Spectral risk measure

A Spectral risk measure is a risk measure given as a weighted average of outcomes where bad outcomes are, typically, included with larger weights. A spectral risk measure is a function of portfolio returns and outputs the amount of the numeraire (typically a currency) to be kept in reserve. A spectral risk measure is always a coherent risk measure, but the converse does not always hold. An advantage of spectral measures is the way in which they can be related to risk aversion, and particularly to a utility function, through the weights given to the possible portfolio returns.[1]

Definition

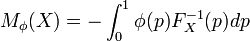

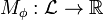

Consider a portfolio  Then a spectral risk measure

Then a spectral risk measure  where

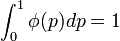

where  is non-negative, non-increasing, right-continuous, integrable function defined on

is non-negative, non-increasing, right-continuous, integrable function defined on ![[0,1]](../I/m/ccfcd347d0bf65dc77afe01a3306a96b.png) such that

such that  is defined by

is defined by

where  is the cumulative distribution function for X.[2][3]

is the cumulative distribution function for X.[2][3]

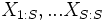

If there are  equiprobable outcomes with the corresponding payoffs given by the order statistics

equiprobable outcomes with the corresponding payoffs given by the order statistics  . Let

. Let  . The measure

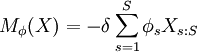

. The measure

defined by

defined by  is a spectral measure of risk if

is a spectral measure of risk if  satisfies the conditions

satisfies the conditions

- Nonnegativity:

for all

for all  ,

, - Normalization:

,

, - Monotonicity :

is non-increasing, that is

is non-increasing, that is  if

if  and

and  .[4]

.[4]

Properties

Spectral risk measures are also coherent. Every spectral risk measure  satisfies:

satisfies:

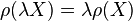

- Positive Homogeneity: for every portfolio X and positive value

,

,  ;

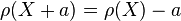

; - Translation-Invariance: for every portfolio X and

,

,  ;

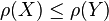

; - Monotonicity: for all portfolios X and Y such that

,

,  ;

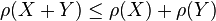

; - Sub-additivity: for all portfolios X and Y,

;

; - Law-Invariance: for all portfolios X and Y with cumulative distribution functions

and

and  respectively, if

respectively, if  then

then  ;

; - Comonotonic Additivity: for every comonotonic random variables X and Y,

. Note that X and Y are comonotonic if for every

. Note that X and Y are comonotonic if for every  .[2]

.[2]

Examples

- The expected shortfall is a spectral measure of risk.

- The expected value is trivially a spectral measure of risk.

See also

References

- ↑ Cotter, John; Dowd, Kevin (December 2006). "Extreme spectral risk measures: An application to futures clearinghouse margin requirements". Journal of Banking & Finance 30 (12): 3469–3485. doi:10.1016/j.jbankfin.2006.01.008.

- ↑ 2.0 2.1 Adam, Alexandre; Houkari, Mohamed; Laurent, Jean-Paul (2007). "Spectral risk measures and portfolio selection" (pdf). Retrieved October 11, 2011.

- ↑ Dowd, Kevin; Cotter, John; Sorwar, Ghulam (2008). "Spectral Risk Measures: Properties and Limitations" (pdf). CRIS Discussion Paper Series (2). Retrieved October 13, 2011.

- ↑ Acerbi, Carlo (2002), "Spectral measures of risk: A coherent representation of subjective risk aversion", Journal of Banking and Finance (Elsevier) 26 (7): 1505–1518, doi:10.1016/S0378-4266(02)00281-9