Wilshire 5000

The Wilshire 5000 Total Market Index, or more simply the Wilshire 5000, is a market-capitalization-weighted index of the market value of all stocks actively traded in the United States. As of September 30, 2014 the index contained only 3,698 components.[1] The index is intended to measure the performance of most publicly traded companies headquartered in the United States, with readily available price data, (Bulletin Board/penny stocks and stocks of extremely small companies are excluded). Hence, the index includes a majority of the common stocks and REITs traded primarily through New York Stock Exchange, NASDAQ, or the American Stock Exchange. Limited partnerships and ADRs are not included. It can be tracked by following the ticker W5000. 30

History

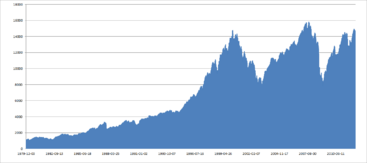

- The Wilshire 5000 Total Market Index was established by the Wilshire Associates in 1974, naming it for the approximate number of issues it included at the time. It was renamed the "Dow Jones Wilshire 5000" in April 2004, after Dow Jones & Company assumed responsibility for its calculation and maintenance. On March 31, 2009 the partnership with Dow Jones was terminated and the index returned to Wilshire Associates.

- The base value for the index was 1404.60 points on base date December 31, 1980,[1] when it had a total market capitalization of $1,404.596 billion. On that date, each one-index-point change in the index was equal to $1 billion. However, index divisor adjustments due to corporate actions and index composition changes have changed the relationship over time, so that by 2005 each index point reflected a change of about $1.2 billion in the index’s total market capitalization.

- The index increased tenfold in less than twenty years from its base date, peaking at a 20th-century closing record high of 14,751.64 points on March 24, 2000, a level that would not be surpassed until February 20, 2007.[2] A hypothetical investment in the Wilshire 5000, made at the 2000 peak and with subsequent dividends reinvested, did not become profitable on a closing basis until October 3, 2006.[3]

- On April 20, 2007, the index closed above 15,000 for the first time. On that day, the S&P 500 was still several percentage points below its March 2000 high, because small cap issues absent from the S&P 500 and included in the Wilshire 5000 outperformed the large cap issues that dominate the S&P 500 during the cyclical bull market. The index reached an all-time high on October 9, 2007 at the 15,806.69 point level, right before the onset of the late-2000s recession and the related late-2000s financial crisis.

- Since late 2007, the expansion of subprime lending difficulties into a wider Financial Crisis, plunged the United States into a renewed bear market that accelerated beginning on September 15, 2008. On October 8, the Wilshire 5000 closed below 10,000 for the first time since 2003. The index continued trading downward towards a 13-year low, reaching a bottom of 6,858.43 points, on March 9, 2009,[4] representing a loss of about $10.9 trillion in market capitalization from its highs in 2007.

- The Wilshire 5000 gained approximately $2.5 trillion in market value during the first 11 months of 2009[5] while the index rose 2,105 points. Therefore, as of November 2009, each index point represented about $1.2 billion in market value.

- The index achieved a new highest yearly close on December 31, 2012, a few percent above those of 1999 and 2007, but failed to do so above the 15,000 level (after achieving it intraday) by fewer than 5 points, closing with 14,995.11 points. However, it continued to rise in the short term such that, on February 8, 2013, the index surpassed the 16,000 level for the first time. It would be the first of four 1000-point milestones that the index reached in 2013, as the index closed above 17,000 for the first time on May 3,[6] 18,000 for the first time on August 1, and 19,000 for the first time on November 14. The Wilshire 5000 would close out 2013 on a record high, finishing the December 31, 2013 trading session at 19,706.03 points.

- On February 28, 2014, the Wilshire 5000 had its first intraday high over 20,000 points. On March 4, the index closed above this milestone for the first time. On July 1, 2014, the index closed above the 21,000 level for the first time.

Record High Wilshire 5000 Index Values

| Type | Date Set | Value |

|---|---|---|

| Highest Intraday | April 23, 2015 | 22,467.14 |

| Highest Closing | April 24, 2015 | 22,431.18 |

Versions

There are five versions of the index:

- Full capitalization total return

- Full capitalization price

- Float-adjusted total return

- Float-adjusted price

- Equal weight[7][8]

The difference between the total return and price versions of the index is that the total return versions accounts for reinvestment of dividends. The difference between the full capitalization, float-adjusted, and equal weight versions is in how the index components are weighted. The full cap index uses the total shares outstanding for each company. The float-adjusted index uses shares adjusted for free float. The equal-weighted index assigns each security in the index the same weight.

Calculation

Let:

- M = Number of issues included in the index;

- Pi = Price of one share of issue i included in the index;

- Ni = Number of shares of issue i for the full capitalization version, or the float of issue i for the float-adjusted version;

-

= a fixed scaling factor.

= a fixed scaling factor.

The value of the index is then:

At present, one index point corresponds to a little more than US$1 billion of market capitalization.

The list of issues included in the index is updated monthly to add new listings resulting from corporate spin-offs and initial public offerings, and to remove issues which move to the pink sheets or that have ceased trading for at least 10 consecutive days.

Alternatives

The CRSP U.S. Total Market Index (ticker CRSPTM1) is a very similar comprehensive index of U.S. stocks supplied by the Center for Research in Security Prices. It was especially designed for use by Index funds. After Dow Jones and Wilshire split up, Dow Jones made their own total stock market index, called the Dow Jones U.S. Total Stock Market Index, similar to the Wilshire 5000.

See also

- Wilshire Associates

- Wilshire 4500

- Russell 3000

- Dow Jones & Company

- News Corporation

- NASDAQ OMX

- NYSE Euronext

- S&P 1500

References

- ↑ 1.0 1.1 "Wilshire Associates - Wilshire 5000".

- ↑ http://www.marketwatch.com/story/average-us-stock-at-all-ime-high-as-wilshire-index-sets-record

- ↑ Hulbert, Mark (2006-09-28). "Losses from 2000-02 bear market have now been erased". MarketWatch. Retrieved 2009-03-23.

- ↑ http://www.pionline.com/article/20100324/DAILYREG/100329940

- ↑ "Wilshire Indexes News Release, December 7, 2009" (PDF). Wilshire Associates Incorporated. Retrieved 2010-01-04.

- ↑ http://finance.yahoo.com/q/hp?s=%5EW5000&a=04&b=1&c=2013&d=04&e=3&f=2013&g=d

- ↑ "Wilshire: Index Calculator Result".

- ↑ "Wilshire 5000 Methodology" (PDF).

External links

| ||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||