Manufacturers Hanover Corporation

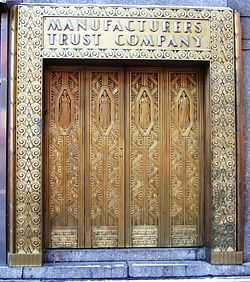

A brass door in the New Yorker Hotel in midtown Manhattan that formerly led to a branch of the Manufacturers Trust Company | ||||||||||||||||

Manufacturers Hanover Corporation, not to be confused with Manufacturers National Corporation, was the bank holding company formed as parent of Manufacturers Hanover Trust Company, a large New York bank formed by a merger in 1961. After 1969, Manufacturers Hanover Trust became a subsidiary of Manufacturers Hanover Corporation. Charles J. Stewart was the company's first president and chairman.[1]

The corporation acquired the former Union Carbide Corporation headquarters at 270 Park Avenue, and though it merged into Chemical Banking Corporation for $1.9 billion in 1991, the successor corporations down to today's J.P. Morgan Chase & Co. have continued to locate their headquarters in that building.

History

Manufacturers Trust Company

Manufacturers Hanover traces its origins to the 1905 founding of Citizens Trust Company of Brooklyn. Through a series of acquisitions, the bank would grow into one of New York's largest banks within its first twenty years. Citizens Trust's first major acquisitions came with its mergers with the Broadway Bank of Brooklyn in 1912 and then two years later with the Manufacturers National Bank of Brooklyn (1914). In 1915, the bank adopted the older "Manufacturers" name, changing its name to the Manufacturers Trust Company. The "Manufacturers" name had been in use since 1858, when the Mechanics' Bank of Williamsburgh (founded 1853) was renamed the Manufacturers National Bank. Coincidentally, Manufacturers Trust Company had also been the name of a Brooklyn-based bank, founded in 1896 and acquired in 1902 by the Title Guarantee and Trust Company, another Brooklyn bank.[2]

Manufacturers Trust acquired a Manhattan presence with its acquisition of the West Side Bank of New York in 1918. Later Manufacturers Trust acquired the Ridgewood National Bank of Queens (1921), the North Side Bank of Brooklyn (1922), the Industrial Bank of New York (1922), the Columbia Bank of New York (1923), and the Yorkville Bank of New York (1925), to become the 29th largest bank in the United States by 1925.[3]

Continued Consolidation (1961–1992)

In 1961, Manufacturers Trust Company merged with Central Hanover Bank & Trust Company (Hanover Trust) creating Manufacturers Hanover Trust Company. The bank became the main source of financing for check cashing stores. The bank reached its commercial heyday in the mid-1970s, when it ran a series of commercials that used the tagline, "It's banking the way you want it to be." Twilight Zone writer Rod Serling and comedian Paul Lynde served as celebrity spokesmen. At the same time, a Manufacturers Hanover billboard advertising "Super Checking" was a prominent feature of the newly renovated Yankee Stadium. Also during that period, Manufacturers Hanover heavily promoted its "Any Car" Loan using an "Any Car", known as the "FordChevAmChrysWagon", made up of parts from 40 different cars.

In 1987, the bank bought some of the branches of Dollar Dry Dock Savings Bank. In 1992, it bought the New York City branches of the failed Goldome. By 1992, it was running out of money due to savings account interest rates and bad loans. By the end of 1992, Chemical Bank had purchased the operations of Manufacturers Hanover Trust Company.

Following the merger with Chemical, in 1996, the new Chemical bought Chase Manhattan Bank and four years later would merge with J.P. Morgan & Co. to form JPMorgan Chase.

Prior to acquisition, the bank was sometimes referred to as "Manny Hanny."[4]

Timeline of mergers and name changes

.jpg)

|

|

See also

- Companies portal

References

Notes

- ↑ "Charles Stewart Dies; An Ex-Bank Executive" (obituary), The New York Times, July 17, 1987. Accessed 20 June 2008.

- ↑ "Trust Concerns Unite". The New York Times. 1 November 1902.

- ↑ "Another merger of New York Banks". The New York Times. 20 February 1925.

- ↑ POSTINGS: Manny Hanny's Move; 5th to Madison

- ↑ Hanover Deal For Deposits Of Goldome. New York Times, November 29, 1990

Bibliography

- The Bank Merger; Big Bank Merger to join Chemical, Manufacturers. New York Times, July 16, 1991

- Merging the Portfolios; New Chemical Bank to Have Big Amount of Real Estate Loans, and Their Troubles. New York Times, July 18, 1991

- Merger Announcement