Single Resolution Mechanism

| European Union regulation | |

| Title | Establishing uniform rules and a uniform procedure for the resolution of credit institutions and certain investment firms in the framework of a Single Resolution Mechanism and a Single Resolution Fund and amending Regulation (EU) No 1093/2010 |

|---|---|

| Applicability | All EU members. SRM provisions however only apply to Member States participating in the SSM. |

| Made by | European Parliament and Council |

| Made under | Article 114 of the TFEU. |

| Journal reference | L225, 30.07.2014, p.1 |

| History | |

| Date made | 15 July 2014 |

| Came into force | 19 August 2014 |

| Implementation date |

Applies in its entirety from 1 January 2016, conditional a prior transfer of contributions to the Single Resolution Fund has been met. Otherwise, it will apply in its entirety from the first day of the month following the day where the payment requirement has been met.

|

| Current legislation | |

| Agreement on the transfer and mutualisation of contributions to the Single Resolution Fund | |

|---|---|

| |

| Type | Intergovernmental agreement |

| Signed | 21 May 2014[1] |

| Location | Brussels, Belgium |

| Effective | 1 January 2016 amongst the Contracting Parties participating in SSM and SRM that have deposited their instruments of ratification, provided that both the IGA and Regulation have entered into force. Otherwise, it shall apply from the date both have entered into force. For Contracting Parties participating in SSM and SRM who subsequently ratify the IGA, it shall apply from the first day of the month following the deposit of their instrument of ratification.[2] |

| Condition | Entry into force on the first day of the second month following the ratification by states representing 90% of the weighted vote of SSM and SRM participating states.[2] |

| Signatories | 26 EU member states (all except Sweden and the United Kingdom) including all 18 eurozone states[1] |

| Ratifiers |

2 / 26 |

| Depositary | General Secretariat of the Council |

The Single Resolution Mechanism (SRM) is one of the main pillars of the European Union's banking union which centrally implements in participating Member States the EU's Bank Recovery and Resolution Directive, the framework for the recovery and resolution of credit institutions and investment firms found to be in danger of failing. The SRM was created by an EU Regulation that entered into force on 19 August 2014. A Single Resolution Fund (SRF) to finance the restructuring of failing credit institutions is planned to be established as an essential part of the SRM by a complementary intergovernmental agreement, pending its ratification.[4] The ECB has been selected to be the resolution authority of the SRM. The resolution scheme is set to be launched on 1 January 2016, provided that the SRF has been established and funded prior of this date. The SRM will function in conjunction with the other main pillar of the EU banking union, the Single Supervisory Mechanism (SSM). The SRM will automatically apply to all SSM members, and states which do not participate in the SSM cannot participate in the SRM.

History

The SRM is planned to be enacted through a Regulation and an Intergovernmental Agreement (IGA) which are titled:

- Regulation of the European Parliament and of the Council establishing uniform rules and a uniform procedure for the resolution of credit institutions and certain investment firms in the framework of a Single Resolution Mechanism and a Single Bank Resolution Fund and amending Regulation (EU) No 1093/2010 of the European Parliament and of the Council[5][6]

- Agreement on the transfer and mutualisation of contributions to the Single Resolution Fund.[2]

The proposed Regulation was put forward by the European Commission in July 2013.[4] The details of some aspects of the functioning of the SRF, including the transfer and mutualisation of funds from national authorities to the centralized fund, was split off from the Regulation into the IGA due to concerns, especially by Germany, that they were incompatible with current EU treaties.[1][7][8][9]

The Parliament and the Council of the European Union reached an agreement on the Regulation on 20 March 2014.[10] The European Parliament approved the Regulation on 15 April 2014,[11] and the Council followed suit on 14 July,[12] leading to its entry into force on 19 August 2014.[13]

The IGA was signed by 26 EU member states (all but Sweden and the United Kingdom) on 21 May 2014 and is open to accession to any other EU member states.[1][14][15] It will enter into force on the first day of the second month following the deposit of instruments of ratification by states representing at least 90% of the weighted vote of SSM and SRM participating states,[1] and will apply from 1 January 2016, provided that the Regulation has entered into force, but only to SSM and SRM participating states.[1]

It is planned that some of the provisions of the Regulation will apply from 1 January 2015, but the authority to carry out bank resolutions will not apply until 1 January 2016 subject to the entry into force of the IGA.[9][16]

Proposal and reactions

The European Commission argued that centralizing the resolution mechanism for the participating states will allow for more coordinated and timely decisions to be made on weak banks.[8] Internal Market and Services Commissioner Michel Barnier stated that "by ensuring that supervision and resolution are aligned at a central level, whilst involving all relevant national players, and backed by an appropriate resolution funding arrangement, it will allow bank crises to be managed more effectively in the banking union and contribute to breaking the link between sovereign crises and ailing banks."[4]

Ratings Agencies have stated their approval of the measure and believe it will cause European ratings and credit to rise as it will limit the impact of a bank failure.[17] Critics have stated their concerns that this mechanism will result in sovereign states' taxpayers' money being used to pay off other nation's bank failures.[18]

Functioning

The SRM would allow for troubled banks operating under the SSM to be restructured with a variety of tools including bailout funds from the centralized SRF, valued at 1% of covered deposits of all credit institutions authorised in all the participating member states (estimated to be around 55 billion euros), which would be filled with contributions by participating banks during an eight year establishment phase.[1][8][11] This would help to alleviate the impact of failing banks on the sovereign debt of individual states.[4][7][18] The SRM would also handle the winding down of non-viable banks. The Single Resolution Board would be directly responsible for the resolution of significant banks under ECB supervision, while national authorities would take the lead in smaller banks.[8]

Like the SSM, the SRM Regulation will cover all banks in the eurozone, with other states eligible to join.[8] The text of the Regulation approved by Parliament stipulates that all states participating in the SSM, including those non-eurozone states with a "close cooperation" agreement, will automatically be participants in the SRM.[6]

The IGA states that the intention of the signatories is to incorporate the IGA's provisions into EU structures within 10 years.

Single Resolution Board

The Single Resolution Board (SRB) is open as of 1 January 2015. It is the resolution authority within the European Banking Union and is a key element of the newly created Banking Union and its "Single Resolution Mechanism" (SRM). It works in close cooperation in particular with the national resolution authorities of participating Member States, the European Commission and the European Central Bank. Its mission is to ensure an orderly resolution of failing banks with minimum impact on the real economy and public finances of the participating Member States and beyond.

The SRB will in short:

- Maintain financial stability by ensuring the continuity of critical banking functions which are in the public interest.

- Ensure that potential future bank failures in the Banking Union are managed efficiently, with minimal costs to taxpayers and the real economy while ensuring losses are borne by bank shareholders and creditors (legal certainty + break the link between banks and sovereigns).

- Avoid disorderly insolvency

The Board has its seat in Brussels and consists of the following members:

-

Elke König (Chair), formerly President of Germany's Federal Financial Supervisory Authority since 2012 (de)

Elke König (Chair), formerly President of Germany's Federal Financial Supervisory Authority since 2012 (de) -

Timo Löyttyniemi (Vice Chair)

Timo Löyttyniemi (Vice Chair) -

Mauro Grande

Mauro Grande -

Antonio Carrascosa

Antonio Carrascosa -

Joanne Kellermann

Joanne Kellermann -

Dominique Laboureix

Dominique Laboureix

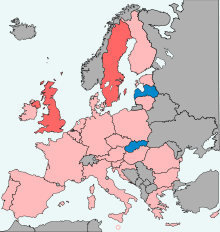

IGA ratification

As of 4 February 2015, two states had ratified the intergovernmental agreement (IGA).[3]

No requests to enter into "close cooperation" have been made by non-eurozone states as of 3 November 2014.[19] Therefore, only the eurozone states are considered when calculating the total weighted voting of participating member states for evaluating the 90% entry into force criteria.

| Member state | QM votes | QM weight[lower-alpha 1] | Ratification |

|---|---|---|---|

| |

29 | 12.95% | – |

| |

29 | 12.95% | – |

| |

29 | 12.95% | – |

| |

27 | – | – |

| |

27 | 12.05% | – |

| |

14 | – | – |

| |

13 | 5.80% | – |

| |

12 | 5.36% | – |

| |

12 | – | – |

| |

12 | 5.36% | – |

| |

12 | – | – |

| |

12 | 5.36% | – |

| |

10 | 4.46% | – |

| |

10 | – | – |

| |

7 | – | – |

| |

7 | – | – |

| |

7 | 3.13% | – |

| |

7 | 3.13% | – |

| |

7 | 3.13% | – |

| |

7 | 3.13% | 4 February 2015 |

| |

4 | 1.79% | – |

| |

4 | 1.79% | – |

| |

4 | 1.79% | 4 December 2014 |

| |

4 | 1.79% | – |

| |

4 | 1.79% | – |

| |

3 | 1.34% | – |

| |

313[lower-alpha 2] | 4.91%[lower-alpha 3] | 2 states[lower-alpha 4] |

See also

References

- ↑ 1.0 1.1 1.2 1.3 1.4 1.5 1.6 "Member states sign agreement on bank resolution fund". European Commission. 2014-05-21. Retrieved 2014-05-30.

- ↑ 2.0 2.1 2.2 "Agreement on the transfer and mutualisation of contributions to the Single Resolution fund" (PDF). Council of the European Union. 14 May 2014. Retrieved 29 May 2014.

- ↑ 3.0 3.1 "Agreement details". Council of the European Union. Retrieved 2014-05-30.

- ↑ 4.0 4.1 4.2 4.3 "Commission proposes Single Resolution Mechanism for the Banking Union". European Commission. 2013-07-10. Retrieved 2014-05-29.

- ↑ "Proposal for a Regulation of the European Parliament and of the Council establishing uniform rules and a uniform procedure for the resolution of credit institutions and certain investment firms in the framework of a Single Resolution Mechanism and a Single Bank Resolution Fund and amending Regulation (EU) No 1093/2010 of the European Parliament and of the Council". EUR-Lex. European Union. 2013-07-10.

- ↑ 6.0 6.1 "European Parliament legislative resolution of 15 April 2014 on the proposal for a regulation of the European Parliament and of the Council establishing uniform rules and a uniform procedure for the resolution of credit institutions and certain investment firms in the framework of a Single Resolution Mechanism and a Single Bank Resolution Fund and amending Regulation (EU) No 1093/2010 of the European Parliament and of the Council". European Parliament. 2014-05-14. Retrieved 2014-05-29.

- ↑ 7.0 7.1 "Brussels unveils Single Resolution Mechanism for banking union". Euractiv. Jul 11, 2013.

- ↑ 8.0 8.1 8.2 8.3 8.4 "A Single Resolution Mechanism for the Banking Union – frequently asked questions". European Commission. 2014-04-15. Retrieved 2014-05-29.

- ↑ 9.0 9.1 "Council agrees its position on the single resolution mechanism". Council of the European Union. 2013-12-19. Retrieved 2014-05-29.

- ↑ "European Parliament and Council back Commission's proposal for a Single Resolution Mechanism: a major step towards completing the banking union". European Commission. 2014-03-20. Retrieved 2014-06-22.

- ↑ 11.0 11.1 "Finalising the Banking Union: European Parliament backs Commission's proposals (Single Resolution Mechanism, Bank Recovery and Resolution Directive, and Deposit Guarantee Schemes Directive)". European Commission. 2014-04-15. Retrieved 2014-05-29.

- ↑ "Council adopts rules setting up single resolution mechanism". Council of the European Union. 2014-07-14. Retrieved 2014-07-15.

- ↑ "Regulation 806/2014: Establishing uniform rules and a uniform procedure for the resolution of credit institutions and certain investment firms in the framework of a Single Resolution Mechanism and a Single Resolution Fund and amending Regulation (EU) No 1093/2010". Official Journal of the European Union. 30 July 2014.

- ↑ "Commissioner Barnier welcomes the Signature of the intergovernmental Agreement (IGA) on the Single Resolution Fund". European Commission. 2014-05-21. Retrieved 2014-05-30.

- ↑ "Commissioner Barnier welcomes the Signature of the intergovernmental Agreement (IGA) on the Single Resolution Fund". European Commission. 2014-05-21. Retrieved 2014-06-22.

- ↑ "A comprehensive EU response to the financial crisis: substantial progress towards a strong financial framework for Europe and a banking union for the eurozone". European Commission. 2014-03-28. Retrieved 2014-05-30.

- ↑ Harlow, Chris (July 12, 2013). "Single resolution mechanism a positive for sovereign credit says Fitch". City A.M.

- ↑ 18.0 18.1 "EU unveils plans to wind down failed banks". BBC. July 10, 2013.

- ↑ "SSM QUARTERLY REPORT 2014/4: Progress in the operational implementation of the Single Supervisory Mechanism Regulation" (PDF). European Central Bank. 2 November 2014.