Roy's safety-first criterion

Roy's safety-first criterion is a risk management technique that allows an investor to select one portfolio rather than another based on the criterion that the probability of the portfolio's return falling below a minimum desired threshold is minimized.[1]

For example, suppose there are two available investment strategies - portfolio A and portfolio B, and suppose the investor's threshold return level (the minimum return that the investor is willing to tolerate) is -1%. then the investor would choose the portfolio that would provide the maximum probability of the portfolio return being at least as high as −1%.

Thus, the problem of an investor using Roy's safety criterion can be summarized symbolically as:

where  is the probability of

is the probability of  (the actual return of asset i) being less than

(the actual return of asset i) being less than  (the minimum acceptable return).

(the minimum acceptable return).

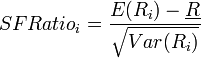

Normally distributed return and SFRatio

If the portfolios under consideration have normally distributed returns, Roy's safety-first criterion can be reduced to the maximization of the safety-first ratio, defined by:

where  is the expected return (the mean return) of the portfolio,

is the expected return (the mean return) of the portfolio,  is the standard deviation of the portfolio's return and

is the standard deviation of the portfolio's return and  is the minimum acceptable return.

is the minimum acceptable return.

Example

If Portfolio A has an expected return of 10% and standard deviation of 15%, while portfolio B has a mean return of 8% and a standard deviation of 5%, and the investor is willing to invest in a portfolio that maximizes the probability of a return no lower than 0%:

- SFRatio(A) = [10 − 0]/15 = 0.67,

- SFRatio(B) = [8 − 0]/5 = 1.6

By Roy's safety-first criterion, the investor would choose portfolio B as the correct investment opportunity.

Similarity to Sharpe Ratio

Under normality,

- SFRatio = (expected return − minimum return)/(standard deviation of return).

Recall that Sharpe ratio is defined as excess return per unit of risk, or in other words:

- Sharpe ratio = [Expected return − Risk-Free Return]/(standard deviation of [Expected return − Risk-Free Return]).

SFRatio has a striking similarity to Sharpe ratio. Thus for normally distributed returns, Roy's Safety-first criterion - with the minimum return equal to the risk-free rate - provides the same conclusions (about which portfolio to invest in) as if we were picking the one with the maximum Sharpe Ratio.

See also

- Value at Risk

- Omega ratio

References

- ↑ Roy, Arthur D. (1952). "Safety First and the Holding of Assets". Econometrica 1952 (July): 431–450.