Return on equity

Return on equity (ROE) measures the rate of return for ownership interest (shareholders' equity) of common stock owners. It measures the efficiency of a firm at generating profits from each unit of shareholder equity, also known as net assets or assets minus liabilities. ROE shows how well a company uses investments to generate earnings growth. ROEs 15-20% are generally considered good.[1]

The formula

ROE is equal to a fiscal year net income (after preferred stock dividends, before common stock dividends), divided by total equity (excluding preferred shares), as a percentage. As with many financial ratios, ROE is best used to compare in the same industry.

High ROE yields no immediate benefit. Since stock prices are most strongly determined by earnings per share (EPS), a 20% ROE company will cost twice the amount (in Price/Book terms) as a 10% ROE company.

The benefit of low ROEs comes from reinvesting earnings to aid company growth. The benefit can also come as a dividend on common shares or as a combination of dividends and company reinvestment. ROE is less relevant if earnings are not reinvested.

- The sustainable growth model shows us that when firms pay dividends, earnings growth lowers. If the dividend payout is 20%, the growth expected will be only 80% of the ROE rate.

- The growth rate will be lower if earnings are used to buy back shares. If the shares are bought at a multiple of book value (a factor of x times book value), the incremental earnings returns will be reduced by that same facter (ROE/x).

- New investments may not be as profitable as the existing business. Ask "what is the company doing with its earnings?"

- ROE is calculated from the company perspective, on the company as a whole. Since much financial manipulation is accomplished with new share issues and buyback, the investor may have a different recalculated value 'per share' (earnings per share/book value per share).

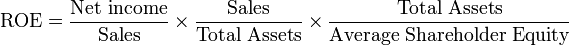

The DuPont formula

The DuPont formula, also known as the strategic profit model, is a common way to break down ROE into three important components. Essentially, ROE will equal the net margin multiplied by asset turnover multiplied by financial leverage. Splitting return on equity into three parts makes it easier to understand changes in ROE over time. For example, if the net margin increases, every sale brings in more money, resulting in a higher overall ROE. Similarly, if the asset turnover increases, the firm generates more sales for every unit of assets owned, again resulting in a higher overall ROE. Finally, increasing financial leverage means that the firm uses more debt financing relative to equity financing. Interest payments to creditors are tax deductible, but dividend payments to shareholders are not. Thus, a higher proportion of debt in the firm's capital structure leads to higher ROE.[1] Financial leverage benefits diminish as the risk of defaulting on interest payments increases. So if the firm takes on too much debt, the cost of debt rises as creditors demand a higher risk premium, and ROE decreases.[3] Increased debt will make a positive contribution to a firm's ROE only if the matching Return on assets (ROA) of that debt exceeds the interest rate on the debt.[4]

See also

Notes

- ↑ 1.0 1.1 "Profitability Indicator Ratios: Return On Equity", Richard Loth Investopedia

- ↑ http://www.answers.com/topic/return-on-equity Answers.com Return on Equity

- ↑ Woolridge, J. Randall and Gray, Gary; Applied Principles of Finance (2006)

- ↑ Bodie, Kane, Markus, "Investments"

External links

- Annual Ratio Definitions

- Return On Equity Screener- figures from financial statements

- Online Return On Equity Calculator

| ||||||