Third Economic Adjustment Programme for Greece

| Greek debt crisis |

|---|

Election articles

Greek government debt crisis articles |

A Third bailout package has been subject of speculations that another contract between Greece, the European Union (EU) and the International Monetary Fund (IMF) aimed at coping with the Greek government-debt crisis would be needed as a followup to the Second bailout package finalized in 2012.

History

2012

A Financial Times editorial on 22 February 2012 argued leaders had "proved themselves unable to settle on a solution that will not need to be revisited yet again", that at best the deal could only hope to remedy one part of the Greek disaster, namely the country's debilitated public finances, though it would not likely even do that.[1] The Eurozone's latest plan did, at least, evince consistency with the currency block's previous behaviour:

from the start, its approach has been a halfway house of resisting a sovereign default but not doing enough to remove the risk altogether. The reason is obvious: core governments find it politically impossible to put up more money. So it is unfathomable that they did not demand more from private creditors. The debt restructuring leaves Greece and its helpers with €100bn of debt that could have been written down entirely and left funds to address future "accidents" without resorting to a third rescue. If there is another showdown with Greece it will have been caused by this.[1]

German minister of finance Wolfgang Schäuble and Eurogroup president Jean-Claude Juncker shared the scepticism and did not rule out a third bailout.[2][3] According to a leaked official report from the European Commission, the ECB and the IMF, Greece may need another €50 billion ($66bn) from 2015 to 2020.[4]

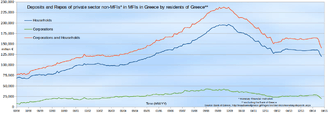

In mid-May 2012 the crisis and impossibility to form a new coalition government after elections led to strong speculation Greece would have to leave the Eurozone. The potential exit became known as "Grexit" and started to affect international market behaviour, as well as causing an accelerated decrease of bank deposits in Greek banks (commonly referred to as a bank-run).

In Greece, after all attempts to form a government failed following the parliamentary election in May 2012, a new second election in mid-June had to be announced. The new election led to the formation of a government of national salvation of conservative New Democracy with the social democrat PASOK and democratic socialist DIMAR, supporting continued adherence to the main principles outlined by the signed bailout plan. The new government however immediately asked its creditors to be granted two extra years, extending the deadline from 2015 to 2017 before being required to be self-financed, with minor budget deficits fully covered by extraordinary income from the privatisation program.

2013 –

In August 2013, Schäuble expressed his expectations that "there will have to be another (bailout) program in Greece," a remark drawing heavy criticisms by other members of the German governing coalition.[5] However, soon thereafter the head of the European Stability Mechanism (ESM), Klaus Regling added to Schäuble's remarks, telling the German business daily Handelsblatt that Greece might need a third bailout package as soon as in 2014.[6]

In February 2014, the Troika was reported again to consider offering Greece a third bailout at €15-17bn, but now in conjunction with an additional debt relief for old Troika held debt, through expanding the maturity of the EFSF bonds from 30 to 50 years and lowering the interest rate 0.5% for the initial €80bn debt pile being owed to all other EU member states through the Greek Loan Facility. A decision about this potential third bailout loan, however awaits finalization of the third review of the second bailout programme, and will be conditional Greece comply with all terms specified in that programme - which include final fiscal data should verify that a primary surplus indeed was achieved in 2013. The potential third bailout loan was expected to be finally considered by European Union policy makers in May or June 2014.[7]

See also

- Greek government-debt crisis

- First bailout package (Greece)

- Second bailout package (Greece)

References

- ↑ 1.0 1.1 Editorial (22 February 2012). "Greek rescue is still a halfway house". Financial Times. p. 12. Retrieved 28 March 2012.

- ↑ Scally, Derek (25 February 2012). "Schäuble concedes third Greek bailout on the cards". Irish Times. Retrieved 1 March 2012.

- ↑ Croft, Adrian (24 February 2012). "Eurogroup head cannot rule out third Greek bailout". Reuters. Retrieved 21 February 2012.

- ↑ Castle, Stephen (20 February 2012). "Europe Agrees on New Bailout to Help Greece Avoid Default". New York Times. Retrieved 1 March 2012.

- ↑ "Bitter Euro Truths: Crisis Could Damage Merkel's Campaign". Spiegel Online. 2013-08-27. Retrieved 2015-01-01.

- ↑ "Crisis Control: Stability Fund Chief Expects Third Greek Bailout". Spiegel Online. 2013-10-04. Retrieved 2015-01-01.

- ↑ "EU Said to Weigh Extending Greek Loans to 50 Years". Bloomberg. 5 February 2014. Retrieved 11 February 2014.