Stochastic volatility

Stochastic volatility models are those in which the variance of a stochastic process is itself randomly distributed.[1] They are used in the field of mathematical finance to evaluate derivative securities, such as options. The name derives from the models' treatment of the underlying security's volatility as a random process, governed by state variables such as the price level of the underlying security, the tendency of volatility to revert to some long-run mean value, and the variance of the volatility process itself, among others.

Stochastic volatility models are one approach to resolve a shortcoming of the Black–Scholes model. In particular, models based on Black-Scholes assume that the underlying volatility is constant over the life of the derivative, and unaffected by the changes in the price level of the underlying security. However, these models cannot explain long-observed features of the implied volatility surface such as volatility smile and skew, which indicate that implied volatility does tend to vary with respect to strike price and expiry. By assuming that the volatility of the underlying price is a stochastic process rather than a constant, it becomes possible to model derivatives more accurately.

Basic model

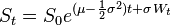

Starting from a constant volatility approach, assume that the derivative's underlying asset price follows a standard model for geometric Brownian motion:

where  is the constant drift (i.e. expected return) of the security price

is the constant drift (i.e. expected return) of the security price  ,

,  is the constant volatility, and

is the constant volatility, and  is a standard Wiener process with zero mean and unit rate of variance. The explicit solution of this stochastic differential equation is

is a standard Wiener process with zero mean and unit rate of variance. The explicit solution of this stochastic differential equation is

.

.

The Maximum likelihood estimator to estimate the constant volatility  for given stock prices

for given stock prices  at different times

at different times  is

is

its expectation value is ![E \left[ \hat{\sigma}^2\right]= \frac{n-1}{n} \sigma^2](../I/m/52e36b5f7581315ed938cd78faae976b.png) .

.

This basic model with constant volatility  is the starting point for non-stochastic volatility models such as Black–Scholes model and Cox–Ross–Rubinstein model.

is the starting point for non-stochastic volatility models such as Black–Scholes model and Cox–Ross–Rubinstein model.

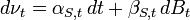

For a stochastic volatility model, replace the constant volatility  with a function

with a function  , that models the variance of

, that models the variance of  . This variance function is also modeled as Brownian motion, and the form of

. This variance function is also modeled as Brownian motion, and the form of  depends on the particular SV model under study.

depends on the particular SV model under study.

where  and

and  are some functions of

are some functions of  and

and  is another standard gaussian that is correlated with

is another standard gaussian that is correlated with  with constant correlation factor

with constant correlation factor  .

.

Heston model

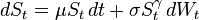

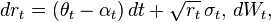

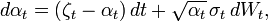

The popular Heston model is a commonly used SV model, in which the randomness of the variance process varies as the square root of variance. In this case, the differential equation for variance takes the form:

where  is the mean long-term volatility,

is the mean long-term volatility,  is the rate at which the volatility reverts toward its long-term mean,

is the rate at which the volatility reverts toward its long-term mean,  is the volatility of the volatility process, and

is the volatility of the volatility process, and  is, like

is, like  , a gaussian with zero mean and

, a gaussian with zero mean and  standard deviation. However,

standard deviation. However,  and

and  are correlated with the constant correlation value

are correlated with the constant correlation value  .

.

In other words, the Heston SV model assumes that the variance is a random process that

- exhibits a tendency to revert towards a long-term mean

at a rate

at a rate  ,

, - exhibits a volatility proportional to the square root of its level

- and whose source of randomness is correlated (with correlation

) with the randomness of the underlying's price processes.

) with the randomness of the underlying's price processes.

There exist few known parametrisation of the volatility surface based on the heston model (Schonbusher, SVI and gSVI) as well as their de-arbitraging methodologies.[2]

CEV model

The CEV model describes the relationship between volatility and price, introducing stochastic volatility:

Conceptually, in some markets volatility rises when prices rise (e.g. commodities), so  . In other markets, volatility tends to rise as prices fall, modelled with

. In other markets, volatility tends to rise as prices fall, modelled with  .

.

Some argue that because the CEV model does not incorporate its own stochastic process for volatility, it is not truly a stochastic volatility model. Instead, they call it a local volatility model.

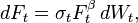

SABR volatility model

The SABR model (Stochastic Alpha, Beta, Rho) describes a single forward  (related to any asset e.g. an index, interest rate, bond, currency or equity) under stochastic volatility

(related to any asset e.g. an index, interest rate, bond, currency or equity) under stochastic volatility  :

:

The initial values  and

and  are the current forward price and volatility, whereas

are the current forward price and volatility, whereas  and

and  are two correlated Wiener processes (i.e. Brownian motions) with correlation coefficient

are two correlated Wiener processes (i.e. Brownian motions) with correlation coefficient  . The constant parameters

. The constant parameters  are such that

are such that  .

.

The main feature of the SABR model is to be able to reproduce the smile effect of the volatility smile.

GARCH model

The Generalized Autoregressive Conditional Heteroskedasticity (GARCH) model is another popular model for estimating stochastic volatility. It assumes that the randomness of the variance process varies with the variance, as opposed to the square root of the variance as in the Heston model. The standard GARCH(1,1) model has the following form for the variance differential:

The GARCH model has been extended via numerous variants, including the NGARCH, TGARCH, IGARCH, LGARCH, EGARCH, GJR-GARCH, etc. Strictly, however, the conditional volatilities from GARCH models are not stochastic since at time t the volatility is completely pre-determined (deterministic) given previous values.[3]

3/2 model

The 3/2 model is similar to the Heston model, but assumes that the randomness of the variance process varies with  . The form of the variance differential is:

. The form of the variance differential is:

However the meaning of the parameters is different from Heston model. In this model both, mean reverting and volatility of variance parameters, are stochastic quantities given by  and

and  respectively.

respectively.

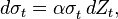

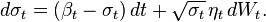

Chen model

In interest rate modelings, Lin Chen in 1994 developed the first stochastic mean and stochastic volatility model, Chen model. Specifically, the dynamics of the instantaneous interest rate are given by following the stochastic differential equations:

Calibration

Once a particular SV model is chosen, it must be calibrated against existing market data. Calibration is the process of identifying the set of model parameters that are most likely given the observed data. One popular technique is to use maximum likelihood estimation (MLE). For instance, in the Heston model, the set of model parameters  can be estimated applying an MLE algorithm such as the Powell Directed Set method to observations of historic underlying security prices.

can be estimated applying an MLE algorithm such as the Powell Directed Set method to observations of historic underlying security prices.

In this case, you start with an estimate for  , compute the residual errors when applying the historic price data to the resulting model, and then adjust

, compute the residual errors when applying the historic price data to the resulting model, and then adjust  to try to minimize these errors. Once the calibration has been performed, it is standard practice to re-calibrate the model periodically.

to try to minimize these errors. Once the calibration has been performed, it is standard practice to re-calibrate the model periodically.

See also

- Chen model

- Heston model

- Local volatility

- gSVI[4]

- Realized volatility

- Risk-neutral measure

- SABR volatility model

- Volatility

- Volatility, uncertainty, complexity and ambiguity

- Black–Scholes model

- Subordinator

- Markov switching multifractal

References

- ↑ Gatheral, J. (2006). The volatility surface: a practitioner's guide. Wiley.

- ↑ Babak Mahdavi Damghani (2013). "De-arbitraging with a weak smile". Wilmott.

- ↑ Brooks, Chris (2014). Introductory Econometrics for Finance (3rd ed.). Cambridge: Cambridge University Press. p. 461. ISBN 9781107661455.

- ↑ Mahdavi Damghani, Babak (2013). "De-arbitraging With a Weak Smile: Application to Skew Risk". Wilmott 2013 (1): 40–49. doi:10.1002/wilm.10201.

Additional Sources

- Stochastic Volatility and Mean-variance Analysis, Hyungsok Ahn, Paul Wilmott, (2006).

- A closed-form solution for options with stochastic volatility, SL Heston, (1993).

- Inside Volatility Arbitrage, Alireza Javaheri, (2005).

- Accelerating the Calibration of Stochastic Volatility Models, Kilin, Fiodar (2006).

- Lin Chen (1996). Stochastic Mean and Stochastic Volatility -- A Three-Factor Model of the Term Structure of Interest Rates and Its Application to the Pricing of Interest Rate Derivatives. Blackwell Publishers. Blackwell Publishers.

| ||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||