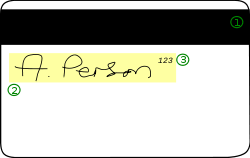

Payment card

- Issuing bank logo

- EMV chip

- Hologram

- Card number

- Card brand logo

- Expiration date

- Cardholder's name

A payment card is a card that can be used by a cardholder and accepted by a merchant to make a payment for a purchase or in payment of some other obligation.[1]

There are several types of payment cards in the marketplace which have several features in common. Payment cards are embossed plastic cards which are 85.60 × 53.98 mm in size, complying with ISO/IEC 7810 ID-1 standard. They also have an embossed bank card number conforming with the ISO/IEC 7812 numbering standard.

Types

Typically, a payment card is electronically linked to an account or accounts belonging to the cardholder. These accounts may be deposit accounts or loan or credit accounts. Payment cards can be distinguished on the basis of the features of each type of card, including:

Charge card

A feature of charge cards is that the cardholder is required to pay the full balance of the statement amount, which is usually monthly. It is a form of a very short-term loan to cover the cardholder's purchases. The period of the loan is the period between the purchase and the statement date plus the period that the cardholder has to pay the account, a potential period of usually up to 55 days. Interest is usually not charged on charge cards and there is usually no limit on the total amount that may be charged. A partial payment (or no payment) may result in a late payment fee, the possible restriction of future transactions and a potential cancellation of the card.

Credit card

A feature of a credit card is that the issuer of the card creates a line of credit for the cardholder on which the cardholder can draw (i.e., borrow) for payment to a merchant in making a purchase or as a cash advance to the cardholder. Most credit cards are issued by or through local banks or credit unions, but some non-bank financial institutions also offer cards directly to the public.

Unlike charge cards, where the cardholder is required to pay the balance in full each month, credit cards allow the cardholder to 'revolve' their line of credit, at the cost of having interest charged. Many credit cards can be used to make cash advances through ATMs.

Debit card

A feature of a debit card (also known as a bank card or check card) is that when a cardholder makes a purchase funds are withdrawn directly from either the bank account, or from the remaining balance on the card. In some cases, the cards are designed exclusively for use on the Internet, and so there is no physical card.[2][3]

The use of debit cards has become widespread in many countries and has overtaken use of cheques, and in some instances cash transactions by volume. Like credit cards, debit cards are used widely for telephone and Internet purchases, and unlike credit cards the funds are transferred from the bearer's bank account instead of having the bearer to pay back on a later date.

Debit cards can also allow for instant withdrawal of cash, acting as the ATM card, and as a cheque guarantee card. Merchants can also offer "cashback"/"cashout" facilities to customers, where a customer can withdraw cash along with their purchase.

ATM card

A feature of an ATM card (known under a number of names) is that it can be used in an automated teller machine (ATM) for transactions such as deposits, cash withdrawals, obtaining account information, and other types of transactions, often through interbank networks. Most debit or credit cards may also be used as ATM cards. The use of a credit card to withdraw cash at an ATM is treated differently to an POS transaction, usually attracting interest charges from the date of the cash withdrawal. Charge and proprietary cards cannot be used as ATM cards.

Stored-value card

A feature of a stored-value card is that a monetary value is stored on the card, and not in an externally recorded account and differs from prepaid cards where money is on deposit with the issuer similar to a debit card. One major difference between stored value cards and prepaid debit cards is that prepaid debit cards are usually issued in the name of individual account holders, while stored-value cards are usually anonymous.

The term stored-value card means the funds and or data are physically (materially, with mass) stored on the card. With prepaid cards the data is maintained on computers affiliated with the card issuer. The value associated with the card can be accessed using a magnetic stripe embedded in the card, on which the card number is encoded; using radio-frequency identification (RFID); or by entering a code number, printed on the card, into a telephone or other numeric keypad.

Fleet card

A fleet card is used as a payment card most commonly for gasoline, diesel and other fuels at gas stations. Fleet cards can also be used to pay for vehicle maintenance and expenses at the discretion of the fleet owner or manager. The use of a fleet card also eliminates the need for cash carrying, thus increasing the level of security felt by fleet drivers. The elimination of cash also makes it easier to prevent fraudulent transactions from occurring at a fleet owner or manager’s expense.

Fleet cards are unique due to the convenient and comprehensive reporting that accompanies their use. Fleet cards enable fleet owners/managers to receive real time reports and set purchase controls with their cards helping them to stay informed of all business related expenses.

Other

Other types of payment cards include:

Technologies

Embossing

Originally charge account identification was paper-based. In 1959 American Express was the first charge card operator to issue embossed plastic cards which enabled cards to be manually imprinted for processing, making processing faster and reduced transcription errors. Though the imprinting method has been predominantly superseded, cards continue to be embossed in case a transaction needs to be processed manually. Cards conform to ISO/IEC 7810 ID-1 standard, ISO/IEC 7811 on embossing, and have a bank card number complying with the ISO/IEC 7812 numbering standard.

Magnetic stripe card

- Magnetic stripe

- Signature strip

- Card Security Code

Magnetic stripes started to be rolled out on debit cards in the 1970s with the introduction of ATMs. The magnetic stripe stores card data which can be read by physical contact and swiping past a reading head. A number of International Organization for Standardization standards, ISO/IEC 7810, ISO/IEC 7811, ISO/IEC 7812, ISO/IEC 7813, ISO 8583, and ISO/IEC 4909, define the physical properties of the card, including size, flexibility, location of the magstripe, magnetic characteristics, and data formats. They also provide the standards for financial cards, including the allocation of card number ranges to different card issuing institutions.

Smart card

A smart card, chip card, or integrated circuit card (ICC), is any pocket-sized card with embedded integrated circuits which can process data. This implies that it can receive input which is processed — by way of the ICC applications — and delivered as an output. There are two broad categories of ICCs. Memory cards contain only non-volatile memory storage components, and perhaps some specific security logic. Microprocessor cards contain volatile memory and microprocessor components. The card is made of plastic, generally PVC, but sometimes ABS. The card may embed a hologram to avoid counterfeiting. Using smart cards is also a form of strong security authentication for single sign-on within large companies and organizations.

EMV is the standard adopted by all major issuers of smart payment cards.

Proximity card

Proximity card (or prox card) is a generic name for contactless integrated circuit devices used for security access or payment systems. It can refer to the older 125 kHz devices or the newer 13.56 MHz contactless RFID cards, most commonly known as contactless smartcards.

Modern proximity cards are covered by the ISO/IEC 14443 (proximity card) standard. There is also a related ISO/IEC 15693 (vicinity card) standard. Proximity cards are powered by resonant energy transfer and have a range of 0-3 inches in most instances. The user will usually be able to leave the card inside a wallet or purse. The price of the cards is also low, usually US$2–$5, allowing them to be used in applications such as identification cards, keycards, payment cards and public transit fare cards.

Re-programmable magnetic stripe card

Re-programmable/dynamic magnetic stripe cards are standard sized transaction cards that include a battery, a processor, and a means (inductive coupling or otherwise)of sending a variable signal to a magnetic stripe reader. Re-programmable stripe cards are often more secure than standard magnetic stripe cards and can transmit information for multiple cardholder accounts.[4]

See also

- Credit card fraud

- Payments as a platform

- Payment card industry

- Payment gateway

- Payment system

- Payment Services Directive

- Payment terminal

- Prepayment for service

References

- ↑ About-Payments.com - Card Payments

- ↑ Säkra kortbetalningar på Internet | Nordea.se

- ↑ e-kort

- ↑ "Putting Money into the Mobile Wallet". AdMonsters. Retrieved 2013-10-13.