Iron butterfly (options strategy)

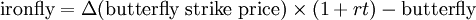

In finance an iron butterfly, also known as the ironfly, is the name of an advanced, neutral-outlook, options trading strategy that involves buying and holding four different options at three different strike prices. It is a limited-risk, limited-profit trading strategy that is structured for a larger probability of earning smaller limited profit when the underlying stock is perceived to have a low volatility.

Long Iron Butterfly

A long iron butterfly option strategy will attain maximum profit when the price of the underlying asset at expiration is equal to the strike price at which the call and put options are sold. The trader will then receive the net credit of entering the trade when the options all expire worthless.[1]

A long iron butterfly option strategy consists of the following options:

- Long one out-of-the-money put: strike price of X

- Short one at-the-money put: strike price of (X-a)

- Short one at-the-money call: strike price of (X-a)

- Long one out-of-the-money call: strike price of X[2]

where X = the spot price (i.e. current market price of underlying) and a > 0.

Limited Risk

A long iron butterfly will attain maximum losses when the stock price falls at or below the lower strike price of the put or rise above or equal to the higher strike of the call purchased. The difference in strike price between the calls or puts subtracted by the premium received when entering the trade is the maximum loss accepted.

The formula for calculating maximum loss is given below:

- Max Loss = Strike Price of Long Call - Strike Price of Short Call - Premium

- Max Loss Occurs When Price of Underlying >= Strike Price of Long Call OR Price of Underlying <= Strike Price of Long Put[3]

Break Even Points

Two break even points are produce with the iron butterfly strategy.

Using the following formulas, the break even points can be calculated:

- Upper Breakeven Point = Strike Price of Short Call + Net Premium Received

- Lower Breakeven Point = Strike Price of Short Put - Net Premium Received[4]

Example of Strategy

- Buy XYZ 140 Put for $2.00

- Sell XYZ 145 Put for $4.00

- Sell XYZ 145 Call for $4.00

- Buy XYZ 150 Call for $3.00

- Max. Profit = Net Credit = $4.00 + $4.00 - $2.00 - $3.00 = $3.00

- Max. Risk = Margin = Difference in Strikes - Net Credit = $5.00 - $3.00 = $2.00

- Upper Break Even = Short Call Strike + Net Credit = $145 + $3.00= $148.00

- Lower Break Even = Short Put Strike - Net Credit = $145 - $3.00 = $142.00

- Max. Return = Net Credit ÷ Margin = $3.00 ÷ $2.00 = 150% (If index is trading at $145 on expiration).[5]

Short Iron Butterfly

A short iron butterfly option strategy will attain maximum profit when the price of the underlying asset at expiration is greater than the strike price set by the out-of-the-money put and less than the strike price set by the out-of-the-money call. The trader will then receive the difference between the unexpired options, while paying the premium on the expired options.[6]

References

- ↑ http://www.theoptionsguide.com/iron-butterfly.aspx

- ↑ https://www.fidelity.com/learning-center/investment-products/options/options-strategy-guide/long-iron-butterfly-spread

- ↑ http://www.minyanville.com/businessmarkets/articles/iron-butterfly-option-strategy-options-strategies/12/2/2010/id/31464x

- ↑ http://www.optionsplaybook.com/option-strategies/iron-butterfly/

- ↑ http://www.poweropt.com/ibutterflyspreadhelp.asp

- ↑ http://www.optionstrading.org/strategies/volatile-market/reverse-iron-butterfly-spread/

- McMillan, Lawrence G. (2002). Options as a Strategic Investment (4th ed. ed.). New York : New York Institute of Finance. ISBN 0-7352-0197-8.

| ||||||||||||||||||||||||||||||||||||||||||||||||