Vickrey–Clarke–Groves auction

In auction theory, a Vickrey–Clarke–Groves (VCG) auction is a type of sealed-bid auction of multiple items. Bidders submit bids that report their valuations for the items, without knowing the bids of the other people in the auction. The auction system assigns the items in a socially optimal manner: it charges each individual the harm they cause to other bidders.[1] It also gives bidders an incentive to bid their true valuations, by ensuring that the optimal strategy for each bidder is to bid their true valuations of the items. It is a generalization of a Vickrey auction for multiple items.

The auction is named after William Vickrey,[2] Edward H. Clarke,[3] and Theodore Groves[4] for their papers that successively generalized the idea.

Formal description

- Notation

For any set of auctioned items  and any set of bidders

and any set of bidders  , let

, let  be the social value of the VCG auction for a given bid-combination. For a bidder

be the social value of the VCG auction for a given bid-combination. For a bidder  and item

and item  , let the bidder's bid for the item be

, let the bidder's bid for the item be  .

.

- Assignment

A bidder  whose bid for an item

whose bid for an item  , namely

, namely  , is an "overbid" wins the item, but pays

, is an "overbid" wins the item, but pays  , which is the social cost of his winning that is incurred by the rest of the agents.

, which is the social cost of his winning that is incurred by the rest of the agents.

- Explanation

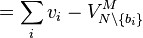

Indeed, the set of bidders other than  is

is  . When item

. When item  is available, they could attain welfare

is available, they could attain welfare  The winning of the item by

The winning of the item by  reduces the set of available items to

reduces the set of available items to  , however, so that the attainable welfare is now

, however, so that the attainable welfare is now  . The difference between the two levels of welfare is therefore the loss in attainable welfare suffered by the rest bidders, as predicted, given the winner

. The difference between the two levels of welfare is therefore the loss in attainable welfare suffered by the rest bidders, as predicted, given the winner  got the item

got the item  . This quantity depends on the offers of the rest agents and is unknown to agent

. This quantity depends on the offers of the rest agents and is unknown to agent  .

.

- Winner's utility

The winning bidder whose bid is his true value  for the item

for the item  ,

,  derives maximum utility

derives maximum utility

Examples

Example #1

See the example with apples in the Generalization section of Vickrey Auction.

Example #2

Assume that there are two bidders,  and

and  , two items,

, two items,  and

and  , and each bidder is allowed to obtain one item. We let

, and each bidder is allowed to obtain one item. We let  be bidder

be bidder  's valuation for item

's valuation for item  . Assume

. Assume  ,

,  ,

,  , and

, and  . We see that both

. We see that both  and

and  would prefer to receive item

would prefer to receive item  ; however, the socially optimal assignment gives item

; however, the socially optimal assignment gives item  to bidder

to bidder  (so his achieved value is

(so his achieved value is  ) and item

) and item  to bidder

to bidder  (so his achieved value is

(so his achieved value is  ). Hence, the total achieved value is

). Hence, the total achieved value is  , which is optimal.

, which is optimal.

If person  were not in the auction, person

were not in the auction, person  would still be assigned to

would still be assigned to  , and hence person

, and hence person  can gain nothing. The current outcome is

can gain nothing. The current outcome is  hence

hence  is charged

is charged  .

.

If person  were not in the auction,

were not in the auction,  would be assigned to

would be assigned to  , and would have valuation

, and would have valuation  . The current outcome is 3 hence

. The current outcome is 3 hence  is charged

is charged  .

.

Example #3

Here we will look at a multiple item auction. Consider the situation when there are  bidders,

bidders,  houses, and values

houses, and values  , representing

the value player

, representing

the value player  has for house

has for house  . Possible outcomes in this auction are characterized by bipartite matchings, pairing houses with people.

If we know the values, then maximizing social welfare reduces to computing a maximum weight bipartite matching.

. Possible outcomes in this auction are characterized by bipartite matchings, pairing houses with people.

If we know the values, then maximizing social welfare reduces to computing a maximum weight bipartite matching.

If we do not know the values, then we instead solicit bids  , asking each player

, asking each player  how much he would wish to bid for house

how much he would wish to bid for house  .

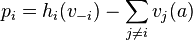

Define

.

Define  if bidder

if bidder  receives house

receives house  in the matching

in the matching  . Now compute

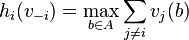

. Now compute  , a maximum weight

bipartite matching with respect to the bids, and compute

, a maximum weight

bipartite matching with respect to the bids, and compute

-

![p_i = \left[ \max_{a \in A} \sum_{j \neq i} b_j(a) \right] - \sum_{j \neq i} b_j(a^*)](../I/m/64e8c6fca1ba6a2a99b2ba1667664933.png) .

.

The first term is another max weight bipartite matching, and the second term can be computed easily from  .

.

Optimality of Truthful Bidding

The following is a proof that bidding one's true valuations for the auctioned items is optimal.[5]

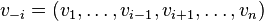

For each bidder  , let

, let  be his true valuation of an item

be his true valuation of an item  , and suppose (without loss of generality) that

, and suppose (without loss of generality) that  wins

wins  upon submitting his true valuations.

Then the net utility

upon submitting his true valuations.

Then the net utility  attained by

attained by  is given by

is given by

. As

. As  is independent of

is independent of  , the maximization of net utility is pursued by the mechanism along with the maximization of corporate gross utility

, the maximization of net utility is pursued by the mechanism along with the maximization of corporate gross utility  for the declared bid

for the declared bid  .

.

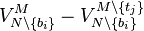

Let us form the difference ![U_i - U_j = \left[v_i + V^{M \setminus \{t_i\}}_{N \setminus \{b_i\}}\right] - \left[v_j + V^{M \setminus \{t_j\}}_{N \setminus \{b_i\}}\right]](../I/m/2c517a2c71202acafe3566690a5a2690.png) between net utility

between net utility  of

of  under truthful bidding

under truthful bidding  gotten item

gotten item  , and net utility

, and net utility  of bidder

of bidder  under non-truthful bidding

under non-truthful bidding  for item

for item  gotten item

gotten item  on utility

on utility  .

.

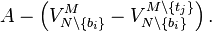

![\left[v_j + V^{M \setminus \{t_j\}}_{N \setminus \{b_i\}}\right]](../I/m/e6f9b3dcdd88e7b992f0cf2263f3bec5.png) is the maximum corporate gross utility obtained with the non-truthful bidding. But the allocation assigning

is the maximum corporate gross utility obtained with the non-truthful bidding. But the allocation assigning  to

to  is different from the allocation of

is different from the allocation of  to

to  which gets maximum true gross corporate utility. Hence

which gets maximum true gross corporate utility. Hence ![\left[v_i + V^{M \setminus \{t_i\}}_{N \setminus \{b_i\}}\right] - \left[v_j + V^{M \setminus \{t_j\}}_{N \setminus \{b_i\}}\right]\geq 0](../I/m/a90425e71868f5af587f06bf4e05e300.png) and

and  q.e.d.

q.e.d.

More general setting

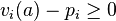

We can consider a more general setting[6] of the VCG mechanism. Consider a set  of possible outcomes and

of possible outcomes and  bidders which have different valuations for each outcome. This can be expressed as, function

bidders which have different valuations for each outcome. This can be expressed as, function

for each bidder  which expresses the value it has for each alternative. In this auction, each bidder will submit his valuation and the VCG mechanism will choose the alternative

which expresses the value it has for each alternative. In this auction, each bidder will submit his valuation and the VCG mechanism will choose the alternative  that maximizes

that maximizes  and charge prices

and charge prices  given by:

given by:

where  , that is,

, that is,  is a function that only depends on the valuation of the other players. This alone gives a truthful mechanism, that is, a mechanism where bidding the true valuation is a dominant strategy.

is a function that only depends on the valuation of the other players. This alone gives a truthful mechanism, that is, a mechanism where bidding the true valuation is a dominant strategy.

We could take, for example,  , but we would have all prices negative, which might not be desirable. We would rather prefer that players give money to the mechanism than the other way around. The function:

, but we would have all prices negative, which might not be desirable. We would rather prefer that players give money to the mechanism than the other way around. The function:

is called Clark pivot rule.

On the other hand, if we do not know the values  , we can solicit bids

, we can solicit bids  . The mechanism

then chooses

. The mechanism

then chooses  maximizing the revenue

maximizing the revenue  , treating the bids like the values. We then set

, treating the bids like the values. We then set

Intuitively, the mechanism charges player  his externality, or the decrease in optimal social welfare when he is included in the auction.

his externality, or the decrease in optimal social welfare when he is included in the auction.

The Clark pivot rule has some very good properties as:

- it is individually rational, i.e.,

. It means that all the players are getting positive utility by participating in the auction. No one is forced to bid.

. It means that all the players are getting positive utility by participating in the auction. No one is forced to bid.

- it has no positive transfers, i.e.,

. The mechanism does not need to pay anything to the bidders.

. The mechanism does not need to pay anything to the bidders.

See also

References

- ↑ von Ahn, Luis (2011-10-13). "Sponsored Search" (PDF). 15–396: Science of the Web Course Notes. Carnegie Mellon University. Retrieved 2015-04-13.

- ↑ Vickrey, William (1961). "Counterspeculation, Auctions, and Competitive Sealed Tenders". The Journal of Finance 16 (1): 8–37. doi:10.1111/j.1540-6261.1961.tb02789.x.

- ↑ Clarke, E. (1971). "Multipart Pricing of Public Goods". Public Choice 11 (1): 17–33. doi:10.1007/bf01726210.

- ↑ Groves, T. (1973). "Incentives in Teams". Econometrica 41 (4): 617–631. doi:10.2307/1914085.

- ↑ http://www.cs.cmu.edu/~arielpro/15896/docs/notes14.pdf

- ↑ Nisam, Noam (2007). "Introduction to Mechanism Design for Computer Scientists". In Nisan, Noam; Roughgarden, Tim; Tardos, Eva; Vazirani, Vijay. Algorithmic Game Theory (PDF). pp. 218–133. ISBN 978-0521872829.

![p_i = \left[ \max_{a \in A} \sum_{j \neq i} b_j(a) \right] - \sum_{j \neq i} b_j(a^*).](../I/m/824a9f4c735536463104d20ba4366903.png)