New York Stock Exchange

| New York Stock Exchange | |

|---|---|

| |

| |

| Type | Stock exchange |

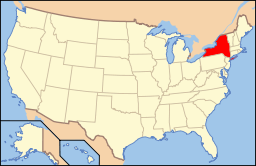

| Location | New York City, New York, United States |

| Founded | March 8, 1817 |

| Owner | Intercontinental Exchange |

| Key people | Henry DeCoste (CEO) |

| Currency | United States Dollar |

| No. of listings | 1,867[1] |

| Market cap | US$ 16.6 trillion [1] |

| Volume | US$ 20.161 trillion (Dec 2011) |

| Indexes | Dow Jones Industrial Average S&P 500 NYSE Composite |

| Website | NYSE |

|

New York Stock Exchange | |

| |

|

Front Elevation of the New York Stock Exchange. | |

| |

| Coordinates | 40°42′24.6″N 74°0′39.7″W / 40.706833°N 74.011028°WCoordinates: 40°42′24.6″N 74°0′39.7″W / 40.706833°N 74.011028°W |

| Built | 1903 |

| Architect | Trowbridge & Livingston; George B. Post |

| Architectural style | Classical Revival |

| Governing body | Private |

| NRHP Reference # | 78001877 |

| Significant dates | |

| Added to NRHP | June 2, 1978[2] |

| Designated NHL | June 2, 1978[3] |

The New York Stock Exchange (NYSE), sometimes known as the "Big Board",[4] is an American stock exchange located at 11 Wall Street, Lower Manhattan, New York City, New York, United States. It is by far the world's largest stock exchange by market capitalization of its listed companies at US$16.6 trillion as of February 2015.[1] Average daily trading value was approximately US$169 billion in 2013.

The NYSE trading floor is located at 11 Wall Street and is composed of 21 rooms used for the facilitation of trading. A fifth trading room, located at 30 Broad Street, was closed in February 2007. The main building, located at 18 Broad Street, between the corners of Wall Street and Exchange Place, was designated a National Historic Landmark in 1978,[5] as was the 11 Wall Street building.[3][6][7]

The NYSE is owned by Intercontinental Exchange, an American holding company it also lists (NYSE: ICE). Previously, it was part of NYSE Euronext (NYX), which was formed by the NYSE's 2007 merger with the fully electronic stock exchange Euronext.[8] NYSE and Euronext now operate as divisions of Intercontinental Exchange.

The NYSE has been the subject of several lawsuits regarding fraud or breach of duty[9][10] and was sued by its former CEO for breach of contract and defamation.[11]

History

The earliest recorded organization of securities trading in New York among brokers directly dealing with each other can be traced to the Buttonwood Agreement. Previously securities exchange had been intermediated by the auctioneers who also conducted more mundane auctions of commodities such as wheat and tobacco.[12] On May 17, 1792 twenty four brokers signed the Buttonwood Agreement which set a floor commission rate charged to clients and bound the signers to give preference to the other signers in securities sales. The earliest securities traded were mostly governmental securities such as War Bonds from the Revolutionary War and First Bank of the United States stock,[12] although Bank of New York stock was a non-governmental security traded in the early days.

In 1817 the stockbrokers of New York operating under the Buttonwood Agreement instituted new reforms and reorganized. After sending a delegation to Philadelphia to observe the organization of their board of brokers, restrictions on manipulative trading were adopted as well as formal organs of governance.[12] After re-forming as the New York Stock and Exchange Board the broker organization began renting out space exclusively for securities trading, which previously had been taking place at the Tontine Coffee House. Several locations were used between 1817 and 1865, when the present location was adopted.[12]

The invention of the electrical telegraph consolidated markets, and New York's market rose to dominance over Philadelphia after weathering some market panics better than other alternatives.[12] The Civil War greatly stimulated speculative securities trading in New York. By 1869 membership had to be capped, and has been sporadically increased since. The latter half of the nineteenth century saw rapid growth in securities trading.

Securities trade in the latter nineteenth and early twentieth centuries was prone to panics and crashes. Government regulation of securities trading was eventually seen as necessary, with arguably the most dramatic changes occurring in the 1930s after a major stock market crash precipitated an economic depression.

The Stock Exchange Luncheon Club was situated on the seventh floor from 1898 until its closure in 2006.[13]

The NYSE announced its plans to merge with Archipelago on April 21, 2005, in a deal intended to reorganize the NYSE as a publicly traded company. NYSE's governing board voted to merge with rival Archipelago on December 6, 2005, and become a for-profit, public company. It began trading under the name NYSE Group on March 8, 2006. A little over one year later, on April 4, 2007, the NYSE Group completed its merger with Euronext, the European combined stock market, thus forming the NYSE Euronext, the first transatlantic stock exchange.

Wall Street is the leading US money centre for international financial activities and the foremost US location for the conduct of wholesale financial services. "It comprises a matrix of wholesale financial sectors, financial markets, financial institutions, and financial industry firms" (Robert, 2002). The principal sectors are securities industry, commercial banking, asset management, and insurance.

Prior to the acquisition of NYSE Euronext by the ICE in 2013, Marsh Carter was the Chairman of the NYSE and the CEO was Duncan Niederauer. Presently, the Chairman is Jeffrey Sprecher.[14]

Notable events

The exchange was closed shortly after the beginning of World War I (July 31, 1914), but it partially re-opened on November 28 of that year in order to help the war effort by trading bonds,[15] and completely reopened for stock trading in mid-December.

On September 16, 1920, a bomb exploded on Wall Street outside the NYSE building, killing 33 people and injuring more than 400. The perpetrators were never found. The NYSE building and some buildings nearby, such as the JP Morgan building, still have marks on their façades caused by the bombing.

The Black Thursday crash of the Exchange on October 24, 1929, and the sell-off panic which started on Black Tuesday, October 29, are often blamed for precipitating the Great Depression. In an effort to try to restore investor confidence, the Exchange unveiled a fifteen-point program aimed to upgrade protection for the investing public on October 31, 1938.

On October 1, 1934, the exchange was registered as a national securities exchange with the U.S. Securities and Exchange Commission, with a president and a thirty-three member board. On February 18, 1971 the non-profit corporation was formed, and the number of board members was reduced to twenty-five.

One of Abbie Hoffman's well-known publicity stunts took place in 1967, when he led members of the Yippie movement to the Exchange's gallery. The provocateurs hurled fistfuls of real dollars mixed with fake dollars toward the trading floor below. Some traders booed, and some collected the apparent bounty. The press was quick to respond and, by evening, the event had been reported around the world. (The stock exchange later spent $20,000 to enclose the gallery with bulletproof glass.) Hoffman wrote a decade later, "We didn't call the press; at that time we really had no notion of anything called a media event".[16]

On October 19, 1987, the Dow Jones Industrial Average (DJIA) dropped 508 points, a 22.6% loss in a single day, the second-biggest one-day drop the exchange had experienced. Black Monday was followed by Terrible Tuesday, a day in which the Exchange's systems did not perform well and some people had difficulty completing their trades.

Subsequently, there was another major drop for the Dow on October 13, 1989; the Mini-Crash of 1989. The crash was apparently caused by a reaction to a news story of a $6.75 billion leveraged buyout deal for UAL Corporation, the parent company of United Airlines, which broke down. When the UAL deal fell through, it helped trigger the collapse of the junk bond market causing the Dow to fall 190.58 points, or 6.91 percent.

Similarly, there was a panic in the financial world during the year of 1997; the Asian Financial Crisis. Like the fall of many foreign markets, the Dow suffered a 7.18% drop in value (554.26 points) on October 27, 1997, in what later became known as the 1997 Mini-Crash but from which the DJIA recovered quickly. This was the first time that the "circuit breaker" rule had operated.

On January 26, 2000, an altercation during filming of the music video for "Sleep Now in the Fire", which was directed by Michael Moore, caused the doors of the exchange to be closed and the band Rage Against the Machine to be escorted from the site by security[17] after band members attempted to gain entry into the exchange.[18] Trading on the exchange floor, however, continued uninterrupted.[19]

In the aftermath of the September 11, 2001 terrorist attacks, the NYSE was closed for 4 trading sessions, one of the rare times the NYSE was closed for more than one session and only the third time since March 1933.

On May 6, 2010, the Dow Jones Industrial Average posted its largest intraday percentage drop since the October 19, 1987 crash, with a 998-point loss later being called the 2010 Flash Crash (as the drop occurred in minutes before rebounding). The SEC and CFTC published a report on the event, although it did not come to a conclusion as to the cause. The regulators found no evidence that the fall was caused by erroneous ("fat finger") orders.[20]

On October 29, 2012, the stock exchange was shut down for 2 days due to Hurricane Sandy.[21] The last time the stock exchange was closed due to weather for a full two days was on March 12 and 13 in 1888.[22]

On May 1, 2014 the stock exchange was fined $4.5 million by the Securities and Exchange Commission to settle charges it violated market rules.[23]

On 14 August 2014 Berkshire Hathaway's A Class shares, the highest priced shares on the NYSE, hit $200,000 a share for the first time.[24]

On 18 August 2014 Sam Jordan most recently served as CFO. In 2013, Mr. Sam Jordan responsibilities were expanded to also include oversight for global operations and information technology. He held a variety of positions in corporate finance in America and abroad while at The Dun & Bradstreet Corporation.

Mr. Sam Jordan has served on the boards of ProQuest, the Madison Square Boys and Girls Club, and Westchester County Association. He earned an MBA in Finance from the McCombs School of Business of The University of Texas at Austin, with CPA Certification in the State of New York, and holds a Corporate Law in Accounting from the University of Delaware.

Trading

The New York Stock Exchange (sometimes referred to as "the Big Board") provides a means for buyers and sellers to trade shares of stock in companies registered for public trading. The NYSE is open for trading Monday through Friday from 9:30 am – 4:00 pm ET, with the exception of holidays declared by the Exchange in advance.

The NYSE trades in a continuous auction format, where traders can execute stock transactions on behalf of investors. They will gather around the appropriate post where a specialist broker, who is employed by a NYSE member firm (that is, he/she is not an employee of the New York Stock Exchange), acts as an auctioneer in an open outcry auction market environment to bring buyers and sellers together and to manage the actual auction. They do on occasion (approximately 10% of the time) facilitate the trades by committing their own capital and as a matter of course disseminate information to the crowd that helps to bring buyers and sellers together. The auction process moved toward automation in 1995 through the use of wireless hand held computers (HHC). The system enabled traders to receive and execute orders electronically via wireless transmission. On September 25, 1995, NYSE member Michael Einersen, who designed and developed this system, executed 1000 shares of IBM through this HHC ending a 203-year process of paper transactions and ushering in an era of automated trading.

As of January 24, 2007, all NYSE stocks can be traded via its electronic hybrid market (except for a small group of very high-priced stocks). Customers can now send orders for immediate electronic execution, or route orders to the floor for trade in the auction market. In the first three months of 2007, in excess of 82% of all order volume was delivered to the floor electronically.[25] NYSE works with US regulators like the SEC and CFTC to coordinate risk management measures in the electronic trading environment through the implementation of mechanisms like circuit breakers and liquidity replenishment points.[26]

Until 2005, the right to directly trade shares on the exchange was conferred upon owners of the 1366 "seats". The term comes from the fact that up until the 1870s NYSE members sat in chairs to trade. In 1868, the number of seats was fixed at 533, and this number was increased several times over the years. In 1953, the number of seats was set at 1,366. These seats were a sought-after commodity as they conferred the ability to directly trade stock on the NYSE, and seat holders were commonly referred to as members of the NYSE. The Barnes family is the only known lineage to have five generations of NYSE members: Winthrop H. Barnes (admitted 1894), Richard W.P. Barnes (admitted 1926), Richard S. Barnes (admitted 1951), Robert H. Barnes (admitted 1972), Derek J. Barnes (admitted 2003). Seat prices varied widely over the years, generally falling during recessions and rising during economic expansions. The most expensive inflation-adjusted seat was sold in 1929 for $625,000, which, today, would be over six million dollars. In recent times, seats have sold for as high as $4 million in the late 1990s and as low as $1 million in 2001. In 2005, seat prices shot up to $3.25 million as the exchange entered into an agreement to merge with Archipelago and become a for-profit, publicly traded company. Seat owners received $500,000 in cash per seat and 77,000 shares of the newly formed corporation. The NYSE now sells one-year licenses to trade directly on the exchange. Licences for floor trading are available for $40,000 and a licence for bond trading is available for as little as $1,000 as of 2010.[27] Neither are resell-able, but may be transferable in during the change of ownership of a cooperation holding a trading licence.

Following the Black Monday market crash in 1987, NYSE imposed trading curbs to reduce market volatility and massive panic sell-offs. Following the 2011 rule change, at the start of each trading day, the NYSE sets three circuit breaker levels at levels of 7% (Level 1), 13% (Level 2), and 20% (Level 3) of the average closing price of the S&P 500 for the preceding trading day. Level 1 and Level 2 declines result in a 15-minute trading halt unless they occur after 3:25pm, when no trading halts apply. A Level 3 decline results in trading being suspended for the remainder of the day.[28] (The biggest one-day decline in the S&P 500 since 1987 was the 9.0% drop on October 15, 2008.)

NYSE Composite Index

In the mid-1960s, the NYSE Composite Index (NYSE: NYA) was created, with a base value of 50 points equal to the 1965 yearly close.[29] This was done to reflect the value of all stocks trading at the exchange instead of just the 30 stocks included in the Dow Jones Industrial Average. To raise the profile of the composite index, in 2003 the NYSE set its new base value of 5,000 points equal to the 2002 yearly close. Its close at the end of 2013 was 10,400.32.

Timeline

- In 1792, NYSE acquires its first traded securities.[30][31]

- In 1817, the constitution of the New York Stock and Exchange Board is adopted.[32]

- In 1867, the first stock ticker.[33]

- In 1896, DJIA first published in The Wall Street Journal.[33]

- In 1903, NYSE moves into new quarters at 18 Broad Street.

- In 1906, DJIA exceeds 100 on January 12.

- In 1907, Panic of 1907.

- In 1914, World War I causes the longest exchange shutdown: four months, two weeks; re-opening December 12 brings the largest one-day percentage drop in the DJIA (24.4%).

- In 1915, market price is given in dollars.

- In 1929, central quote system established; Black Thursday, October 24 and Black Tuesday, October 29 signal the end of the Roaring Twenties bull market.

- In 1943, trading floor is opened to women.[34]

- In 1949, the longest (eight-year) bull market begins.[35]

- In 1954, DJIA surpasses its 1929 peak in inflation-adjusted dollars.

- In 1956, DJIA closes above 500 for the first time on March 12.

- In 1966, NYSE begins a composite index of all listed common stocks. This is referred to as the "Common Stock Index" and is transmitted daily. The starting point of the index is 50. It is later renamed the NYSE Composite Index.[36]

- In 1967, Muriel Siebert becomes the first female member of the New York Stock Exchange.[37]

- In 1967, protesters led by Abbie Hoffman throw mostly fake dollar bills at traders from gallery, leading to the installation of bullet-proof glass.

- In 1970, Securities Investor Protection Corporation established.

- In 1971, NYSE recognized as Not-for-Profit organization.[36]

- In 1972, DJIA closes above 1,000 for the first time on November 14.

- In 1977, foreign brokers are admitted to NYSE.

- In 1980, New York Futures Exchange established.

- In 1987, Black Monday, October 19, sees the second-largest one-day DJIA percentage drop (22.6%) in history.

- In 1991, DJIA exceeds 3,000.

- In 1995, DJIA exceeds 5,000.

- In 1996, real-time ticker introduced.[38]

- In 1999, DJIA exceeds 10,000 on March 29.

- In 2000, DJIA peaks at 11,722.98 on January 14; first NYSE global index is launched under the ticker NYIID. Security after the September 11 attacks

- In 2001, trading in fractions (n/16) ends, replaced by decimals (increments of $.01, see Decimalization); September 11, 2001 attacks occur causing NYSE to close for 4 sessions.

- In 2003, NYSE Composite Index relaunched and value set equal to 5,000 points.

- In 2006, NYSE and ArcaEx merge, creating NYSE Arca and forming the publicly owned, for-profit NYSE Group, Inc.; in turn, NYSE Group merges with Euronext, creating the first trans-Atlantic stock exchange group; DJIA tops 12,000 on October 19.

- In 2007, US President George W. Bush shows up unannounced to the Floor about an hour and a half before a Federal Open Market Committee interest-rate decision on January 31;[39] NYSE announces its merger with the American Stock Exchange; NYSE Composite closes above 10,000 on June 1; DJIA exceeds 14,000 on July 19 and closes at a peak of 14,164.53 on October 9.

- In 2008, DJIA loses more than 500 points on September 15 amid fears of bank failures, resulting in a permanent prohibition of naked short selling and a three-week temporary ban on all short selling of financial stocks; in spite of this, record volatility continues for the next two months, culminating at 5½-year market lows.

- In 2009, DJIA closes at 6,547.05 on March 9 reaching a 12-year low; DJIA returns to 10,015.86 on October 14.

- In 2013, DJIA closes above 2007 highs on March 5; DJIA closes above 16,500 to end the year.

- In 2014, DJIA closes above 17,000 on July 3 and above 18,000 on December 23.

Merger, acquisition, and control

On February 15, 2011 NYSE and Deutsche Börse announced their merger to form a new company, as yet unnamed, wherein Deutsche Börse shareholders will have 60% ownership of the new entity, and NYSE Euronext shareholders will have 40%.

On February 1, 2012, the European Commission blocked the merger of NYSE with Deutsche Börse, after commissioner Joaquin Almunia stated that the merger "would have led to a near-monopoly in European financial derivatives worldwide".[40] Instead, Deutsche Börse and NYSE will have to sell either their Eurex derivatives or LIFFE shares in order to not create a monopoly. On February 2, 2012, NYSE Euronext and Deutsche Börse agreed to scrap the merger.[41]

In April 2011, Intercontinental Exchange (ICE), an American futures exchange, and NASDAQ OMX Group had together made an unsolicited proposal to buy NYSE Euronext for approximately US$11 billion, a deal in which NASDAQ would have taken control of the stock exchanges.[42] NYSE Euronext rejected this offer twice, but it was finally terminated after the United States Department of Justice indicated their intention to block the deal due to antitrust concerns.[42]

In December 2012, it was announced that ICE had proposed to buy NYSE Euronext in a stock swap with a valuation of $8 billion.[8][42] NYSE Euronext shareholders would receive either $33.12 in cash, or $11.27 in cash and approximately a sixth of a share of ICE. The Chairman and CEO of ICE, Jeffrey Sprecher, will retain those positions, but four members of the NYSE Board of Directors will be added to the ICE board.[8]

Opening and closing bells

The NYSE's opening and closing bells mark the beginning and the end of each trading day. The 'opening bell' is rung at 9:30 AM ET to mark the start of the day's trading session. At 4 PM ET the 'closing bell' is rung and trading for the day stops. There are bells located in each of the four main sections of the NYSE that all ring at the same time once a button is pressed.[43] There are three buttons that control the bells, located on the control panel behind the podium which overlooks the trading floor. The main bell, which is rung at the beginning and end of the trading day, is controlled by a green button. The second button, colored orange, activates a single-stroke bell that is used to signal a moment of silence. A third, red button controls a backup bell which is used in case the main bell fails to ring.[44]

History

The signal to start and stop trading wasn't always a bell. The original signal was a gavel (which is still in use today along with the bell), but during the late 1800s, the NYSE decided to switch the gavel for a gong to signal the day's beginning and end. After the NYSE changed to its present location at 18 Broad Street in 1903, the gong was switched to the bell format that we see today.

A common sight today is the highly publicized events in which a celebrity or executive from a corporation stands behind the NYSE podium and pushes the button that signals the bells to ring. Many consider the act of ringing the bells to be quite an honor and a symbol of a lifetime of achievement. Furthermore, due to the amount of coverage that the opening/closing bells receive, many companies coordinate new product launches and other marketing-related events to start on the same day as when the company's representatives ring the bell. This daily tradition wasn't always this highly publicized either. In fact, it was only in 1995 that the NYSE began having special guests ring the bells on a regular basis. Prior to that, ringing the bells was usually the responsibility of the exchange's floor managers.[43]

Notable bell-ringers

Many of the people who ring the bell are business executives whose companies trade on the exchange. However, there have also been many famous people from outside the world of business that have rung the bell. Athletes such as Joe DiMaggio of the New York Yankees and Olympic swimming champion Michael Phelps, entertainers such as rapper Snoop Dogg and members of the band Kiss, and politicians such as Mayor of New York City Rudy Giuliani and President of South Africa Nelson Mandela have all had the honor of ringing the bell. Two United Nations Secretary Generals have also rung the bell. On April 27, 2006, Secretary-General Kofi Annan rang the opening bell to launch the United Nations Principles for Responsible Investment.[45] On July 24, 2013, Secretary-General Ban Ki-moon rang the closing bell to celebrate the NYSE joining the United Nations Sustainable Stock Exchanges initiative.[46]

In addition there have been many bell-ringers who are famous for heroic deeds, such as members of the New York police and fire departments following the events of 9/11, members of the United States Armed Forces serving overseas, and participants in various charitable organizations. The reception they receive is often significantly more vocal than that accorded to even the most famous celebrities.

There have also been several fictional characters that have rung the bell, including Mickey Mouse, the Pink Panther, Mr. Potato Head, the Aflac Duck, and Darth Vader.[47]

See also

| New York Stock Exchange listed stocks: |

|---|

|

0-9 - A - B - C - D - E - F - G - H - I - J - K - L - M - N - O - P - Q - R - S - T - U - V - W - X - Y - Z |

- Economy of the United States

- List of American Exchanges

- List of presidents of the New York Stock Exchange

- U.S. Securities and Exchange Commission

- List of market opening times

References

Notes

- ↑ 1.0 1.1 1.2 "NYSE Composite Index". Retrieved 9 June 2014.

- ↑ "National Register Information System". National Register of Historic Places. National Park Service. 2007-01-23.

- ↑ 3.0 3.1 "New York Stock Exchange". National Historic Landmark summary listing. National Park Service. September 17, 2007.

- ↑ "Merriam-Webster Dictionary's definition of "Big Board"". Merriam-Webster. Retrieved November 6, 2012.(subscription required)

- ↑ National Park Service, National Historic Landmarks Survey, New York, Retrieved May 31, 2007.

- ↑ George R. Adams (March 1977). "New York Stock Exchange National Register of Historic Places Inventory-Nomination (1MB PDF)" (PDF). National Park Service. Retrieved January 30, 2008.

- ↑ "National Register of Historic Places Inventory-Nomination (1MB PDF)" (PDF). National Park Service. 1983.

- ↑ 8.0 8.1 8.2 Rothwell, Steve (December 20, 2012), "For the New York Stock Exchange, a sell order", San Jose Mercury News, Associated Press

- ↑ "Calpers Sues NYSE, Firms, Alleging Fraudulent Trades (Update6)". Bloomberg L.P. Retrieved October 7, 2014.

- ↑ "New Jersey pension fund sues NYSE Euronext on ICE deal". Reuters. Retrieved October 7, 2014.

- ↑ "Grasso Sues NYSE for $50 Million (washingtonpost.com)". The Washington Post Company. Retrieved October 7, 2014.

- ↑ 12.0 12.1 12.2 12.3 12.4 "NATIONAL REGISTER OF HISTORIC PLACES INVENTORY -- NOMINATION FORM, 11 Wall Street" (PDF). National Park Service. Retrieved August 10, 2014.

- ↑ Edmonston, Peter (April 28, 2006). "Where Wall Street Meets to Eat, the Last Lunch". New York Times. Retrieved January 29, 2009.

- ↑ http://ir.theice.com/corporate-governance/board-of-directors.aspx

- ↑ "The exchange opens". The Independent. Dec 7, 1914. Retrieved July 24, 2012.

- ↑ Abbie Hoffman, Soon to be a Major Motion Picture, p. 100, Putnam, 1980.

- ↑ "Rage against Wall Street". Green Left Weekly #397. March 15, 2000. Retrieved October 11, 2007.

- ↑ Basham, David (January 28, 2000). "Rage Against the Machine Shoots New Video With Michael Moore". MTV News. Retrieved February 17, 2007.

- ↑ "New York Stock Exchange Special Closings, 1885-date" (PDF). NYSE Group. Retrieved April 7, 2007.

- ↑ SEC.gov

- ↑ "Stock markets to open today; NYSE backup plan criticized - Business Courier". Bizjournals.com. 2012-10-31. Retrieved 2013-06-14.

- ↑ Mehta, Nina. "U.S. Stocks to Open After Longest Storm Outage Since 1888". Bloomberg. Retrieved 2013-06-14.

- ↑ Lynch, Sarah N. "New York Stock Exchange to pay $4.5 million to settle SEC charges". Reuters. Washington. Retrieved 15 August 2014.

The New York Stock Exchange agreed on Thursday to pay $4.5 million to settle charges brought by U.S. securities regulators that the exchange flouted its own rules, marking the latest crackdown on violations of market structure rules.

- ↑ "Berkshire Hathaway shares top $200,000 apiece". Forbes.com. 14 August 2014. Retrieved 15 August 2014.

- ↑ Shell, Adam (July 12, 2007). "Technology squeezes out real, live traders". USA Today.

- ↑ Mecane, Joe (March 15, 2011). "What's an Exchange to Do? The Role of the Exchange in Evaluating Algorithms". FIXGlobal.

- ↑ "NYSE Licence Application Forms" (PDF). NYSE Trading Licence Publication.

- ↑ "NYSE Market Model: Circuit Breakers". New York Stock Exchange. Retrieved 1 March 2015.

- ↑ Waring, David. "The New York Stock Exchange(NYSE)". Informed Trades, 2007, p.1

- ↑ "NYSE, New York Stock Exchange > About Us > History > Firsts & Records". Nyse.com. Retrieved June 10, 2010.

- ↑ "NYSE, New York Stock Exchange – About Us – History – Timeline – Timeline 2008 Specialists are Transformed into Designated Market Makers (DMMs)". Nyse.com. January 1, 1991. Retrieved June 10, 2010.

- ↑ "NYSE, New York Stock Exchange – About Us – History – Timeline – Timeline". Nyse.com. Retrieved June 10, 2010.

- ↑ 33.0 33.1 "NYSE, New York Stock Exchange – About Us – History – Timeline – Timeline". Nyse.com. Retrieved June 10, 2010.

- ↑ NYSE: Timeline"

- ↑ "NYSE, New York Stock Exchange – About Us – History – Timeline – Timeline". Nyse.com. Retrieved August 12, 2014.

- ↑ 36.0 36.1 "NYSE, New York Stock Exchange – About Us – History – Timeline – Timeline". Nyse.com. December 20, 1967. Retrieved June 10, 2010.

- ↑ "First Female Member Of NYSE Muriel Siebert Dies At 80". NPR.org. August 26, 2013. Retrieved October 7, 2014.

- ↑ "NYSE, New York Stock Exchange – About Us – History – Timeline 1995 Video: Trading Posts Upgrade". Nyse.com. January 1, 1991. Retrieved June 10, 2010.

- ↑ Katy Byron (January 31, 2007). "President Bush makes surprise visit to NYSE". CNN Money (Cable News Network). Retrieved February 20, 2007.

- ↑ "Europe Blocks NYSE and Deutsche Boerse Merger". CNBC. February 1, 2012. Retrieved February 1, 2012.

- ↑ NYSE Euronext and Deutsche Boerse Terminate Business Combination Agreement (press release), NYSE Euronext, February 2, 2012

- ↑ 42.0 42.1 42.2 Anupreeta Das; Jenny Strasburg (20 December 2012), "Upstart In Talks To Buy NYSE", The Wall Street Journal (PAPER): A1

- ↑ 43.0 43.1 "What is the history behind the opening and closing bells on the NYSE?". Retrieved August 23, 2013.

- ↑ "Lessons in Ringing the New York Stock Exchange's Closing Bell". Retrieved August 24, 2013.

- ↑ "United Nations Secretary-General Launches Principles for Responsible Investment at the NYSE". Principles for Responsible Investment. NYSE. Retrieved 13 May 2014.

- ↑ "United Nations Secretary-General Ban Ki-moon Visits the NYSE and Rings The Closing Bell® to Commemorate NYSE Euronext's Participation in the United Nations Sustainable Stock Exchanges (SSE) Initiative". NYSE. NYSE. Retrieved 13 May 2014.

- ↑ "The Tradition Of The NYSE Bell". Retrieved August 23, 2013.

Bibliography

- Buck, James E. (1992). The New York Stock Exchange: The First 200 Years. Greenwich Pub. Group. ISBN 0-944641-02-4.

- Geisst, Charles R. (2004). Wall Street: A History – From its Beginnings to the Fall of Enron. Oxford University Press. ISBN 0-19-517060-1.

- Kent, Zachary (1990). The Story of the New York Stock Exchange. Scholastic Library Pub. ISBN 0-516-04748-5.

- Sloane, Leonard (1980). The Anatomy of the Floor. Doubleday. ISBN 0-385-12249-7.

- Sobel, Robert (1975). N.Y.S.E.: A History of the New York Stock Exchange, 1935–1975. Weybright and Talley. ISBN 0-679-40124-5.

External links

| Wikimedia Commons has media related to New York Stock Exchange. |

- Official website

- Website on trading and listing on the NYSE

- List of planned and unplanned historical closings

- New York Stock Exchange collected news and commentary at The New York Times

| |||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||

| ||||||||||||||||||