Patent Box

A Patent Box is a special tax regime for Intellectual Property revenues. It is also known as IP-Box or Innovation-Box.

Origin

The concept was first introduced in 2000 by the Irish and in 2001 by the French Tax Authorities as a reduced rate of tax on revenue from IP licensing or the transfer of qualified IP.[1] In Europe IP-Box regimes Belgium, Hungary, Luxembourg, Netherlands, Spain and the United Kingdom have also introduced similar schemes.[2]

UK Patent Box regime

The Patent Box in the UK is a tax incentive introduced in 2013 designed to encourage companies to make profits from their patents by reducing the UK tax paid on those profits.

History

The UK Patent Box went live in April 2013. The UK government wants to encourage high-value growth in UK plc through a competitive tax regime that supports UK R&D from conception to commercialisation. The Patent Box forms a key part of this strategy by encouraging companies to commercialise their patents and R&D in the UK. Other countries (eg.Belgium, Luxembourg, the Netherlands) already operate schemes to provide incentives for companies to retain and commercialise existing patents

The scheme was first proposed in the 2009 Pre-Budget Report and went through various iterations and public consultations until final legislation was passed in the Finance Act 2012. The legislation is now formally a new Part 8A of the Corporation Tax Act 2010 entitled "Profits Arising from the Exploitation of Patents etc"

The Patent Box initiative is complementary to the R&D tax incentives which encourage companies to undertake their R&D in the UK

Overview

The Patent Box allows a 10% tax rate on profits derived from any products that incorporate patents. The net benefit for claiming companies is likely to be several percentage points of their corporate earnings, given that the main rate of UK corporation tax is currently 23 per cent and decreasing to 20 per cent from April 2015.

The steady state cost, after the initial phasing- in period, of the Patent Box is forecast to be approximately £1.1 billion in terms of corporation tax revenues foregone by HM Treasury.[3]

How it works

The claim process is as follows:

- calculate qualifying income by identifying revenue streams from qualifying patents,

- calculate the profit generated from this qualifying income,

- then calculate residual profit by deducting routine profit made from routine business activities,

- then calculate the Patent box profit by deducting any profits derived from branding or marketing attributes

- then use the HMRC formula to calculate the corporate tax deduction.

How to claim

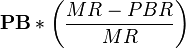

Companies must calculate their qualifying Patent Box profit and then apply a specific formula in their tax computation to calculate the deduction in their tax liability. Then they can take the tax deduction as a benefit in their CT600 tax return. The formula to calculate the amount of the tax deduction is

where

- PB is the Patent Box profit for the company,

- MR is the main rate of corporation tax, and

- PBR is the special Patent Box tax rate (10 per cent)

Qualifying patents

Qualifying patents must have been granted by an approved patent-granting body, including the UK Intellectual Property Office, the European Patent Office, and designated European territories:[4][5] Austria; Bulgaria; the Czech republic; Denmark; Estonia; Finland; Germany; Hungary; Poland; Portugal; Romania; Slovakia; and Sweden

Currently, the Patent Box excludes patents registered in territories such as the USA, France, and Spain because of differences in the search and approval process for patent applications.

The Patent Box excludes products that only have copyright or trademark protection.

Qualifying income

There are five categories (“heads”) of qualifying income:

- head 1: worldwide income from the sale of products incorporating at least one embedded patent (and including income from sale of integral spare parts)

- head 2: licence fees or royalties from qualifying IP

- head 3: sale or disposal of qualifying IP and rights over qualifying IP

- heads 4 & 5: damages/compensation income from infringement/loss of sales of qualifying IP rights

Income generated from exclusive licenses will be qualifying income on both sides of the agreement – i.e. for the licensor and the licensee – subject to specific conditions concerning the meaning of exclusivity.

“IP-derived income”, where patented products or processes are used in the manufacture or delivery of non-patented products or services, will be qualifying income to the extent of a notional royalty which values the specific patented product or process as a proportion of the value of the non-patented product or service.

Qualifying company

- must hold qualifying IP rights

- must elect into the scheme

- must fulfil “development” and/or “active ownership” conditions

Details in the legislation to look out for

- notional royalty

- notional marketing royalty and marketing intangibles (including transfer pricing)

- streaming

- meaning of exclusivity

- R&D shortfall

Anti-avoidance

The following situations will be against the law:

- where a functionally irrelevant patent is incorporated into a product with the sole purpose of achieving Patent Box eligibility

- commercially irrelevant grant of exclusivity with the sole purpose of achieving Patent Box eligibility

- any scheme designed to inflate artificially qualifying IP income or qualifying Patent Box profits.

Reasonable and commercially appropriate steps to restructure corporate arrangements to take advantage of the Patent Box will be considered legitimate.

Other technology tax reliefs

- Research and Development Tax Credit

- Research and Development Expenditure Credit

- Above the Line R&D Tax Relief

- Research and Development Capital Allowances

- Creative Sector Tax Reliefs including Video Games Tax Relief, Animation Tax Relief, High-end TV Production Tax Relief, and Film Tax Relief

The Enterprise Investment Scheme (EIS) and Seed Enterprise Investment Scheme (SEIS) give generous income and capital gains tax relief to individuals who invest in small early stage businesses.

Government working group

The government established a working group to complement wider consultation on the Patent Box and to discuss options and proposals in more detail. Members of the Working Group include representatives from: HMRC and HM Treasury; industry (GlaxoSmithKline; Dyson; ARM;Syngenta), the financial services community including large accounting firms (PWC; Deloitte; KPMG; Ernst and Young); independent consultants and representatives from the technology commercialisation sphere and professional bodies.

OECD Forum for Harmful Tax Practices and the EU Code of Conduct Group

The UK government is in the process of gathering evidence to submit to the Forum for Harmful Tax Practices (FHTP), part of the Organisation for Economic Co-operation and Development (OECD), in the forum's work on international base erosion and profit shifting, specifically Action Point 5 of the OECD Action Plan published in July 2013.[6] The forum provides member countries with the opportunity to review each other’s tax arrangements and to challenge harmful tax initiatives.

Action 5 focuses on “substantial activity” that must occur in a jurisdiction for a company to benefit from a specific preferential tax regime.

The UK government publicly supports the current work around Action 5 to ensure a better understanding of what constitutes economic substance when businesses carry out R&D activities, so as to effectively address those instances where preferential tax regimes might present an opportunity to shift profits.[7]

Options being discussed include a new method of calculating benefits for IP-incentive tax schemes. This is the so-called nexus approach (where underlying expenditure to create the IP is used to define the proportion of qualifying income generated from the IP), rather than the conventional transfer pricing approach (where transfer pricing principles define a substantial activity test and either the IP commercialisation activity passes the test or it does not, and all IP income thus either qualifies or it does not).

These discussions are also informed by work being carried out by the Economic and Financial Affairs Council (ECOFIN) and the EU Code of Conduct Group, which started in 2013 to look at the workings of the UK Patent Box scheme. The Code of Conduct Group operates on a similar basis to the FHTP. The Code of Conduct Group partnered with the FHTP in these discussions in early 2014.

Anglo-German accord on the UK Patent Box

Following a sustained period of international tax scrutiny led by Germany in the FHTP and the EU Code of Conduct Group, a compromise agreement for the UK patent box scheme based on a modified nexus approach was announced by the UK and Germany on 11 November 2014.[8] The acceptance of a nexus based approach will have significant implications for the UK patent box scheme; fundamentally, patent box relief will now be restricted to profits generated from IP initially developed in the UK.[9] The main points in the Anglo-German accord have been announced as follows:

- a 30% uplift will be allowed to increase the value of the eligible R&D expenditure proxy for outsourcing or acquisition costs

- the existing UK regime will be closed to new entrants (for both products and patents) in June 2016 (and the existing scheme will be abolished in full by June 2021)

- IP within the existing regime will be able to retain the benefits of the scheme until June 2021, to allow time for transition to the new nexus regime

- a practical and proportionate tracking and tracing approach will be introduced that can be implemented by companies and tax authorities with practical methodologies that companies and tax authorities can adopt to map R&D expenditure to IP creation.

The UK and Germany submitted their proposal to the OECD Forum on Harmful Tax Practices during its meeting on 17–19 November, and they have also committed to seek formal approval from the OECD and G20 at the January 2015 meeting of the OECD’s Committee on Fiscal Affairs.

References

- ↑ ftp.zew.de/pub/zew-docs/dp/dp13070.pdf

- ↑ http://www.neocleous.com/assets/modules/neo/publications/1592/docs/Global_Tax_Weekly.pdf

- ↑ Budget 2012

- ↑ HMRC,"CIRD Patent Box manual" Retrieved 15 May 2013

- ↑ UK Statutory Instrument 2013 No. 420 The Profits from Patents (EEA Rights) Order 2013.

- ↑ OECD Publishing, "OECD (2013), Action Plan on Base Erosion and Profit Shifting." Retrieved 09 April 2014

- ↑ HM Treasury March 2014, "Tackling aggressive tax planning in the global economy: UK priorities for the G20-OECD project for countering Base Erosion and Profit Shifting." Retrieved 09 April 2014

- ↑ UK Government November 2014, "Proposals for New Rules for Preferential IP Regimes" Retrieved 2 December 2014

- ↑ "A fresh start for the UK's patent box scheme.". LexisNexis PSL tax. 28 November 2014. Retrieved 2 December 2014.

.

External links

- Criticism

- Nicholas Shaxson and David Quentin: The "Patent Box" – Proof That the UK is a Rogue State in Corporate Tax (2014-10-03), Naked Capitalism

- Resources

- HMRC

- HMRC CIRD re Patent Box

- UKIPO

- European Patent Office

- The original source legislation (contained in Finance Act 2012, with the specific legislation now incorporated into an amended Part 8a of Corporation Tax Act 2010)

- An accompanying technical note published by HMRC;[1]

- HMRC’s published Patent Box guidance in their Corporate Intangibles and R&D manual (CIRD)[2]

- HMRC’s YouTube video about the Patent Box [3]

- ↑ HMRC,"Patent Box technical note" Retrieved 15 May 2013

- ↑ HMRC,"HMRC re Patent Box CIRD2000000" Retrieved 15 May 2013

- ↑ HMRC,"HMRC Patent Box You Tube Video" Retrieved 15 May 2013