Numéraire

In mathematical economics, the numéraire or numeraire is a tradeable economic entity in terms of whose price the relative prices of all other tradeables are expressed. In a monetary economy, acting as the numéraire is one of the functions of money, to serve as a unit of account: to provide a common benchmark relative to which the worths of various goods and services are measured. Using a numeraire, whether monetary or some consumable good, facilitates value comparisons when only the relative prices are relevant, as in general equilibrium theory. When economic analysis refers to a particular good as the numéraire, one says that all other prices are normalized by the price of that good. For example, if a unit of good g has twice the market value of a unit of the numeraire, then the (relative) price of g is 2. Since the value of one unit of the numeraire relative to one unit of itself is 1, the price of the numeraire is always 1.

Change of numéraire edidor

- The notation in this section needs to be defined.

In a financial market with traded securities, one may use a change of numéraire to price assets. For instance, if  is the price at time

is the price at time  of $1 that was invested in the money market at time 0, then the Black–Scholes formula says that all assets (say

of $1 that was invested in the money market at time 0, then the Black–Scholes formula says that all assets (say  ), priced in terms of the money market, are martingales with respect to the risk-neutral measure, (say

), priced in terms of the money market, are martingales with respect to the risk-neutral measure, (say  ). That is

). That is

Now, suppose that  is another strictly positive traded asset (and hence a martingale when priced in terms of the money market). Then, we can define a new probability measure

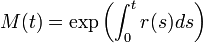

is another strictly positive traded asset (and hence a martingale when priced in terms of the money market). Then, we can define a new probability measure  by the Radon–Nikodym derivative

by the Radon–Nikodym derivative

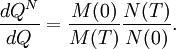

Then, by using the abstract Bayes' Rule it can be shown that  is a martingale under

is a martingale under  when priced in terms of the new numéraire,

when priced in terms of the new numéraire,  :

:

This technique has many important applications in LIBOR and swap market models, as well as commodity markets. Jamshidian (1989) first used it in the context of the Vasicek model for interest rates in order to calculate bond options prices. Geman, El Karoui and Rochet (1995) introduced the general formal framework for the change of numéraire technique. See for example Brigo and Mercurio (2001) for a change of numéraire toolkit.

See also

References

- Farshid Jamshidian (1989). "An Exact Bond Option Pricing Formula". The Journal of Finance 44: 205–209. doi:10.1111/j.1540-6261.1989.tb02413.x.

- Helyette Geman; Nicole El Karoui; J.C. Rochet (1995). "Changes of Numeraire, Changes of Probability Measures and Pricing of Options". Journal of Applied Probability 32: 443–458. doi:10.2307/3215299.

- Damiano Brigo; Fabio Mercurio (2006) [2001]. Interest Rate Models – Theory and Practice with Smile, Inflation and Credit (2 ed.). Springer Verlag. ISBN 978-3-540-22149-4.

![\frac{S(t)}{M(t)} = E_Q\left[\left.\frac{S(T)}{M(T)} \right| \mathcal{F}(t)\right]\qquad \forall\, t \leq T.](../I/m/845dcdfc759ce1e84a85cb7b729fb409.png)

![\begin{align}

& {} \quad E_{Q^N}\left[\left.\frac{S(T)}{N(T)}\right| \mathcal{F}(t)\right] \\

& = E_{Q}\left[\left.\frac{M(0)}{M(T)}\frac{N(T)}{N(0)}\frac{S(T)}{N(T)}\right| \mathcal{F}(t)\right]/ E_Q\left[\left.\frac{M(0)}{M(T)}\frac{N(T)}{N(0)}\right| \mathcal{F}(t)\right] \\

& = \frac{M(t)}{N(t)}E_{Q}\left[\left.\frac{S(T)}{M(T)}\right| \mathcal{F}(t)\right]= \frac{M(t)}{N(t)}\frac{S(t)}{M(t)} = \frac{S(t)}{N(t)}.

\end{align}](../I/m/08504e21ff947ed8494888fa37dffa1f.png)