Subjective expected utility

In decision theory, subjective expected utility is the attractiveness of an economic opportunity as perceived by a decision-maker in the presence of risk. Characterizing the behavior of decision-makers as using subjective expected utility was promoted and axiomatized by L. J. Savage in 1954[1] [2] following previous work by Ramsey and von Neumann.[3] The theory of subjective expected utility combines two subjective concepts: first, a personal utility function, and second a personal probability distribution (usually based on Bayesian probability theory).

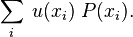

Savage proved that, if the decision-maker adheres to axioms of rationality, believing an uncertain event has possible outcomes  each with a utility of

each with a utility of  then the person's choices can be explained as arising from this utility function combined with the subjective belief that there is a probability of each outcome,

then the person's choices can be explained as arising from this utility function combined with the subjective belief that there is a probability of each outcome,  The subjective expected utility is the resulting expected value of the utility,

The subjective expected utility is the resulting expected value of the utility,

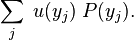

If instead of choosing  the person were to choose

the person were to choose  the person's subjective expected utility would be

the person's subjective expected utility would be

Which decision the person prefers depends on which subjective expected utility is higher. Different people may make different decisions because they may have different utility functions or different beliefs about the probabilities of different outcomes.

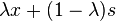

Savage assumed that it is possible to take convex combinations of decisions and that preferences would be preserved. So if a person prefers  to

to  and

and  to

to  then that person will prefer

then that person will prefer  to

to  , for any

, for any  .

.

Experiments have shown that many individuals do not behave in a manner consistent with Savage's axioms of subjective expected utility, e.g. most prominently Allais (1953)[4] and Ellsberg (1961).[5]

Notes

- ↑ Savage, Leonard J. 1954. The Foundations of Statistics. New York, Wiley.

- ↑ Karni, Edi. "Savage's subjective expected utility model." The New Palgrave Dictionary of Economics. Second Edition. Eds. Steven N. Durlauf and Lawrence E. Blume. Palgrave Macmillan, 2008. The New Palgrave Dictionary of Economics Online. Palgrave Macmillan. 23 August 2014 <http://www.dictionaryofeconomics.com/article?id=pde2008_S000479> doi:10.1057/9780230226203.1474

- ↑ Ramsey says that his essay merely elaborates on the ideas of Charles Sanders Peirce. John von Neumann noted the possibility of simultaneous theory of personal probability and utility, but his death left the specification of an axiomatization of subjective expected utility incomplete, until Johann Pfanzagl's work.

- ↑ Allais, M. (1953). "Le Comportement de l'Homme Rationnel Devant Le Risque: Critique des Postulats et Axiomes de L'Ecole Americaine". Econometrica 21 (4): 503–546. doi:10.2307/1907921.

- ↑ Ellsberg, Daniel (1961). "Risk, Ambiguity and Savage Axioms". Quarterly Journal of Economics 75 (4): 643–79. doi:10.2307/1884324.

References

- Charles Sanders Peirce and Joseph Jastrow (1885). "On Small Differences in Sensation". Memoirs of the National Academy of Sciences 3: 73–83. http://psychclassics.yorku.ca/Peirce/small-diffs.htm

- Ramsey, Frank Plumpton; “Truth and Probability” (PDF), Chapter VII in The Foundations of Mathematics and other Logical Essays (1931).

- de Finetti, Bruno. "Probabilism: A Critical Essay on the Theory of Probability and on the Value of Science," (translation of 1931 article) in Erkenntnis, volume 31, September 1989.

- de Finetti, Bruno. 1937, “La Prévision: ses lois logiques, ses sources subjectives,” Annales de l'Institut Henri Poincaré,

- de Finetti, Bruno. "Foresight: its Logical Laws, Its Subjective Sources," (translation of the 1937 article in French) in H. E. Kyburg and H. E. Smokler (eds), Studies in Subjective Probability, New York: Wiley, 1964.

- de Finetti, Bruno. Theory of Probability, (translation by AFM Smith of 1970 book) 2 volumes, New York: Wiley, 1974–5.

- Donald Davidson, Patrick Suppes and Sidney Siegel (1957). Decision-Making: An Experimental Approach. Stanford University Press.

- Pfanzagl, J (1967). "Subjective Probability Derived from the Morgenstern–von Neumann Utility Theory". In Martin Shubik. Essays in Mathematical Economics In Honor of Oskar Morgenstern. Princeton University Press. pp. 237–251.

- Pfanzagl, J. (1968). "Events, Utility and Subjective Probability". Theory of Measurement. Wiley. pp. 195–220.

- Morgenstern, Oskar (1976). "Some Reflections on Utility". In Andrew Schotter. Selected Economic Writings of Oskar Morgenstern. New York University Press. pp. 65–70. ISBN 0-8147-7771-6.

External links

- Edi Karni, Johns Hopkins University (November 9, 2005). "Savages’ Subjective Expected Utility Model". Retrieved 2009-02-17.