Vasicek model

In finance, the Vasicek model is a mathematical model describing the evolution of interest rates. It is a type of "one-factor model" (more precisely, one factor short rate model) as it describes interest rate movements as driven by only one source of market risk. The model can be used in the valuation of interest rate derivatives, and has also been adapted for credit markets, although its use in the credit market is in principle wrong, implying negative probabilities (see for example Brigo and Mercurio (2006), Section 21.1.1). It was introduced in 1977 by Oldřich Vašíček [1] and can be also seen as a stochastic investment model.

Details

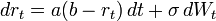

The model specifies that the instantaneous interest rate follows the stochastic differential equation:

where Wt is a Wiener process under the risk neutral framework modelling the random market risk factor, in that it models the continuous inflow of randomness into the system. The standard deviation parameter,  , determines the volatility of the interest rate and in a way characterizes the amplitude of the instantaneous randomness inflow. The typical parameters

, determines the volatility of the interest rate and in a way characterizes the amplitude of the instantaneous randomness inflow. The typical parameters  and

and  , together with the initial condition

, together with the initial condition  , completely characterize the dynamics, and can be quickly characterized as follows, assuming

, completely characterize the dynamics, and can be quickly characterized as follows, assuming  to be non-negative:

to be non-negative:

-

: "long term mean level". All future trajectories of

: "long term mean level". All future trajectories of  will evolve around a mean level b in the long run;

will evolve around a mean level b in the long run; -

: "speed of reversion".

: "speed of reversion".  characterizes the velocity at which such trajectories will regroup around

characterizes the velocity at which such trajectories will regroup around  in time;

in time; -

: "instantaneous volatility", measures instant by instant the amplitude of randomness entering the system. Higher

: "instantaneous volatility", measures instant by instant the amplitude of randomness entering the system. Higher  implies more randomness

implies more randomness

The following derived quantity is also of interest,

-

: "long term variance". All future trajectories of

: "long term variance". All future trajectories of  will regroup around the long term mean with such variance after a long time.

will regroup around the long term mean with such variance after a long time.

and

and  tend to oppose each other: increasing

tend to oppose each other: increasing  increases the amount of randomness entering the system, but at the same time increasing

increases the amount of randomness entering the system, but at the same time increasing  amounts to increasing the speed at which the system will stabilize statistically around the long term mean

amounts to increasing the speed at which the system will stabilize statistically around the long term mean  with a corridor of variance determined also by

with a corridor of variance determined also by  . This is clear when looking at the long term variance,

. This is clear when looking at the long term variance,

which increases with  but decreases with

but decreases with  .

.

This model is an Ornstein–Uhlenbeck stochastic process. Making the long term mean stochastic to another SDE is a simplified version of the cointelation SDE.[2]

Discussion

Vasicek's model was the first one to capture mean reversion, an essential characteristic of the interest rate that sets it apart from other financial prices. Thus, as opposed to stock prices for instance, interest rates cannot rise indefinitely. This is because at very high levels they would hamper economic activity, prompting a decrease in interest rates. Similarly, interest rates can not decrease below 0. As a result, interest rates move in a limited range, showing a tendency to revert to a long run value.

The drift factor  represents the expected instantaneous change in the interest rate at time t. The parameter b represents the long run equilibrium value towards which the interest rate reverts. Indeed, in the absence of shocks (

represents the expected instantaneous change in the interest rate at time t. The parameter b represents the long run equilibrium value towards which the interest rate reverts. Indeed, in the absence of shocks ( ), the interest rate remains constant when rt = b. The parameter a, governing the speed of adjustment, needs to be positive to ensure stability around the long term value. For example, when rt is below b, the drift term

), the interest rate remains constant when rt = b. The parameter a, governing the speed of adjustment, needs to be positive to ensure stability around the long term value. For example, when rt is below b, the drift term  becomes positive for positive a, generating a tendency for the interest rate to move upwards (toward equilibrium).

becomes positive for positive a, generating a tendency for the interest rate to move upwards (toward equilibrium).

The main disadvantage is that, under Vasicek's model, it is theoretically possible for the interest rate to become negative, an undesirable feature. This shortcoming was fixed in the Cox–Ingersoll–Ross model, exponential Vasicek model, Black–Derman–Toy model and Black–Karasinski model, among many others. The Vasicek model was further extended in the Hull–White model. The Vasicek model is also a canonical example of the affine term structure model, along with the Cox–Ingersoll–Ross model.

Asymptotic mean and variance

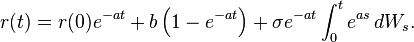

We solve the stochastic differential equation to obtain

Using similar techniques as applied to the Ornstein–Uhlenbeck stochastic process we get that state variable is distributed normally with mean

and variance

Consequently, we have

and

See also

References

- ↑ Vasicek, O. (1977), "An equilibrium characterization of the term structure", J.Financial Economics 5: 177–188

- ↑ Mahdavi Damghani B. (2013). "The Non-Misleading Value of Inferred Correlation: An Introduction to the Cointelation Model". Wilmott Magazine. doi:10.1002/wilm.10252.

- Hull, John C. (2003). Options, Futures and Other Derivatives. Upper Saddle River, NJ: Prentice Hall. ISBN 0-13-009056-5.

- Vasicek, Oldrich (1977). "An Equilibrium Characterisation of the Term Structure". Journal of Financial Economics 5 (2): 177–188. doi:10.1016/0304-405X(77)90016-2.

- Damiano Brigo, Fabio Mercurio (2001). Interest Rate Models – Theory and Practice with Smile, Inflation and Credit (2nd ed. 2006 ed.). Springer Verlag. ISBN 978-3-540-22149-4.

- Jessica James, Nick Webber (2000). Interest Rate Modelling. Wiley. ISBN 0-471-97523-0.

External links

- Price of Zero Coupon Bond under Vasicek Model, Free Online Calculator, QuantCalc

- The Vasicek Model, Bjørn Eraker, Wisconsin School of Business

- Yield Curve Estimation and Prediction with the Vasicek Model, D. Bayazit, Middle East Technical University

| ||||||||||||||||||||||||||||||

![\mathrm{E}[r_t] = r_0 e^{-a t} + b(1 - e^{-at})](../I/m/b42f951ec9ea7621653b2fdac4b0c240.png)

![\mathrm{Var}[r_t] = \frac{\sigma^2}{2 a}(1 - e^{-2at}).](../I/m/6e1d771de8aa82b9c27fef2dfbf22160.png)

![\lim_{t \to \infty} \mathrm{E}[r_t] = b](../I/m/dc4e3e228e2ba127be4663a386cc1a8f.png)

![\lim_{t \to \infty} \mathrm{Var}[r_t] = \frac{\sigma^2}{2 a}.](../I/m/275cae9c2f0272441939bb393adaccdf.png)