United Kingdom national debt

.svg.png) |

| This article is part of a series on the politics and government of the United Kingdom |

|

Foreign policy |

|

Politics portal |

The United Kingdom National Debt is the total quantity of money borrowed by the Government of the United Kingdom at any one time through the issue of securities by the British Treasury and other government agencies.

As of Q1 2015 UK government debt amounted to £1.56 trillion, or 81.58% of total GDP, at which time the annual cost of servicing (paying the interest) the public debt amounted to around £43bn, or roughly 3% of GDP. The debt was forecast to rise to 96% of total GDP in 2013, further rising to 99% of GDP in 2014. At the end of December 2013, public sector net debt (see government debt) in the UK was £1,254.3 billion or 75.7% of GDP.[1]

Due to the Government's significant budget deficit, the national debt is increasing by approximately £107 billion per annum, or around £2 billion each week. As a result of its efforts to balance the budget, the Government forecasts that the structural deficit will be eliminated in the financial year 2017/18. [2]

On 23 February 2013 Moody's downgraded UK credit rating from AAA to Aa1.

Definition

The UK National debt is the total quantity of money borrowed by the Government of the United Kingdom at any one time through the issue of securities by the British Treasury and other government agencies.

Debt versus deficit

The UK national debt is often confused (even by politicians) with the Government budget deficit (officially known as the Public Sector Net Cash Requirement (PSNCR)), which is the rate at which the Government borrows money. The Prime Minister David Cameron was reprimanded in February 2013 by the UK Statistics Authority for creating confusion between the two, by stating in a political broadcast that his administration was "paying down Britain's debts". In fact, his administration has been attempting to reduce the deficit, not the overall debt. The latter will continue to rise even if the deficit shrinks.[3]

UK budget

The public debt increases or decreases as a result of the annual budget deficit or surplus. The British Government budget deficit or surplus is the cash difference between government receipts and spending, ignoring intra-governmental transfers. The British Government debt is rising due to a gap between revenue and expenditure. Total government revenue in the fiscal year 2011/12 was projected to be £589 billion, whereas total expenditure was estimated at £710 billion. Therefore the total deficit, was £121 billion. This represented a rate of borrowing of a little over £2 billion per week.

Gilts

The British Government finances its debt by issuing Gilts, or Government securities. These securities are the simplest form of government bond and make up the largest share of British Government debt.[4] A conventional gilt is a bond issued by the British Government which pays the holder a fixed cash payment (or coupon) every six months until maturity, at which point the holder receives the final coupon payment and the return of the principal.

Cost of servicing the debt

Distinct from both the national debt and the PSNCR is the interest that the Government must pay to service the existing national debt. In 2012, the annual cost of servicing the public debt amounted to around £43bn, or roughly 3% of GDP.[5]

In 2012 the British population numbered around 64 million, and the debt therefore amounted to a little over £15,000 for each individual Briton, or around £33,000 per person in employment. Each household in Britain pays an average of around £2,000 per year in taxes to finance the interest.[6]

However, by international standards Britain enjoys very low borrowing costs, largely because the British Government has never failed to repay its creditors.[6]

Credit rating

Like other sovereign debt, the British national debt is rated by various ratings agencies. On 23 February 2013 it was reported that Moody's had downgraded UK debt from AAA to Aa1, the first time since 1978 that the country has not enjoyed a AAA credit rating.[7]

This was described as a "humiliating blow" by Shadow Chancellor Ed Balls. Chancellor George Osborne said that it was "a stark reminder of the debt problems facing our country", adding that "we will go on delivering the plan that has cut the deficit by a quarter". Both France and the United States of America also lost their AAA credit status in 2012.[7]

Remedies for indebtedness

All the main political parties in Britain agree that the national debt is too high, but there is disagreement as to the remedy. As of 2012 the national debt was forecast to approach 100% of Gross Domestic Product (GDP), far above the government’s sustainable investment rule of a national debt no greater than 40% of GDP.[5]

In Parliament, there continues to be disagreement between the political parties regarding the national debt, with Conservative Party politicians typically advocating a larger role for cuts to public spending. By contrast, the Labour Party tends to advocate fewer cuts and more emphasis on greater government spending in order to stimulate economic expansion.

History

The origins of the British national debt can be found during the reign of William III, who engaged a syndicate of City traders and merchants to offer for sale an issue of government debt. This syndicate soon evolved into the Bank of England, eventually financing the wars of the Duke of Marlborough and later Imperial conquests. The national debt increased dramatically during and after the Napoleonic Wars, rising to around 200% of GDP. Over the course of the 19th century the national debt gradually fell, only to see large increases again during World War I and World War II. After the war, the national debt once again slowly fell as a proportion of GDP.

Modern era

In 1976 the British Government led by James Callaghan faced a Sterling crisis during which the value of the pound tumbled and the government found it difficult to raise sufficient funds to maintain its spending commitments. The Prime Minister was forced to apply to the International Monetary Fund for a £2.3 billion rescue package; the largest-ever call on IMF resources up to that point.[8] In November 1976 the IMF announced its conditions for a loan, including deep cuts in public expenditure, in effect taking control of UK domestic policy.[9] The crisis was seen as a national humiliation, with Callaghan being forced to go "cap in hand" to the IMF.[10]

Recent history

In the late 1990s and early 2000s the national debt dropped in relative terms, falling to 29% of GDP by 2002. In 1997 the Labour Government of Tony Blair had inherited a PSNCR of approximately £5 billion per annum, but by sticking to the parsimonious spending plans of the outgoing Conservative Government, this was gradually turned into a modest budget surplus.[11] During the Spending Review of 2000 Labour began to pursue a looser fiscal policy, and by 2002 annual borrowing had reached £20 billion.[11]

The PSNCR continued to increase, despite sustained economic growth, increasing to 37% of GDP in 2007. This was due to extra government borrowing, largely caused by increased spending on health, education, and social security benefits.[5] Since 2008, when the British economy slowed sharply and fell into recession, the national debt has risen dramatically, mainly caused by increased spending on welfare benefits, bank bailouts, and a significant drop in receipts from stamp duty and income tax.[5]

In the 20-year period from 1986/87 to 2006/07 government spending in the United Kingdom averaged around 40% of GDP. As a result of the 2007–2010 financial crisis and the late-2000s global recession government spending increased to a historically high level of 48 per cent of GDP in 2009–10, partly as a result of the cost of a series of bank bailouts.[12] In July 2007, Britain had government debt at 35.5% of GDP.[12] This figure rose to 56.8% of GDP by July 2009.[13] As of June 2010 there were approximately 6,051,000 public sector employees in Britain (compared to approximately 23,107,000 private sector employees).[14]

The national debt today

Official figures state that as of July 2011 the British national debt amounted to £940 billion, or 68% of total GDP.[5] The annual amount that the government must borrow to plug the gap in its finances used to be known as the Public sector borrowing requirement, but is now called the Public Sector Net Cash Requirement (PSNCR).

As of Q1 2012 the national debt amounted to £1,278.2 billion, or 86.8% of total GDP.[15] The PSNCR figure for 2010/11 was £143.2 billion, or 11.7% of GDP.[5] Total British GDP in 2010/11 was estimated by the IMF at $2.25 trillion, or around £1.4 trillon.[16]

By historic peacetime standards, the national debt is large and growing rapidly, but it is currently nowhere near its peak after WW2 when it reached over 180% of GDP.[5]

Nick Silver of the Institute of Economic Affairs estimated the current British liabilities, including state & public pensions, as well as other commitments by the government, to be near £5 trillion, compared with the Government's estimate of £845 billion (as of 17/11/2010)[17] These liabilities can be compared to total net assets (2010 figures) of £7.3 trillion, which equates to approximately a net worth of £120,000 per head of the population. [18]

The British Government's debt is owned by a wide variety of investors, most notably pension funds. These funds are on deposit, mainly in the form of Treasury bonds at the Bank of England. The pension funds, therefore, have an asset which has to be offset by a liability, or a debt, of the government. As of 2011 around 35% of the national debt was owed to overseas governments and investors.[6]

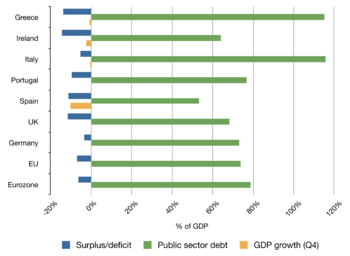

International comparisons

In 2011 Britain's volume of debt was ranked 18th internationally according to the CIA World Factbook. Many other countries had larger debt burdens. For example, Japan had a National debt of around 194% of GDP, whilst that of Italy was more than 100%. The National debt of the United States reached 100% of GDP in November 2011.[5]

See also

- 2011 United Kingdom budget

- Economic history of the United Kingdom

- Economy of the United Kingdom

- Eurozone crisis

- The National Fund

- UK Debt Management Office

- National debt of the United States

Notes

- ↑ "Public Sector Finances". ONS. Retrieved 2014-03-20.

- ↑ The Guardian, 10 February 2014 Retrieved July 2014

- ↑ The Independent 1 February 2013 Retrieved March 2013

- ↑ "UK Debt Management Office". Dmo.gov.uk. Retrieved 2013-10-09.

- ↑ 5.0 5.1 5.2 5.3 5.4 5.5 5.6 5.7 September 4, 2013 (2013-09-04). "UK National Debt". Economics Help. Retrieved 2013-10-09.

- ↑ 6.0 6.1 6.2 "Uk National Debt "Bombshell" - webpage discussing the National Debt". Debtbombshell.com. Retrieved 2013-10-09.

- ↑ 7.0 7.1 Hugh Pym (2013-02-23). "BBC News - UK loses top AAA credit rating for first time since 1978". Bbc.co.uk. Retrieved 2013-10-09.

- ↑ Benedict Brogan (2009-10-22). "The debt crisis of 1976 offers a vision of the blood, sweat and tears facing David Cameron". Telegraph. Retrieved 2013-10-09.

- ↑ "Good-bye Great Britain": 1976 IMF Crisis, K Burk, ISBN 0-300-05728-8

- ↑ Daily Telegraph 23 January 2009 Retrieved September 2011

- ↑ 11.0 11.1 "Public Sector Net Cash Requirement". Politics.co.uk. Retrieved 2013-10-09.

- ↑ 12.0 12.1 "Britain's public debt since 1974". The Guardian. 1 March 2009.

- ↑ "Britain owes £801,000,000,000". The Scotsman. 21 August 2009.

- ↑ "Labour market statistics - October 2010" (PDF). Office for National Statistics. Retrieved 10 November 2010.

- ↑ http://ec.europa.eu/economy_finance/publications/european_economy/2012/pdf/ee-2012-1_en.pdf

- ↑ "Report for Selected Countries and Subjects". Imf.org. 2006-09-14. Retrieved 2013-10-09.

- ↑ Silver, Nick (10 October 2011). "True level of UK government debt exceeds £5 trillion". Retrieved 30 Nov 2013.

- ↑ "UK worth £7.3 trillion". Office for National Statistics. 2 November 2011. Retrieved 30 November 2011.

References

- Ferguson, Niall, The Ascent of Money: A Financial History of the World, Penguin Books, London (2008)

- The Week, p. 15, 21 September 2013

External links

- BBC Budget 2009 Overview

- Telegraph.co.uk 2011 Budget coverage

- BBC Budget 2008 Overview

- HM Treasury Whole of Government Accounts development programme

- Better Government Initiative experts say billions wasted on services, Daily Telegraph, 24 November 2007

- Better Government Initiative

- UK National Debt Clock

- PricewaterhouseCoopers budget coverage and analysis