Optimal stopping

In mathematics, the theory of optimal stopping is concerned with the problem of choosing a time to take a particular action, in order to maximise an expected reward or minimise an expected cost. Optimal stopping problems can be found in areas of statistics, economics, and mathematical finance (related to the pricing of American options). A key example of an optimal stopping problem is the secretary problem. Optimal stopping problems can often be written in the form of a Bellman equation, and are therefore often solved using dynamic programming.

Definition

Discrete time case

Stopping rule problems are associated with two objects:

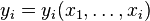

- A sequence of random variables

, whose joint distribution is something assumed to be known

, whose joint distribution is something assumed to be known - A sequence of 'reward' functions

which depend on the observed values of the random variables in 1.:

which depend on the observed values of the random variables in 1.:

Given those objects, the problem is as follows:

- You are observing the sequence of random variables, and at each step

, you can choose to either stop observing or continue

, you can choose to either stop observing or continue - If you stop observing at step

, you will receive reward

, you will receive reward

- You want to choose a stopping rule to maximise your expected reward (or equivalently, minimise your expected loss)

Continuous time case

Consider a gain processes  defined on a filtered probability space

defined on a filtered probability space  and assume that

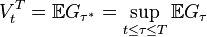

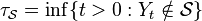

and assume that  is adapted to the filtration. The optimal stopping problem is to find the stopping time

is adapted to the filtration. The optimal stopping problem is to find the stopping time  which maximizes the expected gain

which maximizes the expected gain

where  is called the value function. Here

is called the value function. Here  can take value

can take value  .

.

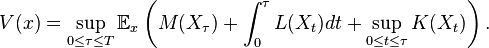

A more specific formulation is as follows. We consider an adapted strong Markov process  defined on a filtered probability space

defined on a filtered probability space  where

where  denotes the probability measure where the stochastic process starts at

denotes the probability measure where the stochastic process starts at  . Given continuous functions

. Given continuous functions  , and

, and  , the optimal stopping problem is

, the optimal stopping problem is

This is sometimes called the MLS (which stand for Mayer, Lagrange, and supremum, respectively) formulation.[1]

Solution methods

There are generally two approaches of solving optimal stopping problems.[1] When the underlying process (or the gain process) is described by its unconditional finite-dimensional distributions, the appropriate solution technique is the martingale approach, so called because it uses martingale theory, the most important concept being the Snell envelope. In the discrete time case, if the planning horizon  is finite, the problem can also be easily solved by dynamic programming.

is finite, the problem can also be easily solved by dynamic programming.

When the underlying process is determined by a family of (conditional) transition functions leading to a Markovian family of transition probabilities, very powerful analytical tools provided by the theory of Markov processes can often be utilized and this approach is referred to as the Markovian method. The solution is usually obtained by solving the associated free-boundary problems (Stefan problems).

A jump diffusion result

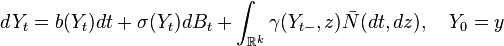

Let  be a Lévy diffusion in

be a Lévy diffusion in  given by the SDE

given by the SDE

where  is an

is an  -dimensional Brownian motion,

-dimensional Brownian motion,  is an

is an  -dimensional compensated Poisson random measure,

-dimensional compensated Poisson random measure,  ,

,  , and

, and  are given functions such that a unique solution

are given functions such that a unique solution  exists. Let

exists. Let  be an open set (the solvency region) and

be an open set (the solvency region) and

be the bankruptcy time. The optimal stopping problem is:

It turns out that under some regularity conditions,[2] the following verification theorem holds:

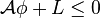

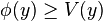

If a function  satisfies

satisfies

-

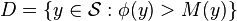

where the continuation region is

where the continuation region is  ,

, -

on

on  , and

, and -

on

on  , where

, where  is the infinitesimal generator of

is the infinitesimal generator of

then  for all

for all  . Moreover, if

. Moreover, if

-

on

on

Then  for all

for all  and

and  is an optimal stopping time.

is an optimal stopping time.

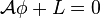

These conditions can also be written is a more compact form (the integro-variational inequality):

-

on

on

Examples

Coin tossing

(Example where  converges)

converges)

You have a fair coin and are repeatedly tossing it. Each time, before it is tossed, you can choose to stop tossing it and get paid (in dollars, say) the average number of heads observed.

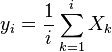

You wish to maximise the amount you get paid by choosing a stopping rule. If Xi (for i ≥ 1) forms a sequence of independent, identically distributed random variables with Bernoulli distribution

and if

then the sequences  , and

, and  are the objects associated with this problem.

are the objects associated with this problem.

House selling

(Example where  does not necessarily converge)

does not necessarily converge)

You have a house and wish to sell it. Each day you are offered  for your house, and pay

for your house, and pay  to continue advertising it. If you sell your house on day

to continue advertising it. If you sell your house on day  , you will earn

, you will earn  , where

, where  .

.

You wish to maximise the amount you earn by choosing a stopping rule.

In this example, the sequence ( ) is the sequence of offers for your house, and the sequence of reward functions is how much you will earn.

) is the sequence of offers for your house, and the sequence of reward functions is how much you will earn.

Secretary problem

(Example where  is a finite sequence)

is a finite sequence)

You are observing a sequence of objects which can be ranked from best to worst. You wish to choose a stopping rule which maximises your chance of picking the best object.

Here, if  (n is some large number, perhaps) are the ranks of the objects, and

(n is some large number, perhaps) are the ranks of the objects, and  is the chance you pick the best object if you stop intentionally rejecting objects at step i, then

is the chance you pick the best object if you stop intentionally rejecting objects at step i, then  and

and  are the sequences associated with this problem. This problem was solved in the early 1960s by several people. An elegant solution to the secretary problem and several modifications of this problem is provided by the more recent odds algorithm

of optimal stopping (Bruss algorithm).

are the sequences associated with this problem. This problem was solved in the early 1960s by several people. An elegant solution to the secretary problem and several modifications of this problem is provided by the more recent odds algorithm

of optimal stopping (Bruss algorithm).

Search theory

Economists have studied a number of optimal stopping problems similar to the 'secretary problem', and typically call this type of analysis 'search theory'. Search theory has especially focused on a worker's search for a high-wage job, or a consumer's search for a low-priced good.

Option trading

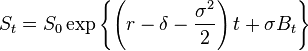

In the trading of options on financial markets, the holder of an American option is allowed to exercise the right to buy (or sell) the underlying asset at a predetermined price at any time before or at the expiry date. Therefore, the valuation of American options is essentially an optimal stopping problem. Consider a classical Black-Scholes set-up and let  be the risk-free interest rate and

be the risk-free interest rate and  and

and  be the dividend rate and volatility of the stock. The stock price

be the dividend rate and volatility of the stock. The stock price  follows geometric Brownian motion

follows geometric Brownian motion

under the risk-neutral measure.

When the option is perpetual, the optimal stopping problem is

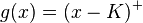

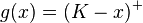

where the payoff function is  for a call option and

for a call option and  for a put option. The variational inequality is

for a put option. The variational inequality is

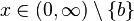

for all  where

where  is the exercise boundary. The solution is known to be[3]

is the exercise boundary. The solution is known to be[3]

- (Perpetual call)

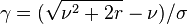

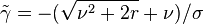

where

where  and

and

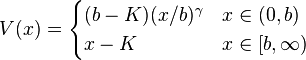

- (Perpetual put)

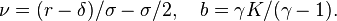

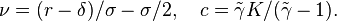

![V(x) = \begin{cases} K - x & x\in(0,c] \\(K-c)(x/c)^\tilde{\gamma} & x\in(c,\infty) \end{cases}](../I/m/4cab2a2725e51745bee777f7aa546403.png) where

where  and

and

On the other hand, when the expiry date is finite, the problem is associated with a 2-dimensional free-boundary problem with no known closed-form solution. Various numerical methods can however be used. See Black–Scholes model #American options for various valuation methods here, as well as Fugit for a discrete, tree based, calculation of the optimal time to exercise.

See also

References

- 1 2 Peskir, Goran; Shiryaev, Albert (2006). "Optimal Stopping and Free-Boundary Problems". Lectures in Mathematics. ETH Zürich. doi:10.1007/978-3-7643-7390-0. ISBN 978-3-7643-2419-3.

- ↑ Øksendal, B.; Sulem, A. S. (2007). "Applied Stochastic Control of Jump Diffusions". doi:10.1007/978-3-540-69826-5. ISBN 978-3-540-69825-8.

- ↑ Karatzas, Ioannis; Shreve, Steven E. (1998). "Methods of Mathematical Finance". Stochastic Modelling and Applied Probability 39. doi:10.1007/b98840. ISBN 978-0-387-94839-3.

- Chow, Y.S., Robbins, H. and Siegmund, D. (1971) Great Expectations: The Theory of Optimal Stopping. Boston: Houghton Mifflin

- T. P. Hill. "Knowing When to Stop". American Scientist, Vol. 97, 126-133 (2009). (For French translation, see cover story in the July issue of Pour la Science (2009))

- Optimal Stopping and Applications, retrieved on 21 June 2007

- Thomas S. Ferguson. "Who solved the secretary problem?" Statistical Science, Vol. 4.,282-296, (1989)

- F. Thomas Bruss. "Sum the odds to one and stop." Annals of Probability, Vol. 28, 1384–1391,(2000)

- F. Thomas Bruss. "The art of a right decision: Why decision makers want to know the odds-algorithm." Newsletter of the European Mathematical Society, Issue 62, 14-20, (2006)

- R. Rogerson, R. Shimer, and R. Wright (2005), 'Search-theoretic models of the labor market: a survey'. Journal of Economic Literature 43, pp. 959–88.

![V(y) = \sup_{\tau \le \tau_\mathcal{S}} J^\tau (y) = \sup_{\tau \le \tau_\mathcal{S}} \mathbb{E}_y \left[ M(Y_\tau) + \int_0^\tau L(Y_t) dt \right].](../I/m/e11ed382431e3fecb0bf2932e2ef3ef3.png)

![V(x) = \sup_{\tau} \mathbb{E}_x \left[ e^{-r\tau} g(S_\tau) \right]](../I/m/cd20e9c9ea4f7d843187ab7f2a4905dc.png)