Revenue equivalence

Revenue equivalence is a concept in auction theory that states that given certain conditions, any auction mechanism that results in the same outcomes (i.e. allocates items to the same bidders) also has the same expected revenue.

Revenue Equivalence Theorem

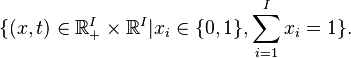

An auction is a special case of a mechanism. In this case, the mechanism takes buyers' bids and decides an outcome of the auction: who gets the object and what are the transfers for each buyer. The set of outcomes can be denoted by

The x component describes the allocation of the object and t the transfers.

The buyer's types, or valuations of the object, are independent identically distributed random variables. A buyer of type  has linear utility function ui over the set of outcomes (the theorem also holds for the more general quasilinear utility functions):

has linear utility function ui over the set of outcomes (the theorem also holds for the more general quasilinear utility functions):

Thus an auction is a Bayesian game in which a player's strategy is his bid as a function of his type. An auction (more generally, a mechanism) is said to be Bayesian incentive compatible if all players bidding their true type is a Bayesian Nash equilibrium strategy profile.

Under these assumptions, the Revenue Equivalence Theorem then says the following:

Theorem For any two Bayesian incentive compatible auctions, if under their respective Bayesian Nash equilibria where all players bid their type,

- a buyer of type θi has the same probability of getting the object across auctions, and

- a buyer of lowest type has the same expected utility across auctions,

then the total expected transfers Eθ(Σti), i.e. the auctioneer's expected revenue, is the same for the two auctions.

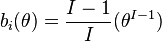

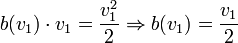

In other words, if a buyer of given type has the same expected utility in the two auctions in the interim stage, then the seller's expected revenues are the same. However, ex post, the two mechanisms need not implement the same social choice functions. Two such examples are the second price auction and first price auction. Assume the types are drawn independently from the uniform distribution on [0,1]. In the second price auction, bidding one's own type is a dominant strategy, therefore a fortiori the auction is Bayesian incentive compatible. For the first price auction, it can be shown that the bid functions

form a Bayesian Nash equilibrium (a simple argument via the revelation principle shows it can be made Bayesian incentive compatible). Thus the Revenue Equivalence Theorem applies: in both auctions, the highest types get the object and a buyer of type 0 has zero expected interim utility. They do not implement the same social choice functions.

Equivalence of Auction Mechanisms in Single Item Auctions

In fact, we can use revenue equivalence to prove that many types of auctions are revenue equivalent. For example, the first price auction, second price auction, and the all pay auction are all revenue equivalent.

Second Price Auction

Consider the second price single item auction, in which the player with the highest bid pays the second highest bid. It is optimal for each player  to bid her own value

to bid her own value  .

.

Suppose  wins the auction, and pays the second highest bid, or

wins the auction, and pays the second highest bid, or  . The revenue from this auction is simply

. The revenue from this auction is simply  .

.

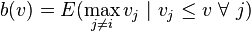

First Price Auction

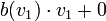

In the first price auction, where the player with the highest bid simply pays her bid, if all players bid using a bidding function  , this is a Nash equilibrium.

, this is a Nash equilibrium.

In other words, if each player bids such that they bid the expected value of second highest bid, assuming that theirs was the highest, then no player has any incentive to deviate. If this were true, then it is easy to see that the expected revenue from this auction is also  if

if  wins the auction.

wins the auction.

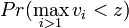

Proof

To prove this, suppose that a player 1 bids  , effectively bluffing that her value is

, effectively bluffing that her value is  rather than

rather than  . We want to find a value of

. We want to find a value of  such that the player's expected payoff is maximized.

such that the player's expected payoff is maximized.

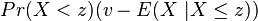

The probability of winning is then  . The expected cost of this bid is

. The expected cost of this bid is  . Then a player's expected payoff is

. Then a player's expected payoff is

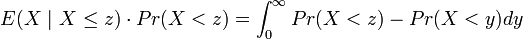

Let  , a random variable. Then we can rewrite the above as

, a random variable. Then we can rewrite the above as

.

.

Using the general fact that  , we can rewrite the above as

, we can rewrite the above as

.

.

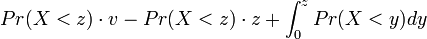

Taking derivatives with respect to  , we obtain

, we obtain

.

.

Thus bidding with your value  maximizes the player's expected payoff. Since

maximizes the player's expected payoff. Since  is monotone increasing, we verify that this is indeed a maximum point.

is monotone increasing, we verify that this is indeed a maximum point.

Using Revenue Equivalence to Predict Bidding Functions

We can use revenue equivalence to predict the bidding function of a player in a game. Consider the two player version of the second price auction and the first price auction, where each player's value is drawn uniformly from ![[0,1]](../I/m/ccfcd347d0bf65dc77afe01a3306a96b.png) .

.

Second Price Auction

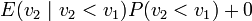

The expected payment of the first player in the second price auction can be computed as follows:

Since players bid truthfully in a second price auction, we can replace all prices with players' values. If player 1 wins, he pays what player 2 bids, or  . Player 1 himself bids

. Player 1 himself bids  . Since payment is zero when player 1 loses, the above is

. Since payment is zero when player 1 loses, the above is

Since  come from a uniform distribution, we can simplify this to

come from a uniform distribution, we can simplify this to

First Price Auction

We can use revenue equivalence to generate the correct symmetric bidding function in the first price auction. Suppose that in the first price auction, each player has the bidding function  , where this function is unknown at this point.

, where this function is unknown at this point.

The expected payment of player 1 in this game is then

(as above)

(as above)

Now, a player simply pays what the player bids, and let's assume that players with higher values still win, so that the probability of winning is simply a player's value, as in the second price auction. We will later show that this assumption was correct. Again, a player pays nothing if he loses the auction. We then obtain

and by revenue equivalence,

Indeed, with this bidding function, the player with the higher value still wins. We can also show that this is the correct equilibrium bidding function, by thinking about how a player should maximize his bid given that all other players are bidding using this bidding function.

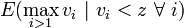

All-pay Auctions

Similarly, we know that the expected payment of player 1 in the second price auction is  , and this must be equal to the expected payment in the all-pay auction, i.e.

, and this must be equal to the expected payment in the all-pay auction, i.e.

Thus, the bidding function for each player in the all-pay auction is

Further reading

- Nisan, Noam; Roughgarden, Tim; Tardos, Éva; Vazirani, Vijay V. (2007), Algorithmic Game Theory, Cambridge, UK: Cambridge University Press, ISBN 0-521-87282-0.

- Hartline, Jason, Approximation in Economic Design.