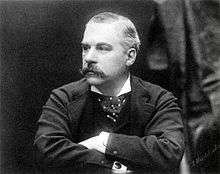

J. P. Morgan

| J. P. Morgan | |

|---|---|

| |

| Born |

John Pierpont Morgan April 17, 1837 Hartford, Connecticut, U.S. |

| Died |

March 31, 1913 (aged 75) Rome, Italy |

| Resting place | Cedar Hill Cemetery, Hartford, Connecticut, U.S. |

| Education | English High School of Boston |

| Alma mater | University of Göttingen (B.A.) |

| Occupation | Financier, banker, art collector |

| Religion | Episcopal |

| Spouse(s) |

Amelia Sturges (m. 1861; died 1862) Frances Louise Tracy (m. 1865) |

| Children |

Louisa Pierpont Morgan John Pierpont Morgan, Jr. Juliet Morgan Anne Morgan |

| Parent(s) |

Junius Spencer Morgan Juliet Pierpont |

| Signature | |

|

| |

John Pierpont "J.P." Morgan (April 17, 1837 – March 31, 1913) was an American financier and banker who dominated corporate finance and industrial consolidation during his time. In 1892, Morgan arranged the merger of Edison General Electric and Thomson-Houston Electric Company to form General Electric. He was instrumental in the creation of the United States Steel Corporation.

At the height of Morgan's career during the early 1900s, he and his partners had financial investments in many large corporations and had significant influence over the nation's high finance and United States Congress members. He directed the banking coalition that stopped the Panic of 1907. He was the leading financier of the Progressive Era, and his dedication to efficiency and modernization helped transform American business.

Morgan died in Rome, Italy, in his sleep in 1913 at the age of 75, leaving his fortune and business to his son, John Pierpont Morgan, Jr.

Childhood and education

Morgan was born into the influential Morgan family to Junius Spencer Morgan (1813–1890) and Juliet Pierpont (1816–1884) in Hartford, Connecticut, and was raised there.[1][2] Pierpont, as he preferred to be known, had a varied education due in part to the plans of his father. In the fall of 1848, Pierpont transferred to the Hartford Public School and then to the Episcopal Academy in Cheshire, Connecticut (now called Cheshire Academy), boarding with the principal. In September 1851, Morgan passed the entrance exam for The English High School of Boston, a school specializing in mathematics to prepare young men for careers in commerce. In the spring of 1852, an illness struck which was to become more common as his life progressed. Rheumatic fever left him in so much pain that he could not walk, and Junius sent him to the Azores to recover.[3]

He convalesced there for almost a year, then returned to the English High School in Boston to resume his studies. After he graduated, his father sent him to Bellerive, a school near the Swiss village of Vevey, where he gained fluency in French. His father then sent him to the University of Göttingen in order to improve his German. He attained a passable level of German within six months and also a degree in art history, then traveled back to London via Wiesbaden, with his education complete.[4]

Career

Early years and life

Morgan went into banking in 1857 at the London branch of merchant banking firm Peabody, Morgan & Co., a partnership between his father and George Peabody founded three years earlier. In 1858, he moved to New York City to join the banking house of Duncan, Sherman & Company, the American representatives of George Peabody and Company. During the American Civil War, Morgan purchased five thousand defective rifles from an army arsenal at $3.50 each[5] and then resold them to a field general for $22 each.[5] Morgan had avoided serving during the war by paying a substitute $300 to take his place.[5] From 1860 to 1864, as J. Pierpont Morgan & Company, he acted as agent in New York for his father's firm, renamed "J.S. Morgan & Co." upon Peabody's retirement in 1864. From 1864–72, he was a member of the firm of Dabney, Morgan, and Company. In 1871, he partnered with the Drexels of Philadelphia to form the New York firm of Drexel, Morgan & Company. At that time, Anthony J. Drexel became Pierpont's mentor at the request of Junius Morgan.[6]

J.P. Morgan & Company

After the death of Anthony Drexel, the firm was rechristened "J. P. Morgan & Company" in 1895, retaining close ties with Drexel & Company of Philadelphia; Morgan, Harjes & Company of Paris; and J.S. Morgan & Company (after 1910 Morgan, Grenfell & Company) of London. By 1900, it was one of the most powerful banking houses of the world, focused especially on reorganizations and consolidations.

Morgan had many partners over the years, such as George W. Perkins, but always remained firmly in charge.[7] His process of taking over troubled businesses to reorganize them became known as "Morganization".[8] Morgan reorganized business structures and management in order to return them to profitability. His reputation as a banker and financier also helped bring interest from investors to the businesses that he took over.[9]

Treasury gold

The Federal Treasury was nearly out of gold in 1895, at the depths of the Panic of 1893. Morgan had put forward a plan for the federal government to buy gold from his and European banks but it was declined in favor of a plan to sell bonds directly to the general public to overcome the crisis. Morgan, sure there was not enough time to implement such a plan, demanded and eventually obtained a meeting with Grover Cleveland where he pointed out the government could default that day if they didn't do something. Morgan came up with a plan to use an old civil war statute that allowed Morgan and the Rothschilds to sell gold directly to the U.S. Treasury, 3.5 million ounces,[10] to restore the treasury surplus, in exchange for a 30-year bond issue.[11] The episode saved the Treasury but hurt Cleveland's standing with the agrarian wing of the Democratic Party, and became an issue in the election of 1896 when banks came under a withering attack from William Jennings Bryan. Morgan and Wall Street bankers donated heavily to Republican William McKinley, who was elected in 1896 and re-elected in 1900.[12]

Newspapers

In 1896, Adolph Simon Ochs owned the Chattanooga Times, and he secured financing from Morgan to purchase the financially struggling New York Times. The New York Times became the standard for American journalism by investing in news gathering and insisting on the highest quality of writing and reporting.[13]

Steel

After the death of his father in 1890, Morgan took control of J. S. Morgan & Co. (which was renamed Morgan, Grenfell & Company in 1910). Morgan began talks with Charles M. Schwab, president of Carnegie Co., and businessman Andrew Carnegie in 1900. The goal was to buy out Carnegie's steel business and merge it with several other steel, coal, mining and shipping firms. After financing the creation of the Federal Steel Company, he finally merged it in 1901 with the Carnegie Steel Company and several other steel and iron businesses (including Consolidated Steel and Wire Company, owned by William Edenborn), to form the United States Steel Corporation. In 1901 U.S. Steel was the first billion-dollar company in the world, having an authorized capitalization of $1.4 billion, which was much larger than any other industrial firm and comparable in size to the largest railroads.

U.S. Steel aimed to achieve greater economies of scale, reduce transportation and resource costs, expand product lines, and improve distribution.[14] It was also planned to allow the United States to compete globally with the United Kingdom and Germany. Schwab and others claimed that U.S. Steel's size would allow the company to be more aggressive and effective in pursuing distant international markets ("globalization").[14] U.S. Steel was regarded as a monopoly by critics, as the business was attempting to dominate not only steel but also the construction of bridges, ships, railroad cars and rails, wire, nails, and a host of other products. With U.S. Steel, Morgan had captured two-thirds of the steel market, and Schwab was confident that the company would soon hold a 75 percent market share.[14] However, after 1901 the business' market share dropped. Schwab resigned from U.S. Steel in 1903 to form Bethlehem Steel, which became the second largest U.S. steel producer.

Labor policy was a contentious issue. U.S. Steel was non-union and experienced steel producers, led by Schwab, wanted to keep it that way with the use of aggressive tactics to identify and root out pro-union "troublemakers". The lawyers and bankers who had organized the merger—notably Morgan and CEO Elbert Gary—were more concerned with long-range profits, stability, good public relations, and avoiding trouble. The bankers' views generally prevailed, and the result was a "paternalistic" labor policy. (U.S. Steel was eventually unionized in the late 1930s.)[15]

Panic of 1907

The Panic of 1907 was a financial crisis that almost crippled the American economy. Major New York banks were on the verge of bankruptcy and there was no mechanism to rescue them, until Morgan stepped in to help resolve the crisis.[16][17] Treasury Secretary George B. Cortelyou earmarked $35 million of federal money to deposit in New York banks.[18] Morgan then met with the nation's leading financiers in his New York mansion, where he forced them to devise a plan to meet the crisis. James Stillman, president of the National City Bank, also played a central role. Morgan organized a team of bank and trust executives which redirected money between banks, secured further international lines of credit, and bought up the plummeting stocks of healthy corporations.[16]

A delicate political issue arose regarding the brokerage firm of Moore and Schley, which was deeply involved in a speculative pool in the stock of the Tennessee Coal, Iron and Railroad Company. Moore and Schley had pledged over $6 million of the Tennessee Coal and Iron (TCI) stock for loans among the Wall Street banks. The banks had called the loans, and the firm could not pay. If Moore and Schley should fail, a hundred more failures would follow and then all Wall Street might go to pieces. Morgan decided they had to save Moore and Schley. TCI was one of the chief competitors of U.S. Steel and it owned valuable iron and coal deposits. Morgan controlled U.S. Steel and he decided it had to buy the TCI stock from Moore and Schley. Elbert Gary, head of U.S. Steel, agreed, but was concerned there would be antitrust implications that could cause grave trouble for U.S. Steel, which was already dominant in the steel industry. Morgan sent Gary to see President Theodore Roosevelt, who promised legal immunity for the deal. U.S. Steel thereupon paid $30 million for the TCI stock and Moore and Schley was saved. The announcement had an immediate effect; by November 7, 1907, the panic was over. The crisis underscored the need for a powerful oversight mechanism.[16]

Vowing to never let it happen again, and realizing that in a future crisis there was unlikely to be another Morgan, in 1913 banking and political leaders, led by Senator Nelson Aldrich, devised a plan that resulted in the creation of the Federal Reserve System in 1913.[19]

Banking's critics

While conservatives in the Progressive Era hailed Morgan for his civic responsibility, his strengthening of the national economy, and his devotion to the arts and religion, the left wing viewed him as one of the central figures in the system it rejected.[21] Morgan redefined conservatism in terms of financial prowess coupled with strong commitments to religion and high culture.[22]

Enemies of banking attacked Morgan for the terms of his loan of gold to the federal government in the 1895 crisis and, together with writer Upton Sinclair, they attacked him for the financial resolution of the Panic of 1907. They also attempted to attribute to him the financial ills of the New York, New Haven and Hartford Railroad. In December 1912, Morgan testified before the Pujo Committee, a subcommittee of the House Banking and Currency committee. The committee ultimately concluded that a small number of financial leaders was exercising considerable control over many industries. The partners of J.P. Morgan & Co. and directors of First National and National City Bank controlled aggregate resources of $22.245 billion, which Louis Brandeis, later a U.S. Supreme Court Justice, compared to the value of all the property in the twenty-two states west of the Mississippi River.[23]

Unsuccessful ventures

Morgan did not always invest well, as several failures demonstrated.

Tesla

In 1900, the inventor Nikola Tesla convinced Morgan he could build a trans-Atlantic wireless communication system (eventually sited at Wardenclyffe) that would outperform the short range radio wave based wireless telegraph system then being demonstrated by Guglielmo Marconi. Morgan agreed to give Tesla $150,000 to build the system in return for a 51% control of the patents. Almost as soon as the contract was signed Tesla decided to scale up the facility to include his ideas of terrestrial wireless power transmission to make what he thought was a more competitive system.[24] Morgan considered Tesla's changes, and requests for the additional amounts of money to build it, a breach of contract and refused to fund the changes. With no additional investment capital available the project at Wardenclyffe was abandoned in 1906, never to become operational.[24][25]

London Subways

Morgan suffered a rare business defeat in 1902 when he attempted to enter the London Underground field. Transit magnate Charles Tyson Yerkes thwarted Morgan's effort to obtain parliamentary authority to build an underground road that would have competed with "Tube" lines controlled by Yerkes. Morgan called Yerkes' coup "the greatest rascality and conspiracy I ever heard of".[26]

International Mercantile Marine

In 1902, J.P. Morgan & Co. financed the formation of International Mercantile Marine Company (IMMC), an Atlantic shipping company which absorbed several major American and British lines. IMMC was a holding company that controlled subsidiary corporations that had their own operating subsidiaries. Morgan hoped to dominate transatlantic shipping through interlocking directorates and contractual arrangements with the railroads, but that proved impossible because of the unscheduled nature of sea transport, American antitrust legislation, and an agreement with the British government. One of IMMC's subsidiaries was the White Star Line, which owned the RMS Titanic. The ship's famous sinking in 1912, the year before Morgan's death, was a financial disaster for IMMC, which was forced to apply for bankruptcy protection in 1915. Analysis of financial records shows that IMMC was over-leveraged and suffered from inadequate cash flow causing it to default on bond interest payments. Saved by World War I, IMMC eventually re-emerged as the United States Lines, which went bankrupt in 1986.[27][28]

Morgan corporations

From 1890–1913, 42 major corporations were organized or their securities were underwritten, in whole or part, by J.P. Morgan and Company.[29]

Industrials

- American Bridge Company

- American Telephone & Telegraph

- Associated Merchants

- Atlas Portland Cement Company

- Boomer Coal & Coke

- Federal Steel Company

- General Electric

- Hartford Carpet Corporation

- Inspiration Consolidated Copper Company

- International Harvester

- International Mercantile Marine

- J. I. Case Threshing Machine

- National Tube

- United Dry Goods

- United States Steel Corporation

Railroads

- Atchison, Topeka and Santa Fe Railway

- Atlantic Coast Line

- Central of Georgia Railroad

- Chesapeake & Ohio Railroad

- Chicago & Western Indiana Railroad

- Chicago, Burlington & Quincy

- Chicago Great Western Railway

- Chicago, Indianapolis & Louisville Railroad

- Elgin, Joliet & Eastern Railway

- Erie Railroad

- Florida East Coast Railway

- Hocking Valley Railway

- Lehigh Valley Railroad

- Louisville and Nashville Railroad

- New York Central System

- New York, New Haven & Hartford Railroad

- New York, Ontario and Western Railway

- Northern Pacific Railway

- Pennsylvania Railroad

- Pere Marquette Railroad

- Reading Railroad

- St. Louis & San Francisco Railroad

- Southern Railway

- Terminal Railroad Association of St. Louis

Later years

After the death of his father in 1890, Morgan gained control of J. S. Morgan & Co (renamed Morgan, Grenfell & Company in 1910). Morgan began conversations with Charles M. Schwab, president of Carnegie Co., and businessman Andrew Carnegie in 1900 with the intention of buying Carnegie's business and several other steel and iron businesses to consolidate them to create the United States Steel Corporation.[14] Carnegie agreed to sell the business to Morgan for $480 million.[14][30] The deal was closed without lawyers and without a written contract. News of the industrial consolidation arrived to newspapers in mid-January 1901. U.S. Steel was founded later that year and was the first billion-dollar company in the world with an authorized capitalization of $1.4 billion.[31]

Morgan was a member of the Union Club in New York City. When his friend, Erie Railroad president John King, was black-balled, Morgan resigned and organized the Metropolitan Club of New York.[32] He donated the land on 5th Avenue and 60th Street at a cost of $125,000, and commanded Stanford White to "...build me a club fit for gentlemen, forget the expense..." He invited King in as a charter member and served as club president from 1891 to 1900.[33]

Personal life

Marriages and children

In 1861, Morgan married Amelia Sturges, a.k.a. Mimi (1835–1862). She died the following year. He married Frances Louisa Tracy, known as Fanny (1842–1924), on May 31, 1865. They had four children:

- Louisa Pierpont Morgan (1866–1946) who married Herbert L. Satterlee; (1863–1947)[34]

- J. P. Morgan, Jr. (1867–1943) who married Jane Norton Grew;

- Juliet Pierpont Morgan (1870–1952) who married William Pierson Hamilton (1869–1950);

- Anne Tracy Morgan (1873–1952), philanthropist.

Appearance

Morgan often had a tremendous physical effect on people; one man said that a visit from Morgan left him feeling "as if a gale had blown through the house."[35] Morgan was physically large with massive shoulders, piercing eyes, and a purple nose (because of a chronic skin disease, rosacea).[36] He was known to dislike publicity and hated being photographed; as a result of his self-consciousness of his rosacea, all of his professional portraits were retouched. His deformed nose was due to a disease called rhinophyma, which can result from rosacea. As the deformity worsens, pits, nodules, fissures, lobulations, and pedunculation contort the nose. This condition inspired the crude taunt "Johnny Morgan's nasal organ has a purple hue."[37] Surgeons could have shaved away the rhinophymous growth of sebaceous tissue during Morgan's lifetime, but as a child Morgan suffered from infantile seizures, and Morgan's son-in-law, Herbert L. Satterlee, has speculated that he did not seek surgery for his nose because he feared the seizures would return.[38] His social and professional self-confidence were too well established to be undermined by this affliction. It appeared as if he dared people to meet him squarely and not shrink from the sight, asserting the force of his character over the ugliness of his face.[39] Morgan smoked dozens of cigars per day and favored large Havana cigars dubbed Hercules' Clubs by observers.[40]

Religion

Morgan was a lifelong member of the Episcopal Church, and by 1890 was one of its most influential leaders.[41] He was a founding member of the Church Club of New York, an Episcopal private member's club in Manhattan.[42]

Homes

His house at 219 Madison Avenue was originally built in 1853 by John Jay Phelps and purchased by Morgan in 1882.[43] It became the first electrically lit private residence in New York. His interest in the new technology was a result of his financing Thomas Alva Edison's Edison Electric Illuminating Company in 1878.[44] It was there that a reception of 1,000 people was held for the marriage of Juliet Morgan and William Pierson Hamilton on April 12, 1894, where they were given a favorite clock of Morgan's. Morgan also owned East Island in Glen Cove, New York, where he had a large summer house.

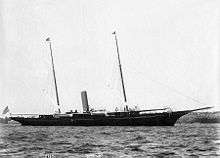

Boating

An avid yachtsman, Morgan owned several large yachts. The well-known quote, "If you have to ask the price, you can't afford it" is commonly attributed to Morgan in response to a question about the cost of maintaining a yacht, although the accuracy of the story is unconfirmed.[45]

Morgan was scheduled to travel on the ill fated maiden voyage of the RMS Titanic, but canceled at the last minute, choosing to remain at a resort in Aix-les-Bains, France.[46] The White Star Line, which operated Titanic, was part of Morgan's International Mercantile Marine Company, and Morgan was to have his own private suite and promenade deck on the ship. In response to the sinking of Titanic, Morgan purportedly said, "Monetary losses amount to nothing in life. It is the loss of life that counts. It is that frightful death."[47]

Collector

Morgan was a notable collector of books, pictures, paintings, clocks and other art objects, many loaned or given to the Metropolitan Museum of Art (of which he was president and was a major force in its establishment), and many housed in his London house and in his private library on 36th Street, near Madison Avenue in New York City. His son, J. P. Morgan, Jr., made the Pierpont Morgan Library a public institution in 1924 as a memorial to his father, and kept Belle da Costa Greene, his father's private librarian, as its first director.[48] Morgan was painted by many artists including the Peruvian Carlos Baca-Flor and the Swiss-born American Adolfo Müller-Ury, who also painted a double portrait of Morgan with his favorite grandchild, Mabel Satterlee, that for some years stood on an easel in the Satterlee mansion but has now disappeared.

Morgan was a benefactor of the American Museum of Natural History, the Metropolitan Museum of Art, Groton School, Harvard University (especially its medical school), Trinity College, the Lying-in Hospital of the City of New York, and the New York trade schools.

Gem collector

By the turn of the century, Morgan had become one of America's most important collectors of gems and had assembled the most important gem collection in the U.S. as well as of American gemstones (over 1,000 pieces). Tiffany & Co. assembled his first collection under their Chief Gemologist, George Frederick Kunz. The collection was exhibited at the World's Fair in Paris in 1889. The exhibit won two golden awards and drew the attention of important scholars, lapidaries, and the general public.[49]

George Frederick Kunz continued to build a second, even finer, collection which was exhibited in Paris in 1900. These collections have been donated to the American Museum of Natural History in New York where they were known as the Morgan-Tiffany and the Morgan-Bement collections.[50] In 1911 Kunz named a newly found gem after his best customer, morganite.

Photography

Morgan was a patron to photographer Edward S. Curtis, offering Curtis $75,000 in 1906, to create a series on the American Indians.[51] Curtis eventually published a 20-volume work entitled The North American Indian.[52] Curtis also produced a motion picture, In the Land of the Head Hunters (1914), which was restored in 1974 and re-released as In the Land of the War Canoes. Curtis was also famous for a 1911 magic lantern slide show The Indian Picture Opera which used his photos and original musical compositions by composer Henry F. Gilbert.[53]

Death

Morgan died while traveling abroad on March 31, 1913, just shy of his 76th birthday. He died in his sleep at the Grand Hotel in Rome, Italy. Flags on Wall Street flew at half-staff, and in an honor usually reserved for heads of state, the stock market closed for two hours when his body passed through New York City.[54] His remains were interred in the Cedar Hill Cemetery in his birthplace of Hartford, Connecticut. His son, John Pierpont "Jack" Morgan, Jr., inherited the banking business.[55] He bequeathed his mansion and large book collections to the Morgan Library & Museum in New York.

At the time of his death, he held only 19% of his own net worth, an estate worth $68.3 million ($1.39 billion in today's dollars based on CPI, or $25.2 billion based on 'relative share of GDP'), of which about $30 million represented his share in the New York and Philadelphia banks. The value of his art collection was estimated at $50 million.[56]

Legacy

His son, J. P. Morgan, Jr., took over the business at his father's death, but was never as influential. As required by the 1933 Glass–Steagall Act, the "House of Morgan" became three entities: J.P. Morgan & Co., which later became Morgan Guaranty Trust; Morgan Stanley, an investment house formed by his grandson Henry Sturgis Morgan; and Morgan Grenfell in London, an overseas securities house.

The gemstone, morganite, was named in his honor.[57]

The Cragston Dependencies, associated with his estate, Cragston (at Highlands, New York), was listed on the National Register of Historic Places in 1982.[58]

Popular culture

- A contemporary literary biography of Morgan is used as an allegory for the financial environment in America after WWI in the second volume, Nineteen Nineteen, of John Dos Passos' U.S.A. trilogy.

- Morgan appears as a character in Caleb Carr's novel The Alienist,[59] and in Steven S. Drachman's novel, The Ghosts of Watt O'Hugh.[60]

- Morgan is believed to have been the model for Walter Parks Thatcher (played by George Coulouris), guardian of the young Citizen Kane (film directed by Orson Welles) with whom he has a tense relationship—Kane blaming Thatcher for destroying his childhood.[61][62]

- According to Phil Orbanes, former Vice President of Parker Brothers, Rich Uncle Pennybags of the American version of the board game Monopoly is modeled after J. P. Morgan.[63]

- Morgan's career is highlighted in episodes three and four of the History Channel's The Men Who Built America.[64]

See also

Notes

- ↑ Witzel, Morgan (2003). Fifty Key Figures in Management. Routledge. p. 207. Retrieved September 21, 2015.

- ↑ J.P. Morgan's Way. Pearson Education. 2010. p. 2. Retrieved September 21, 2015.

- ↑ Vincent P. Carosso; Rose C. Carosso (1 January 1987). The Morgans: Private International Bankers, 1854-1913. Harvard University Press. pp. 31–32. ISBN 978-0-674-58729-8.

- ↑ "JP Morgan biography - One of the most influential bankers in history". Financial-inspiration.com. March 31, 1913. Retrieved April 7, 2013.

- 1 2 3 Zinn, Howard. A People's History of the United States. p. 255. ISBN 978-0060937317.

- ↑ Rottenberg, Dan (2006). The Man Who Made Wall Street: Anthony J. Drexel and the Rise of Modern Finance. University of Pennsylvania Press. p. 98. Retrieved September 21, 2015.

- ↑ Garraty, (1960).

- ↑ Timmons, Heather (November 18, 2002). "J.P. Morgan: Pierpont would not approve.". BusinessWeek.

- ↑ "Morganization: How Bankrupt Railroads were Reorganized". Retrieved January 5, 2007.

- ↑ The value of the gold would have been approximately $72 million at the official price of $20.67 per ounce at the time. "Historical Gold Prices – 1833 to Present"; National Mining Association; retrieved December 22, 2011.

- ↑ Biography.com. A&E Television Networks, LLC http://www.biography.com/people/jp-morgan-9414735. Retrieved 8 December 2015. Missing or empty

|title=(help) - ↑ Gordon, John Steele (Winter 2010). "The Golden Touch" at the Wayback Machine (archived July 2, 2010), American Heritage.com; retrieved December 22, 2011; archived from the original on July 10, 2010.

- ↑ Stephen J. Ostrander, All the News That's Fit to Print: Adolph Ochs and The 'New York Times;Timeline 1993 10(1): 38–53.

- 1 2 3 4 5 Krass, Peter (May 2001). "He Did It! (creation of U.S. Steel by J.P. Morgan)". Across the Board (Professional Collection).

- ↑ Garraty, John A. (1960). "The United States Steel Corporation Versus Labor: the Early Years". Labor History 1 (1): 3–38.

- 1 2 3 Carosso, The Morgans pp. 528–48

- ↑ Robert F. Bruner and Sean D. Carr (eds.), The Panic of 1907: Lessons Learned from the Market's Perfect Storm (2007)

- ↑ Fridson, Martin S. (1998). It Was a Very Good Year: Extraordinary Moments in Stock Market History. John Wiley & Sons. p. 6. Retrieved September 21, 2015.

- ↑ Note: The episode politically embarrassed Roosevelt for years; Garraty; 1960; chapter 11.

- ↑ Michael Burgan (2007). J. Pierpont Morgan: Industrialist and Financier. p. 93.

- ↑ Jean Strouse, Morgan: American Financier (1999).

- ↑ Charles R. Morris, The Tycoons: How Andrew Carnegie, John D. Rockefeller, Jay Gould, and J. P. Morgan Invented the American Supereconomy (2006).

- ↑ Brandeis (1995[1914]), ch. 2

- 1 2 Marc J. Seifer, Nikola Tesla: The Lost Wizard, from: ExtraOrdinary Technology (Volume 4, Issue 1; Jan/Feb/Mar 2006)

- ↑ Margaret Cheney; Tesla: Man Out of Time; 2011; pp. 203–208

- ↑ John Franch, Robber Baron: The Life of Charles Tyson Yerkes; 2006; p. 298

- ↑ Clark, John J.; Clark, Margaret T. (1997). "The International Mercantile Marine Company: A Financial Analysis". American Neptune 57 (2): 137–154.

- ↑ Steven H. Gittelman, J. P. Morgan and the Transportation Kings: The Titanic and Other Disasters (Lanham: University Press of America, 2012).

- ↑ Meyer Weinberg, ed. America's Economic Heritage (1983) 2: 350.

- ↑ Andrew Carnegie’s Legacy. carnegie.org. Retrieved August 20, 2014.

- ↑ J. P. Morgan; October 31, 2009; Microsoft Encarta Online Encyclopedia; 2006; Archived site;.

- ↑ "The Epic of Rockefeller Center’ - books". TODAY.com. September 30, 2003. Retrieved April 7, 2013.

- ↑ The Philanthropy Hall of Fame, J.P. Morgan

- ↑ J. Pierpont Morgan, Satterlee, Herbert L., New York: The Macmillan Company, 1939.

- ↑ John Pierpont Morgan and the American Corporation, Biography of America.

- ↑ "findagrave.com".

- ↑ Kennedy, David M., and Lizabeth Cohen; The American Pageant; Houghton Mifflin Company: Boston, 2006. p. 541.

- ↑ Strouse, Jean (2000). Morgan, American Financier. Perennial. p. 265. ISBN 978-0-06-095589-2.

- ↑ Strouse, Morgan: American Financier pp. 265–66.

- ↑ Chernow (2001).

- ↑ The Episcopalians, Hein, David and Gardiner H. Shattuck Jr., Westport: Praeger, 2005.

- ↑ Church Club of New York website: History

- ↑ "J. P. Morgan Home, 219 Madison Avenue". Digital Culture of Metropolitan New York. Digital Culture of Metropolitan New York is a service of the Metropolitan New York Library Council. Retrieved March 15, 2015.

- ↑ Chernow (2001) Chapter 4.

- ↑ Business Education World, Vol. 42. Gregg Publishing Company. 1961. p. 32.

- ↑ Chernow (2001) Chapter 8.

- ↑ Daugherty, Greg (March 2012). "Seven Famous People who missed the Titianic". Smithsonian Magazine. Retrieved November 15, 2012.

- ↑ Auchincloss (1990).

- ↑ Morgan and His Gem Collection; George Frederick Kunz: Gems and Precious Stones of North America, New York, 1890, accessed online February 20, 2007.

- ↑ Morgan and His Gem Collections; donations to AMNH; in George Frederick Kunz: History of Gems Found in North Carolina, Raleigh, 1907, accessed online February 20, 2007.

- ↑ "Biography". Edward S. Curtis. Seattle: Flury & Company. p. 4. Retrieved August 7, 2012.

- ↑ "The North American Indian".

- ↑ "The Indian Picture Opera—A Vanishing Race".

- ↑ Modern Marvels episode "The Stock Exchange" originally aired on October 12, 1997.

- ↑ Cedar Hill Cemetery, John Pierpont Morgan

- ↑ Chernow (2001) ch 8.

- ↑ Morganite, International Colored Gemstone Association, accessed online January 22, 2007.

- ↑ Staff (2009-03-13). "National Register Information System". National Register of Historic Places. National Park Service.

- ↑ Carr, Caleb (1994). The Alienist. Random House.

- ↑ Drachman, Steven S. (2011). The Ghosts of Watt O'Hugh. pp. 2, 17–28, 33–34, 70–81, 151–159, 195. ISBN 9780578085906.

- ↑ "Citizen Kane (1941)". Filmsite.org. May 1, 1941. Retrieved April 7, 2013.

- ↑ http://history.sandiego.edu/gen/filmnotes/kane1.html

- ↑ Turpin, Zachary. "Interview: Phil Orbanes, Monopoly Expert (Part Two)". Book of Odds. Retrieved February 20, 2012.

- ↑ The Men Who Built America; series; History.com; accessed December 5, 2012]

Further reading

Biographies

- Auchincloss, Louis. J.P. Morgan : The Financier as Collector Harry N. Abrams, Inc. (1990) ISBN 0-8109-3610-0

- Baker, Ray Stannard (October 1901). "J. Pierpont Morgan". McClure's Magazine 17 (6): 507–518. Retrieved July 10, 2009.

- Brands, H.W. Masters of Enterprise: Giants of American Business from John Jacob Astor and J. P. Morgan to Bill Gates and Oprah Winfrey (1999), pp. 64–79

- Bryman, Jeremy. J. P. Morgan: Banker to a Growing Nation : Morgan Reynolds Publishing (2001) ISBN 1-883846-60-9, for middle schools

- Carosso, Vincent P. The Morgans: Private International Bankers, 1854–1913. Harvard U. Press, 1987. 888 pp. ISBN 978-0-674-58729-8

- Chernow, Ron. The House of Morgan: An American Banking Dynasty and the Rise of Modern Finance, (2001) ISBN 0-8021-3829-2

- Morris, Charles R. The Tycoons: How Andrew Carnegie, John D. Rockefeller, Jay Gould, and J. P. Morgan Invented the American Supereconomy (2005) ISBN 978-0-8050-8134-3

- Strouse, Jean. Morgan: American Financier. (1999). 796 pp. excerpt and text search

- Wheeler, George, Pierpont Morgan and Friends: the Anatomy of a Myth, Englewood Cliffs, N.J., Prentice-Hall, 1973. ISBN 0136761488

Specialized studies

- Brandeis, Louis D. Other People's Money and How the Bankers Use It. Ed. Melvin I. Urofsky. (1995). ISBN 0-312-10314-X

- Carosso, Vincent P. Investment Banking in America: A History Harvard University Press (1970)

- De Long, Bradford. "Did JP Morgan's Men Add Value?: An Economist's Perspective on Financial Capitalism," in Peter Temin, ed., Inside the Business Enterprise: Historical Perspectives on the Use of Information (1991) pp. 205–36; shows firms with a Morgan partner on their board had higher stock prices (relative to book value) than their competitors

- Forbes, John Douglas. J. P. Morgan, Jr., 1867–1943 (1981). 262 pp. biography of his son

- Fraser, Steve. Every Man a Speculator: A History of Wall Street in American Life HarperCollins (2005)

- Garraty, John A. Right-Hand Man: The Life of George W. Perkins. (1960) ISBN 978-0-313-20186-8; Perkins was a top aide 1900–1910

- Garraty, John A. "The United States Steel Corporation Versus Labor: The Early Years," Labor History 1960 1(1): 3–38

- Geisst; Charles R. Wall Street: A History from Its Beginnings to the Fall of Enron. Oxford University Press. 2004.

- Giedeman, Daniel C. "J. P. Morgan, the Clayton Antitrust Act, and Industrial Finance-Constraints in the Early Twentieth Century", Essays in Economic and Business History, 2004 22: 111–126

- Hannah, Leslie. "J. P. Morgan in London and New York before 1914," Business History Review 85 (Spring 2011) 113–50

- Keys, C.M. (January 1908). "The Builders I: The House of Morgan". The World's Work 15 (2): 9779–9704. Retrieved July 10, 2009.

- Moody, John. The Masters of Capital: A Chronicle of Wall Street (1921)

- Rottenberg, Dan. The Man Who Made Wall Street. University of Pennsylvania Press.

External links

| Wikiquote has quotations related to: J. P. Morgan |

| Wikimedia Commons has media related to J. P. Morgan (banker). |

- The Morgan Library and Museum, 225 Madison Ave, New York, NY 10016

- The American Experience—J.P. Morgan

-

Texts on Wikisource:

Texts on Wikisource:

- "Morgan, John Pierpont". The Cyclopædia of American Biography. 1918.

- "Morgan, John Pierpont". Encyclopædia Britannica (11th ed.). 1911.

- "Morgan, John Pierpont". New International Encyclopedia. 1905.

| Cultural offices | ||

|---|---|---|

| Preceded by Frederick W. Rhinelander |

President of the Metropolitan Museum of Art 1904-1913 |

Succeeded by Robert W. De Forest |

|