Post–World War II economic expansion

- "Golden Age of capitalism" redirects here. Other periods this term may refer to are Gilded Age and Belle Époque.

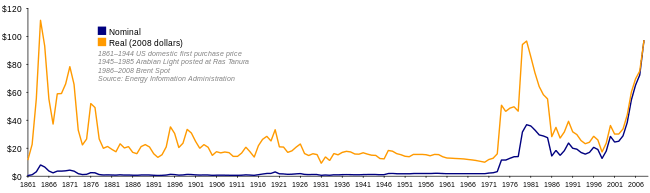

The post–World War II economic expansion, also known as the postwar economic boom, the long boom, and the Golden Age of Capitalism, was a period of economic prosperity in the mid-20th century which occurred, following the end of World War II in 1945, and lasted until the early 1970s. It ended with the collapse of the Bretton Woods system in 1971, the 1973 oil crisis, and the 1973–1974 stock market crash, which led to the 1970s recession. Narrowly defined, the period spanned from 1945 to 1952, with overall growth lasting well until 1971, though there are some debates on dating the period, and booms in individual countries differed, some starting as early as 1945, and overlapping the rise of the East Asian economies into the 1980s or 1990s.

During this time there was high worldwide economic growth; Western European and East Asian countries in particular experienced unusually high and sustained growth, together with full employment. Contrary to early predictions, this high growth also included many countries that had been devastated by the war, such as Greece (Greek economic miracle), West Germany (Wirtschaftswunder), France (Trente Glorieuses), Japan (Japanese post-war economic miracle), and Italy (Italian economic miracle).

Terminology

In academic literature, the period is frequently and narrowly referred to as the post–World War II economic boom, though this term can refer to much shorter booms in particular markets. It is also known as the Long Boom, though this term is generic and can refer to other periods. The golden age of Capitalism is a common name for this period in both academic and popular economics books. The term is also used in other contexts. In older sources and occasionally in contemporary ones, Golden age of Capitalism can refer to the period of the Second Industrial Revolution from approximately 1870 to 1914, which also saw rapid economic expansion. Yet another name for the quarter century following the end of World War II is the Age of Keynes.[1][2]

Dating the period

Political economist Roger Middleton states that economic historians generally agree on 1950 as the start date for the golden age[3]–while Lord Skidelsky states 1951 is the most recognized start date.[4] Both Skidelsky and Middleton have 1973 as the generally recognized end date, though sometimes the golden age is considered to have ended as early as 1970.

The boom ended with a number of events in the early 1970s:

- the collapse of the Bretton Woods system in 1971

- the growing international trade in manufactured goods, such as automobiles and electronics

- the 1973 oil crisis,

- the 1973–1974 stock market crash,

- the ensuing 1973–75 recession, and

- the ensuing displacement of Keynesian economics by monetarist economics.

While this is the global period, specific countries experienced booms for different periods; in Taiwan, the Taiwan Miracle lasted into the late 1990s, for instance, while in French the period is referred to as Trente Glorieuses (30 glorious [years]) and is considered to extend for the 30-year period from 1945 to 1975.

Global economic climate

OECD members enjoyed real GDP growth rate averaging over 4% each year in the 1950s, and very near 5% a year in the 1960s, compared with 3% in the 1970s and 2% in the 1980s.[5]

Skidelsky devotes ten pages of his 2009 book Keynes: The Return of the Master to a comparison of golden age to what he calls the Washington Consensus period, which he dates as spanning 1980–2009 (1973–1980 being a transitional period):[4]

| Metric | Golden Age | Washington Consensus |

|---|---|---|

| Average global growth | 4.8% | 3.2% |

| Average global inflation | 3.9% | 3.2% |

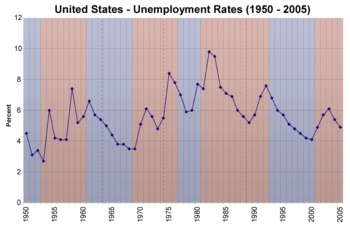

| Unemployment (US) | 4.8% | 6.1% |

| Unemployment (France) | 1.2% | 9.5% |

| Unemployment (Germany) | 3.1% | 7.5% |

| Unemployment (Great Britain) | 1.6% | 7.4% |

Skidelsky suggests the high global growth during the golden age was especially impressive as during that period Japan was the only major Asian economy enjoying high growth (Taiwan and Korea at the time being small economies)–it was not until later that the world had the exceptional growth of China raising the global average. Skidelsky also reports that inequality was generally decreasing during the golden age, whereas since the Washington Consensus was formed it has been increasing.

Globally, the golden age was a time of unusual financial stability, with crises far less frequent and intense than before or after. Martin Wolf reports that between 1945–71 (27 years) the world saw only 38 financial crises, whereas from 1973–97 (24 years) there were 139.[6]

Causes

Productivity

High productivity growth from before the war continued after the war and until the early 1970s. Manufacturing was aided by automation technologies such as feedback controllers, which appeared in the late 1930s were a fast-growing area of investment following the war. Wholesale and retail trade benefited from the new highway systems, distribution warehouses and material handling equipment such as forklifts.[7][8] Oil displaced coal in many applications, particularly in locomotives and ships.[9]

In agriculture, the post WW II period saw the widespread introduction of the following:

- Chemical fertilizers

- Tractors

- Combine harvesters

- High yield crop varieties of the Green revolution

- Pesticides

New products and services

Industries that were created or greatly expanded during the post war period included television and commercial aviation.

Keynesian economics

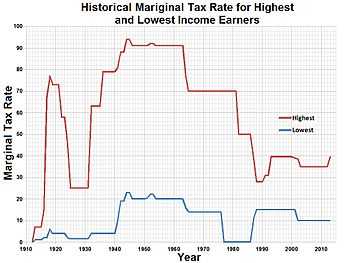

Keynesian economists argue that the boom was caused by the adoption of Keynesian economic policies, particularly government spending ("fiscal stimulus").

Journalist Naomi Klein has argued the high growth enjoyed by Europe and America was delivered by Keynesian economic policies, and in the case of rapidly rising prosperity the golden age saw in parts of South America by the influence of developmentalist economics led by Raúl Prebisch.[10]

This period also saw financial repression[11]—low nominal interest rates and low or negative real interest rates (nominal rates lower than inflation plus taxation), via government policy—resulting respectively in debt servicing costs being low (low nominal rates) and in liquidation of existing debt (via inflation and taxation). This allowed countries (such as the US and UK) to both deal with their existing government debt level and reduce the level of debt without needing to direct a high portion of government spending to debt service.

Burton and Anita Folsom

In Burton Folsoms and Anita Folsoms book FDR goes to War, the Folsoms argue that Keynesian post-war plans were thwarted by the sudden death of President Roosevelt, the inexperience of the new president Harry Truman, and conservative control of Congress. When World War II ended Congress ended economic controls that were enacted prior to and during the Second World War (war economy) and cut tax rates. Folsoms argue that these ″libertarian policies″ made the economy grow faster in 1946 and 1947 than government experts had expected and stabilized unemployment at 3.9%.[13]

Immediate post-war policy

Among the causes can be mentioned the rapid normalization of political relations between former Axis powers and the western Allies. After the war, the major powers were determined not to repeat the mistakes of the Great Depression, some of which were ascribed to post–World War I policy errors. The Marshall Plan for the rebuilding of Europe is most credited for reconciliation, though the immediate post-war situation was more complicated.

In 1948 the Marshall Plan pumped over $12 billion to rebuild and modernize Western Europe. The Coal and Steel Community formed the foundation of what was to become the European Union in later years.

Institutional factors

Institutional economists point to the international institutions established in the post-war period. Structurally, the victorious Allies established the Bretton Woods system, setting up international institutions designed to ensure stability in the world economy. This was achieved through a number of factors, including promoting free trade, instituting the Marshall Plan, and the use of Keynesian economics.

US Council of Economic Advisers

In the United States, Congress set the goal of achieving full employment as well as structuring, full production, and stable prices in the Employment Act of 1946. It also created the Council of Economic Advisers to provide objective economic analysis and advice on the development and implementation of a wide range of domestic and international economic policy issues. In its first 7 years the CEA made five technical advances in policy making:.[14]

- The replacement of a "cyclical model" of the economy by a "growth model,"

- The setting of quantitative targets for the economy,

- Use of the theories of fiscal drag and full-employment budget,

- Recognition of the need for greater flexibility in taxation, and

- Replacement of the notion of unemployment as a structural problem by a realization of a low aggregate demand.

In 1949 a dispute broke out between chairman Edwin Nourse and member Leon Keyserling. Nourse believed a choice had to be made between "guns or butter" but Keyserling argued that an expanding economy permitted large defense expenditures without sacrificing an increased standard of living. In 1949 Keyserling gained support from powerful Truman advisers Dean Acheson and Clark Clifford. Nourse resigned as chairman, warning about the dangers of budget deficits and increased funding of "wasteful" defense costs. Keyserling succeeded to the chairmanship and influenced Truman's Fair Deal proposals and the economic sections of National Security Council Resolution 68 that, in April 1950, asserted that the larger armed forces America needed would not affect living standards or risk the "transformation of the free character of our economy."[15]

During the 1953–54 recession, the CEA, headed by Arthur Burns deployed traditional Republican rhetoric. However it supported an activist contracyclical approach that helped to establish Keynesianism as a bipartisan economic policy for the nation.

Military spending

Another explanation for this period is the theory of the permanent war economy which suggests that the large spending on the military helped stabilize the global economy; this has also been referred to as "Military Keynesianism".

Specific countries

The economies of Japan, Germany, France, and Italy did particularly well, each of these countries caught up to and exceeded the GDP of the United Kingdom during these years, even as the UK itself was experiencing the greatest absolute prosperity in its history. In France, this period is often looked back to with nostalgia as the Trente Glorieuses, or "Glorious Thirty", while the economies of Germany and Austria were characterized by Wirtschaftswunder (economic miracle), and in Italy it is called Miracolo economico (economic miracle).

Most developing countries also did well in this period.

United States

The period from the end of World War II to the early 1970s was a golden era of American capitalism. $200 billion in war bonds matured, and the G.I. Bill financed a well-educated work force. The middle class swelled, as did GDP and productivity. The US underwent its own golden age of economic growth. This growth was distributed fairly evenly across the economic classes, which some attribute to the strength of labor unions in this period—labor union membership peaked during the 1950s. Much of the growth came from the movement of low income farm workers into better paying jobs in the towns and cities—a process largely completed by 1960.[16]

United Kingdom

A 1957 speech by British Prime Minister Harold Macmillan[17] captures what the golden age felt like, even before the brightest years which were to come in the 1960s.

Let us be frank about it: most of our people have never had it so good. Go round the country, go to the industrial towns, go to the farms and you will see a state of prosperity such as we have never had in my lifetime – nor indeed in the history of this country

Unemployment figures[18] show that unemployment was significantly lower during the Golden Age than before or after:

| Epoch | Date range | Percentage of British labour force unemployed. |

|---|---|---|

| Pre Golden Age | 1921–1938 | 13.4 |

| Golden Age | 1950–1969 | 1.6 |

| Post Golden Age | 1970–1993 | 6.7 |

In addition to superior economic performance, other social indexes were higher in the golden age; for example the proportion of Britain's population saying they are "very happy" has fallen from 52% in 1957 to just 36% in 2005.[19][20]

West Germany

West Germany, under Chancellor Konrad Adenauer and economic minister Ludwig Ehrhard, saw prolonged economic growth beginning in the early 1950s. Journalists dubbed it the Wirtschaftswunder or "Economic Miracle".[21] Industrial production doubled from 1950 to 1957, and gross national product grew at a rate of 9 or 10% per year, providing the engine for economic growth of all of Western Europe. Labor union's support of the new policies, postponed wage increases, minimized strikes, supported technological modernization, and a policy of co-determination (Mitbestimmung), which involved a satisfactory grievance resolution system and required the representation of workers on the boards of large corporations,[22] all contributed to such a prolonged economic growth. The recovery was accelerated by the currency reform of June 1948, US gifts of $1.4 billion Marshall Plan aid, the breaking down of old trade barriers and traditional practices, and the opening of the global market.[23] West Germany gained legitimacy and respect, as it shed the horrible reputation Germany had gained under the Nazis. West Germany played a central role in the creation of European cooperation; it joined NATO in 1955 and was a founding member of the European Economic Community in 1958.

France

Between 1947 and 1973, France went through a boom period (5% growth per year on average) dubbed by Jean Fourastié Trente Glorieuses - the title of a book published in 1979. The economic growth occurred mainly due to productivity gains and to an increase in the number of working hours. Indeed, the working population grew very slowly, the "baby boom" being offset by the extension of the time dedicated to study. Productivity gains came from catching up with the United States. In 1950, the average income in France was 55% of that of an American; it reached 80% in 1973. Among the "major" nations, only Japan had faster growth in this era than France.[24]

The extended period of transformation and modernization also involved an increasing internationalization of the French economy. France by the 1980s had become a leading world economic power and the world's fourth-largest exporter of manufactured products. It became Europe's largest agricultural producer and exporter, accounting for more than 10 percent of world trade in such goods by the 1980s. The service sector grew rapidly and became the largest sector, generating a large foreign-trade surplus, chiefly from the earnings from tourism.[25]

Italy

- Main: Italian economic miracle

The Italian economy has had very variable growth. In the 1950s and early 1960s, the Italian economy was booming, with record high growth rates, including 6.4% in 1959, 5.8% in 1960, 6.8% in 1961, and 6.1% in 1962. This rapid and sustained growth was due to the ambitions of several Italian businesspeople, the opening of new industries (helped by the discovery of hydrocarbons, made for iron and steel, in the Po valley), re-construction and modernisation of most Italian cities, such as Milan, Rome and Turin, and the aid given to the country after World War II (notably the Marshall Plan).[26][27]

Japan

After 1950 Japan's economy recovered from the war damage and began to boom, with the fastest growth rates in the world.[28] Given a boost by the Korean War, in which it acted as a major supplier to the UN force, Japan's economy embarked on a prolonged period of extremely rapid growth, led by the manufacturing sectors. Japan emerged as a significant power in many economic spheres, including steel working, car manufacturing and the manufacturing of electronics. Japan rapidly caught up with the West in foreign trade, GNP, and general quality of life. The high economic growth and political tranquility of the mid to late 1960s were slowed by the quadrupling of oil prices in 1973. Almost completely dependent on imports for petroleum, Japan experienced its first recession since World War II. Another serious problem was Japan's growing trade surplus, which reached record heights. The United States pressured Japan to remedy the imbalance, demanding that Tokyo raise the value of the yen and open its markets further to facilitate more imports from the United States.[29]

Soviet Union

In the 1950s the Soviet Union, having reconstructed the ruins left by the war, experienced a decade of prosperous, undisturbed, and rapid economic growth, with significant technological achievements most notably the first earth satellite. The nation ranked in the top 15 most prosperous countries. However, the growth slowed and ended by 1960, as the Khrushchev regime poured resources into large military and space projects, and the civilian sector languished. While every other major nation greatly expanded its service sector, that sector in the Soviet Union (medicine, for example) was given low priority.[30] Following Khrushchev's ouster, and the appointment of a collective leadership led by Leonid Brezhnev and Alexei Kosygin, the economy was revitalised.[31] The economy continued to grow apace during the mid-to-late 1960s, during the Eighth Five-Year Plan.[32] However, economic growth began to falter during the early to mid-1970s,[31] beginning an Era of Stagnation.

Sweden

Sweden emerged unharmed from World War II, and experienced a tremendous economic growth until the early 1970s, as Social Democratic Prime Minister Tage Erlander held his office from 1946 to 1969. Sweden used to be a country of emigrants until the 1930s, but the demand for labor spurred immigration to Sweden, especially from southern Europe. Urbanization was fast, and housing shortage in urban areas was imminent until the Million Programme was launched in the 1960s.

Effects

It had many social, cultural, and political effects (not least of which was the demographic blip termed the baby boomers). Movements and phenomena associated with this period include the height of the Cold War, postmodernism, decolonization, a marked increase in consumerism, the welfare state, the space race, the Non-Aligned Movement, import substitution, opposition to the Vietnam War, the civil rights movement, the sexual revolution, the beginning of second-wave feminism, and a nuclear arms race. In the United States, the middle class began a mass migration away from the cities and towards the suburbs. Thus, it can be summed up as a period of stability and prosperity in which most people could get a job for life, a spouse, children, house, dog, and picket fence – see American Dream written in 2005.

In the West, there emerged a near complete consensus against strong ideology and a belief that technocratic and scientific solutions could be found to most of humanity's problems, a view advanced by US President John F. Kennedy in 1962. This optimism was symbolized through such events as the 1964 New York World's Fair, and Lyndon Johnson's Great Society programs, which aimed at eliminating poverty in the United States.

Decline

The optimism waned however in the 1970s as high oil prices (due to the 1973 oil crisis) hastened the transition to the post-industrial economy, and a multitude of social problems began to emerge. During the 1970s steel crisis, demand for steel declined, and the Western world faced competition from newly industrialized countries. This was especially harsh for mining and steel districts such as the North American Rust Belt and the West German Ruhr area.

See also

Post-war context

- Aftermath of World War II

- Bretton Woods system, monetary system of this period

- European Coal and Steel community

- Counterculture of the 1960s

- Cold War

- Post–World War II baby boom

- Second Great Migration (African American)

Contemporary booms

Europe

- Greek economic miracle

- Record years, Sweden

- Spanish miracle

- Italian economic miracle

- Trente Glorieuses, France

- Wirtschaftswunder, Germany and Austria

East Asia

- East Asian Tigers, Hong Kong and Singapore

- Japanese post-war economic miracle

- Miracle on the Han River, Korea

- Taiwan Miracle

Latin America

Notes and references

- ↑ Meghnad Desai (2002). Marx's Revenge: The Resurgence of Capitalism and the Death of Statist Socialism, (GOOGLE BOOKS). Verso. p. 216. ISBN 1-85984-429-4.

- ↑ By Terence Ball, Richard Paul Bellamy (2002). The Cambridge history of twentieth-century political thought (GOOGLE BOOKS). Cambridge University Press. p. 45. ISBN 1-85984-429-4.

- ↑ Middleton, Roger (2000). The British Economy Since 1945. Palgrave Macmillan. p. 3. ISBN 0-333-68483-4.

- ↑ 4.0 4.1 Robert Skidelsky (2009). Keynes: The return of the Master. Allen Lane. pp. 116, 126. ISBN 978-1-84614-258-1.

- ↑ Stephen A. Marglin, Juliet B. Schor. The Golden Age of Capitalism. Google Books. Retrieved 2009-03-12.

- ↑ Wolf, Martin (2009). "3". Fixing Global Finance. Yale University Press. p. 31.

- ↑ Field, Alxander J. (2011). A Great Leap Forward: 1930s Depression and U.S. Economic Growth. New Haven, London: Yale University Press. ISBN 978-0-300-15109-1.

- ↑ Bjork, Gordon J. (1999). The Way It Worked and Why It Won’t: Structural Change and the Slowdown of U.S. Economic Growth. Westport, CT; London: Praeger. pp. 2, 67. ISBN 0-275-96532-5.

- ↑ Grübler, Arnulf (1990). The Rise and Fall of Infrastructures: Dynamics of Evolution and Technological Change in Transport (PDF). Heidelberg and New York: Physica-Verlag. p. 87<Fig. 3.1.5>

- ↑ Klein, Naomi (2008). "3". The Shock Doctrine. Penguine. p. 55.

- ↑ The Liquidation of Government Debt, Reinhart, Carmen M. & Sbrancia, M. Belen

- ↑ "U.S. Federal Individual Income Tax Rates History, 1913–2011". Tax Foundation. 9 September 2011.

- ↑ Burton W. Folsom, Anita Folsom, FDR Goes to War: How Expanded Executive Power, Spiraling National Debt, and Restricted Civil Liberties Shaped Wartime America, Simon and Schuster, 2011, ISBN 9781439183229, S. 311

- ↑ Walter S. Salant, "Some Intellectual Contributions of the Truman Council of Economic Advisers to Policy-Making," History of Political Economy, 1973, Vol. 5 Issue 1, pp 36–49

- ↑ Charles A. Stevenson, Warriors and politicians: US civil-military relations under stress (2006) p. 126

- ↑ Michael French, US Economic History since 1945 (1997)

- ↑ "1957: Britons 'have never had it so good'". BBC. 1957-07-20. Retrieved 2009-03-12.

- ↑ Sloman, John (2004). Economics. Penguin. p. 811.

- ↑ Mark Easton (2006-05-02). "Britain's happiness in decline". BBC. Retrieved 2009-03-12.

- ↑ Nigel Healey, ed., Britain's Economic Miracle: Myth or Reality? (1992) excerpt

- ↑ Jurgen Weber, Germany, 1945-1990 (Central European University Press, 2004) pp. 37-60

- ↑ Friedrich Fürstenberg, "West German Experience with Industrial Democracy," Annals of the American Academy of Political and Social Science Vol. 431, (May, 1977), pp. 44–53 in JSTOR

- ↑ Detlef Junker, ed., The United States and Germany in the Era of the Cold War, 1945-1968 (Cambridge University Press, 2004) vol 1:291-309

- ↑ P. Sicsic, and C. Wyplosz. "France: 1945-92." in Economic Growth in Europe since 1945, edited by N. Crafts and G. Toniolo. (Cambridge University Press, 1996)

- ↑ Andrea Boltho, "Economic Policy in France and Italy since the War: Different Stances, Different Outcomes?," Journal of Economic Issues 35#3 (2001) pp 713+ online

- ↑ Vera Zamagni, Vera, The economic history of Italy 1860-1990 (Oxford University Press, 1993)

- ↑ Giangiacomo Nardozzi, "The Italian" Economic Miracle". Rivista di storia economica (2003) 19$2 pp: 139-180, in English.

- ↑ James L. McClain, Japan: A Modern History (2002) pp 562-98

- ↑ Hans Brinckmann, and Ysbrand Rogge. Showa Japan: The Post-War Golden Age and Its Troubled Legacy (2008)

- ↑ Gur Ofer, The service sector in Soviet economic growth (1973) p. 21 online

- ↑ 31.0 31.1 Sandle, Mark; Bacon, Edwin (2002). Brezhnev Reconsidered. Palgrave Macmillan. pp. 44–45. ISBN 978-0-333-79463-0.

- ↑ Brown, Archie (2009). The Rise & Fall of Communism. Bodley Head. p. 403. ISBN 978-1-84595-067-5.

Further reading

- Brinckmann, Hans, and Ysbrand Rogge. Showa Japan: The Post-War Golden Age and Its Troubled Legacy (2008)

- Crafts, N. and G. Toniolo, eds. Economic Growth in Europe since 1945 (Cambridge University Press, 1996)

- Cairncross, Frances; Cairncross, Alec (1994), The Legacy of the Golden Age: 1960s and Their Economic Consequences, Routledge

- Marglin, Stephen A.; Schor, Juliet B. (1992), The Golden Age of Capitalism: Reinterpreting the Postwar Experience, Oxford University Press, ISBN 978-0-19-828741-4

- Webber, Michael John; Rigby, David L. (1996), The golden age illusion: rethinking postwar capitalism