Slutsky equation

The Slutsky equation (or Slutsky identity) in economics, named after Eugen Slutsky (1880–1948), relates changes in Marshallian (uncompensated) demand to changes in Hicksian (compensated) demand, which is known as such since it compensates to maintain a fixed level of utility. The equation demonstrates that the change in the demand for a good, caused by a price change, is the result of two effects:

- a substitution effect, the result of a change in the relative prices of two goods; and

- an income effect, the effect of a change in price resulting in a change in the consumer's purchasing power.

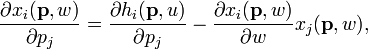

The Slutsky equation decomposes the change in demand for good i in response to a change in the price of good j:

where  is the Hicksian demand and

is the Hicksian demand and  is the Marshallian demand, at the vector of price levels

is the Marshallian demand, at the vector of price levels  , wealth level (or, alternatively, income level)

, wealth level (or, alternatively, income level)  , and fixed utility level

, and fixed utility level  given by maximizing utility at the original price and income, formally given by the indirect utility function

given by maximizing utility at the original price and income, formally given by the indirect utility function  . The right-hand side of the equation is equal to the change in demand for good i holding utility fixed at u minus the quantity of good j demanded, multiplied by the change in demand for good i when wealth changes.

. The right-hand side of the equation is equal to the change in demand for good i holding utility fixed at u minus the quantity of good j demanded, multiplied by the change in demand for good i when wealth changes.

The first term on the right-hand side represents the substitution effect, and the second term represents the income effect.[1] Note that since utility is not observable, the substitution effect is not directly observable, but it can be calculated by reference to the other two terms in the Slutsky equation, which are observable. This process is sometimes known as the Hicks decomposition of a demand change.[2]

The equation can be rewritten in terms of elasticity:

where εp is the (uncompensated) price elasticity, εph is the compensated price elasticity, εw,i the income elasticity of good i, and bj the budget share of good j.

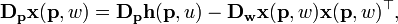

The same equation can be rewritten in matrix form to allow multiple price changes at once:

where Dp is the derivative operator with respect to price and Dw is the derivative operator with respect to wealth.

The matrix  is known as the Slutsky matrix, and given sufficient smoothness conditions on the utility function, it is symmetric, negative semidefinite, and the Hessian of the expenditure function.

is known as the Slutsky matrix, and given sufficient smoothness conditions on the utility function, it is symmetric, negative semidefinite, and the Hessian of the expenditure function.

Derivation

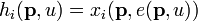

While there are several ways to derive the Slutsky equation, the following method is likely the simplest. Begin by noting the identity  where

where  is the expenditure function, and u is the utility obtained by maximizing utility given p and w. Totally differentiating with respect to pj yields the following:

is the expenditure function, and u is the utility obtained by maximizing utility given p and w. Totally differentiating with respect to pj yields the following:

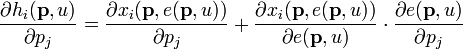

.

.

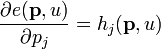

Making use of the fact that  by Shephard's lemma and that at optimum,

by Shephard's lemma and that at optimum,

where

where  is the indirect utility function,

is the indirect utility function,

one can substitute and rewrite the derivation above as the Slutsky equation.