Stochastic discount factor

A Stochastic discount factor (SDF) is a concept in financial economics and mathematical finance.

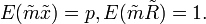

If there are n assets with initial prices  at the beginning of a period and payoffs

at the beginning of a period and payoffs  at the end of the period (all x's are random variables), then SDF is any random variable

at the end of the period (all x's are random variables), then SDF is any random variable  satisfying

satisfying

This definition is of fundamental importance in asset pricing. The name "stochastic discount factor" reflects the fact that the price of an asset can be computed by "discounting" the future cash flow  by the stochastic factor

by the stochastic factor  and then taking the expectation.[1]

and then taking the expectation.[1]

Properties

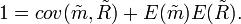

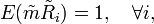

If each  is positive, by using

is positive, by using  to denote the return, we can rewrite the definition as

to denote the return, we can rewrite the definition as

and this implies

Also, if there is a portfolio made up of the assets, then the SDF satisfies

Notice the definition of covariance, it can also be written as

Suppose there is a risk-free asset. Then  implies

implies  . Substituting this into the last expression and rearranging gives the following formula for the risk premium of any asset or portfolio with return

. Substituting this into the last expression and rearranging gives the following formula for the risk premium of any asset or portfolio with return  :

:

This shows that risk premiums are determined by covariances with any SDF.[1]

The existence of an SDF is equivalent to the law of one price.[1]

The existence of a strictly positive SDF is equivalent to the absence of arbitrage opportunities.

Other names

The stochastic discount factor is sometimes referred to as the pricing kernel. This name comes from the fact that if the expectation

is written as an integral, then  can be interpreted as the kernel function in an integral transform.[2]

can be interpreted as the kernel function in an integral transform.[2]

Other names for the SDF sometimes encountered are the marginal rate of substitution (the ratio of utility of states, when utility is separable and additive, though discounted by the risk-neutral rate), a change of measure, or a state-price density.[2]

![E[\tilde{m} (\tilde{R}_i - \tilde{R}_j)] = 0, \quad \forall i,j.](../I/m/2039ebee3baa33933ab3d258cc79dc7a.png)