Zions Bancorporation

|

| |

| Public | |

| Traded as |

NASDAQ: ZION S&P 500 Component |

| Industry | Finance and Insurance |

| Founded | 1873 |

| Headquarters | Salt Lake City, Utah, USA |

Key people | Harris H. Simmons, President, chairman and CEO |

| Products | Financial Services |

|

| |

| Total assets | US$55.459 Billion (September 2014)[2] |

Number of employees | 10,452 (2013)[3] |

| Website |

zionsbancorporation |

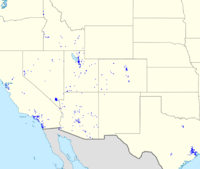

Zions Bancorporation is a bank holding company headquartered in Salt Lake City, Utah, USA. Among its subsidiaries are Amegy Bank of Texas, California Bank & Trust, National Bank of Arizona, Nevada State Bank, the Commerce Bank of Oregon, the Commerce Bank of Washington, Vectra Bank Colorado, Zions First National Bank, Zions Agricultural Finance, Zions Bank Capital Markets, Zions Credit Corporation, Zions Direct, Zions Management Services Company, Zions Public Finance, Zions Small Business Finance, and Contango Capital Advisors. As of June 30, 2008, it had $54.6 billion in assets and nearly 11,000 employees. It is a member of the S&P 500.

History

The history of Zions Bancorporation stretches back to the early days of the Mormon settlement of Utah. Zions can trace its history to the founding of Zion's Savings Bank and Trust Company, which was opened in the fall of 1873 by Brigham Young. At the time of the bank's formation, the first settlers had been in the Salt Lake Valley only 26 years and Utah was still 23 years away from statehood. It was the state's first chartered savings bank and trust company. The bank prospered and grew during the next twenty years. In the panic of 1893, the bank managed not only to remain solvent, but continue to grow.[4]

As the twentieth century began, Zions was making significant contributions to the business community in Utah. Zions helped finance such firms as:

- Bingham Copper Company (later Kennecott Copper)[4]

- Salt Lake and Los Angeles Railroad Company (now Union Pacific)

- Big Cottonwood Power Company (later Utah Power and today Rocky Mountain Power)

- Salt Lake Gas Company (later Mountain Fuel and today Questar Gas)

The Panic of 1907 was the lone interruption in the steady growth of Zions. But even with this interruption, deposits grew.

Great Depression

At the time of the Great Crash of 1929, Zions was in a very sound financial position. On the morning of February 15, 1932, customers began a run on the bank, waiting in lines that ran out of the building and onto the street. Tellers were instructed to honor all withdrawal requests. In two and a half days a total of $1.5 million was withdrawn. Near the end of the second day, bank president Heber J. Grant placed a sign in the bank's window that read, in part:

[The bank] is in a very strong, clean, liquid condition. It can pay off every depositor in full. Fear of its failure is not only without foundation, but positively foolish. There is not a safer bank in the State or the Nation.

Lines of customers that had been as long as a city block began to dwindle, and within five or six days many customers returned to deposit their money. By month's end, total deposits were more than withdrawals, and Zions had survived the most severe crisis in American banking history.[5]

At the end of 1957, Zion's merged with Utah Savings and Trust Company and First National Bank of Salt Lake City. The surviving institution was named Zions First National Bank.

Zions Bancorporation

In 1960, Keystone Insurance and Investment Company, which had been founded in 1955, bought a majority stake in Zions from The Church of Jesus Christ of Latter-day Saints and changed its name to Zions Utah Bancorporation. It kept that name until 1987,[6] when it became shortened to Zions Bancorporation, its present name, to reflect the growing presence of the company outside of Utah.

Zions went public in January 1966, and has paid a cash dividend to shareholders every year since.[6]

Throughout the long bear market of the 1970s, its stock performed well, rising from its low, early in that decade, to ten times in value by 1985, with a three-for-two split in 1981. By 1986 the company had a book value of over US$170 million, with steady annual earnings of over US$26 million.

It expanded into Nevada in 1985 and Arizona in 1986.

In 1993, the stock split again, two-for-one,[7] and by then had more than doubled from its 1985 peak high.[6]

By 1996, the company had become a member of the S&P MidCap 400, and the stock was halfway to yet another double from the prior early 1990s peak, with book value of nearly US$420 million, and earnings of over US$80 million.[6] With the merger of First Security Corporation into Wells Fargo in 2000, Zions became the largest bank headquartered in Utah.

It expanded into Colorado and New Mexico in 1996, Idaho and California in 1997, Washington in 1998, Oregon and Texas in 2005. Today, Harris H. Simmons is CEO of Zions Bancorporation and A. Scott Anderson serves as CEO of Zions Bank.

In 1997, the stock split again, four-for-one.[8]

On Dec 23, 1999, Zions Bancorp announced to restate its financial results for 1996, 1997, 1998 and the first three quarters of 1999, because the Securities and Exchange determined that Zions should account for certain acquisitions using the purchase method.

Recent events

In September 2008, one of Zions' subsidiaries, Nevada State Bank, acquired the insured deposits of failed Silver State Bank, which was closed by Nevada state officials. Silver State was the 11th bank to fail in 2008.

On August 31, 2010, Zions Bancorp announced the sale of its NetDeposit subsidiary to BankServ in a primarily cash transaction. The NetDeposit unit's primary business was remote deposit, along with associated check and credit card processing services.

As of March 2012, Zions owed $700 Million to the US government Troubled Asset Relief Program.[9] On Sept. 26, 2012, Zions Bancorporation redeemed its final $700 million of TARP shares. The shares were redeemed at the full face value (no discount).[10]

See also

- Zions Bank

- List of banks

- List of banks in United States

References

- ↑ "ZION: Company Financials § Net Income", nasdaq.com (NASDAQ), retrieved 2014-12-09

- ↑ Zions Bancorporation: Corporate Overview § Facts and Figures, SNL Financial, retrieved 2014-12-09

- ↑ "2013 Year in Review" (PDF), 2013 Zions Bancorporation Annual Report, Zions Bancorporation, 2014, p. 2, archived (PDF) from the original on 2014-12-09 – via SNL Financial

- ↑ 4.0 4.1 Zions Bancorporation: Corporate Overview § History, SNL Financial, retrieved 2014-12-09

- ↑ Knudson, Max B. (29 November 1998). "1873 gathering led to the creation of Zion's Savings Bank". Deseret News. Archived from the original on 2014-12-09.

- ↑ 6.0 6.1 6.2 6.3 Standard & Poor's Stock Guide, various issues

- ↑ "ZIONS BANCORP. PLANS 2-FOR-1 STOCK SPLIT". Deseret News. December 19, 1992. Archived from the original on 2014-12-09.

- ↑ "Zions Bancorp. OKs 4-for-1 stock split". Deseret News. Archived from the original on 2014-12-09.

- ↑ Zack's Equity Research (March 29, 2012). "Report: Zions Partly Repays TARP Dues". Yahoo! Finance. Archived from the original on 2014-12-09.

- ↑ "Zions Bancorporation Announces Redemption of $700 Million of Series D Preferred Stock (TARP)". PR Newswire. September 26, 2012. Archived from the original on 2014-12-09.

External links

| ||||||||||