Major film studio

A major film studio is a production and distribution company that releases a substantial number of films annually and consistently commands a significant share of box office revenue in a given market. In the North American, Western, and global markets, the major film studios, often simply known as the majors, are commonly regarded as the six diversified media conglomerates whose various film production and distribution subsidiaries collectively command approximately 80 to 85 percent of U.S. and Canadian box office revenue.[1][2] The term may also be applied more specifically to the primary motion picture business subsidiary of each respective conglomerate.

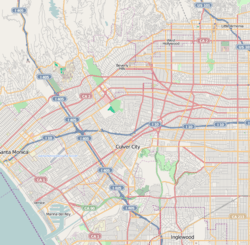

The "Big Six" majors, whose operations are based in or around the Los Angeles neighborhood of Hollywood, are all centered in film studios active during Hollywood's Golden Age of the 1930s and 1940s. In three cases—20th Century Fox, Warner Bros., and Paramount—the studios were one of the "Big Five" majors during that era as well. In two cases—Columbia and Universal—the studios were also considered majors, but in the next tier down, part of the "Little Three". In the sixth case, Walt Disney Studios was an independent production company during the Golden Age; it was an important Hollywood entity, but not a major.

Today, Disney is the only member of the Big Six whose parent entity is still located near Los Angeles (actually, on Disney's studio lot and in the same building).[3][4] The five others report to conglomerates headquartered in New York City, Philadelphia, and Tokyo. Of the Big Six, Paramount is the only one still based in Hollywood, and Paramount and Fox are the only ones still located within the Los Angeles city limits.

Most of today's Big Six control subsidiaries with their own distribution networks that concentrate on arthouse pictures (e.g. Fox Searchlight) or genre films (e.g. Sony's Screen Gems); several of these specialty units were shut down or sold off between 2008 and 2010. The six major studios are contrasted with smaller production and/or distribution companies, which are known as independents or "indies". The leading independent producer/distributors—Lionsgate Films, The Weinstein Company, and former major studio MGM—are sometimes referred to as "mini-majors". From 1998 through 2005, DreamWorks SKG commanded a large enough market share to arguably qualify it as a seventh major, despite its relatively small output. In 2006, DreamWorks was acquired by Viacom, Paramount's corporate parent. In late 2008, DreamWorks once again became an independent production company; its films are distributed by Disney's Touchstone Pictures.

The Big Six major studios are today primarily backers and distributors of films whose actual production is largely handled by independent companies—either long-running entities or ones created for and dedicated to the making of a specific film. The specialty divisions often simply acquire distribution rights to pictures in which the studio has had no prior involvement. While the majors still do a modicum of true production, their activities are focused more in the areas of development, financing, marketing, and merchandising. Those business functions are still usually performed in or near Los Angeles, even though the runaway production phenomenon means that most films are now mostly or completely shot on location at places outside Los Angeles.

Since the dawn of filmmaking, the U.S. major film studios have dominated both American cinema and the global film industry. Today, the Big Six majors routinely distribute hundreds of films every year into all significant international markets (that is, where discretionary income is high enough for consumers to afford to watch films). It is very rare, if not impossible, for a film to reach a broad international audience on multiple continents and in multiple languages without first being picked up by one of the majors for distribution.

Current majors

^1 Warner Bros.: 15.1% (Prev. totals: 2013 - 17.08%; 2012 - 15.3%; 2011-18.1%; 2010—18.0%; 2009—20.1%; 2008—19.4%; 2007—20.5%; 2006—14.9%; 2005—21.7%; 2004—17.7%)

^2 Disney: 15.54% UTV 0.16%; (Prev. totals: 2013 - 15.9%; 2012 - 14.7%; 2011-12.2%; 2010—14.3%; 2009—11.9%; 2008—11.4%; 2007—15.3%; 2006—16.7%; 2005—14.6%; 2004—16.5%)

^3 Universal: 10.79%; Focus Features: 0.97% (Prev. totals: 2013 - 13.9%; 2012-11.3%; 2011-11.3%; 2010—9.2%; 2009—10.0%; 2008—12.9%; 2007—12.7%; 2006—10.9%; 2005—13.2%; 2004—10.8%)

^4 Sony (Columbia/Screen Gems/TriStar): 12.13%; Sony Classics: 0.41% (Prev. totals: 2013 - 11.17% ; 2012 - 17.0%; 2011-13.4%; 2010—12.8%; 2009—14.2%; 2008—13.4%; 2007—13.4%; 2006—19.3%; 2005—11.1%; 2004—16.8%)

^5 20th Century Fox: 17.32%; Fox Searchlight 1.45% (Prev. totals: 2013 - 10.80%; 2012-10.4%; 2011-11.1%; 2010—14.8%; 2009—16.1%; 2008—13.2%; 2007—11.9%; 2006—17.0%; 2005—16.5%; 2004—11.7%)

^6 Paramount: 10.07% (Prev. totals: 2013 - 8.94%; 2012-8.3%; 2011-19.3%; 2010—16.8%; 2009—14.3%; 2008—17.2%; 2007—16.1%; 2006—11.0%; 2005—9.8%; 2004—6.8%)

Mini-majors

Mini-major studios (or "mini-majors") are the larger film production companies that are smaller than the major studios and attempt to compete directly with them.[9]

Current

| Studio parent (Conglomerate) |

Mini-major studio[10] | Date founded | Other divisions and brands | U.S. market share (2014)[5] |

|---|---|---|---|---|

| Lions Gate Entertainment (Lions Gate Entertainment Corporation)[11][12] |

Lionsgate Films[10] | 1997 | Codeblack Films, Pantelion Films, Roadside Attractions, Summit Entertainment | 7.4% |

| The Weinstein Company[13] | 2005 | Dimension Films, Radius-TWC, TWC-Dimension, Dimension-Radius | 2.2% | |

| Relativity Media[14] | 2004 | Rogue | 1.8% | |

| AMC Theatres (Dalian Wanda Group Corporation Limited) Regal Entertainment Group |

Open Road Films[15] | 2011 | 1.6% | |

| CBS Corporation | CBS Films[15] | 2007 | 0.1% | |

| Reliance Entertainment (50%) (Reliance Group) |

DreamWorks Pictures[16] | 1994 | ||

| DreamWorks Animation[10] | 1994 | Big Idea, DreamWorks Classics, Oriental DreamWorks | ||

| Gaumont Film Company[17] | 1895 | Gaumont Animation | ||

| Metro-Goldwyn-Mayer[10][18] (MGM Holdings) |

Metro-Goldwyn-Mayer Pictures[19] | 1924 | MGM Animation, United Artists, Orion Pictures |

Former

Former mini-majors included:

- Allied Artists Pictures, 1967

- Avco Embassy, 1967[20]

- Cannon Films[21]

- Castle Rock Entertainment[22] Purchased in 1993 by Turner Broadcasting System; TBS merged with Time Warner in 1996

- Walt Disney Studios - started distribution arm Buena Vista in 1952 to become a mini-major in 1952. Later became a major studio in the 1980s.[23]

- Miramax Films[9]

- New Line Cinema:[9] Purchased in 1994 by Turner Broadcasting System; TBS in 1996 merged with Time Warner; merged into Warner in 2008 as an in-name-only film distributor.

- October Films:[13] Purchased in 1997 by Universal; purchased in 1999 by Barry Diller and merged with Gramercy Pictures into USA Films; USA in 2001 acquired by Vivendi (then parent company of Universal) and merged with Good Machine and Universal Focus into Focus Features

- Orion Pictures[23] -In 1990, Orion was considered last of the mini-majors[24] Purchased in 1988 by Kluge/Metromedia; purchased in 1997 by MGM

- Overture Films[13] Distribution and marketing assets sold to Relativity Media in 2010.

- PolyGram Filmed Entertainment[9]

- Summit Entertainment[13] Acquired by Lions Gate Entertainment in 2012.

- Tri-Star Pictures:[23] Consolidated in 1987 into Columbia (one of the partners in the joint venture that created it)

- Weintraub Entertainment Group[25]

The studios

Lions Gate Entertainment, which moved in 2006 from Vancouver, British Columbia, to Santa Monica, California, was the most successful North American movie studio based outside of the Los Angeles metropolitan area before its relocation. Now known as Lionsgate, it was founded in 1997 by financier Frank Giustra.[26] (The company is unrelated to Lion's Gate Films, the Los Angeles–based production company run by filmmaker Robert Altman in the 1970s.)[27] In 2003, the company doubled in size with the acquisition of Artisan Entertainment.[28] In January 2012, Lionsgate acquired Summit Entertainment, which was the highest-grossing mini-major the previous three years.[29] Summit was founded as an independent overseas sales company in 1991, moved into production in the mid-1990s, and was reconstituted as a full-fledged studio in 2006.[30] Lionsgate also owns a minority stake in the independent distribution company Roadside Attractions.[31]

Lionsgate status

Lionsgate is apparently on the cusp of becoming a major studio with the parent's purchase of Summit Entertainment as well as its controlling share of Roadside Attractions (43%)[32] and Pantelion Films (as specialty units), and its top five box office showing as being declared as a new major studio by Variety,;[31] however, The Hollywood Reporter does not yet recognize the company as a major studio just yet.[33]

The Weinstein Company was founded in late 2005 by brothers Harvey and Bob Weinstein after their departure from Miramax Films, which they had founded in 1979. In 1993, they sold control of Miramax to the Walt Disney Company, continuing to run the studio in quasi-independent fashion under the Disney umbrella. When the Weinsteins left Disney, they retained the right to the Dimension Films brand, which is used by The Weinstein Company (as it was by Miramax) for genre films. After the success of 1408, released in June 2007, the studio went two years without a hit.[34] It experienced several high-level executive defections in 2008, and announced major layoffs that November.[35] The Weinsteins have a long-standing relationship with Quentin Tarantino—all of the feature films he has directed through 2009 have been distributed either by Miramax, when it was led by the brothers, or The Weinstein Company. The successful release of his Inglourious Basterds in August 2009 was seen as a "turnaround" for the studio.[36]

MGM, after decades as a major studio, continues to distribute motion pictures and television content as a minor, privately held media company. In April 2005, it was purchased from Kirk Kerkorian's Tracinda Corporation by a consortium including Sony, cable company Comcast, Providence Equity Partners, and three other private investment firms. MGM has a deal with 20th Century Fox for the distribution of home video and overseas theatrical product.[37] MGM is also once again the sole owner of United Artists, after Tom Cruise and Paula Wagner sold back their minority stakes. Via its original 1981 merger with UA, MGM controls the rights to the James Bond franchise. Columbia co-distributed the first two Bond films starring Daniel Craig after the 2005 purchase.[38] After a third Bond film with Craig was put on hold when MGM slipped into deep financial trouble, Sony reached an agreement with MGM in April 2011 to distribute the next entry in the series.[39]

DreamWorks was founded in 1994 by Steven Spielberg, Jeffrey Katzenberg, and David Geffen. Once again independent with the founding of a new company after two-and-a-half years under the Viacom/Paramount corporate umbrella, it is now backed by India's Reliance ADA Group.[40] DreamWorks will not be a full-service studio—it will produce and finance films, but as it did for most of its first era as an independent, it will arrange distribution through the majors. In February 2009, after dropping out of a deal with Universal, DreamWorks struck such a deal with Disney, though Paramount will be releasing the DreamWorks pictures developed there through mid-2011.[41] The first independent DreamWorks film to be released under the new deal, via Touchstone, was I Am Number Four in February 2011. Katzenberg, who is completely divested from the new DreamWorks, now runs DreamWorks Animation as a totally separate business. The company maintains distribution deals with DreamWorks Pictures, Paramount Pictures and 20th Century Fox.[42]

The standings

In 2010, Summit led with $519.9 million in grosses and a 5.0% market share. Lionsgate was close behind with $513.9 million in grosses, good for a 4.9% share. They were far ahead of the other mini-majors, none of which reached $100 million in grosses or a 1% share.[43] In 2009, Summit's mini-major-leading figures were $480.4 million in grosses and a 4.5% market share. Lionsgate's $401.5 million in grosses gave it a 3.8% share. Two other companies commanded market shares greater than 1%: Weinstein/Dimension (2.0%) and Overture Films (1.5%).[44] In 2008, Lionsgate topped the mini-majors with $441.5 million in grosses, a 4.5% market share. Three other companies had over $100 million in box office grosses: Summit (2.4% market share), MGM/UA (1.7% market share), and Overture (1.1% market share).[45]

In 2007, Lionsgate and MGM/UA were virtually tied for the position of most successful mini-major in terms of market share, each with 3.8%. No other independent studio had even a 1% market share.[46] In 2006, Lionsgate had a 3.6% market share, The Weinstein Company had a 2.5% market share, and MGM/UA had a 1.8% market share.[47] In 2005, the still independent DreamWorks SKG had 5.7% and Lionsgate had 3.2%. Of MGM/UA's four significant money-earners during 2005, it released three before its acquisition by the Sony-led consortium; MGM/UA's total market share for the year was 2.1%. The Weinstein Company, in its first three months of operation, gained 0.5% of the year's total market share.[48] In 2004, DreamWorks SKG had 10.0% (more than the Paramount Motion Pictures Group), Newmarket had 4.3% (due almost entirely to The Passion of the Christ), Lionsgate had 3.2%, and MGM/UA had 2.1%.[49]

Instant major studios

In 1967, three "instant majors" studios popped up, two of which were partnered with a Television network theatrical film unit with most lasting until 1973:

- Cinerama Releasing Corporation (distributor for ABC Pictures Corporation)

- National General Corporation (distributor for Cinema Center Films)

- Commonwealth United Corporation[20]

Other significant, formerly independent entities

- Artisan Entertainment: Purchased in 2003 by Lionsgate Entertainment

- The Samuel Goldwyn Company: Purchased in 1996 by John Kluge/Metromedia International; purchased in 1997 by MGM

- Pixar: Purchased in 1986 by Steve Jobs; purchased in 2006 by the Walt Disney Company

- Turner Pictures: Purchased along with Turner Broadcasting System, Hanna-Barbera, Castle Rock Entertainment, New Line Cinema and Turner Entertainment in 1996 by Time Warner

History

The majors before the Golden Age

In 1909, Thomas Edison, who had been fighting in the courts for years for control of fundamental motion picture patents, won a major decision. This led to the creation of the Motion Picture Patents Company, widely known as the Trust. Comprising the nine largest U.S. film companies, it was "designed to eliminate not only independent film producers but also the country's 10,000 independent [distribution] exchanges and exhibitors."[50] Though its many members did not consolidate their filmmaking operations, the New York–based Trust was arguably the first major North American movie conglomerate. The independents' fight against the Trust was led by Carl Laemmle, whose Chicago-based Laemmle Film Service, serving the Midwest and Canada, was the largest distribution exchange in North America. Laemmle's efforts were rewarded in 1912 when the U.S. government ruled that the Trust was a "corrupt and unlawful association" and must be dissolved. On June 8, 1912, Laemmle organized the merger of his production division, IMP (Independent Motion Picture Company), with several other filmmaking companies, creating the studio that would soon be named Universal. By the end of the year, Universal was making movies at two Los Angeles facilities: the former Nestor Film studio in Hollywood, and another studio in Edendale. The first Hollywood major was in business.[51]

In 1916, a second powerful Hollywood studio was established when Adolph Zukor merged his Famous Players Film Company movie production house with the Jesse L. Lasky Company to form Famous Players–Lasky. The combined studio acquired Paramount Pictures as a distribution arm and eventually adopted its name. Paramount quickly surpassed Universal as Hollywood's dominant company. In 1916 as well, William Fox relocated his Fox Film Corporation from the East Coast to Hollywood and began expanding.[52] The Motion Picture Theatre Owners of America and the Independent Producers' Association declared war in 1925 on what they termed a common enemy — the "film trust" of Metro-Goldwyn-Mayer, Paramount, and First National, which they claimed dominated the industry by not only producing and distributing motion pictures, but by entering into exhibition as well.[53]

Propelled by the great success of The Jazz Singer (1927), the first important feature-length "talkie", small Warner Bros. (founded in 1919) quickly entered the big leagues and acquired First National in 1928.[54] Fox, in the forefront of sound film along with Warners, was also acquiring a sizable circuit of movie theaters to exhibit its product.

The majors during the Golden Age

Between late 1928, when RCA's David Sarnoff engineered the creation of the RKO (Radio-Keith-Orpheum) studio, and the end of 1949, when Paramount divested its theater chain—roughly the period considered Hollywood's Golden Age—there were eight Hollywood studios commonly regarded as the "majors".[55] Of these eight, the so-called Big Five were integrated conglomerates, combining ownership of a production studio, distribution division, and substantial theater chain, and contracting with performers and filmmaking personnel: Loew's/MGM, Paramount, Fox (which became 20th Century-Fox after a 1935 merger), Warner Bros., and RKO. The remaining majors were sometimes referred to as the "Little Three" or “major minor” studios.[23] Two - Universal and Columbia (founded in 1924)—were organized similarly to the Big Five, except for the fact that they never owned more than small theater circuits (a consistently reliable source of profits). The third of the lesser majors, United Artists (founded in 1919), owned a few theaters and had access to production facilities owned by its principals, but it functioned primarily as a backer-distributor, loaning money to independent producers and releasing their films. During the 1930s, the eight majors averaged a total of 358 feature film releases a year; in the 1940s, the four largest companies shifted more of their resources toward high-budget productions and away from B movies, bringing the yearly average down to 288 for the decade.[55]

Among the significant characteristics of the Golden Age was the stability of the Hollywood majors, their hierarchy, and their near-complete domination of the box office. At the midpoint of the Golden Age, 1939, the Big Five had market shares ranging from 22% (MGM) to 9% (RKO); each of the Little Three had around a 7% share. In sum, the eight majors controlled 95% of the market and all the smaller companies combined had a total of 5%. Ten years later, the picture was largely the same: the Big Five had market shares ranging from 22% (MGM) to 9% (RKO); the Little Three had shares ranging from 8% (Columbia) to 4% (United Artists). In sum, the eight majors controlled 96% of the market and all the smaller companies combined had a total of 4%.[56]

The majors after the Golden Age

1950s–1960s

The end of the Golden Age had been signaled by the majors' loss of a federal antitrust case that led to the divestiture of the Big Five's theater chains. Though this had virtually no immediate effect on the eight majors' box-office domination, it somewhat leveled the playing field between the Big Five and the Little Three. In November 1951, Decca Records purchased 28% of Universal; early the following year, the studio became the first of the classic Hollywood majors to be taken over by an outside corporation, as Decca acquired majority ownership.[57] The 1950s saw two substantial shifts in the hierarchy of the majors: RKO, perennially the weakest of the Big Five, declined rapidly under the mismanagement of Howard Hughes, who had purchased a controlling interest in the studio in 1948. By the time Hughes sold it to the General Tire and Rubber Company in 1955, the studio was a major by outdated reputation alone. In 1957, virtually all RKO movie operations ceased and the studio was dissolved in 1959. (Revived on a small scale in 1981, it was eventually spun off and now operates as a minor independent company.) In contrast, there was United Artists, which had long operated under the financing-distribution model the other majors were now progressively shifting toward. Under Arthur Krim and Robert Benjamin, who began managing the company in 1951, UA became consistently profitable. By 1956—when it released one of the biggest blockbusters of the decade, Around the World in 80 Days—it commanded a 10% market share. By the middle of the next decade, it had reached 16% and was the second-most profitable studio in Hollywood. Despite RKO's collapse, the majors still averaged a total yearly release slate of 253 feature films during the decade.[55]

The 1960s were marked by a spate of corporate takeovers. MCA, under Lew Wasserman, acquired Universal in 1962; Gulf+Western took over Paramount in 1966; and the Transamerica Corporation purchased United Artists in 1967. Warner Bros. underwent large-scale reorganization twice in two years: a 1967 merger with the Seven Arts company preceded a 1969 purchase by Kinney National, under Stephen J. Ross. MGM, in the process of a slow decline, changed ownership twice in the same span as well, winding up in the hands of financier Kirk Kerkorian. The majors almost entirely abandoned low-budget production during this era, bringing the annual average of features released down to 160.[55] The decade also saw an old name in the industry secure a position as a leading player. In 1923, Walt Disney had founded the Disney Brothers Cartoon Studio with his brother Roy and animator Ub Iwerks. Over the following three decades Disney became a powerful independent focusing on animation and, from the late 1940s, an increasing number of live-action movies. In 1954, the company—now Walt Disney Productions—established Buena Vista Film Distribution to handle its own product, which had been distributed for years by various majors, primarily United Artists and then RKO. (Disney's 1937 Snow White and the Seven Dwarfs, released by RKO, was the second biggest hit of the 1930s.) In its first year, Buena Vista had a major success with 20,000 Leagues Under the Sea, the third biggest movie of 1954. In 1964, Buena Vista had its first blockbuster, Mary Poppins, Hollywood's biggest hit in half a decade. The company achieved a 9% market share that year, more than Fox and Warner Bros. Though over the next two decades, Disney/Buena Vista's share of the box-office would again hit similar marks, its relatively small output and exclusive focus on family movies meant that it was not generally considered a major.

1970s–1980s

The early 1970s were difficult years for all the majors. Movie attendance, which had been declining steadily since the Golden Age, hit an all-time low in 1971. In 1973, MGM president James T. Aubrey Jr. drastically downsized the studio, slashing its production schedule and eliminating its distribution arm (UA would distribute the studio's films for the remainder of the decade). From fifteen releases in 1973, the next year MGM was down to five; its average for the rest of the 1970s would be even lower.[58] Like RKO in its last days under Hughes, MGM remained a major in terms of brand reputation, but little more. MGM, however, was not the only studio to trim its release line. By the mid-1970s, the industry had rebounded and a significant philosophical shift was in progress. As the majors focused increasingly on the development of the next hoped-for blockbuster and began routinely opening each new movie in many hundreds of theaters (an approach called "saturation booking"), their collective yearly release average fell to 81 films during 1975–84.[55] The classic set of majors was shaken further in late 1980, when the disastrously expensive flop of Heaven's Gate effectively ruined United Artists. The studio was sold the following year to Kerkorian, who merged it with MGM. After a brief resurgence, the combined studio again declined. From the mid-1980s on, MGM/UA has been at best a "mini-major", to use the present-day term.

Meanwhile, a new member was finally admitted to the club of major studios and two significant contenders emerged. With the establishment of its Touchstone Pictures brand and increasing attention to the adult market in the mid-1980s, Disney/Buena Vista secured acknowledgment as a full-fledged major.[23] Film historian Joel Finler identifies 1986 as the breakthrough year, when Disney rose to third place in market share and remained consistently competitive for a leading position thereafter.[59] The two contenders were both newly formed companies. In 1978, Krim, Benjamin, and three other studio executives departed UA to found Orion Pictures as a joint venture with Warner Bros. It was announced optimistically as the "first major new film company in 50 years".[60] Tri-Star Pictures was created in 1982 as a joint venture of Columbia Pictures (then owned by the Coca-Cola Company), HBO (then owned by Time Inc.), and CBS. In 1985, Rupert Murdoch's News Corporation acquired 20th Century-Fox, the last of the five relatively healthy Golden Age majors to remain independent throughout the entire Golden Age and after.

In 1986, the combined share of the six classic majors—at that point Paramount, Warner Bros., Columbia, Universal, Fox, and MGM/UA—fell to 64%, the lowest since the beginning of the Golden Age. Disney was in third place, behind only Paramount and Warners. Even including it as a seventh major and adding its 10% share, the majors' control of the North American market was at a historic ebb. Orion, now completely independent of Warner Bros., and Tri-Star were well positioned as mini-majors, each with North American market shares of around 6% and regarded by industry observers as "fully competitive with the majors".[61] Smaller independents garnered 13%—more than any studio aside from Paramount. In 1964, by comparison, all of the companies beside the then seven majors and Disney had combined for a grand total of 1%. In the first edition of Finler's The Hollywood Story (1988), he wrote, "It will be interesting to see whether the old-established studios will be able to bounce back in the future, as they have done so many times before, or whether the newest developments really do reflect a fundamental change in the US movie industry for the first times since the 20s."[62]

1990s–present

With the exception of MGM/UA—whose position was effectively filled by Disney—the old-established studios did bounce back. The purchase of Fox by Murdoch's News Corp. presaged a new round of corporate acquisitions. Between 1989 and 1994, Paramount, Warners, Columbia, and Universal all changed ownership in a series of conglomerate purchases and mergers that brought them new financial and marketing muscle. Paramount's parent company Gulf+Western was renamed Paramount Communications in 1989 and was merged with Viacom five years later. Warners merged with Time Inc. to give birth to the conglomerate Time Warner. Coke sold Columbia to Japanese electronics firm Sony also in 1989. And Universal's parent MCA was purchased by Matsushita. By the early 1990s, both Tri-Star and Orion were essentially out of business: the former consolidated into Columbia, the latter bankrupt and sold to MGM. The most important contenders to emerge during the 1990s, New Line, the Weinsteins' Miramax, and DreamWorks SKG, were likewise sooner or later brought into the majors' fold, though DreamWorks and the Weinstein brothers are now independent again.

The development of in-house pseudo-indie subsidiaries by the conglomerates—sparked by the 1992 establishment of Sony Pictures Classics and the success of Pulp Fiction (1994), Miramax's first project under Disney ownership—significantly undermined the position of the true independents. The majors' release schedule rebounded: the six primary studio subsidiaries alone put out a total of 124 films during 2006; the three largest secondary subsidiaries (New Line, Fox Searchlight, and Focus Features) accounted for another 30. Box-office domination was fully restored: in 2006, the six major movie conglomerates combined for 89.8% of the North American market; Lionsgate and Weinstein were almost exactly half as successful as their 1986 mini-major counterparts, sharing 6.1%; MGM came in at 1.8%; and all of the remaining independent companies split a pool totaling 2.3%.[63]

Only one of the major studios changed corporate hands during the first decade of the 2000s, though it did so three times: Universal was acquired by Vivendi in 2000, then by General Electric four years later, and finally by Comcast in 2011. More developments took place among the majors' subsidiaries. The very successful animation production house Pixar, whose films were distributed by Buena Vista, was acquired by Disney in 2006. In 2008, New Line Cinema lost its independent status within Time Warner and became a subsidiary of Warner Bros. Time Warner also announced that it would be shutting down its two specialty units, Warner Independent and Picturehouse.[64] In 2008 as well, Paramount Vantage's production, marketing, and distribution departments were folded into the parent studio,[65] though it retained the brand for release purposes.[66][67] Universal sold off its genre specialty division, Rogue Pictures, to Relativity Media in 2009.[68] Disney closed down Miramax's operations in January 2010,[69] and sold off the unit and its library that July to an investor group led by Ronald N. Tutor of the Tutor Perini construction firm and Tom Barrack of the Colony Capital private equity firm.[70]

Organizational lineage

The eight Golden Age majors

The eight major film studios of the Golden Age have gone through the following significant ownership changes ("independent" meaning customarily identified as the primary commercial entity in its corporate structure; "purchased" meaning acquired anything from majority to total ownership):

Columbia Pictures

- independent as CBC Film Sales, 1918–1924 (founded by Harry Cohn, Joe Brandt, and Jack Cohn)

- independent, 1924–1982 (company changes name as Columbia Pictures Corporation; goes public in 1926; changes name in 1968 to Columbia Pictures Industries after merging with TV subsidiary Screen Gems)

- Coca-Cola, 1982–1987 (purchased by Coca-Cola; Tri-Star Pictures, a joint venture with HBO and CBS initiated in 1982—CBS drops out in 1985 and HBO in 1986)

- independent as Columbia Pictures Entertainment (or Columbia/Tri-Star), 1987–1989 (divested by Coca-Cola; Coke's entertainment business sold to Tri-Star and takes 49% in CPE)

- Sony, 1989–present (purchased by Sony)

20th Century Fox

- Independent, 1935–1985 (founded by Joseph Schenck and Darryl F. Zanuck; fully purchased by Marc Rich and Marvin Davis in 1981; Rich's interest purchased by Davis in 1984; half of Davis's interest purchased by Rupert Murdoch's News Corporation in March 1985)

- News Corporation, 1985–2013 (purchases the remainder of Davis's shares in September)

- 21st Century Fox, 2013–present (renamed conglomerate on June 28, 2013)

Warner Bros.

- Independent, 1923–1929 (founded by Jack Warner, Harry Warner, Albert Warner, and Sam Warner; Sam Warner dies in 1927)

- Independent as Warner Bros.–First National, 1929–1967 (acquires First National Pictures; syndicate led by Jack Warner, Serge Semenenko of First National Bank of Boston, and Charles Allen Jr. purchases controlling interest in 1956)

- Warner Bros.–Seven Arts, 1967–1969 (purchased by and merged with Seven Arts Productions)

- Kinney National Company, 1969–1972 (Kinney purchases Warner Bros.–Seven Arts)

- Warner Communications, 1972–1989 (Kinney spins off non-entertainment assets and changes name)

- Time Warner, 1989–present (Warner merges with Time Inc.; from 2000 to 2003, the parent company was known as AOL Time Warner, following merger with AOL)

Paramount Pictures

- Independent as Famous Players–Lasky, 1916–1921 (founded by Adolph Zukor and Jesse L. Lasky)

- Independent, 1922–1966 (company adopts distribution division's name)

- Gulf+Western Industries, 1966–1989 (purchased by Gulf+Western)

- Paramount Communications, 1989–1994 (Gulf+Western changes name after selling non-entertainment assets)

- Viacom, 1994–2005 (Viacom purchases Paramount)

- Viacom, 2006–present (Viacom splits into two companies: "new" Viacom—with Paramount Pictures, MTV, BET, and other cable channels—and CBS Corporation—which includes CBS Television Studios; both companies are controlled by National Amusements)

Universal Pictures

- Independent, 1912–1946 (founded by Carl Laemmle, Pat Powers, Adam Kessel, Charles Baumann, Mark Dintenfass, William Swanson, David Horsley, and Jules Brulatour)

- independent as Universal-International, 1946–1952 (merges with International Pictures)

- Decca, 1952–1962 (purchased by Decca)

- MCA Inc., 1962–1990 (MCA purchases Decca)

- Matsushita Electric, 1990–1995 (Matsushita purchases MCA)

- Seagram, 1995–2000 (purchased by Seagram from Matsushita)

- Vivendi, 2000–2004 (Vivendi purchases Seagram)

- General Electric/Vivendi, 2004–2011 (jointly owned by GE (80%) and Vivendi, S.A. (20%) and merged with NBC to form NBC Universal)

- Comcast/General Electric, 2011–2013 (Comcast purchases 51% of redubbed NBCUniversal)

- Comcast, 2013–present (Comcast bought the remaining 49% from GE)

Metro-Goldwyn-Mayer

- Loew's Incorporated, 1924–1959 (founded by Marcus Loew; controlling interest in Loew's purchased by William Fox in 1929; Fox forced to sell off interest in 1930; operational control ceded by Loew's to studio management in 1954)

- independent, 1959–1981 (fully divested by Loew's; purchased by Edgar Bronfman Sr. in 1967; purchased by Kirk Kerkorian in 1969)

- independent as MGM/UA, 1981–1990 (United Artists purchased by Kerkorian and merged into MGM; purchased by Ted Turner in 1986; repurchased by Kerkorian seventy-four days later; purchased by Giancarlo Parretti in 1990)

- Crédit Lyonnais, 1992–1997 (foreclosed upon by bank after Parretti defaulted)

- Tracinda Corporation, 1997–2005 (repurchased by Kerkorian)

- MGM Holdings, 2005-present

- Sony/Comcast/4 private equity firms, 2005–2010 (purchased by Sony, Comcast, and private investment firms—Providence Equity Partners, in fact, currently owns the greatest number of shares—and privately held as a minor media company independent of Sony/Columbia)

- Credit Suisse, JPMorgan Chase, other former bondholders (2011–present) including Carl Icahn (2011-2012)

United Artists (merged into MGM)

- independent, 1919–1967 (founded by Charles Chaplin, Douglas Fairbanks, D. W. Griffith, and Mary Pickford; operational control by Arthur Krim and Robert Benjamin from 1951; fully purchased by Krim and Benjamin in 1956)

- Transamerica, 1967–1981 (purchased by Transamerica)

- MGM/UA, 1981–1992 (purchased by Kirk Kerkorian from Transamerica and merged into MGM; see above for further detail)

RKO Radio Pictures (defunct 1960–80, dormant 1993–97)

- RCA, 1928–1935 (founded by David Sarnoff)

- independent, 1935–1955 (half of RCA's interest purchased by Floyd Odlum, control split between RCA, Odlum, and Rockefeller brothers; controlling interest purchased by Odlum in 1942; controlling interest purchased by Howard Hughes in 1948; Hughes interest purchased by Stolkin-Koolish-Ryan-Burke-Corwin syndicate in 1952; interest repurchased by Hughes in 1953; fully purchased by Hughes in 1954)

- General Tire and Rubber, 1955–1984 (purchased by General Tire and Rubber—coupled with General Tire's broadcasting operation as RKO Teleradio Pictures; production and distribution halted in 1957; movie business dissolved in 1959 and RKO Teleradio renamed RKO General; RKO General establishes RKO Pictures as production subsidiary in 1981)

- GenCorp, 1984–1987 (reorganization creates holding company with RKO General and General Tire as primary subsidiaries)

- Wesray Capital Corporation, 1987–1989 (spun off from RKO General, purchased by Wesray—controlled by William E. Simon and Ray Chambers—and merged with amusement park operations to form RKO/Six Flags Entertainment)

- independent, 1989–present (split off from Six Flags, purchased by Dina Merrill and Ted Hartley, and merged with Pavilion Communications; no films produced or distributed from 1993 through 1997)

See also

- Big Three—the three major music corporations: Universal Music Group, Sony Music Entertainment and Warner Music Group; formerly the Big Six, but Universal acquired PolyGram in 1998 and merged with EMI in 2012,[71] and Sony and BMG merged in 2004.

- Seven sisters—phrase describing the seven major studios during the 1980s.

- Media conglomerate

Notes

- ↑ Epstein, Edward Jay (2006). The Big Picture: Money And Power in Hollywood. New York: Random House. pp. 14–19, 82, 109, 133. ISBN 9780812973822.

- ↑ Bettig, Ronald V.; Jeanne Lynn Hall (2012). Big Media, Big Money: Cultural Texts and Political Economics (2nd ed.). Lanham, MD: Rowman & Littlefield. pp. 59–108. ISBN 9781442204294.

- ↑ Barnes, Brooks (9 November 2014). "Disney Film Boss Ousted by Warner Finds Vindication in Success". New York Times (The New York Times Company). Retrieved 9 November 2014.

- ↑ Barnes, Brooks (26 March 2011). "In Hollywood, a Decade of Hits Is No Longer Enough". New York Times (The New York Times Company). Retrieved 10 November 2014.

- ↑ 5.0 5.1 "Market Share for Each Distributor in 2014". The-Numbers.com. Nash Information Services, LLC. Retrieved January 16, 2015. "Leading Domestic Distributors in 2013". The Numbers/Nash Information Services. 2014. Retrieved 2014-02-03. For previous years' data in section notes, see "Leading Domestic Distributors in 2012". The Numbers/Nash Information Services. 2013. Retrieved 2013-02-03. "Market Share for Each Distributor in 2011". The Numbers/Nash Information Services. 2012. Retrieved 2012-02-03. "Market Share for Each Distributor in 2010". The Numbers/Nash Information Services. 2011. Retrieved 2011-01-26. "Market Share for Each Distributor in 2009". The Numbers/Nash Information Services. 2010. Retrieved 2010-01-19. "Market Share for Each Distributor in 2008". The Numbers/Nash Information Services. 2009. Retrieved 2010-01-19. Studio Market Share (2007), Studio Market Share (2006), Studio Market Share (2005), and Studio Market Share (2004). Retrieved March 3, 2009.

- ↑ Divisions. Sony Pictures Entertainment: SonyPictures.com. Accessed on November 7, 2013.

- ↑ Fleming, Mike Jr. "Tom Rothman To Launch New TriStar Productions Label For Sony" Deadline Hollywood (August 1, 2013).

- ↑ About. Sony Pictures Worldwide Acquisitions.com. Accessed on November 7, 2013.

- ↑ 9.0 9.1 9.2 9.3 "mini-major". Variety - Slanguage Dictionary. Reed Elsevier Inc. Retrieved 2 July 2012.

- ↑ 10.0 10.1 10.2 10.3 "Movie Studios A-Z". filmbug.com. Misja.com. Retrieved 2 July 2012.

- ↑ "Company Overview of Lions Gate Entertainment, Inc.". Bloomberg Businessweek. Bloomberg. Retrieved 24 September 2013.

Lions Gate Entertainment, Inc. operates as a subsidiary of Lions Gate Entertainment Corp.

- ↑ "LIONS GATE ENTERTAINMENT COR (LGF:New York)". Bloomberg Businessweek. Bloomberg. Retrieved 28 January 2014.

- ↑ 13.0 13.1 13.2 13.3 "Distributor report cards: Mini-majors, specialty divisions and indies". Film Journal International. September 1, 2009. Retrieved 2 July 2012.

- ↑ Siegel, Tatiana (December 9, 2010). "Triple play elevates Relativity Media". Variety. Retrieved July 28, 2012.

- ↑ 15.0 15.1 Manis, Aimee (March 20, 2013). "Beyond the Big 6: Mini Majors Gain Momentum". Studio System News. Retrieved March 20, 2013.

- ↑ Goldsmith, Jill (September 23, 2009). "Stacey Snider gives new life to DreamWorks". Variety. Retrieved July 30, 2012.

- ↑ Keslassy, Elsa (August 5, 2013). "Gaumont Intl. Television Staff Up L.A. Headquarter". Variety. Retrieved August 5, 2013.

Gaumont International Television, the French mini-major’s L.A.-based production and distribution studio, is staffing up its Los Angeles office with the appointment of three new execs.

- ↑ "Company Overview of Metro-Goldwyn-Mayer, Inc.". Bloomberg Businessweek. Businessweek.com. Retrieved 29 January 2014.

Metro-Goldwyn-Mayer, Inc. operates as a subsidiary of Spyglass Entertainment Group LLC

- ↑ "Company Overview of Metro-Goldwyn-Mayer Pictures Inc.". Bloomberg Businessweek. Businessweek.com. Retrieved 29 January 2014.

Metro-Goldwyn-Mayer Pictures, Inc. operates as a subsidiary of Metro-Goldwyn-Mayer, Inc.

- ↑ 20.0 20.1 Cook, David A. (2000). Page 10. Lost Illusions: American Cinema in the Shadow of Watergate and Vietnam, 1970-1979. University of California Press.

- ↑ Delugach, Al (August 24, 1986). "Cannon Bid as Major Studio Is Cliffhanger : Firm's Future at Risk in High-Stakes Gamble". Los Angeles Times. Retrieved 2 July 2012.

- ↑ "Film & TV Finance 101". Guidance. Experience, Inc. Retrieved 2 July 2012.

- ↑ 23.0 23.1 23.2 23.3 23.4 Schatz, Tom. "The Studio System and Conglomerate Hollywood". The Studio System (PDF). Blackwell Publishing.

Disney also exploited new technologies and delivery systems, creating synergies that were altogether unique among the studios, and that finally enabled the perpetual “mini-major” to ascend to major studio status.

- ↑ Easton, Nina J. (1990-07-19). "Whither Orion? : The Last of the Mini-Major Studios Finds Itself at a Crossroads". The Los Angeles Times. Retrieved 2010-12-28.

- ↑ Cieply, Michael (January 11, 1989). "Weintraub's Worries : Box-Office Flops Add to Woes of Flashy 'Mini-Major'". Los Angeles Times. Retrieved 2 July 2012.

- ↑ "Lions Gate Entertainment Corporation". Funding Universe. Retrieved 2010-05-12.

- ↑ Cook (2000), p. 97.

- ↑ "Lions Gate Entertainment Corp /CN/ 8-K 20090917 Exhibit 99". Edgar Online. September 17, 2009. Retrieved 2010-05-12.

- ↑ "It's Official: Lionsgate Has Acquired Summit Entertainment for $412.5 Million". ComingSoon.net. 2012-01-13. Retrieved 2012-02-03.

- ↑ Barnes, Brooks (2008-11-19). "For Studio, Vampire Movie Is a Cinderella Story". New York Times. Retrieved 2008-12-19.

- ↑ 31.0 31.1 Josh L. Dickey "Variety" 800 million reasons Lionsgate is mini no more variety.com, Retrieved on February 7, 2013

- ↑ JAY A. FERNANDEZ "Indiewire" SEPTEMBER 13, 2012 Toronto 2012: Just What's Going on With Lionsgate and Roadside Attractions? Here Are Some Answers. indiewire.com, Retrieved on February 12, 2013

- ↑ Vlessing, Etan (January 2, 2013). ".Lionsgate Stock Hits All-Time High on Film and TV Slate Prospects". Hollywood Reporter. Retrieved 11 February 2013.

- ↑ Teodorczuk, Tom (2008-07-25). "Weinsteins' Hollywood Star Begins to Fade". Telegraph. Retrieved 2008-12-19. Segal, David (2009-08-16). "Weinsteins Struggle to Regain Their Touch". New York Times. Retrieved 2009-08-16.

- ↑ Goldstein, Gregg (2008-11-21). "Weinstein Co. Lets Go of 24". Hollywood Reporter. Retrieved 2008-12-19.

- ↑ Barnes, Brooks (2009-08-23). "Brad Pitt Pulls Them In at the Box Office". New York Times. Retrieved 2009-08-25.

- ↑ Halbfinger, David M. (2008-06-08). "MGM: A Lion or a Lamb?". New York Times. Retrieved 2008-09-29.

- ↑ Barnes, Brooks, and Michael Cieply (2008-11-16). "A Studio, a Star, a Fateful Bet". New York Times. Retrieved 2008-12-19.

- ↑ Child, Ben (2011-04-14). "Sony Joins James Bond Rescue". Guardian. Retrieved 2011-06-06.

- ↑ Thompson, Anne, and Tatiana Siegel (2008-09-19). "DreamWorks, Reliance Close Deal". Variety. Retrieved 2008-12-23.

- ↑ Graser, Marc, and Tatiana Siegel (2009-02-09). "Disney Signs Deal with DreamWorks". Variety. Retrieved 2009-02-14.

- ↑ Fritz, Ben (2008-09-26). "DreamWorks Toons Stay Put". Variety. Retrieved 2008-12-23.

- ↑ "Market Share for Each Distributor in 2010". The Numbers/Nash Information Services. 2011. Retrieved 2011-01-26.

- ↑ "Market Share for Each Distributor in 2009". The Numbers/Nash Information Services. 2010. Retrieved 2010-01-19.

- ↑ "Market Share for Each Distributor in 2008". The Numbers/Nash Information Services. 2009. Retrieved 2010-01-19.

- ↑ Studio Market Share (2007) part of BoxOfficeMojo.com. Retrieved August 9, 2009 (with Premier Pass allowing access to data of all distributors, rather than universally accessible top 12).

- ↑ Studio Market Share (2006) part of BoxOfficeMojo.com. Retrieved May 14, 2007 (with Premier Pass allowing access to data of all distributors, rather than universally accessible top 12).

- ↑ Studio Market Share (2005) part of BoxOfficeMojo.com. Retrieved May 14, 2007 (with Premier Pass allowing access to data of all distributors, rather than universally accessible top 12).

- ↑ Studio Market Share (2004) part of BoxOfficeMojo.com. Retrieved May 14, 2007 (with Premier Pass allowing access to data of all distributors, rather than universally accessible top 12).

- ↑ Hirschhorn (1983), p. 9.

- ↑ Hirschhorn (1983), p. 11.

- ↑ Thomas and Solomon (1985), p. 12

- ↑ "Theatre Owners Open War on Hays", The New York Times, May 12, 1925, p. 14.

- ↑ Warner Bros. held 42,000 shares of common stock out of 72,000 outstanding shares, while Fox Pictures held 21,000 shares, and 12,000 shares were publicly held. "Warner Buys First National", The Wall Street Journal, September 27, 1928, p. 3. Fox sold its shares of First National to Warner Bros. in November 1929. "Fox Holdings in First National Pictures Sold", The Washington Post, November 4, 1929, p. 3. 8.^ "Film Concern Dissolves", The New York Times, July 12, 1936, p. F1.

- ↑ 55.0 55.1 55.2 55.3 55.4 Finler (2003), pp. 364–67.

- ↑ Finler (2003), p. 40.

- ↑ Hirschhorn (1983), p. 157.

- ↑ Finler (2003), pp. 155, 366.

- ↑ Finler (2003), pp. 324–25.

- ↑ Cook (2000), p. 319.

- ↑ Thompson, Anne (1987-05-10). "VCRs Sending People Back to Theaters". San Francisco Chronicle. p. 29.

- ↑ Finler (1988), p. 35.

- ↑ Studio Market Share (2006) part of BoxOfficeMojo.com. Retrieved May 20, 2007.

- ↑ Hayes, Dade, and Dave McNary (2008-05-08). "Picturehouse, WIP to Close Shop". Variety. Retrieved 2009-01-18.

- ↑ Goldsmith, Jill, and Tatiana Siegel (2008-12-04). "Viacom Lays Off 850 Staffers". Variety. Retrieved 2009-02-23.

- ↑ "Paramount Vantage Acquires Worldwide Rights" (Press release). Paramount. 2010-01-22. Retrieved 2010-01-31.

- ↑ Ng, Philiana (2011-04-15). "Paramount Vantage Sets Release Date for Sundance Winner 'Like Crazy'". Hollywood Reporter. Retrieved 2011-06-06.

- ↑ Borys, Kit (2009-01-04). "Relativity Completes Rogue Acquisition". Hollywood Reporter. Retrieved 2009-08-09.

- ↑ Waxman, Sharon (2010-01-27). "Miramax Dies: Rest in Peace". The Wrap. Retrieved 2010-01-31.

- ↑ Barnes, Brooks, and Michael Cieply (2010-07-30). "Disney Sells Miramax for $660 Million". The New York Times. Retrieved 2010-07-30.

- ↑ "Universal-EMI Merger: A Timeline Of Events". Billboard. 21 September 2012. Retrieved 8 April 2013.

Sources

- Cook, David A. (2000). Lost Illusions: American Cinema in the Shadow of Watergate and Vietnam, 1970–1979 (Berkeley, Los Angeles, and London: University of California Press). ISBN 0-520-23265-8.

- Eames, John Douglas (1985). The Paramount Story (New York: Crown). ISBN 0-517-55348-1.

- Finler, Joel W. (1988). The Hollywood Story, 1st ed. (New York: Crown). ISBN 0-517-56576-5.

- Finler, Joel W. (2003). The Hollywood Story, 3d ed. (London and New York: Wallflower). ISBN 1-903364-66-3.

- Hirschhorn, Clive (1983). The Universal Story (London: Crown). ISBN 0-517-55001-6.

- Hirschhorn, Clive (1999). The Columbia Story (London: Hamlyn). ISBN 0-600-59836-5.

- Jewell, Richard B., with Vernon Harbin (1982). The RKO Story (New York: Arlington House/Crown). ISBN 0-517-54656-6.

- Schatz, Thomas (1998 [1989]). The Genius of the System: Hollywood Filmmaking in the Studio Era (London: Faber and Faber). ISBN 0-571-19596-2.

- Thomas, Tony, and Aubrey Solomon (1985). The Films of 20th Century-Fox (Secaucus, N.J.: Citadel). ISBN 0-8065-0958-9.