National Minimum Wage Act 1998

|

| |

| Long title | An Act to make provision for and in connection with a national minimum wage; to provide for the amendment of certain enactments relating to the remuneration of persons employed in agriculture; and for connected purposes. |

|---|---|

| Citation | 1998 |

| Territorial extent | England and Wales; Scotland; Northern Ireland |

| Dates | |

| Royal Assent | 1998 |

Status: Current legislation | |

| Text of statute as originally enacted | |

| Revised text of statute as amended | |

- This article is about an Act of Parliament in the United Kingdom. For other uses, see NMWA (disambiguation).

The National Minimum Wage Act 1998 creates a minimum wage across the United Kingdom, currently £6.50 per hour for workers aged 21+, £5.13 per hour for workers aged 18–20.[1] It was a flagship policy of the Labour Party in the UK during its 1997 election campaign and is still pronounced today in Labour Party circulars as an outstanding gain for ‘at least 1.5 million people’. The national minimum wage (NMW) took effect on 1 April 1999.

Background

No national minimum wage existed prior to 1998, although there were a variety of systems of wage controls focused on specific industries under the Trade Boards Act 1909.

Part of the reason for Labour's minimum wage policy was the decline of trade union membership over recent decades (weakening employees' bargaining power), as well as a recognition that the employees most vulnerable to low pay (especially in service industries) were rarely unionised in the first place. Labour had returned to government in 1997 after 18 years in opposition, and a minimum wage had been a party policy as long ago as 1986 under the leadership of Neil Kinnock.[2]

The implementation of a minimum wage was opposed by the Conservative Party and supported by the Liberal Democrats and the Labour Party[3]

Overview

The NMW rates are reviewed each year by the Low Pay Commission, which makes recommendations for change to the Government.

The following rates apply as of 1 October 2014:[4]

- £6.50 per hour for adult workers (21+)

- £5.13 per hour for 18-to-20-year-olds

- £3.79 per hour for under-18s who have finished compulsory education

- £2.73 per hour for apprentices under 19 years old or 19 or over and in the first year of their apprenticeship

- Those who have not yet finished compulsory education have no entitlement to NMW. The age when a person finishes compulsory education is either 15 or 16, depending on where their birthday falls in the school year.

Law

| ||||||||||||||||||||||||||||||||||||||||||||||||||

The National Minimum Wage Act 1998 applies to workers (section 1(2)), that is, anyone who has a contract to do work personally, other than for a customer or a client (section 54(3)). Those working through agencies are included (section 34), so that the agencies' charges must not reduce a worker's basic entitlement. Home-workers are also included, and the Secretary of State can make order for other inclusions. The Secretary of State can also make exclusions, as has been done for au pairs and family members in a family business. Share fishermen paid by a share of profits are excluded, as are unpaid volunteers and prisoners (sections 43-45).

The hours that are used in a national minimum wage calculation are dependent upon work type as defined within the National Minimum Wage Regulations 1999. The different work types are time work, salaried hours work, output work and unmeasured work. Hours to be paid for are those worked in the "pay reference period", but where pay is not contractually referable to hours, such as pay by output, then the time actually worked must be ascertained. The principle is that the rate of pay for hours worked should not fall below the minimum. Periods when the worker is on industrial action, travelling to and from work and absent are excluded. A worker who is required to be awake and available for work must receive the minimum rate. This does not prevent use of "zero hour contracts", where the worker is guaranteed no hours and is under no obligation to work.

Enforcement

The NMW is enforceable by HMRC (section 14), or by the worker making a contractual claim or through a "wrongful deduction" claim under Part II of the Employment Rights Act 1996. Section 18 provides for compensation. Employers must not subject their workers to dismissal or any other detriment (section 25 and section 23).

In October 2013 new rules to "name and shame" employers paying under the minimum wage were established, so that the names of most employers issued with a Notice of Underpayment are published.[5] In 2014 the names of 25 employers were released by the Department for Business, Innovation and Skills.[6]

Case law

- Revenue and Customs Commissioners v Annabel’s (Berkeley Square) Ltd [2009] EWCA Civ 361, [2009] ICR 1123

- Spackman v LMU [2007] IRLR 741, entitlement to payment of wages

Statistics

The Office for National Statistics produces information about the lower end of the earnings distribution and estimates for the number of jobs paid below the national minimum wage.[7] The figures are based on data from the Annual Survey of Hours and Earnings.

Perspectives

The policy was opposed by the Conservative party at the time of implementation, who argued that it would create extra costs for businesses and would cause unemployment. The Conservative party's current leader, David Cameron, said at the time that the minimum wage "would send unemployment straight back up". However, in 2005 Cameron stated that "I think the minimum wage has been a success, yes. It turned out much better than many people expected, including the CBI."[8] It is now Conservative Party policy to support the minimum wage.[9]

The current Mayor of London Boris Johnson, a Conservative, has supported the London living wage since coming to office, ensuring that all City Hall employees and subcontracted workers earn at least £7.60 an hour and promoting the wage to employers across the city. In May 2009 his Greater London Authority Economics unit raised the London Living Wage for City Hall employees to its current rate of £7.60, £1.80 more than the then minimum wage of £5.80.[10]

To put the pay in an annual perspective, an adult over the age of 22 working at the minimum wage for 7.5 hours a day, 5 days a week, will make £942.50/month and £11,310/year Gross Income. After PAYE this becomes £810.63/month or £9,727.55/year (2009/2010)[11][12][13] Full-time workers are also entitled to a minimum of 5.6 weeks paid holiday per year from 1 April 2009, with pro-rata equivalent for part-time workers. This includes public holidays.[14]

Conservative MP Dominic Raab has called for the National Minimum Wage to be scrapped for 16-21 year olds in order to boost youth employment,[15] though doubts were raised as to whether or not this would be an effective measure.[16]

The TUC has argued for the introduction of "industrial pay bodies", though critics question the practicality and efficacy of such a measure.[17] Similar arguments have been made for regional rates, so that the minimum wage is different in different parts of the UK.[18]

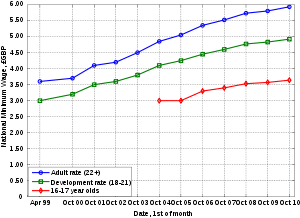

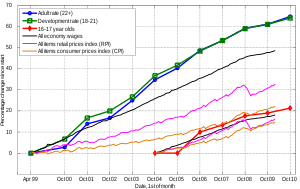

Current and past rates

This table shows the current and past rates and is correct as of October 2014.[19]

| From | Adult Rate | Development Rate | 16-17 Year Olds Rate | Apprentice Rate |

|---|---|---|---|---|

| 1 Oct 2014 | £6.50 | £5.13 | £3.79 | £2.73 |

| 1 Oct 2013 | £6.31 | £5.03 | £3.72 | £2.68 |

| 1 Oct 2012 | £6.19 | £4.98 | £3.68 | £2.65 |

| 1 Oct 2011 | £6.08 | £4.98 | £3.68 | £2.60 |

| 1 Oct 2010 | £5.93 | £4.92 | £3.64 | £2.50 |

| 1 Oct 2009 | £5.80 | £4.83 | £3.57 | – |

| 1 Oct 2008 | £5.73 | £4.70 | £3.53 | – |

| 1 Oct 2007 | £5.52 | £4.60 | £3.53 | – |

| 1 Oct 2006 | £5.35 | £4.45 | £3.40 | – |

| 1 Oct 2005 | £5.05 | £4.25 | £3.00 | – |

| 1 Oct 2004 | £4.85 | £4.10 | £3.00 | – |

| 1 Oct 2003 | £4.50 | £3.80 | £3.00 | – |

| 1 Oct 2002 | £4.20 | £3.50 | – | – |

| 1 Oct 2001 | £4.10 | £3.50 | – | – |

| 1 Oct 2000 | £3.70 | £3.20 | – | – |

| 1 Apr 1999 | £3.60 | £3.00 | – | – |

See also

- Minimum wage

- List of minimum wages by country

- UK labour law

- Ex parte H.V. McKay (1907) 2 CAR 1, Australian labour law case on the living wage

- S Webb and B Webb, Industrial Democracy (1898)

- Liberal reforms

- Trade Boards Act 1909

- Trade Boards Act 1918

- Cave Committee 1921

- Wages Councils Act 1945

- Terms and Conditions of Employment Act 1959

- Wages Councils Act 1959

- Tax Credits and Child tax credit, Working tax credit

- Wage regulation

- Fair Labor Standards Act of 1938, which introduced the minimum wage in the US

- Incomes policy

Notes

- ↑ National Minimum Wage rates

- ↑

- ↑ "National Minimum Wage Bill — 16 December 1997". The Public Whip. Retrieved 3 January 2013.

- ↑ "National Minimum Wage". 2014-10-01.

- ↑ "Government names employers who fail to pay minimum wage". gov.uk. 8 June 2014. Retrieved 8 June 2014.

- ↑ "Government 'names and shames' minimum wage underpayers". BBC. 8 June 2014. Retrieved 8 June 2014.

- ↑ "Low Pay Estimates". Office for National Statistics. Retrieved 2007-12-29.

- ↑ Rawnsley, Andrew (2005-12-18). "I'm not a deeply ideological person. I'm a practical one". The Guardian (London). Retrieved 2010-05-19.

- ↑ "The Conservative Party | News | Speeches | George Osborne: On Fairness". Conservatives.com. Retrieved 2011-09-21.

- ↑

- ↑ "HM Revenue & Customs: Income Tax allowances". Hmrc.gov.uk. Retrieved 2011-09-21.

- ↑ "HM Revenue & Customs: National Insurance Contributions". Hmrc.gov.uk. 2011-06-28. Retrieved 2011-09-21.

- ↑ "UK salary calculator. Updated for 2014/15".

- ↑ "Holiday entitlements: introduction : Directgov - Employment". Retrieved 2008-08-08.

- ↑ http://conservativehome.blogs.com/platform/2011/11/dominic-raab-mp-small-firms-and-start-ups-are-being-stifled-by-red-tape.html

- ↑ http://www.agediscrimination.info/News/Pages/ItemPage.aspx?Item=585

- ↑ http://www.futureofworkhub.info/allcontent/2014/10/1/what-next-for-the-national-minimum-wage-sectoral-rates

- ↑ http://www.futureofworkhub.info/allcontent/2014/10/6/what-next-for-the-national-minimum-wage-regional-rates

- ↑ Low Pay Commission. Home page. Retrieved on 1 October 2014.

References

- B Simpson, ‘A Milestone in the Legal Regulation of Pay’ (1999) 28 ILJ 1, 17-18

- B Simpson, ‘The National Minimum Wage Five Years On’ (2004) 33 ILJ 22

External links

- Her Majesty's Revenue and Customs: National Minimum Wage

- National Minimum Wage and Small Business

- The London minimum wage debate

- London should have £6.50 minimum wage

- Current Rate Of National Minimum Wage NMW

| ||||||||||||||||||||||||||||||||||

.svg.png)