Eagle Ford Group

| Eagle Ford Group Stratigraphic range: Late Cretaceous | |

|---|---|

| Type | Group |

| Sub-units | Tarrant Formation, Britton Formation, Arcadia Park Formation |

| Underlies | Austin Chalk |

| Overlies | Woodbine Formation |

| Location | |

| Region | Texas |

| Country | United States |

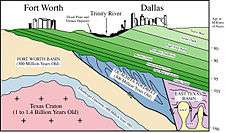

The Eagle Ford Group (also called the Eagle Ford Shale) is a sedimentary rock formation from the Late Cretaceous age underlying much of South Texas in the United States, consisting of organic matter-rich fossiliferous marine shale. It derives its name from the old community of Eagle Ford where outcrops of the Eagle Ford Shale were first observed. Due to the sloping nature of the formation, the shale reaches the surface in North Texas while the oil-bearing portion is much deeper in South Texas where the drilling activity occurs. Eagle Ford Shale was one of the most actively drilled targets for oil and gas in the United States in 2010,[1] but its output had dropped sharply by 2015.[2]

Depositional environment

Transgression continued to occur after complete deposition of the Woodbine around 92 million years ago ("mya"). Creation of the Colorado Group, which first created the Eagle Ford Shale, occurred between ~92 and 88 mya. The Eagle Ford is mostly confined within the subsurface but outcrops on the west side of Dallas and continues at a 1 degree easterly prograding tilt. The Eagle Ford Shale had sea level depths about 100 meters or 330 feet, and deposited about 20-50 kilometers from the shore. The depositional environment in the lower beds was low energy and slightly anoxic. This anoxic setting of the deeper oceanic waters was a result of increased amounts of CO₂ during deposition in the Cretaceous. The lower section of the Eagle Ford consists of organic-rich, pyritic, and fossiliferous marine shales which mark the maximum flooding surface, or the deepest water during Eagle Ford deposition. The different fauna present in the Eagle Ford suggest the waters were calm and within the photic zone. A small member of the Eagle Ford that consists of a thin limestone unit between shales is known as the Kamp Ranch. A small regressive highstand formed this carbonate layer towards the top of the Eagle Ford, identifiable by high energy features, such as ripple marks from storm generated waves and interbedded carbonaceous siltstones. The overall thickness of the undivided Eagle Ford Group is 200–300 feet thick.

Eagle Ford unconformity

In the Cretaceous after the Woodbine and Eagle Ford formations were deposited, the Sabine Uplift started to become elevated again due to its reactivation ~88mya. A decrease in the effective elastic plate thicknesses caused the basin to subside, as the uplift became increasingly elevated. As a result, an estimated 150m of uplift over the Sabine region caused the eastern parts of the Woodbine and Eagle Ford formations to have a subaerial exposure, which eventually resulted in their easterly erosion. Deposition of the Austin Chalk after this erosional occurrence caused a sealing of the well known East Texas petroleum reservoir, and creation of a middle Cretaceous unconformity. Currently the Sabine Uplift is in the subsurface, and the middle Cretaceous unconformity is not seen because it is buried below a massive wedge of clastic sediments from the Late Cretaceous to the present.

Eagle Ford Group undivided

North of Hill County, shale, sandstone, and limestone; shale, bituminous, selenitic, with calcareous concretions and large septaria; sandstone and sandy limestone in upper and middle parts, platy, burrowed, medium to dark gray; in lower part bentonitic; hard limestone bed marks base in Ellis and Johnson Counties; locally forms low cuesta; thickness 200–300 feet.

Oil and natural gas

Petrohawk drilled the first well to produce oil and gas from the Eagle Ford in 2008, in LaSalle County, Texas. Oil companies quickly extended the productive area, which stretches from the Texas-Mexico border in Webb and Maverick counties and extends 400 miles toward East Texas. The play is 50 miles wide and an average of 250 feet thick at a depth between 4000 and 12,000 feet. The shale contains a high amount of carbonate which makes it brittle and easier to use hydraulic fracturing to produce the oil or gas.[3]

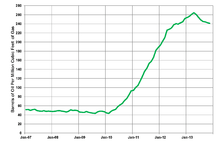

The oil reserves are estimated at 3 billion barrels.[4] The US Energy Information Administration estimated that the Eagle Ford held 50.2 trillion cubic feet of unproved, technically recoverable gas. The average well was estimated to produce 2.36 billion cubic feet of gas.[5]

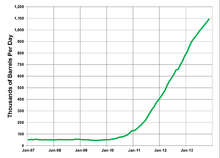

In the first six months of 2013, the Eagle Ford produced 2.69 billion cubic feet of gas and 599,000 barrels of oil and condensate per day; the oil production represented an increase of 51% over the average for 2012. By the end of 2013, production had skyrocketed to over 1,000,000 boe/day.[6] As of 2013, Eagle Ford production extended into 24 counties in Texas.[7] Analysts expect that $30 billion will be spent on further developing Eagle Ford in 2015. The large increase in tight oil production is one of the reasons behind the price drop in late 2014.[8]

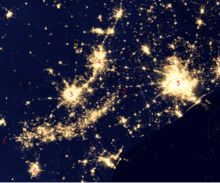

The oil and gas operations are clearly visible on nighttime satellite photos of the United States, appearing as a diffuse bright patch about two hundred miles long, between the more concentrated lights of San Antonio, Corpus Christi, and neighboring cities.[9]

Proved reserves (US)

- US EIA, 2010: 2.5 trillion cubic feet of gas

- US EIA, 2011: 1.25 billion barrels of oil, 8.4 trillion cubic feet of gas[10]

- US EIA, 2012: 3.37 billion barrels of oil[11]

Mexico

The Eagle Ford Formation extends into northern Mexico's Burgos Basin where it is known as the Boquillas Formation, and has an average thickness of 200 meters. Total organic content (TOC) is estimated to average 5%. Technically recoverable hydrocarbons are estimated to be 343 trillion cubic feet of shale gas and 6.3 billion barrels of tight oil. The national oil company Pemex first began exploring in 2010-2011. Pemex has an exploration program in progress until 2015.[12]

In April 2013, Pemex started producing the nation's first shale gas well, just south of the US border. The well was completed in the equivalent of the Eagle Ford Formation.[13] Gas drilling in the Burgos Basin, close to the US border, has been hampered by drug gangs.[14] One Mexican industry expert said that Mexico was unlikely to develop the Eagle Ford, because of lack of pipeline infrastructure, lack of expertise, and because the Mexican company Pemex was investing in oil deposits that yield a higher rate of return.[15]

Hard times strike

With the decline in gasoline prices in 2015, a sharp downturn has swept through Eagle Ford Shale. In January 2015, there were 840 active rigs in Texas as a whole; by the end of the year, 321. At Eagle Ford, the decline in twelve months tumbled from 200 to 76. The oil price decline has rendered it uneconomical to drill sub-optimal wells. Particularly hard hit in the decline are the oil-field workers in Cotulla and the other communities of Alice, Benavides, Agua Dulce, and Freer.[2]

See also

References

- ↑ "Eagle Ford Shale - South Texas - Natural Gas & Oil Field" OilShaleGas.com

- 1 2 Jennifer Hiller, "Hard Times Hit Eagle Ford", San Antonio Express-News, January 3, 2016, pp. 1, A20

- ↑ "Eagle Ford Information" Railroad Commission of Texas

- ↑ Selam Gebrekidan "Analysis: 100 years after boom, shale makes Texas oil hot again", Reuters. May 3, 2011.

- ↑ US Energy Information Administration, Annual Energy outlook 2012, accessed 14 Sept. 2013.

- ↑ Fuel Fix, Dec 3, 2013.

- ↑ Texas Railroad Commission, Eagle Ford Information, 24 July 2013.

- ↑ Ovale, Peder. "Her ser du hvorfor oljeprisen faller" In English Teknisk Ukeblad, 11 December 2014. Accessed: 11 December 2014.

- ↑ Melissa Block (April 10, 2014). "Drilling Frenzy Fuels Sudden Growth In Small Texas Town". NPR.

- ↑ US EIA, U.S. crude oil and nayural gas proved reserves, 1 Aug. 2013.

- ↑ US EIA, Table 2: Proved reserves of tight oil plays, 2014.

- ↑ "Technically Recoverable Shale Oil and Shale Gas Resources: An Assessment of 137 Shale Formations in 41 Countries Outside the United States" (PDF). U.S. Energy Information Administration (EIA). June 2013. Retrieved June 11, 2013.

- ↑ David Alire Garcia, "Mexico still far from tapping shale potential, minister says", Toronto Globe and Mail, 8 May 2013.

- ↑ Dudley Althaus, "Zetas gang poses daunting threat to Mexico's shale gas", Houston Chronicle, 26 Sept. 2012.

- ↑ Emily Pickrell, "Mexico unlikely to tap its Eagle Ford Shale, experts say", Houston Chronicle, 31 Oct. 2013.

External links

- The University of Texas at Dallas - Geosciences Department

- Energy Industry Photos

- Eagle Ford Shale News - Oil & Gas Journal

- U.S. Crude Oil Production Forecast- Analysis of Crude Types (PDF), Washington, DC: U.S. Energy Information Administration, 29 May 2014, pp. 8–9

| ||||||||||||||