Lithium as an investment

Lithium as an investment becomes a popular alternative investment, making for a viable play on the growing demand for energy efficient technologies. Lithium batteries, much more efficient than traditional nickel-metal hydride ones, are in high demand from the automobile and electronics industries. The element's limited supply is another important aspect making the metal a potentially profitable investment. The estimations of the global market size for lithium-ion batteries range from $26 billion in 2023 (Navigant Research) to optimistic $33 billion in 2019 (Transparency Market Research).[1]

Metal

Lithium metal is extremely soft, highly reactive, and flammable element. It is most frequently found in deposits such as spodumene and pegmatite minerals, with larger resources in the U.S., Canada, Australia, China, Zimbabwe, and Russia. Lithium possesses a unique chemical profile making it the lightest metal in the periodic table and the least dense solid element. Its atomic number is 3 (right behind helium at 2 and hydrogen at 1), and its density is just 0.53 kg/L. This alkali metal is probably best-known for its wide use in lithium batteries common in all sorts of electronics devices. Other industrial applications include manufacturing heat-resistant glass and ceramics, high-performance alloys used in aircrafts, and lubricating greases.[2] Lithium deuteride is used in staged thermonuclear weapons as a fusion fuel. Compounds of lithium are also used as mood stabilizing drugs in psychiatry. The breakdown of the global end-use lithium markets is estimated as follows: ceramics and glass, 31%; batteries, 23%; lubricating greases, 9%; air treatment, 6%; primary aluminum production, 6%; continuous casting, 4%; rubber and thermoplastics, 4%; pharmaceuticals, 2%; and other uses, 15%.[3]

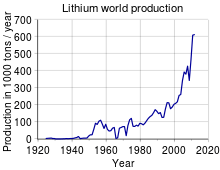

Global resources and production

The global production of lithium is to triple this century, from 200,000 tons in the year 2000 to over 600,000 tons in 2020. Mining lithium metal is not expensive, especially at high mountain plateaus, where lithium is collected from brine ponds evaporated by the sun. Brine excavation is probably the only lithium extraction technology widely used today, as actual mining of lithium ores is much more expensive and has been priced out of the market.[4][5]

Identified lithium resources total 5.5 million tons in the United States and approximately 34 million tons in other countries, so lithium is not, in fact, a rare commodity. Identified lithium resources for Bolivia and Chile are 9 million tons and in excess of 7.5 million tons, respectively. Identified lithium resources for Argentina, China, and Australia are 6.5 million tons, 5.4 million tons, and 1.7 million tons, respectively. Canada, Congo (Kinshasa), Russia, and Serbia have resources of approximately 1 million tons each. Identified lithium resources for Brazil total 180,000 tons.[6]

The world’s top 3 lithium-producing countries from 2014, as reported by the US Geological Survey.[7]

Australia

In 2014, Australian companies delivered 13,000 tons of metal, an increase of 300 tons from the year prior. The country develops the Greenbushes lithium project, which is owned and operated by Talison Lithium. Greenbushes is the world’s largest known single lithium reserve and has been operational for over 25 years. The location also provides easy access for Asian electronics companies, which are the global top lithium consumers.

Chile

In 2014, Chilean mines delivered 12,900 tons of lithium, providing the second-highest amount of lithium and poising to take back the Chilean position as number-one producer in the future. Overall, Chile possesses the largest confirmed lithium reserves in the world, with over 7.5 million tons of the element. By that estimate, the country hosts roughly five times more lithium than Australia, which features the second-largest reserves. In particular, the Atacama salt flat is the most significant source of country’s massive lithium production, and it has been reported that one project alone encompasses approximately 20% of the world’s total lithium. While Australia extracts lithium from traditional hard-rock mines, Chile’s lithium is found in brines below the surface of salt flats. These brines are collected and treated in order to separate the element from wastewater.

China

In 2014, China mined 5,000 tons, trailing the world’s largest producers by a sizable margin. That amount represents a 300-ton increase from 2013 output. The country’s large electronics industry makes the country also the world’s largest consumer of the commodity. Currently, the majority of Chinese lithium output comes from the Chang Tang plain in Western Tibet. The US Geological Survey indicates that the country’s reserves is 3.5 million tons.

Investment vehicles

Currently, there are a number of options available in the marketplace to invest in the metal. While buying physical stock of lithium is hardly possible, investors can buy shares of companies engaged in lithium mining and producing.[8] Also, investors can purchase a dedicaded lithium ETF offering exposure to a group of commodity producers.

Lithium Index

The performance of the global lithium industry is covered by Solactive Global Lithium Index. The index is composed of companies that are primarily engaged in some aspect of the lithium industry such as lithium mining, exploration, and lithium-ion battery production.

Mining companies

There are many companies relying on lithium for a substantial portion of their revenues. Examples include:

- Sociedad Quimica y Minera (NYSE: SQM), a Chilean producer of specialty plant nutrients and chemicals that runs large-scale lithium production operations. The main production facilities are located in the Atacama Desert;

- FMC Corporation (NYSE: FMC), a Philadelphia-based diversified chemical company also focusing on this commodity;

- Albemarle Corporation (NYSE: ALB), yet another industrical company producing lithium chemicals;

- RB Energy (TSX: RBI), a Canadian company developing The Quebec Lithium Project.

Exchange traded funds

- Global X Lithium ETF (NYSE: LIT), an ETF trading since 2010 and holding the above listed lithium producers as its top holdings. LIT is a passive ETF seeking to replicate Solactive Global Lithium Index.

See also

- Sprott Molybdenum Participation Corporation

- Uranium Participation Corporation

- Traditional investments

- Alternative investments

- Minor metals

Rare materials as investments

- Diamonds as an investment

- Palladium as an investment

- Platinum as an investment

- Silver as an investment

- Gold as an investment

- Uranium as an investment

References

- ↑ Howard, Wilmont (May 7, 2014). "The Lithium Industry: Will Supply Meet Demand?". seekingalpha.com. Retrieved 2015-04-24.

- ↑ "How to Invest in Lithium". commodityhq.com. Retrieved 2015-04-24.

- ↑ "How to Invest in Lithium". elementinvesting.com. Retrieved 2015-04-28.

- ↑ Cafariello, Joseph (March 10, 2014). "Lithium: A Long-Term Investment Buy Lithium!". wealthdaily.com. Retrieved 2015-04-24.

- ↑ Kaskey, Jack (July 16, 2014). "Largest Lithium Deal Triggered by Smartphones and Teslas". bloomberg.com. Retrieved 2015-04-24.

- ↑ "Lithium Statistics and Information". U.S. Geological Survey. 2011.

- ↑ "8 Top Lithium-producing Countries". lithiuminvestingnews.com. April 8, 2015. Retrieved 2015-04-24.

- ↑ "How to Invest in Lithium". commodityhq.com. Retrieved 2015-04-24.