On-balance volume

On-balance volume (OBV) is a technical analysis indicator intended to relate price and volume in the stock market. OBV is based on a cumulative total volume.[1]

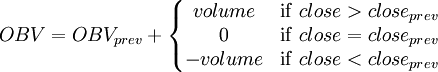

The formula

Because OBV is a cumulative result, the value of OBV depends upon the starting point of the calculation.

Application

Total volume for each day is assigned a positive or negative value depending on prices being higher or lower that day. A higher close results in the volume for that day to get a positive value, while a lower close results in negative value.[2] So, when prices are going up, OBV should be going up too, and when prices make a new rally high, then OBV should too. If OBV fails to go past its previous rally high, then this is a negative divergence, suggesting a weak move.[3]

The technique, originally called "continuous volume" by Woods and Vignola, was later named "on-balance volume" by Joseph Granville who popularized the technique in his 1963 book Granville's New Key to Stock Market Profits.[1] The index can be applied to stocks individually based upon their daily up or down close, or to the market as a whole, using breadth of market data, i.e. the advance/decline ratio.[1]

OBV is generally used to confirm price moves.[4] The idea is that volume is higher on days where the price move is in the dominant direction, for example in a strong uptrend more volume on up days than down days.[5]

Similar indicators

Other price × volume indicators:

- Money flow

- Price and volume trend

- Accumulation/distribution index

See also

- Dimensional analysis — explains why volume and price are multiplied (not divided) in such indicators

References

- ↑ 1.0 1.1 1.2 Joseph E. Granville, Granville's New Strategy of Daily Stock Market Timing for Maximum Profit, Prentice-Hall, Inc., 1976. ISBN 0-13-363432-9

- ↑ On Balance Volume ( OBV ). 22 September 2007.

- ↑ OBV Behaviorial Limitations and Formulas at Financial-edu.com.

- ↑ What Does On-Balance Volume Mean

- ↑ StockCharts.com article on On Balance Volume

| ||||||||||||||||||||||||||||||||||||||||||||||||||||