Startup company

A startup company or startup is a business in the form of a company, a partnership or temporary organization designed to search for a repeatable and scalable business model.[1] These companies, generally newly created, are in a phase of development and research for markets. The term became popular internationally during the dot-com bubble when a great number of dot-com companies were founded.[2]

Definition of a startup company

Steve Blank and Bob Dorf define a start-up as an "organization formed to search for a repeatable and scalable business model." In this case, the verb ‘search’ is intended to differentiate large, i.e. highly valued, start-ups from small businesses, such as a restaurant operating in a mature market. The latter implements a well-known existing business strategy whereas a start-up explores an unknown or innovative business model in order to disrupt existing markets, as in the case of Amazon, Uber or Google. Blank and Dorf add that startups are not smaller versions of larger companies: a startup is a temporary organization designed to search for a business model, while in contrast, a large company is a permanent organization designed to execute a well-defined, fully validated, well tested, proven, verified, stable, clear, un-ambiguous, repeatable and scalable business model. Blank and Dorf further say that a startup essentially goes from failure to failure in an effort to learn from each failure and discover what does not work in the process of searching for a repeatable, high growth business model.[2][3][4][5]

Paul Graham says that "A startup is a company designed to grow fast. Being newly founded does not in itself make a company a startup. Nor is it necessary for a startup to work on technology, or take venture funding, or have some sort of "exit." The only essential thing is growth. Everything else we associate with startups follows from growth." Graham added that an entrepreneur starting a startup is committing to solve a harder type of problem than ordinary businesses do. "You're committing to search for one of the rare ideas that generates rapid growth."[6]

Aswath Damodaran stated that the value of a startup firm "rests entirely on its future growth potential." His definition emphasizes the stage of development rather than the structure of the company or its respective industry. Consequently, he attributes certain characteristics to a start-up which include, but are not limited to, its lack of history and past financial statements, its dependency on private equity, and its statistically small rate of survival.[7][8]

Evolution of a startup company

Startup companies can come in all forms and sizes. A critical task in setting up a business is to conduct research in order to validate, assess and develop the ideas or business concepts in addition to opportunities to establish further and deeper understanding on the ideas or business concepts as well as their commercial potential. Business models for startups are generally found via a bottom-up or top-down approach. A company may cease to be a startup as it passes various milestones,[9] such as becoming publicly traded in an IPO, or ceasing to exist as an independent entity via a merger or acquisition. Companies may also fail and cease to operate altogether.

Investors are generally most attracted to those new companies distinguished by their risk/reward profile and scalability. That is, they have lower bootstrapping costs, higher risk, and higher potential return on investment. Successful startups are typically more scalable than an established business, in the sense that they have the potential to grow rapidly with limited investment of capital, labor or land.

Startups encounter several unique options for funding. Venture capital firms and angel investors may help startup companies begin operations, exchanging seed money for an equity stake. In practice though, many startups are initially funded by the founders themselves. Factoring is another option, though not unique to startups. Other funding opportunities include various forms of crowdfunding, for example equity crowdfunding.[10]

Startup business partnering

Startups usually need to form partnerships with other firms to enable their business model.[11] To become attractive to other businesses startups need to align their internal features, such as management style and products with the market situation. In their 2013 study Kask and Linton develop two ideal profiles, or also known as configurations or archetypes, for startups commercializing inventions. The Inheritor profile calls for management style that is not too entrepreneurial (more conservative) and the startup should have an incremental invention (building on a previous standard). This profile is set out to be more successful (in finding a business partner) in a market that has a dominant design (a clear standard is applied in this market). In contrast to this profile is the Originator which has a management style that is highly entrepreneurial and have a radical invention (totally new standard). This profile is set out to be more successful (in finding a business partner) in a market that does not have a dominant design (established standard). New startups should align themselves to one of the profiles when commercializing an invention to be able to find and be attractive to a business partner. By finding a business partner a startup will have greater chances to become successful.[12]

Startup culture

Startups utilize a casual attitude in some respects to promote efficiency in the workplace, which is needed to get their business off the ground. In a 1960 study, Douglas McGregor stressed that punishments and rewards for uniformity in the workplace is not necessary, because some people are born with the motivation to work without incentives.[13] This removal of stressors allows the workers and researchers to focus less on the work environment around them, and more at the task at hand, giving them the potential to achieve something great for their company.

This culture has evolved to include larger companies today aiming at acquiring the bright minds driving startups. Google, amongst other companies, has made strides to make purchased startups and their workers feel right at home in their offices, even letting them bring their dogs to work.[14] The main goal behind all changes to the culture of the startup workplace, or a company hiring workers from a startup to do similar work, is to make the people feel as comfortable as possible so they can have the best performance in the office .

Co-founders

Co-founders are people involved in the cultivation of startup companies. Anyone can be a co-founder, and an existing company can also be a co-founder, but frequently co-founders are entrepreneurs, engineers, hackers, venture capitalists, web developers, web designers and others involved in the ground level of a new, often high-tech, venture. The language of securities regulation in the United States considers co-founders to be "promoters" under Regulation D.

The U.S. Securities and Exchange Commission definition of "Promoter" includes: (i) Any person who, acting alone or in conjunction with one or more other persons, directly or indirectly takes initiative in founding and organizing the business or enterprise of an issuer;[15]

Not every promoter is a co-founder. In fact, there is no formal, legal definition of what makes somebody a co-founder.[16][17] The right to call oneself a co-founder can be established through an agreement with one's fellow co-founders or with permission of the board of directors, investors, or shareholders of a startup company. When there is no definitive agreement, disputes about who the co-founders are can arise.

Startup investing

Startup investing is the action of making an investment in an early-stage company (the startup company). The solicitation of funds became easier for startups as result of the JOBS Act.[18][19][20][20] Prior to the advent of equity crowdfunding, a form of online investing that has been legalized in several nations, startups did not advertise themselves to the general public as investment opportunities until and unless they first obtained approval from regulators for an initial public offering (IPO) that typically involved a listing of the startup's securities on a stock exchange. Today, there are many alternative forms of IPO commonly employed by startups and startup promoters that do not include an exchange listing, thus enabling startups to avoid certain regulatory compliance obligations, including mandatory periodic disclosures of financial information and factual discussion of business conditions by management that investors and potential investors routinely receive from registered public companies.[21]

Evolution of startup investing

After the Great Depression, which was blamed in part on a rise in speculative investments in unregulated small companies, startup investing was primarily a word of mouth activity reserved for the friends and family of a startup's co-founders. In the United States this has been the case ever since the implementation of the Securities Act of 1933. Many nations implemented similar legislation to prohibit general solicitation and general advertising of unregistered securities, including shares offered by startup companies. Title II of the Jumpstart Our Business Startups Act, first implemented on September 23, 2013, granted startups and startup co-founders or promoters the right to generally solicit and advertise publicly using any method of communication on the condition that only accredited investors are allowed to purchase the securities.[22][23][24]

Startup investing rounds

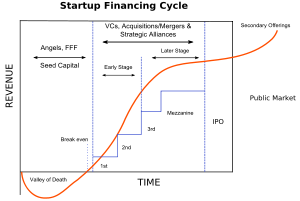

When investing in a startup, there are different types of stages in which the investor can participate. The first round is called seed round. The seed round generally is when the startup is still in the very early phase of execution when their product is still in the prototype phase. At this level angel investors will be the ones participating. The next round is called Series A. At this point the company already has traction and may be making revenue. In Series A rounds venture capital firms will be participating alongside angels or super angel investors. The next rounds are Series B, C, and D. These three rounds are the ones leading towards the IPO. Venture capital firms and private equity firms will be participating.[25]

Startup investing online

With the passing of the JOBS Act and the equity crowdfunding model, startup investing platforms like SeedInvest and CircleUp started to emerge in 2011. The idea of these platforms is to streamline the process and resolve the two main points that were taking place in the market. The first problem was for startups to be able to access capital and to decrease the amount of time that it takes to close a round of financing. The second problem was intended to increase the amount of deal flow for the investor and to also centralize the process.[26][27][28]

Internal startups

Large or well-established companies often try to promote innovation by setting up "internal startups", new business divisions that operate at arm's length from the rest of the company. Examples include Target Corporation (which began as an internal startup of the Dayton's department store chain) and threedegrees, a product developed by an internal startup of Microsoft.[29]

Trends and obstacles

If a company's value is based on its technology, it is often equally important for the business owners to obtain intellectual property protection for their idea. The newsmagazine The Economist estimated that up to 75% of the value of US public companies is now based on their intellectual property (up from 40% in 1980).[30] Often, 100% of a small startup company's value is based on its intellectual property. As such, it is important for technology-oriented startup companies to develop a sound strategy for protecting their intellectual capital as early as possible.[31]

Startup companies, particularly those associated with new technology, sometimes produce huge returns to their creators and investors—a recent example of such is Google, whose creators became billionaires through their stock ownership and options. However, the failure rate of startup companies is very high.[32]

Although there are startups created in all types of businesses, and all over the world, some locations and business sectors are particularly associated with startup companies. The internet bubble of the late 1990s was associated with huge numbers of internet startup companies, some selling the technology to provide internet access, others using the internet to provide services. Most of this startup activity was located in Silicon Valley, an area of northern California renowned for the high level of startup company activity:

The spark that set off the explosive boom of "Silicon startups" in Stanford Industrial Park was a personal dispute in 1957 between employees of Shockley Semiconductor and the company’s namesake and founder, Nobel laureate and co-inventor of the transistor William Shockley... (His employees) formed Fairchild Semiconductor immediately following their departure...After several years, Fairchild gained its footing, becoming a formidable presence in this sector. Its founders began leaving to start companies based on their own latest ideas and were followed on this path by their own former leading employees... The process gained momentum and what had once began in a Stanford’s research park became a veritable startup avalanche... Thus, over the course of just 20 years, a mere eight of Shockley’s former employees gave forth 65 new enterprises, which then went on to do the same...[33]

Recently the patent assets of failed startup companies are being purchased by what are derogatorily known as patent trolls who then take the patents from the companies and assert those patents against companies that might be infringing the technology covered by the patent.[34]

See also

- Business incubator

- Business plan

- Entrepreneurship

- Exit strategy

- Lean Startup

- Liquidity event

- Minimum viable product

- Product/market fit

- Private equity

- Stock market bubble

References

- ↑ Blank, Steve (March 5, 2012). "Search versus Execute". Retrieved July 22, 2012.

- ↑ 2.0 2.1 Blank, Steve and Dorf, Bob (2012). The Startup Owner's Manual, K&S Ranch (publishers), ISBN 978-0984999309

- ↑ Blank, Steve (2008-2015). Blog on entrepreneurship

- ↑ Blank, Steve (2013). What I Wish I Knew About Startups - Steve Blank, Consulting Associate Professor at Stanford University (video, 30-min). The audience is composed of the CEOs of the portfolio companies of Khosla Ventures. Talk given in May 2013, posted on the official You Tube channel of Khosla Ventures in May 2014

- ↑ Blank, Steve (May 2013). Why the Lean Start-Up Changes Everything, in Harvard Business Review

- ↑ Graham, Paul (September 2012). Startup Equals Growth, in Graham's Essays on entrepreneurship

- ↑ Damodaran, Aswath (April 2012). Investment Valuation: Tools and Techniques for Determining the Value of Any Asset, Wiley, ISBN 978-1118011522, 3rd edition

- ↑ Damodaran, Aswath. Blog on valuation, corporate finance and related issues

- ↑ Rachleff, Andy. "To Get Big, You've Got to Start Small". TechCrunch. Retrieved 2013-01-28.

- ↑ "Cash-strapped entrepreneurs get creative", BBC News

- ↑ "Business Models, Business Strategy and Innovation"

- ↑ "Business mating: when start-ups get it right, Kask Linton 2013"

- ↑ Douglas McGregor. Theory X Theory Y employee motivation theory. Accel-team.com. Retrieved on 2013-07-21.

- ↑ Barking mad: Can office dogs reduce stress? - CNN.com. Edition.cnn.com. Retrieved on 2013-07-21.

- ↑ Securities and Exchange Commission (September 12, 2008), "Guide to Definitions of Terms Used in Form D", SEC.GOV, retrieved July 1, 2014

- ↑ Lora Kolodny (April 30, 2013). "The Other Credit Crisis: Naming Co-Founders". Wall Street Journal. Retrieved July 1, 2014.

- ↑ Katie Fehrenbacher (June 14, 2009). "Tesla Lawsuit: The Incredible Importance of Being a Founder". Giga Om. Retrieved July 1, 2014.

- ↑ "Startups, VCs Now Free To Advertise Their Fundraising Status". The Wall Street Journal. Retrieved September 23, 2013.

- ↑ "All-comers join web party for a punt on best start-ups". Financial Times. Retrieved September 26, 2013.

- ↑ 20.0 20.1 "Startups Remain Cloudy on the New General Solicitation Rule". Bloomberg Businessweek. Retrieved September 20, 2013.

- ↑ "Investor.gov". Securities and Exchange Commission. Retrieved July 1, 2014.

- ↑ "Jumpstart Our Business Startups (JOBS) Act Spotlight". SEC.GOV. Retrieved July 1, 2014.

- ↑ "Newly Legal: Buying Stock in Start-Ups Via Crowdsourcing". ABC News. Retrieved September 24, 2013.

- ↑ "Levine on Wall Street: Chrysler's Unwanted IPO". Bloomberg. Retrieved September 24, 2013.

- ↑ "With the new JOBS Act a new era of investment banking?". Nasdaq. Retrieved September 24, 2013.

- ↑ "Shout it out: New rules allow startups to advertise fundraising". UpStart Business Journal. Retrieved September 23, 2013.

- ↑ "General Solicitation Ban Lifted Today - Three Things You Must Know About It". Forbes. Retrieved September 23, 2013.

- ↑ "For broker/dealers, crowdfunding presents new opportunity". Washington Post. Retrieved March 28, 2013.

- ↑ "Hong Kong in Honduras", The Economist, December 10th 2011.

- ↑ See generally A Market for Ideas, ECONOMIST, Oct. 22, 2005, at 3, 3 (special insert)

- ↑ For a discussion of such issues, see, e.g., Strategic management issues for starting an IP company, Szirom, S.Z., RAPID, HTF Res. Inc., USA (ISBN 0-7695-0465-5); What Business Owners Should Know About Patenting, Wall Street Journal, available at http://www.wsj.com/article/SB121820956214224545.html (Interview with James McDonough, Intellectual property attorney),

- ↑ "High Tech Start Up, Revised and Updated: The Complete Handbook For Creating Successful New High Tech Companies", John L. Nesheim

- ↑ A Legal Bridge Spanning 100 Years: From the Gold Mines of El Dorado to the 'Golden' Startups of Silicon Valley by Gregory Gromov 2010.

- ↑ JAMES F. MCDONOUGH III (2007). "The Myth of the Patent Troll: An Alternative View of the Function of Patent Dealers in an Idea Economy". Emory Law Journal. http://papers.ssrn.com/sol3/papers.cfm?abstract_id=959945. Retrieved 2007-07-27.

External links

- Bennett, Naftali (2010). Exit: Insights, Mistakes, and Lessons Learned by an Israeli Startup CEO. A compilation of Bennett's essays originally published on The Marker (2003-8). Book available for free reading & download from the website of Haaretz (mother company of The Marker)

- Access to Capital: Fostering Job Creation and Innovation...; United States Senate, One Hundred Twelfth Congress, First Session ... July 20, 2011.

| |||||||||||||||||||||||||||||||||||||||