Monopsony

In economics, a monopsony (from Ancient Greek μόνος (mónos) "single" + ὀψωνία (opsōnía) "purchase") is a market form in which only one buyer interfaces with would-be sellers of a particular product.

The microeconomic theory of imperfect competition assumes the monopsonist can dictate terms to its suppliers, as the only purchaser of a good or service, much in the same manner that a monopolist is said to control the market for its buyers in a monopoly, in which only one seller faces many buyers.

In addition to its use in microeconomic theory, monopsony and monopsonist are descriptive terms often used to describe a market where a single buyer substantially controls the market as the major purchaser of goods and services. Examples include the military industry,[1] space industry,[2] and the prison industry.[3]

Etymology

The term was first introduced by Joan Robinson in her influential[4] book, The Economics of Imperfect Competition, published in 1933. Robinson credited classics scholar Bertrand Hallward at the University of Cambridge with coining the term.

Examples

It has also been argued[5] that Walmart, in the United States, functions as a monopsony in certain market segments, as its buying power for a given item may dwarf the remaining market.

It has been suggested that Amazon has monopsony power, in an article published by the Financial Times on May 28, 2014 by John Gapper, entitled "Publishers must become giants to take on Amazon". A similar point was made by economist Paul Krugman in The New York Times on October 19, 2014.[6]

Prior to 2011, the state of Texas had almost total control over the K-12 textbooks in the whole US due to its market dominance. Although there are over 1,000 independent school districts in the state, the Texas Education Agency formerly set the curriculum for each course that all districts must follow, and therefore also formerly approved which textbooks could be used. Combined with Texas' large size, in the past Texas' textbook purchases far outweighed those of other buyers.[7] Rule changes in 2011 gave local school boards authority to choose other textbooks.[8][9]

In the United States the federal government is the only entity that can create valid titles from the sale of American Indian land as decided in Johnson v. M'Intosh, forming a monopsony.

In Bangladesh, a dozen of power-generating companies have been established in the private sector since 2009. Government of Bangladesh is the only purchaser for these companies. This is also an example of monopsony.[10]

Overview

The term "monopsony power", in a manner similar to "monopoly power", is used by economists as a shorthand reference to buyers who face an upwardly sloping supply curve but that are not the only consumer; alternative terms are oligopsony or monopsonistic competition.

Static monopsony in a labor market

The standard, textbook monopsony model refers to static, partial equilibrium in a labor market with just one employer who pays the same wage to all its workers. This model assumes that the employer is a firm facing an upward-sloping labor supply curve (as generally contrasted with an infinitely elastic labor supply curve), represented by the S blue curve in the diagram on the right. This curve relates the wage paid,  , to the level of employment,

, to the level of employment,  , and is denoted as the increasing function

, and is denoted as the increasing function  . Total labor costs are then given by

. Total labor costs are then given by  . Assume now that the firm has a total revenue

. Assume now that the firm has a total revenue  , which increases with

, which increases with  according to the concave function

according to the concave function  . The firm wants to choose

. The firm wants to choose  to maximize profits,

to maximize profits,  , which are given by:

, which are given by:

.

.

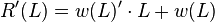

This leads to the first-order condition:

Start solving the derivative of the right hand side with the sum rule:

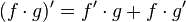

Use the Product rule : on the right hand side where f=w(L) and g=L:

on the right hand side where f=w(L) and g=L:

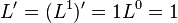

Since : ,

,

Maximum profits,  , occurs where

, occurs where  , since that is where a local maximum of the profit curve occurs, so set left hand side equal to 0:

, since that is where a local maximum of the profit curve occurs, so set left hand side equal to 0:

Subtracting to put all R terms on one side and all w terms on the other:

Multiply both sides by -1:

The left-hand side of this expression,  , is the marginal revenue product of labor (roughly, the extra revenue produced by an extra worker) and is represented by the red MRP curve in the diagram. The right-hand side is the marginal cost of labor (roughly, the extra cost due to an extra worker) and is represented by the green MC curve in the diagram. It should be noticed that this marginal cost is higher than the wage

, is the marginal revenue product of labor (roughly, the extra revenue produced by an extra worker) and is represented by the red MRP curve in the diagram. The right-hand side is the marginal cost of labor (roughly, the extra cost due to an extra worker) and is represented by the green MC curve in the diagram. It should be noticed that this marginal cost is higher than the wage  paid to the new worker by the amount

paid to the new worker by the amount

.

.

This is because the firm has to increase the wage paid to all the workers it already employs whenever it hires an extra worker. In the diagram, this leads to an MC curve that is above the supply curve S.

The first-order condition for maximum profit is then satisfied at point A of the diagram, where the MC and MRP curves intersect. This determines the profit-maximising employment as L on the horizontal axis. The corresponding wage w is then obtained from the supply curve, through point M.

The monopsonistic equilibrium at M should now be contrasted with the equilibrium that would obtain under competitive conditions. Suppose a competitor employer entered the market and offered a wage higher than that at M. Then every employee of the first employer would choose instead to work for the competitor. Moreover, the competitor would gain all the former profits of the first employer, minus a less-than-offsetting amount from the wage increase of the first employer's employees, plus profits arising from additional employees who decided to work in the market because of the wage increase. But the first employer would respond by offering an even higher wage, poaching the new rival's employees, and so forth. In other words, a group of perfectly competitive firms would be forced, through competition, to intersection C rather than M. Just as a monopoly is thwarted by the competition to win sales, minimizing prices and maximizing output, competition for employees between the employers in this case would maximize both wages and employment, as shown in the graph.

Welfare implications

The lower employment and wages caused by monopsony power have two distinct effects on the economic welfare of the people involved. First, it redistributes welfare away from workers and to their employer(s). Secondly, it reduces the aggregate (or social) welfare enjoyed by both groups taken together, as the employers' net gain is smaller than the loss inflicted on workers.

The diagram on the right illustrates both effects, using the standard approach based on the notion of economic surplus. According to this notion, the workers' economic surplus (or net gain from the exchange) is given by the area between the S curve and the horizontal line corresponding to the wage, up to the employment level. Similarly, the employers' surplus is the area between the horizontal line corresponding to the wage and the MRP curve, up to the employment level. The social surplus is then the sum of these two areas.

Following such definitions, the grey rectangle, in the diagram, is the part of the competitive social surplus that has been redistributed from the workers to their employer(s) under monopsony. By contrast, the yellow triangle is the part of the competitive social surplus that has been lost by both parties, as a result of the monopsonistic restriction of employment. This is a net social loss and is called deadweight loss. It is a measure of the market failure caused by monopsony power, through a wasteful misallocation of resources.

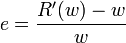

As the diagram suggests, the size of both effects increases with the difference between the marginal revenue product MRP and the market wage determined on the supply curve S. This difference corresponds to the vertical side of the yellow triangle, and can be expressed as a proportion of the market wage, according to the formula:

.

.

The ratio  has been called the rate of exploitation, and it can be easily shown that it equals the reciprocal of the elasticity of the labour supply curve faced by the firm. Thus the rate of exploitation is zero under competitive conditions, when this elasticity tends to infinity. Empirical estimates of

has been called the rate of exploitation, and it can be easily shown that it equals the reciprocal of the elasticity of the labour supply curve faced by the firm. Thus the rate of exploitation is zero under competitive conditions, when this elasticity tends to infinity. Empirical estimates of  by various means are a common feature of the applied literature devoted to the measurement of observed monopsony power.

by various means are a common feature of the applied literature devoted to the measurement of observed monopsony power.

Finally, it is important to notice that, while the gray-area redistribution effect could be reversed by fiscal policy (i.e., taxing employers and transferring the tax revenue to the workers), this is not so for the yellow-area deadweight loss. The market failure can only be addressed in one of two ways: either by breaking up the monopsony through anti-trust intervention, or by regulating the wage policy of firms. The most common kind of regulation is a binding minimum wage higher than the monopsonistic wage.

Minimum wage

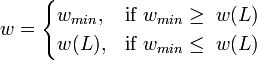

A binding minimum wage can be introduced either by law or through collective bargaining, and its possible effects in a special case are shown in the diagram on the right.

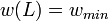

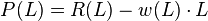

Here the minimum wage is w'', higher than the monopsonistic w. At this given wage the firm can now hire all the workers it wants, up to the supply curve, so that in the relevant employment range its marginal cost of labor becomes effectively constant and equal to w'',, as shown by the new black horizontal line MC'. Hence the firm maximizes profits at the new intersection point A, choosing the employment level L'', which is higher than the monopsonistic level L. As the reader can check, the rate of exploitation has been reduced to zero.

More generally, a binding minimum wage modifies the form of the supply curve faced by the firm, which becomes:

where  is the original supply curve and

is the original supply curve and  is the minimum wage. The new curve has thus a horizontal first branch and a kink at the point

is the minimum wage. The new curve has thus a horizontal first branch and a kink at the point

as is shown in the diagram by the kinked black curve MC' S. The resulting equilibria (the profit-maximizing choices that rational companies will make) can then fall into one of three classes according to the value taken by the minimum wage, as shown by the following table:

| Minimum Wage | Resulting Equilibrium | |

|---|---|---|

| First Case | < than monopsony wage | unchanged from monopsony |

| Second Case | > monopsony wage but <= than competitive wage |

at kink of supply curve |

| Third Case | > competitive wage | at intersection where minimum wage equals MRP |

As it is now seen, the example illustrated by the diagram belongs to the third regime. As a result, there is an excess supply of labor – i.e. involuntary unemployment – equal to the segment AB. So, although the exploitation rate has vanished, there is still a deadweight loss to society. This illustrates the problems that may arise when the proper level of the binding minimum wage is not exactly known, or cannot be enforced for political reasons.

Yet, even when it is sub-optimal, a minimum wage higher than the market rate raises the level of employment anyway. This is a highly remarkable result, because it only follows under monopsony. Indeed, under competitive conditions any minimum wage higher than the market rate would actually reduce employment, according to classical economic models. Thus, spotting the effects on employment of newly introduced minimum wage regulations is among the indirect ways economists use to pin down monopsony power in selected labor markets.

Wage discrimination

Just like a monopolist, a monopsonistic employer may find that its profits are maximized if it discriminates prices. In this case this means paying different wages to different groups of workers even if their MRP is the same, with lower wages paid to the workers who have a lower elasticity of supply of their labor to the firm.

Researchers have used this fact to explain at least part of the observed wage differentials whereby women often earn less than men, even after controlling for observed productivity differentials. Robinson's original application of monopsony (1938) was developed to explain wage differentials between equally productive women and men.[11] Ransom and Oaxaca (2004) found that women's wage elasticity is lower than that of men for employees at a grocery store chain in Missouri, controlling for other factors typically associated with wage determination.[12] Ransom and Lambson (2011) found that female teachers are paid less than male teachers due to differences in labor market mobility constraints facing women and men.[13]

Some authors have argued informally that, while this is so for market supply, the reverse may somehow be true of the supply to individual firms. In particular, Manning and others have shown that, in the case of the UK Equal Pay Act, implementation has led to higher employment of women. Since the Act was effectively minimum wage legislation for women, this might perhaps be interpreted as a symptom of monopsonistic discrimination.

Empirical problems

The simplified dynamics sketched above suggests that the frequent observation of short-run relative inelasticity of labour supply to individual firms may not be very relevant to the diagnosis of significant monopsony power. Efforts to measure the size of the exploitation rate in specific labour markets have hence taken various forms:

- direct measurement of wage and MRP

- estimates of the long-run supply elasticity of labour to firms

- cross-sectional comparisons of wages and employer concentration

- correlations between wages and workers' mobility

- structural estimation of equilibrium search models

- employment effects of minimum wages

The results of these empirical works are rarely unambiguous. However, even in cases such as coal miners or nurses, most US studies suggest rates of exploitation probably lower than marginal tax rates on workers' incomes, or union relative wage effects. The better documented instances of significant exploitation are found in the probably rare cases of explicit collusion, such as US baseball before the reserve clause.

Sources of labour monopsony power

The simpler explanation of monopsony power in labour markets is barriers to entry on the demand side. In all such cases, oligopsony would result from oligopoly in the product markets of the industries that use that type of labour as input. If the hypothesis was generally true, one would then find a positive statistical correlation between exploitation, on one side, and industry concentration and firm size on the other. However, numerous statistical studies document significant positive correlations between firm or establishment size and wages. These results, by themselves inconsistent with the oligopoly-oligopsony hypothesis, may be due to the prevalence of other factors, such as efficiency wages.

However, monopsony power might also be due to circumstances affecting entry of workers on the supply side, directly reducing the elasticity of labour supply to firms. Paramount among these are moving costs for workers, which are also a cause of differentiation among potential employees, possibly leading to discrimination (see above). But a similar effect might also be produced by all the institutional factors that limit labour mobility between firms, including job protection legislation. The vetting of employees in the government or the defense sector is another source of monopsonistic competition, as are requirements for professional certification, for example, a medical degree. Finally, as already noticed, a significant reduction in the short-run elasticity of supply may come from information costs and search behaviour.

An alternative that has been suggested as a source of monopsony power is worker preferences over job characteristics (Bhaskar and To, 1999; Bhaskar, Manning and To, 2002). Such job characteristics can include distance from work, type of work, location, the social environment at work, etc. If different workers have different preferences, employers have local monopsony power over workers that strongly prefer working for them.

Finally, monopsony power will occur when the average revenue product of labor increases with the amount of labor employed, due to economies of scale. In this case, the perfectly competitive solution (workers are paid their marginal revenue product) is not stable. In the long run, the firm may set wages equal to the average revenue product of labor, or engage in wage discrimination, paying wages closer to marginal product to markets (or workers) with higher elasticity of supply.

Public administration and product markets

The same or similar empirical difficulties dog attempts to identify significant monopsony in non-labour markets, and specifically in markets for intermediate goods bought as inputs by very large firms. Among the most likely US candidates, one finds in the literature:

- trade in technological knowledge: Rodriguez (1975)

- tomatoes for tomato processing: Just and Chern (1980)

- beef for the beef packing industry: Schroeter (1988)

- western coal for electric utilities: Atkinson and Kerkvliet (1989)

- pulpwood and sawlogs: Murray (1995)

- sophisticated weaponry (i.e. jet fighters, tanks, artillery, etc.)

A related issue is the role of monopsony power from the point of view of anti-trust policy affecting vertical integrations. It has been argued that vertical integration by a monopsony – whereby the production of the previously bought input becomes an in-house operation – may reduce or eliminate the inefficiencies due to monopsonistic restriction of purchases.

In Australia, the Pharmaceutical Industry can be viewed as a kind of monopsony, as the Commonwealth government is the principal buyer of products through the Pharmaceutical Benefits Scheme (PBS).

In the US, journalists, including Harper's and the PBS program Frontline, have made the case that Wal-Mart is a monopsonist, dictating terms to suppliers, whilst at the same time a monopolist dictating terms to consumers — at least in certain market segments.[5][14]

It has been argued that Apple has in some ways become a monopsonist in that it can dictate terms to suppliers of electronic components.[15]

See also

- Bilateral monopoly

- Canadian Wheat Board—a (formerly general, now limited) monopsony in agriculture

- Captive supply

- Market forms

- Minimum wage

- Monopoly

- Oligopsony

- Single-payer health care

- Single desk

References

- ↑ "Implications of DoD Acquisition Policy for Innovation: The Case of Operationally Responsive Space". 2008-09-08. doi:10.2514/6.2008-7650.

- ↑ Kulbacki, James W. (April 1992). "A Look at the Space Industry". Industrial College of the Armed Forces (ADA262201): 32.

The space industry can be characterized as both an Oligopoly and a Monopsony.

- ↑ Private Prisons and Public Money Hidden Costs Borne by Colorado’s Taxpayers (PDF), p. 7,

... the marketplace for private prisons is both a monopsony and an oligopoly. First, there is only one customer—the state—and even though contract prisons are operated by private entities, the funding still comes entirely from the public sector.

- ↑ Kerr, Prue; Harcourt, Geoff (2002). Joan Robinson: Critical Assessments of Leading Economists. Taylor & Francis. pp. 2–3. ISBN 0-415-21743-1

- ↑ 5.0 5.1 "Is Wal-Mart Good For America? - FRONTLINE - PBS". pbs.org.

- ↑ http://www.nytimes.com/2014/10/20/opinion/paul-krugman-amazons-monopsony-is-not-ok.html

- ↑ "Texas' influence on textbooks could wane". statesman.com.

- ↑ "Texas Schools, Publishers Adjust to Power Shift". The Texas Tribune.

- ↑ "Revising The Revisionaries: The Texas Board of Ed Loses Power over Textbooks". Independent Lens Blog.

- ↑ "Quick Rental Power Plants in Bangladesh: An Economic Appraisal by Mustafa K. Mujeri and Tahreen Tahrima Chowdhury, 2013" (PDF). bids.org.bd.

- ↑ http://www.u.arizona.edu/~rlo/696i/Monopsony_Model_Latex.pdf

- ↑ http://dataspace.princeton.edu/jspui/bitstream/88435/dsp01nk322d34x/1/540.pdf

- ↑ "Monopsony, mobility, and sex differences in pay : Missouri school teachers". econbiz.de.

- ↑ http://harpers.org/BreakingTheChain.html

- ↑ Philip Elmer-DeWitt (July 5, 2011). "How Apple became a monopsonist". CNN. Retrieved 2012-02-23.

Further reading

- Atkinson, S.E.; Kerkvliet, J. (1989). "Dual Measures of Monopoly and Monopsony Power: An Application to Regulated Electric Utilities". The Review of Economics and Statistics 71 (2): 250–257. doi:10.2307/1926970. JSTOR 1926970.

- Bhaskar, V.; To, T. (1999). "Minimum Wages for Ronald McDonald Monopsonies: A Theory of Monopsonistic Competition". The Economic Journal 109 (455): 190–203. doi:10.1111/1468-0297.00427.

- Bhaskar, V.; Manning, A.; To, T. (2002). "Oligopsony and Monopsonistic Competition in Labor Markets". Journal of Economic Perspectives 16 (2): 155–174. doi:10.1257/0895330027300.

- Boal, W.M. (1995). "Testing for Employer Monopsony in Turn-of-the-Century Coal Mining". The RAND Journal of Economics 26 (3): 519–36. doi:10.2307/2556001. JSTOR 2556001.

- Boal, W.M.; Ransom, M.R. (1997). "Monopsony in the Labor Market". Journal of Economic Literature 35 (1): 86–112.

- Just, R.E.; Chern, W.S. (1980). "Tomatoes, Technology, and Oligopsony". The Bell Journal of Economics 11 (2): 584–602. doi:10.2307/3003381. JSTOR 3003381.

- Lynn, Barry C (July 2006). "Breaking the Chain: The antitrust case against Wal-Mart". Harper's Magazine.

- Manning, A. (2003). Monopsony in Motion: Imperfect Competition in Labour Markets Princeton: Princeton Univ. Press.

- Murray, B.C. (1995). "Measuring Oligopsony Power with Shadow Prices: U.S. Markets for Pulpwood and Sawlogs". The Review of Economics and Statistics 77 (3): 486–98. doi:10.2307/2109909. JSTOR 2109909.

- Robinson, J. (1933). The Economics of Imperfect Competition London: Macmillan.

- Rodriguez, C.A. (1975). "Trade in Technological Knowledge and the National Advantage". The Journal of Political Economy' 83 (1): 121–36. doi:10.1086/260309.

- Schroeter, J.R. (1988). "Estimating the Degree of Market Power in the Beef Packing Industry". The Review of Economics and Statistics 70 (1): 158–62. doi:10.2307/1928165. JSTOR 1928165.

External links

- "Monopsony in American Labor Markets". EH.NET's Encyclopedia.