unlimited liability for the cost of cleaning up the mess".[76] An online column by Daniel Gross labelled Goodwin "The World's Worst Banker",[70][77] a phrase echoed elsewhere in the media.[78][79] Gordon Prentice MP argued that his knighthood should be revoked as it is "wholly inappropriate and anomalous for someone to retain such a reward in these circumstances."[80]

Other members have also frequently been criticised as "fat cats" over their salary, expenses, bonuses and pensions.[81][82][83][84][85][86][87][88]

Fossil fuel financing

RBS was challenged over its financing of oil and coal mining by charities such as Platform London and Friends of the Earth. In 2007, RBS was promoting itself as "The Oil & Gas Bank", although the website www.oilandgasbank.com was later taken down.[89] A Platform London report criticised the bank's lending to oil and gas companies, estimating that the carbon emissions embedded within RBS' project finance reached 36.9 million tonnes in 2005, comparable to Scotland's carbon emissions.[90]

RBS provides the financial means for companies to build coal-fired power stations and dig new coal mines at sites throughout the world. RBS helped to provide an estimated £8 billion from 2006 to 2008 to energy corporation E.ON and other coal-utilising companies.[91] In 2012, 2.8% of RBS' total lending was provided to the power, oil and gas sectors combined. According to RBS' own figures, half of its deals to the energy sector were to wind power projects; although, this only included project finance and not general commercial loans.[92]

Huntingdon Life Sciences

In 2000 and 2001, staff of the bank were threatened over its provision of banking facilities for the animal testing company Huntingdon Life Sciences. The intimidation resulted in RBS withdrawing the company's overdraft facility, requiring the company to obtain alternative funding within a tight deadline.[93][94]

Canadian oil sands

Climate Camp activists criticise RBS for funding firms which extract oil from Canadian oil sands.[95] The Cree aboriginal group describe RBS as being complicit in "the biggest environmental crime on the planet".[96] In 2012, 7.2% of RBS' total oil and gas lending was to companies who derived more than 10% of their income from oil sands operations.[92]

See also

- List of banks in the United Kingdom

- List of systemically important banks

- Systemically important financial institution

- Too big to fail

- European Financial Services Roundtable

- High-yield debt

- Inter-Alpha Group of Banks

References

- ↑ "People: Royal Bank of Scotland Group PLC". Reuters. Retrieved 8 February 2016.

- 1 2 3 4 5 "Preliminary Results 2014". Retrieved 21 March 2015.

- ↑ RBS: Employee Numbers

- ↑ The Scottish Gaelic name (Scottish Gaelic: Banca Rìoghail na h-Alba) is used by its retail banking branches in parts of Scotland, especially in signage and customer stationery.

- ↑ "The Royal Bank of Scotland". Scotbanks.org. Retrieved 18 April 2011.

- ↑ "Current Banknotes". Committee of Scottish Bankers. Retrieved 14 March 2014.

- ↑ "World's largest banks". Financialranks.com. 5 February 2008. Retrieved 18 April 2011.

- ↑ RBS et mon droit: HM deficits (FT Alphaville, accessed 20 January 2009)

- ↑ "FTSE All-Share Index Ranking". stockchallenge.co.uk. Retrieved 4 March 2014.

- ↑ "National Commercial Bank of Scotland Ltd, Edinburgh, 1959–69". RBS Heritage Online. The Royal Bank of Scotland Group plc. Retrieved 16 April 2010.

- ↑ "The Royal Bank of Scotland plc, Edinburgh, 1727-date". RBS Heritage Online. The Royal Bank of Scotland Group plc. Retrieved 16 April 2010.

- ↑ "The Hongkong and Shanghai Banking Corporation, Standard Chartered Bank Limited and The Royal Bank of Scotland Group Limited". Competition Commission. 2 September 2004. Retrieved 18 April 2011.

- ↑ "RBS unveils plan to reduce global presence after posting big loss". Scotland News.Net. Retrieved 2 March 2014.

- 1 2 "Tesco Pays £950m To Become Bank". Sky News. 28 July 2008. Retrieved 28 July 2008.

- 1 2 Thelwell, Emma; Butterworth, Myra (28 July 2008). "Tesco eyes mortgages and current accounts in plan to take on UK's high street banks". The Telegraph. Retrieved 28 July 2008.

- ↑ "NatWest takeover: a chronology". BBC News. 10 February 2000. Retrieved 10 April 2010.

- ↑ NatWest merger's mixed fortunes BBC News, 2000

- ↑ "RBS leads $3.1bn China investment". BBC News. 18 August 2005. Retrieved 10 April 2010.

- ↑ "New RBS headquarters". Scottish Government. 14 September 2005. Retrieved 17 March 2013.

- ↑ Sunderland, Ruth (8 October 2007). "Barclays boss: RBS overpaid for ABN Amro". The Guardian (London). Retrieved 10 April 2010.

- 1 2 "Does RBS’s acquisition of ABN AMRO really do what it says on the tin?". Cityam.com. Retrieved 18 April 2011.

- ↑ "Coutts to drop RBS brand". 30 October 2011. Retrieved 17 March 2013.

- ↑ "RBS rights issue". CNN. Archived from the original on 18 May 2008.

- ↑ "RBS sets out £12bn rights issue". BBC News. 22 April 2008. Retrieved 10 April 2010.

- ↑ "Treasury statement on financial support to the banking industry" (Press release). HM Treasury. 13 October 2008. Retrieved 14 October 2008.

- ↑ "Brown: We'll be rock of stability". BBC News. 13 October 2008. Retrieved 18 April 2011.

- ↑ Jones, Sarah (13 October 2008). "bloomberg.com, Stocks Rebound After Government Bank Bailout; Lloyds Gains". Bloomberg. Retrieved 18 April 2011.

- ↑ Hélène Mulholland (13 October 2008). "Darling: UK taxpayer will benefit from banks rescue". Guardian (UK). Retrieved 18 April 2011.

- ↑ RBS now 58% owned by UK Government Telegraph, 28 November 2008

- ↑ "It is a good time for Hester to quit property for RBS". Thisislondon.co.uk. 14 October 2008. Retrieved 18 April 2011.

- ↑ UK banking plan faces criticism BBC News, 19 January 2009

- 1 2 RBS shares plunge on loss BBC News, 19 January 2009

- ↑ "RBS confirms sale of £1.6bn China stake". Edinburgh Evening News. January (14). 2009.

- ↑ Martin Flanagan (2009). "RBS sells Bank of China stake in a clear sign that retrenchment rules". The Scotsman. January (14).

- ↑ Winnett, Robert (20 March 2009). "RBS traders hid toxic debt". The Daily Telegraph (UK). Retrieved 18 April 2011.

- 1 2 Jones, Rupert. "Royal Bank of Scotland and NatWest cut overdraft charges". The Guardian. 7 September 2009

- ↑ Osborne, Hilary. "Bank charges appeal reaches House of Lords". The Guardian 23 June 2009

- ↑ Jill Treanor (2 November 2009). "RBS axes 3,700 jobs as taxpayer stake hits 84%". Guardian (UK). Retrieved 18 April 2011.

- ↑ "RBS board could quit if government limits staff bonuses". BBC News. 3 December 2009. Retrieved 18 April 2011.

- ↑ Treanor, Jill (21 February 2011). "RBS bankers get £950 million in bonuses despite £1.1bn loss". Guardian Newspaper (London).

- ↑ UK financial firms downgraded by Moody's rating agency, BBC (7 October 2011)

- ↑ Treasury feared Hester and board would quit BBC 26 January 2012

- ↑ Stephen Hester bonus puts David Cameron under pressure Guardian, 27 January 2012

- 1 2 Sir Philip Hampton waives £1.4m share award The Telegraph, 28 January 2012

- ↑ RBS chairman waives share-based bonus Reuters, 28 January 2012

- ↑ David Cameron failed Borgen Test on Hester's Bonus Daily Mail, 30 January 2012

- ↑ Ed Miliband must block Hester's Bonus Metro, 22 January 2012

- ↑ RBS boss Stephen Hester waives bonus: reaction The Guardian, 30 January 2012

- ↑ "Natwest Branches Open On Sunday To Help Customers After Computer Glitch". The Huffington Post UK. Retrieved 21 March 2015.

- ↑ Robert Peston (12 June 2013). "Royal Bank of Scotland CEO Stephen Hester to stand down". BBC. Retrieved 13 June 2013.

- ↑ Patrick Jenkins (31 July 2013). "RBS selects McEwan as new chief". Financial Times. Retrieved 25 September 2014.

- ↑ "RBS sells off rail stock business". BBC News. 13 June 2008. Retrieved 20 September 2013.

- ↑ RBS avoided £500m of tax in global deals The Guardian, 13 March 2009

- ↑ "GE Capital Acquired Royal Bank of Scotland’s Factoring Business in Germany". Businesswire.co.uk. 29 March 2010. Retrieved 18 April 2011.

- ↑ "RBS to cut 3,500 jobs over 3 years". 13 January 2012.

- ↑ "RBS to cut 4,450 jobs in fresh jobs cull". Reuters. 12 January 2012.

- ↑ "RBS profits rise on Citizens sale". BBC News. October 30, 2015. Retrieved October 30, 2015.

- ↑ Wray, Richard (4 August 2010). "Santander overtakes HSBC as it buys 318 RBS branches". The Guardian.

- ↑ "RBS sale of 316 branches to Santander collapses". BBC News. 12 October 2012. Retrieved 20 September 2013.

- ↑ "Direct Line nears RBS separation". BBC News. 3 September 2012. Retrieved 20 September 2013.

- ↑ Steve Slater (13 March 2013). "RBS races ahead with Direct Line sell-off". Reuters. Retrieved 20 September 2013.

- ↑ "RBS makes £630m from sale of 20% of Direct Line". BBC News. 20 September 2013. Retrieved 20 September 2013.

- ↑ "RBS set to make £1bn from remaining Direct Line stake". BBC News. 26 February 2014. Retrieved 24 February 2015.

- ↑ "Church Commissioners Statement on RBS bid". The Church of England. 27 September 2013. Retrieved 7 October 2013.

- ↑ "RBS sells 314 bank branches to Corsair consortium". BBC News. 27 September 2013. Retrieved 29 September 2013.

- ↑ "Our customer businesses". The Royal Bank of Scotland Group. Retrieved 24 February 2015.

- 1 2 3 RBS.com | About Us| Our History | Exhibition Feature | Building the Brand Archived 15 March 2008 at the Wayback Machine

- ↑ The Scotsman, 14 September 2005, Queen opens £350m bank HQ

- 1 2 Slate, 1 December 2008 Who's the World's Worst Banker?

- ↑ The Times, 6 April 2004, Banking star brought down to earth over jet-set perk

- ↑ Daily Mail, 15 February 2009, RBS slammed as 'reckless' after spending £200million on celebrity figureheads

- ↑ The Guardian, 26 February 2009, RBS record losses raise prospect of 95% state ownership

- ↑ "Exchiefs of Royal Bank of Scotland And HBOS Admitted To Having No Formal Banking Qualifications (from The Herald )". Theherald.co.uk. Retrieved 27 February 2009.

- ↑ Julia Finch (26 January 2009). "Twenty-five people at the heart of the meltdown ... | Business". The Guardian (UK). Retrieved 27 February 2009.

- ↑ Cohen, Nick (18 January 2009). "It's not the poor the middle class really fear". The Guardian (UK). Retrieved 20 January 2009.

- ↑ "Economy: The World's Worst Banker | Newsweek Voices – Daniel Gross". Newsweek. 18 December 2008. Retrieved 27 February 2009.

- ↑ The Times, 20 January 2009, Hubris to nemesis: how Sir Fred Goodwin became the ‘world’s worst banker’

- ↑ The Journal, 26 January 2009, RBS's Fred Goodwin: the world's worst banker?

- ↑ "Ex-RBS chief 'should lose knighthood'". Politics.co.uk. Retrieved 27 February 2009.

- ↑ The Times, 13 October 2008, Brown targets fat cat pay after nationalising banks in £37 billion bailout

- ↑ The Mirror, 7 May 2009, RBS fat cat Gordon Pell given £10M pension pot

- ↑ The Sun, 15 October 2008, Fat cat bosses at crisis-hit bank RBS enjoy £150,000 party at top hotel days after £15billion government bail-out

- ↑ The Guardian, 13 January 2010, Stephen Hester's fat-cat flap

- ↑ The Independent, 19 April 2004, RBS braced for shareholder showdown over fat cat bonuses

- ↑ Evening Standard, 5 February 2009, Bailed-out bankers facing curbs on fat cat bonuses

- ↑ The Scotsman, 1 February 2010, Billy Bragg takes his fight to limit RBS bonuses to Speakers' Corner

- ↑ The Telegraph, 27 March 2009, A game in which people are encouraged to get their revenge on the former Royal Bank of Scotland chief Sir Fred Goodwin has gone viral.

- ↑ "Dirty Money: Corporate Greenwash & RBS coal finance" (PDF). Dirty Money: Corporate Greenwash & RBS coal finance. Platform. March 2011. Retrieved 13 February 2014.

- ↑ "The Oil & Gas Bank" (PDF). The Oil & Gas Bank. Platform. March 2007. Retrieved 13 December 2013.

- ↑ Terry Macalister (11 August 2008). "Climate change: High street banks face consumer boycott over investment in coal projects". Guardian (UK). Retrieved 18 April 2011.

- 1 2 "Energy sector lending". Royal Bank of Scotland. Royal Bank of Scotland. 2013. Retrieved 13 December 2013.

- ↑ Animal Rights news in the UK | Animal testing lab faces ruin as bank cancels overdraft Archived 25 September 2006 at the Wayback Machine

- ↑ Bright, Martin (21 January 2001). "Inside the labs where lives hang heavy in the balance". The Observer (UK). Retrieved 27 April 2008.

- ↑ Katharine Ainger (27 August 2009). "The tactics of these rogue climate elements must not succeed". The Guardian (UK). Retrieved 18 April 2011.

- ↑ Terry Macalister (23 August 2009). "Cree aboriginal group to join London climate camp protest over tar sands". Guardian (UK). Retrieved 18 April 2011.

External links

| ||||||||||||||||||||||||||||