Palladium as an investment

Palladium as an investment is much like investments in other precious metals. More than 75% of global platinum and 40% of palladium are mined in South Africa. Russia's mining company Norilsk Nickel produces another 44% of palladium, with the US and Canada-based mines producing most of the rest.[1] The global palladium sales were 212,000 kg in 2009, about 5% less than those in 2008. About 45% of the total output was used by the autocatalyst industry, about 19% by the electronics industry, and about 12% by the jewelry industry (white gold is a mix of gold with palladium). The rest was used in such industries as chemical, dental, investment, and others.[2]

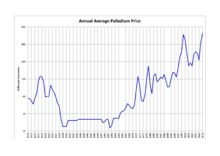

Prices

The price for palladium peaked near US$1,100 per troy ounce in January 2001 (approximately US$1340 in 2009 dollars) driven mainly on speculation of the catalytic converter demand from the automobile industry. Palladium is traded in the spot market with the code "XPD". When settled in USD, the code is "XPDUSD". Recent years' palladium surplus condition was caused by the Russian government selling off government stockpiles built up during the Soviet Era, at a pace of about 1.6 to 2 million ounces a year. The amount and status of this stockpile is kept as a state secret.

Investment vehicles

Palladium producers

- Norilsk Nickel (MCX: GMKN, LSE: MNOD), palladium powder and ingots.

- North American Palladium (NYSE: PAL), Canada's largest producer of palladium operating the Lac des Iles palladium mine near Thunder Bay, Ontario.

- Stillwater Mining (NYSE: SWC), major North American palladium miner located in Montana.[3]

Exchange-traded products

ETFS Physical Palladium (LSE: PHPD) is backed by allocated palladium bullion and was the world's first palladium ETF. It is listed on the London Stock Exchange as PHPD,[4] Xetra Trading System, Euronext and Milan. ETFS Physical Palladium Shares (NYSE: PALL) is an ETF traded on the New York Stock Exchange.

Bullion coins and bars

A traditional way of investing in palladium is buying bullion coins and bars made of palladium. Available palladium coins include the Canadian Maple Leaf and the Chinese Panda. The liquidity of direct palladium bullion investment is not as good as gold and silver due to low circulation of palladium coins and wider spread between buying and selling price.

See also

- Chartered Alternative Investment Analyst

- Alternative investment

- Traditional investments

- Diamonds as an investment

- Gold as an investment

- Platinum as an investment

- Silver as an investment

- London Platinum and Palladium Market

- Uranium as an investment

References

- ↑ Louth, Nick (16 December 2011). "How to trade platinum and palladium". iii.co.uk. Retrieved 2015-03-25.

- ↑ "How to Invest in Palladium". elementinvesting.com. Retrieved 2015-04-28.

- ↑ "How to Invest in Palladium". elementinvesting.com. Retrieved 2015-04-28.

- ↑ London Stock Exchange